Global AI for Debt Collection Market Size, Share, Statistics Analysis Report By Component (Software, Services), By Deployment (Cloud-Based, On-Premises, Hybrid), By Enterprise Size (Large Enterprise, Small & Medium Enterprise), By Industry Vertical (Banking, Financial Services and Insurance (BFSI), Telecommunications, Utilities, Retail & E-commerce, Healthcare, Others (Government, Automotive, and Education)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: December 2024

- Report ID: 136597

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

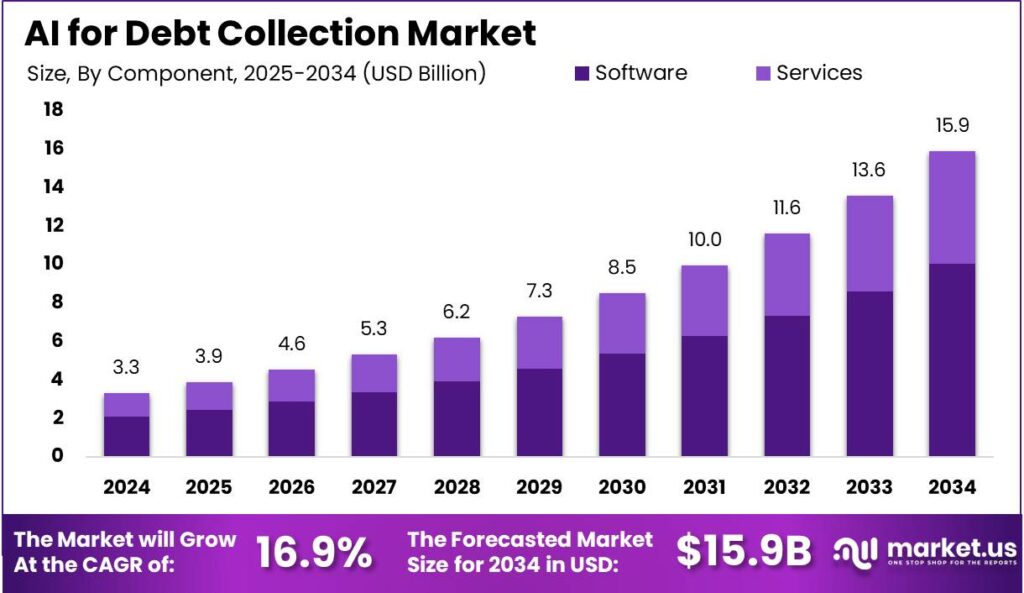

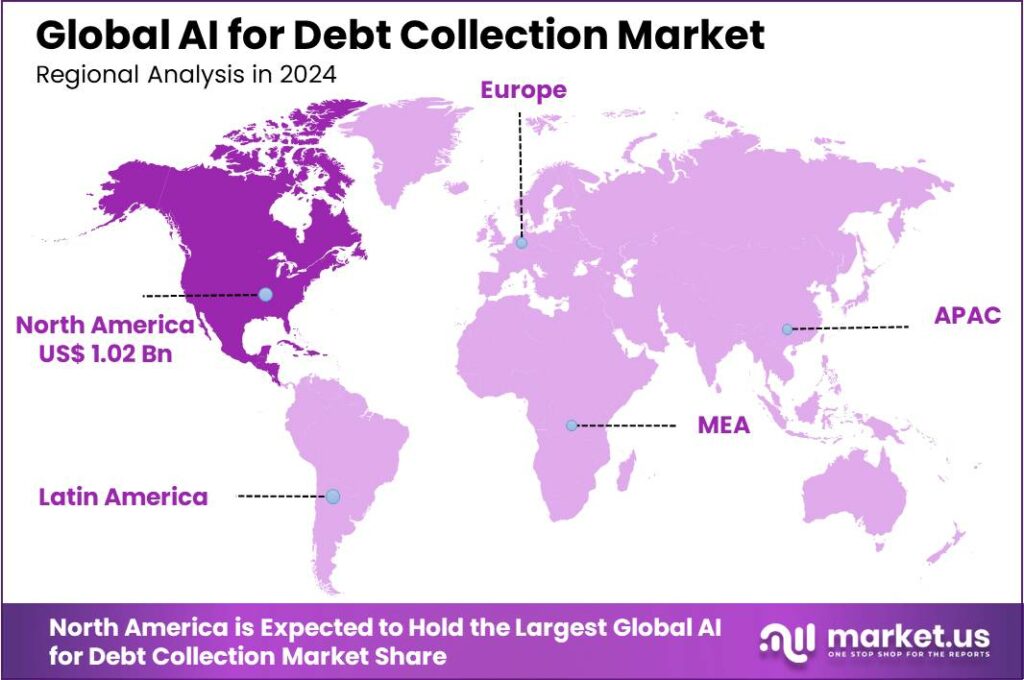

The Global AI for Debt Collection Market size is expected to be worth around USD 15.9 Billion By 2034, from USD 3.34 Billion in 2024, growing at a CAGR of 16.90% during the forecast period from 2025 to 2034. In 2024, North America led the AI for debt collection market, capturing over 30.7% of the share, with revenues reaching around USD 1.02 billion.

AI for debt collection refers to the use of artificial intelligence technologies to enhance and streamline the process of collecting debts. This method incorporates various AI tools such as machine learning, natural language processing, and data analytics to analyze debtor profiles, predict payment probabilities, and automate communication strategies.

The market for AI in debt collection is experiencing rapid growth, driven by the technology’s ability to significantly improve both the scale and effectiveness of collection efforts. AI is being integrated into various aspects of the debt collection process, from initial customer communication to final payment negotiations, using sophisticated algorithms that can learn and adapt over time.

The financial impact is substantial, with AI expected to enhance operational efficiencies and compliance, while also boosting recovery rates and reducing operational costs. Key drivers of AI adoption in the debt collection industry include the need to increase collection rates and customer satisfaction while reducing operational costs.

AI helps collection agencies achieve a higher success rate in contact and negotiation with debtors, leading to improved customer satisfaction and operational efficiencies. Additionally, AI-driven analytics and predictive models provide agencies with insights to optimize strategies and forecast debtor behavior with high accuracy, which is crucial for effective risk management and decision-making.

Market demand for AI in debt collection is on the rise due to its potential to significantly improve the recovery rates of outstanding debts while minimizing the costs associated with traditional collection methods. Debt collection agencies are increasingly adopting AI technologies to gain a competitive edge in a crowded market.

According to ScienceSoft, AI is transforming debt collection, making processes faster, smarter, and more cost-effective. Automated collections planning and execution can make operations up to 8 times faster and boost collector productivity by 2-4 times. With intelligent automation, the cost of debtor interactions can drop by 70%, while response rates improve up to 10 times.

AI-driven strategies also help reduce loan delinquencies by over 25% and bad debt by up to 20%, creating a significant impact on financial stability for businesses. In Europe, 57% of businesses report liquidity challenges due to late payments, with Greece facing the highest rate at 96%, according to a report by Intrum Justitia. These challenges highlight the urgency for innovative solutions like AI.

A TransUnion survey of 90 companies reveals how AI is being applied in debt collection. 58% use AI to predict payment outcomes, while 56% segment and profile customers for better workflows. AI-powered virtual negotiators are employed by 53%, and 47% use AI to recommend communication methods or analyze account life cycle workflows.

Additionally, 46% leverage AI to anticipate consumer behavior, and 37% help customers find the best communication channels. Even internal processes benefit, with 32% of companies using AI to monitor worker behavior and performance.

This includes the use of AI-driven chatbots and virtual negotiation agents that can handle initial debtor interactions and payment arrangements autonomously. Additionally, the integration of AI with other emerging technologies like blockchain for secure transactions presents new avenues for growth. There is also a significant opportunity in developing regions where the penetration of AI in debt collection is still in the early stages.

Technological advancements in AI are continually reshaping the debt collection landscape. Recent developments include the use of machine learning algorithms for better prediction of payment outcomes and behavioral analytics to understand debtor actions more profoundly. AI technologies are also improving in terms of their integration with existing systems, ease of use, and the ability to provide real-time insights, which are crucial for making informed decisions quickly.

Key Takeaways

- The Global AI for Debt Collection Market is projected to reach USD 15.9 Billion by 2034, up from USD 3.34 Billion in 2024, growing at a CAGR of 16.90% from 2025 to 2034.

- In 2024, the Software segment dominated the market, holding more than 63.3% of the share.

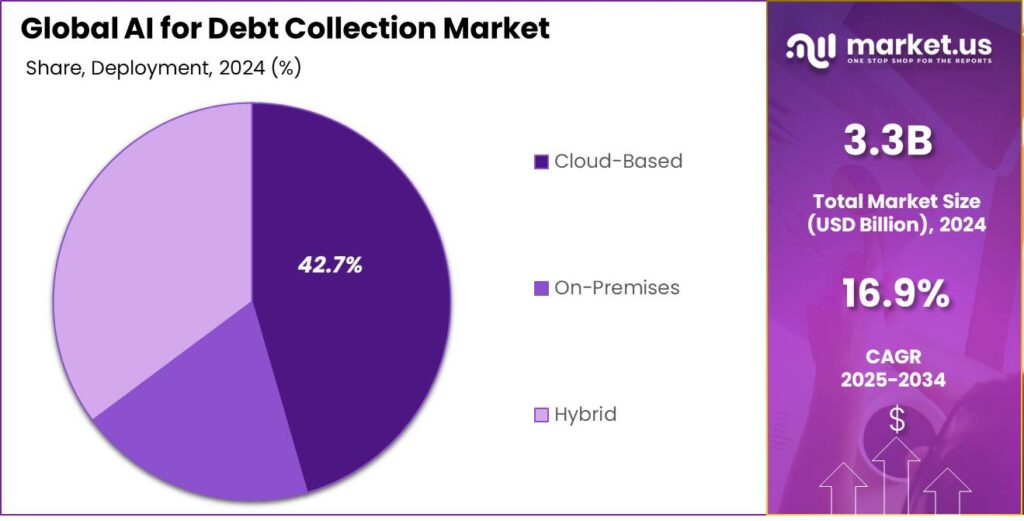

- The Cloud-Based segment led the market in 2024, capturing over 42.7% of the share.

- The Large Enterprise segment held the largest market share in 2024, with more than 72.3% of the market.

- The Banking, Financial Services, and Insurance (BFSI) segment had a dominant position in the market, accounting for over 31.6% of the share in 2024.

- North America was the leading region, holding more than 30.7% of the market, with revenues reaching approximately USD 1.02 billion in 2024.

Component Analysis

In 2024, the Software segment held a dominant market position within the AI for debt collection market, capturing more than a 63.3% share. This significant market share is primarily attributed to the critical role software plays in the operational deployment of AI technologies.

Software solutions are essential for AI-driven debt collection, offering algorithms, data processing, and user interfaces for efficient recovery. Their strong demand stems from seamless integration with existing financial systems, allowing organizations to improve collections without major infrastructure changes.

The leadership of the Software segment is further bolstered by continuous advancements in AI and machine learning technologies. As these technologies evolve, they enhance the capabilities of debt collection software, making it more effective at analyzing debtor data, predicting payment behavior, and automating communications.

Moreover, the shift towards digital transformation in the financial services industry supports the predominance of the software segment. Financial institutions are increasingly adopting digital solutions to improve their operational efficiencies and customer service, including in the area of debt collection.

Deployment Analysis

In 2024, the Cloud-Based segment held a dominant market position within the AI for debt collection market, capturing more than a 42.7% share. This segment’s leadership is primarily attributed to its scalability and flexibility, which are crucial for businesses seeking to adapt to varying volumes of debt collection needs.

The predominance of the Cloud-Based segment is also reinforced by its ability to provide real-time data access and updates. Companies in the debt collection sector are increasingly relying on immediate insights to make informed decisions and strategies effectively.

Another factor contributing to the growth of the Cloud-Based segment is its inherent security and compliance features. With data protection regulations tightening globally, cloud providers have strengthened their security measures to comply with industry standards and laws.

Lastly, the Cloud-Based model supports seamless integration with other digital tools and platforms, which is essential for leveraging advanced analytics and machine learning algorithms. These integrations enable debt collection agencies to automate processes and personalize debtor communication, further improving operational efficiency and debtor satisfaction.

Enterprise Size Analysis

In 2024, the Large Enterprise segment held a dominant market position in the AI for debt collection market, capturing more than a 72.3% share. This significant market share can be attributed to several key factors that favor large enterprises in the integration and utilization of AI technologies.

Large enterprises typically have greater financial resources, which enable them to invest in advanced AI solutions and technologies. This investment capacity allows for the adoption of sophisticated AI systems that streamline debt collection processes, enhance decision-making, and improve customer interactions, contributing to their dominant position in the market.

These enterprises often have a broader customer base and handle larger volumes of debt, necessitating more efficient debt collection methods. AI technologies in these organizations are implemented to manage vast amounts of data and automate complex processes.

This capability not only increases efficiency but also reduces the potential for human error, thereby enhancing overall effectiveness in debt recovery. The scale of operations in large enterprises thus directly correlates with the adoption of AI, reinforcing their lead in the market.

Industry Vertical Analysis

In 2024, the Banking, Financial Services, and Insurance (BFSI) segment held a dominant market position in the AI for debt collection market, capturing more than a 31.6% share. This prominence is largely due to the inherent nature of the BFSI sector, which deals extensively with credit and debt management as core components of its services.

The high volume of transactions and the critical need for efficient debt recovery processes drive BFSI institutions to adopt advanced AI solutions. These solutions enhance the accuracy and efficiency of debt collection strategies, ensuring higher recovery rates and minimizing financial risks.

The BFSI sector’s adoption of AI for debt collection is further supported by the increasing regulatory pressures to maintain high standards of customer data management and financial reporting. AI technologies assist BFSI institutions in complying with these regulations by providing sophisticated tools for data analysis and management.

These tools help in identifying patterns, assessing customer credit risk, and optimizing collection strategies based on predictive analytics. The ability to leverage AI for compliance and operational efficiency strongly contributes to the sector’s leading position in the market.

Key Market Segments

By Component

- Software

- Services

By Deployment

- Cloud-Based

- On-Premises

- Hybrid

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

By Industry Vertical

- Banking, Financial Services and Insurance (BFSI)

- Telecommunications

- Utilities

- Retail & E-commerce

- Healthcare

- Others (Government, Automotive, and Education)

Driver

Enhanced Efficiency and Cost Reduction

Artificial Intelligence (AI) is transforming debt collection by automating routine tasks, leading to significant efficiency gains and cost savings. AI-powered systems handle high-volume, low-value tasks, allowing human agents to focus on complex cases that require personal attention.

Moreover, AI-driven platforms can manage thousands of accounts simultaneously, ensuring comprehensive coverage of debt portfolios. This scalability enables debt collection agencies to expand their outreach without a proportional increase in resources.

AI automates payment reminders and customer interactions, reducing human error and ensuring timely, accurate communication. This boosts debt recovery efficiency, improves profitability, and allows human agents to focus on strategic decisions and customer relationships.

Restraint

Compliance and Ethical Considerations

AI in debt collection offers benefits but also raises concerns about compliance and ethics. Strict laws protect consumers, and without proper oversight, AI systems may unintentionally violate regulations, such as contacting consumers at inappropriate times or failing to provide required disclosures.

Additionally, ethical considerations arise when deploying AI in debt collection. The use of AI must be transparent, and consumers should be informed when they are interacting with automated systems. There is also the risk of AI making decisions based on biased data, leading to unfair treatment of certain debtor groups.

Opportunity

Personalized Debtor Engagement

AI presents a significant opportunity to enhance debtor engagement through personalized communication strategies. By analyzing debtor profiles, payment histories, and behavioral data, AI systems can tailor interactions to individual circumstances.This personalized approach boosts debt recovery by tailoring communication to each debtor’s situation.

It can also suggest customized payment plans that align with a debtor’s financial capacity, making it easier for them to commit to repayments. By fostering a more empathetic and individualized approach, AI not only improves recovery rates but also enhances the overall customer experience, leading to better long-term relationships.

Challenge

Integration with Existing Systems

Integrating AI into existing debt collection systems is challenging, as many agencies use legacy systems incompatible with advanced AI. The process is time-consuming and resource-intensive, and without proper integration, AI’s benefits may be limited, potentially disrupting workflows.

Furthermore, staff may require training to effectively utilize new AI tools, adding to the implementation timeline and costs. To address these challenges, it is essential to choose AI solutions that offer compatibility with existing systems and provide comprehensive support during the integration process. This approach ensures a smoother transition and maximizes the potential benefits of AI in debt collection.

Emerging Trends

Artificial intelligence (AI) is reshaping debt collection by making it more efficient and customer-friendly. One key development is the use of predictive analytics, where AI examines past data to forecast how likely debtors are to pay. This helps collection agencies focus on accounts that are more likely to pay, improving recovery rates.

Another trend is personalized communication. AI can tailor messages to fit each debtor’s situation, making interactions more effective and respectful. This personalized approach leads to better engagement and higher chances of repayment.

AI enhances communication across SMS, email, social media, and phone, reaching debtors through their preferred channels for timely payments. It also offers real-time reporting, providing agencies with up-to-date insights to make quick, informed decisions and improve outcomes.

Business Benefits

- Personalized Communication: AI analyzes each debtor’s behavior and preferences, allowing businesses to tailor their communication strategies. This personalized approach leads to better engagement and higher recovery rates.

- Improved Efficiency: By automating routine tasks like sending reminders and processing payments, AI reduces manual work. This automation speeds up the collection process and lowers operational costs.

- Predictive Analytics: AI uses historical data to predict debtor behavior, helping businesses identify accounts that are likely to default. This insight enables proactive measures to prevent delinquencies.

- Enhanced Compliance: AI systems can be programmed to follow industry regulations, ensuring that all collection activities are compliant. This reduces the risk of legal issues and maintains ethical standards.

- Better Customer Experience: With AI-driven self-service options, customers can manage their debts at their convenience. This flexibility leads to higher satisfaction and encourages timely payments.

Regional Analysis

In 2024, North America held a dominant market position in the AI for debt collection market, capturing more than a 30.7% share, with revenues reaching approximately USD 1.02 billion. This leadership is largely attributed to the high concentration of financial technology companies and the early adoption of advanced technologies in this region.

North American businesses are at the forefront of integrating AI into various operations, including debt collection, driven by a strong technological infrastructure and a competitive economic environment that demands efficiency and innovation.

Strict regulations like the Fair Debt Collection Practices Act (FDCPA) in North America, particularly the U.S., ensure ethical debt collection. AI technologies help companies comply with these rules by automating communication and ensuring legal and ethical collection strategies. This focus on compliance drives more businesses to adopt AI solutions, reducing legal risks and improving collection efficiency.

Furthermore, the presence of a mature financial sector in North America, characterized by significant volumes of consumer and corporate debt, creates a substantial demand for efficient debt collection solutions. The increasing amount of defaulted loans and rising credit card debts among consumers necessitate the use of more sophisticated and effective collection technologies, such as AI.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the rapidly evolving AI for debt collection market, several key players stand out due to their innovative approaches and significant market impact.

Fair Isaac Corporation (FICO) is a prominent leader in the field of analytics and decision-making solutions, including those for debt collection. Known primarily for its credit scoring models, FICO also offers sophisticated AI-driven platforms that help organizations optimize their debt recovery strategies.

Experian is another influential figure in the AI for debt collection market. As one of the largest credit information companies globally, Experian brings a wealth of data and analytical expertise to the table. Their AI solutions are designed to provide deeper insights into consumer behavior and creditworthiness, which aids in more targeted and strategic collection practices.

Convergent Outsourcing focuses on offering cost-effective debt recovery services that integrate AI technologies to streamline collection processes. Their use of AI helps to personalize the debt collection approach for each debtor, increasing the likelihood of successful recovery.

Top Key Players in the Market

- Fair Isaac Corporation

- Experian

- Convergent Outsourcing

- InDebted

- CGI Group Inc.

- Simplifai

- receeve

- Nucleus Software Exports Ltd.

- Chetu Inc.

- Nucleus Software

- Other Key Players

Top Opportunities Awaiting for Players

The integration of Artificial Intelligence (AI) in the debt collection market is poised to bring significant transformations, enhancing efficiency, compliance, and customer engagement.

- Enhanced Predictive Analytics: AI can analyze vast amounts of data to predict the likelihood of debt repayment, helping collection agencies prioritize high-risk accounts. This capability allows for more strategic allocation of resources, focusing efforts on accounts with the highest probability of recovery.

- Automation of Routine Tasks: Automation through AI can handle repetitive tasks such as sending reminders, scheduling calls, and drafting collection letters. This reduces the need for manual intervention, freeing up human agents to focus on more complex and high-value tasks. Automated workflows not only increase operational efficiency but also minimize human errors, ensuring a more streamlined and effective collection process.

- Personalized Communication: AI-driven chatbots and virtual assistants can engage with debtors in a personalized manner, using machine learning algorithms to tailor communication strategies based on individual payment histories and behavior patterns. This personalized approach can improve customer engagement and satisfaction, leading to higher collection rates.

- Compliance and Risk Management: AI systems can monitor and ensure that all collection activities comply with relevant laws and regulations, reducing the risk of legal issues and penalties. These systems can also assess the risk of default for each debtor, providing data-driven insights to inform collection strategies.AI ensures compliance and risk management, safeguarding the reputation and integrity of collection agencies.

- Cost Efficiency and Resource Optimization: AI can analyze the cost-effectiveness of various collection activities, helping agencies optimize resource allocation and reduce operational costs. By identifying the most efficient channels and methods for debt recovery, AI enables agencies to make data-driven decisions that maximize their return on investment.

Recent Developments

- In September 2024, InDebted secured $60 million in funding to enhance its AI and machine learning capabilities in debt collection. This investment is intended to support the company’s mergers and acquisitions strategy and expand its product offerings.

- In October 2024, Neowise and Sarvam have launched AI-driven debt collection SaaS tools in India, powered by advanced large language models (LLMs). These solutions boost efficiency by 15% and reduce costs by 33%, transforming the way lenders handle debt recovery.

- In November 2024, PAIR Finance launched a new generative AI technology based on Llama 3 to revolutionize customer service in debt collection. This innovation aims to improve communication during the debt collection process.

Report Scope

Report Features Description Market Value (2024) USD 3.34 Bn Forecast Revenue (2034) USD 15.9 Bn CAGR (2025-2034) 16.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Deployment (Cloud-Based, On-Premises, Hybrid), By Enterprise Size (Large Enterprise, Small & Medium Enterprise), By Industry Vertical (Banking, Financial Services and Insurance (BFSI), Telecommunications, Utilities, Retail & E-commerce, Healthcare, Others (Government, Automotive, and Education)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fair Isaac Corporation, Experian, Convergent Outsourcing, InDebted, CGI Group Inc., Simplifai, receeve, Nucleus Software Exports Ltd., Chetu Inc., Nucleus Software, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI for Debt Collection MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

AI for Debt Collection MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Fair Isaac Corporation

- Experian

- Convergent Outsourcing

- InDebted

- CGI Group Inc.

- Simplifai

- receeve

- Nucleus Software Exports Ltd.

- Chetu Inc.

- Nucleus Software

- Other Key Players