Global AI In Procurement Market Size, Share, Statistics Analysis Report By Component (Software, Services), By Deployment Mode (Cloud-Based, On-Premise), By Technology (Machine Learning (ML), Natural Language Processing (NLP), Computer Vision, Other Technologies), By Industry Vertical (Retail and E-commerce, Manufacturing, Healthcare, Transportation and Logistics, Government and Public Sector, Other Industry Verticals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 132998

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Deployment Mode Analysis

- Technology Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

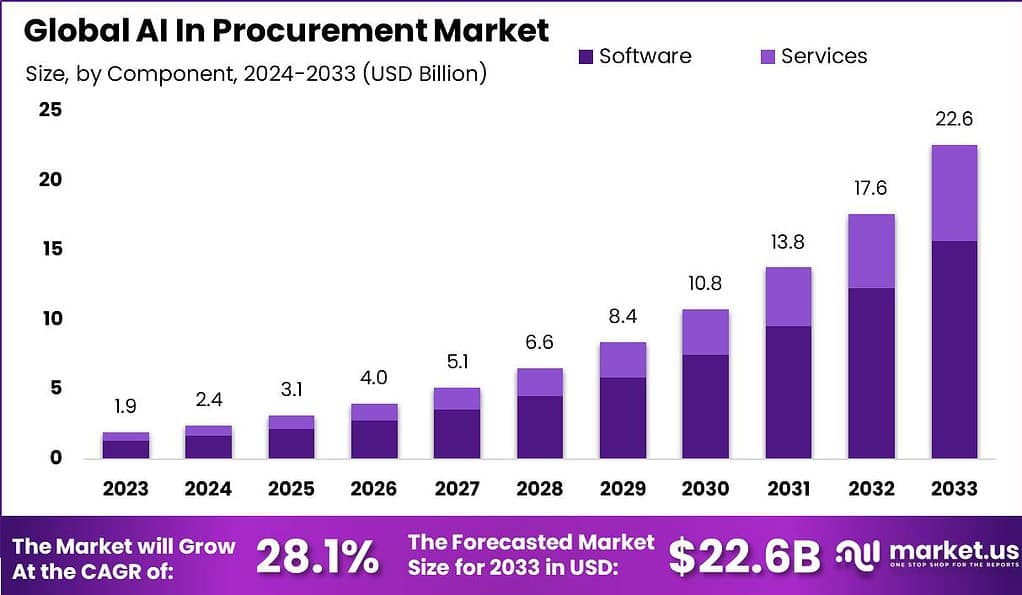

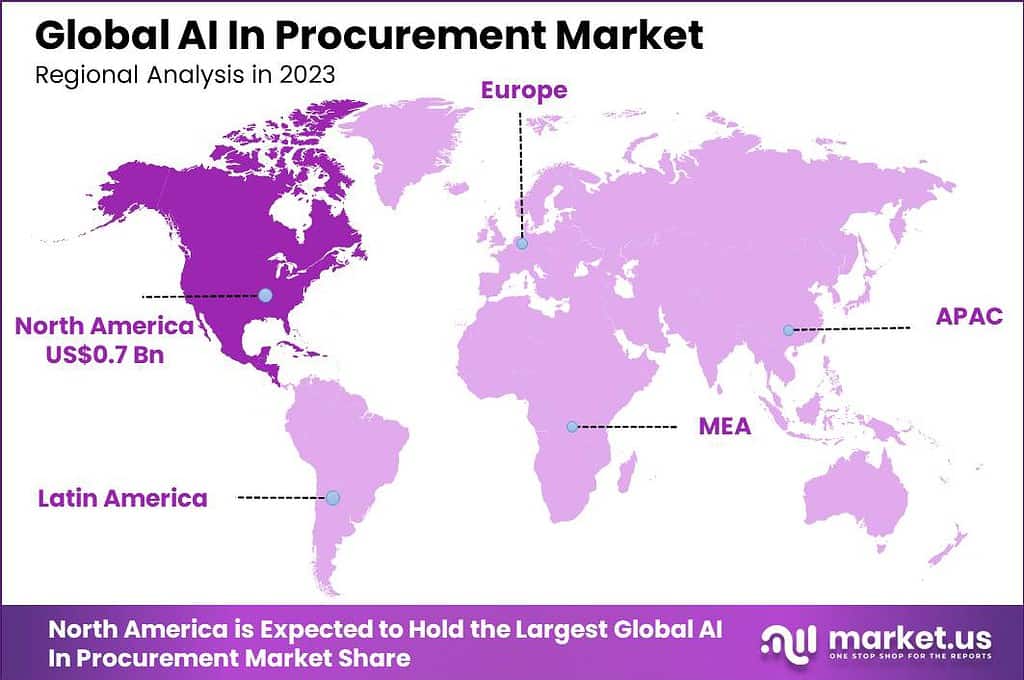

The Global AI in Procurement Market size is expected to be worth around USD 22.6 Billion by 2033, from USD 1.9 Billion in 2023, growing at a CAGR of 28.1% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38% share, holding USD 0.7 Billion revenue.

Artificial Intelligence (AI) in procurement refers to the integration of digital technologies designed to automate, enhance, and streamline various procurement processes. By employing advanced technologies such as machine learning, natural language processing (NLP), and robotic process automation (RPA), AI enables procurement teams to improve efficiency and accuracy across different operational tasks.

The procurement market is increasingly adopting AI technologies to transform traditional procurement strategies into more agile and intelligent operations. This shift is driven by the need to manage costs more effectively, enhance supply chain resilience, and optimize supplier relationships. As a result, AI in procurement has become a pivotal element in enabling businesses to stay competitive in a rapidly changing economic environment.

One of the major driving factors for the adoption of AI in procurement is the need for cost reduction and efficiency improvements. AI-powered tools help identify inefficiencies and overspending, automate routine tasks, and enable more effective demand forecasting and inventory management. This leads to smarter spending and procurement strategies, significantly cutting down costs and enhancing operational efficiencies.

Technological advancements in AI, like deep learning and generative AI, are setting new benchmarks for what can be achieved in procurement. These technologies provide the ability to process and analyze vast amounts of data, offering unprecedented insights into procurement operations. Furthermore, AI advancements are improving the automation of complex procurement tasks, such as contract analysis and risk assessment, leading to more resilient and adaptable procurement strategies.

The market demand for AI in procurement is growing as companies seek new ways to enhance decision-making and optimize spending. AI offers substantial opportunities in areas such as predictive analytics, which allows businesses to forecast future needs and market conditions more accurately. Additionally, AI facilitates better supplier risk management and compliance monitoring, ensuring that procurement activities align with both internal policies and external regulations.

According to Tipalti, 98% of companies have already incorporated AI into their workflows, including areas like procurement, customer management, and finance operations. This widespread adoption highlights how businesses are using AI to streamline processes, enhance decision-making, and improve efficiency across multiple departments.

Research from Zipdo reveals that 57% of procurement professionals believe AI will significantly impact the industry by 2025. Already, 35% of procurement organizations are leveraging AI tools in some capacity, reaping benefits such as reduced costs and improved efficiency. AI-powered solutions have been shown to lower purchasing expenses by up to 8%, showcasing the tangible value of this technology.

AI is not only about cost savings but also about unlocking new opportunities. For example, AI-driven spend analysis can uncover potential savings of up to 20%, while automating up to 95% of routine procurement tasks. This shift enables teams to focus on strategic projects rather than time-consuming manual processes, driving long-term organizational growth.

Procurement leaders are increasingly viewing AI as a transformative tool. In fact, 63% see AI as a game-changer for optimizing procurement processes. AI-powered chatbots can resolve up to 80% of routine inquiries, and by 2023, 30% of procurement teams will rely on AI to automate supplier risk management. These advancements are set to redefine how businesses manage procurement in the coming years.

Key Takeaways

- The Global AI in Procurement Market is on a remarkable growth trajectory, with its value projected to reach USD 22.6 billion by 2033, up from USD 1.9 billion in 2023. This represents an impressive compound annual growth rate (CAGR) of 28.1% over the forecast period (2024–2033).

- North America led the market in 2023, securing over 38% of the global share. The region generated approximately USD 0.7 billion in revenue, driven by rapid adoption and technological advancements.

- The software component dominated the AI in procurement market, holding a significant 69.5% share in 2023, reflecting the increasing demand for AI-driven tools and platforms.

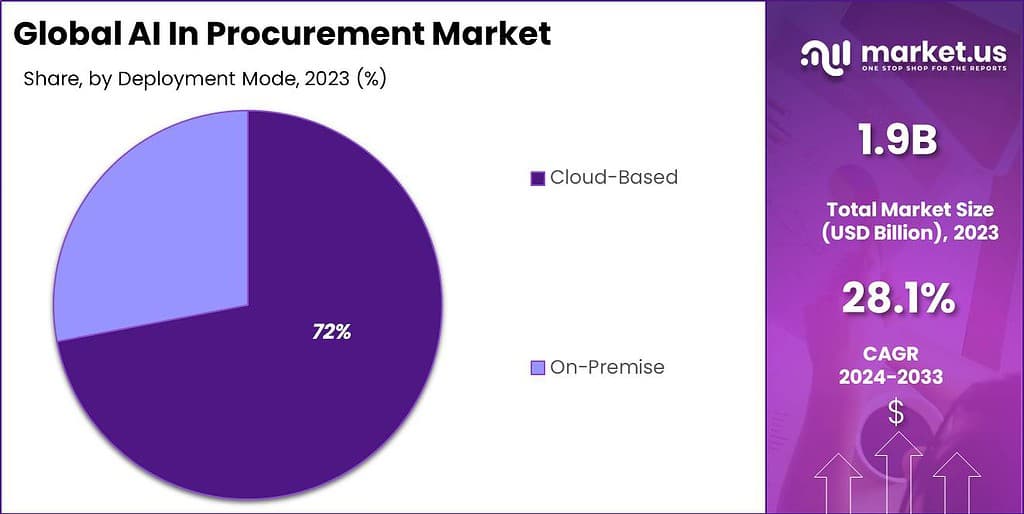

- Cloud-based solutions gained strong traction, with the cloud deployment segment commanding a robust 72% share of the market in 2023, as businesses prioritized scalability and ease of use.

- Among AI technologies, Machine Learning (ML) emerged as the leader, capturing more than 43.4% of the market share in 2023, owing to its ability to improve decision-making processes and drive efficiency.

- The Retail and E-commerce sector dominated industry applications, accounting for over 23.1% of the market share in 2023, as these industries increasingly leveraged AI for cost optimization and supplier management.

Component Analysis

In 2023, the software component within the AI in procurement market held a dominant position, capturing more than 69.5% of the market share. This prominence can be attributed to the crucial role that AI-driven software solutions play in enhancing the effectiveness of procurement processes.

By integrating artificial intelligence, these software solutions help businesses automate complex tasks, refine data analytics, and bolster decision-making accuracy. Such capabilities are essential for optimizing efficiency and reducing operational costs in procurement operations, which are critical for maintaining competitive advantage in various industries.

The dominance of the software segment is further underscored by the adoption of advanced machine learning algorithms and the increasing availability of cloud-based AI solutions. These technological advancements have made AI software more accessible and scalable, appealing to a wide range of businesses, from small startups to large enterprises.

Additionally, the deployment of cloud-based solutions offers the benefit of reducing substantial upfront investments in hardware, making it economically feasible for companies to adopt AI without incurring significant capital expenditures. Moreover, AI-driven software in procurement not only streamlines operations such as inventory management and demand forecasting but also plays a pivotal role in areas like route optimization and freight brokerage.

These functions are crucial for ensuring efficient supply chain management, which directly impacts the overall productivity and profitability of businesses. As the market continues to evolve, the importance of AI software in procurement is expected to grow, driven by ongoing technological innovations and the increasing complexity of global supply chains.

Thus, the software segment’s significant market share is a reflection of its integral role in transforming procurement into a more strategic, responsive, and cost-efficient function within organizations. This trend is likely to persist as AI technologies continue to advance, offering even more sophisticated tools for procurement professionals to enhance their operations and strategic decision-making capabilities.

Deployment Mode Analysis

In 2023, the cloud-based deployment segment of the AI in procurement market held a commanding lead, capturing more than a 72% share. This dominance is primarily due to the numerous advantages cloud-based solutions offer over traditional on-premise models.

Firstly, cloud-based AI solutions provide remarkable scalability and flexibility, allowing businesses to adjust resources based on their current needs without significant upfront investments. This flexibility is particularly valuable in procurement, where the scale of operations can vary significantly based on market conditions and business demands.

Additionally, cloud-based platforms facilitate easier and more robust data integration and management. They enable seamless updates and upgrades without disrupting the user experience, ensuring that procurement teams always have access to the latest functionalities and security features. This is crucial for maintaining the integrity and efficiency of procurement processes in a landscape that increasingly relies on real-time data for decision-making.

The popularity of cloud-based AI in procurement is also bolstered by the lower total cost of ownership when compared to on-premise solutions. Cloud solutions reduce the need for extensive internal IT infrastructure and maintenance, which can be particularly cost-prohibitive for small to medium-sized enterprises. Instead, these businesses can leverage sophisticated AI tools through the cloud at a fraction of the cost, enabling them to compete more effectively with larger companies and optimize their procurement strategies more effectively.

This segment’s growth is further supported by the increasing trust in cloud security and enhanced regulatory compliance that cloud service providers offer. As cloud technology continues to mature, the concerns regarding data security and privacy that once acted as barriers to its adoption are being addressed through rigorous security measures and compliance with international data protection regulations, making cloud-based solutions a preferred choice in the AI in procurement space.

Technology Analysis

In 2023, the Machine Learning (ML) technology segment in the AI in procurement market held a dominant position, capturing more than a 43.4% market share. This substantial share can be attributed to the versatility and efficacy of ML in enhancing various procurement processes.

Machine learning automates complex decision-making processes by analyzing large data sets, enabling procurement teams to make faster and more informed decisions. This technology is pivotal for tasks such as spend analysis, where it can identify patterns and insights that help in cost reduction and risk mitigation.

Moreover, ML’s capability to improve demand forecasting and inventory management is particularly valuable in procurement. By accurately predicting future demands based on historical data and market trends, organizations can optimize their inventory levels, reducing both excess stock and shortages. This not only ensures operational efficiency but also contributes to substantial cost savings.

Additionally, ML technologies play a critical role in enhancing supplier relationship management and contract management. They allow for the automation of routine tasks and the processing of complex datasets to evaluate supplier performance and compliance, streamlining these essential procurement functions. As a result, companies can manage their supplier relationships more effectively, ensuring compliance and fostering better collaboration.

The dominance of the ML segment is expected to continue as advancements in AI technologies drive further integration into procurement systems, making processes even more efficient and data-driven. This will likely solidify ML’s role as a foundational technology in the evolving landscape of procurement automation.

Industry Vertical Analysis

In 2023, the Retail and E-commerce sector held a dominant position in the AI in procurement market, capturing more than a 23.1% share. This leading position can be attributed to several pivotal factors that underscore the crucial role of AI in transforming procurement operations within this sector.

Retailers and e-commerce platforms are increasingly leveraging AI to enhance efficiency across their complex supply chains, optimize inventory management, and improve customer experience by ensuring product availability and timely delivery.

AI technologies, particularly in machine learning and predictive analytics, are instrumental in forecasting demand, managing vast amounts of inventory data, and optimizing logistics. This enables retailers to respond swiftly to market changes and consumer preferences, which is vital in the fast-paced retail environment.

Furthermore, AI-driven tools assist in automating routine procurement tasks such as supplier selection and purchase order processing, which significantly reduces operational costs and increases the accuracy of procurement decisions.

Moreover, the integration of AI in retail procurement helps in strategic sourcing by providing insights into supplier performance and market dynamics. This not only ensures the stability of supply chains but also enhances the ability to negotiate better terms with suppliers, thereby driving cost efficiencies and improving profit margins. As the retail and e-commerce sector continues to grow and evolve, the reliance on AI technologies to streamline procurement processes and improve competitive edge is expected to increase further.

Key Market Segments

Component

- Software

- Services

Deployment Mode

- Cloud-Based

- On-Premise

Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Computer Vision

- Other Technologies

Industry Vertical

- Retail and E-commerce

- Manufacturing

- Healthcare

- Transportation and Logistics

- Government and Public Sector

- Other Industry Verticals

Driver

Enhanced Decision-Making and Efficiency

One of the primary drivers of AI in procurement is its capacity to significantly enhance decision-making and increase operational efficiency. AI technologies, especially machine learning and predictive analytics, allow procurement teams to analyze vast quantities of data quickly and accurately.

This capability supports smarter decision-making by providing detailed insights into spending patterns, supplier performance, and market trends. By automating data-intensive tasks such as spend analysis and supplier evaluations, AI frees up human resources to focus on more strategic and value-added activities.

Restraint

Data Quality and Integration Challenges

A significant restraint in the deployment of AI within procurement is the high dependency on data quality and the complexity of system integration. AI systems require large volumes of accurate and comprehensive data to function optimally.

Poor data quality can lead to incorrect insights, potentially compromising decision-making processes. Integrating AI with existing procurement and enterprise resource planning (ERP) systems poses another challenge, often requiring substantial customization and middleware. These factors can increase the complexity and cost of AI implementation, potentially slowing down adoption rates.

Opportunity

Advanced Analytics and Automation

AI presents considerable opportunities for automation and advanced analytics in procurement. With AI, organizations can automate routine procurement tasks such as transaction processing and compliance checks, which not only speeds up operations but also reduces errors.

Furthermore, AI’s advanced analytics capabilities enable procurement teams to conduct deep dives into supplier data, spending habits, and market conditions, uncovering opportunities for cost savings and risk mitigation. These opportunities are particularly crucial in helping organizations maintain competitiveness and adaptability in rapidly changing markets.

Challenge

Ethical and Compliance Concerns

The implementation of AI in procurement is not without its challenges, with ethical considerations and compliance issues at the forefront. AI systems can inadvertently perpetuate existing biases present in the training data, leading to unfair outcomes in supplier selection or spend categorization.

Additionally, as procurement processes often involve sensitive data, ensuring the security and privacy of this information when using AI systems is critical. Organizations must navigate these challenges carefully by implementing robust data governance frameworks and ensuring that AI applications adhere to ethical guidelines and compliance standards.

Growth Factors

The evolution of AI in procurement is primarily driven by the technology’s ability to enhance decision-making and operational efficiency. AI’s deep learning and predictive analytics capabilities allow for more informed strategic decisions by analyzing comprehensive data on supplier performance, market trends, and internal procurement operations.

This leads to more effective risk management, cost savings, and optimized procurement strategies. Additionally, AI facilitates the automation of routine tasks such as transaction processing and compliance checks, which improves speed and reduces errors, freeing up human resources for strategic initiatives that add greater value.

Emerging Trends

Emerging trends in AI procurement include the integration of advanced analytical tools and machine learning algorithms that enable real-time spend analysis and supplier assessments. These technologies are reshaping how organizations handle their procurement by providing deeper insights into spend categorization and enabling proactive management of procurement activities.

Furthermore, the use of natural language processing (NLP) is on the rise, improving the automation of customer service and data management within procurement processes. Another significant trend is the adoption of robotic process automation (RPA) to streamline and accelerate time-consuming procurement tasks, such as invoice processing and purchase order generation.

Business Benefits

AI in procurement offers substantial business benefits, including enhanced efficiency and cost-effectiveness. By automating manual and repetitive tasks, AI allows procurement teams to focus on strategic and high-value activities. This shift not only boosts productivity but also enhances the overall effectiveness of procurement functions.

AI-driven tools provide sophisticated data analysis that supports better supplier selection and strategic sourcing decisions, leading to improved business negotiations and cost savings. Additionally, AI enables greater scalability and adaptability in procurement operations, accommodating varying data volumes and complex business needs, which is particularly beneficial for growing businesses or those entering new markets.

Regional Analysis

In 2023, North America held a dominant market position in the global AI in Procurement Market, capturing more than a 38% share. The dominance of North America in the AI in procurement market is driven by a convergence of several influential factors.

The region boasts a thriving technological ecosystem, with numerous tech giants, start-ups, and research institutions at the forefront of AI innovation. This concentration of expertise fosters a culture of innovation and entrepreneurship, driving the development and adoption of cutting-edge AI solutions in procurement.

Moreover, North America’s strong economy and high level of industrialization have propelled the adoption of advanced technologies across various sectors, including procurement. Organizations in industries such as manufacturing, retail, healthcare, and finance are increasingly turning to AI-powered procurement solutions to streamline operations, optimize supply chains, and gain a competitive edge.

Additionally, North America benefits from a supportive regulatory environment and robust infrastructure, which facilitate the deployment and integration of AI technologies in procurement processes. This conducive ecosystem encourages investment in AI initiatives and fosters collaboration between industry players, academia, and government agencies to drive innovation and market growth.

Furthermore, the region’s large and diverse market provides ample opportunities for AI vendors to showcase their solutions and establish a strong presence. This market size and diversity enable vendors to cater to the unique needs of various industries and verticals, further solidifying North America’s dominance in the AI in procurement market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading player in the market is SAP Ariba, that offers an AI powered procurement solutions. SAP Airba focuses on automation suppliers management and contract negotiations. Further another prominent player in the market is IBM, that helps businesses optimize procurement processes by utilizing machine learning and natural language processing.

Top Key Players in the Market

- IBM Corporation

- SAP SE

- Microsoft Corporation

- Oracle Corporation

- Coupa Software Inc.

- GEP

- Basware Corporation

- Xeeva, Inc.

- Zycus Inc.

- Ivalua Inc.

- Tradeshift Holdings, Inc.

- Proactis Holdings Limited

- Other Key Players

Recent Developments

- In November 2024, Jabil Inc. (NYSE:JBL), a global leader in engineering, manufacturing, and supply chain solutions today announced ID8 Global, a joint venture with Cyferd Inc., a pioneering AI company specializing in data technology. Together, they are introducing a generative AI-driven, autonomous supply chain and procurement software platform that will transform how industries manage complex logistics, procurement, and operations on a global scale.

- In November 2024, Jabil and Cyferd have announced a joint venture called ID8 Global to launch an AI-driven autonomous supply chain and procurement platform. The collaboration combines Jabil’s global supply chain expertise with Cyferd’s proprietary self-learning AI engine, Neural Genesis.

Report Scope

Report Features Description Market Value (2023) USD 1.9 Bn Forecast Revenue (2033) USD 22.6 Bn CAGR (2024-2033) 28.1% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), Deployment Mode (Cloud-Based, On-Premise), By Technology (Machine Learning (ML), Natural Language Processing (NLP), Computer Vision, Other Technologies), By Industry Vertical (Retail and E-commerce, Manufacturing, Healthcare, Transportation and Logistics, Government and Public Sector, Other Industry Verticals) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape IBM Corporation, SAP SE, Microsoft Corporation, Oracle Corporation, Coupa Software Inc., GEP, Basware Corporation, Xeeva, Inc., Zycus Inc., Ivalua Inc., Tradeshift Holdings, Inc., Proactis Holdings Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBM Corporation

- SAP SE

- Microsoft Corporation

- Oracle Corporation

- Coupa Software Inc.

- GEP

- Basware Corporation

- Xeeva, Inc.

- Zycus Inc.

- Ivalua Inc.

- Tradeshift Holdings, Inc.

- Proactis Holdings Limited

- Other Key Players