Global AI in Regtech Market By Type (Solutions, Services), By Application (Regulatory Compliance, Risk Management, Financial Crime, Identity Management, Compliance Support, Analytics, Automated Trading, Other Applications), By Operation Mode (Unsupervised Learning, Supervised Learning, Reinforced Learning, Semi-Supervised Learning), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120612

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

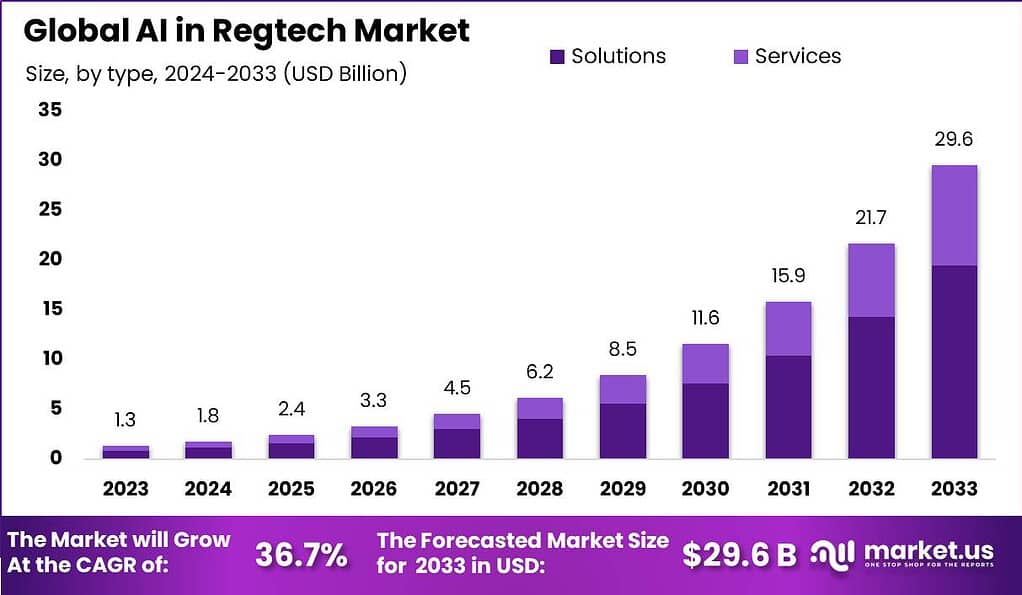

The Global AI in Regtech Market size is expected to be worth around USD 29.6 Billion By 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 36.7% during the forecast period from 2024 to 2033.

The AI in Regtech (Regulatory Technology) market refers to the application of artificial intelligence (AI) technologies and techniques in regulatory compliance and risk management processes. Regtech aims to streamline and automate regulatory processes for businesses, helping them navigate complex regulatory environments more efficiently while ensuring compliance. The AI in Regtech market is growing rapidly as businesses seek to enhance compliance processes and minimize the costs associated with regulatory requirements.

Key drivers for this market include the increasing need for risk management solutions and the pressure to comply with tightening global regulations. As AI technologies improve, they offer more precise analytics and stronger predictive capabilities, making them indispensable for companies aiming to stay ahead in regulatory compliance. This market trend is expected to continue, with AI playing a pivotal role in transforming how companies manage compliance and regulatory challenges.

The integration of AI in Regtech offers numerous benefits and opportunities. Firstly, AI can assist in automating compliance tasks, such as monitoring and analyzing vast amounts of data to detect potential risks and non-compliance issues. By leveraging machine learning algorithms, AI systems can learn from historical data and identify patterns and anomalies that indicate potential regulatory violations. This automation reduces the reliance on manual processes, improves accuracy, and provides real-time insights, enabling organizations to proactively address compliance issues.

The AI in Regtech market also presents challenges and considerations. One major challenge is data privacy and security. Regtech systems rely on access to sensitive and confidential data, including customer information and financial records. Ensuring robust data protection measures and compliance with regulations such as GDPR (General Data Protection Regulation) is crucial to maintain trust and safeguard against potential breaches.

Interpreting and explaining AI-driven decision-making processes is another challenge. Regulators and auditors need transparency and understandability in AI systems to evaluate compliance accurately. Developing explainable AI models and frameworks that can provide insights into the decision-making process is essential to address this challenge. Moreover, the implementation of AI in Regtech requires skilled professionals who possess both regulatory expertise and technical knowledge.

According to IBM’s findings, artificial intelligence (AI) is being progressively embraced within regulatory technology (RegTech) across three primary domains: Financial Risk Management, Financial Crime Risk Management (FCRM), and Governance, Risk & Compliance (GRC). A notable 70% of respondents from each sector are currently utilizing AI to enhance risk and compliance management. Meanwhile, only a minor fraction, about 4%, represent institutions that hold reservations towards AI integration.

The most widely utilized techniques in these RegTech solutions are Machine Learning (ML) and Natural Language Processing (NLP). NLP has become a fundamental component in numerous applications for 11% of institutions. While compliance requirements remain the primary driving force behind implementing AI in RegTech solutions for 64% of financial institutions, cost reduction (56%) and improved accuracy of processes and analysis (44%) were also cited as significant reasons.

The survey revealed that 42% of respondents believe that AI will have a substantial impact on data validation for regulatory reporting. Additionally, as GRC analytics gain momentum, there is increasing focus on quantifying Operational Risk (OpRisk), which is expected to be a growing area within the sector. Interviewees highlighted that among various OpRisk categories, cyber risk is currently at the forefront of quantification and modeling, benefitting from the rapid emergence of advanced AI techniques involving ML and other approaches.

Key Takeaways

- The global AI in regtech market size was valued at USD 1.3 billion in the year 2023 and is estimated to be at USD 30.5 billion in the year 2033 with a CAGR of 36.7% during the forecast period.

- Based on the type, the solution segment has dominated the market with a share of 65.9% in the year 2023.

- Based on the applications, the regulatory compliance segment is leading the market with a share of 30.6% in the year 2023.

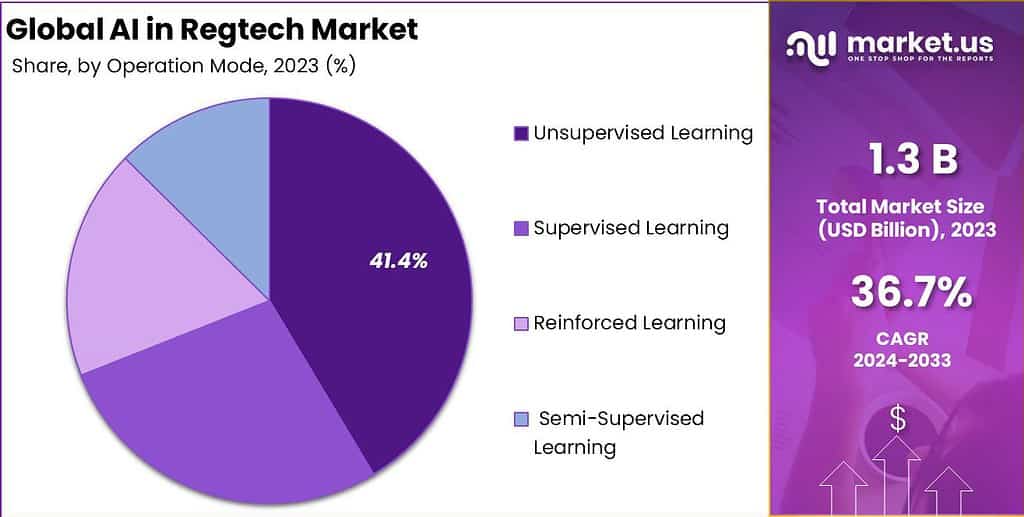

- Based on the operation mode, unsupervised learning has dominated the market with a share of 41.4% in the year 2023.

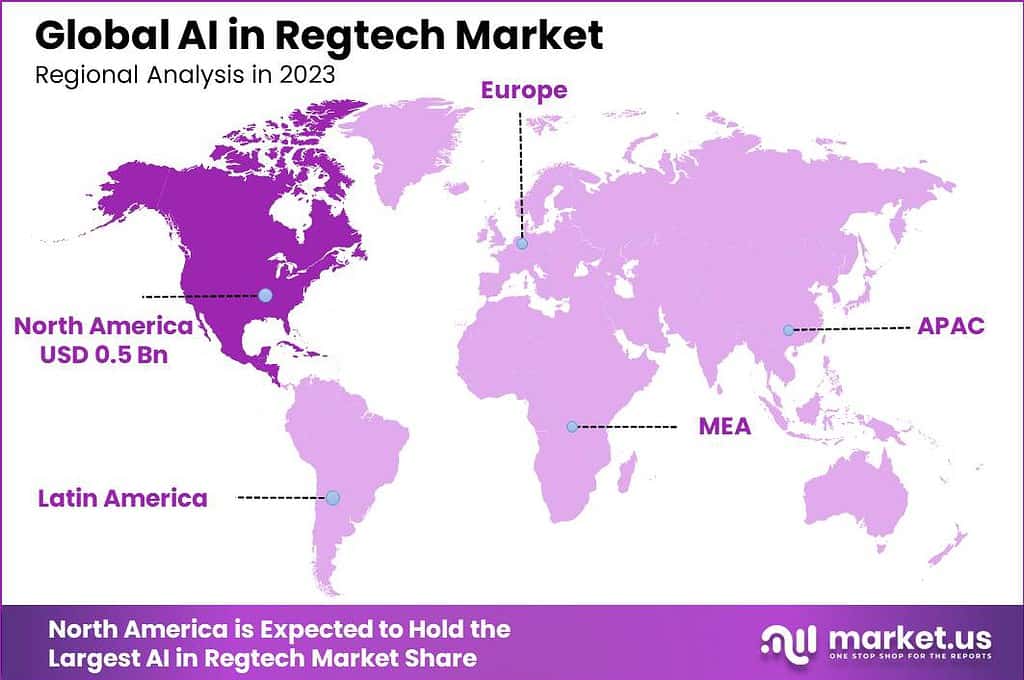

- North America region is leading the market with a share of 36.7% in the year 2023.

Type Analysis

In 2023, the Solutions segment held a dominant position in the AI in Regtech market, capturing more than 65.9% of the market share. This significant dominance can be attributed to the growing demand for automated regulatory compliance tools that reduce the need for manual intervention and increase efficiency.

AI-powered solutions such as compliance software, risk management systems, and audit trail systems are in high demand as they provide comprehensive and seamless management of regulatory processes. The adoption of these solutions enables businesses to adapt more rapidly to regulatory changes while ensuring accuracy and reducing the likelihood of non-compliance penalties.

Furthermore, AI-driven solutions in the Regtech sector have proven instrumental in analyzing large sets of data to identify potential risks and compliance issues before they escalate. This proactive approach in risk management is crucial for sectors like banking, financial services, and healthcare, where regulatory requirements are particularly stringent and the cost of non-compliance can be substantial. The integration of AI in these solutions allows for continuous learning and improvement, enhancing their effectiveness and making them a preferred choice for many organizations.

The leading position of the Solutions segment is also supported by technological advancements and increased investment in AI research, which have significantly enhanced the capabilities of regulatory technology solutions. Innovations such as natural language processing and machine learning enable these solutions to interpret complex regulatory documents and track changes with high precision, further driving their adoption. As organizations continue to face an increasingly challenging regulatory landscape, the reliance on AI-powered solutions is expected to grow, underpinning the segment’s dominant market share.

Application Analysis

In 2023, the Regulatory Compliance segment held a dominant market position in the AI in Regtech market, capturing more than a 30.6% share. This segment leads due to the critical need for organizations across industries to ensure that they are in compliance with ever-changing and increasingly complex regulations.

AI technologies streamline and automate compliance processes, which are otherwise resource-intensive and prone to human error. The adoption of AI in regulatory compliance helps organizations efficiently manage their compliance workflows, from monitoring and reporting to ensuring that all practices meet governmental standards.

The prominence of the Regulatory Compliance segment is further emphasized by the steep penalties and financial risks associated with non-compliance. AI-driven systems provide real-time monitoring and analysis capabilities, which are vital for keeping up with the rapid pace of regulatory changes and avoiding potential violations. These systems can also predict compliance risks before they become issues, allowing organizations to take preventative measures.

Additionally, the demand within this segment is bolstered by the increasing global expansion of companies and the corresponding complexity of managing compliance across different jurisdictions. AI solutions are adept at navigating these complexities, making them essential for multinational corporations. As regulatory burdens continue to grow and the global business environment becomes more interconnected, the reliance on AI for regulatory compliance is expected to increase, ensuring sustained growth and dominance of this segment in the Regtech market.

Operation Mode Analysis

In 2023, the Unsupervised Learning segment held a dominant market position in the AI in Regtech market, capturing more than a 41.4% share. This lead is largely due to unsupervised learning’s ability to analyze and interpret vast amounts of unstructured data without requiring specific programming for every task. This form of AI is particularly effective in identifying hidden patterns and anomalies in data, which are crucial for detecting potential compliance and regulatory risks that are not immediately obvious.

Unsupervised learning algorithms are highly valued in the Regtech sector for their efficiency in sifting through large datasets to discover insights that help financial institutions and other businesses prevent fraud and manage regulatory compliance more proactively. Since these algorithms do not require labeled data to operate, they can adapt to new and evolving types of data more swiftly than other AI methods. This adaptability makes unsupervised learning a powerful tool for organizations dealing with diverse and frequently changing regulatory environments.

The superiority of the Unsupervised Learning segment is also reinforced by its scalability and the reduced need for continuous oversight. As businesses increasingly rely on digital processes that generate large quantities of data, the importance of unsupervised learning grows. It allows companies to automate more of their data analysis processes, leading to significant cost savings and enhanced operational efficiency. These advantages ensure that unsupervised learning remains a cornerstone in the application of AI in the Regtech industry, driving its strong market share.

Key Market Segments

By Type

- Solutions

- Services

By Application

- Regulatory Compliance

- Risk Management

- Financial Crime

- Identity Management

- Compliance Support

- Analytics

- Automated Trading

- Other Applications

By Operation Model

- Unsupervised Learning

- Supervised Learning

- Reinforced Learning

- Semi-Supervised Learning

Driver

Increasing Demand for Compliance Efficiency

The growing need for improved efficiency and effectiveness in compliance management is a major driver in the AI Regtech market. Financial institutions and other organizations are faced with increasingly complex regulations, and AI helps manage these through efficient automation and precise analytics. By reducing manual processes and providing insights into compliance risks, AI technologies allow companies to streamline their compliance operations and react quickly to regulatory changes. This not only helps organizations reduce the risk of non-compliance and associated penalties but also significantly lowers the costs related to compliance management.

Restraint

Evolving Market with Integration Challenges

Despite the advantages, the AI Regtech market faces significant challenges due to its relatively recent emergence and the complexity of integration with existing systems. Many organizations are cautious about adopting new technologies without clear evidence of successful implementations and proven use cases.

This restraint is particularly pronounced in an industry where reliability and trust are paramount. Additionally, integrating sophisticated AI technologies with existing IT infrastructures can be complex and resource-intensive, posing a barrier to rapid adoption.

Opportunity

Expanding Application of AI and ML

There’s a substantial opportunity in the expanded application of AI and machine learning within Regtech for identifying and managing financial threats and risks. These technologies are increasingly capable of analyzing vast data sets to predict potential compliance issues before they become problematic.

Furthermore, with general data protection regulations like GDPR placing a greater emphasis on data management, financial institutions are compelled to adopt advanced regulatory technologies that ensure compliance and safeguard customer data. This trend presents significant growth opportunities for providers of AI-driven Regtech solutions.

Challenge

Keeping Pace with Regulatory Changes

One of the biggest challenges in the AI Regtech market is keeping pace with the rapid evolution and increasing complexity of financial regulations. AI systems must be continuously updated and trained on the latest regulatory requirements to ensure effectiveness. This dynamic regulatory landscape demands substantial ongoing investment in technology development and may strain the resources of Regtech providers. Furthermore, as new regulations are frequently introduced, ensuring that AI systems can quickly adapt and continue to provide accurate compliance support remains a daunting challenge for the sector.

Growth Factors

- Increased Regulatory Complexity: As regulations become more complex, the demand for AI-driven solutions to streamline and automate compliance processes grows, helping organizations to keep up with regulatory changes efficiently.

- Advancement in AI and Machine Learning Technologies: Continuous improvements in AI and ML technologies enhance the ability of Regtech solutions to analyze large datasets and identify compliance risks, driving their adoption.

- Global Increase in Financial Crimes: With the rise in financial crimes like money laundering, there is a greater need for effective regulatory technologies that can detect and prevent such illegal activities.

- Demand for Data Protection: The growing need for stringent data protection, driven by regulations like GDPR, pushes organizations to adopt Regtech solutions that ensure compliance and secure customer data.

- Integration of Regtech with Fintech: The merging of financial technology and regulatory technology provides more cohesive solutions that improve compliance and operational efficiency in financial services.

Latest Trends

- Cloud-Based Regtech Solutions: There’s a noticeable shift towards cloud-based solutions, offering scalability and accessibility benefits, which are particularly appealing for organizations looking to streamline their regulatory processes without heavy upfront investments.

- Focus on Anti-Money Laundering (AML) and Fraud Prevention: AI-driven Regtech tools are increasingly being used to enhance AML and fraud prevention measures, capable of detecting complex patterns and potential threats more effectively.

- Greater Emphasis on Consumer Protection: As consumer protection laws become stricter, there’s a trend towards using AI to ensure compliance and protect consumer rights, particularly in terms of privacy and data security.

- Adoption of Blockchain in Regtech: Blockchain technology is being explored for its potential to improve transparency and security in regulatory processes, particularly in areas like identity management and secure data sharing.

- Expansion in Emerging Markets: As markets in Asia-Pacific, Latin America, and the Middle East develop, there’s increased adoption of Regtech solutions to support rapid economic growth and ensure compliance with international standards.

Regional Analysis

In 2023, North America held a dominant market position in the AI in Regtech market, capturing more than a 36.7% share. This dominance is primarily due to the high concentration of financial service institutions and advanced technological infrastructure in the region, particularly in the United States and Canada. These countries are pioneers in adopting new technologies, including AI, to enhance regulatory processes and compliance management. The presence of major tech companies and startups focusing on AI solutions for regulatory compliance further fuels this trend.

Moreover, North America’s stringent regulatory environment requires robust compliance solutions, driving demand for AI-powered Regtech services. Regulatory bodies in the U.S., such as the Securities and Exchange Commission (SEC) and the Federal Reserve, continuously update regulations to address emerging financial risks and complexities, necessitating agile and effective compliance tools that AI technologies offer.

Additionally, the region’s openness to adopting cloud-based solutions amplifies the integration of AI in Regtech, making compliance processes more adaptable and less resource-intensive. This tech-forward approach, combined with significant investments in AI research and development from both private and public sectors, ensures that North America remains at the forefront of the global AI in Regtech market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The AI in the regulatory technology (regtech) market is highly competitive with several key players driving innovation and adoption. IBM Watson Financial Services leads with its robust AI solutions tailored for risk management and compliance, leveraging deep learning and natural language processing to enhance regulatory workflows. Trulioo and Onfido specialize in digital identity verification, employing AI to streamline KYC (Know Your Customer) and AML (Anti-Money Laundering) processes, crucial for financial institutions globally.

ComplyAdvantage and Behavox Ltd. focus on detecting financial crimes and ensuring compliance through sophisticated AI-driven monitoring systems. FundApps Ltd. and WorkFusion provide automation solutions that simplify the compliance processes for investment and asset management firms, integrating AI to manage and monitor regulatory requirements effectively.

Sift Science and Elliptic are pivotal in preventing fraud and financial crimes by utilizing AI to analyze transaction patterns and identify suspicious activities. AlgoDynamix offers risk analytics solutions that predict market disruptions by analyzing complex financial datasets with AI.

Top Key Players in the Market

- IBM Watson Financial Services

- White and Case LLP

- Sysxnet Limited

- Trulioo

- Onfido

- ComplyAdvantage

- Behavox Ltd.

- FundApps Ltd.

- Sift Science

- AlgoDynamix

- WorkFusion

- Trunomi

- Elliptic

- Fund Recs

- IdentityMind Global

- Corlytics Ltd.

- Other Key Players

Recent Developments

- In February 2024, Archer acquired Compliance.ai, a supplier of AI-driven regulatory change management solutions, and has launched AI-driven Regtech solutions.

- In October 2023, Surge Ventures, a California-based fintech company launched RegVerse, a new AI-driven compliance platform that focuses on advancing regulatory technology.

- In January 2023, Trulioo announced the launch of its latest identity verification platform enhancements, aimed at improving the speed and accuracy of regulatory compliance processes.

- In October 2023, FundApps, a provider of regulatory reporting solutions, announced the acquisition of Silverfinch to broaden its AI capabilities in regulatory compliance.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Bn Forecast Revenue (2033) USD 29.6 Bn CAGR (2024-2033) 36.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Solutions, Services), By Application (Regulatory Compliance, Risk Management, Financial Crime, Identity Management, Compliance Support, Analytics, Automated Trading, Other Applications), By Operation Mode (Unsupervised Learning, Supervised Learning, Reinforced Learning, Semi-Supervised Learning) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Watson Financial Services, White and Case LLP, Sysxnet Limited, Trulioo, Onfido, ComplyAdvantage, Behavox Ltd., FundApps Ltd., Sift Science, AlgoDynamix, WorkFusion, Trunomi, Elliptic, Fund Recs, IdentityMind Global, Corlytics Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Regtech?Regtech refers to the use of technology, particularly information technology, to enhance regulatory processes. The aim is to improve transparency, consistency, and compliance in the financial services industry.

How big is AI in Regtech Market?The Global AI in Regtech Market size is expected to be worth around USD 29.6 Billion By 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 36.7% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the AI in Regtech Market?The growth of AI in the Regtech market is driven by the increasing complexity of regulations, which demand more sophisticated compliance solutions. Financial institutions face rising costs of compliance and the risk of hefty fines for non-compliance. AI offers automation, accuracy, and efficiency, making it attractive

What are the current trends and advancements in AI in Regtech Market?Current trends in AI for Regtech include the integration of machine learning and natural language processing to improve data analysis and regulatory reporting. There's a growing focus on predictive analytics to foresee compliance issues before they arise. Blockchain technology is being combined with AI to enhance transparency and security in transactions.

What are the major challenges and opportunities in the AI in Regtech Market?One major challenge is ensuring data privacy and security while using AI technologies. Integrating AI systems with existing legacy systems can be complex and costly. There is also the risk of bias in AI algorithms, which can lead to unfair or inaccurate compliance decisions. However, opportunities abound in the form of reducing compliance costs, improving accuracy, and enhancing the ability to manage large volumes of regulatory data.

Who are the leading players in the AI in Regtech Market?Leading players in the AI Regtech market include companies like IBM Watson Financial Services, White and Case LLP, Sysxnet Limited, Trulioo, Onfido, ComplyAdvantage, Behavox Ltd., FundApps Ltd., Sift Science, AlgoDynamix, WorkFusion, Trunomi, Elliptic, Fund Recs, IdentityMind Global, Corlytics Ltd., Other Key Players

-

-

- IBM Watson Financial Services

- White and Case LLP

- Sysxnet Limited

- Trulioo

- Onfido

- ComplyAdvantage

- Behavox Ltd.

- FundApps Ltd.

- Sift Science

- AlgoDynamix

- WorkFusion

- Trunomi

- Elliptic

- Fund Recs

- IdentityMind Global

- Corlytics Ltd.

- Other Key Players