Global AI Marine Market Size, Share Analysis Report By Component (Hardware, Software, Services), By Technology (Natural Language Processing, Machine Learning, Computer Vision, Robotics & Autonomous Systems, Others), By Application (Navigation & Route Optimization, Predictive Maintenance, Port Operations & Management, Vessel & Cargo Tracking, Surveillance & Security, Autonomous Shipping, Others), By Deployment (On Premise, Cloud-Based), By End Use (Commercial Shipping, Energy & Utilities, Warehouse & Logistics, Port Authorities, Fishing Industry, Offshore Energy, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152201

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

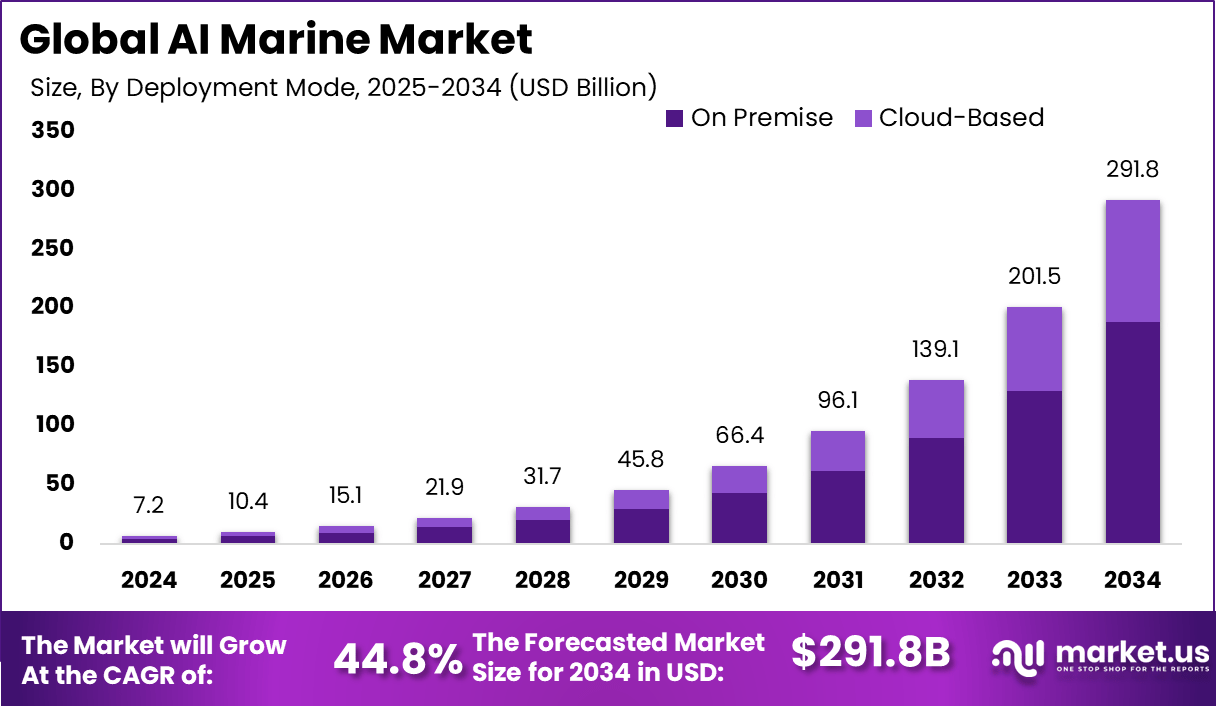

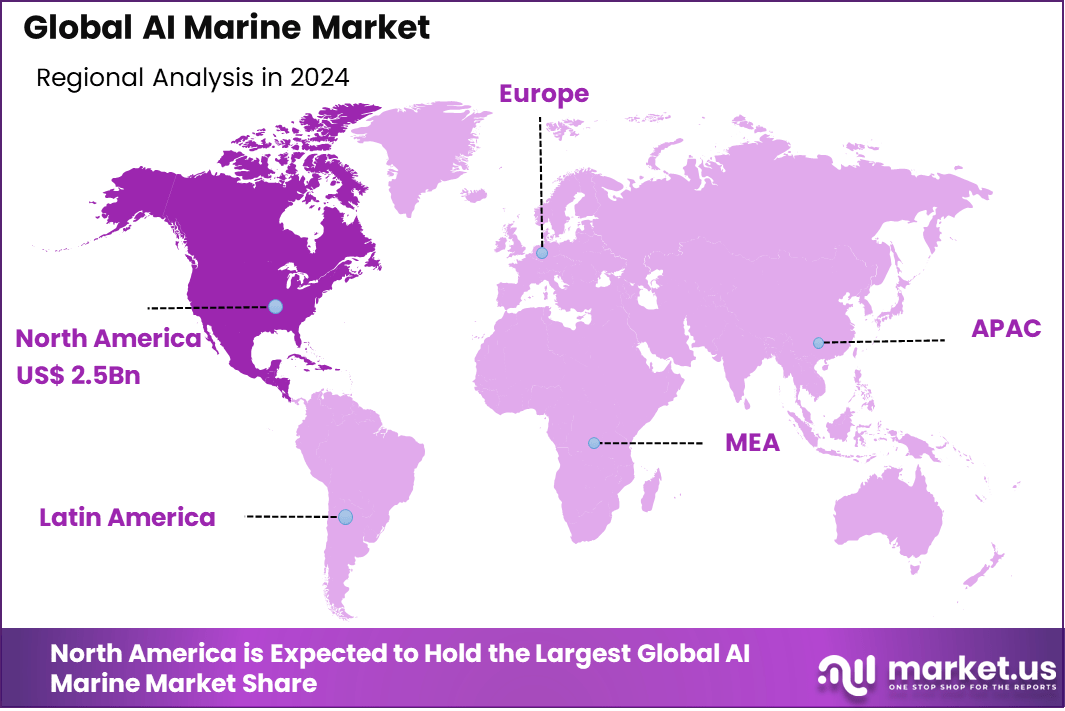

The Global AI Marine Market size is expected to be worth around USD 291.8 Billion By 2034, from USD 7.2 billion in 2024, growing at a CAGR of 44.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.6% share, holding USD 2.5 Billion revenue.

The AI Marine market refers to the integration of artificial intelligence (AI) across maritime operations, encompassing software, autonomous vessels, underwater drones, monitoring systems, and predictive analytics solutions. This market addresses logistical, environmental, safety, and naval applications – from coastal waters to the deep sea. AI’s role enhances decision-making, automation, and resilience across a variety of marine contexts, including shipping, research, defense, and conservation.

The demand for AI in marine environments is being driven by rising cargo traffic, vessel complexity, and the need for real-time monitoring across fleets. Commercial shipping operators are deploying AI to gain predictive insights, reduce fuel usage, and minimize unscheduled maintenance. Defense and government fleets are also turning to AI for enhanced situational awareness and threat detection.

According to the findings from wifitalents, 65% of shipping companies have improved their route planning efficiency using AI, helping reduce delays and fuel usage. Predictive maintenance powered by AI has lowered vessel downtime by up to 40%, making operations smoother and less costly.

In safety, 78% of marine firms are now investing in AI to enhance monitoring and risk detection. Autonomous ships are also cutting crew-related costs by nearly 30%, indicating a shift toward more efficient operations. In 2023, 55% of marine logistics companies adopted AI-based cargo and fleet management systems to streamline operations and improve cargo tracking.

Data from gitnux shows AI simulations have cut disaster response analysis times by 50%, enabling quicker emergency actions. About 52% of maritime companies plan to boost AI investments in the next 3 years. AI’s impact on vessel design has led to 10–15% better fuel efficiency, and real-time analytics have helped lower accident risks by 22%, highlighting the growing trust in AI across marine sectors.

The increasing adoption of technologies includes autonomous navigation systems, AI-fueled underwater drones, sensor fusion, and real-time analytics. Autonomous surface vessels are being trialed by navies and maritime agencies, while underwater drones detect threats, monitor infrastructure, and support biodiversity studies.

The key reasons for adopting these technologies lie in efficiency optimization, cost savings, environmental compliance, and risk mitigation. Predictive tools reduce downtime; autonomous maintenance lowers crew dependency; and underwater robots reduce manual labor exposure. AI also helps meet regulatory demands on emissions, safety, and data transparency.

Key Insight Summary

- The market is projected to expand significantly from USD 7.2 billion in 2024 to approximately USD 291.8 billion by 2034, reflecting a remarkable CAGR of 44.8%, driven by increasing automation, efficiency needs, and sustainability goals in the maritime sector.

- North America led the global market in 2024, holding over 35.6% share with revenues of around USD 2.5 billion, supported by strong technological adoption and advanced shipping infrastructure.

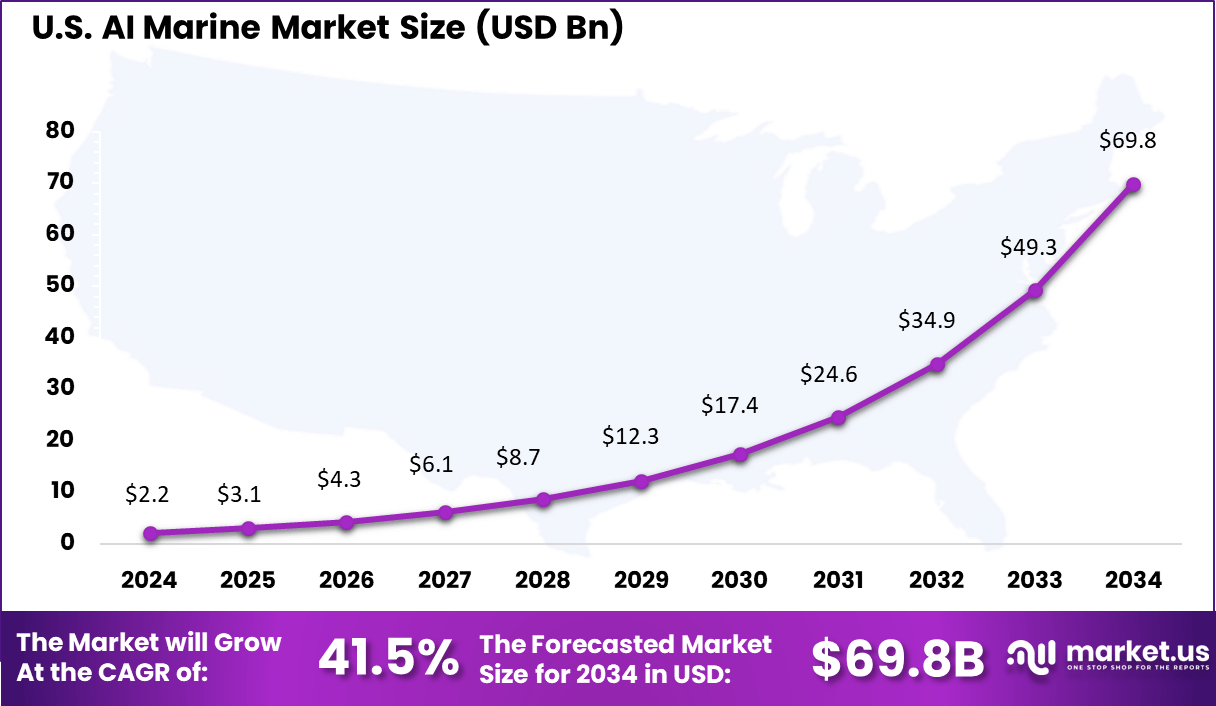

- Within North America, the U.S. market contributed approximately USD 2.17 billion in 2024, projected to grow at a CAGR of 41.5%, reflecting substantial investments in AI-powered marine systems for commercial and defense purposes.

- By component, Hardware dominated with a 52.7% share, driven by demand for sensors, AI-enabled devices, and control systems for marine applications.

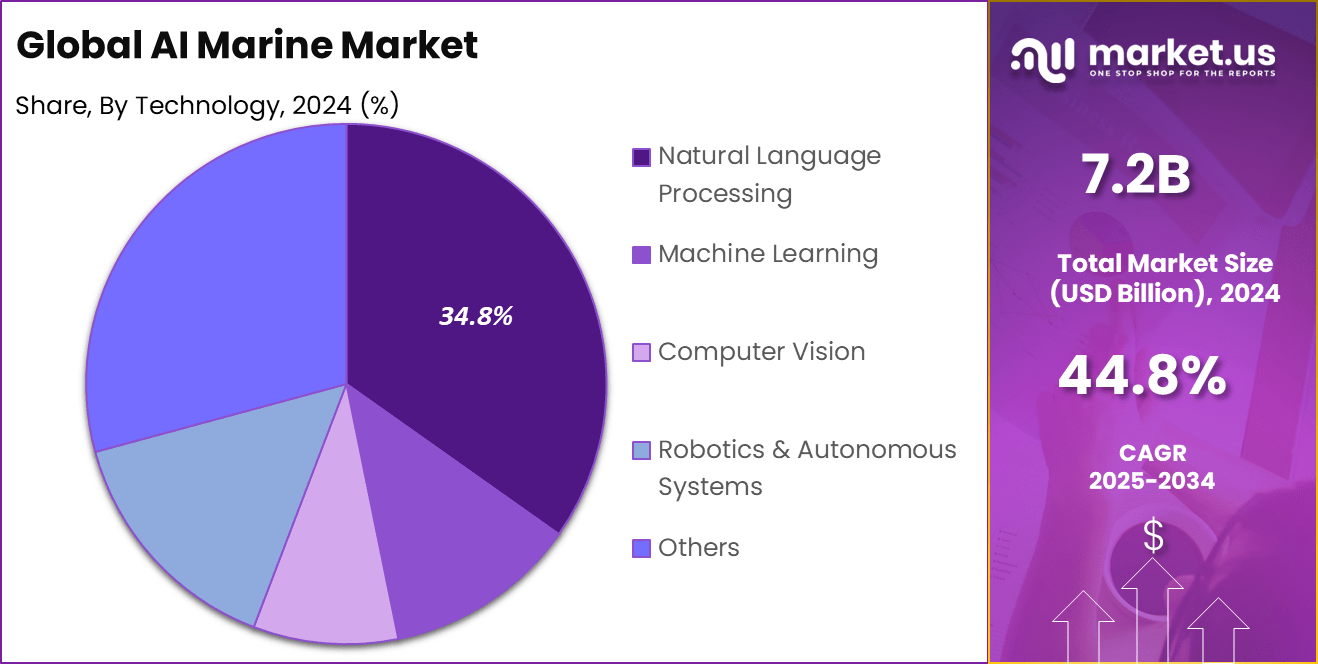

- By technology, Natural Language Processing (NLP) held 34.8% share, owing to its growing use in ship-to-shore communication, intelligent reporting, and autonomous decision support.

- By application, Navigation & Route Optimization led with 30.5% share, as operators prioritize AI-driven efficiency, fuel savings, and emission reductions through optimized routing.

- By deployment mode, On-Premise systems accounted for 64.7% share, reflecting the industry’s preference for secure, localized processing of sensitive operational data.

- Among end-use segments, Commercial Shipping held the largest share at 28.9%, driven by global trade growth and the push for smarter, more cost-efficient fleet operations.

US Market Size

The U.S. AI Marine Market was valued at USD 2.2 Billion in 2024 and is anticipated to reach approximately USD 69.8 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 41.5% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 35.6% share, holding USD 2.5 billion in revenue. The region’s leadership in the AI Marine market can be attributed to the strong presence of advanced defense systems, widespread use of autonomous marine technologies, and consistent government funding directed toward naval modernization.

High adoption of AI-based navigation, vessel tracking, and predictive maintenance systems across military and commercial fleets has reinforced the region’s technological edge. Additionally, early integration of AI with underwater surveillance and robotic systems has helped North America maintain a competitive advantage in intelligent maritime solutions.

By Component Analysis

In 2024, Hardware segment held a dominant market position, capturing more than a 52.2% share. This leadership is primarily due to the increasing installation of AI-powered onboard systems that support real-time decision-making in marine operations.

Hardware such as sensors, edge processors, and marine-grade GPUs are playing a vital role in enabling automation, collision avoidance, and predictive maintenance. As ships operate in isolated and harsh environments, they require robust and durable AI hardware that can function independently without relying on shore-based systems.

The demand for AI-based navigation systems and autonomous marine surveillance is further boosting the need for high-performance computing units. The growing interest in green shipping and operational efficiency has pushed vessel operators to invest in hardware capable of real-time emissions tracking and fuel optimization.

Compared to software and services, hardware carries a higher capital cost and a longer lifecycle, which makes it the foundation of any AI integration. This strong dependence on physical AI infrastructure has made the hardware segment the top contributor within the component landscape of the AI marine market.

By Technology Analysis

In 2024, Natural Language Processing segment held a dominant market position, capturing more than a 34.8 % share. This leadership can be attributed to the increasing reliance on NLP for real-time communication, command interpretation, and intelligent reporting within marine operations.

Onboard systems now beam weather alerts, maintenance alerts, and navigational updates through voice or text interfaces. Such interactive capabilities significantly improve crew situational awareness and reduce error potential when language barriers or technical complexity are involved.

The segment’s dominance is further supported by the broad applicability of NLP beyond simple command execution. It underpins multilingual crew support, automated log analysis, and AI-powered incident reporting. Advances in cloud-based and edge-deployed NLP systems have enabled seamless integration of these capabilities, reinforcing their value aboard vessels with limited connectivity.

The capacity to parse unstructured communications and convert them into actionable insight in near real time has driven adoption across safety, compliance, and operational efficiency functions. Moreover, NLP’s emergence as the leading technology has been reinforced by escalating investments in transformer-based models – such as BERT and GPT variants – that enhance maritime domain language understanding and context sensitivity.

By Application Analysis

In 2024, Navigation & Route Optimization segment held a dominant market position, capturing more than a 30.5% share. This leadership is underpinned by the critical role of real-time route planning in reducing fuel consumption, enhancing safety, and minimizing transit time – core priorities for modern maritime operations.

AI‑driven navigation systems process dynamic data streams such as weather forecasts, sea currents, port congestion, and vessel performance to recommend optimal paths. These systems have become indispensable as shipping companies strive to cut emissions and operational costs while meeting environmental regulations.

The segment’s prominence can also be attributed to improved situational awareness and hazard avoidance. Enhanced obstacle detection and rerouting capabilities – facilitated by AI and advanced sensor fusion – have significantly reduced navigational risks, especially in congested or hazardous waters. This directly contributes to lower incidence rates, fewer delays, and increased crew confidence during voyage execution.

Moreover, Navigation & Route Optimization remains foundational to autonomous and semi‑autonomous shipping initiatives. These systems serve as the decision-making backbone for autonomous voyage planning in uncrewed or minimally crewed vessels, enabling independent, efficient routing in compliance with evolving regulations.

By Deployment Analysis

In 2024, On Premise segment held a dominant market position, capturing more than a 64.7% share. This leadership stems from the need for maritime operators to maintain full control over data and systems. On‑premise deployment ensures high data sovereignty and compliance with strict maritime security regulations.

Marine IT infrastructures – often aged or legacy – integrate more smoothly with shielded, shore‑side server environments. These factors contribute to preference for on‑premise systems as the primary method of deploying AI and management tools. The segment leads due to performance reliability in environments with unstable connectivity.

Ships operating in remote waters face intermittent or low-bandwidth links, making cloud-only systems prone to downtime. On‑premise servers mitigate this risk by enabling local data processing, real‑time analytics, and mission‑critical AI inference without relying on continuous internet access. This reduces operational risk and ensures consistent availability of essential systems.

Furthermore, on‑premise deployments offer enhanced customization and reduced latency. Maritime stakeholders frequently require specialized configurations, cybersecurity controls, and integration with onboard hardware. Local installations provide fine‑grained control over updates, patches, and system configurations.

By End Use Analysis

In 2024, Commercial Shipping segment held a dominant market position, capturing more than a 28.9 percent share. This leadership is driven by the extensive use of AI across fleet operations and cargo logistics, where real-time decision support is essential.

Commercial vessels depend on technologies such as route optimization, fuel efficiency tools, predictive maintenance, and cargo tracking, all integrated under a unified digital ecosystem. These tools enhance fleet reliability, increase utilization, and lower operating costs, meeting the rising demand for efficiency in global trade.

The segment’s dominance is also reinforced by regulatory and sustainability pressures facing large-scale shipping operations. Commercial shipping firms must comply with stricter emission limits and decarbonization targets, which has led to widespread adoption of AI-driven navigation systems and real-time fuel monitoring tools.

For instance, studies indicate that AI-aided navigation alone can reduce carbon emissions by substantial volumes, highlighting the alignment of AI deployment with environmental and economic objectives . This necessity-driven integration fosters deeper investment in intelligent systems within commercial fleets.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- Natural Language Processing

- Machine Learning

- Computer Vision

- Robotics & Autonomous Systems

- Others

By Application

- Navigation & Route Optimization

- Predictive Maintenance

- Port Operations & Management

- Vessel & Cargo Tracking

- Surveillance & Security

- Autonomous Shipping

- Others

By Deployment

- On Premise

- Cloud-Based

By End Use

- Commercial Shipping

- Energy & Utilities

- Warehouse & Logistics

- Port Authorities

- Fishing Industry

- Offshore Energy

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Increasing Use of Autonomous Underwater Robotics

A growing trend in the AI marine market is the use of autonomous underwater robots for maintenance tasks such as hull cleaning. These robots can perform inspections, monitor ship conditions, and even clean the surface of vessels while they remain in operation. This helps save time, reduce drydock requirements, and lower fuel consumption due to cleaner hulls.

The use of such robotics is increasing as they reduce risks to human divers and allow shipping companies to manage maintenance more efficiently. With AI integration, these robots can make decisions in real time, navigate underwater structures, and collect critical data for performance analysis. This trend reflects a broader movement toward automation in routine and hazardous marine tasks.

Driver

Rising Pressure to Lower Maritime Emissions

One of the strongest drivers in the AI marine sector is the growing pressure from global regulatory bodies to cut down emissions from commercial shipping. Authorities are encouraging the use of smart technologies that can reduce fuel consumption, optimize vessel performance, and minimize environmental impact. AI tools in navigation and engine management are playing a key role in this effort.

As ship operators seek to meet sustainability targets, AI systems that help with real-time decision-making are gaining traction. These tools not only ensure compliance with regulations but also improve fuel efficiency and reduce costs. The push toward greener operations is making AI adoption a necessity rather than an option.

Restraint

Limited Connectivity at Sea

A major challenge for implementing AI in the marine sector is the limited availability of high-speed internet while at sea. Most vessels still rely on satellite communication, which is expensive and not always reliable. This makes it difficult for ships to use cloud-based AI systems that require constant data exchange.

To address this issue, some companies are deploying hybrid systems with on-board processing capabilities. However, this increases the complexity of system design and raises the overall cost of deployment. As a result, small and mid-sized fleet operators may delay AI investments due to infrastructure limitations.

Opportunity

Growth of Edge AI Solutions

An important opportunity in the AI marine market lies in the growing use of edge AI. These systems process data directly on the vessel, without needing to send it to a cloud server. This reduces the delay in decision-making and helps vessels operate independently in remote locations.

Edge AI enables real-time monitoring, predictive maintenance, and safety alerts even in areas with weak connectivity. It also reduces dependency on bandwidth and protects sensitive data. This capability is especially useful for offshore vessels and long-haul shipping routes where access to cloud infrastructure is limited.

Challenge

Uncertainty Around Autonomy Regulations

The widespread use of autonomous marine systems is currently limited by unclear legal frameworks. Most international maritime regulations are designed for human-operated ships, not for AI-based decision-making. This gap in legal clarity creates hesitation among shipping companies planning to adopt fully autonomous technologies.

There is also uncertainty around liability in case of accidents involving autonomous systems. Without clear rules on accountability, insurers and regulatory agencies face difficulty in approving or supporting such systems. This uncertainty continues to delay large-scale adoption of full autonomy in marine transportation.

Key Player Analysis

The AI marine industry is being shaped by several key innovators driving automation, data intelligence, and maritime safety. Anduril Industries, Sea Machines Robotics, and Saildrone are at the forefront of autonomous vessel systems and unmanned surface technologies. These firms specialize in AI-powered navigation, situational awareness, and mission-driven maritime robotics.

Companies such as Orca AI, Nautilus Labs, and OrbitMI are enabling shipping companies to optimize fleet performance using AI-based analytics. These platforms focus on fuel efficiency, route optimization, emission tracking, and voyage planning. Their systems use machine learning and real-time data to support decision-making and compliance.

Similarly, Windward and Blue Visby Services Ltd. are building advanced maritime intelligence platforms that provide predictive insights on vessel behavior, port congestion, and regulatory risks, helping operators achieve smarter and safer voyages. Emerging players like Rovco, ThayerMahan, and EyeROV are advancing AI-based underwater inspection, surveillance, and seabed mapping. Their technologies serve energy, offshore wind, and naval markets.

Meanwhile, Awake.AI, Blue Water Autonomy, Domino Data Lab, and Spire Global are contributing to port digitalization, autonomous logistics, and satellite-driven ocean monitoring. These companies are leveraging AI to solve key challenges like environmental monitoring, cargo visibility, and predictive maintenance. Their combined efforts are modernizing the global maritime ecosystem with scalable, AI-first solutions.

Top Key Players Covered

- Anduril Industries

- Awake.AI

- Blue Visby Services Ltd.

- Blue Water Autonomy

- Domino Data Lab

- EyeROV

- Nautilus Labs

- OrbitMI

- Orca AI

- Rovco

- Saildrone

- Sea Machines Robotics

- Spire Global

- ThayerMahan

- Windward

Recent Developments

- In May 2025, Anduril Industries expanded its AI-led maritime portfolio through the acquisition of Klas, a firm known for edge-computing systems used in secure battlefield communications. This move reinforced Anduril’s integrated approach toward autonomy, data processing, and tactical operations.

- In early 2025, Rovco unveiled its upgraded AI-powered perception system for deep-sea inspections using remotely operated vehicles. These tools have reportedly increased data resolution for seabed infrastructure mapping by 35% compared to earlier versions.

Report Scope

Report Features Description Market Value (2024) USD 7.2 Bn Forecast Revenue (2034) USD 291.8 Bn CAGR (2025-2034) 44.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Technology (Natural Language Processing, Machine Learning, Computer Vision, Robotics & Autonomous Systems, Others), By Application (Navigation & Route Optimization, Predictive Maintenance, Port Operations & Management, Vessel & Cargo Tracking, Surveillance & Security, Autonomous Shipping, Others), By Deployment (On Premise, Cloud-Based), By End Use (Commercial Shipping, Energy & Utilities, Warehouse & Logistics, Port Authorities, Fishing Industry, Offshore Energy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Anduril Industries, Awake.AI, Blue Visby Services Ltd., Blue Water Autonomy, Domino Data Lab, EyeROV, Nautilus Labs, OrbitMI, Orca AI, Rovco, Saildrone, Sea Machines Robotics, Spire Global, ThayerMahan, Windward Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anduril Industries

- Awake.AI

- Blue Visby Services Ltd.

- Blue Water Autonomy

- Domino Data Lab

- EyeROV

- Nautilus Labs

- OrbitMI

- Orca AI

- Rovco

- Saildrone

- Sea Machines Robotics

- Spire Global

- ThayerMahan

- Windward