Global AI Athlete Recovery Optimization Market Size, Share and Analysis Report By Type (Hardware-Based Solutions, Software Platforms, Integrated AI Recovery Systems, Wearable AI Devices), By Component (Sensors and Trackers, AI Algorithms and Analytics Engines, Cloud and Edge Computing Infrastructure, Mobile and Web Applications), By Application (Professional Sports Teams, Individual Athletes, Sports Rehabilitation Centers, Fitness & Wellness Clubs), By Technology (Machine Learning and Predictive Analytics, Computer Vision, Natural Language Processing (NLP), Internet of Things (IoT) Integration, Others), By Deployment Mode (Cloud-Based Deployment, On-Premise Deployment), By Recovery Technique (Sleep and Rest Optimization, Muscle Fatigue Analysis, Hydration and Nutrition Monitoring, Injury Detection and Prevention), By End-User (Sports Institutes and Academies, Healthcare and Sports Medicine Professionals, Wearable Device Manufacturers, Research and Training Centers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174991

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Type Analysis

- Component Analysis

- Application Analysis

- Technology Analysis

- Deployment Mode Analysis

- Recovery Technique Analysis

- End-User Analysis

- U.S. Market Size

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

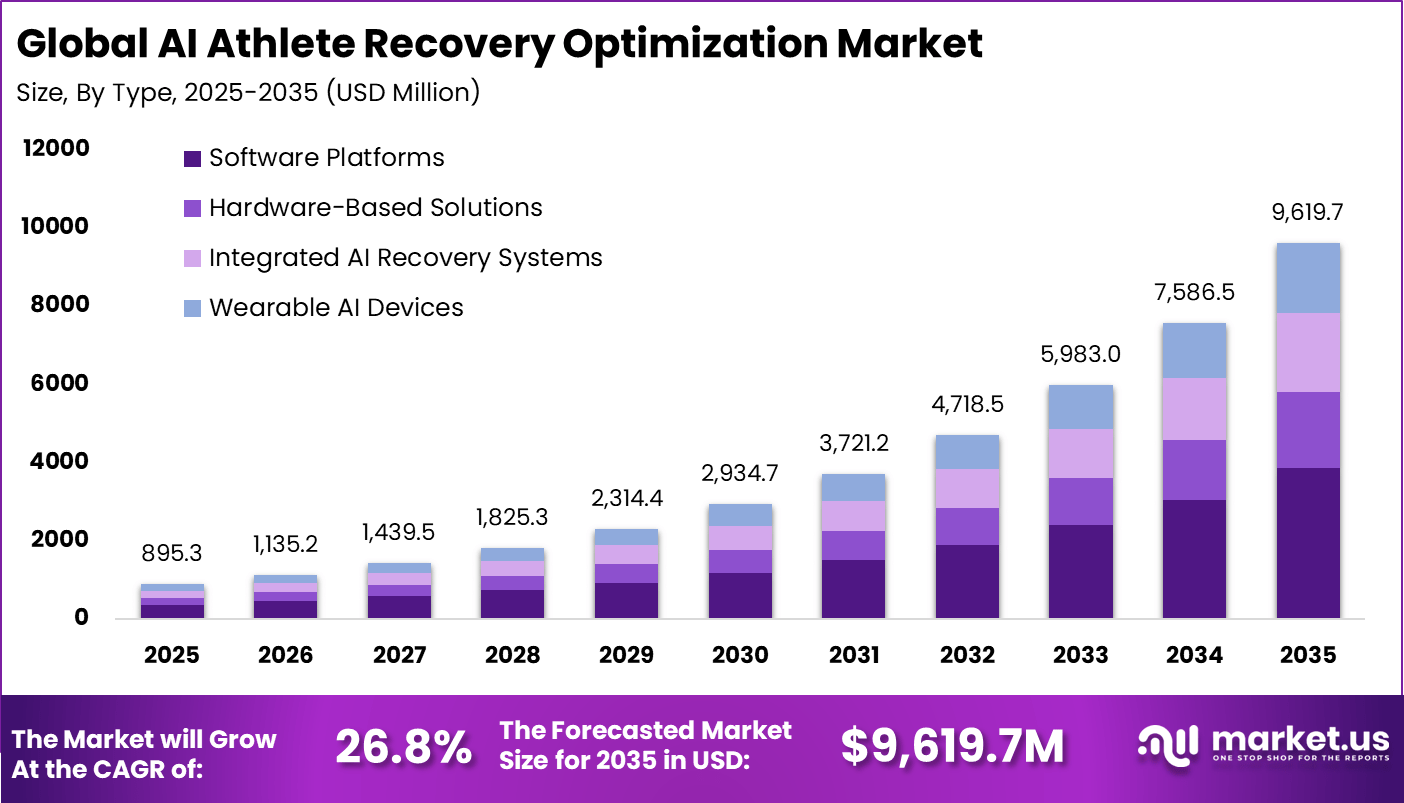

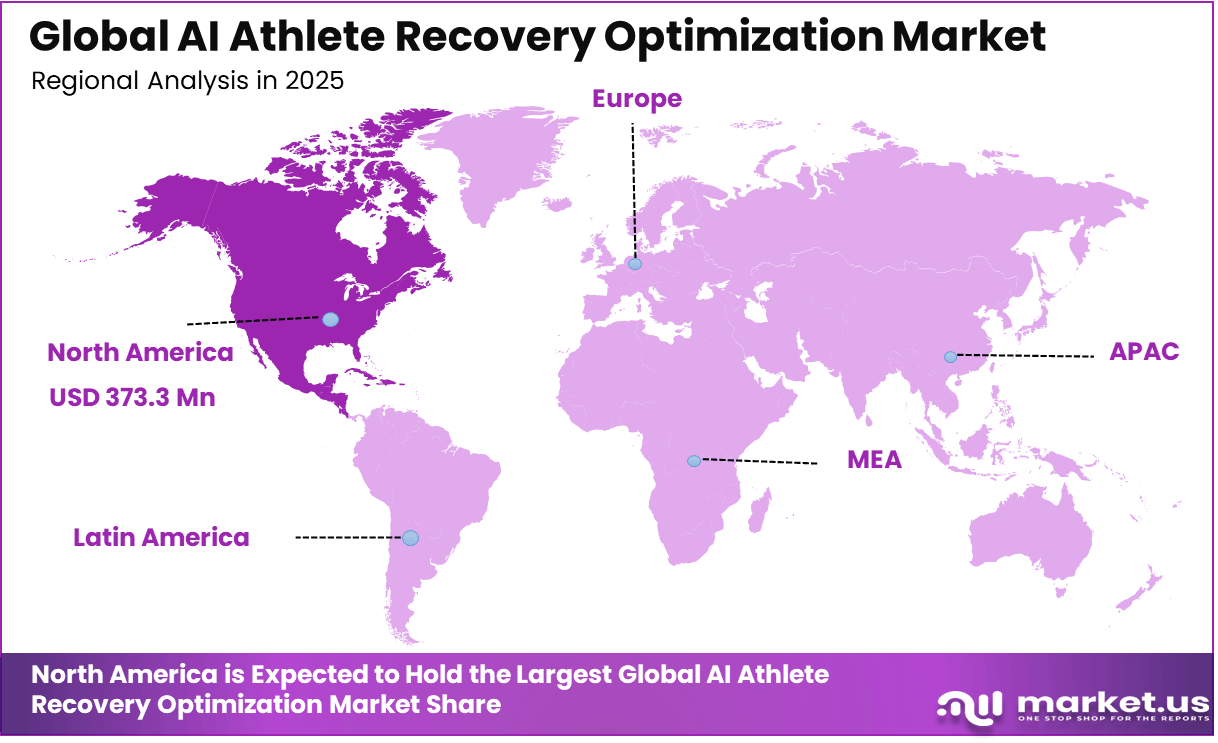

The Global AI Athlete Recovery Optimization Market size is expected to be worth around USD 9,619.7 million by 2035, from USD 895.3 million in 2025, growing at a CAGR of 26.8% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 41.7% share, holding USD 373.3 million in revenue.

The AI athlete recovery optimization market refers to software and data-driven platforms that use artificial intelligence to monitor, analyze, and improve athlete recovery processes. These solutions assess physical load, fatigue levels, sleep quality, and physiological signals to guide recovery planning. AI-based recovery tools are used by professional sports teams, training centers, sports academies, and individual athletes. They support personalized recovery strategies and injury prevention.

Adoption improves long-term athletic performance and durability. Market development has been influenced by the increasing focus on performance longevity in competitive sports. Athletes face intense training schedules and frequent competitions. Traditional recovery methods often rely on subjective assessment and experience. AI introduces objective and continuous recovery analysis. As performance margins narrow, optimized recovery becomes a strategic priority.

One major driving factor of the AI athlete recovery optimization market is the growing awareness of injury prevention. Overtraining and inadequate recovery increase injury risk. AI systems analyze workload and recovery indicators to detect early warning signs. Proactive intervention reduces downtime. Injury reduction strongly drives adoption.

For instance, in October 2025, Oura expanded preventive features with AI Advisor, analyzing sleep and biomarkers for recovery trends. New Health Panels launched, empowering 18-64 users with proactive insights.

Demand for AI athlete recovery optimization solutions is influenced by the professionalization of sports science. Teams invest in data-driven performance management to gain competitive advantage. Recovery optimization supports consistent performance throughout seasons. AI systems provide actionable insights at scale. Professional adoption increases demand.

Key Takeaway

- Software platforms led by type with a 40.3% share, reflecting strong adoption of centralized recovery monitoring and optimization tools.

- AI algorithms and analytics engines accounted for 34.2%, driven by demand for predictive insights into fatigue, injury risk, and recovery readiness.

- Professional sports teams dominated applications with a 62.7% share, supported by high-performance training environments and competitive pressure.

- Machine learning and predictive analytics captured 48.9%, highlighting their role in forecasting recovery timelines and performance outcomes.

- Cloud-based deployment led with a 74.1% share, enabled by real-time data access, scalability, and remote athlete monitoring.

- Sleep and rest optimization represented 36.8%, emphasizing recovery-focused approaches to improve endurance, reaction time, and injury prevention.

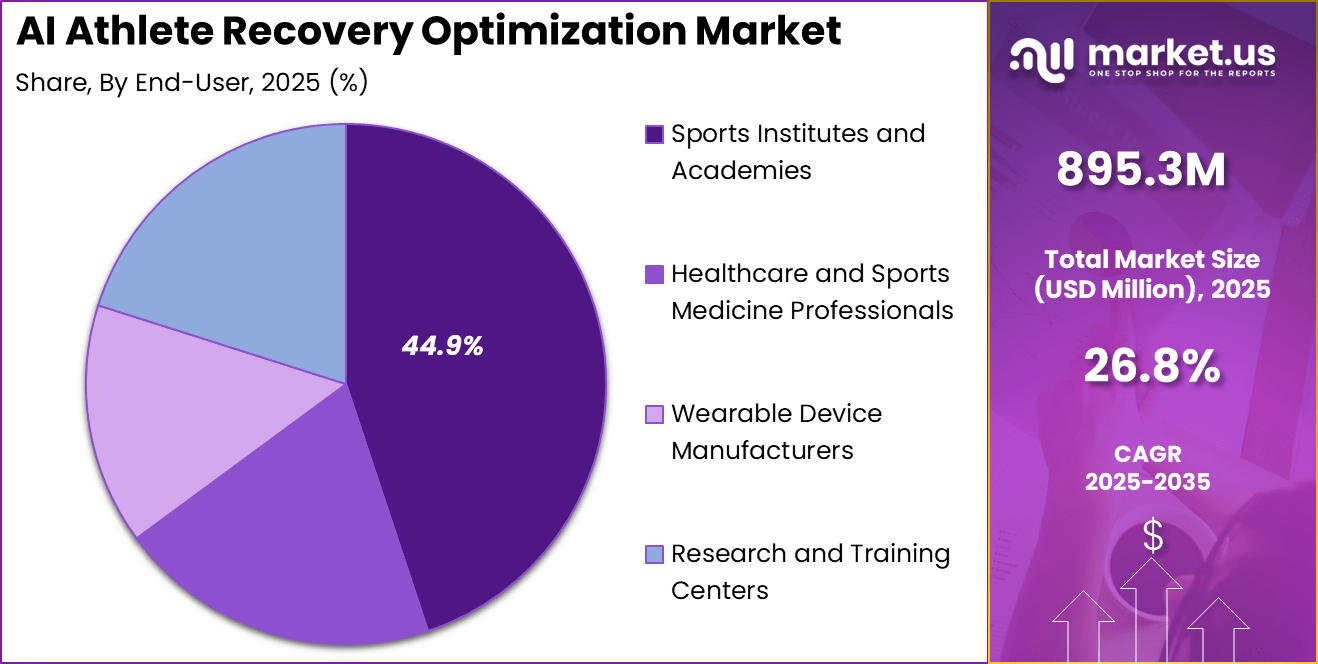

- Sports institutes and academies accounted for 44.9%, driven by structured athlete development programs and long-term performance tracking.

- North America held a 41.7% share, supported by advanced sports science infrastructure and early AI adoption.

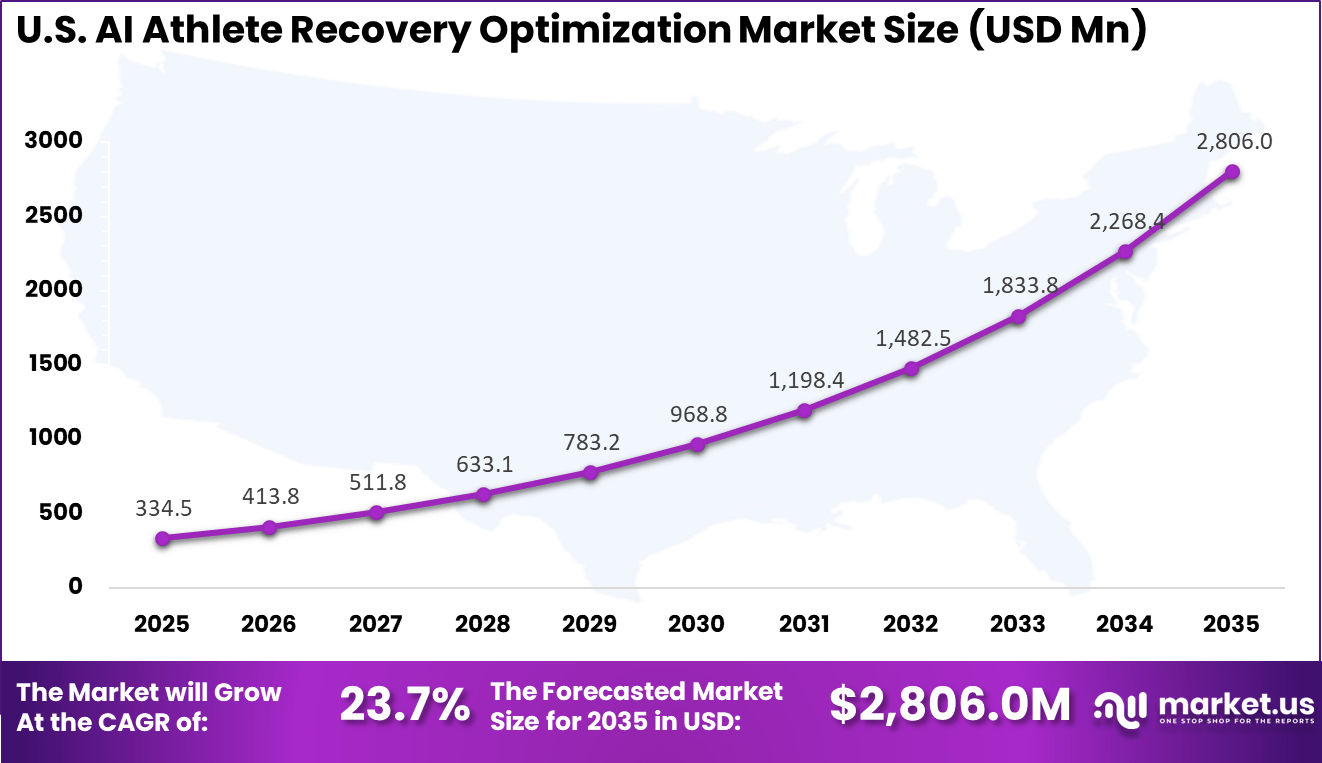

- The U.S. market reached USD 334.5 million, expanding at a strong 23.7% CAGR, driven by professional league investments and data-driven athlete management.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Rising athlete injury rates Need for proactive recovery monitoring ~6.9% Global Short Term Professionalization of sports science Data driven recovery protocols ~6.1% North America, Europe Short Term Integration of AI and biometrics Personalized recovery optimization ~5.4% Global Mid Term Growth of high performance training centers Continuous athlete condition tracking ~4.7% Global Mid Term Focus on career longevity Load management and fatigue control ~3.7% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High system cost Advanced sensors and analytics platforms ~5.6% Emerging Markets Short Term Data accuracy variability Inconsistent physiological inputs ~4.7% Global Short Term Athlete data privacy concerns Compliance with data protection rules ~3.9% Europe, North America Mid Term Integration challenges Alignment with medical workflows ~3.1% Global Mid Term Dependence on expert interpretation Limited automation of insights ~2.4% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High upfront investment AI platforms and wearable ecosystems ~6.3% Emerging Markets Short to Mid Term Limited adoption in amateur sports Budget and infrastructure gaps ~5.0% Global Mid Term Lack of standardized recovery metrics Inconsistent performance benchmarks ~3.8% Global Mid Term Technical skill requirements Need for sports data specialists ~3.0% Global Long Term Unclear ROI measurement Performance gains hard to quantify ~2.3% Global Long Term Type Analysis

Software platforms account for 40.3% of the AI athlete recovery optimization market, reflecting their role in managing recovery data and workflows. These platforms aggregate inputs from wearables, training logs, and health metrics into unified dashboards. Sports organizations use them to monitor athlete readiness and recovery progress. The value of software platforms lies in their ability to translate complex data into actionable insights.

Coaches and medical staff rely on visual reports and alerts to guide recovery decisions. This improves consistency in athlete care. As recovery management becomes more data-driven, demand for centralized software platforms continues to grow. Ease of use and integration with existing systems support adoption. This keeps software platforms as a key market segment.

For Instance, in January 2026, Kitman Labs teamed up with Xplere for performance intelligence in MENA sports. This alliance boosts software platforms by merging athlete data into user-friendly dashboards. Teams now get seamless tracking of recovery metrics, helping coaches fine-tune loads on the go. It speeds up decisions, cuts injury risks, and fits right into daily workflows for pro squads handling high-stakes games.

Component Analysis

AI algorithms and analytics engines represent 34.2% of the component segment, highlighting their importance in recovery optimization. These engines process physiological and performance data to identify fatigue and recovery patterns. Advanced analytics support personalized recovery recommendations. Machine-driven analysis helps detect early signs of overtraining or injury risk.

This allows proactive intervention before performance declines. Accuracy and continuous learning improve decision reliability. As data volumes increase, analytics engines become more valuable. Their ability to adapt to individual athlete profiles strengthens outcomes. This component remains central to AI-driven recovery solutions.

For instance, in December 2025, Sparta Science rolled out AI-powered force plates for jump analysis. These engines break down strength imbalances and fatigue, powering core algorithms in recovery tech. By processing biomechanics data fast, they deliver personalized fixes that trainers trust. Growth in this component comes from accurate predictions that keep athletes training safely longer. It’s changing how teams spot and fix issues early.

Application Analysis

Professional sports teams account for 62.7% of application demand, making them the largest users of recovery optimization tools. Teams operate under intense performance schedules that require effective recovery management. AI systems support these needs through continuous monitoring. Teams use recovery analytics to manage workload and rest cycles.

Insights help optimize training intensity and reduce injury risks. This improves player availability and long-term performance. As competition intensifies, teams prioritize recovery as a performance differentiator. AI adoption supports structured recovery planning. This sustains strong demand in this application segment.

For Instance, in January 2026, WHOOP added advanced lab uploads for all members, expanding to more regions by year-end. Pro teams use this for precise recovery tracking across rosters, vital for packed schedules. It flags fatigue from games, guiding rest to boost availability. With real-time insights, coaches avoid burnout, making it a staple for leagues like the NFL and soccer, where every match counts.

Technology Analysis

Machine learning and predictive analytics account for 48.9% of technology adoption. These technologies enable systems to forecast recovery timelines and fatigue levels. Predictive insights support data-driven recovery decisions. ML models learn from historical and real-time data to refine recommendations.

This improves personalization across athletes and sports. Predictive analytics also support injury prevention strategies. As model accuracy improves, reliance on predictive technologies increases. Their ability to adapt to changing conditions strengthens value. This technology segment remains dominant.

For Instance, in July 2025, WHOOP announced adaptive coaching with predictive AI models for training and recovery. Machine learning adjusts plans based on live data, predicting optimal rest windows. This tech learns from individual patterns, slashing downtime for athletes. Teams see it prevent overstrain, fueling adoption in high-performance environments where margins are thin.

Deployment Mode Analysis

Cloud-based deployment leads with a 74.1% share, driven by scalability and accessibility needs. Cloud platforms allow medical and performance teams to access recovery data remotely. This supports coordination across training locations.

Cloud systems simplify updates and data storage. Real-time synchronization improves decision speed. Cost efficiency also supports adoption. As organizations adopt connected recovery ecosystems, cloud deployment remains preferred. Flexibility and scalability support long-term use. This model continues to dominate deployment choices.

For Instance, in December 2025, Kitman Labs enhanced its cloud platform with 3D motion capture via tablet. Cloud deployment shines here, offering instant access to analytics without hardware hassles. Remote teams sync data effortlessly, scaling for tournaments. It cuts costs and setup time, letting staff focus on athletes over tech woes during travel-heavy seasons.

Recovery Technique Analysis

Sleep and rest optimization account for 36.8% of recovery techniques used. Adequate rest is critical for muscle repair and mental recovery. AI tools monitor sleep quality and recovery indicators. Data-driven sleep insights help personalize rest schedules.

Teams use these insights to improve readiness and reduce fatigue. This supports performance consistency. As awareness of sleep impact grows, adoption increases. AI-driven monitoring enhances recovery planning. Sleep optimization remains a core recovery focus.

For Instance, in December 2025, WHOOP upgraded sleep tracking with clinical validation and smarter guidance. This targets rest optimization by scoring recovery from overnight data, suggesting tweaks for better recharge. Athletes wake with clear plans, improving next-day output. As science ties sleep to healing, teams lean on it to combat travel fatigue and build resilience.

End-User Analysis

Sports institutes and academies represent 44.9% of end-user demand. These organizations focus on long-term athlete development and injury prevention. AI recovery tools support structured training programs. Institutes use AI systems to monitor young athletes safely.

Recovery insights guide training intensity and rest periods. This supports sustainable performance development. As talent development programs expand, adoption increases. AI tools support evidence-based coaching. This keeps institutes and academies as key end users.

For Instance, in November 2025, Sportsbox AI partnered with Foresight Sports for 3D motion in golf apps, aiding youth training. Academies use this for early form corrections and recovery monitoring in young athletes. It prevents bad habits, customizing drills to growing bodies. With affordable access, institutes develop talent safely, preparing them for pro levels without early injuries.

U.S. Market Size

The United States contributes USD 334.5 million in market value, driven by adoption across professional leagues and academies. Recovery optimization is viewed as essential to performance sustainability. AI solutions align with this focus.

A CAGR of 23.7% reflects strong growth momentum across the region. Rising awareness of injury prevention supports expansion. North America remains a leading market for AI-driven recovery optimization.

For instance, in December 2025, WHOOP launched major AI enhancements, including adaptive coaching and enhanced personal guidance that integrates strain, sleep, stress, and lab results for athlete recovery optimization. The WHOOP 5.0 platform provides real-time predictive insights and personalized recovery recommendations, solidifying U.S. leadership in performance wearables.

North America holds a 41.7% share of the AI athlete recovery optimization market, supported by advanced sports science adoption. Professional teams and training institutions invest heavily in performance health technologies. Strong digital infrastructure supports integration.

For instance, in August 2025, Fitbit unveiled an AI-powered personal health coach for Fitbit Premium, featuring adaptive workout plans, sleep optimization, and recovery adjustments based on biometric data. The Gemini AI-driven coach analyzes readiness scores to prioritize recovery when needed, reinforcing North American dominance in AI athlete monitoring.

Driver Analysis

The AI athlete recovery optimization market is being driven by the increasing emphasis on performance enhancement and injury prevention in competitive sports. Traditional recovery protocols often rely on subjective assessments and one-size-fits-all practices that may not reflect individual physiological responses.

AI-enabled solutions integrate data from wearable sensors, biometric monitoring, training load records, and historical injury profiles to deliver personalised recovery plans that optimise rest intervals, nutrition timing, and therapeutic interventions. These data-driven insights help coaches, trainers, and sports medical professionals improve athlete readiness, minimise downtime, and extend career longevity through tailored recovery strategies.

Restraint Analysis

A notable restraint in the AI athlete recovery optimization market relates to concerns about data privacy, security, and ethical use of sensitive biometric information. Recovery systems often require continuous access to detailed health and performance data, which raises questions about how this information is stored, processed, and shared.

Athletes and organisations may be cautious about adopting AI tools without robust governance to protect personal data and ensure compliance with privacy regulations. These concerns can slow adoption, particularly among amateur and grassroots sports where formal data policies are less established.

Opportunity Analysis

Emerging opportunities in the AI athlete recovery optimization market are linked to the integration of multimodal data sources that support comprehensive health and performance profiling. Combining heart rate variability, sleep quality metrics, muscle fatigue indicators, and metabolic data enables AI models to predict recovery needs with greater nuance and accuracy.

There is also potential for extending solutions beyond elite sports into broader fitness, rehabilitation, and wellness markets, where personalised recovery insights can support injury prevention and performance improvement for recreational athletes and active populations. Advancements in mobile and wearable technologies further broaden the reach of intelligent recovery monitoring.

Challenge Analysis

A central challenge confronting this market involves balancing algorithmic recommendations with clinical oversight and sport science expertise. While AI can identify patterns and forecast recovery trajectories, human practitioners must interpret these insights within the context of sport-specific demands, psychological readiness, and competitive schedules.

Ensuring that AI systems are transparent, explainable, and aligned with established training philosophy requires continuous validation, collaboration between technologists and practitioners, and rigorous ethical standards. Overreliance on automated guidance without professional interpretation can risk misapplication of recovery strategies.

Emerging Trends

Emerging trends in the AI athlete recovery optimization landscape include the adoption of predictive analytics that forecast injury risk and inform proactive mitigation strategies before symptoms escalate. AI platforms are increasingly incorporating adaptive learning that adjusts recovery recommendations in response to real-time sensor feedback and athlete feedback loops.

Another trend involves immersive feedback interfaces, such as virtual reality guidance for therapeutic exercises and biofeedback visualisations that support athlete engagement with recovery protocols. Integration with team management systems and performance dashboards enhances coordination among coaches, medical staff, and support personnel.

Growth Factors

Growth in the AI athlete recovery optimization market is supported by heightened investment in sports science, wearable sensor technologies, and data analytics infrastructure. Competitive pressures in professional leagues, collegiate athletics, and performance training centres drive adoption of tools that can deliver measurable gains in recovery outcomes and reduce the incidence of overuse injuries.

Advances in artificial intelligence, cloud processing, and real-time data capture strengthen the capability to deliver personalised, actionable insights at scale. As sport organisations prioritise holistic athlete care and performance sustainability, AI-powered recovery optimization becomes an integral component of modern training ecosystems.

Key Market Segments

By Type

- Hardware-Based Solutions

- Software Platforms

- Integrated AI Recovery Systems

- Wearable AI Devices

By Component

- Sensors and Trackers

- AI Algorithms and Analytics Engines

- Cloud and Edge Computing Infrastructure

- Mobile and Web Applications

By Application

- Professional Sports Teams

- Individual Athletes

- Sports Rehabilitation Centers

- Fitness & Wellness Clubs

By Technology

- Machine Learning and Predictive Analytics

- Computer Vision

- Natural Language Processing (NLP)

- Internet of Things (IoT) Integration

- Others

By Deployment Mode

- Cloud-Based Deployment

- On-Premise Deployment

By Recovery Technique

- Sleep and Rest Optimization

- Muscle Fatigue Analysis

- Hydration and Nutrition Monitoring

- Injury Detection and Prevention

By End-User

- Sports Institutes and Academies

- Healthcare and Sports Medicine Professionals

- Wearable Device Manufacturers

- Research and Training Centers

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading players such as WHOOP, Catapult Sports, and Kitman Labs focus on continuous athlete monitoring and recovery analytics. Their platforms use AI to track workload, fatigue, and readiness. Insights support injury prevention and recovery planning. Sparta Science strengthens biomechanical assessment. These solutions are widely adopted by professional teams and sports institutes seeking data driven recovery decisions.

Wearable and sensor based providers such as Garmin, Oura Health, and Fitbit emphasize sleep, heart rate variability, and physiological recovery metrics. Apple expands the ecosystem through consumer friendly health integration. VALD Performance supports clinical grade recovery assessment. These players drive adoption across both elite and amateur athletes.

Training, therapy, and analytics focused players such as Athos, Kinexon, and Sportsbox AI address movement quality and recovery efficiency. PlayerTek and Restore Hyper Wellness expand applied recovery solutions. Other vendors add innovation across sensors and AI models. This competitive landscape supports steady growth in AI driven athlete recovery optimization.

Top Key Players in the Market

- WHOOP

- Catapult Sports

- Kitman Labs

- Sparta Science

- Halo Neuroscience (Halo Sport)

- Kinduct Technologies

- Exogen (a Datalogix company)

- VALD Performance

- Fitbit (Google)

- Apple (Apple Watch & HealthKit)

- Garmin

- Oura Health

- Athos

- PlayerTek (by Catapult)

- Perch

- Strive

- Kinexon

- Sportsbox AI

- Restore Hyper Wellness

- Oxehealth

- Others

Recent Developments

- January, 2026 – WHOOP teamed up with Scuderia Ferrari HP as their official health and fitness wearable partner, focusing on recovery insights, sleep tracking, and strain management to boost driver and team performance under extreme conditions.

- June, 2025 – Catapult Sports acquired Perch for $18 million, integrating AI-powered gym monitoring with on-field tracking to enhance athlete recovery strategies and strength training analysis.

Report Scope

Report Features Description Market Value (2025) USD 895.3 Mn Forecast Revenue (2035) USD 9,619.7 Mn CAGR(2026-2035) 26.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Hardware-Based Solutions, Software Platforms, Integrated AI Recovery Systems, Wearable AI Devices), By Component (Sensors and Trackers, AI Algorithms and Analytics Engines, Cloud and Edge Computing Infrastructure, Mobile and Web Applications), By Application (Professional Sports Teams, Individual Athletes, Sports Rehabilitation Centers, Fitness & Wellness Clubs), By Technology (Machine Learning and Predictive Analytics, Computer Vision, Natural Language Processing (NLP), Internet of Things (IoT) Integration, Others), By Deployment Mode (Cloud-Based Deployment, On-Premise Deployment), By Recovery Technique (Sleep and Rest Optimization, Muscle Fatigue Analysis, Hydration and Nutrition Monitoring, Injury Detection and Prevention), By End-User (Sports Institutes and Academies, Healthcare and Sports Medicine Professionals, Wearable Device Manufacturers, Research and Training Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape WHOOP, Catapult Sports, Kitman Labs, Sparta Science, Halo Neuroscience (Halo Sport), Kinduct Technologies, Exogen (a Datalogix company), VALD Performance, Fitbit (Google), Apple (Apple Watch & HealthKit), Garmin, Oura Health, Athos, PlayerTek (by Catapult), Perch, Strive, Kinexon, Sportsbox AI, Restore Hyper Wellness, Oxehealth, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Athlete Recovery Optimization MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI Athlete Recovery Optimization MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- WHOOP

- Catapult Sports

- Kitman Labs

- Sparta Science

- Halo Neuroscience (Halo Sport)

- Kinduct Technologies

- Exogen (a Datalogix company)

- VALD Performance

- Fitbit (Google)

- Apple (Apple Watch & HealthKit)

- Garmin

- Oura Health

- Athos

- PlayerTek (by Catapult)

- Perch

- Strive

- Kinexon

- Sportsbox AI

- Restore Hyper Wellness

- Oxehealth

- Others