Global Agrochemicals Market By Product Type (Fertilizers, Pesticides, and Plant Growth Regulators), By Crop Type (Fruits And Vegetables, Cereal And Grains, Oilseeds And Pulses, Turf And Ornamentals And Others), By Form (Solid, and Liquid), By Application Methods (Foliar Spray, Soil Treatment, Seed Treatment And Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 103949

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- Formulation Analysis

- Crop Type Analysis

- Application Method Analysis

- Agrochemicals Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Geopolitical Impact Analysis

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

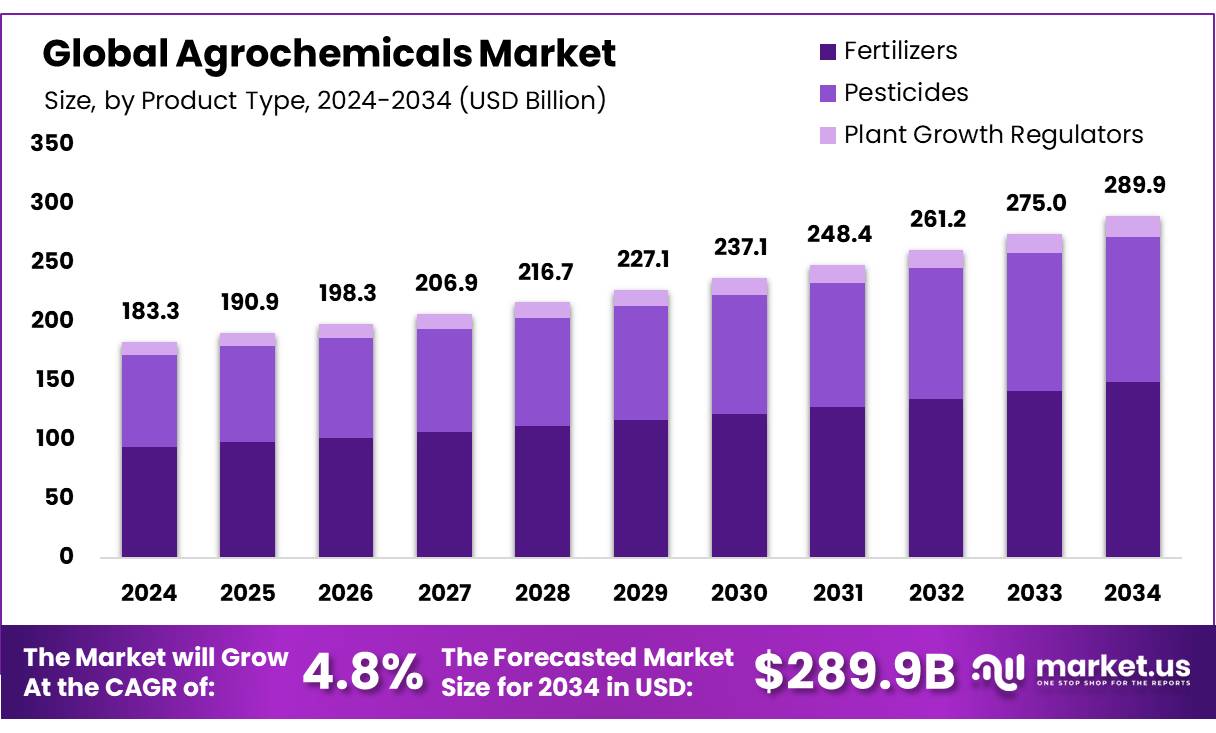

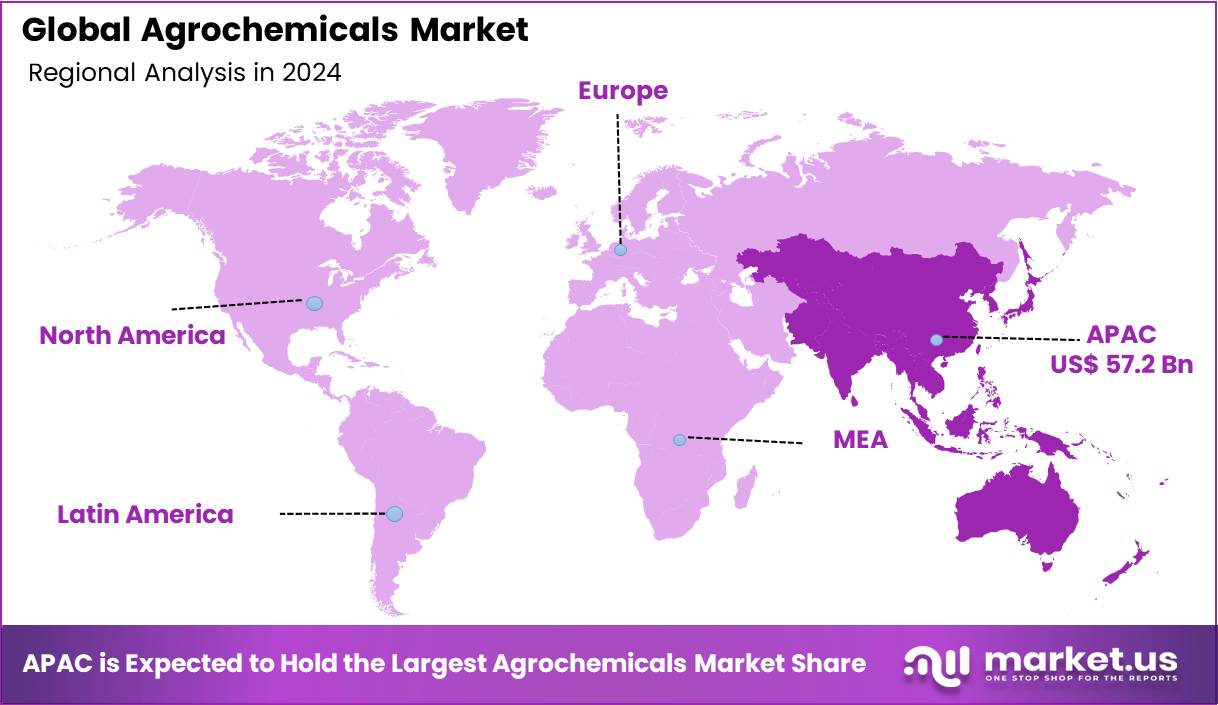

The global Agrochemicals Market size is expected to be worth around USD 289.9 Billion by 2034, from USD 183.3 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 31.2% share, holding USD 57.2 billion revenue.

Agrochemicals are used in agriculture to enhance crop production, protect plants from pests and diseases, and improve soil fertility. They encompass a wide range of products, including fertilizers, pesticides (insecticides, herbicides, fungicides), and soil conditioners. Additionally, the agricultural industry is witnessing increased demand for agrochemicals due to their ability to enhance the growth, quality, and texture of the crop.

A key driver of the global agrochemical market is the rising population globally. The growing demand for food security, along with advancements in plant growth regulators, is expected to further propel the market. Despite their ability to increase the quantity and quality of the crop yield, the market is facing challenges due to concerns about the impact of fertilizers and pesticides on human health and the environment.

- According to the Organization for Economic Co-operation and Development (OECD), agriculture’s global greenhouse gas (GHG) emissions intensity is expected to decline, as growth will be based on productivity improvements, which give space for the agrochemicals industry to thrive, rather than cultivated land and livestock herd expansions, although direct emissions from agriculture will still increase by 5%.

Key Takeaways

- The global agrochemicals market was valued at USD 183.3 billion in 2024.

- The global agrochemicals market is projected to grow at a CAGR of 4.8% and is estimated to reach USD 289.9 billion by 2034.

- In the product segment, fertilizers dominate the market with constituting around 51.4% of the market.

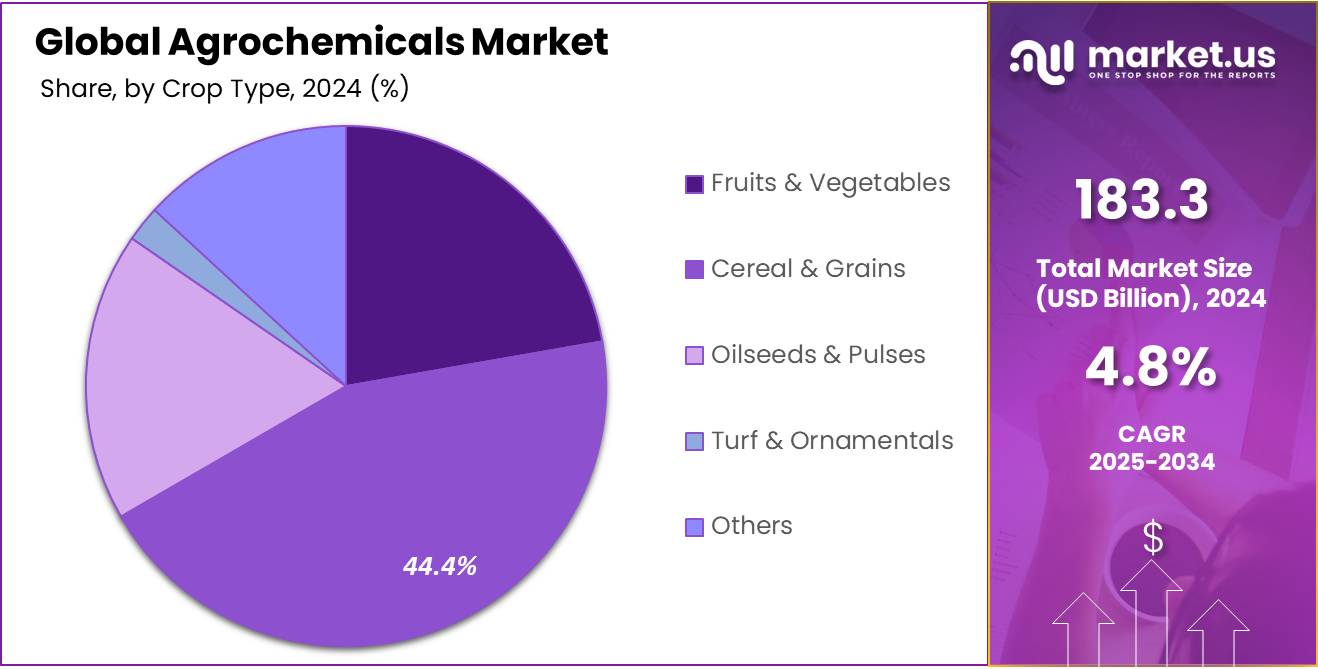

- Among the crops, cereal & grains held the majority of revenue share in 2024 at 44.4%.

- Based on form, the market was led by solid agrochemicals with a substantial market share of 75.8% in 2024.

- The soil treatment application method led the global market in 2024 with an extensive revenue share of 40.6%.

- Asia-Pacific is estimated as the largest market for traffic road marking coatings with a share of 31.2% of the market share and is anticipated to register the highest CAGR of 6.0%.

By Product Type Analysis

Fertilizers Dominate the Agrochemicals Market Due to Their Application in Providing Important Nutrients to The Crops.

The agrochemicals market is segmented based on product type as fertilizers, pesticides, and plant growth regulators. In 2024, fertilizers held a dominant market position, capturing more than a 51.4% share of the global agrochemicals market. Soil is the most important factor that is needed by the crops to grow and thrive. Fertilizers are considered essential in the agricultural industry as they provide vital nutrients such as nitrogen, phosphorus, and potassium, which are necessary for soil fertility and increased agricultural productivity.

Another major segment is the pesticide segment, as they focus on protecting plants from pests and diseases that can hinder growth and yield. The low sales of the plant growth regulators are attributed to the lack of knowledge regarding the product among the farmers. But, in recent years, the segment has also seen a rise in revenue due to its ability to enhance crop quality.

Formulation Analysis

Solid Agrochemicals Dominate the Market due to Their Ease of Use and Less Probability of Contamination.

Based on formulation, the market can be segregated into solid and liquid. In 2024, solid agrochemicals dominated the global market with a substantial market share of 75.8%, driven by their stability, extended shelf life, and ease of handling during storage and transportation. Solid agrochemicals, which are further divided into prills, granules, and crystals, are mostly used in fertilizers and pesticides and are mostly suitable for large-scale applications.

Additionally, solid formulations can be designed for controlled or sustained release of the active ingredient, providing a more consistent and prolonged pest or disease control. While liquid agrochemicals cover a smaller market share, plant growth regulators are mostly liquid, gaining traction over the period of years. Additionally, liquid agrochemicals are mostly suitable for placement applications and foliar spraying.

Crop Type Analysis

The Agrochemicals Market is Dominated by cereal & Grains Primarily Due To Their Critical Role In Global Staple Diets.

Based on crop type, the market is further divided into fruits & vegetables, cereal & grains, oilseeds & pulses, turf & ornamentals & others. In 2024, cereal & grains held a dominant market position, capturing more than a 44.4% market share of the global agrochemicals market. Crops such ass rice, wheat, corn, and barley are produced in massive volumes across major agricultural economies such as China, India, the U.S., and Brazil. These crops require substantial inputs of fertilizers, herbicides, and pesticides to ensure high yield and protect against pests, weeds, and disease outbreaks.

Additionally, cereals and grains are more susceptible to weather variations and pest pressures due to their extensive cultivation, driving demand for crop protection chemicals. Government policies supporting cereal production and global demand for animal feed, ethanol, and processed food further amplify agrochemical usage. The scale of industrial farming operations and the need for productivity optimization have positioned cereals and grains as the primary drivers of agrochemical consumption worldwide.

Application Method Analysis

The Agrochemicals Market is Dominated by Soil Treatment due to the Important Role that Soil Plays in the Growth of Crops.

Based on application method, the agrochemical market is divided into foliar spray, soil treatment, seed treatment, others. The most dominant segment in the application methods is the soil treatment, comprising about 40.6% of the market share. Soil treatment is seen as the most important segment due to the importance of soil fertility in the growth of the crop. Soil treatment comprises the use of fertilizers and pesticides to increase the fertility of soil and avoid pests and diseases, making it an ideal environment for crops to grow. In recent years, foliar treatments and seed treatments are seen as major segments due to their ability to release minimal agrochemicals to the surrounding environment, reducing soil and water pollution.

Agrochemicals Market Segments

By Product Type

- Fertilizer

- Nitrogenous

- Urea

- Ammonium Nitrate

- Ammonium Sulfate

- Ammonia

- Calcium Ammonium Nitrate

- Others

- Phosphatic

- Monoammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Triple Superphosphate (TSP)

- Others

- Potassic

- Potassium Chloride

- Potassium Sulfate

- Others

- Pesticide

- Insecticide

- Fungicide

- Herbicide

- Others

- Plant Growth Regulators

By Crop Type

- Fruits & Vegetables

- Cereal & Grains

- Oilseeds & Pulses

- Turf & Ornamentals

- Others

By Form

- Solid

- Liquid

By Application Methods

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Others

Driving Factors

Increasing Food Demand due to Population Growth Propels the Agrochemicals Market the Most.

The increasing population of the world, which raises the demand for food security, is the key driver in the development of the agrochemicals market. For instance, according to the World Population Prospects report by the United Nations in 2024, the world’s population is expected to continue growing over the coming 50 or 60 years, reaching a peak of around 10.3 billion people in the mid-2080s, up from 8.2 billion in 2024. In an era marked by rapid population growth and escalating environmental concerns, the agricultural sector faces immense pressure to produce more food with fewer resources.

According to the Food and Agriculture Organization (FAO), the world will need 50 percent more food by 2050 to feed the increasing global population in the context of natural resource constraints, environmental pollution, ecological degradation, and climate change. Traditional farming practices, while time-tested, are increasingly proving insufficient to meet these challenges. Agrochemicals help improve soil fertility, crop protection treatments, and advance the growth of the plants.

- Additionally, according to FAO, every year up to 40% of the global crop production is lost due to plant diseases and pests. Moreover, each year, these losses cost the global economy over USD 20 billion, and invasive insects at least USD 70 billion. To mitigate these problems, crop protection agrochemicals, also called pesticides, such as insecticides and herbicides, play an important role in the agricultural industry.

Restraining Factors

Human Health Concerns Might Restrain the Agrochemicals Market from Growing.

The use of agrochemicals has risen over the past three decades, exposing almost all individuals in the world to direct or indirect contact with these chemicals. Over the period of decades, there have been several studies on the negative impact of agrochemicals, especially fertilizers and pesticides, on the environment and human health.

- According to a study by the University of Edinburgh, every year, 385 million people, which is 44% of the world’s farming population, are poisoned in the course of their work, with an estimated 11,000 people losing their lives, especially in underdeveloped countries. Even more significantly, more than 100,000 people die yearly from intentional (self-harm) poisoning with pesticides.

Moreover, according to the Stockholm Convention on Persistent Organic Pollutants, nine out of the twelve most dangerous and persistent chemicals are pesticides. These concerns regarding human health may restrict the market from growing.

Growth Opportunity

Advancements in Plant Growth Regulators Are Anticipated to Create More Opportunities in the Market.

The market for agrochemicals is witnessing significant growth, driven by ongoing advancements in plant growth regulators. Plant growth regulators are artificially produced substances in very low quantities. They play an important role in earliness, sex modification, increasing the yield, quality, resistance to insect-disease, regulating the growth of plants, and are important measures to ensure production. It decreased susceptibility towards biotic and abiotic stress, improved morphological structure, facilitation of harvesting, and modification of plant constituents. In recent years, several new advancements have taken place in the product.

For instance, the discovery of gibberellins and cytokines led to commercial uses of products in these hormone categories that include improved shape of fruit, enhanced market value by reducing blemishes, and optimization of tree architecture that may be accomplished by overcoming apical dominance. Plant growth regulators were later discovered that could either advance ripening or extend postharvest life, thus greatly expanding the effective period when high-quality fruit could be harvested and marketed. Other areas of fruit production where plant bio-regulators are especially useful include the prevention of pre-harvest fruit drop, control of vegetative growth, enhanced flower bud formation, and control of fruit ripening.

Latest Trends

Shift Towards Precision Agriculture

In recent days, many countries have advocated the use of precision agriculture, as precision agriculture offers a transformative solution to the pressing challenges facing modern farming.

- For instance, according to the U.S. Department of Agriculture, guidance auto steering systems on tractors, harvesters, and other equipment were used by 52 percent of midsize farms and 70 percent of large-scale crop-producing farms in 2023, which is upscale from adoption rates in the single digits in the early 2000s. By leveraging advanced technologies, it promotes efficient use of resources, sustainable practices, and enhanced productivity.

As the world grapples with the twin imperatives of feeding a growing population and preserving the environment, precision agriculture emerges as a more resilient and sustainable agricultural future. The technique revolves around the idea of maximizing yield with fewer resources, such as water and agrochemicals.

Geopolitical Impact Analysis

Geopolitical Tensions Between Several Countries Disrupted the Global Supply Chain, and New Tariffs Impact the Cost of Agrochemicals

Two main events that affected the agrochemical prices in recent years are the Ukraine war and the recent tariffs introduced by the U.S. federal government on imports. For instance, in 2022, Russia’s incursion into Ukraine prompted global supply chain disruptions in markets for key food crops and fertilizers, threatening food security globally. At the time of the Russian attack, fertilizer and pesticide prices were already at all-time high levels. On the supply side, increases in prices of natural gas and coal, key feedstock and energy sources in fertilizer production, as well as some reductions in production capacity, also added upward pressure on prices.

In 2020, Russia accounted for 14% of global trade in urea and 11% of trade in phosphate, while Russia and Belarus jointly accounted for 41% of global trade in potash. But after the war started, countries that were heavily dependent on fertilizer imports from Russia and Belarus feared an immediate shortfall, and many sought to secure alternative sources. Agrochemicals used in the United States have raw ingredients that are outsourced worldwide, often from China, Canada, and Mexico. Reciprocal tariffs imposed recently can drive up agrochemical input prices, disrupt supply chains, and reduce cost-effectiveness for farmers, which can lead to higher food costs for customers.

On the contrary, some agrochemical raw materials are excused from tariffs, such as certain pesticide ingredients and potash-containing fertilizers, which reduces the cost impact of tariffs for these materials. USMCA-compliant materials from Canada and Mexico continue to be tariff-free, preserving supply chain stability to some extent. Several agrochemical companies may invest in domestic production or diversify supply chains to tariff-exempt regions, such as Europe or Asia, which would require significant capital and time to achieve. The tariff situation remains fluid, changing rapidly, and the agrochemical industry, like many others, must adapt through strategic purchasing, supply chain diversification, and advocacy for trade resolutions to mitigate these impacts.

Regional Analysis

Asia-Pacific Held the Largest Share of the Global Agrochemicals Market

In 2024, Asia-Pacific dominated the global agrochemicals market, holding about 31.2%, valued at approximately USD 57.2 billion. The continuously growing population of the region accounts for the majority of the reason for the domination of the region. Additionally, countries such as China, India, and Southeast Asian countries are conventionally agriculture-first nations, predominantly experiencing high agricultural activities.

Moreover, according to the report from FAO, Asia is the region with the largest agricultural land area of around 2.08 billion ha, one-third of which is in China. The Americas follow with 1.1 billion ha, and Europe has around 0.5 billion ha of agricultural land. North America and Europe also hold a significant share of the market due to the focus of these regions on technological advancements in agrochemicals and farming tools. On the contrary, despite having abundant agricultural land African market holds a relatively smaller share of the market, mainly due to a lack of knowledge among farmers.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the highly competitive market of agrochemicals, various big giants such as BASF SE, Bayer AG, ADM, UPL, and Syngenta try to gain the upper hand in the market through product developments, investments, partnerships and collaborations, and mergers and acquisitions. For instance, Sumitomo Corporation agreed to invest in Bio Insumos Nativa, a Chilean biocontrol manufacturing company, through Summit Agro South America, an agrochemical distribution company in South America.

BASF SE has maintained its position in the agrochemical market for several years due to its broad product portfolio, including crop protection products (both chemical and biological), seed treatment, seeds and traits, and digital farming solutions. This edge has enabled BASF to serve its customers, sustaining its competitive advantage.

Bayer AG’s agricultural solutions division, also known as Bayer Crop Science, focuses on developing and providing innovative solutions for modern agriculture, including seeds, crop protection, and digital farming tools. Their robust supply chain helps them maintain their competitive edge. Similarly, Nufarm, Corteva Agriscience, Yara International, Nutrien, A+S, and Sumitomo encompass large value in the market.

Top Key Players

- BASF SE

- Bayer AG

- ChemChina (Syngenta)

- UPL Limited

- Nufarm Ltd.

- Corteva Agriscience

- Yara International ASA

- Archer Daniels Midland Company

- Nutrien Ltd.

- K+S AG

- Sumitomo Chemical Co., Ltd.

- Compass Minerals International, Inc.

- ICL Group Ltd.

- Gowan LLC (Isagro s.p.A.)

- FMC Corporation

- Other Key Players

Recent Developments

- In October 2024, BASF’s new product, Liberty Ultra-herbicide, powered by Glu-L technology, received U.S. Environmental Protection Agency (EPA) registration and was approved for use by consumers.

- In May 2024,S. Department of Agriculture (USDA) Secretary Tom Vilsack announced that USDA would invest in domestic fertilizer projects to strengthen competition for U.S. farmers, ranchers, and agricultural producers. The department awarded US$83 million in 12 states for projects through the Fertilizer Production Expansion Program (FPEP). The program provided grants to independent business owners to help them modernize equipment, adopt new technologies, build production plants, and more.

- In July 2025, Bayer signed a development and distribution agreement with French pheromones company M2i Group for the exclusive distribution of pheromone gels for the Asia-Pacific, the Latin America region, and the United States, building on its successful collaboration and related product launches in Europe and Africa.

Report Scope

Report Features Description Market Value (2024) US$ 183.3 Bn Forecast Revenue (2034) US$ 289.9 Bn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fertilizers, Pesticides, and Plant Growth Regulators), By Crop Type (Fruits & Vegetables, Cereal & Grains, Oilseeds & Pulses, Turf & Ornamentals & Others), By Form (Solid, and Liquid), By Application Methods (Foliar Spray, Soil Treatment, Seed Treatment & Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Bayer AG, ChemChina (Syngenta), UPL Limited, Nufarm Ltd., Corteva Agriscience, Yara International ASA, Archer Daniels Midland Company, Nutrien Ltd., K+S AG, Sumitomo Chemical Co., Ltd., Compass Minerals International, Inc., ICL Group Ltd., Gowan LLC (Isagro s.p.A.), FMC Corporation, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Bayer AG

- Syngenta

- UPL Limited

- Nufarm

- ADAMA Ltd

- Corteva, Inc

- Yara International ASA

- ADM

- Nutrien

- K+S AG

- Sumitomo Chemical Co., Ltd.

- Compass Minerals International, Inc

- ICL Group Ltd.

- Isagro

- FMC Corporation

- OCP Group

- Other Key Players