Global AI-Based Data Observability Software Market Size, Share, Industry Analysis Report By Component (Software, Services), By Application (Grid Optimization & Asset Management, Advanced Metering Infrastructure (AMI) Analytics, Demand Response & Load Forecasting, Fault Detection & Outage Management, Renewable Energy Integration), By Deployment (Cloud-based, On-premises), By End-User (Utility Companies, Independent System Operators (ISOs), Renewable Energy Generators, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034.

- Published date: Jan. 2026

- Report ID: 173630

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Component

- By Deployment Mode

- By Organization Size

- By Data Environment

- By End-User Industry

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

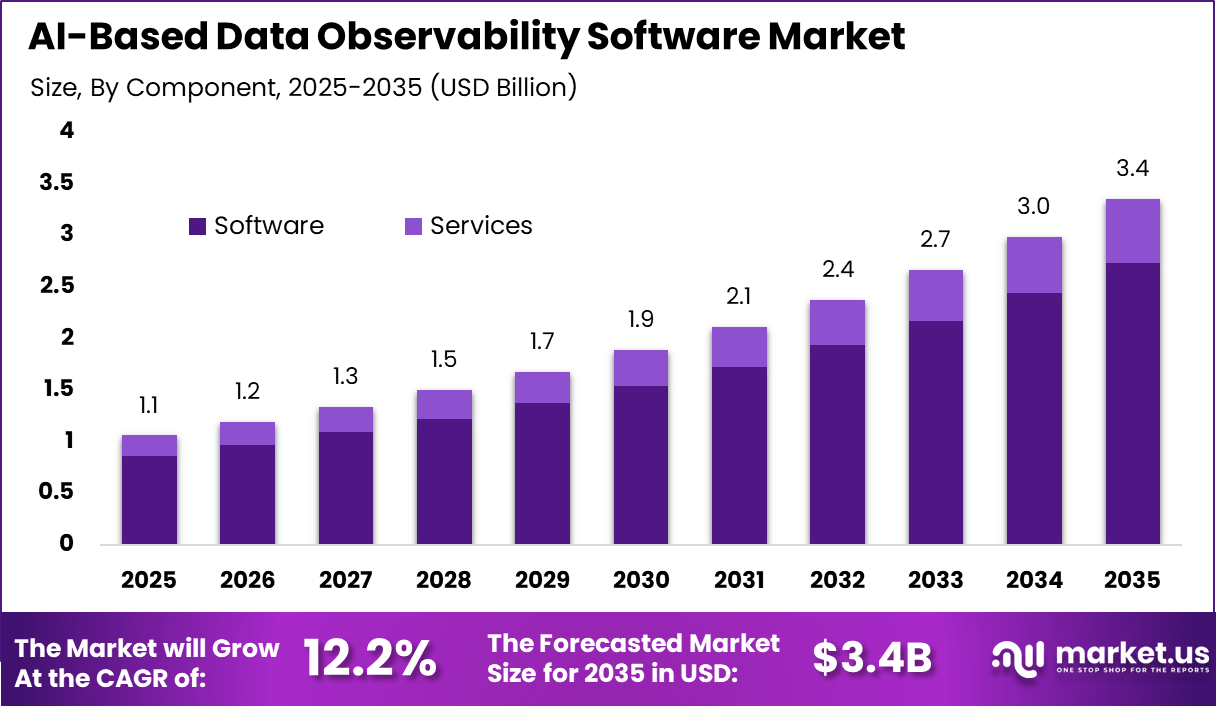

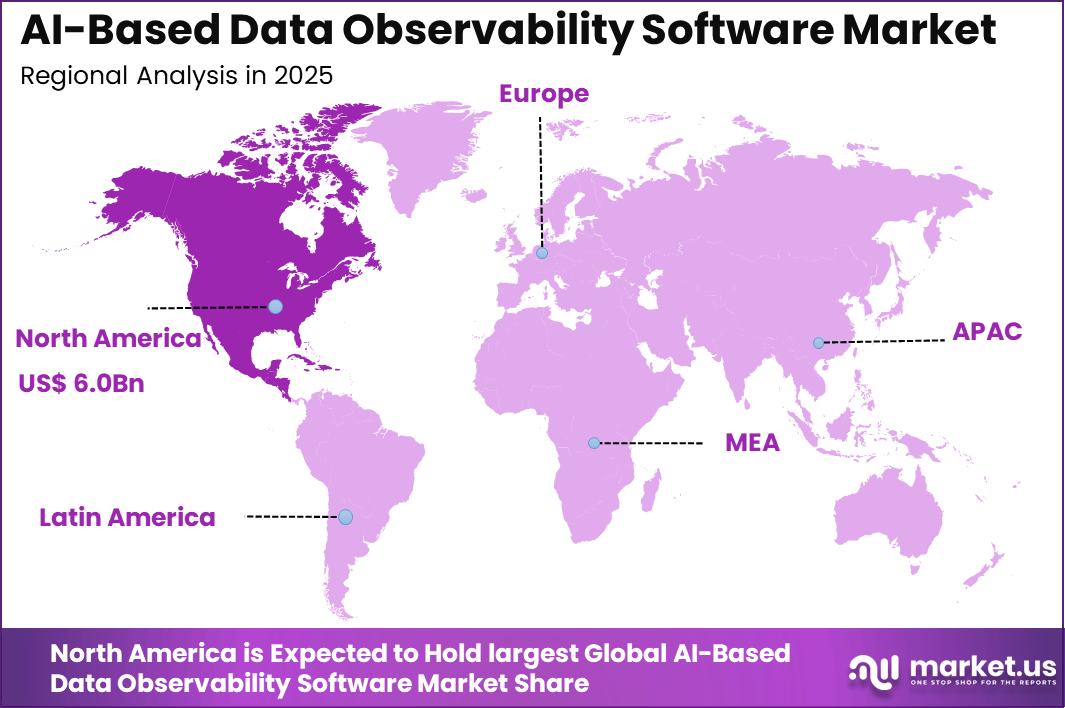

The Global AI-Based Data Observability Software Market size is expected to be worth around USD 3.4 Billion By 2035, from USD 1.1 billion in 2025, growing at a CAGR of 12.2% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 42.6% share, holding USD 6.06 Billion revenue.

The AI based data observability software market refers to platforms that use artificial intelligence to monitor, analyze, and ensure the reliability of data across modern data pipelines. These solutions track data quality, freshness, distribution, and lineage as data moves between sources, storage systems, and analytics tools. AI driven observability software helps organizations detect anomalies, data drift, and pipeline failures automatically.

The market supports enterprises that rely on data for analytics, reporting, and operational decision making. One major driving factor of the AI based data observability software market is the increasing dependence on data driven decision making. Businesses rely on accurate and timely data for forecasting, personalization, and automation. Data quality issues can lead to incorrect insights and operational risk. AI based observability helps maintain trust in data by identifying problems early.

Demand for AI based data observability software is influenced by enterprise adoption of cloud data platforms and analytics tools. As organizations migrate to cloud based data warehouses and streaming systems, visibility into data health becomes critical. Data teams require tools that operate across distributed and hybrid environments. This demand is strong among technology driven and data intensive organizations.

According to Market.us, The global Data Observability market was valued at USD 2.3 billion in 2023 and is expected to grow steadily over the forecast period. The market is projected to reach approximately USD 7.01 billion by 2033, expanding at a CAGR of 11.8% from 2024 to 2033. This growth is driven by increasing reliance on data driven decision making and rising complexity of modern data pipelines.

Machine learning technologies are central to the adoption of AI based data observability software. These systems learn baseline data patterns and automatically flag anomalies without predefined rules. This adaptive monitoring improves accuracy and reduces false alerts. Machine learning also supports faster identification of root causes.

Top Market Takeaways

- Software dominated the market with an 81.6% share, showing that organizations prioritize advanced observability platforms capable of automated anomaly detection, data quality monitoring, and pipeline reliability.

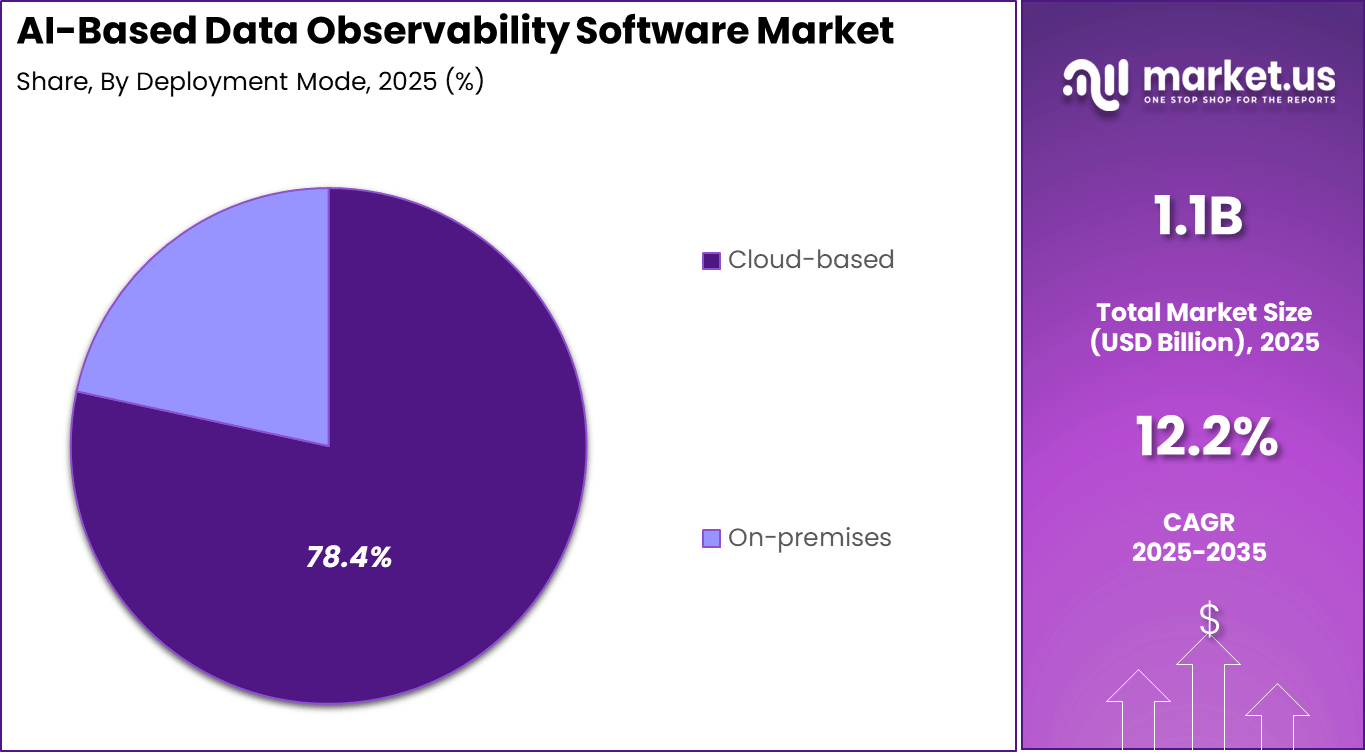

- Cloud based deployment accounted for 78.4%, reflecting strong preference for scalable, centrally managed observability solutions that support distributed and real time data environments.

- Large enterprises represented 73.9% of adoption, driven by complex data ecosystems, high data volumes, and the need for continuous monitoring across multiple data sources.

- Data warehouses and data lakes emerged as the primary data environment with a 48.3% share, as enterprises focused on maintaining accuracy, freshness, and trust in analytical and AI driven workloads.

- The IT and telecommunications sector led end user adoption with a 42.7% share, supported by constant data flows, service reliability requirements, and large scale analytics operations.

- North America held a leading 42.6% share, backed by early cloud adoption, strong data engineering maturity, and widespread use of AI driven monitoring tools.

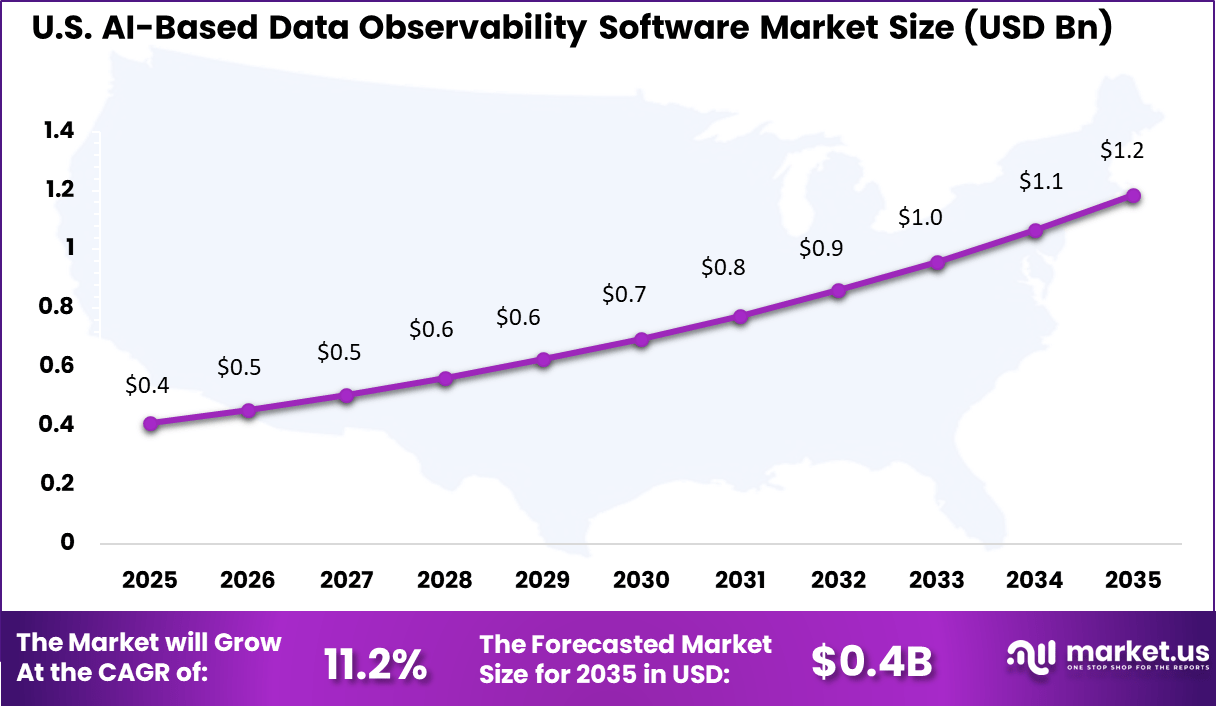

- The United States remained a key contributor, with market activity valued at USD 0.41 billion, reflecting high concentration of enterprise data platforms and observability focused investments.

Quick Market Facts

Adoption and Strategic Importance

- Observability was widely recognized as mission critical, as 90% of IT professionals viewed it as vital to business performance. Despite this awareness, only 26% considered their observability practices to be mature, indicating a clear execution gap.

- Budget prioritization strengthened in 2025, with 70% of organizations increasing spending on observability. Forward planning remained strong, as 75% intended to raise budgets further in 2026, reflecting long term commitment.

- Observability was increasingly embedded across the software lifecycle, with 91% of IT leaders agreeing it is essential for planning, development, and operations.

- AI driven capabilities emerged as the top selection factor, accounting for 29% of decision criteria. This shift marked a transition from basic monitoring toward intelligent, predictive observability.

Operational Impact and Return on Investment

- Advanced observability deployments delivered significant financial benefits by reducing downtime costs by up to 90%. In practical terms, losses were reduced from roughly USD 23.8 million to about USD 2.5 million, demonstrating strong cost avoidance.

- Organizations with mature observability practices achieved higher innovation output, releasing about 60% more products or revenue streams than peers with less developed capabilities.

- Project effectiveness improved, as teams using MLOps and observability practices shelved 30% fewer models. In addition, the overall value generated from AI initiatives increased by up to 60%.

Adoption Trends and Challenges

- Platform selection priorities shifted, with AI capabilities overtaking cloud compatibility as the leading criterion for the first time in 2025–2026. This reflected growing demand for automated insights and predictive monitoring.

- The maturity gap remained a central challenge, as broad recognition of observability importance did not translate into advanced implementation across most organizations.

- Model performance risks persisted, with 91% of machine learning models degrading over time without proper monitoring. This reinforced the need for continuous observability across data and model pipelines.

- Adoption among AI agents expanded, as 89% of organizations implemented observability in these environments. However, 32% identified data and model quality issues as the main barrier to production readiness.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth of data driven enterprises Increasing reliance on analytics and AI pipelines ~3.4% Global Short Term Complexity of modern data stacks Multi cloud and hybrid data environments ~2.8% North America, Europe Short to Mid Term Rising data quality expectations Need for reliable and trusted data ~2.3% Global Mid Term Expansion of real time analytics Demand for continuous data monitoring ~1.9% Global Mid Term Adoption of AI in operations Automated anomaly detection and root cause analysis ~1.8% North America, Asia Pacific Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data security concerns Exposure of sensitive enterprise data ~2.6% Global Short Term Integration challenges Compatibility with legacy data platforms ~2.1% Global Mid Term Skill gaps Limited expertise in data observability tools ~1.7% Global Mid Term Tool overlap Confusion with monitoring and BI platforms ~1.3% Global Long Term Vendor concentration Dependence on few specialized providers ~1.0% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High deployment cost Enterprise scale implementation expenses ~2.9% Emerging Markets Short to Mid Term Limited ROI clarity Difficulty quantifying early benefits ~2.4% Global Mid Term Data governance complexity Compliance and access management issues ~2.0% North America, Europe Long Term Resistance to change Operational teams hesitant to adopt new tools ~1.6% Global Mid Term Platform fragmentation Diverse data sources increase setup effort ~1.2% Global Long Term By Component

Software accounts for 81.6%, indicating that data observability is primarily delivered through software platforms. These tools monitor data pipelines, quality, and system behavior in real time. Organizations use software to detect anomalies and data issues early. Centralized dashboards improve visibility across data assets. Software solutions support continuous improvement.

The dominance of software is driven by the need for scalable monitoring. Enterprises manage complex data environments that require automated oversight. Software platforms integrate with analytics and data tools. Frequent updates improve detection accuracy. This sustains strong adoption of software components.

By Deployment Mode

Cloud-based deployment holds 78.4%, reflecting strong preference for flexible infrastructure. Cloud platforms allow rapid deployment and scaling of observability tools. Organizations access monitoring features without managing local systems. Cloud environments support distributed data architectures. Accessibility remains a key advantage.

Adoption of cloud-based deployment is driven by modern data workflows. Enterprises operate across multiple cloud services. Observability tools align well with cloud-native systems. Automatic updates improve reliability. This keeps cloud deployment dominant.

By Organization Size

Large enterprises represent 73.9%, highlighting their leading role in adoption. These organizations handle large and complex data operations. Data observability helps maintain data reliability at scale. Centralized monitoring supports governance and compliance. Large enterprises require advanced capabilities.

Adoption among large enterprises is driven by data-driven decision-making. Organizations depend on accurate data for operations. Observability tools reduce downtime and errors. Integration with enterprise systems improves control. This sustains strong enterprise demand.

By Data Environment

Data warehouses and data lakes account for 48.3%, making them the primary data environments monitored. These environments store large volumes of structured and unstructured data. Observability tools ensure data accuracy and availability. Monitoring supports analytics and reporting workflows. Data integrity is essential.

Growth in this segment is driven by expanding data storage needs. Organizations consolidate data into centralized repositories. Observability platforms help manage complexity. Early issue detection improves trust in data. This keeps focus on these environments.

By End-User Industry

The IT and telecommunications sector holds 42.7%, making it the leading end-user industry. These organizations manage high volumes of data across systems. Data observability supports service reliability and performance. Real-time monitoring improves issue resolution. Accuracy is critical for operations.

Adoption in this industry is driven by digital service demands. IT and telecom companies rely on analytics and automation. Observability tools ensure data pipelines remain stable. Integration with operational systems improves efficiency. This sustains strong industry usage.

By Region

North America accounts for 42.6%, supported by advanced data infrastructure. Organizations in the region adopt AI-driven monitoring tools. Cloud and analytics adoption remains strong. Data reliability is a business priority. The region remains a major contributor.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Advanced cloud and analytics adoption 42.6% USD 0.45 Bn Advanced Europe Data governance and quality initiatives 27.3% USD 0.29 Bn Advanced Asia Pacific Rapid enterprise digital transformation 22.8% USD 0.24 Bn Developing Latin America Growing analytics modernization 4.2% USD 0.04 Bn Developing Middle East and Africa Early adoption of data platforms 3.1% USD 0.03 Bn Early

The United States reached USD 0.41 Billion with a CAGR of 11.23%, reflecting steady market growth. Expansion is driven by enterprise data complexity. Organizations invest in observability to support analytics. AI adoption improves monitoring accuracy. Market growth remains stable.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior IT and telecom enterprises Very High ~42.7% Data reliability and uptime Platform wide deployment Cloud service providers High ~21% Value added data services Infrastructure aligned Large enterprises Moderate to High ~18% Operational data trust Phased rollout SaaS companies Moderate ~12% Customer experience stability Selective adoption Startups Low to Moderate ~6% Cost effective monitoring Targeted implementation Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status AI based anomaly detection Automated issue identification ~3.8% Growing Metadata and lineage tracking End to end data visibility ~3.1% Growing Cloud native observability platforms Scalable data monitoring ~2.6% Mature Machine learning models Predictive data quality insights ~1.7% Developing Automated alerting systems Faster incident response ~1.0% Developing Emerging Trends

In the AI-based data observability software market, one clear trend is the growing use of smart anomaly detection. Organisations are using artificial intelligence to monitor data systems and alert teams when data patterns shift unexpectedly. This shift from rule based checks to intelligent detection helps teams identify issues more quickly and with fewer manual reviews.

Another trend is the integration of observability with operational data environments such as data warehouses, data lakes, and pipelines. Observability tools are becoming part of broader data platforms, giving users a unified view of data flow, quality, and health. This integration helps teams see where issues originate and how they affect downstream processes.

Growth Factors

A key growth factor in this market is the increasing complexity of data environments. Businesses now operate with multiple data sources, streaming systems, and hybrid infrastructure. Managing and monitoring data at this scale without automation is difficult, so observability solutions that provide visibility across systems are in greater demand.

Another important factor supporting growth is the reliance on data for critical decision making. Organisations depend on accurate and timely data for reporting, analytics, customer insights, and operational planning. Data observability software helps ensure data reliability, which strengthens confidence in decisions driven by analytics.

Opportunity

A strong opportunity exists in the development of self-healing capabilities. Observability software that not only detects issues but also suggests or executes corrective actions can significantly improve data operations. These capabilities can reduce system downtime and improve the efficiency of data teams.

Another opportunity lies in expanding education and advisory support. Many organisations recognise the value of observability but lack the experience to implement it effectively. Training and best practice resources can help users maximise the value of these tools and strengthen adoption.

Challenge

One of the main challenges for the AI-based data observability software market is balancing AI automation with transparency. Users want automated insights, but they also need to understand why a system flagged an issue. Providing clear explanations alongside AI driven alerts is important to build trust and support corrective action.

Another challenge is ensuring performance and scalability. Observability tools must process metadata and monitor data flows without degrading system performance. As data volumes grow, maintaining scalability while delivering timely insights is critical.

Key Market Segments

By Component

- Software

- Automated Monitoring & Alerting

- Data Quality & Anomaly Detection

- Data Lineage & Mapping

- Performance & Cost Optimization

- Others

- Services

- Professional Services

- Managed Services

- Others

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Data Environment

- Data Warehouses & Data Lakes

- Real-time Data Pipelines & Streams

- Cloud Databases

- Hybrid & Multi-cloud Environments

- Others

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance

- Retail & E-commerce

- Healthcare & Life Sciences

- Manufacturing

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Monte Carlo Data, Inc., Acceldata, Inc., and Databricks Inc. lead the AI based data observability software market by providing platforms that monitor data quality, reliability, and pipeline health at scale. Their solutions help enterprises detect anomalies, schema changes, and data downtime in real time. These companies focus on automation, AI driven root cause analysis, and deep integration with modern data stacks.

Datadog, Inc., Splunk Inc., IBM Corporation, and Oracle Corporation strengthen the market by extending observability beyond infrastructure into data layers. Their platforms combine logs, metrics, and traces with data monitoring capabilities. These providers emphasize enterprise scalability, security, and unified visibility.

Informatica Inc., Talend S.A., Alation, Inc., Collibra, Inc., Anomalo, Inc., and Soda Data, Inc. expand the landscape with governance driven and quality focused observability tools. Their offerings support data catalogs, lineage, and compliance aligned monitoring. These companies focus on trust, transparency, and faster issue resolution.

Top Key Players in the Market

- Monte Carlo Data, Inc.

- Acceldata, Inc.

- Databricks Inc.

- Datadog, Inc.

- Splunk Inc.

- IBM Corporation

- Oracle Corporation

- Informatica Inc.

- Talend S.A.

- Alation, Inc.

- Collibra, Inc.

- Anomalo, Inc.

- Bigeye Data, Inc.

- Soda Data, Inc.

- Metaplane, Inc.

- Others

Recent Developments

- In May 2025, Monte Carlo Data launched unstructured data monitoring, letting users run AI-powered checks on non-tabular fields for custom quality metrics tied to real business needs.

- In April 2025, Datadog acquired Metaplane, an AI-driven data observability tool, to speed up its push into monitoring data for AI apps; it now runs as Metaplane by Datadog.

Report Scope

Report Features Description Market Value (2025) USD 1.1 Bn Forecast Revenue (2035) USD 3.4 Bn CAGR(2026-2035) 12.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Data Environment (Data Warehouses & Data Lakes, Real-time Data Pipelines & Streams, Cloud Databases, Hybrid & Multi-cloud Environments, Others), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance, Retail & E-commerce, Healthcare & Life Sciences, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Monte Carlo Data, Inc., Acceldata, Inc., Databricks Inc., Datadog, Inc., Splunk Inc., IBM Corporation, Oracle Corporation, Informatica Inc., Talend S.A., Alation, Inc., Collibra, Inc., Anomalo, Inc., Bigeye Data, Inc., Soda Data, Inc., Metaplane, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Based Data Observability Software MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-Based Data Observability Software MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Monte Carlo Data, Inc.

- Acceldata, Inc.

- Databricks Inc.

- Datadog, Inc.

- Splunk Inc.

- IBM Corporation

- Oracle Corporation

- Informatica Inc.

- Talend S.A.

- Alation, Inc.

- Collibra, Inc.

- Anomalo, Inc.

- Bigeye Data, Inc.

- Soda Data, Inc.

- Metaplane, Inc.

- Others