Global AI Laptop Market Size, Share Report By Processor Type (AI-optimized CPU, NPU, Integrated GPU, Discrete GPU), By Sales Channel (Online Sales, Offline Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153754

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

AI Laptop Market Size

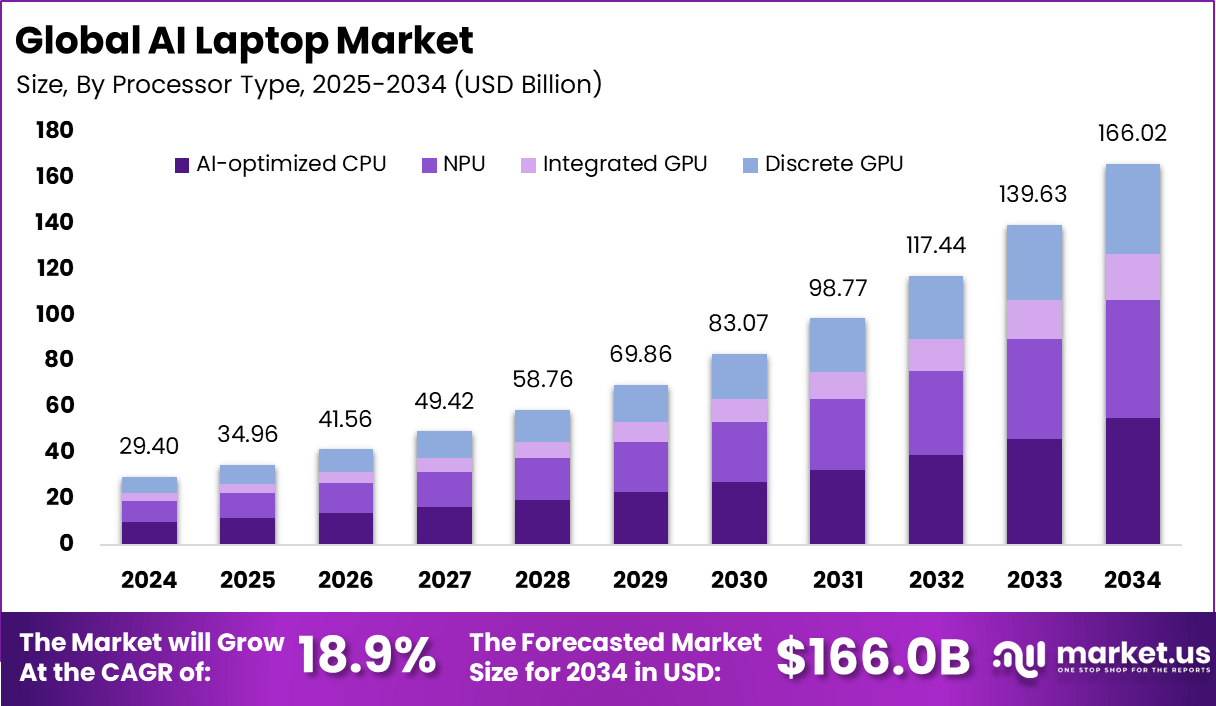

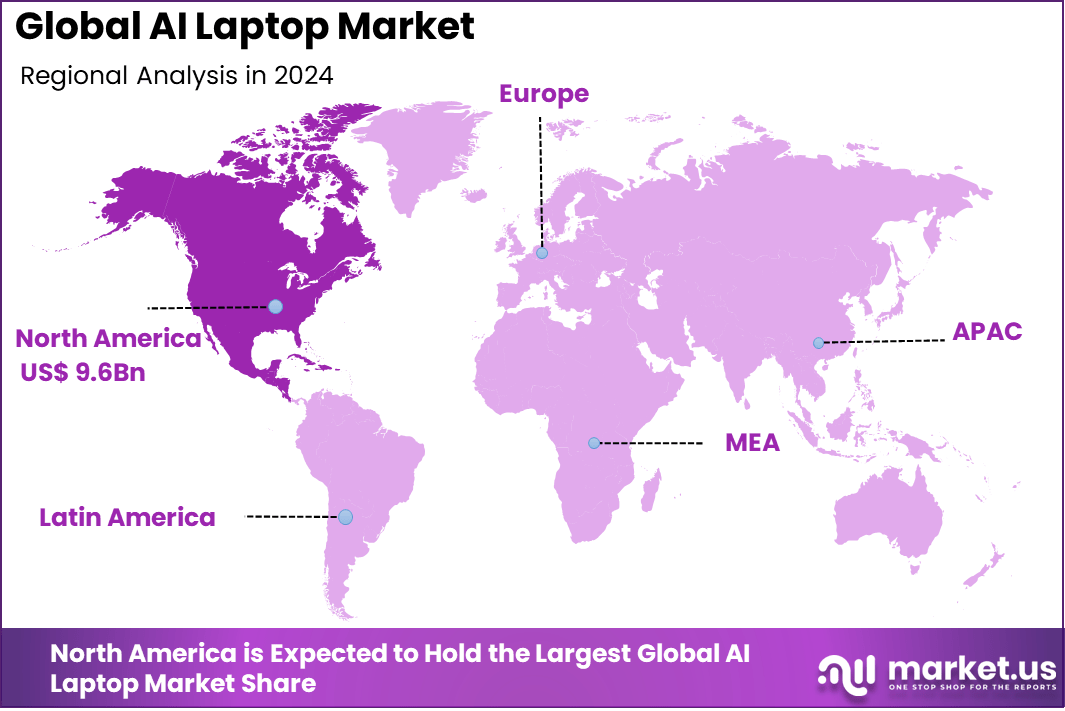

The Global AI Laptop Market size is expected to be worth around USD 166.02 Billion By 2034, from USD 29.40 billion in 2024, growing at a CAGR of 18.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.9% share, holding USD 9.6 Billion revenue.

The AI laptop market refers to portable computers with built‑in artificial intelligence capabilities. These systems include specialized processors and software designed to run machine learning, natural language processing, or predictive analytics directly on the device. It can be stated with clarity that this segment is growing rapidly as overall PC demand evolves toward smarter, locally processing devices that enhance performance and efficiency.

Scope and Forecast

Report Features Description Market Value (2024) USD 29.40Bn Forecast Revenue (2034) USD 166.02 Bn CAGR (2025-2034) 18.6% Leading Segment AI-optimized CPU segment [33.2% in 2024] Largest Market North America [382.9% Market Share] Market Overview

Top driving factors for this market include the expectation of smarter, more efficient computing, a widespread push for automation, and demands for improved security. Notably, the integration of AI for real-time facial recognition and adaptive performance management has dramatically improved device responsiveness and power efficiency.

According to Market.us, The AI PC Market is projected to witness substantial expansion, reaching a value of approximately USD 433.1 Bn by 2033, up from around USD 34.2 Bn in 2023. This growth reflects a strong compound annual growth rate of 28.9% over the forecast period from 2024 to 2033. The rapid adoption of intelligent computing systems, driven by demand for real-time processing and on-device AI capabilities, continues to fuel this upward trend.

Demand analysis reveals that both enterprise and consumer segments are adopting AI laptops for different reasons. In enterprise, devices are being procured as part of strategic upgrades to support modern AI workflows, improve collaboration, and maintain security. In consumer and education sectors, the appeal lies in interactive features that adapt to the user over time, such as personalization in settings and battery management that optimizes usage patterns.

Key Insight Summary

- The global AI laptop market is on a strong growth trajectory, expected to rise from USD 29.40 billion in 2024 to USD 166.02 billion by 2034, driven by increasing demand for intelligent computing capabilities and real-time AI processing.

- North America dominated the global market in 2024, securing a 32.9% share. This leadership was supported by strong tech infrastructure, early AI adoption, and rising demand for AI-powered personal and enterprise devices.

- The AI-optimized CPU segment captured the largest processor type share at 33.2% in 2024. This segment’s strength is attributed to its balance between power efficiency and high-speed AI workloads, appealing to both professional and consumer segments.

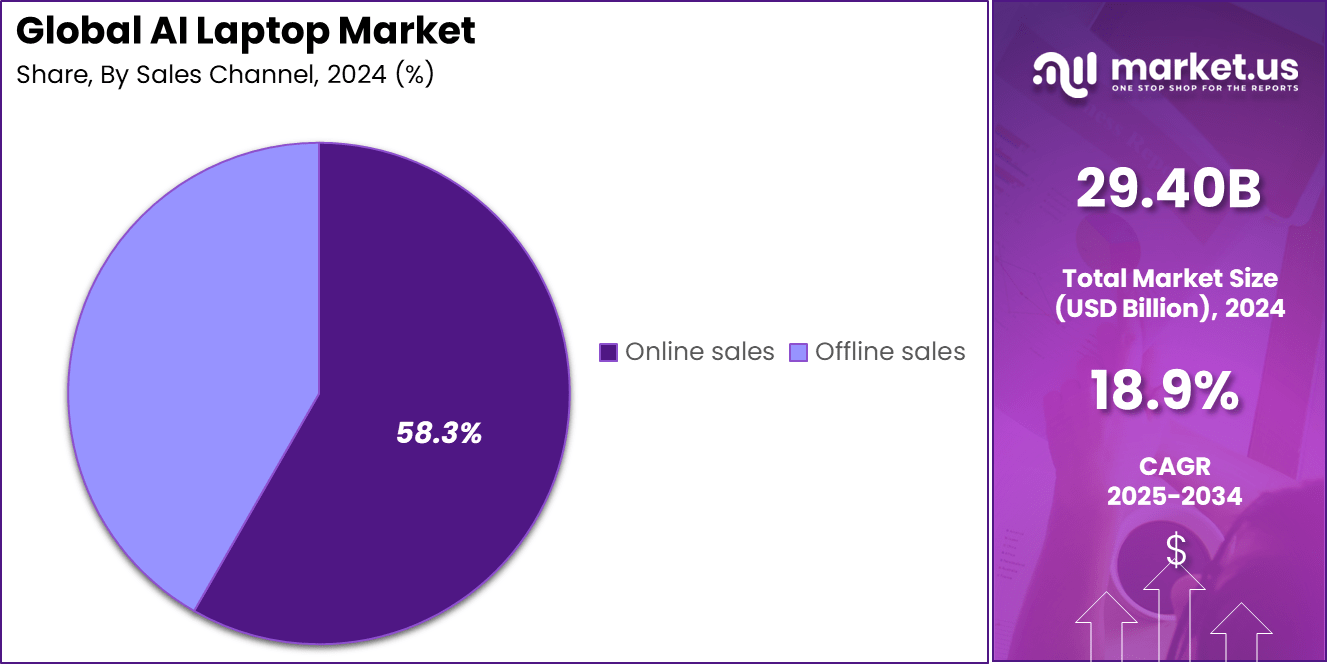

- In terms of distribution, the online sales channel emerged as the dominant route, commanding 58.3% of total revenue in 2024. Increased digital retail adoption, ease of comparison, and broader product visibility continue to support this trend.

Regional Insights

In 2024, North America held a dominant position in the global AI laptop market, accounting for over 32.9% of total revenue and generating approximately USD 9.6 billion. This leadership can be attributed to the early adoption of AI-integrated hardware across consumer and enterprise segments.

Major manufacturers launched AI-optimized laptops powered by advanced NPUs and AI-centric chipsets, supported by strong demand from sectors like education, healthcare, defense, and creative industries. The rollout of AI features in productivity tools and operating systems further accelerated consumer interest in this region.

Meanwhile, Asia Pacific is projected to grow at the fastest pace in the coming years. Within this region, India recorded an exceptional 185% increase in AI laptop sales during the first quarter of 2025, driven by rising tech-savvy consumers, expanding remote work culture, and government push for AI-enabled digital infrastructure.

By Processor Type Analysis

In 2024, AI‑optimized CPU segment held a dominant market position, capturing more than a 33.2 % share.

The AI‑optimized CPU segment led the AI laptop processor market owing to its seamless integration of enhanced instruction sets and architectural designs tailored for AI workloads. These processors deliver advanced acceleration for pattern recognition, predictive analytics, and adaptive performance management directly on the central core, allowing real‑time responsiveness in standard productivity applications.

This integration enables elevated system efficiency and user experience without requiring separate AI accelerators. The leadership of the AI‑optimized CPU segment can be attributed to widespread compatibility with existing software ecosystems, low system design complexity, and cost effectiveness in both hardware manufacturing and device integration.

Many vendors choose this architecture to support AI features while maintaining general purpose compute performance. As a result, consumer and enterprise adoption has been strong, reinforcing its market leadership through consistent year‑over‑year growth. Although other segments such as dedicated NPU, integrated GPU, and discrete GPU deliver specialized advantages, none matched the broad versatility of the AI‑optimized CPU segment.

By Sales Channel Analysis

In 2024, online sales segment held a dominant market position, capturing more than a 58.3 % share.

The online channel assumed leadership in the AI laptop distribution landscape due to exceptional reach and unique value propositions. Consumers increasingly turned to e‑commerce platforms for age‑range demographics, attracted by competitive pricing, extensive product selections, and home delivery convenience.

High‑value laptops benefitted particularly from promotional strategies such as flash sales, bundle offers, and personalized discounts, which were more profitable in the online environment. This played a key role in elevating the online channel’s share relative to offline retail in the same period. The superior performance of the online segment can be attributed to consumer behavior shifts and channel innovations.

In the first half of 2024, laptop sales grew by 7 % online while physical store sales contracted by 3 %, illustrating a clear divergence in growth trajectories. Younger and digitally native buyers researched product specifications, customer reviews, and price comparisons online before finalizing purchases via e‑commerce platforms.

Key Drivers

Driver Details Enhanced performance Users demand higher speed and efficiency for AI tasks like natural language processing, image recognition, and data analysis. AI-driven personalization Laptops adapt to user behavior and preferences for a more tailored user experience. Security and privacy AI enhances security via adaptive facial recognition and advanced biometric authentication. Advancements in hardware Introduction of NPUs and AI-optimized CPUs (e.g., Intel Core Ultra, Apple M4) for faster AI processing. Integration with tech Combining AI with 5G and edge computing enables real-time processing and better collaboration. Key Features and Trends

Feature/Trend Details NPUs as core components Dedicated processors accelerate AI tasks, supporting CPUs and GPUs. Hybrid computing designs Integration of CPUs, GPUs, and NPUs for optimal performance across all workloads. Edge AI/on-device AI Real-time AI processing on-device reduces latency and reliance on the cloud, improving privacy. App compatibility AI laptops support immersive experiences in apps (e.g., Microsoft Copilot). Power-efficient AI Enhanced power management for longer battery life during AI-accelerated workloads. Performance optimization AI dynamically allocates resources for demanding tasks, balancing performance and battery use. AI-powered personalization Systems adapt to individual users (e.g., voice, facial recognition). Increased security AI-driven authentication improves accuracy and reliability of biometrics and facial recognition. Key Market Segments

By Processor Type

- AI-optimized CPU

- NPU

- Integrated GPU

- Discrete GPU

Sales Channel

- Online sales

- Offline sales

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Apple Inc. and Microsoft lead the AI laptop market with strong integration of AI features in their devices. Apple uses its own Neural Engine chips, while Microsoft enhances Windows laptops with Copilot and AI-driven productivity tools. Their focus on seamless AI performance supports high user demand across creative and professional segments.

Lenovo, HP India, and Dell Inc. hold key positions by offering AI-powered laptops with global availability. These brands invest in smart thermal designs, AI chipsets, and enterprise-ready models. Their widespread reach helps them cater to both consumer and business users effectively.

ASUSTeK, Acer, Samsung, Razer, and Google bring innovation in specific niches. ASUS and Acer target gamers and creators with AI-boosted performance. Samsung focuses on ecosystem-based AI features. Razer builds AI-ready laptops for content creators, while Google enhances AI learning on Chromebooks, expanding access in education and low-cost segments.

Top Key Players Covered

- Apple Inc.

- Microsoft

- Lenovo

- HP INDIA SALES PRIVATE LIMITED

- Dell Inc.

- ASUSTeK Computer Inc.

- Acer Inc.

- SAMSUNG

- Razer Inc.

- Google LLC

Recent Developments

- Apple Inc.

- March 2024: Apple released the M3-powered MacBook Air (13-inch and 15-inch). The M3 chip excels at power-efficient performance and supports advanced AI workloads natively, a major step for on-device intelligence.

- October 2024: Apple officially launched Apple AI, expanding AI features across devices and setting a new standard for user-friendly, integrated intelligence.

- March 2024: Acquisition of Canadian AI calendar startup Mayday Labs, enhancing productivity tools with machine learning for personal scheduling.

- Microsoft

- February 2025: Launch of Surface Copilot+ PCs for Business, including the Surface Pro and Surface Laptop. Powered by Intel Core Ultra (Series 2) and Snapdragon options, these devices stand out for best-in-class AI, battery life, and integrated Copilot productivity experience.

- Throughout 2025: The Surface portfolio has expanded to include more Windows Copilot+ features, tailored for professionals working in hybrid and mobile settings, with cellular 5G connectivity promised later this year.

- Lenovo

- March 2025 (MWC): Announced a ThinkBook “Flip” AI PC Concept – one of the most visible signs of AI hardware experimentation. This device features a folding OLED, AI-powered multitasking, and intelligent workspace adaptation.

- March 2025: Introduction of upgrades to ThinkPad and ThinkBook AI PCs, including models qualifying as Copilot+ PCs. Innovations focus on security, AI acceleration, and modularity for business users.

- MWC 2025: Release of Yoga and IdeaPad AI laptops, showcasing expanded Copilot+ access and NVIDIA GPU options for creative tasks, targeting both creators and corporate segments.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Processor Type (AI-optimized CPU, NPU, Integrated GPU, Discrete GPU), By Sales Channel (Online Sales, Offline Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Microsoft, Lenovo, HP INDIA SALES PRIVATE LIMITED, Dell Inc., ASUSTeK Computer Inc., Acer Inc., SAMSUNG, Razer Inc., Google LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apple Inc.

- Microsoft

- Lenovo

- HP INDIA SALES PRIVATE LIMITED

- Dell Inc.

- ASUSTeK Computer Inc.

- Acer Inc.

- SAMSUNG

- Razer Inc.

- Google LLC