Global AI in Accounting Market Report By Component (Software, Services), By Deployment Mode (On-premises, Cloud-based), By Application (Invoice processing, Fraud detection, Financial forecasting, Audit automation, Others), By Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By End-user Industry (BFSI, Manufacturing, Retail, Healthcare, IT & Telecom, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 125529

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

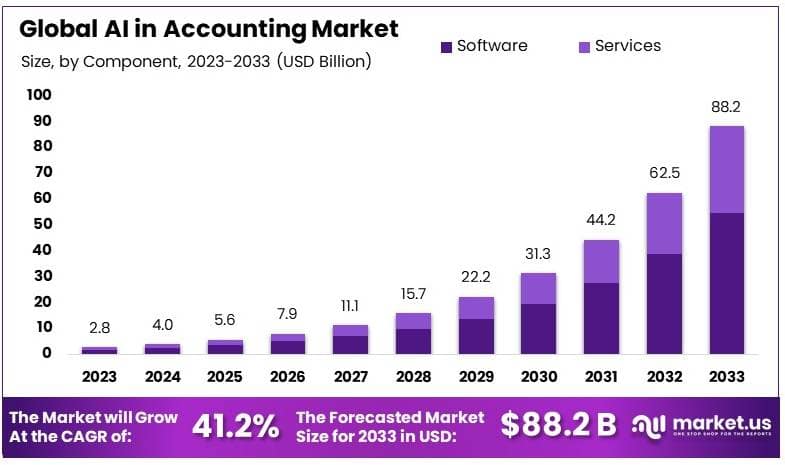

The Global AI in Accounting Market size is expected to be worth around USD 88.2 Billion by 2033, from USD 2.8 Billion in 2023, growing at a CAGR of 41.2% during the forecast period from 2024 to 2033.

The AI in Accounting Market focuses on the use of artificial intelligence to automate and enhance accounting processes. AI technologies streamline tasks such as data entry, invoice processing, and financial analysis. This market is gaining traction as businesses look to improve accuracy, reduce manual workloads, and enhance financial decision-making.

Key applications of AI in accounting include automated bookkeeping, real-time financial reporting, and predictive analytics. These tools help accountants identify trends, forecast financial outcomes, and ensure compliance with regulations. The integration of AI into accounting systems also minimizes the risk of human error and fraud.

As AI continues to advance, its role in accounting will become more significant. Companies that adopt AI in their accounting processes can achieve greater efficiency, cost savings, and strategic insights. The focus for businesses should be on selecting AI solutions that align with their financial goals and regulatory requirements.

The AI in Accounting market is experiencing rapid growth as businesses increasingly integrate artificial intelligence into their financial reporting processes. According to KPMG, 72% of companies are already piloting or using AI in their financial reporting, and this figure is expected to reach 99% within the next three years.

AI is transforming traditional accounting practices by automating routine tasks such as data entry, reconciliation, and report generation. This automation not only reduces the time required for these tasks but also minimizes human error, leading to more accurate financial statements. Additionally, AI tools can analyze large volumes of financial data quickly, identifying patterns and anomalies that might be missed by human accountants.

The role of auditors in this AI-driven environment is also evolving. 64% of companies believe that auditors should play a crucial role in evaluating AI’s use in financial reporting, ensuring the integrity and accuracy of AI-driven processes. This highlights the need for a balanced approach, where AI enhances accounting functions while human oversight maintains trust and reliability.

Geographically, North America is at the forefront of AI adoption in accounting, with 39% of firms rapidly integrating AI into their financial reporting systems. Europe and Asia Pacific follow closely, with 32% and 29% of companies, respectively, embracing AI in their accounting practices. This regional variation reflects differing levels of technological maturity and regulatory environments, but the overall trend points towards widespread global adoption.

As artificial intelligence continues to reshape the accounting landscape, companies that invest in AI-driven solutions are likely to gain a competitive edge. These tools offer significant benefits in terms of speed, accuracy, and cost-efficiency, making them an essential part of modern accounting practices.

The near-universal adoption of AI in financial reporting within the next few years will mark a significant milestone in the evolution of the accounting profession, with profound implications for how financial information is generated, analyzed, and audited.

Key Takeaways

- The AI in Accounting Market was valued at USD 2.8 billion in 2023 and is expected to reach USD 88.2 billion by 2033, with a CAGR of 41.2%.

- Software dominates the component segment with 62% due to its essential role in automating accounting tasks and improving accuracy.

- Cloud deployment mode leads with 65.3%, driven by the need for secure, scalable, and accessible accounting solutions.

- Invoice Processing dominates the application segment with 25% due to the high demand for automating invoice management and reducing errors.

- SMEs lead the organization size segment with 58%, reflecting their increasing adoption of AI to streamline accounting processes.

- North America dominates with 32% due to the strong presence of AI technology providers and early adoption in the accounting sector.

Component Analysis

The Software sub-segment dominates with 62% due to its crucial role in enabling AI functionalities within accounting systems.

In the AI in Accounting Market, components are categorized into Software and Services, with the Software sub-segment leading significantly, capturing 62% of the market. This dominance is driven by the software’s ability to introduce and enhance AI functionalities such as automation, data analysis, and complex computations, which are vital for modern accounting processes.

AI-powered software solutions are designed to streamline operations by automating routine tasks like data entry and transaction matching, reducing errors, and increasing overall efficiency. This automation not only speeds up processes but also frees up human resources to focus on more strategic tasks that require human insight.

Software solutions are increasingly being integrated with advanced AI capabilities, including machine learning algorithms that can predict cash flow scenarios and optimize financial reporting, making these tools indispensable for businesses aiming to enhance their financial operations. Furthermore, these solutions are scalable, allowing businesses of various sizes to implement AI at a pace and scale that suits their specific needs.

While Software is the dominant sub-segment, Services play a critical role in supporting the deployment and ongoing management of AI solutions. These services include consultation, customization, integration, and support, which are essential for maximizing the benefits of AI software. As companies continue to navigate the complexities of digital transformation, the demand for specialized services that can help implement and maintain these AI systems is expected to grow, further supporting the overall development of the AI in Accounting Market.

Deployment Mode Analysis

The Cloud-based sub-segment dominates with 65.3% due to its flexibility, scalability, and cost efficiency.

Deployment modes in the AI in Accounting Market include On-premises and Cloud-based, with the latter holding a dominant market share of 65.3%. The preference for cloud-based solutions is driven by their ability to provide flexible, scalable, and cost-effective access to AI technologies.

Cloud deployment allows organizations to leverage powerful AI tools without the need for significant upfront investments in physical infrastructure. Additionally, it offers the benefit of high scalability, which is crucial for businesses that need to adapt their operations to varying workloads and changing market conditions.

Cloud solutions are particularly appealing because they provide regular updates and maintenance, ensuring that businesses can always access the latest technologies and security features. This is vital in the accounting field, where staying updated with the latest regulations and financial standards is essential.

On-premises solutions, while less popular, are preferred by organizations that require complete control over their data and systems due to security concerns or regulatory requirements. This deployment mode is particularly relevant in industries such as government and defense, where data sovereignty is a priority. Although cloud-based solutions dominate, the ongoing relevance of on-premises infrastructure highlights the diverse needs and preferences within the market.

Application Analysis

The Invoice Processing sub-segment dominates with 25% due to its impact on improving the efficiency of accounts payable

Applications of AI in accounting are diverse, but Invoice Processing stands out as the dominant sub-segment, accounting for 25% of the market. This application has become increasingly critical as businesses seek more efficient ways to manage their accounts payable and receivable.

AI enhances invoice processing by automating the extraction and validation of data from invoices, reducing manual errors, and significantly speeding up the reconciliation and payment processes. This not only improves efficiency but also enhances accuracy and reduces the potential for fraud.

AI-driven invoice processing systems are capable of learning from historical data, enabling them to improve over time and predict and resolve discrepancies before they become issues. This proactive approach to managing invoices is a key factor in the growing reliance on AI in this field.

Other applications such as Fraud Detection and Prevention, Financial Forecasting, and Audit Automation also contribute significantly to the market. These applications leverage AI to provide advanced analytical capabilities, risk assessment, and decision support, which are crucial for comprehensive financial management and compliance.

Organization Size Analysis

Small and Medium-sized Enterprises (SMEs) dominate with 58% due to the tailored AI solutions that significantly enhance their operational efficiency.

In terms of Organization Size, SMEs lead the AI in Accounting Market with a 58% share. This dominance is largely due to the scalability of AI solutions that are particularly beneficial for smaller businesses, which often face resource constraints.

AI technologies enable SMEs to automate many of their routine accounting tasks, which helps to reduce costs and improve accuracy. These solutions are also valuable in providing SMEs with advanced analytical tools that were previously only accessible to larger corporations, leveling the playing field.

The impact of AI on SMEs is significant, as it allows these businesses to compete more effectively by optimizing their financial operations and improving decision-making processes. This is particularly important in a globalized market where SMEs must operate efficiently to sustain growth and profitability.

Large Enterprises also benefit from AI in accounting, particularly in managing complex financial systems and complying with international regulations. For large enterprises, AI provides the necessary tools to handle large volumes of transactions and complex financial data, enhancing both efficiency and compliance.

End-user Industry Analysis

The BFSI sector dominates with 34.7% due to the critical need for accuracy and compliance in financial services.

In the End-user Industry segment, the Banking, Financial Services, and Insurance (BFSI) sector is the most prominent, with a 34.7% share in the AI in Accounting Market. This sector relies heavily on accuracy, efficiency, and compliance, which AI tools are well-equipped to enhance. AI applications in BFSI range from risk assessment and fraud detection to customer financial advisory services, all of which benefit from the advanced analytical capabilities of AI.

The dominance of AI in BFSI is also driven by the sector’s need to process large volumes of complex transactions quickly and accurately. AI systems streamline these processes, reduce the incidence of errors, and ensure compliance with increasingly stringent regulatory requirements.

Other industries such as Manufacturing, Retail, Healthcare, and IT & Telecom also integrate AI into their accounting processes to enhance efficiency, regulatory compliance, and financial decision-making. The growth of AI in these sectors highlights the broad applicability and value of AI technologies across different market verticals, reinforcing its transformative impact on the accounting landscape.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-premises

- Cloud-based

By Application

- Invoice Processing

- Fraud Detection

- Financial Forecasting

- Audit Automation

- Others

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By End-User Industry

- BFSI

- Manufacturing

- Retail

- Healthcare

- IT & Telecom

- Others

Driver

Automation and Efficiency Gains Drive Market Growth

The adoption of AI in accounting is significantly driven by its ability to automate routine tasks, thereby improving efficiency and allowing accountants to focus on higher-value activities. Automation, particularly in data entry, transaction processing, and audit preparation, reduces time spent on these tasks by up to 90%. This streamlining not only speeds up processes but also minimizes errors, which is crucial during tasks like month-end closings.

Moreover, AI enhances fraud detection capabilities by utilizing algorithms that identify irregularities more effectively, helping companies mitigate financial risks. This automation translates into considerable time savings, enabling accountants to shift their focus toward strategic planning and advisory services, which are increasingly valued by clients.

The integration of AI into compliance and regulatory functions ensures that accounting processes adhere to ever-evolving standards. AI can monitor compliance in real time, reducing the burden on human resources and minimizing the risk of non-compliance, which could otherwise result in costly fines or legal issues. Collectively, these factors are driving the rapid adoption of AI in the accounting sector, leading to more efficient, secure, and compliant financial operations.

Restraint

Regulatory and Technological Barriers Restraint Market Growth

The AI in Accounting Market faces several significant challenges that restrain its growth, primarily due to regulatory hurdles, technological limitations, and industry-specific adoption barriers. One of the most pressing issues is the complex regulatory environment governing the use of AI in financial wellness.

Regulations such as the Sarbanes-Oxley Act in the United States and similar frameworks in other regions impose strict compliance and reporting standards. These regulations require that financial data handling and reporting processes are transparent and auditable, which can be challenging to ensure with AI-driven systems. The lack of clear guidelines on how AI can be used in compliance with these laws often leads to hesitancy in adoption, particularly among large firms that are subject to rigorous audits and oversight.

Technological limitations also play a crucial role in restraining the AI in Accounting Market. AI systems require vast amounts of high-quality data to function accurately, but in many cases, this data is not readily available or is fragmented across various platforms. This is particularly problematic in industries where data is sensitive or where there is a high risk of error, such as in the banking and insurance sectors.

Opportunity

Automation, Accuracy, and Compliance Provide Opportunities

The AI in Accounting Market offers significant opportunities for players, driven by the increasing demand for automation, enhanced accuracy, and improved compliance. Automation presents a key opportunity as businesses look to streamline repetitive tasks such as data entry, invoice processing, and reconciliation. AI-powered tools can automate these processes, reducing manual labor, minimizing errors, and freeing up accounting professionals to focus on higher-value activities like strategic financial planning.

Accuracy is another critical growth factor. AI technologies can analyze vast amounts of financial data with precision, identifying patterns and anomalies that might be missed by human eyes. This capability not only improves the accuracy of financial reporting but also helps in early detection of potential issues, such as fraud or mismanagement. Companies that leverage AI to enhance the accuracy of their accounting processes can gain a competitive edge by providing more reliable and insightful financial data.

Compliance also provides a substantial opportunity. With increasingly complex regulatory environments, businesses are under pressure to ensure their accounting practices meet all legal requirements. AI can help by continuously monitoring transactions and records to ensure compliance with the latest regulations. This reduces the risk of costly penalties and enhances the credibility of the business. Firms that develop AI solutions focused on compliance can attract a broad range of clients, particularly in highly regulated industries.

Challenge

Implementation, Cost, and Trust Challenges Market Growth

The growth of AI in the Accounting Market is facing several critical challenges that impact its expansion. One of the most significant challenges is the implementation of AI technologies within existing accounting systems. Many firms rely on traditional methods and legacy software, making the integration of AI complex and resource-intensive. The process often requires a complete overhaul of systems, which can be time-consuming and disrupt business operations.

Another major challenge is the cost associated with AI adoption in accounting. Developing and deploying AI solutions requires significant investment in technology, infrastructure, and skilled personnel. For many small and medium-sized firms, these costs are prohibitive, limiting their ability to adopt AI technologies. Even larger firms may find the return on investment unclear, making them hesitant to fully commit to AI-driven accounting processes.

Additionally, there is a trust issue related to AI in accounting. Accounting is a field where accuracy and reliability are paramount, and there is often skepticism about whether AI can consistently deliver the level of precision required. Concerns about AI making errors, particularly in critical financial decisions, lead to resistance among accountants and decision-makers. This lack of trust slows down the adoption of AI in accounting as firms are cautious about relying on these new technologies.

Growth Factors

- Automation of Routine Tasks: AI automates repetitive accounting tasks such as data entry, invoice processing, and payroll management. This reduces manual work, minimizes errors, and allows accountants to focus on higher-value activities, driving AI adoption.

- Improved Accuracy: AI enhances the accuracy of financial records by reducing human errors in calculations and data handling. This increased precision is vital for compliance and reporting, making AI an attractive solution for accounting firms.

- Enhanced Data Analysis: AI enables deeper analysis of financial data, providing insights that support better decision-making. These advanced analytics help businesses optimize their financial strategies, fueling the demand for AI-driven accounting solutions.

- Fraud Detection and Prevention: AI systems can detect unusual patterns and anomalies in financial transactions, identifying potential fraud quickly. This capability strengthens security and trust, encouraging more companies to integrate AI into their accounting processes.

- Cost Efficiency: By automating tasks and improving accuracy, AI helps reduce operational costs in accounting. This cost-effectiveness is particularly appealing to businesses looking to streamline their financial operations, contributing to market growth.

- Scalability: AI allows accounting processes to scale easily as a business grows, handling larger volumes of data and more complex transactions without requiring proportional increases in resources. This scalability is a significant factor driving the adoption of AI in accounting.

Emerging Trends

- Automated Data Entry and Processing: AI is increasingly being used to automate data entry and processing, reducing the time and effort required for routine accounting tasks. This trend improves accuracy and efficiency, allowing accountants to focus on more strategic activities.

- Real-Time Financial Reporting: AI enables real-time financial reporting by continuously analyzing financial data and generating up-to-date reports. This trend helps businesses make quicker, data-driven decisions and improves transparency in financial management.

- Enhanced Fraud Detection: AI-powered systems are being used to detect anomalies and suspicious activities in financial transactions. This trend strengthens security, helps prevent fraud, and ensures compliance with regulatory standards, making AI a critical tool for accounting firms.

- AI-Driven Tax Preparation: AI is simplifying tax preparation by analyzing financial records and optimizing tax strategies. This trend reduces the complexity and time involved in tax filing, offering significant value to businesses during tax season.

- Predictive Analytics for Financial Planning: AI is being used to predict financial trends and help businesses plan more effectively for the future. This trend provides valuable insights into cash flow management, budgeting, and financial forecasting, driving better business outcomes.

- Natural Language Processing (NLP) for Audit Automation: NLP technology is being integrated into auditing processes, enabling automated analysis of financial documents. This trend reduces the time and cost of audits, improving the efficiency and accuracy of financial reviews.

Regional Analysis

North America Dominates with 32% Market Share in the AI in Accounting Market

North America’s 32% market share with valuation of USD 0.896 Bn in the AI in accounting sector is attributed to its advanced technological landscape and a high concentration of tech firms specializing in AI. The region’s strong financial sector demands innovative solutions for data management and analysis, driving the adoption of AI technologies. Additionally, there’s substantial investment in AI from both the public and private sectors, fostering growth and innovation in AI applications tailored for accounting.

The integration of AI in accounting in North America is enhanced by its mature technological infrastructure, enabling seamless implementation of AI solutions. There’s a significant focus on automating routine tasks and enhancing decision-making with predictive analytics. Furthermore, the presence of a tech-savvy workforce and a culture that promotes rapid adoption of new technologies play pivotal roles in the widespread use of AI in accounting.

The future of North America’s dominance in the AI in accounting market looks promising. Ongoing technological advancements and the growing trend towards digital transformation in finance are likely to increase reliance on AI-driven solutions. This trend, coupled with the region’s innovation capabilities, suggests North America will maintain or even expand its market leadership.

Regional Analysis for Other Markets:

- Europe: Europe maintains a strong position in the AI in accounting market, driven by rigorous data protection standards and a focus on ethical AI development. The region’s emphasis on transparency and accountability in AI applications reassures businesses, supporting adoption across diverse industries. Strategic partnerships between tech firms and financial institutions are likely to keep Europe competitive in this field.

- Asia Pacific: This region exhibits rapid growth in AI in accounting due to its dynamic economic development and digital transformation efforts. Increasing investments in AI by leading economies like China and Japan are key contributors. The burgeoning startup ecosystem, particularly in fintech, suggests significant future growth potential for AI applications in accounting.

- Middle East & Africa: The Middle East and Africa are emerging markets in the AI in accounting sector, with growth driven by initiatives to modernize the financial and business sectors. As the digital infrastructure improves and awareness of AI benefits grows, adoption rates are expected to rise, particularly in the Gulf Cooperation Council (GCC) countries focused on economic diversification.

- Latin America: Latin America’s AI in accounting market is developing, catalyzed by growing digital literacy and the increasing need for operational efficiency in businesses. While the region faces challenges in technological adoption due to economic variability, the potential for growth remains significant as more enterprises begin to recognize the benefits of AI-driven financial processes.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The AI in accounting market is rapidly evolving, with key players driving innovation and adoption of AI technologies to streamline and automate financial processes. This analysis highlights the strategic positioning, market influence, and impact of the top three companies leading the charge in this space: IBM Corporation, Amazon Web Services Inc. (AWS), and Microsoft Corporation.

IBM Corporation is a leading player in the AI in accounting market, known for its AI platform, Watson, which offers advanced data processing and cognitive solutions. IBM has strategically positioned itself by integrating AI with its cloud services, enabling businesses to automate various accounting processes. Its strong presence across multiple industries gives IBM significant influence on market trends. The company’s extensive experience in AI research and development further reinforces its competitive edge, making it a preferred choice for large enterprises seeking innovative accounting solutions.

Amazon Web Services Inc. (AWS) is another major force in the AI in accounting market, primarily due to its powerful cloud infrastructure. AWS provides essential AI tools, including machine learning models and data analytics, which play a crucial role in automating and enhancing accounting tasks. The company’s strategic partnerships with accounting firms have further strengthened its market position. AWS’s ability to offer scalable and cost-effective AI solutions makes it particularly influential among small and medium-sized enterprises. Its robust ecosystem and continuous innovation are key drivers of AI adoption in accounting.

Microsoft Corporation is a key player in AI for accounting, leveraging its Azure cloud platform and extensive AI capabilities. The company offers AI-driven accounting tools that are seamlessly integrated with its widely used Office 365 suite. Microsoft’s strategic positioning is bolstered by its focus on enhancing user experience and streamlining business processes. Its market influence is considerable, especially among enterprises that already utilize Microsoft products. The company’s ongoing investments in AI technology ensure it remains a leader in the market, continuously driving the evolution of AI in accounting.

Top Key Players in the Market

- IBM Corporation

- Amazon Web Services Inc.

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Intuit Inc.

- Xero Limited

- Sage Group Plc

- UiPath

- Kore Inc.

- AppZen Inc.

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers (PwC)

- KPMG International Cooperative

- EY (Ernst & Young)

- Other Key Players

Recent Developments

- April 2023: PwC US announced a USD 1 billion investment over the next three years to expand and scale its AI capabilities. This investment is aimed at integrating AI more deeply into its services to help clients reimagine their businesses through generative AI.

- July 2023: KPMG and Microsoft significantly expanded their global partnership, committing billions of dollars to enhance KPMG’s services with Microsoft’s cloud and AI technologies. This multi-year agreement aims to integrate AI across KPMG’s audit, tax, and advisory services, enabling their 265,000 professionals to leverage AI for faster analysis and improved client services. The alliance is expected to generate over USD 12 billion in growth opportunities for KPMG.

Report Scope

Report Features Description Market Value (2023) USD 2.8 Billion Forecast Revenue (2033) USD 88.2 Billion CAGR (2024-2033) 41.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Deployment Mode (On-premises, Cloud-based), By Application (Invoice processing, Fraud detection, Financial forecasting, Audit automation, Others), By Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By End-user Industry (BFSI, Manufacturing, Retail, Healthcare, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Amazon Web Services Inc., Microsoft Corporation, SAP SE, Oracle Corporation, Intuit Inc., Xero Limited, Sage Group Plc, UiPath, Kore Inc., AppZen Inc., Deloitte Touche Tohmatsu Limited, PricewaterhouseCoopers (PwC), KPMG International Cooperative, EY (Ernst & Young), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the AI in Accounting ?The AI in Accounting involves the use of artificial intelligence technologies to automate and enhance various accounting processes, such as invoice processing, fraud detection, financial forecasting, and audit automation.

How big is the AI in Accounting Market?The AI in Accounting Market is valued at $2.8 billion and is projected to grow to $88.2 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 41.2%.

What are the key factors driving the growth of the AI in Accounting Market?The growth is driven by the increasing adoption of AI for automating accounting tasks, the demand for accuracy and efficiency in financial operations, and the growing need to comply with regulatory requirements.

What are the current trends and advancements in the AI in Accounting Market?Trends include the adoption of AI-driven cloud accounting software, the use of AI for real-time financial analysis and forecasting, and the integration of AI with blockchain technology for enhanced security and transparency.

What are the major challenges and opportunities in the AI in Accounting Market?Challenges include the high cost of AI implementation, data privacy concerns, and the need for skilled professionals to manage AI systems. Opportunities exist in expanding AI capabilities to small and medium-sized enterprises (SMEs), developing more user-friendly AI tools, and enhancing AI's role in regulatory compliance.

Who are the leading players in the AI in Accounting Market?Leading players include IBM Corporation, Amazon Web Services Inc., Microsoft Corporation, SAP SE, Oracle Corporation, Intuit Inc., Xero Limited, Sage Group Plc, UiPath, Kore Inc., AppZen Inc., Deloitte Touche Tohmatsu Limited, PricewaterhouseCoopers (PwC), KPMG International Cooperative, EY (Ernst & Young), and other key players.

-

-

- IBM Corporation

- Amazon Web Services Inc.

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Intuit Inc.

- Xero Limited

- Sage Group Plc

- UiPath

- Kore Inc.

- AppZen Inc.

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers (PwC)

- KPMG International Cooperative

- EY (Ernst & Young)

- Other Key Players