Global AI in Logistics Market By Technology (Machine Learning, Natural Language Processing (NLP), Computer Vision, Others), By Application (Inventory Control & Planning, Transportation Network Design, Purchasing & Supply Management, Demand Planning & Forecasting, Others), By Industry Vertical (Automotive, Food and Beverages, Manufacturing, Healthcare, Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116996

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

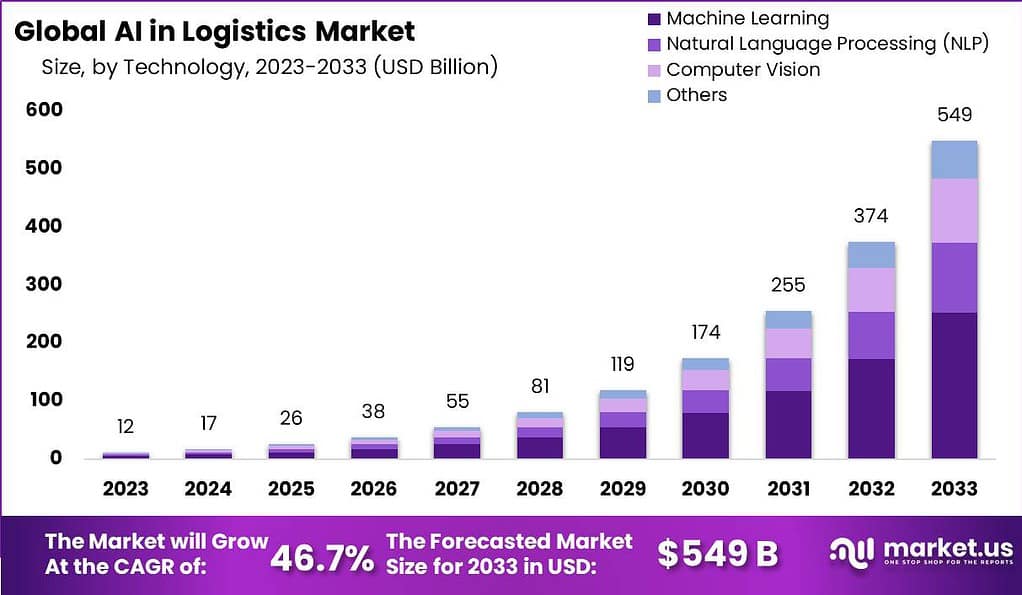

The Global AI in Logistics Market size is expected to be worth around USD 549 Billion by 2033, from USD 12 Billion in 2023, growing at a CAGR of 46.7% during the forecast period from 2024 to 2033.

Artificial intelligence (AI) is transforming the logistics industry by revolutionizing supply chain operations and enabling greater efficiency, cost savings, and improved customer service. AI technologies in logistics, such as machine learning and predictive analytics, are being employed to optimize various aspects of the supply chain.

The AI in Logistics Market is experiencing significant growth as businesses across the globe recognize the transformative potential of AI technologies in optimizing supply chain operations. With increasing adoption by logistics service providers, e-commerce companies, and retailers, the market is expected to expand rapidly.

The market growth is driven by the increasing demand for efficient supply chain management, improved customer service, and the need to adapt to the evolving logistics landscape. AI in logistics offers companies the opportunity to streamline operations, reduce costs, and gain a competitive edge in the dynamic and complex logistics industry.

By 2024, the logistics industry is set to witness a significant shift towards artificial intelligence (AI), with over 65% of companies expected to implement AI in at least one part of their operations, as reported by DHL. This trend underscores the growing importance of AI in enhancing efficiency and accuracy within the logistics sector.

FedEx highlights an equally compelling trend, projecting a 50% increase in the adoption of AI for route optimization and fleet management among logistics providers from 2022 to 2024. This reflects a broader move towards smarter, more responsive logistics operations.

Similarly, UPS points out that around 55% of logistics companies are planning to incorporate AI solutions for demand forecasting and inventory management by the end of 2024. This indicates a significant focus on leveraging AI to predict customer demand more accurately and manage stock levels efficiently, minimizing waste and optimizing resource allocation.

Moreover, IBM anticipates that over 70% of AI platforms used in logistics will feature advanced data visualization and analytics capabilities by 2024. This suggests a future where logistics operations are not only powered by intelligent algorithms but are also informed by deep, actionable insights derived from complex data analyses.

Key Takeaways

- The AI in Logistics Market is estimated to reach a substantial value of USD 549 billion by 2033, reflecting an impressive Compound Annual Growth Rate (CAGR) of 46.7% from 2024 to 2033.

- In 2023, Machine Learning emerged as the leading technology segment, capturing over 46% of the market share. This can be attributed to its pivotal role in optimizing logistics and supply chain operations.

- The Inventory Control & Planning segment held a prominent position in 2023, accounting for more than 32% of the market share. This highlights the critical role of inventory management in logistics and supply chain optimization.

- In 2023, the Retail segment held the dominant position, capturing over 29% of the market share. This can be attributed to the rapid adoption of advanced AI solutions in enhancing operational efficiencies and customer service within the retail industry.

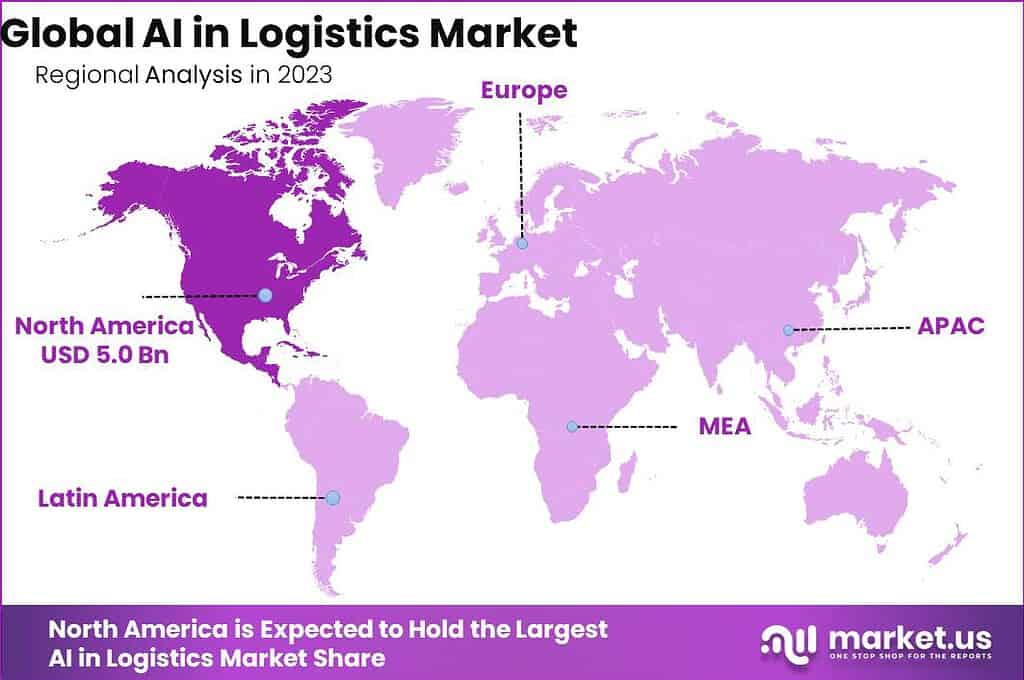

- North America, particularly the United States, led the AI in Logistics market in 2023, with a market share exceeding 41%. This was fueled by rapid technological advancements and early adoption of innovative solutions in logistics and supply chain management.

- AI for predictive maintenance and asset monitoring is expected to grow by 45% between 2022 and 2024. This means machines can tell us when they might break down before it actually happens.

- Around 50% of logistics companies are getting ready to use AI for making their warehouses work almost on their own with robots by the end of 2024. Imagine robots picking up and sorting things without much human help.

- By 2024, over 65% of AI tools in logistics will work smoothly with IoT devices and sensors. It’s like all the tech talking and working together to make things run better.

- The use of AI to make the last part of delivery smoother is going up by 40% among logistics folks from 2022 to 2024. This means getting your package faster and more efficiently.

- Over 55% of AI in logistics will use natural language processing (NLP) for helping customers and powering chatbots by 2024. So, expect more helpful and smart conversations when you need help.

- About 45% of logistics companies are planning to make their supply chains stronger and more risk-free with AI by the end of 2024. This is all about being prepared for anything that comes up.

- It’s expected that by 2024, over 70% of AI platforms for logistics will have top-notch cybersecurity to keep data safe and operations secure. Keeping everything safe and sound is a big priority.

- The use of AI for matching freight bookings and loads is set to increase by 35% among logistics providers between 2022 and 2024. This means getting shipments matched up with the right transport much smoother.

- By 2024, more than 60% of AI in logistics will use cloud-based stuff to make everything more flexible and accessible from anywhere.

Technology Analysis

In 2023, the Machine Learning Segment held a dominant market position in the AI in Logistics market, capturing more than a 46% share. This leadership can be attributed to the pivotal role machine learning plays in optimizing logistics and supply chain operations.

Machine learning algorithms excel at analyzing large volumes of data to identify patterns and predict future outcomes, making them invaluable for forecasting demand, managing inventory, and optimizing routes. This capability not only enhances operational efficiency but also significantly reduces costs and improves service delivery.

Moreover, the machine learning segment benefits from its adaptability and continuous improvement. As it processes more data, its predictive accuracy and operational recommendations become increasingly refined, offering logistics companies a competitive edge in a rapidly evolving market.

This technology also enables the automation of complex decision-making processes, reducing the reliance on manual intervention and minimizing errors. The growing adoption of machine learning in logistics is a testament to its effectiveness in addressing some of the most pressing challenges in the industry, such as managing fluctuating demand and ensuring timely delivery of goods.

Application Analysis

In 2023, the Inventory Control & Planning segment held a dominant market position in the AI in Logistics market, capturing more than a 32% share. This significant market share underscores the crucial role that inventory management plays in the logistics and supply chain sector.

AI technologies, particularly in inventory control and planning, have revolutionized how companies predict demand, manage stock levels, and optimize warehousing operations. The integration of AI enables businesses to automate complex decision-making processes related to inventory management, reducing human errors, and improving operational efficiency.

The leadership of the Inventory Control & Planning segment is also driven by its direct impact on cost reduction and customer satisfaction. By leveraging predictive analytics and machine learning models, companies can anticipate demand fluctuations more accurately, ensuring the right amount of stock is available at the right time, thereby minimizing holding costs and reducing the risk of stockouts or excess inventory.

Industry Vertical Analysis

In 2023, the Retail segment held a dominant position in the AI in Logistics market, capturing more than a 29% share. This leadership can be attributed to the sector’s rapid adoption of advanced AI solutions for enhancing operational efficiencies and customer service quality. Retailers are increasingly relying on AI to streamline supply chain operations, forecast demand more accurately, and optimize inventory management.

The integration of AI technologies, such as machine learning, natural language processing, and robotics, has significantly improved the speed and accuracy of logistical processes. These advancements have enabled retailers to offer faster delivery times, reduce operational costs, and improve overall customer satisfaction, thereby driving the growth of the AI in Logistics market within this industry vertical.

The surge in e-commerce sales, particularly in the wake of digital transformation trends accelerated by the global situation, has further bolstered the need for robust AI-driven logistics solutions in the Retail sector. AI applications in logistics, ranging from autonomous vehicles and drones for delivery to AI-based customer service chatbots, have been pivotal in managing the increased volume of online transactions.

Furthermore, predictive analytics powered by AI has allowed retailers to anticipate consumer buying patterns, optimize stock levels, and mitigate the risks of overstocking or stockouts. This ability to harness data for strategic advantage underscores the leading position of the Retail segment in the AI in Logistics market.

Key Market Segments

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Computer Vision

- Others

By Application

- Inventory Control & Planning

- Transportation Network Design

- Purchasing & Supply Management

- Demand Planning & Forecasting

- Others

By Industry Vertical

- Automotive

- Food and Beverages

- Manufacturing

- Healthcare

- Retail

- Others

Driver

Digitalization in the Logistics Sector

The increasing trend towards digitalization within the logistics sector is a significant driver of growth. As the logistics industry embraces digital technologies, the integration of AI has become crucial in enhancing efficiency and streamlining operations. The adoption of AI enables predictive analysis, reduces errors, offers scalability, and accelerates processes, which are essential in today’s fast-paced market environment. The global manufacturing sector’s expansion further fuels the demand for AI in logistics, highlighting the technology’s role in improving productivity within the supply chain management.

Restraint

High Installation and Maintenance Costs

A major restraint for the AI in Logistics market is the high cost associated with the installation and maintenance of AI technologies. These costs can be prohibitive for small and medium-sized enterprises (SMEs), limiting the widespread adoption of AI solutions in logistics. This challenge underscores the need for more cost-effective solutions that can democratize access to AI technologies across businesses of all sizes.

Opportunity

Advancements in Cutting-edge Technologies

The field of AI is continually evolving, with new advancements presenting promising opportunities for its application within the logistics sector. Innovations in machine learning, natural language processing, and robotics offer the potential to further automate and optimize logistics operations, from warehouse management to transportation and delivery services. The ongoing development of AI technologies opens up new avenues for enhancing operational efficiencies and creating more responsive and adaptive logistics systems.

Challenge

Data Quality and Algorithm Bias

A significant challenge in deploying AI in logistics is ensuring the quality of data and addressing the potential biases in AI algorithms. The effectiveness of AI systems heavily relies on the data they are trained on, and biases in this data can lead to skewed or unfair outcomes. Additionally, the complexity of correcting these biases poses challenges in ensuring AI systems operate fairly and transparently. Ensuring high data quality and addressing algorithmic biases are crucial for building trust in AI applications within the logistics industry.

Growth Factors and Trends

- Digitization and Automation: The integration of Artificial Intelligence (AI) in logistics operations, particularly in route planning, forecasting, and asset management, is expected to enhance efficiency, sustainability, and resilience within the industry. Despite a slow pace in adoption, advancements in AI technologies are likely to promote its use across businesses of all sizes, especially in planning and forecasting applications.

- Green Logistics: As a response to the environmental impact of logistics operations, there is a significant push towards sustainable practices. Efforts are being made to reduce emissions through the adoption of green technologies, such as electric vehicles, and sustainable business practices. The industry is also witnessing a growing preference among consumers for sustainable brands, which is further driving the shift towards green logistics.

- Quick Commerce: The demand for ultra-fast delivery services is accelerating, with projections indicating substantial growth in quick commerce revenue across various regions. This trend highlights the consumers’ growing expectation for convenience and speed, compelling logistics companies to adapt and invest in technologies that enable rapid delivery services.

- Asset-light Logistics Models: The move towards asset-light logistics strategies allows companies to reduce their reliance on physical assets, thereby lowering operational costs and enhancing flexibility. This model is particularly advantageous in navigating the complexities of the labor market and adapting to fluctuating demand.

- Real-time Data and Visibility: The expectation for continuous updates on order status and delivery schedules, driven by the “Amazon effect,” necessitates the integration of logistics operations with supply chain visibility platforms. This integration enables businesses to provide real-time updates to customers, thereby improving service quality and customer satisfaction.

- Innovative AI-Powered Shipping Solutions: The adoption of AI in logistics continues to introduce new efficiencies and capabilities. For instance, AI-powered route optimization platforms are creating unique, cost-controlled capacity solutions for shippers, which not only benefit the logistics companies but also improve the experience for their clients.

- Supply Chain Agility: The need for agility in supply chain management is more critical than ever, with businesses requiring nimble operations to stay competitive. This involves leveraging technology to enable self-managed onboarding, change management, and exception management, thereby ensuring responsiveness and adaptability in the face of evolving market dynamics.

Regional Analysis

In 2023, North America held a dominant market position in the AI in Logistics sector, capturing more than a 41% share. This leadership can be largely attributed to the region’s rapid technological advancements and the early adoption of innovative solutions in logistics and supply chain management. The demand for AI in Logistics in North America was valued at USD 5.0 billion in 2023 and is anticipated to grow significantly in the forecast period.

North America, particularly the United States, is home to some of the world’s leading technology companies and startups focusing on AI and machine learning, which significantly contributes to the region’s commanding presence in the market.

The substantial investments in AI research and development, coupled with a robust digital infrastructure, have enabled North American logistics companies to implement AI-driven solutions effectively. These solutions range from predictive analytics for demand forecasting and inventory management to autonomous vehicles for delivery and drones for warehouse management.

Additionally, the strong emphasis on enhancing the customer experience and operational efficiency has driven the adoption of AI technologies, further solidifying North America’s leadership position in the AI in Logistics market.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Artificial Intelligence (AI) in logistics market is characterized by a dynamic competitive landscape, with key players that are driving innovation and technological advancements. These entities span a diverse range of operations, from supply chain optimization and freight brokerage to autonomous vehicle navigation and predictive analytics.

The growth of the market can be attributed to the increasing demand for efficient and automated operations within the logistics sector, bolstered by the rising e-commerce industry and the need for real-time data analysis and decision-making.

Top Market Leaders

- IBM Corporation

- Intel Corporation

- Amazon Web Services, Inc.

- Microsoft Corporation

- Oracle Corporation

- NVIDIA Corporation

- Transportation Applied Intelligence, LLC

- Pluto7

- GEODIS

- Other Key Players

Recent Developments

- In June 2023, Pidge, a logistics technology provider, introduced a groundbreaking digital parity solution in the unorganized logistics sector. Their innovative low-code and self-serve logistics platform is already available in numerous cities across India, revolutionizing the industry.

- TSRTC, the Telangana State Road Transport Corporation, launched parcel and cargo services on June 19, 2020. Impressively, within just three years of operation, TSRTC’s Khammam region generated a remarkable revenue of Rs. 12.28 Crores from its logistics division.

- In the same month of June 2023, Aviant, a Norwegian drone logistics company, initiated its home delivery services. Their advanced drones are capable of efficiently delivering medicines, groceries, and takeaway food in densely populated areas of Norway.

- Zabka Group, known for its cutting-edge logistics infrastructure, unveiled an automated logistics center near Warsaw in June 2023. This state-of-the-art facility has the capacity to serve approximately 3500 stores, solidifying its position as the most advanced technological infrastructure in the Zabka Group’s logistics network.

- Finally, in June 2023, Alirok.com, an automated logistics interface, made an exciting announcement. They launched a fully automated logistics platform for shipping, catering to over 220 countries, marking a significant milestone in their operations.

Report Scope

Report Features Description Market Value (2023) USD 12 Bn Forecast Revenue (2033) USD 549 Bn CAGR (2024-2033) 46.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Machine Learning, Natural Language Processing (NLP), Computer Vision, Others), By Application (Inventory Control & Planning, Transportation Network Design, Purchasing & Supply Management, Demand Planning & Forecasting, Others), By Industry Vertical (Automotive, Food and Beverages, Manufacturing, Healthcare, Retail, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Intel Corporation, Amazon Web Services Inc., Microsoft Corporation, Oracle Corporation, NVIDIA Corporation, Transportation Applied Intelligence LLC, Pluto7, GEODIS, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is AI in logistics?AI in logistics refers to the integration of artificial intelligence technologies such as machine learning, predictive analytics, and robotics to streamline and optimize various processes within the logistics and supply chain industry.

How big is AI in Logistics Market?The Global AI in Logistics Market size is expected to be worth around USD 549 Billion by 2033, from USD 12 Billion in 2023, growing at a CAGR of 46.7% during the forecast period from 2024 to 2033.

What are some challenges associated with implementing AI in logistics?- Data quality and availability

- Integration with existing systems

- Initial investment and ROI justification

- Regulatory and privacy concerns

- Workforce readiness and skill gap

Which region has the highest growth rate in the AI in logistics market?In 2023, North America held a dominant market position in the AI in Logistics sector, capturing more than a 41% share

What are the major growth factors of the AI in logistics market?Major growth factors include increasing demand for efficient supply chain management, advancements in AI technologies, rising e-commerce activities, and a focus on cost reduction and operational optimization.

-

-

- IBM Corporation

- Intel Corporation

- Amazon Web Services, Inc.

- Microsoft Corporation

- Oracle Corporation

- NVIDIA Corporation

- Transportation Applied Intelligence, LLC

- Pluto7

- GEODIS

- Other Key Players