Global AI in Materials Discovery Market Size, Share, Industry Analysis Report By Technology (Machine Learning, Deep Learning, Generative AI, Natural Language Processing), By Application (Battery Materials, Semiconductor Materials, Polymer Materials, Catalyst Materials, Metal Alloy Materials, Others), By End-User (Chemical Companies, Pharmaceutical Companies, Research Institutions, Manufacturing Companies, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166625

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Findings

- Performance and Key Market Insights

- Role of Generative AI

- Investment and Business Benefits

- China Market Size

- Technology Analysis

- Application Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

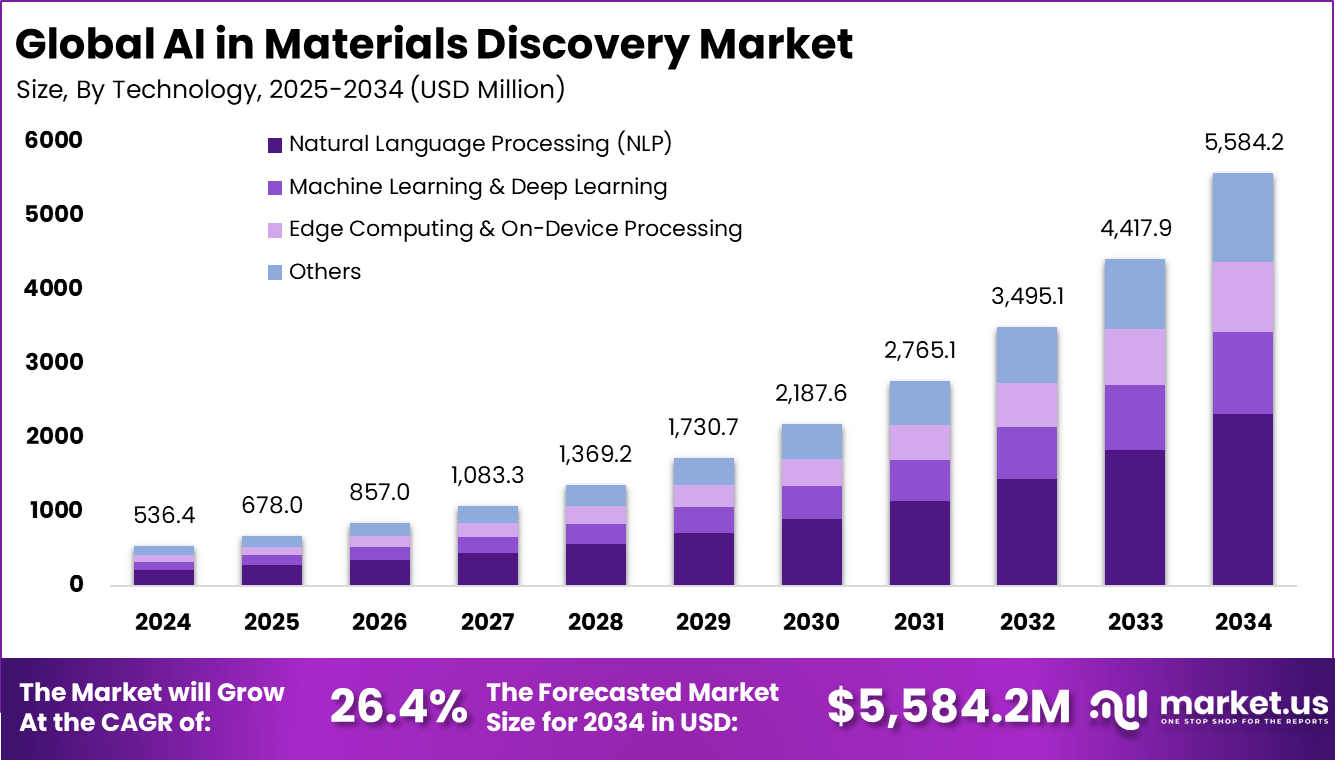

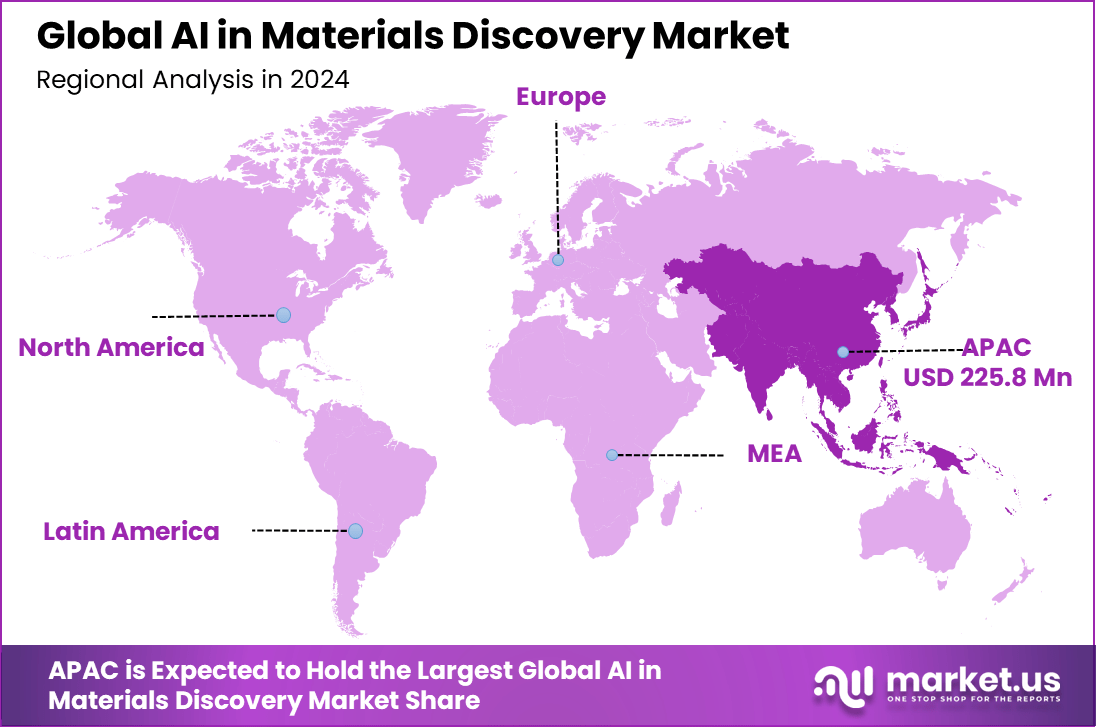

The Global AI in Materials Discovery Market size is expected to be worth around USD 5,584.2 million by 2034, from USD 536.4 million in 2024, growing at a CAGR of 26.4% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 42.1% share, holding USD 225.8 million in revenue, according to latest report published by Market.us.

AI in Materials Discovery Market refers to using artificial intelligence tools like machine learning and data-driven algorithms to speed up discovering, designing, developing, and testing new materials. This technology helps researchers and industries reduce time from concept to product by quickly predicting material properties such as hardness, thermal resistance, and durability. It’s particularly useful for polymers, alloys, nanomaterials, and advanced materials in sectors like aerospace, energy, and electronics.

A major driver is the increasing demand for faster research and development cycles. AI reduces the time needed to experiment by predicting outcomes from large datasets, accelerating innovation. There is also growing demand for smart and sustainable materials, especially in automotive, aerospace, and clean energy. The availability of big data in material science enhances AI’s effectiveness, enabling more precise analysis and design.

The market for AI in materials discovery is driven by the need to accelerate the development of new materials with improved properties. AI technologies enable rapid screening and prediction of material behavior, significantly cutting research time and costs. This speed and efficiency allow companies to innovate faster, meet increasing demand for advanced materials in industries like electronics, energy, and healthcare, and reduce trial-and-error experiments.

For instance, in September 2025, Cambridge-based CuspAI announced it had closed a $100M Series A funding round aimed at accelerating AI-powered materials discovery. The company is focused on developing agentic AI systems that support researchers in achieving specific goals through interaction in plain English. Their technologies aim to shorten the materials innovation cycle significantly by applying advanced AI models to speed up discovery and optimization processes that traditionally take many years.

Key Findings

- In 2024, the Machine Learning segment held the leading position in the Global AI in Materials Discovery Market, with a 41.5% share.

- In 2024, the Battery Materials segment was the top material category, accounting for 32.4% of the Global AI in Materials Discovery Market.

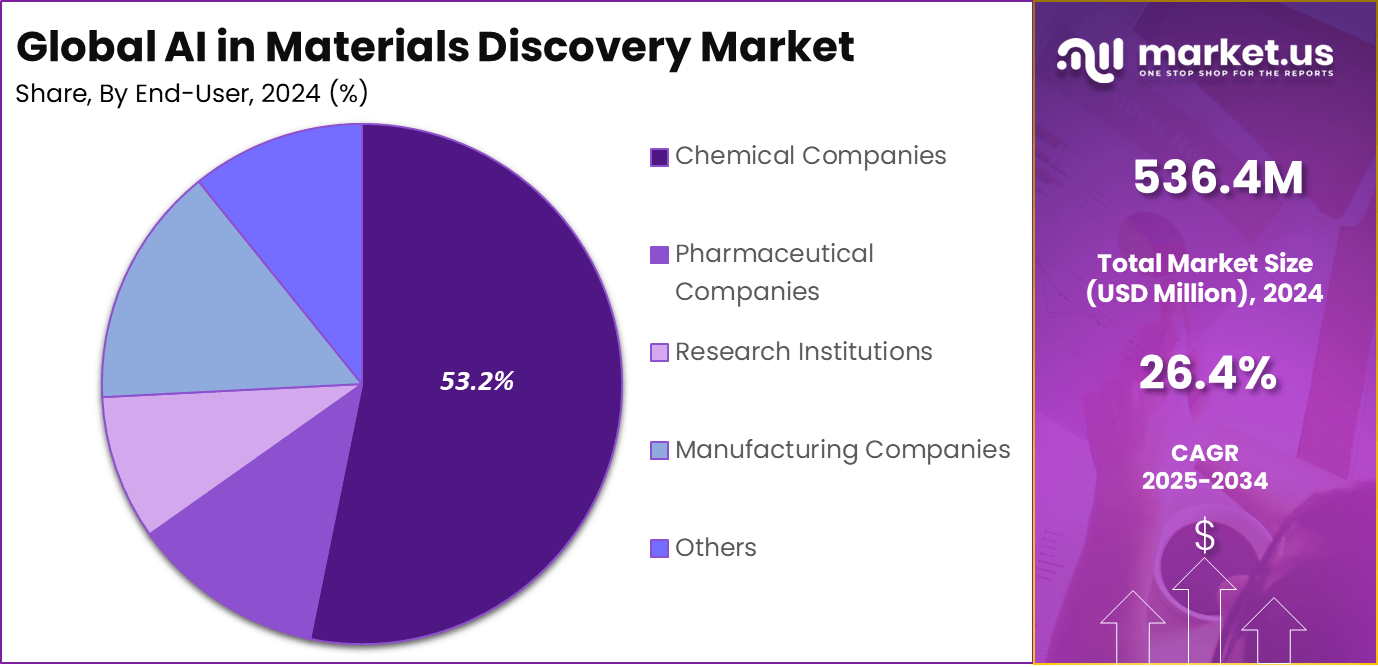

- In 2024, Chemical Companies represented the main end user group, capturing a dominant 53.2% share of the Global AI in Materials Discovery Market.

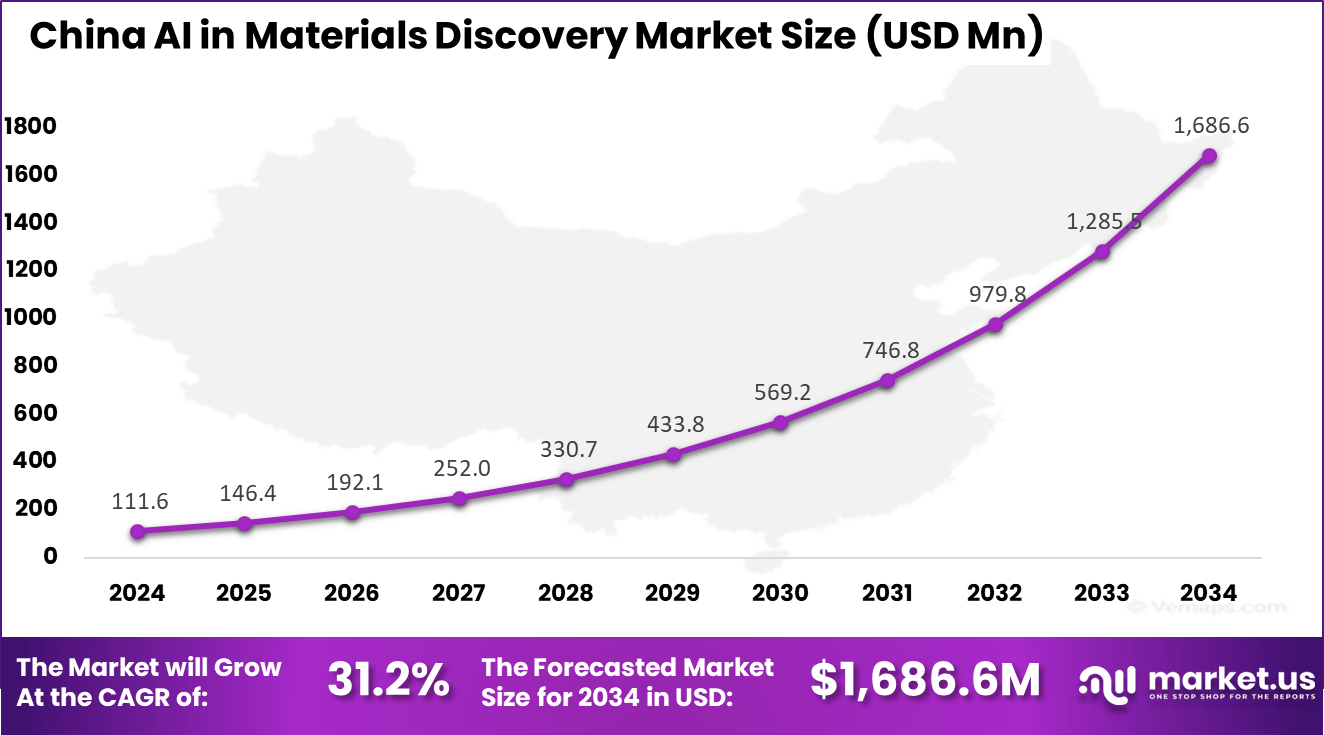

- The China AI in Materials Discovery Market was valued at USD 111.6 million in 2024, supported by a strong CAGR of 31.2%.

- In 2024, Asia Pacific was the leading regional market for AI in materials discovery, holding more than 42.1% of the global share.

Performance and Key Market Insights

Key Performance and Productivity Statistics

- 44% higher material discovery rates are achieved when researchers use AI tools.

- Patent output rises by 39% for AI-assisted research teams.

- AI shortens R&D cycles by 5 to 10 times, improving success rates for new materials by 40 to 60%.

- Overall R&D efficiency improves by 30 to 50% with AI integration.

- A new material such as the AL 7A77 alloy reached commercialization in two years, far faster than traditional timelines.

- AI models can simulate properties of 1,000 two dimensional materials in about 10 seconds, compared to more than 10 million seconds with classical methods.

- Predictive accuracy exceeds 98% for AI systems identifying crystal structures from complex or noisy experimental data.

Industry and Market Statistics

- The Generative AI in Material Science Market is projected to reach USD 11.7 Billion by 2034, rising from USD 1.1 Billion in 2024, with a 26.4% CAGR from 2025 to 2034.

- North America held more than 36% share of the market in 2024, valued at USD 0.3 Billion.

- Investments in AI driven materials R&D increased by 60% in a recent year.

- Around 42% of research teams currently use AI native simulation platforms, while one third more are in testing or evaluation.

- AI based materials account for 30% of the global automotive sector’s materials usage.

- Generative AI could create up to USD 140 Billion in value across the energy and materials sector.

Major AI Discoveries

- Google DeepMind’s GNoME tool identified 2.2 million new stable crystalline materials, equal to roughly 800 years of traditional discovery progress.

- Independent researchers have already synthesized 736 of these predicted materials.

- GNoME uncovered 52,000 new layered compounds similar to graphene.

- The system identified 528 potential lithium ion conductors, which is 25 times more than a previous major study.

- More than 380,000 of the most stable predicted materials have been made available for public research.

Role of Generative AI

Generative AI is changing how new materials are found by quickly designing materials with specific properties. Instead of testing many combinations by hand, generative AI creates new material structures fast, helping researchers save time. It can produce materials that fit precise performance needs that older techniques could miss.

In fact, recent data shows that generative AI models are already producing material ideas up to 10 times closer to actual usable forms compared to previous methods. This technology works by exploring many possible material designs within a virtual space and finding stable candidates that match goals like strength or conductivity.

It has proven especially useful in fields that need tailored materials, such as energy or electronics. Generative AI thus helps scientists look beyond known compounds to create novel, high-performing materials more efficiently, speeding up innovation timelines by large margins.

Investment and Business Benefits

Investment Opportunities in AI-powered materials platforms are rising, driven by government and corporate funding focused on strategic materials development. Governments allocate grants worth tens to hundreds of millions of euros in strategic R&D funding, while large material producers invest strategically in this space.

Venture capital is also flowing into startups equipped with AI-native discovery stacks that promise to disrupt traditional material innovation pipelines. This strong investment signal suggests growing market confidence and an expanding global ecosystem around AI in materials.

Business Benefits include dramatically faster research and innovation cycles, reduced dependency on scarce raw materials, and improved product performance. AI leads to lower material waste and production costs by identifying optimal material combinations earlier. Companies gain a competitive advantage through accelerated product launches and sustainability improvements.

China Market Size

The market for AI in Materials Discovery within China is growing tremendously and is currently valued at USD 111.6 million, the market has a projected CAGR of 31.2%. This rapid growth is driven by strong government support for AI research and materials innovation, along with increasing investments from both private and public sectors.

China’s focus on advanced manufacturing, clean energy technologies, and high-tech materials accelerates the adoption of AI-powered discovery tools. Collaborations between research institutions and industry further boost the development of new materials, helping China maintain a competitive edge in the global technology landscape.

For instance, In October 2025, Insilico Medicine in Hong Kong presented its advanced AI platform for drug and materials discovery at the BIOHK 2025 conference. The company showed how generative AI and automation cut traditional discovery timelines from several years to about 12–18 months, while enabling the synthesis and testing of hundreds of molecules within each program.

In 2024, Asia Pacific held a dominant market position in the Global AI in Materials Discovery Market, capturing more than a 42.1% share, holding USD 225.8 million in revenue. This leadership stems from rapid industrial growth, strong government initiatives supporting AI and materials innovation, and substantial investments in research infrastructure.

Countries like China, Japan, and South Korea drive demand with their focus on advanced manufacturing and energy technologies requiring new materials. The thriving collaboration between academia, industry, and startups further fuels innovation, positioning the Asia Pacific as a key hub for applying AI to accelerate materials discovery and development.

Technology Analysis

In 2024, The Machine Learning segment held a dominant market position, capturing a 41.5% share of the Global AI in Materials Discovery Market. Machine learning has become a key technology in accelerating materials discovery due to its ability to analyze large datasets and find patterns that humans might miss. It can predict material properties like strength and conductivity by learning from existing data, which speeds up the identification of promising new materials.

Moreover, machine learning models are flexible and can be applied across various materials, including metals, polymers, and composites. Their ease of integration into research workflows makes them highly valuable for scientists aiming to innovate efficiently. This technology transforms traditional materials research into a more data-driven and efficient process while lowering costs and speeding results.

For Instance, in October 2025, IBM announced a new AI-driven platform that enhances machine learning models for materials discovery, aiming to reduce the development cycle for new materials. This platform focuses on integrating large data sets and advanced algorithms to predict material properties more accurately, supporting faster innovation in sectors like electronics and energy.

Application Analysis

In 2024, the Battery Materials segment held a dominant market position, capturing a 32.4% share of the Global AI in Materials Discovery Market. Battery materials are one of the fastest-growing application areas for AI in materials discovery. AI helps find new battery components that offer better energy storage, safety, and durability.

By quickly screening thousands of chemical combinations and structures, AI assists in identifying materials with improved performance, which is critical for electric vehicles and renewable energy storage. This approach drastically reduces the trial-and-error time from years to months.

It enables researchers to focus on the most promising candidates earlier in the development process. This speed and precision are essential for meeting the rising demand for advanced battery technologies that support sustainable energy goals.

For instance, in September 2025, Citrine Informatics announced an update to its AI platform that improves the prediction of battery electrolyte stability. This development aims to help manufacturers identify safer, more efficient electrolytes, reducing the time for testing and validation in the battery industry.

End-User Analysis

In 2024, the Chemical Companies segment held a dominant market position, capturing a 53.2% share of the Global AI in Materials Discovery Market. Chemical companies are the leading end users of AI in materials discovery due to their need for continuous innovation.

AI helps them accelerate product development by predicting which new chemicals or materials will perform best, avoiding slow and costly experimental tests. This results in faster innovation cycles and the ability to develop higher-quality products.

These companies benefit from improved efficiency as AI aids in optimizing chemical formulations and processes. By adopting AI tools, they reduce research costs and time, enabling quicker responses to market needs and regulatory requirements. This widespread AI adoption reflects the crucial role it plays in the modern chemical industry R&D.

For Instance, in August 2025, BenevolentAI reported a breakthrough in AI-assisted chemical synthesis predictions, enabling chemical companies to design new high-performance materials more efficiently. This technology improves formulation accuracy, speeding up development cycles and reducing costs.

Emerging Trends

A notable trend is the growing use of AI-driven inverse design, where materials are generated directly from desired outcomes rather than from existing templates. This shift enables exploration beyond known chemical spaces, opening up possibilities for materials with breakthrough properties.

Additionally, AI-powered integration with high-throughput experimentation and expansive materials databases is improving the speed and accuracy of materials screening, with one model doubling the output of stable, unique materials.

The rise of smart materials in sectors like aerospace and electronics is also driving AI adoption, supported by the increasing availability of big data from computational materials science. This trend is pushing AI tool developers to create solutions that can handle complex chemical reaction datasets and optimize nanomaterial innovations.

Growth Factors

The speed and cost advantages offered by AI are key growth drivers. AI significantly cuts down R&D timelines by quickly assessing many material combinations, allowing faster breakthroughs. Its ability to predict material behaviors without exhaustive physical experiments lowers costs and reduces resource use while improving accuracy. These efficiencies are critical as industries demand high-performance and eco-friendly materials.

Another growth factor is the expanding scope of AI applications, from discovering new materials to optimizing existing ones for better performance and cost-efficiency. Advances in AI algorithms and computing power are enabling simulations of complex atomic-level interactions, giving scientists detailed insights to refine material properties. This precision supports innovation in lightweight, durable, and thermally conductive materials suited for emerging industrial needs.

Key Market Segments

By Technology

- Machine Learning

- Deep Learning

- Generative AI

- Natural Language Processing

By Application

- Battery Materials

- Semiconductor Materials

- Polymer Materials

- Catalyst Materials

- Metal Alloy Materials

- Others

By End-User

- Chemical Companies

- Pharmaceutical Companies

- Research Institutions

- Manufacturing Companies

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Accelerated Discovery Process

AI dramatically speeds up the materials discovery process by designing new structures and predicting their properties rapidly. Traditional methods rely heavily on manual experimentation and trial-and-error, which are time-consuming and resource-intensive. AI tools can screen vast candidate materials quickly, identifying the most promising options with higher efficiency. This fast-tracking of discovery and development shortens research timelines and allows faster innovation cycles in materials science.

Moreover, AI-powered autonomous labs now adjust experiments dynamically, further improving research effectiveness. Self-driving lab systems can plan, execute, and analyze experiments with minimal human input. These capabilities help researchers explore a broader range of material possibilities, accelerating progress toward new smart materials and advanced technologies across industries.

For instance, in April 2025, IBM showcased its accelerated materials discovery process by using new AI methods combined with hybrid cloud and quantum computing. In a recent breakthrough, they identified and synthesized a novel photoacid generator in under a year. This is far faster than traditional methods and demonstrates how IBM’s AI models enable rapid screening and testing of materials, significantly cutting down discovery time.

Restraint

High Infrastructure Requirements

One major limitation slowing AI adoption in materials discovery is the need for advanced software and hardware infrastructure. Many startups and smaller research institutions lack access to high-performance computing, large-scale data storage, and sophisticated AI tools essential for complex materials modeling. This restricts the broader use of AI innovations primarily to well-funded labs and developed economies.

Additionally, the steep learning curve to operate and maintain AI systems can be a barrier for research teams without specialized expertise. Establishing AI-driven materials discovery workflows requires substantial initial investment and ongoing support, which can deter some institutions from leveraging AI despite its clear benefits. This infrastructure dependency limits the democratization of AI in materials science.

For instance, in May 2025, Microsoft revealed its new AI platform “Discovery” that drastically shortens materials discovery time by leveraging high-performance AI and Nvidia-accelerated infrastructure. The platform’s efficiency depends greatly on access to powerful computing resources like cloud GPUs, which not all labs or smaller organizations can afford or utilize efficiently. This highlights infrastructure as a restraint in democratizing AI in materials discovery.

Opportunities

Integration of AI with Experimental Workflows

A key opportunity lies in improving the synergy between AI algorithms and practical experimental methods. Emerging approaches focus on combining AI’s capacity for rapid prediction with experimental validations in real lab environments. This hybrid method enhances the reliability and applicability of AI-generated materials by ensuring predictions are grounded in physical reality.

Furthermore, integrating multimodal AI models and closed-loop discovery systems can allow autonomous experimentation, where AI not only suggests new materials but also plans and tests them iteratively. This creates a feedback cycle that continuously refines material designs, opening new avenues for discovering sustainable, efficient, and tailored materials for sectors like energy, healthcare, and electronics.

For instance, in June 2025, Citrine Informatics accelerated solvent blend discovery through AI-driven quantum chemistry simulations. Within five months, they identified over 150 solvent blends outperforming previous benchmarks. This demonstrated how AI integration with experimental validation allows rapid virtual screening combined with physical confirmation, improving reliability and practical outcomes in materials R&D.

Challenges

Data Scarcity and Quality Issues

Despite AI’s potential, a significant challenge remains in the availability and quality of data for training AI models in materials discovery. Many datasets are small, biased, or inconsistent, limiting AI’s ability to make accurate predictions across diverse materials. Without rich, reliable data, AI algorithms struggle to generalize and provide breakthroughs beyond known materials.

Moreover, capturing complex material properties requires costly experiments and sophisticated instrumentation. This scarcity of high-quality, labeled data slows down AI model development and validation. Addressing data challenges demands community efforts to create and share open, extensive databases, as well as develop AI techniques that can work effectively with limited or noisy data.

For instance, in January 2024, Aqemia’s approach focuses on drug discovery but highlights a relevant challenge in AI for materials: generating sufficient data. They use quantum physics-based algorithms to create data in-house rather than relying on experimental data, addressing data scarcity. This underscores the data quality and availability problem limiting AI model accuracy across materials research.

Key Players Analysis

IBM, Google, and Microsoft lead the AI in materials discovery market with strong computational platforms that accelerate modeling, simulation, and prediction. Their systems are used to analyze molecular structures, optimize material properties, and reduce experimental cycles. These companies integrate advanced machine learning with cloud-based tools to support faster discovery of polymers, alloys, and energy materials.

Citrine Informatics, Schrödinger, Materials Zone, Exabyte, Aqemia, Iktos, and Deepmatter strengthen the market with specialized AI-driven discovery engines. Their platforms focus on data-centric workflows, predictive design, and automated experimentation. These providers help R&D teams identify optimal formulations and accelerate lab-to-product timelines.

Atomwise, BenevolentAI, Insilico Medicine, Valence Discovery, Kebotix, and other participants expand the landscape with deep learning architectures tailored for material–molecule interactions. Their technologies support small-scale synthesis prediction, nanomaterial design, and pharmaceutical applications. These companies emphasize accuracy, rapid iteration, and scalable discovery pipelines.

Top Key Players in the Market

- IBM

- Microsoft

- Citrine Informatics

- Schrödinger

- Materials Zone

- Exabyte.io

- Aqemia

- Iktos

- Deepmatter

- Atomwise

- BenevolentAI

- Insilico Medicine

- Valence Discovery

- Kebotix

- Others

Recent Developments

- In January 2025, Schrödinger advanced its AI and machine-learning platform by integrating physics-based methods to improve drug-related materials prediction accuracy. The company is progressing proprietary drug candidates through clinical trials, with Phase 1 data expected in 2025. Schrödinger also launched new predictive toxicology and crystal structure tools in their software.

- In January 2025, Microsoft released MatterGen, a generative AI tool that designs novel materials based on specified properties, enabling faster and more targeted materials discovery. Their AI for Science team partnered with Azure Quantum to apply high-performance computing and quantum computing to materials design problems.

Report Scope

Report Features Description Market Value (2024) USD 536.4 Mn Forecast Revenue (2034) USD 5,584.2 Mn CAGR(2025-2034) 26.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Machine Learning, Deep Learning, Generative AI, Natural Language Processing), By Application (Battery Materials, Semiconductor Materials, Polymer Materials, Catalyst Materials, Metal Alloy Materials, Others), By End-User (Chemical Companies, Pharmaceutical Companies, Research Institutions, Manufacturing Companies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM, Google, Microsoft, Citrine Informatics, Schrödinger, Materials Zone, Exabyte.io, Aqemia, Iktos, Deepmatter, Atomwise, BenevolentAI, Insilico Medicine, Valence Discovery, Kebotix, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Materials Discovery MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Materials Discovery MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM

- Microsoft

- Citrine Informatics

- Schrödinger

- Materials Zone

- Exabyte.io

- Aqemia

- Iktos

- Deepmatter

- Atomwise

- BenevolentAI

- Insilico Medicine

- Valence Discovery

- Kebotix

- Others