Global AI Annotation Market By Data Modality (Image and Video Computer Vision, LiDAR and Sensor Fusion, Text and Natural Language Processing (NLP), Audio and Speech, Tabular, Structured, and Synthetic Data Tagging), By Vertical (Autonomous Vehicles & Mobility, Geospatial & Remote Sensing, Medical Imaging and Healthcare, Retail & E-Commerce, NLP, Enterprise Search, and Finance, Defense & Security), By Buyer Type (OEMs & Large Enterprises, SMEs, NGOs & Public Sector, SaaS Companies & Platform Owners), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 164274

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

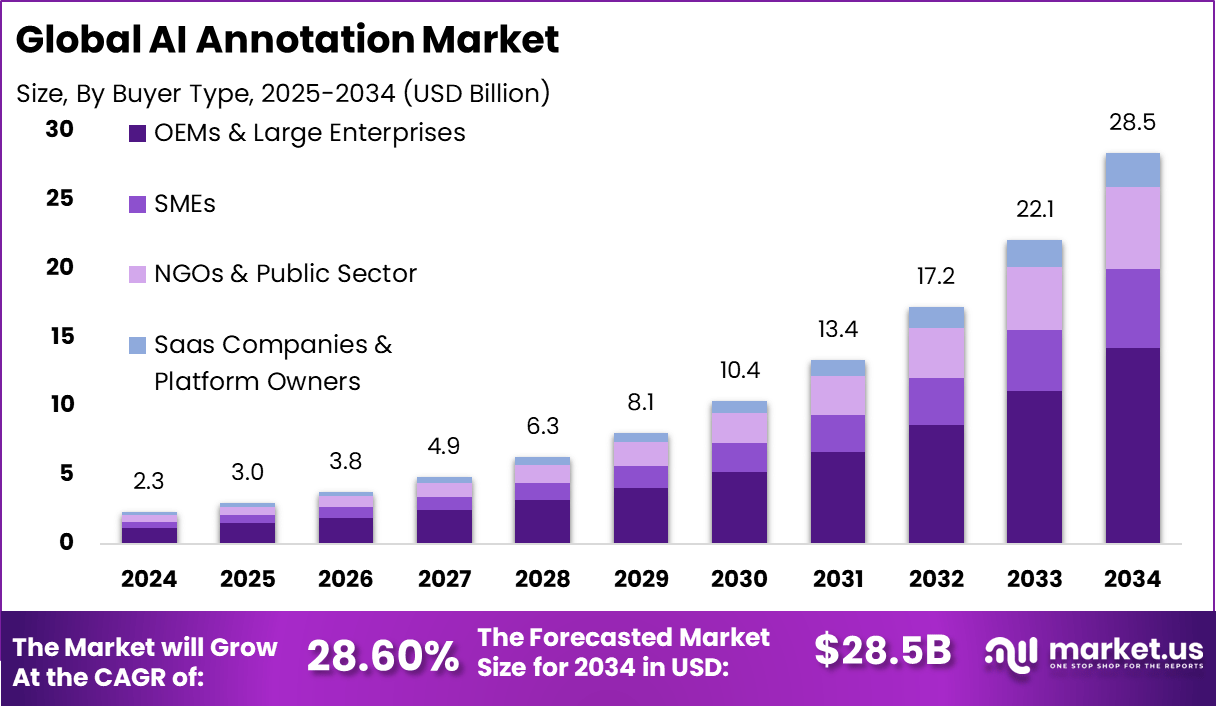

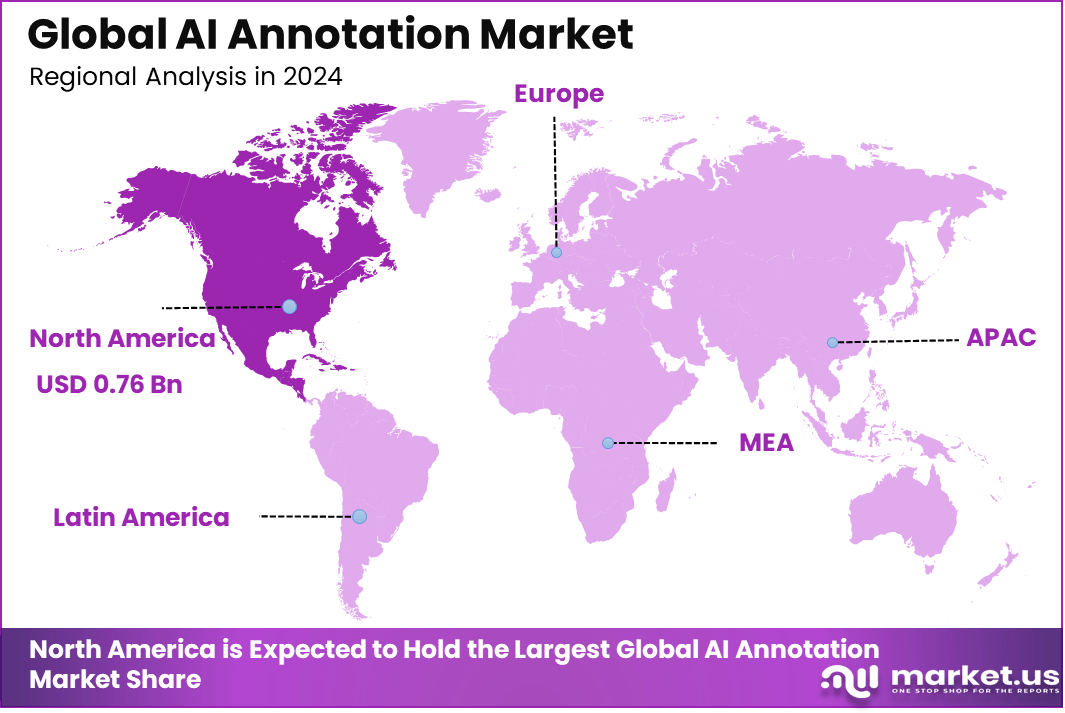

The Global AI Annotation Market generated USD 2.3 billion in 2024 and is predicted to register growth from USD 3.0 billion in 2025 to about USD 28.5 billion by 2034, recording a CAGR of 28.60% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 33.2% share, holding USD 0.76 Billion revenue.

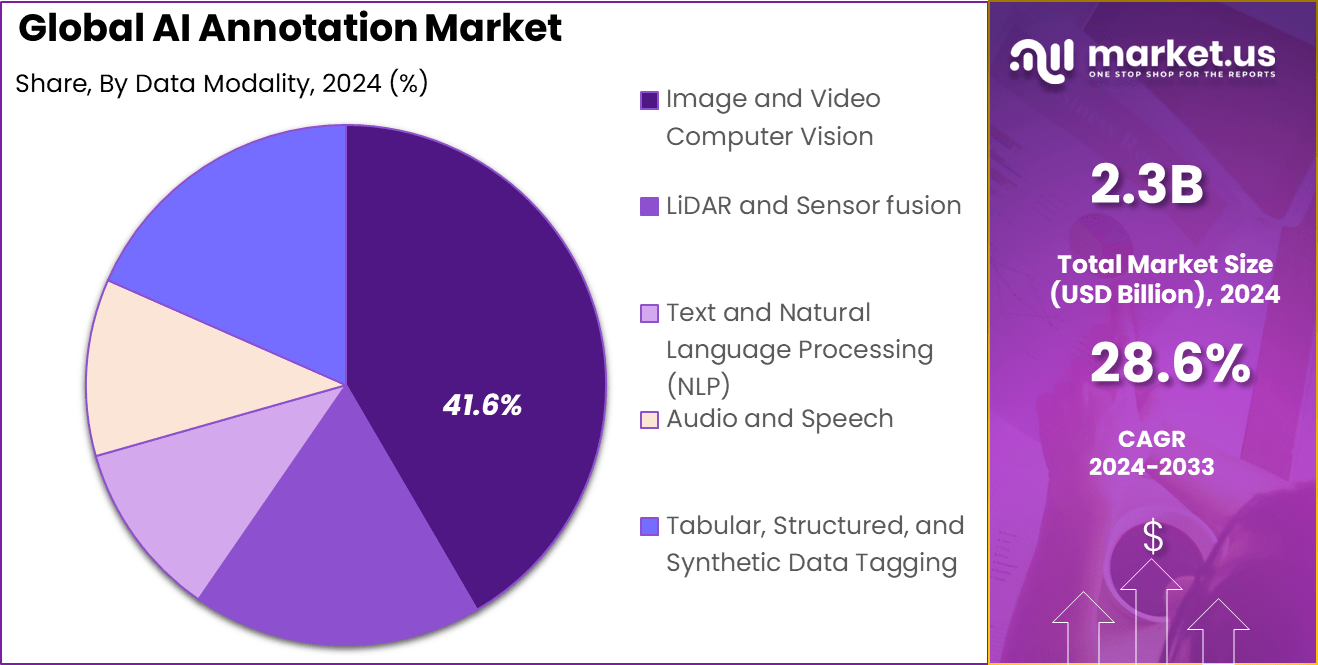

The AI Annotation Market is expanding quickly as more companies need accurately labeled data to train smart AI systems. In 2024, image and video annotation accounted for over 41% of requests, driven by uses like self-driving cars, security, and healthcare. Computer vision applications demand highly precise labels to enable reliable real-time detection and analysis. The United States, as a North American leader, benefits from strong tech expertise and early adoption of annotation tools.

Top driving factors include the increasing integration of AI into daily business and safety-critical systems. Autonomous vehicle development and medical diagnostics have raised the demand for detailed data labeling by more than 30% in recent years. Also, sensors like LiDAR used in mapping and robotics require precise annotations to ensure operational safety and accuracy.

Demand analysis shows that automation in industries such as manufacturing and transportation drives annotation needs. About one-third of annotation projects focus on enabling real-time process control in warehouses and traffic monitoring. Cloud-based platforms have made it easier for smaller companies to generate custom annotations, lowering barriers to use.

Top Market Takeaways

- By data modality, the image and video computer vision segment leads with 41.6%, driven by growing demand for annotated visual datasets in AI model training.

- By vertical, autonomous vehicles and mobility account for 32.9%, reflecting strong use of annotated data for object detection, navigation, and real-time decision-making.

- By buyer type, OEMs and large enterprises dominate with 50.2%, as they scale AI projects requiring high-volume, accurate data annotation.

- North America holds 33.2%, supported by early AI adoption and investment in autonomous systems and computer vision applications

Analyst Overview

Growing technologies include cloud annotation services and AI-assisted labeling, which improve speed and reduce manual work by over 30% compared to older methods. These solutions mix automated pre-labeling with human expert review to balance efficiency and accuracy. Key reasons for adoption include reducing bias and improving consistency in annotated data.

Manual labeling alone can cause error rates up to 25% higher than hybrid approaches. Automated annotation helps companies release AI applications faster while maintaining high quality, particularly important in healthcare, transportation, and customer service. Investment opportunities focus on platforms combining automation and expert oversight.

Business benefits include cutting costs and freeing technical staff to focus on AI model development instead of tedious data labeling. Companies save about 20% of labor time through advanced workflows, reducing errors early with anomaly detection tools. This leads to faster project delivery and higher reliability in AI systems. This mix of improved performance, efficiency, and trustworthiness allows businesses to quickly innovate with AI while ensuring accuracy and adaptability as technologies evolve.

By Data Modality

In 2024, The image and video computer vision segment forms about 41.6% of the AI annotation market. This segment has grown alongside the rise of advanced perception models for tasks like object detection, gesture recognition, and motion tracking. The need for detailed labeling of high-resolution visual datasets is expanding as companies refine algorithms for security systems, retail analytics, and robotics.

The quality and scale of annotated image and video data directly influence model accuracy, prompting sustained investments in precise labeling tools. More enterprises now use automated and semi-automated annotation platforms to speed up visual data labeling while maintaining accuracy.

Technologies such as active learning and model-in-the-loop annotation are helping reduce effort and improve dataset quality. The integration of these methods with cloud-based data pipelines allows faster scaling of projects, especially for industries requiring real-time decision systems. This segment continues to dominate because visual intelligence forms the foundation for many applied AI models across sectors.

By Vertical

In 2024, Autonomous vehicles and mobility applications account for roughly 32.9% of the annotation market. The demand for high-fidelity training data supporting self-driving algorithms has created extensive requirements for frame-by-frame labeling of images, LiDAR, and radar feeds. Companies developing driver-assistance systems are prioritizing accurate annotation for lane detection, obstacle recognition, and behavioral prediction to ensure safety and compliance.

As testing environments become more complex, the scale and precision of labeling have increased significantly. This segment also benefits from partnerships between automotive manufacturers, data labeling providers, and AI platform developers. The shift toward higher levels of driving automation has encouraged continuous dataset expansion to capture diverse weather, lighting, and traffic conditions.

As vehicles become more data-driven, annotation quality increasingly defines how effectively AI can respond to real-world variability. The continued advancement of mobility ecosystems ensures this remains one of the most data-intensive domains within the broader annotation landscape.

By Buyer Type

In 2024, OEMs and large enterprises hold the largest segment share at 50.2%. These organizations often manage vast AI training pipelines and require large-scale annotation programs with strict quality controls. They invest in customized data management solutions that integrate annotation, validation, and version tracking for continuous model improvement. Given their financial capacity, large firms are also driving the automation of labeling workflows to lower time and labor costs.

Partnerships between enterprises and specialized labeling firms are becoming common, reflecting a trend toward outsourcing high-volume tasks while maintaining security of sensitive data. Enterprises in industries like automotive, tech, and healthcare are enhancing in-house labeling capabilities for strategic data assets. This segment’s dominance signals how major corporations continue to shape standards for data quality, platform interoperability, and annotation scalability in the AI ecosystem.

Emerging Trends

Emerging trends in AI annotation for 2025 show a clear shift towards automation combined with human expertise. AI-assisted annotation tools are becoming more common, where automated pre-labeling handles much of the routine work, and human annotators focus on quality control and edge cases. This hybrid model cuts annotation time by about 40% while maintaining high accuracy, especially in fields like healthcare and autonomous vehicles.

Another key trend is the rise of multimodal annotation, where data from text, images, video, and sensors are labeled together to train more complex AI systems. Ethical data annotation is also gaining priority, with organizations placing more emphasis on reducing bias and protecting privacy in their datasets.

Growth Factors

The growth of AI annotation is fueled by increasing AI adoption across industries that demand high-quality, precise data. Critical sectors such as autonomous vehicles and healthcare particularly push for annotated data that is diverse, detailed, and unbiased. The explosion of unstructured data from digital platforms further drives the market’s expansion, creating the need for more sophisticated annotation tools and skilled annotators.

Manual annotation remains crucial despite automation, to ensure data quality in complex scenarios. Additionally, the rising demand for ethical AI practices encourages companies to adopt transparent and fair data annotation approaches to meet regulatory and societal expectations.

Key Market Segments

By Data Modality

- Image and Video Computer Vision

- LiDAR and Sensor fusion

- Text and Natural Language Processing (NLP)

- Audio and Speech

- Tabular, Structured, and Synthetic Data Tagging

By Vertical

- Autonomous Vehicles & Mobility

- Geospatial & Remote Sensing

- Medical Imaging and Healthcare

- Retail & E-Commerce

- NLP, Enterprise Search, and Finance

- Defense & Security

By Buyer Type

- OEMs & Large Enterprises

- SMEs

- NGOs & Public Sector

- SaaS Companies & Platform Owners

Regional Analysis

In 2024, North America accounts for nearly 33.2% of the global AI annotation market. The region leads in AI development, driven by a concentration of technology companies, research institutes, and autonomous system developers.

Demand is supported by strong data regulations and the availability of skilled labeling professionals. The presence of high-value industries such as automotive technology and healthcare AI sustains heavy investment in annotation infrastructure. The U.S. plays a central role through significant funding for AI research and commercialization projects.

Companies in the region emphasize ethical AI and bias mitigation, which increase the importance of carefully managed annotation pipelines. The regional ecosystem’s maturity allows rapid adoption of cloud-based labeling solutions and synthetic data generation tools, maintaining North America’s influence as a key hub for annotated data innovation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for AI and ML-Enabled Applications

The growth of the AI annotation market has been significantly driven by the increasing adoption of artificial intelligence (AI) and machine learning (ML) across multiple industry verticals. As organisations deploy AI solutions for computer vision, natural language processing and autonomous systems, the requirement for large volumes of high-quality annotated data has become essential.

Furthermore, sectors such as automotive, healthcare and e-commerce are contributing to this demand as they integrate AI for object detection, diagnostic imaging and personalised services. The annotation process enables raw unstructured data to be transformed into model-ready inputs, which supports improved algorithmic performance and thereby justifies increased investment in annotation services and tools.

Restraint

High Cost and Complexity of Manual Annotation

A key restraint for the annotation market arises from the high cost and complexity of manual annotation workflows. Achieving high accuracy often requires domain expertise, time-consuming human labour, and rigorous quality assurance, which elevates cost structures and limits scalability. For instance, an analysis highlights that the shortage of domain-specific annotated datasets is a major challenge, particularly in regulated or high-stakes environments.

In addition, as annotation tasks become more sophisticated e.g., 3D point-cloud labelling for autonomous vehicles or fine-grained semantic labelling for generative AI the complexity of annotation increases, making turnaround times longer and costs higher. This can impede broader adoption and profitability of annotation platforms, especially in emerging markets.

Opportunity

Emergence of Automated and Semi-automated Annotation Technologies

An important opportunity exists in the deployment of automated or semi-automated annotation technologies that can reduce turnaround time and cost while improving scalability. Advancements in AI-assisted annotation platforms that combine human input with machine inference are gaining traction. For example, research shows the use of large language models (LLMs) and “model-in-the-loop” frameworks to streamline annotation workflows.

By leveraging such technologies, annotation service providers can extend into adjacent domains such as edge computing, multimodal datasets and augmented reality, thereby unlocking new industry applications and revenue streams. The transition from purely manual workflows to hybrid models presents a meaningful avenue for growth within the annotation ecosystem.

Challenge

Ensuring Data Quality, Bias Mitigation and Regulatory Compliance

A significant challenge for the annotation market resides in maintaining data quality, mitigating annotation bias and complying with data governance standards. As AI models become more pervasive and impact-sensitive (for example in healthcare or autonomous vehicles), the integrity, diversity and fairness of annotated datasets become critical.

The annotation industry must therefore implement robust controls to avoid skewed training data and ensure ethical outcomes. Additionally, evolving regulatory frameworks around data privacy (such as GDPR and similar laws globally) require annotation providers to secure and anonymise data, manage consent and maintain audit trails. These obligations raise operational complexity and cost, especially for cross-border annotation projects involving sensitive personal or medical data.

Competitive Analysis

The AI Annotation Market is driven by platforms that support data labeling for computer vision, natural language processing, and speech recognition models. Scale AI, Appen, and iMerit are among the leading providers, offering scalable annotation services across image, text, video, and lidar data.

These companies leverage skilled human annotators and automation tools to deliver high-quality training datasets for industries such as autonomous driving, healthcare, and retail. Their global delivery centers and quality-assurance workflows make them preferred partners for large AI deployments.

Specialized platforms like Labelbox, SuperAnnotate, and Playment focus on end-to-end data annotation workflows with built-in collaboration, model-assisted labeling, and analytics dashboards. These tools enable enterprises to manage custom annotation projects in-house, reducing dependency on external vendors. Their cloud-based environments also support seamless annotation iteration, thereby accelerating AI development cycles and improving model accuracy.

Top Key Players in the Market

- Scale AI

- Surge AI

- Sama

- iMerit

- Appen

- Playment

- CloudFactory

- Shaip

- Cogito Tech LLC

- Labelbox

- SuperAnnotate

Future Outlook

The future of the AI annotation market looks promising as demand for high-quality labeled data continues to accelerate. OEMs and large enterprises currently make up around 50.2% of the total adoption, driven by their need for scalable and customized datasets for automation, computer vision, and AI model training. This dominance is expected to continue as they invest in in-house data pipelines and advanced analytics systems. The image and video annotation segment, representing nearly 41.6% of the market, will remain central due to its role in computer vision tasks such as object detection, motion tracking, and visual perception across industries like automotive and retail.

In terms of verticals, autonomous vehicles and mobility applications account for about 32.9%, underlining how the push toward driver assistance and smart navigation systems fuels annotation demand. Going forward, the market is projected to expand steadily as SaaS-based platforms improve labeling accuracy and SMEs, NGOs, and public-sector users adopt low-cost cloud tools to support smaller AI projects and social-impact initiatives.

Recent Developments

- June, 2025: Scale AI secured a landmark investment as Meta acquired a 49% stake for $14.3 billion, doubling Scale AI’s valuation to about $29 billion. This deal brings Scale AI’s founder into Meta’s leadership and bolsters Scale AI’s position as a critical player in AI model training infrastructure.

- August, 2025: Shaip solidified its position as a provider of high-quality, diverse datasets across text, audio, and image modalities. The company also offers a Responsible Large Language Model (LLM) Toolkit, which supports evaluation and enhancement via reinforcement learning from human feedback.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Bn Forecast Revenue (2034) USD 28.5 Bn CAGR(2025-2034) 28.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Data Modality (Image and Video Computer Vision, LiDAR and Sensor Fusion, Text and Natural Language Processing (NLP), Audio and Speech, Tabular, Structured, and Synthetic Data Tagging), By Vertical (Autonomous Vehicles & Mobility, Geospatial & Remote Sensing, Medical Imaging and Healthcare, Retail & E-Commerce, NLP, Enterprise Search, and Finance, Defense & Security), By Buyer Type (OEMs & Large Enterprises, SMEs, NGOs & Public Sector, SaaS Companies & Platform Owners) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Scale AI, Surge AI, Sama, iMerit, Appen, Playment, CloudFactory, Shaip, Cogito Tech LLC, Labelbox, SuperAnnotate Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Scale AI

- Surge AI

- Sama

- iMerit

- Appen

- Playment

- CloudFactory

- Shaip

- Cogito Tech LLC

- Labelbox

- SuperAnnotate