Global AI Lawnmower Market Size, Share, Industry Analysis Report By Battery Capacity (Up to 20V, 20V to 30V), By Technology (Deep Learning, Machine Learning, Natural Language Processing, Others), By Sales Channel (Retail Stores/Offline, Online), By End Use (Residential, Commercial), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161917

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

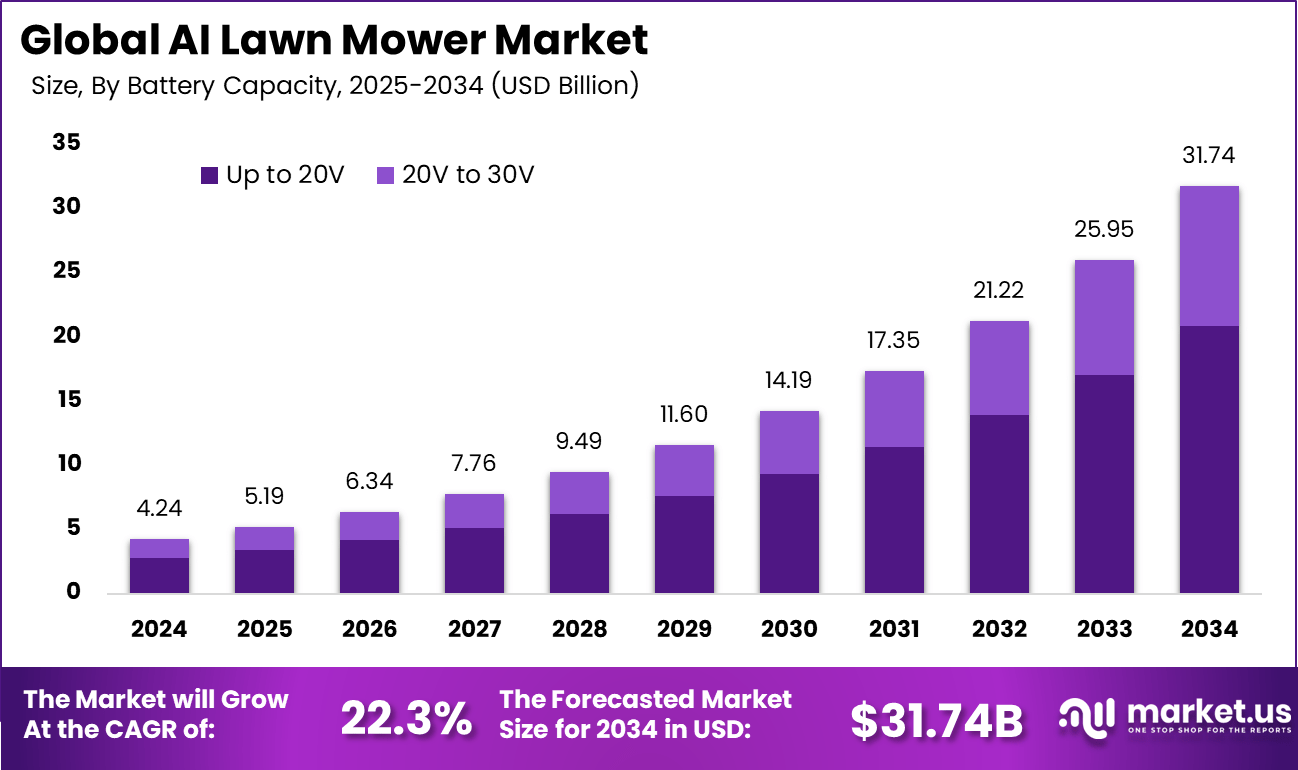

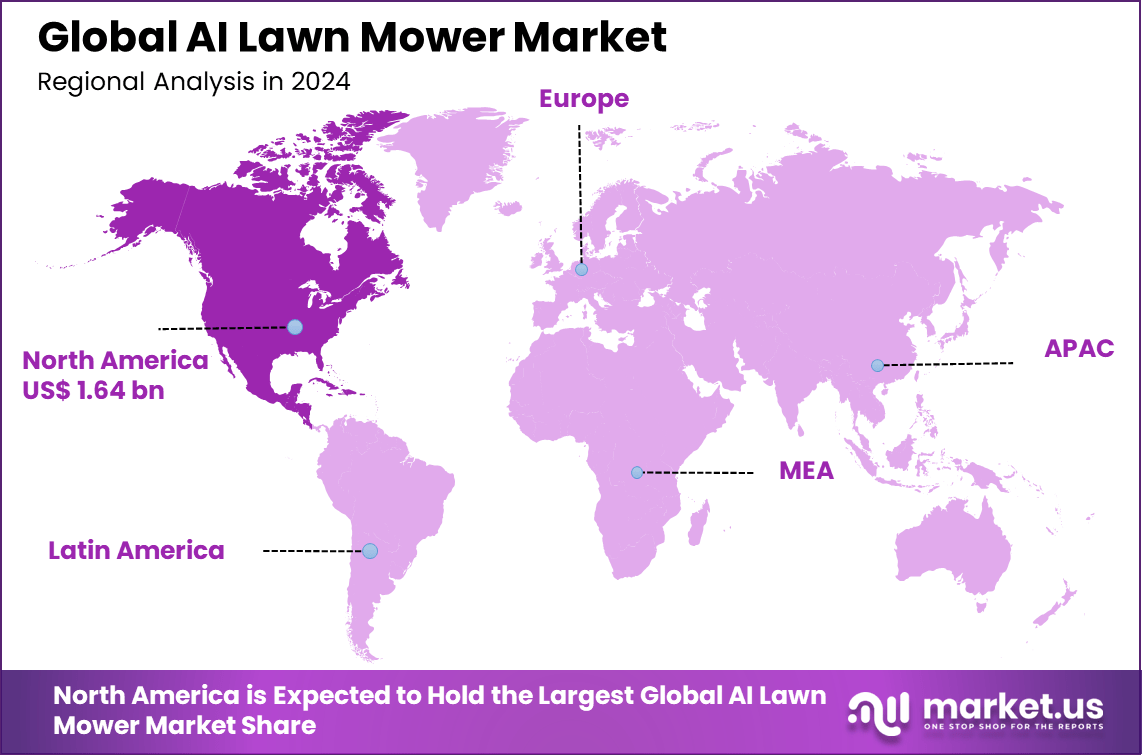

The Global AI Lawn Mower Market size is expected to be worth around USD 31.74 billion by 2034, from USD 4.24 billion in 2024, growing at a CAGR of 22.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.8% share, holding USD 1.64 billion in revenue.

The AI lawn mower market involves autonomous and semi-autonomous mowing systems that use sensors, navigation software, and artificial intelligence to cut grass without continuous human control. These machines operate in residential lawns, commercial landscapes, parks, sports fields, and institutional grounds. They navigate terrain, detect obstacles, and adjust cutting patterns based on programmed zones or environmental input.

A key driver is the need to reduce manual labor and maintenance time. Homeowners and commercial facility managers seek automated solutions to handle routine lawn upkeep. Growing interest in smart outdoor equipment and connected home ecosystems supports adoption. Aging populations and labor shortages in landscaping services also encourage the use of autonomous alternatives. Environmental focus has increased interest in electric AI-based systems over fuel-powered models.

For instance, in October 2025, Husqvarna Group unveiled its new AI Vision robotic lawnmowers set for release in 2026. These advanced models feature a camera-led AI navigation system that eliminates the need for boundary wires, simplifying installation and improving precision. The AI Vision technology enhances obstacle detection and edge-cutting accuracy, allowing the mowers to operate efficiently on varied lawn layouts.

Companies and property managers find that AI-powered mowers lower regular staff costs and boost efficiency for large landscape tasks. Maintenance is simple, with fewer repairs and long battery lives. Versatile models work equally well for small gardens or big city parks, making them attractive for different client types. Strong R&D investments have led to a steady growth in patents and continuous product upgrades in the sector.

Key Takeaway

- 65.6% of the market came from AI lawn mowers with power ratings up to 20V, showing strong consumer preference for low-to-medium voltage systems.

- 42.8% share from the Deep Learning segment reflects growing trust in smarter navigation and automated mowing intelligence.

- 68.7% of sales were driven through retail stores and offline channels, indicating that buyers still rely on physical product evaluation.

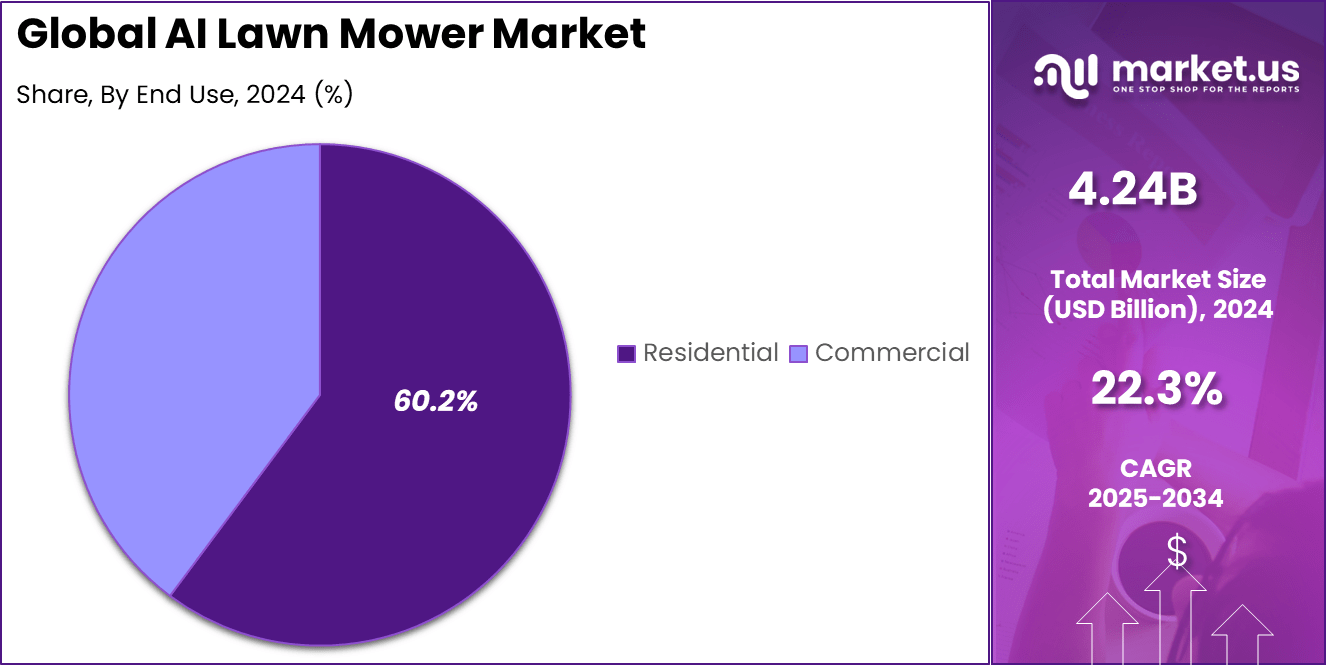

- 60.2% share from residential users shows that home adoption is shaping overall industry demand.

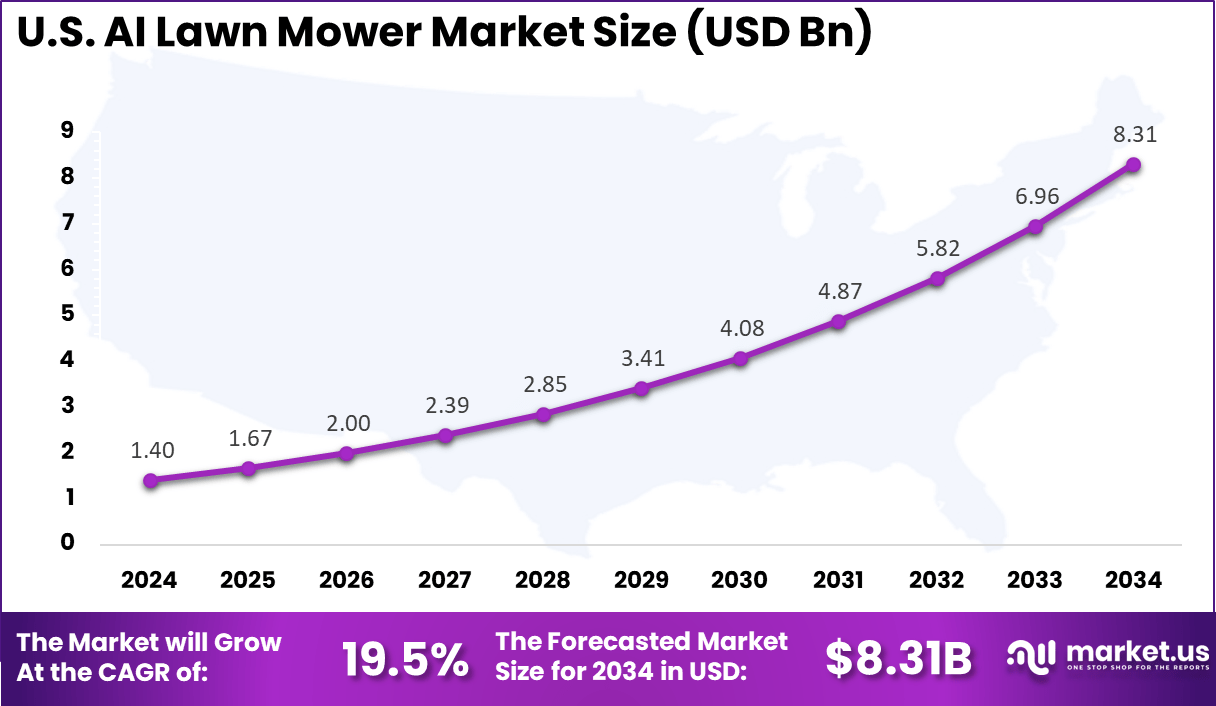

- The US market reached USD 1.40 Billion in 2024, supported by a solid 19.5% CAGR driven by tech adoption and higher landscaping needs.

- North America dominated with 38.8% of global share, supported by strong purchasing power and early use of AI-based outdoor equipment.

Role of Generative AI

Generative AI has helped AI lawn mowers become smarter and more useful for homeowners. In 2025, nearly 45% of newly released AI mowers in North America include learning features that adjust mowing routes by tracking grass growth and local weather patterns.

This technology cuts down mowing times and improves energy use, making the lawn care process easier for people who might not be tech experts. Mowers that use generative AI often show a 30% drop in missed patches compared to older models, improving overall yard appearance .

Manufacturers use generative AI to enable remote diagnostics through mobile apps, reducing service wait times for customers. In recent surveys, about 38% of buyers chose models with built-in AI for better scheduling and troubleshooting . These trends suggest that generative AI is shaping consumer expectations for personalization and ease of use, making high-tech lawn care more accessible and less stressful.

Adoption across industries

- Technology leads with 88% adoption, the highest among all sectors.

- Finance and Banking shows 65% adoption, driven by fraud detection and risk management.

- Healthcare adoption is at 70%, with focus on proofs of concept and implementations.

- Manufacturing has 77% adoption, mainly in production (31%), inventory (28%), and customer service (28%).

- Retail adoption is lower at 44%, focused on personalized marketing and inventory management.

U.S. Market Size

The market for AI Lawn Mowers within the U.S. is growing tremendously and is currently valued at USD 1.40 billion, the market has a projected CAGR of 19.5%. This dominance is growing tremendously due to increasing consumer demand for time-saving and eco-friendly lawn care solutions. Rising awareness about environmental sustainability encourages the adoption of electric and battery-powered mowers that reduce noise and emissions.

Additionally, the surge in smart home technology adoption drives interest in automated lawn care systems that offer convenience and remote control. Labor shortages in landscaping services also contribute, as homeowners and businesses seek autonomous solutions that reduce manual effort while maintaining high-quality lawn care.

For instance, in October 2025, Pandag Tech highlighted the dominance of the U.S. market in AI lawn mowers as it prepared to showcase its Pandag G1 Commercial Autonomous Lawn Mower at Equipment Expo 2025. The U.S. leads due to its early adoption of automation technologies, high demand for labor-saving solutions, and growing emphasis on eco-friendly equipment.

In 2024, North America held a dominant market position in the Global AI Lawn Mower Market, capturing more than a 38.8% share, holding USD 1.64 billion in revenue. This dominance is due to high consumer awareness and widespread adoption of smart home technologies. The region’s strong focus on eco-friendly and energy-efficient products drives demand for electric and AI-powered lawn mowers.

Additionally, urbanization and busy lifestyles increase the preference for automated, time-saving solutions. Robust infrastructure, easy access to advanced technology, and supportive government policies promoting green alternatives further reinforce North America’s lead in this market.

For instance, in August 2025, Sunseeker expanded its presence in the North American AI lawn mower market by launching its robotic mowers on Lowe’s online platform. This move underscores the region’s dominance in adopting AI-powered lawn care technology, supported by a well-established retail network and strong consumer demand for automated, eco-friendly solutions.

Battery Capacity Analysis

In 2024, The Up to 20V segment held a dominant market position, capturing a 65.6% share of the Global AI Lawn Mower Market. This dominance is due primarily to its ideal balance of power and efficiency, which suits most residential lawn sizes without sacrificing mobility or battery life. The lighter weight and cost-effectiveness of these batteries make them especially attractive to homeowners seeking reliable but affordable lawn care solutions.

Additionally, the widespread use of lithium-ion batteries in this voltage range contributes to longer runtimes and faster charging. These batteries enable AI lawn mowers to operate efficiently with less downtime, meeting consumer expectations for convenience and sustainability. Their compatibility with popular smart home technologies further reinforces their strong adoption across key markets.

For Instance, in May 2024, the Worx Landroid S 20V Robotic Lawn Mower stood out with its 20V battery capacity, offering a strong balance of power and efficiency for smaller lawns up to 1/8 acre. This voltage range supports features like a floating blade disc for better navigation on uneven terrain, making it a popular choice among homeowners seeking dependable and smart lawn care solutions.

Technology Analysis

In 2024, the Deep Learning segment held a dominant market position, capturing a 42.8% share of the Global AI Lawn Mower Market. Deep learning enables these mowers to better understand their environments by processing data collected from sensors and cameras. This allows the machines to adapt mowing patterns in real time, improving efficiency and precision. AI-driven decision-making makes the lawnmowers smarter in detecting obstacles and adjusting blade heights based on grass conditions.

Deep learning’s success in boosting autonomous operation reliability is a key reason for its widespread use. As this technology advances, AI lawnmowers can handle more complex terrains and diverse environmental factors, enhancing user satisfaction and expanding adoption beyond simple lawn areas into commercial and uneven landscapes.

For instance, in March 2025, Anthbot celebrated its AI mower anniversary with a focus on deep learning technology that significantly enhances lawn mowing efficiency. The AI mower leverages deep learning algorithms to adapt mowing patterns based on lawn size, shape, and obstacles, allowing it to navigate complex terrains more effectively.

Sales Channel Analysis

In 2024, The Retail Stores/Offline segment held a dominant market position, capturing a 68.7% share of the Global AI Lawn Mower Market. This is mainly driven by consumers’ preference for physically inspecting products before purchase and receiving personalized advice from sales representatives. Retail stores also provide additional value through after-sales services like installation support and maintenance, which builds buyer confidence.

Moreover, retail outlets benefit from seasonal promotions and in-store demonstrations that help introduce new customers to this automated technology. Offline channels remain popular among older demographics and those less comfortable with online shopping, reinforcing the segment’s strong market presence.

For Instance, in October 2025, Husqvarna Group announced the launch of seven new robotic lawnmowers featuring AI Vision technology, highlighting a growing focus on retail and professional markets. Retail stores are playing a pivotal role in bringing these innovative models to consumers by offering in-person demonstrations and installation services, contributing to the expanding adoption of AI lawn mowers.

End Use Analysis

In 2024, The Residential segment held a dominant market position, capturing a 60.2% share of the Global AI Lawn Mower Market. This dominance is due to homeowners looking for convenient, time-saving lawn maintenance solutions. Automated mowers free users from physical effort and noise, two significant barriers of traditional mowing methods. The quiet operation suits suburban neighborhoods where noise restrictions apply, while efficient lawn care enhances curb appeal.

Homeowners are increasingly integrating these devices into smart home systems, reflecting growing comfort with automation. This segment’s growth is supported by the rising disposable income in urban areas and a preference for eco-friendly alternatives, making residential use the clear leader in AI lawn mower adoption.

For Instance, in March 2025, Segway launched its Navimow X3 Series, a powerful AI lawn mower designed specifically for large residential properties. The X3 models cater to lawns ranging from 0.4 to 2.5 acres and feature advanced AI-powered navigation, TÜV-certified efficiency, and intelligent obstacle avoidance. With smart home integration through Amazon Alexa and Google Home, these robotic mowers offer homeowners a seamless, hands-free lawn care experience.

Key Market Segments

By Battery Capacity

- Up to 20V

- 20V to 30V

By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Others

By Sales Channel

- Retail Stores/Offline

- Online

By End Use

- Residential

- Commercial

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging trends

Emerging trends in the AI lawn mower market include better integration with smart home ecosystems and autonomy in energy management. Nearly 50% of new models released in 2025 feature compatibility with voice assistants and home automation platforms, enabling users to control mowing schedules remotely.

Another growing trend is using hybrid solar and battery storage systems, which allow longer operating times even in variable weather. This shift towards autonomous energy optimization improves eco-friendliness and convenience for users. Additionally, AI lawn mowers are evolving to include collaborative operation features where multiple mowers work together on large properties.

This approach is becoming popular in commercial spaces and public parks where consistent lawn maintenance over vast areas is needed. Around 25% of commercial-grade mowers now possess communication technology that helps them coordinate tasks, marking a step forward in efficiency and smart landscaping solutions.

Growth factors

Growth factors for AI lawn mowers include rising consumer demand for automated and eco-friendly lawn care solutions. About 70% of homeowners now favor robotic mowers due to their ability to save time and reduce physical effort.

Alongside convenience, these mowers produce less noise and pollution compared to gas-powered models, meeting growing environmental concerns among consumers and businesses alike. Technological advancements also drive growth; improvements in navigation, sensors, and machine learning algorithms have enhanced mower precision and safety.

Roughly 65% of new AI lawn mowers feature advanced sensors that allow obstacle detection and real-time adjustments. This technology not only delivers better cutting results but also lessens maintenance needs and power consumption, strengthening market appeal.

Drivers

Convenience and Automation

One of the key drivers of the AI lawn mower market is the increasing consumer desire for convenience and automated solutions. Homeowners and commercial users alike are embracing technology that reduces manual labor and allows for effortless, consistent lawn care. These devices enable users to schedule mowing remotely, receiving real-time updates via smartphone apps, which fits well with the growing smart home trend.

Moreover, the environmental benefits of electric-powered mowers that produce less noise and zero emissions compared to gas-powered models increase their attractiveness. This demand for efficient, eco-friendly lawn care aligns with broader sustainability goals and regulations, further fueling market growth. The integration of AI allows these mowers to adapt to various terrains, optimizing performance and convenience.

For instance, in October 2025, Husqvarna unveiled four new robot lawn mowers featuring groundbreaking AI vision technology, further advancing convenience and automated lawn care solutions. The 405VE, 410VE, 430V, and 450V models use infrared cameras to detect obstacles and adapt mowing patterns in real time, even working effectively at night. Designed for lawns ranging from 900m² to 7,500m², these mowers integrate with Husqvarna’s EPOS system to maintain precision across complex terrains.

Restraint

High Initial Costs

One significant restraint in the AI lawn mower market is the high upfront purchase price compared to traditional gas or electric mowers. Despite offering automation and efficiency, these advanced devices require substantial investment, which can deter price-sensitive consumers. Many homeowners still prefer conventional mowing due to lower initial costs and the familiarity of manual operation.

Additionally, maintenance costs and concerns about repair and parts availability can add to the total ownership expense, especially in regions where specialized service centers are scarce. The relatively high price limits widespread adoption in emerging markets and among budget-conscious buyers, slowing market penetration.

For instance, in July 2025, a report on mowingmagic.com highlighted the high upfront purchase price as a major factor affecting the adoption of commercial robotic lawn mowers. While these AI-powered devices offer significant labor savings and operational efficiency over time, the initial investment cost remains substantial, often ranging from several thousand to tens of thousands of dollars.

Opportunities

Expansion into Commercial and Large Property

The AI lawn mower market holds a substantial opportunity in commercial landscaping and large property maintenance. Current residential models mainly target smaller lawns, but demand is growing for robust machines capable of handling expansive areas like parks, golf courses, and estates. Commercial users seek to improve labor efficiency and reduce operational costs, making autonomous lawn mowers an attractive solution for ongoing maintenance.

With advancements in battery life, machine robustness, and navigation technologies, manufacturers can tap into this underserved segment. Developing customizable models that integrate with commercial fleet management systems could further unlock growth opportunities. Additionally, expansion into emerging markets with increasing urbanization and disposable incomes represents a promising frontier.

For instance, in October 2025, Pandag Tech announced it will showcase its Pandag G1 Commercial Autonomous Lawn Mower at Equipment Expo 2025 in the United States. The G1 is designed for large commercial properties, featuring RTK and AI vision navigation for fully autonomous mowing. It supports multi-zone management, collaborative fleet operations, and self-charging with swappable battery options of 8 kWh or 16 kWh, enabling extended runtimes.

Challenges

Technical Complexity and User Adoption

A key challenge facing the AI lawn mower market is overcoming technical complexity and user hesitation. While consumers appreciate the benefits of automation, some find the setup, programming, and troubleshooting of AI lawn mowers daunting. This impacts user experience and can result in reluctance to fully adopt or recommend the technology.

Manufacturers must invest in enhancing usability through simplified interfaces, better customer support, and education efforts. Ensuring consistent performance across diverse lawn types and conditions also demands ongoing innovation. Addressing concerns around privacy, data security, and safety will be important to build trust and confidence among a broader user base.

Key Players Analysis

The AI Lawnmower Market is led by established outdoor equipment manufacturers such as Deere & Company, Husqvarna Group, HONDA MOTOR CO., LTD., and Robert Bosch GmbH. These companies integrate AI-driven navigation, automated mowing schedules, obstacle detection, and smart terrain mapping into their robotic lawnmower product lines. Their strong distribution networks and brand reliability support adoption in both residential and commercial landscaping applications.

Specialized robotics and lawn care brands such as AL-KO, Belrobotics, STIGA S.p.A., and WIPER S.R.L. focus on autonomous mowing systems equipped with smart sensors, GPS guidance, and remote-control capabilities via mobile apps. These companies cater to large property owners, sports fields, and professional landscaping services seeking high efficiency and low-maintenance solutions.

Innovative entrants like Worx, Segway Navimow, and other emerging players are advancing the market with AI-enabled perimeter-free mowing, voice assistant integration, and real-time monitoring. Their emphasis on consumer-friendly features, safety automation, and smart home compatibility is increasing adoption across suburban households and tech-forward markets.

Top Key Players in the Market

- AL-KO

- Belrobotics

- Deere & Company

- HONDA MOTOR CO., LTD.

- Husqvarna Group

- Robert Bosch GmbH

- STIGA S.p.A.

- WIPER S.R.L.

- Worx

- Segway Navimow

- Other Major Players

Recent Developments

- In March 2025, Segway Navimow launched its X3 Series, specifically targeting large properties. These models feature TÜV-certified efficiency and AI-powered navigation, enabling precise, automated lawn maintenance for lawns up to 2.5 acres. The X3 Series includes advanced obstacle avoidance and smart home integration, delivering a professional-grade mowing solution tailored to expansive residential and commercial landscapes.

- In January 2025, MAMMOTION unveiled its next-generation robotic mowers featuring the UltraSense AI Vision system at CES 2025. The new technology offers AI auto-mapping to create precise virtual lawn maps up to 2.5 acres and maintains reliable mowing even in weak GPS areas. The expanded lineup includes four series, such as the LUBA 2 AWD for large lawns and the compact YUKA mini for smaller yards.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Bn Forecast Revenue (2034) USD 31.7 Bn CAGR(2025-2034) 22.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Battery Capacity (Up to 20V, 20V to 30V), By Technology (Deep Learning, Machine Learning, Natural Language Processing, Others), By Sales Channel (Retail Stores/Offline, Online), By End Use (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AL-KO, Belrobotics, Deere & Company, HONDA MOTOR CO., LTD., Husqvarna Group, Robert Bosch GmbH, STIGA S.p.A., WIPER S.R.L., Worx, Segway Navimow, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AL-KO

- Belrobotics

- Deere & Company

- HONDA MOTOR CO., LTD.

- Husqvarna Group

- Robert Bosch GmbH

- STIGA S.p.A.

- WIPER S.R.L.

- Worx

- Segway Navimow

- Other Major Players