Global AI Doorbell Market Size, Share, Industry Analysis Report By Product Type (Wired Doorbell, Wireless Doorbell), By End-User (Residential, Commercial), By Technology (Deep Learning, Machine Learning, Natural Language Processing (NLP), Machine Vision, Generative AI), By Distribution (Offline, Online), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163544

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Consumer Adoption and Feature

- Trends Statistics

- Role of Generative AI

- U.S. AI Doorbell Market Size

- Product Type Analysis

- End-User Analysis

- Technology Analysis

- Distribution Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

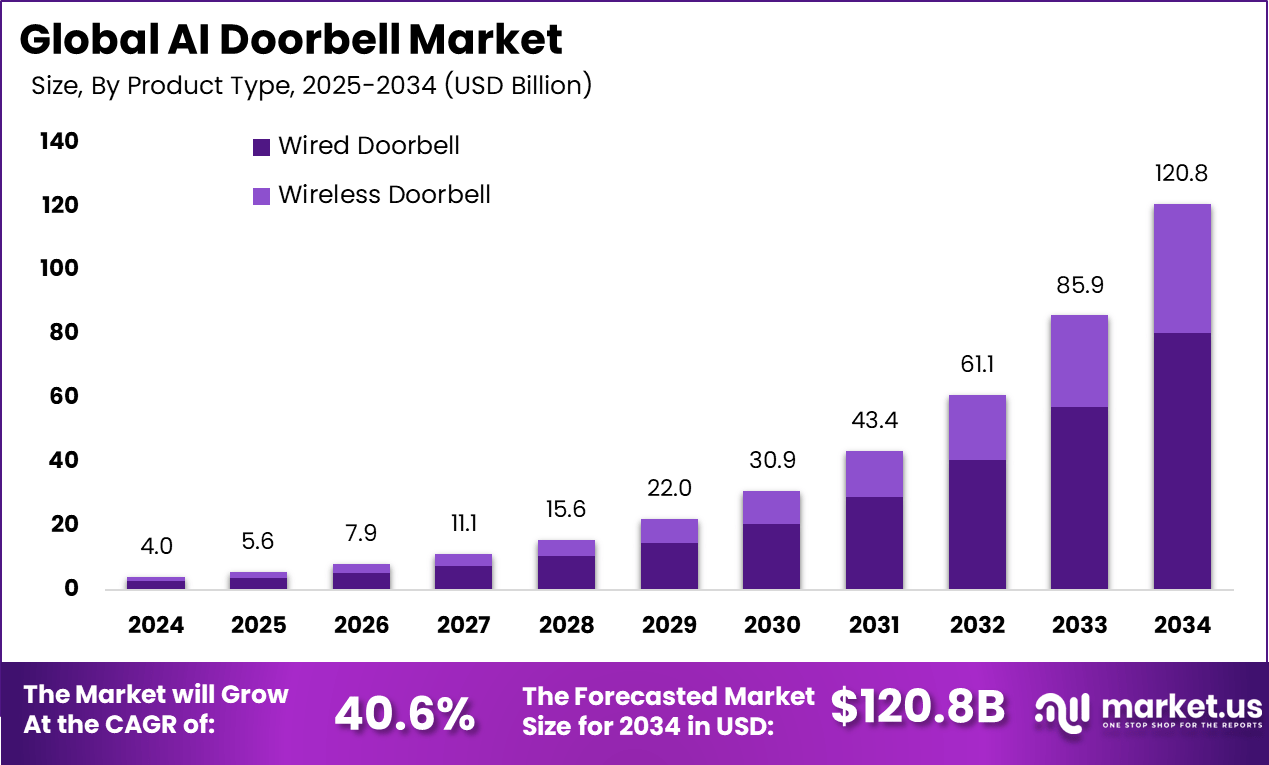

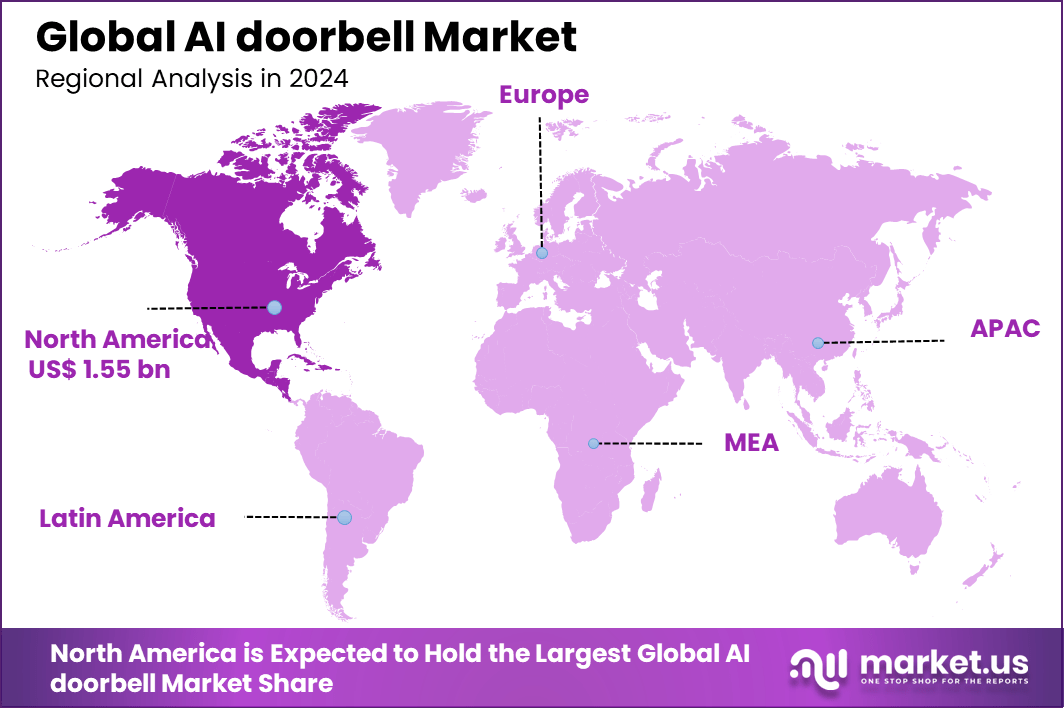

The Global AI doorbell Market size is expected to be worth around USD 120.8 billion by 2034, from USD 4.0 billion in 2024, growing at a CAGR of 40.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.9% share, holding USD 1.55 billion in revenue.

The AI doorbell market is expanding rapidly, driven by a strong demand for enhanced home security and convenience. People increasingly want smarter ways to monitor and control access to their homes remotely, leading to greater adoption of AI-powered doorbells that offer features such as motion detection, facial recognition, and two-way communication. With urban living on the rise and awareness about home safety growing, more households see the value in investing in these devices for peace of mind.

Top driving factors in this market include technological progress in AI and IoT integration. The ability of AI doorbells to distinguish familiar faces from strangers and reduce false alarms with advanced algorithms makes them highly effective compared to traditional doorbells. Additionally, rising internet availability and the desire for connected smart homes accelerate demand. Consumers appreciate the ease of managing home security from mobile apps, which also often integrate with popular smart home ecosystems, increasing their appeal.

For instance, in October 2025, SwitchBot launched a new 2K video doorbell equipped with advanced AI features for enhanced home security. The doorbell offers clear, high-resolution video to capture detailed footage, and its AI capabilities include intelligent motion detection and real-time alerts to minimize false alarms. Designed to seamlessly integrate with smart home ecosystems, SwitchBot’s latest product aims to provide users with reliable, intelligent security monitoring, enhancing convenience.

The increasing adoption of technologies such as facial recognition, night vision, and AI-based person detection drives consumers to choose these smart doorbells primarily for improved security and convenience. Key reasons for adopting these technologies include the ability to remotely screen visitors, receive instant alerts, and prevent package theft or unauthorized entry. Buyers also favor models compatible with voice assistants, making these devices easier to integrate into modern homes.

Key Takeaway

- In 2024, the Wired Doorbell segment led with a 66.7% share, highlighting strong consumer preference for reliable, power-stable installations.

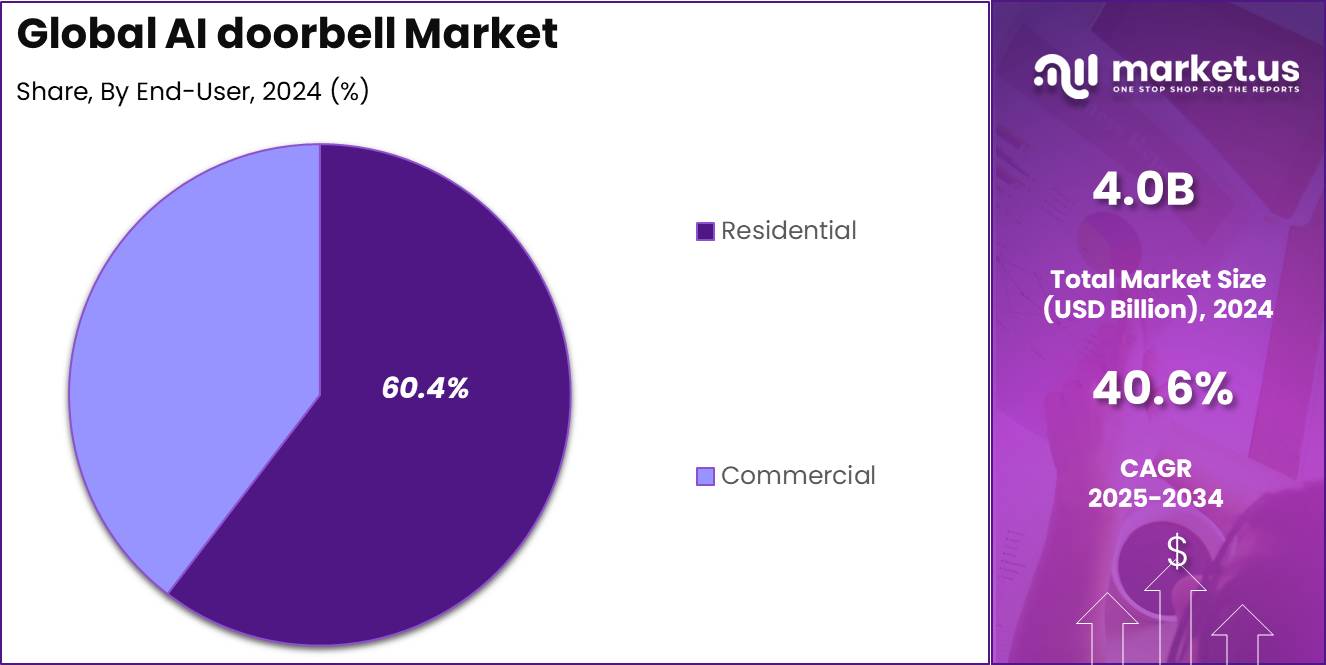

- The Residential segment dominated with 60.4%, reflecting growing smart home adoption and increased focus on home security.

- The Natural Language Processing (NLP) segment captured 40.4%, showcasing integration of intelligent voice recognition and interaction features.

- The Offline segment held 55.6%, indicating ongoing demand for locally operated systems without cloud dependency.

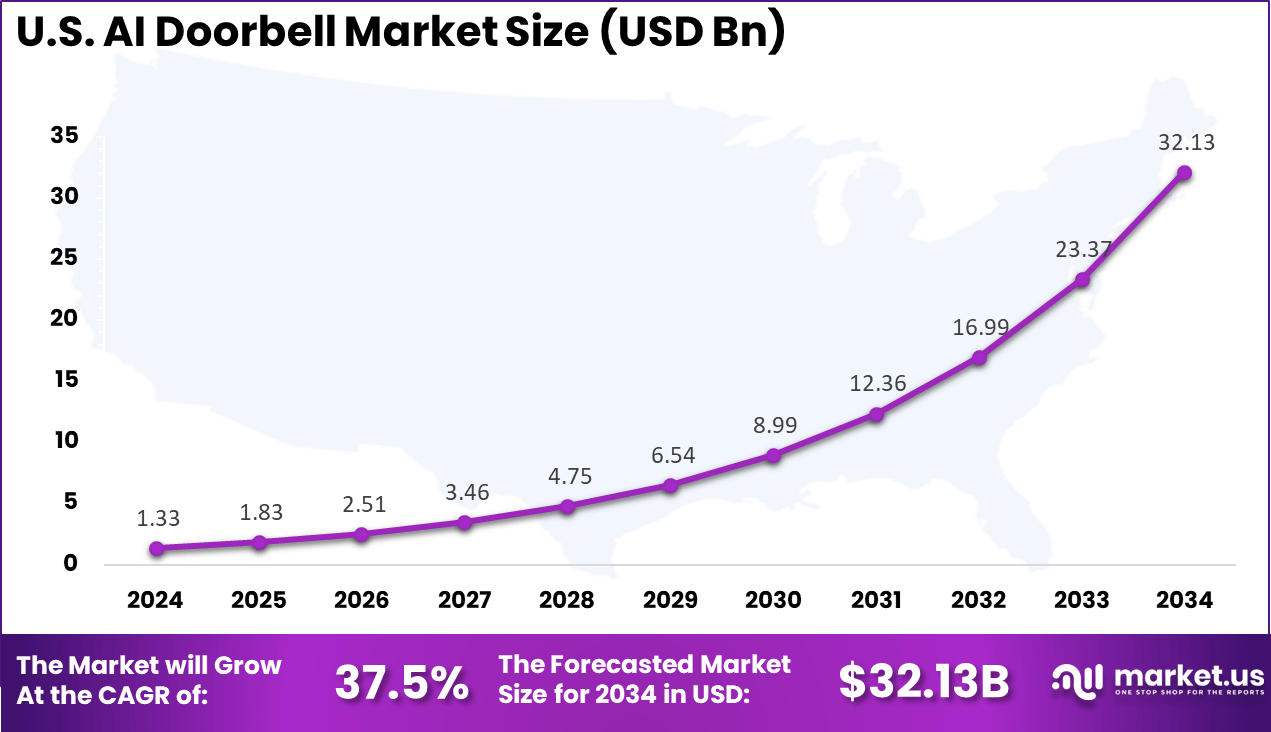

- The US market was valued at USD 1.33 billion in 2024 and is expanding at a robust CAGR of 37.5%, underscoring rapid smart home technology adoption.

- North America accounted for more than 38.9%, driven by advanced IoT ecosystems, rising safety awareness, and widespread integration of AI-enabled devices.

Consumer Adoption and Feature

- AI feature integration: In 2023, over 60% of new smart doorbells included motion analysis or person detection features, reflecting rapid adoption of AI-driven functionality.

- Advanced features: By 2024, AI capabilities such as facial recognition and two-way audio accounted for over 35% of new product sales, indicating rising consumer preference for intelligent security solutions.

- Consumer importance: In a recent survey, 61% of consumers ranked video doorbells as the most important smart home device, ahead of other connected technologies.

- Household adoption: Around 45% of U.S. households had a video doorbell in 2024, up from 42% in 2023, demonstrating steady year-over-year adoption.

- Security-driven demand: Growing concerns about package theft and home security continue to drive consumer interest in AI-enhanced features.

Trends Statistics

- Software growth: The software segment is projected to be the fastest-growing part of the market, supported by demand for AI functionality, cloud-based video storage, and app-based control systems.

- Privacy concerns: Despite rising adoption, data privacy remains a key barrier—nearly 43% of potential users express concern about how their data is collected and stored.

- Local storage preference: More than 41% of smart doorbell models now offer SD-card compatibility, reflecting consumer preference for local video storage over cloud-only options.

- Voice assistant integration: Over 68% of new smart doorbells support integration with voice assistants, underscoring the growing convergence between home automation ecosystems and voice-enabled technologies.

Role of Generative AI

The role of generative AI in the AI doorbell market is becoming increasingly significant, enhancing the overall user experience and security capabilities. About 35% of AI doorbell systems now use generative AI to generate concise text summaries of detected activities, allowing users to quickly understand important events without watching long video clips.

This technology helps in reducing false alarms by focusing alerts on the main subject, improving decision-making speed for homeowners. The adoption of generative AI has also led to smarter notification systems, where motion and facial recognition data are synthesized into easy-to-read alerts delivered directly to users’ smartphones.

Generative AI is shaping how AI doorbells function beyond simple recording, enabling automated insights and personalized security alerts. Approximately 40% of newly launched AI doorbells integrate generative AI features to filter and contextualize motion detection, enhancing threat detection accuracy. By offering these brief yet informative alerts, users can act faster while managing home security more efficiently.

U.S. AI Doorbell Market Size

The market for AI doorbells within the U.S. is growing tremendously and is currently valued at USD 1.33 billion, the market has a projected CAGR of 37.5%. This market is growing due to rising consumer concerns about home security and the increasing adoption of smart home technologies. Homeowners are seeking advanced features such as AI-powered person detection, high-definition video, and night vision to enhance their doorstep security.

Furthermore, the integration of AI with voice assistants and mobile connectivity improves user convenience and control over home access. Reduced hardware costs and expanding online and offline distribution channels further fuel market expansion. The focus on improving device reliability and battery life also supports adoption.

For instance, In October 2025, Google launched its Gemini AI-powered Nest Doorbell (3rd Gen) with 2K HDR video and a 166-degree field of view. The new Gemini for Home enables smart alerts, natural language video search, and condensed video highlights for faster reviews.

In 2024, North America held a dominant market position in the Global AI doorbell Market, capturing more than a 38.9% share, holding USD 1.55 billion in revenue. This dominance stems from the region’s strong adoption of smart home technologies, high consumer awareness regarding home security, and widespread availability of products through various retail and online channels.

The integration of AI-enabled features such as facial recognition and real-time alerts resonates strongly with security-conscious consumers. Additionally, North America benefits from early IoT technology adoption, high disposable incomes, and compatibility with popular smart home platforms like Amazon Alexa and Google Home.

For instance, In November 2024, a top North American brand adopted iCatch’s AI Imaging SoC Vi57 for its smart doorbells, offering 4K2K video, AI-based activity detection, and seamless integration with other devices, ensuring clear low-light streaming without extra lighting.

Product Type Analysis

In 2024, The Wired Doorbell segment held a dominant market position, capturing a 66.7% share of the Global AI doorbell Market. This dominance is due to the consistent power supply wired doorbells offer, eliminating worries about battery life. Additionally, they provide a reliable connection, important for uninterrupted functionality, making them a favored choice for many homeowners.

Moreover, wired doorbells tend to be compatible with a wide range of smart home systems and security setups. Their established presence and straightforward installation in many homes make them a dependable option for users looking for a stable, no-fuss security solution.

For Instance, in September 2025, Ring Inc. introduced its first-ever 4K Wired Doorbell Pro as part of a new camera lineup featuring Retinal Vision technology. This wired doorbell model boosts video clarity and offers enhanced AI features such as familiar face recognition and AI-powered delivery management, reflecting the segment’s focus on wired, high-performance solutions.

End-User Analysis

In 2024, the Residential segment held a dominant market position, capturing a 60.4% share of the Global AI doorbell Market. Homeowners value these devices for their roles in enhancing home security and convenience. Features such as live video, two-way communication, and package detection are especially appealing for everyday use at home.

This segment benefits from increasing awareness around home safety and smart technology integration. Residential users appreciate how AI doorbells help monitor entrances, deter unwanted visitors, and allow remote interaction with guests or couriers.

For instance, in October 2025, Vivint, Inc. launched the new Vivint Doorbell Camera Pro, designed specifically for residential users. This AI-powered doorbell includes intelligent package detection and advanced HDR for better low-light video quality, enhancing home security and convenience for homeowners.

Technology Analysis

In 2024, The Natural Language Processing (NLP) segment held a dominant market position, capturing a 40.4% share of the Global AI doorbell Market. NLP enables these devices to respond to voice commands, enhancing user convenience and accessibility. Interaction becomes more intuitive as users can speak directly to the doorbell for various functions like answering or unlocking.

The use of NLP is a key factor in improving the user experience, making doors smarter and more responsive. It also enables better integration with voice assistants, advancing the overall smart home ecosystem.

For Instance, in October 2025, August Home Inc. released updates to its Doorbell Cam Pro, enabling voice unlocking via Google Assistant and doorbell announcements through Alexa and Google platforms. These features leverage NLP technology, allowing users hands-free control and personalized interaction with their doorbells.

Distribution Analysis

In 2024, The Offline segment held a dominant market position, capturing a 55.6% share of the Global AI doorbell Market. Many customers prefer to buy AI doorbells in physical stores where they can see and try products before purchasing. Offline stores also provide easier access to professional installation services, which some buyers require for wired models.

Despite growing online sales, offline channels remain vital due to consumer trust and the ability to receive in-person support. For many users, the assurance of direct interaction with sales staff and quick service outweighs e-commerce convenience.

For Instance, in May 2025, Aeotec Technology (Shenzhen) Co. Ltd. remains strongly present in offline retail channels, with its Doorbell 6 product praised for features like Z-Wave Plus security and long battery life. This focus on offline distribution aligns with consumers’ preference for physical store purchases and professional installation support.

Emerging Trends

Emerging trends in the AI doorbell market highlight growing cloud connectivity and real-time video analysis being adopted by more than 50% of new devices. This allows remote monitoring and uninterrupted live streaming via mobile apps, meeting consumer demand for greater accessibility.

Another important trend is the integration of AI with smart home ecosystems, with over 60% of AI doorbells now compatible with voice assistants and home automation platforms, making home security seamless and easier to manage.

The development of wireless, battery-efficient AI doorbells is also accelerating, with about 45% of the market devices featuring advanced battery technology that supports longer usage times and easier installation. Consumers increasingly choose models that combine high-definition video, night vision, and AI-powered person detection.

Growth Factors

Growth in the AI doorbell market is driven by rising concerns over home security, with 70% of buyers citing safety as their primary reason for adopting these products. Additionally, increasing smart home adoption worldwide propels demand, with smart home users now making up around 55% of the market’s customer base.

The demand is further bolstered by the availability of affordable wireless devices and improvements in wireless technology such as 5G and Wi-Fi 6, which enhance device performance and connectivity. Another important factor fueling growth is the enhanced functionality AI brings to doorbells, including AI-powered facial recognition, package detection, and predictive analytics.

These smart features improve deterrence against theft and allow remote management of home access, encouraging more homeowners to invest in AI doorbells. The combination of rising consumer awareness and technological advancements ensures continued expansion of this market in the coming years.

Key Market Segments

By Product Type

- Wired Doorbell

- Wireless Doorbell

By End-User

- Residential

- Commercial

By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing (NLP)

- Machine Vision

- Generative AI

By Distribution

- Offline

- Online

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Enhanced Home Security

The increasing concern among homeowners about security and safety is a primary driver for the AI doorbell market. AI-powered doorbells offer features like facial recognition, motion detection, and real-time alerts, which provide an advanced layer of security compared to traditional doorbells. This technology allows homeowners to monitor their homes remotely and receive instant notifications about visitors or suspicious activities, improving overall peace of mind.

Additionally, the seamless integration of AI doorbells with smart home ecosystems such as Alexa and Google Home enhances user convenience and drives adoption. As urbanization rises and people seek smarter, more connected lifestyles, AI doorbells are becoming essential components of home security systems. This demand is fostering continuous innovation and market growth globally.

For instance, in September 2025, Ring Inc. announced its first-ever 4K security cameras and next-generation AI features, including facial recognition and familiar faces detection. These features not only improve security but also reduce false alerts, meeting growing consumer demand for smarter home safety solutions.

Restraint

High Initial Costs and Privacy Concerns

One significant restraint to the wider adoption of AI doorbells is the relatively high initial investment cost. Advanced features such as AI-driven facial recognition, cloud storage, and IoT connectivity increase the price of these doorbells compared to traditional models. For many consumers, especially in developing regions, this cost can be a barrier to purchase despite growing interest in smart security.

Moreover, privacy concerns regarding the collection and storage of video data create hesitation among potential buyers. Users worry about unauthorized access, data breaches, and misuse of personal video feeds. These concerns often limit the willingness to fully embrace AI doorbells, prompting manufacturers to focus on improving data security and encryption to address consumer apprehensions.

For instance, in October 2025, privacy concerns surfaced regarding Ring’s cooperation with law enforcement agencies to share user footage, which sparked debates about user data privacy. While such features aim to aid public safety, they raise restraint issues around consumer trust and data security in AI doorbell adoption.

Opportunities

Expansion in Emerging Markets

Emerging economies, especially in the Asia-Pacific and Latin America, present promising growth opportunities for the AI doorbell market. Increasing disposable incomes, rapid urbanization, and higher adoption of smart home technology in these regions are driving demand. Homeowners and businesses in these markets are becoming more aware of security needs, making AI doorbells an attractive option for modern safety solutions.

Additionally, manufacturers have the chance to cater to these markets by offering cost-effective and energy-efficient smart doorbells. Features like solar-powered models and compatibility with local connectivity infrastructure can appeal to environmentally conscious and budget-sensitive consumers in these regions. Strategic focus on emerging markets could unlock substantial revenue streams and broaden global market penetration.

For instance, in October 2025, Ring expanded its product lineup with new 4K AI-powered doorbells and cameras, enhancing its market presence in the US and UK. The launch included advanced AI features like facial recognition and interactive visitor management, broadening Ring’s appeal and pushing deeper into smart home security segments.

Challenges

Technical Issues and System Vulnerabilities

The AI doorbell market faces continuous challenges related to technical reliability and cybersecurity. Devices relying on AI and IoT are susceptible to software bugs, network interruptions, and malfunctions, which can diminish user experience and trust. Poor performance in critical moments could reduce the perceived value and limit broader adoption.

Cybersecurity vulnerabilities also pose a serious challenge, as hackers may exploit weaknesses to gain unauthorized access, steal data, or manipulate device functions. Addressing these security risks requires ongoing investment in robust encryption, firmware updates, and user education.

For instance, in May 2025, Arlo Technologies launched Arlo Secure 6, an AI-powered subscription service aimed at enhancing data security and reducing false alarms. Despite this advancement, they continue facing challenges related to device connectivity and occasional software glitches that may impact consumer confidence.

Key Players Analysis

Ring Inc., Arlo Technologies, and August Home are leading players in the AI Doorbell Market, offering smart doorbell solutions with advanced motion detection, facial recognition, and two-way communication features. Their focus on AI integration enhances home security by enabling real-time alerts, visitor identification, and seamless connectivity with smart home ecosystems.

Vivint, Smartwares Group, and SkyBell Technologies are expanding their product lines with AI-driven surveillance and voice-enabled control systems. Their solutions emphasize ease of installation, energy efficiency, and integration with home automation platforms. These brands cater to growing consumer demand for affordable and intelligent home security devices.

Emerging players like Aeotec Technology, Intelligent Technology Co., Eques Inc., and iseeBell are focusing on innovation and customization to attract new users. These firms are enhancing AI-based recognition accuracy and privacy protection while offering flexible pricing. Their continuous improvements in connectivity and data encryption support safer, smarter households.

Top Key Players in the Market

- Ring Inc.

- Vivint, Inc.

- Smartwares Group

- Intelligent Technology Co. Ltd.

- Sky Bell Technologies Inc.

- Aeotec Technology (Shenzhen) Co., Ltd.

- Arlo Technologies Inc.

- August Home Inc.

- Eques Inc.

- iseeBell Inc.

- Other Major Players

Recent Developments

- In October 2025, Ring Inc. unveiled new AI features, including Smart Video Descriptions and Familiar Faces, which enhance motion alerts with more specific contextual details. It also introduced Alexa+ Greetings, allowing automated visitor interaction, and launched Search Party for finding lost pets via AI-powered camera scans.

- In September 2025, Arlo Technologies launched an AI-powered Early Warning System in Europe under Arlo Secure, with features like person, vehicle, and fire detection, plus customizable alerts for specific objects or environment changes. This service emphasizes proactive security and real-time user intervention.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Bn Forecast Revenue (2034) USD 120.8 Bn CAGR(2025-2034) 40.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Wired Doorbell, Wireless Doorbell), By End-User (Residential, Commercial), By Technology (Deep Learning, Machine Learning, Natural Language Processing (NLP), Machine Vision, Generative AI), By Distribution (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ring Inc., Vivint, Inc., Smartwares Group, Intelligent Technology Co. Ltd., Sky Bell Technologies Inc., Aeotec Technology (Shenzhen) Co. Ltd., Arlo Technologies Inc., August Home Inc., Eques Inc., iseeBell Inc., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ring Inc.

- Vivint, Inc.

- Smartwares Group

- Intelligent Technology Co. Ltd.

- Sky Bell Technologies Inc.

- Aeotec Technology (Shenzhen) Co., Ltd.

- Arlo Technologies Inc.

- August Home Inc.

- Eques Inc.

- iseeBell Inc.

- Other Major Players