Global AI in Financial Wellness Market By Type (Software, Service), By Deployment (On-Premises, Cloud-Based), By Application (Wealth Management, Fraud Detection and Prevention, Risk Management and Compliance, Customer Service and Support, Other Applications), By End User (Financial Institutions, Enterprises, Individuals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 119760

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

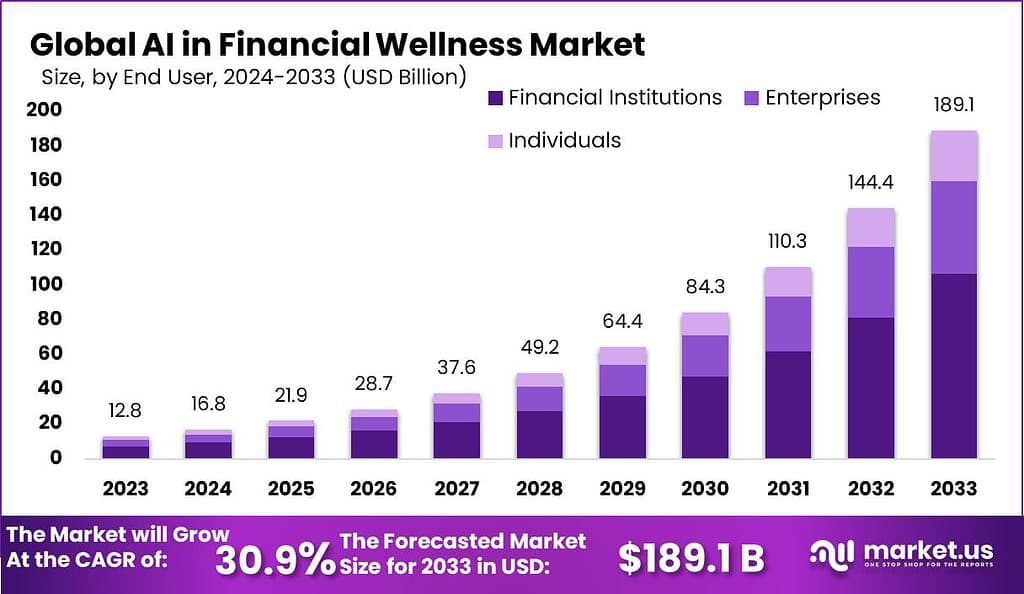

The Global AI in Financial Wellness Market size is expected to be worth around USD 189.1 Billion By 2033, from USD 12.8 Billion in 2023, growing at a CAGR of 30.9% during the forecast period from 2024 to 2033.

Artificial Intelligence (AI) is playing an increasingly significant role in financial wellness, helping individuals manage their money more effectively. By integrating AI technologies, financial services can offer personalized advice, forecast future financial scenarios, and provide automated management of investments and savings. AI systems analyze vast amounts of data to identify spending patterns, optimize budgets, and suggest strategies to improve financial health.

The AI in Financial Wellness industry is set to experience significant growth. Projected revenue for this sector in 2023 stands at USD 12.8 billion. Over the next decade, the broader Artificial Intelligence market is expected to expand dramatically, from USD 177 billion in 2023 to approximately USD 2,745 billion by 2032. This represents a compound annual growth rate (CAGR) of 36.8% from 2024 to 2033.

Specifically, within the Financial Wellness segment, growth is anticipated to continue at a strong annual rate of 30.9%, reaching a market size of USD 37.6 billion by 2027. Consumer perception in this market is also noteworthy, with nearly 42% of respondents from varied demographic backgrounds reporting that they feel “somewhat” or “entirely” financially healthy.

Moreover, a significant majority, about 70% of employees, believe that financial wellness programs not only reduce stress but also improve relationships between employers and employees. This trend underscores the potential benefits and expanding adoption of AI-driven solutions in enhancing financial wellness.

Key Takeaways

- The AI in financial wellness market is estimated to reach USD 189.06 billion in the year 2033 with a CAGR of 30.9% during the forecast period 2024-2033 and was valued at USD 12.8 billion in the year 2023.

- Based on the types, the software segment has dominated the market with a market share of 62.7% in the year 2023.

- Based on deployment, the cloud-based segment has led the market with a market share of 75% in the year 2023.

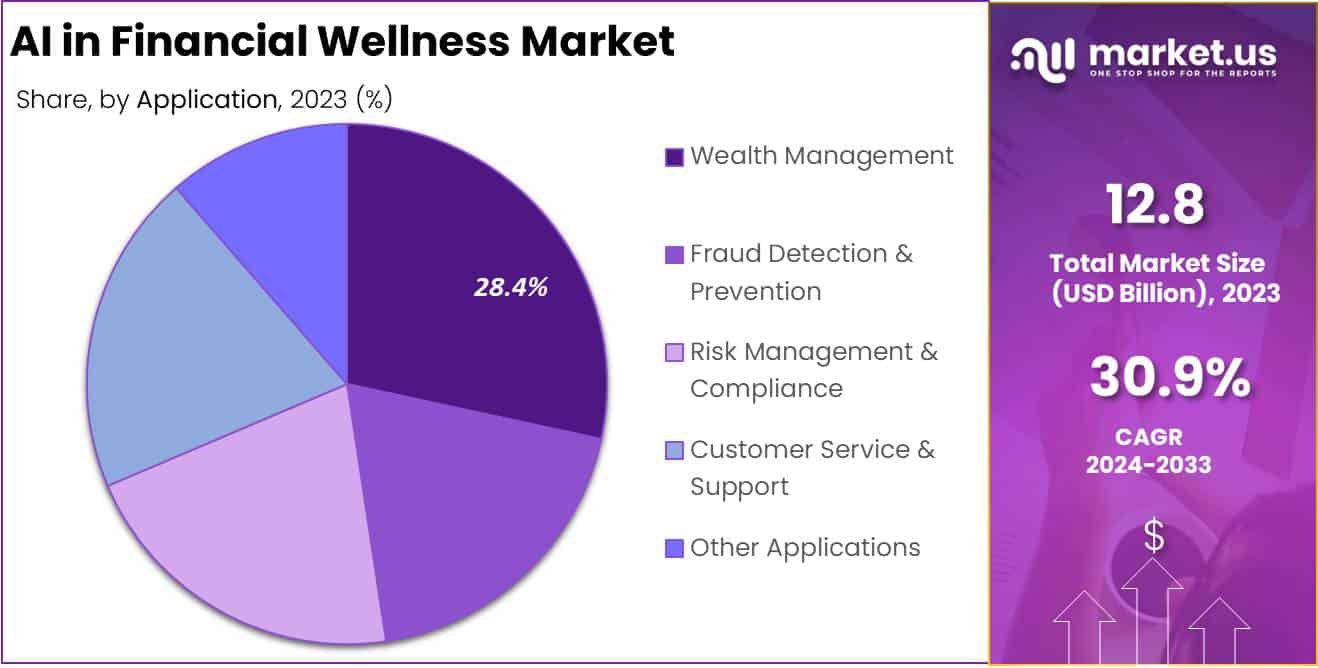

- By segmenting based on application, the wealth management segment with a market share of 28.4% in the year 2023.

- Based on the end users, the market is dominated by the financial institutions segment with a market share of 56.3% in the year 2023.

- In 2023, North America held a dominant market position in the AI in financial wellness sector, capturing more than a 36.7% share.

- The financial stability of many adults remains precarious. As of recent reports, 78% of adults are living paycheck to paycheck, indicating a widespread issue of limited financial flexibility. Furthermore, two-thirds of all families lack an emergency fund, highlighting a significant gap in financial preparedness.

- Credit card debt continues to be a common challenge, with 60% of adults having incurred such debt in the past year. The stress associated with financial insecurity is notably high among specific groups; for instance, 83% of government and university employees in the U.S. report experiencing some form of financial stress, be it physical, mental, or emotional.

- A detailed report by pymnts from November 2023 reveals that this trend is particularly pronounced among lower-income earners. Approximately 77% of consumers with annual incomes under $50,000 are living paycheck to paycheck, underscoring the acute financial pressures faced by this demographic.

By Type Analysis

Based on the types the market is segmented into software and service segments. Among these, the software segment has dominated the market with a market share of 62.7% in the year 2023. Financial institutions can easily adjust to shifting market conditions and regulatory requirements due to the scalability and flexibility offered by software solutions. These solutions cause the least amount of operational disturbance.

Financial institutions can obtain a more insightful knowledge of client behavior, and market trends with the use of these solutions. AI software solutions frequently offer sophisticated data processing and analytics capabilities. Decision-making is enhanced, and individualized financial services and advice are made possible with the use of these solutions.

Furthermore, machine learning methods are frequently used in software solutions in the AI financial wellness sector to gradually enhance accuracy and performance. Furthermore, as software-based AI solutions require less infrastructure and maintenance than hardware-based alternatives, they are usually more affordable. This promotes their adoption and market expansion by making them more accessible to additional financial institutions, including start-ups and small enterprises.

By Deployment Analysis

Based on the deployment type the market is segmented into cloud-based and on-premise where the cloud-based segment has dominated the market with a market share of around 75% in the year 2023. Organizational operations have been changed by the integration of cloud-based solutions in the current technology infrastructure.

Cloud services offer flexibility in terms of modifying resources to adapt to the changing demand. This gives businesses the capability to grow without having to make large initial hardware investments and giving them a crucial competitive edge in fast-paced industries. Another important reason for the widespread use of cloud systems is cost-effectiveness. Businesses can save money on capital expenses for hardware and upkeep by switching from traditional on-premises infrastructure to the cloud.

A key component of cloud-based systems is accessibility, which enables users to access data and apps from any location with an Internet connection. This remote access feature encourages teamwork, adaptability, and productivity across geographic boundaries, stimulating creativity and agility inside businesses. Furthermore, the cloud service offers redundancy and dependability. The cloud’s capacity to make cutting-edge technologies like big data analytics, machine learning, and artificial intelligence more accessible, accelerates innovation.

By Application Analysis

The market is segmented into wealth management, fraud detection and prevention, risk management and compliance, customer service and support, and other segments. Among these, the wealth management segment dominated the market with a share of around 28.4% in the year 2023.

Artificial intelligence (AI) is particularly well-suited for wealth management since it can evaluate vast volumes of data to generate relevant investment suggestions and risk assessments. An integral part of wealth management is risk management. Real-time risk assessments, trend monitoring, and portfolio danger identification are all possible with AI-powered solutions.

Wealth managers can reduce risk and increase investment returns by using machine learning algorithms to guide their decisions. Wealth management companies may now automate repetitive processes like trade execution, performance reporting, and portfolio rebalancing with the help of AI technology.

Furthermore, without compromising quality, AI-based systems may evolve to accommodate massive data volumes and meet the needs of the business. The financial services business is subject to severe regulatory restrictions, especially involving wealth management. By automating regulatory reporting, identifying suspicious activity, and guaranteeing adherence to industry norms, AI systems can help with compliance. Wealth management firms can lower operational expenses and lower legal risks by optimizing compliance processes.

By End User Analysis

Based on the end users, the market is segmented into financial institutions, enterprises, and individuals. The market is dominated by the financial institutions segment with a market share of 56.3% in the year 2023, due to its wide range of services, varied clients, and intense competition.

AI is being used by financial institutions in retail banking, risk management, wealth management, and insurance to enhance client satisfaction, spur innovation, and maintain regulatory compliance. Organizations utilize AI to minimize risk, optimize decision-making, and personalize services since it has access to enormous volumes of data.

Furthermore, companies can expand their service offerings and gain access to advanced AI capabilities through partnerships with fintech start-ups and technology providers. Financial institutions can navigate the complexities of the financial services sector while enhancing their competitive position, attracting and retaining consumers, and driving business growth by implementing AI.

Key Market Segments

By Type

- Software

- Service

By Deployment Type

- Cloud-based

- On-premises

By Application

- Wealth Management

- Fraud Detection & Prevention

- Risk Management & Compliance

- Customer Service & Support

- Other Applications

By End-User Type

- Financial Institutions

- Enterprises

- Individuals

Drivers

Higher demand for automated financial assistance

Consumers are highly demanding automated financial assistance with the advancement in technology, thus driving the market. AI-based financial wellness solution provides detailed and customized financial advice to people through automated financial guidance as compared to conventional financial advice techniques. Due to the increasing need for more efficient and practical guidance that may assist in making better financial decisions, customers are increasingly demanding automated financial assistance.

Financial planning solutions that rely on artificial intelligence (AI) are getting attention from the financial industry. These tools are developed to provide people with information and guidance about money that is specifically saved for their requirements and meeting financial objectives. Users now have an automatic and effective approach to managing their funds and making wise decisions due to financial planning solutions driven by AI. AI-based financial planning tools are highly preferred as they are viewed as effective and affordable substitutes for conventional financial planning techniques.

Restraints

Higher initial investment

AI technology is higher in cost as it needs considerable funds for implementation and maintenance. In addition to the high cost of software and hardware, manpower costs for system maintenance and training might also hamper the market growth.

Applications of AI are still in their early stages, and many underdeveloped countries lack the legal frameworks in place for implementing these solutions. It may be challenging to develop AI applications that abide by state, and national rules due to a lack of uniformity. Furthermore, the absence of international regulations raises the possibility of data privacy violations, which could have harmful financial effects on companies.

Opportunities

Advancement in the efficiency of the AI-based financial wellness solution

The rising demand for AI-based financial wellness solutions and the increasing awareness of financial wellness issues are fuelling the robust expansion of the market for AI in financial wellness. AI-powered financial wellness solutions now have enormous opportunities. Employers, financial institutions, and people are increasingly using AI-powered financial wellness solutions to manage their financial well-being.

There are many advantages to using AI-based solutions, including increased accuracy, cost savings, and efficiency. Employers and financial organizations can gain help with cash flow forecasting, forecasting, and budgeting by using AI-based solutions. Automating tasks like account management, bill payment, and personal budgeting is another application for these products.

AI-powered solutions are being utilized to give people individualized financial advice, including investing and retirement plan recommendations. The goal of these solutions to handle financial crises and lessen financial stress is another factor behind the rising demand for AI-based financial wellness solutions.

Challenges

Data inaccuracy can be an obstacle to the market

The AI in financial wellness market tends to face several obstacles. Strong encryption and adherence to laws like the CCPA and GDPR are necessary to ensure the privacy and security of sensitive financial data. To produce accurate and useful insights, AI must negotiate the intricacies of market dynamics and financial regulation. There are substantial obstacles due to the inherent biases in data and algorithms, which may produce unfair results or exacerbate already-existing data.

Furthermore, effective justifications for AI-based recommendations concerning the finance management is challenging for businesses. Maintaining the reliabiliy of these recommendations is essential for establishing user trust. Overall, the market needs to undertake constant innovation and adaptation to advanced technology to stay ahead in the competition by grabbing these opportunities.

Latest Trends

Advancement in Technology

AI-powered technology has assisted people to receive personalized financial advice. Artificial intelligence (AI)-powered apps currently offer personalized budgeting, savings plans, and investment recommendations to monitor spending trends, income sources, and financial objectives.

Artificial intelligence (AI) chatbots that can negotiate bills, manage bill payments, and offer financial guidance are growing in popularity and have evolved as the latest trend. Natural language processing is used by these chatbots to comprehend client requests and deliver individualized help on time.

These solutions have users saving time and effective money management due to this automation. By analyzing vast amounts of financial data, AI can forecast future spending patterns, and potential risks, and approach financial requirements. This enables customers to set up emergency savings accounts, choose wisely among their investments, and adjust their budgets in advance. Furthermore, AI-based systems can highlight anomalous spending patterns that can point to fraud or identity theft, providing an additional degree of security.

Regional Analysis

In 2023, North America held a dominant market position in the AI in financial wellness sector, capturing more than a 36.7% share. This leadership can be largely attributed to the region’s robust financial sector, high technology adoption rates, and substantial investments in AI and machine learning. The demand for AI in Financial Wellness in North America was valued at USD 4.6 billion in 2023 and is anticipated to grow significantly in the forecast period.

North American companies have been pioneers in integrating AI into various financial services, from personal finance apps to sophisticated asset management systems. The presence of major technology and financial hubs, such as Silicon Valley and Wall Street, further supports extensive development and deployment of these technologies.

The widespread acceptance of digital banking and personal finance management tools among consumers also drives growth in this region. Additionally, regulatory support for fintech innovations in countries like the United States and Canada plays a critical role. These governments provide a favorable environment for testing and implementing new AI-driven financial solutions, thereby encouraging more firms to enter the market and innovate. As a result, North America not only leads in terms of market share but also sets trends in the global AI in financial wellness landscape.

Europe follows North America in the AI financial wellness market, propelled by increasing fintech adoption and supportive government policies aimed at digital transformation in financial services. The European market benefits from a strong regulatory framework that fosters innovation while ensuring data protection and consumer rights, particularly under frameworks like GDPR.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The financial wellness sector has witnessed a remarkable transformation with the advent of artificial intelligence (AI) technologies. AI has empowered individuals to manage their finances more effectively and make informed decisions about their financial well-being. Several key players have emerged in this space, leveraging AI to provide innovative solutions that cater to the unique needs of individuals seeking financial wellness.

One of the prominent players in this field is Mint.com. Powered by AI algorithms, Mint.com is a personal finance management platform that analyzes users’ financial data to offer personalized recommendations for budgeting, saving, and investment opportunities. By providing valuable insights into their financial health, Mint.com enables individuals to make informed decisions and improve their overall financial well-being.

Top Key Players in the Market

- Aduro

- Ayco

- Beacon Health Options

- Best Money Moves

- BrightDime

- DHS Group

- Edukate

- Enrich Financial Wellness

- Financial Fitness Group

- HealthCheck360

- Health Advocate

- Money Starts Here

- PayActive

- Purchasing Power

- Ramsey Solutions

- Sum180

- Transamerica

- Personetics

- Other Key Players

Recent Developments

- In March 2024, the Central Bank of Missouri elevated its financial wellness for customers through the introduction of Personetic’s AI-powered platform.

- In March 2024, AgentSmyth, a New York-based tech firm launched AU Agents which helps the financial sector in enhancing financial analysis.

Report Scope

Report Features Description Market Value (2023) USD 12.8 Bn Forecast Revenue (2033) USD 189.1 Bn CAGR (2024-2033) 30.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Software, Service), By Deployment (On-Premises, Cloud-Based), By Application (Wealth Management, Fraud Detection and Prevention, Risk Management and Compliance, Customer Service and Support, Other Applications), By End User (Financial Institutions, Enterprises, Individuals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aduro, Ayco, Beacon Health Options, Best Money Moves, BrightDime, DHS Group, Edukate, Enrich Financial Wellness, Financial Fitness Group, HealthCheck360, Health Advocate, Money Starts Here, PayActive, Purchasing Power, Ramsey Solutions, Sum180, Transamerica, Personetics, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is AI in financial wellness?AI in financial wellness refers to the integration of artificial intelligence technologies such as machine learning, natural language processing, and predictive analytics into financial tools and services aimed at improving individuals' financial health and well-being.

How big is AI in Financial Wellness Market?The Global AI in Financial Wellness Market size is expected to be worth around USD 189.1 Billion By 2033, from USD 12.8 Billion in 2023, growing at a CAGR of 30.9% during the forecast period from 2024 to 2033.

Who are the prominent players operating in the AI in Financial Wellness market?Aduro, Ayco, Beacon Health Options, Best Money Moves, BrightDime, DHS Group, Edukate, Enrich Financial Wellness, Financial Fitness Group, HealthCheck360, Health Advocate, Money Starts Here, PayActive, Purchasing Power, Ramsey Solutions, Sum180, Transamerica, Personetics, Other Key Players

Which are the driving factors of the AI in Financial Wellness market?The driving factors of the AI in Financial Wellness market include increasing demand for personalized financial services, growing adoption of AI and machine learning technologies in the financial sector, and rising awareness about the importance of financial wellness.

Which region will lead the global AI in Financial Wellness market?In 2023, North America held a dominant market position in the AI in financial wellness sector, capturing more than a 36.7% share.

AI in Financial Wellness MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

AI in Financial Wellness MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Aduro

- Ayco

- Beacon Health Options

- Best Money Moves

- BrightDime

- DHS Group

- Edukate

- Enrich Financial Wellness

- Financial Fitness Group

- HealthCheck360

- Health Advocate

- Money Starts Here

- PayActive

- Purchasing Power

- Ramsey Solutions

- Sum180

- Transamerica

- Personetics

- Other Key Players