Global AI-Driven Inventory Optimization Market Size, Share, Industry Analysis Report By Component (Solutions (Demand Forecasting, Inventory Planning, Replenishment Optimization, Multi-Echelon Inventory Optimization (MEIO), Pricing & Promotion Optimization), Services (Consulting, Implementation & Integration, Training & Support), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Large Enterprises, Small & Medium-Sized Enterprises (SMEs)), By Industry Vertical (Retail & E-commerce, Manufacturing, Automotive, Consumer Goods, Healthcare & Pharmaceuticals, Food & Beverage, Logistics & Transportation, Others (Aerospace, Energy, etc.), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156270

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

- Market Size

- Key Insight Summary

- Report Overview

- Key AI Use Cases

- Economic Impact

- US Market Size

- Growth Drivers

- Key Trends & Innovations

- By Component

- By Deployment Mode

- By Enterprise Size

- By Industry Vertical

- Key Market Segments

- Customer Insights

- Driver Factor

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Market Size

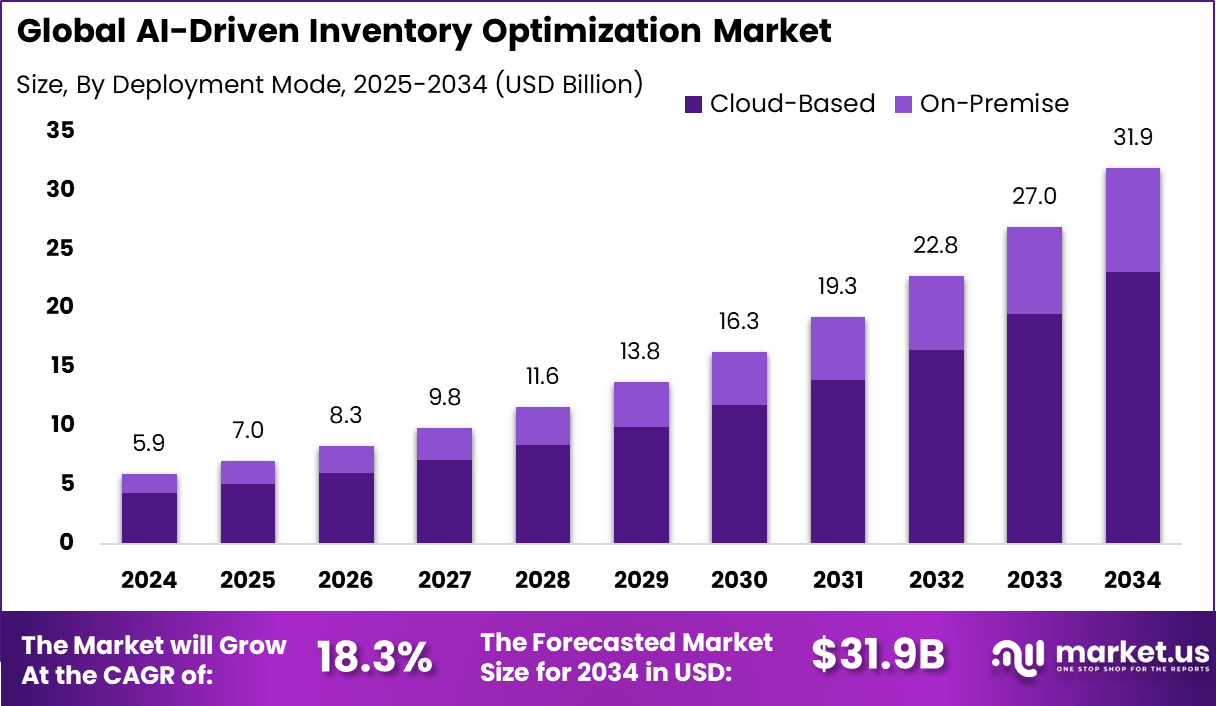

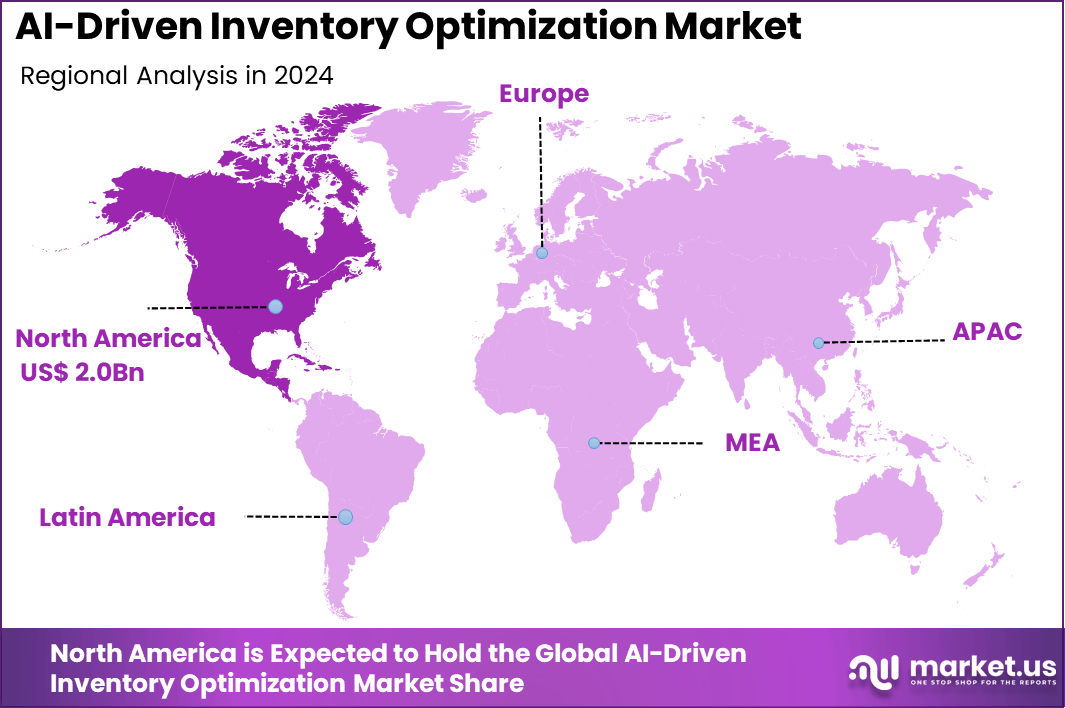

The Global AI-Driven Inventory Optimization Market size is expected to be worth around USD 31.9 Billion By 2034, from USD 5.9 billion in 2024, growing at a CAGR of 18.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 35% share, holding USD 2.0 Billion revenue.

Key Insight Summary

- By Component, Solutions dominated with a 75% share, reflecting strong adoption of AI-powered platforms for inventory planning and forecasting.

- By Deployment Mode, Cloud-Based systems led with 72.3% share, driven by scalability, integration, and real-time data access.

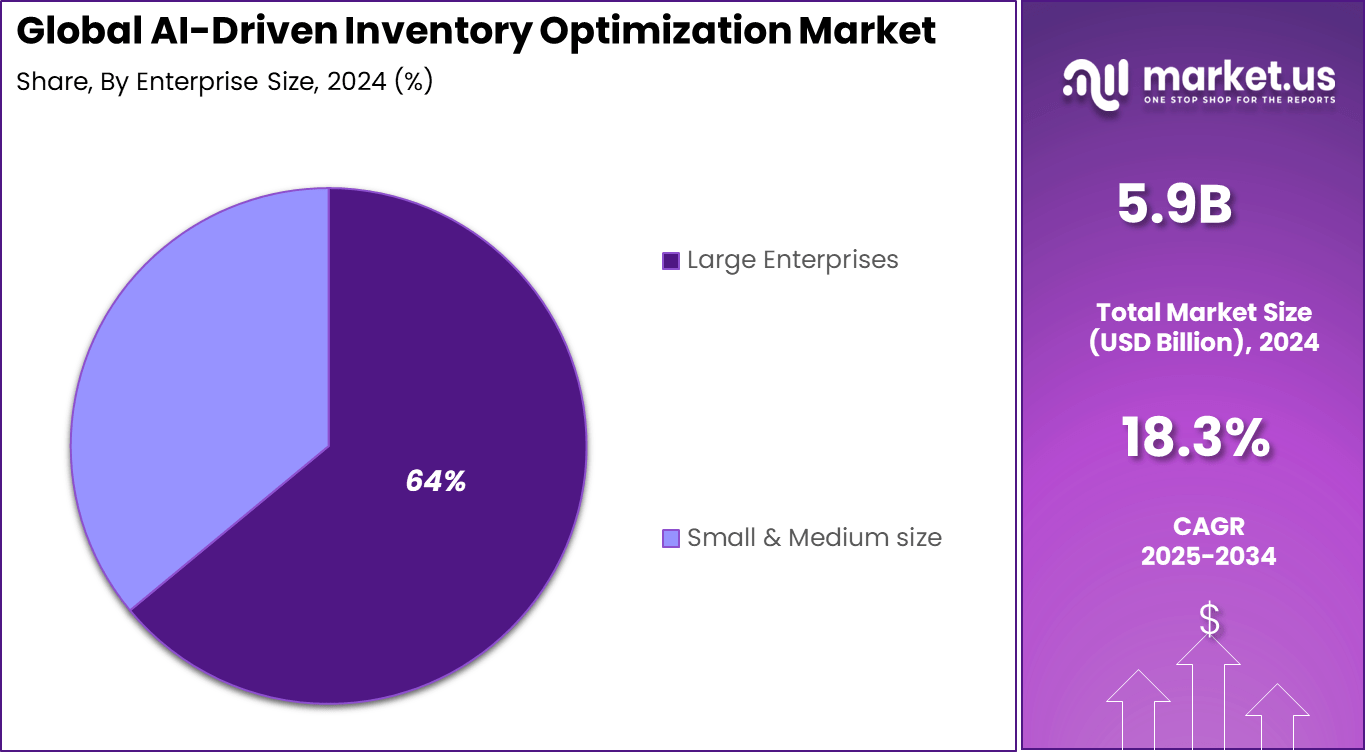

- By Enterprise Size, Large Enterprises held a 64% share, supported by their extensive supply chain networks and investment capacity.

- By Industry Vertical, Retail & E-commerce was the leading sector, capturing 22% share, fueled by demand for automated stock management and omnichannel optimization.

- By Region, North America accounted for 35% share, showcasing advanced AI adoption across industries.

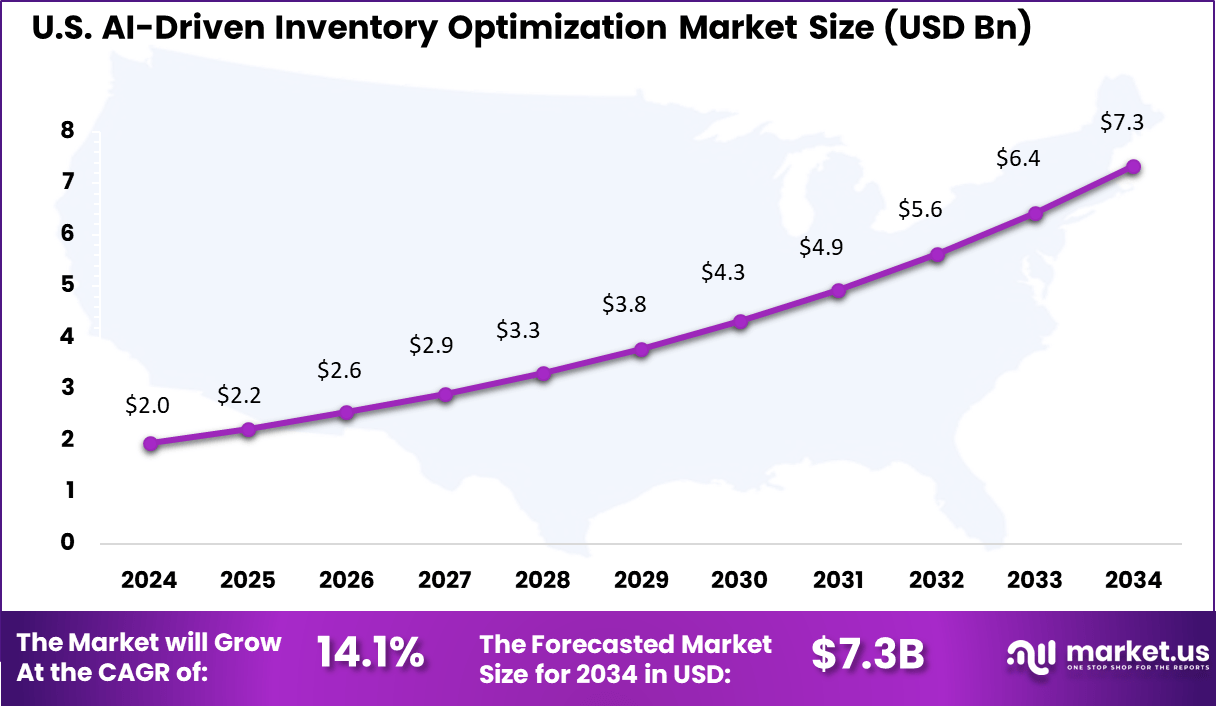

- The U.S. market reached USD 1.96 Billion in 2024, with a projected CAGR of 14.1%, highlighting steady growth in enterprise-led adoption.

Report Overview

The AI-driven inventory optimization market is expanding as businesses increasingly adopt artificial intelligence technologies to enhance supply chain efficiency, reduce costs, and improve customer satisfaction. AI in inventory optimization leverages machine learning to analyze large datasets including sales trends, seasonal fluctuations, and supplier information, enabling precise demand forecasting and automated stock level adjustments.

Key drivers of this market include the growing need for real-time visibility across inventory, the complexity of global supply chains, and the rise of omnichannel retailing which demands synchronized inventory across multiple sales channels. The integration of IoT technologies with AI further intensifies these capabilities by providing real-time inventory data, enabling dynamic recalibration of inventory levels according to shifting market signals.

A study by IBISWorld revealed that businesses lose approximately 10% to 15% of their revenue because of inventory-related challenges. This underscores the rising importance of AI-powered inventory management systems, which enable accurate demand forecasting, real-time stock monitoring, and automated optimization

Demand for AI-driven inventory optimization is particularly strong in retail and e-commerce sectors, generating over 27% of the market share. These sectors face intense pressure to streamline operations and deliver seamless customer experiences. AI solutions here support automated replenishment, real-time stock tracking, demand forecasting, and predictive analytics, all of which lead to significant cost savings and improved service levels.

Based on data from Superagi, more than 75% of companies identify supply chain optimization as a top priority. The AI inventory management market is projected to grow by over 20% in the next two years, driven by the need to address costly inefficiencies. Businesses lose nearly USD 1.1 trillion annually due to poor inventory practices, with the average firm carrying about 30% excess stock.

Key AI Use Cases

Use Cases Description Predictive Analytics AI forecasts demand accurately using historical sales, trends, seasonality, and external data Automated Replenishment Real-time inventory monitoring triggers optimal reorder points to reduce stockouts and overstock Dynamic Pricing AI-driven pricing adjusts based on demand and stock levels Multi-Warehouse Management AI coordinates inventory across multiple locations to optimize stock distribution Returns Management AI classifies returns and predicts resale potential Economic Impact

Impact Details Cost Reduction Up to 20-30% reduction in inventory carrying costs and operational expenses Productivity Improvement 15-30% improvement in supply chain efficiency and inventory turnover rates Revenue Growth 15-24% revenue increases via sales optimization and stock availability improvements ROI 150-300% ROI reported within two years of AI implementation US Market Size

The U.S. AI-Driven Inventory Optimization Market was valued at USD 2.0 Billion in 2024 and is anticipated to reach approximately USD 7.3 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 14.1% during the forecast period from 2025 to 2034.

Firstly, U.S. possesses one of the most advanced digital supply chain infrastructures globally. Enterprises in the region have prioritized end-to-end supply chain visibility and automation, especially after the disruptions caused by the pandemic. The availability of high-quality enterprise resource planning (ERP) systems, IoT sensors, and real-time data platforms has enabled faster integration of AI into inventory planning, forecasting, and replenishment workflows.

Second, the country benefits from a concentrated presence of AI and cloud-native technology vendors that offer tailored solutions for inventory management. These firms provide scalable platforms that allow manufacturers, retailers, and distributors to shift from reactive inventory practices to proactive, demand-driven models. Cloud computing penetration across U.S. businesses exceeds 90%, offering the necessary flexibility and computing power for AI model deployment.

In 2024, North America held a dominant market position, capturing more than 35% share in the AI-driven inventory optimization market, generating approximately USD 2 billion in revenue. This stronghold is largely attributed to the advanced digital maturity of supply chain operations across the region.

U.S. based enterprises, in particular, have increasingly adopted AI algorithms to enhance forecasting accuracy, minimize stockouts, and reduce excess inventory. The rapid shift toward omnichannel retailing and e-commerce has also demanded intelligent inventory systems capable of real-time decision-making, which traditional tools could no longer manage efficiently.

Growth Drivers

Key Driver Description Real-time Inventory Management Increasing need for instant tracking and adjustment of inventory levels to improve efficiency. Supply Chain Complexities Growing complexities demand smarter optimization through AI analytics and automation. Cost Reduction AI-driven optimization reduces inventory holding and operational costs significantly. Rapid Digitization & Cloud AI Adoption Increasing use of cloud-based AI solutions facilitates scalable, efficient inventory management. Improved Service Levels Enhanced accuracy in stock levels improves customer satisfaction and reduces stockouts/overstocking. Key Trends & Innovations

Trend/Innovation Description Predictive Demand Forecasting AI algorithms analyze data patterns to forecast demand accurately, minimizing stock issues. Autonomous Inventory Replenishment Automated ordering triggered by AI based on real-time inventory and demand predictions. AI-Powered Warehouse Automation Use of robots and AI systems to optimize picking, packing, and storage strategies. Real-time Inventory Visibility & IoT Integration Enhanced sensor networks and IoT provide granular, real-time inventory tracking and analytics. Personalized Inventory Strategies AI tailors stock levels and assortments to specific customer segments and market trends. By Component

In 2024, the solutions segment dominates the AI-driven inventory optimization market, accounting for approximately 75% of the overall share. These solutions include advanced software platforms that leverage artificial intelligence to analyze inventory data, forecast demand, and automate replenishment processes.

The high adoption rate reflects how businesses increasingly rely on these sophisticated tools to reduce inefficiencies such as stockouts and overstocking, thereby cutting costs and enhancing operational efficiency. Solutions focus on predictive analytics, real-time tracking, and automated decision-making to ensure optimal inventory levels tailored to dynamic market demands.

This dominance is driven by the tangible benefits these solutions deliver. Companies that implement AI-powered inventory solutions often witness improvements in inventory accuracy and responsiveness, resulting in lower carrying costs and higher customer satisfaction. The integration capabilities of these solutions with existing enterprise systems further increase their appeal, enabling seamless supply chain coordination and data-driven planning.

By Deployment Mode

In 2024, Cloud-based deployment holds a significant share of 72.3% within the AI-driven inventory optimization market. This reflects a strong shift towards cloud technologies, favored for their flexibility, scalability, and cost-effectiveness.

Cloud platforms allow businesses to quickly access powerful AI capabilities without the need for large upfront investments in hardware or maintenance. This model is particularly appealing to companies needing rapid deployment and scalable systems that can grow with their inventory management needs.

The cloud approach also supports real-time data integration from multiple sources, enabling continuous inventory monitoring and more accurate demand forecasting. Moreover, cloud-based solutions facilitate easier updates and feature rollouts, ensuring users benefit from the latest AI advancements.

By Enterprise Size

In 2024, Large enterprises represent 64% of the AI-driven inventory optimization market, highlighting their leading role in adopting these technologies. These enterprises typically have more complex supply chains and larger inventories, creating greater opportunities for cost savings and efficiency gains through AI applications.

The scale of their operations demands sophisticated inventory management tools capable of handling vast data volumes, multiple warehouse locations, and diverse product lines. The financial resources and technical capabilities of large enterprises enable them to integrate AI solutions with their existing enterprise resource planning and supply chain management systems more effectively.

This results in more comprehensive and robust inventory strategies that improve demand forecasting, reduce excess inventory, and enhance service levels. As a result, large organizations continue to drive the market growth and set benchmarks for AI adoption in inventory management.

By Industry Vertical

In 2024, the retail and e-commerce sector captures 22% of the AI-driven inventory optimization market, reflecting its critical focus on inventory management to meet fast-changing consumer demands. In this highly competitive industry, maintaining the right product availability is essential to avoid lost sales and customer dissatisfaction.

AI technologies empower retailers and online sellers with precise demand forecasting, automated stock replenishment, and dynamic pricing, which are crucial to managing high SKU counts and seasonal fluctuations. The rapid growth of e-commerce has accelerated the adoption of AI-inventory solutions, driven by the need for real-time inventory visibility across multiple sales channels and warehouses.

Retailers benefit from AI’s ability to analyze consumer behavior and market trends, enabling smarter inventory decisions and greater operational agility. This vertical is expected to continue investing in advanced inventory optimization technologies to stay competitive and meet evolving customer expectations.

Key Market Segments

By Component

- Solutions

- Demand Forecasting

- Inventory Planning

- Replenishment Optimization

- Multi-Echelon Inventory Optimization (MEIO)

- Pricing and Promotion Optimization

- Services

- Consulting

- Implementation & Integration

- Training & Support

By Deployment Mode

- Cloud-Based

- On-Premise

By Enterprise Size

- Large Enterprises

Small & Medium-Sized Enterprises (SMEs)

By Industry Vertical

- Retail & E-commerce

- Manufacturing

- Automotive

- Consumer Goods

- Healthcare & Pharmaceuticals

- Food & Beverage

- Logistics & Transportation

- Others (Aerospace, Energy, etc.)

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Customer Insights

Key Insight Observations Increased Customer Satisfaction Customers experience higher product availability and timely order fulfillment Preference for Personalization AI supports inventory aligned with customer buying patterns and preferences Demand for Transparency Real-time inventory visibility builds trust with customers Challenges Integration complexity with legacy systems and initial investment costs Driver Factor

Enhanced Demand Forecasting Accuracy

AI-driven inventory optimization is primarily propelled by its ability to significantly improve demand forecasting accuracy. Traditional forecasting methods often fail to account for complex patterns like seasonality, sudden market shifts, or changing consumer preferences.

In contrast, AI models can analyze large datasets, including historic sales, external market trends, and real-time signals, enabling businesses to predict demand more precisely and adjust inventory levels proactively. This predictive power reduces costly stockouts and overstocks, leading to enhanced customer satisfaction and cost savings.

Companies adopting AI-driven forecasting have reported improvements in forecast accuracy by up to 30%, translating into leaner inventory holdings without risking product availability. Retail giants like Amazon and Walmart leverage these AI capabilities to continuously refine their inventory plans, improving supply chain responsiveness and operational efficiency.

Restraint

Data Quality and Integration Issues

Despite the significant benefits, the AI-driven inventory optimization market faces constraints due to data quality and integration challenges. Effective AI implementation requires access to clean, comprehensive, and timely data from multiple sources. However, many companies struggle with fragmented data spread across legacy systems, inconsistent formats, and missing or outdated information.

These issues hinder AI models’ ability to generate accurate forecasts and recommendations. Additionally, integrating AI systems with existing Enterprise Resource Planning (ERP) or supply chain software can be complex and costly. Smaller or less technologically mature companies may find it difficult to invest in the necessary infrastructure or expertise to deploy AI solutions effectively.

Opportunity

Expansion in E-commerce and Omnichannel Retail

The rapid growth of e-commerce and omnichannel retail presents a tremendous opportunity for AI-driven inventory optimization. Online shopping demands fast, accurate fulfillment across multiple distribution points, creating complexity in inventory planning. AI technologies offer a powerful solution by providing granular demand forecasts and dynamic stock allocation to meet customer expectations for speedy delivery and availability.

AI can optimize inventory not only in warehouses but also across networked storefronts and fulfillment centers, balancing stock levels to minimize holding costs while maximizing responsiveness. The increasing consumer preference for personalized shopping experiences and rapid fulfillment further drives adoption of AI inventory tools, enabling retailers to compete effectively in a digital-first marketplace.

Challenge

High Implementation Costs and Complexity

One major challenge slowing the broader adoption of AI in inventory optimization is the high upfront cost and complexity of deployment. Building or acquiring AI systems involves considerable investment in technology infrastructure, software licensing, and skilled talent. Small and medium-sized enterprises often find these costs prohibitive, despite potential long-term savings.

Moreover, the complexity of developing accurate AI models tailored to specific industries or business needs requires specialized knowledge. Continuous monitoring and updating of AI systems to maintain performance add to ongoing operational expenses. Companies must balance these challenges carefully against the expected benefits to ensure sustainable AI adoption in inventory management.

Competitive Analysis

In the AI-Driven Inventory Optimization Market, companies such as Blue Yonder, o9 Solutions, and ToolsGroup are positioned as leaders with advanced predictive analytics and machine learning capabilities. These vendors focus on demand forecasting, replenishment planning, and multi-echelon optimization, enabling enterprises to reduce stock-outs and minimize excess inventory.

Llamasoft, now part of Coupa Software, along with Oracle Corporation and SAP SE, hold strong influence through their global presence and wide product portfolios. Their offerings support end-to-end supply chain visibility and scenario planning, allowing companies to make data-driven decisions. By embedding AI into planning systems, these players address disruptions and ensure resilient operations.

Kinaxis, E2open, Infor, and IBM Corporation represent another group of significant players expanding AI adoption in inventory optimization. These companies provide flexible solutions tailored to specific industries such as manufacturing, healthcare, and retail. Their platforms integrate supply chain planning with AI-powered decision-making tools, enabling enterprises to balance demand and supply more effectively.

Top Key Players in the Market

- Blue Yonder (formerly JDA Software)

- o9 Solutions

- ToolsGroup

- Llamasoft (Coupa Software)

- Oracle Corporation

- SAP SE

- Kinaxis

- E2open

- Infor

- IBM Corporation

- Others

Recent Developments

- January 2025: Launched Inventory.io, an AI-powered inventory optimization platform for retailers improving profit and reducing stockouts.

- December 2024: Released EOQ and MOQ recommendations powered by AI to optimize inventory ordering and management.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Bn Forecast Revenue (2034) USD 31.9 Bn CAGR(2025-2034) 18.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions (Demand Forecasting, Inventory Planning, Replenishment Optimization, Multi-Echelon Inventory Optimization (MEIO), Pricing & Promotion Optimization), Services (Consulting, Implementation & Integration, Training & Support), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Large Enterprises, Small & Medium-Sized Enterprises (SMEs)), By Industry Vertical (Retail & E-commerce, Manufacturing, Automotive, Consumer Goods, Healthcare & Pharmaceuticals, Food & Beverage, Logistics & Transportation, Others (Aerospace, Energy, etc.) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Blue Yonder (formerly JDA Software), o9 Solutions, ToolsGroup, Llamasoft (Coupa Software), Oracle Corporation, SAP SE, Kinaxis, E2open, Infor, IBM Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Driven Inventory Optimization MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

AI-Driven Inventory Optimization MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Blue Yonder (formerly JDA Software)

- o9 Solutions

- ToolsGroup

- Llamasoft (Coupa Software)

- Oracle Corporation

- SAP SE

- Kinaxis

- E2open

- Infor

- IBM Corporation

- Others