Global Agricultural Micronutrients Market Size, Share, And Business Benefits By Type (Zinc, Boron, Manganese, Iron, Molybdenum, Copper, Others), By Form (Solid, Liquid), By Application Mode (Soil, Foliar, Fertigation, Seed Treatment, Others), By Crop Type (Cereals, Pulses and Oilseeds, Fruits and Vegetables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 156868

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

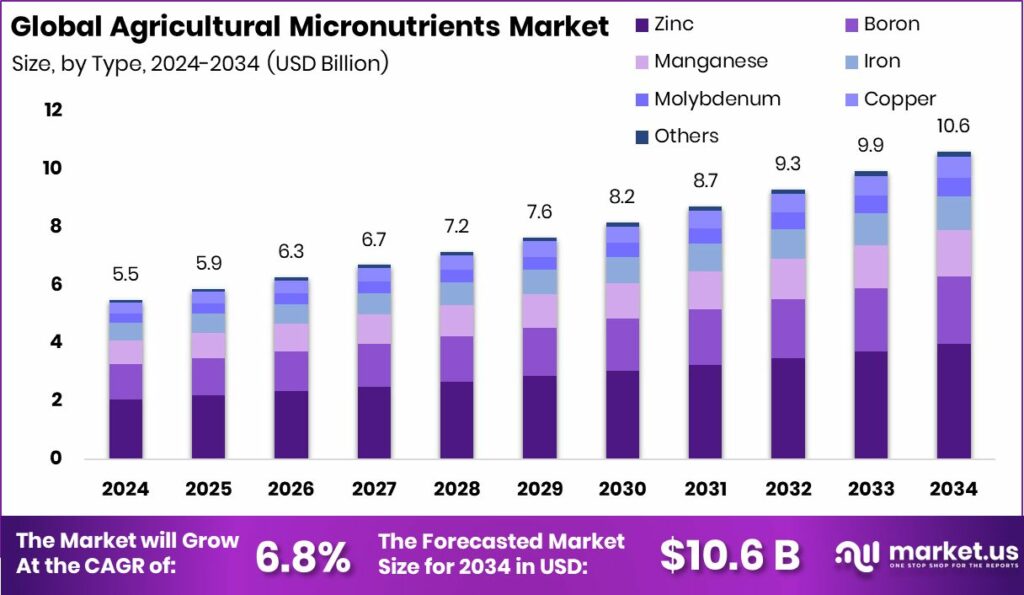

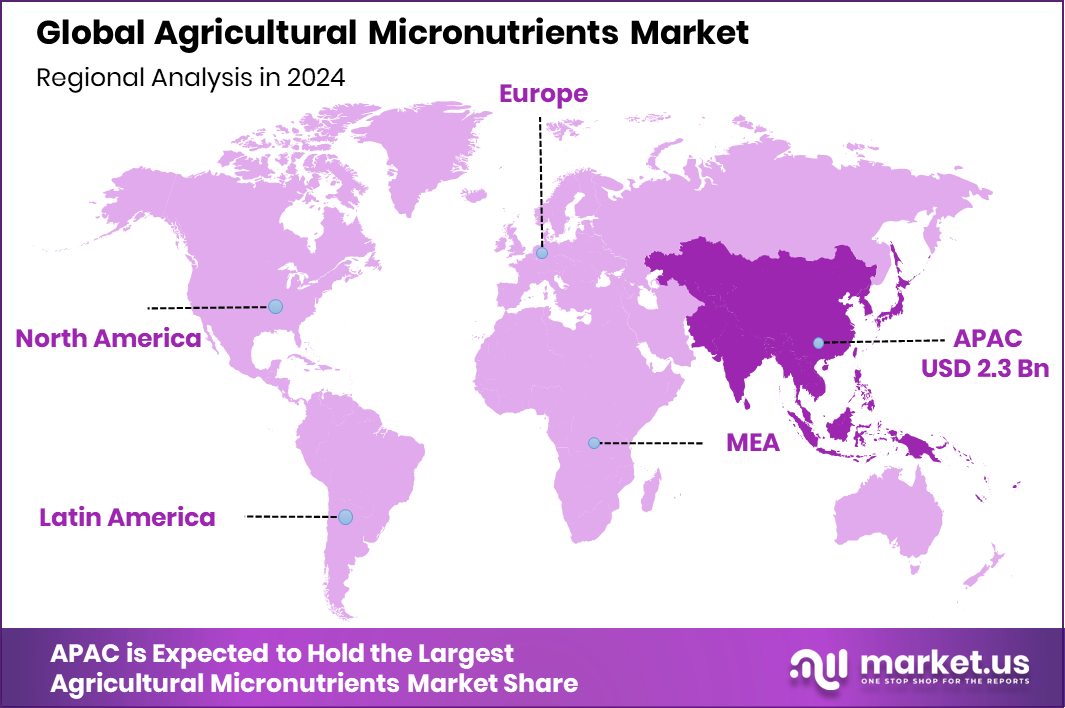

The Global Agricultural Micronutrients Market is expected to be worth around USD 10.6 billion by 2034, up from USD 5.5 billion in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034. With a 42.80% share, the Asia-Pacific Agricultural Micronutrients Market continues expanding, valued steadily at USD 2.3 Bn.

Agricultural micronutrients are essential trace elements such as zinc, iron, manganese, copper, boron, and molybdenum that plants need in very small quantities for proper growth and development. Though required in minute amounts, these nutrients play a vital role in enzyme systems, chlorophyll production, and overall plant metabolism. A deficiency in any of these micronutrients can lead to reduced crop yield, poor quality, and increased vulnerability to diseases.

The agricultural micronutrients market refers to the industry that supplies these critical elements in different forms, such as chelated and non-chelated products, for soil application, foliar sprays, or seed treatments. This market has gained importance due to the growing focus on crop productivity, soil health, and sustainable farming practices, as micronutrient deficiencies are becoming more common in intensively farmed soils worldwide. According to an industry report, Sound Agriculture secures $25 million to advance bioinspired nutrient innovations.

A key growth factor driving this market is the rising need to boost food production for a growing population. With the United Nations projecting the global population to reach 9.7 billion by 2050, ensuring higher agricultural productivity with balanced nutrient supply has become essential. Farmers are increasingly aware that macronutrients alone cannot guarantee yield, making micronutrients critical in modern agriculture. According to an industry report, Ferrero, maker of Nutella, struck $3.1 billion deal for Kellogg’s U.S. cereal unit.

Demand is further fueled by declining soil fertility due to the overuse of chemical fertilizers and intensive farming. Many soils have become deficient in zinc, iron, and boron, directly impacting crop output. The use of micronutrient-based fertilizers and foliar sprays is helping to restore soil balance, improve crop resilience, and ensure better quality harvests. According to an industry report, WK Kellogg sets aside $200 million for supply chain improvements in 2025.

Key Takeaways

- The Global Agricultural Micronutrients Market is expected to be worth around USD 10.6 billion by 2034, up from USD 5.5 billion in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034.

- In 2024, zinc dominated the Agricultural Micronutrients Market, holding a 37.4% share due to crop nutrition.

- Solid form products captured 61.9% share, highlighting farmers’ preference for easy application and longer stability.

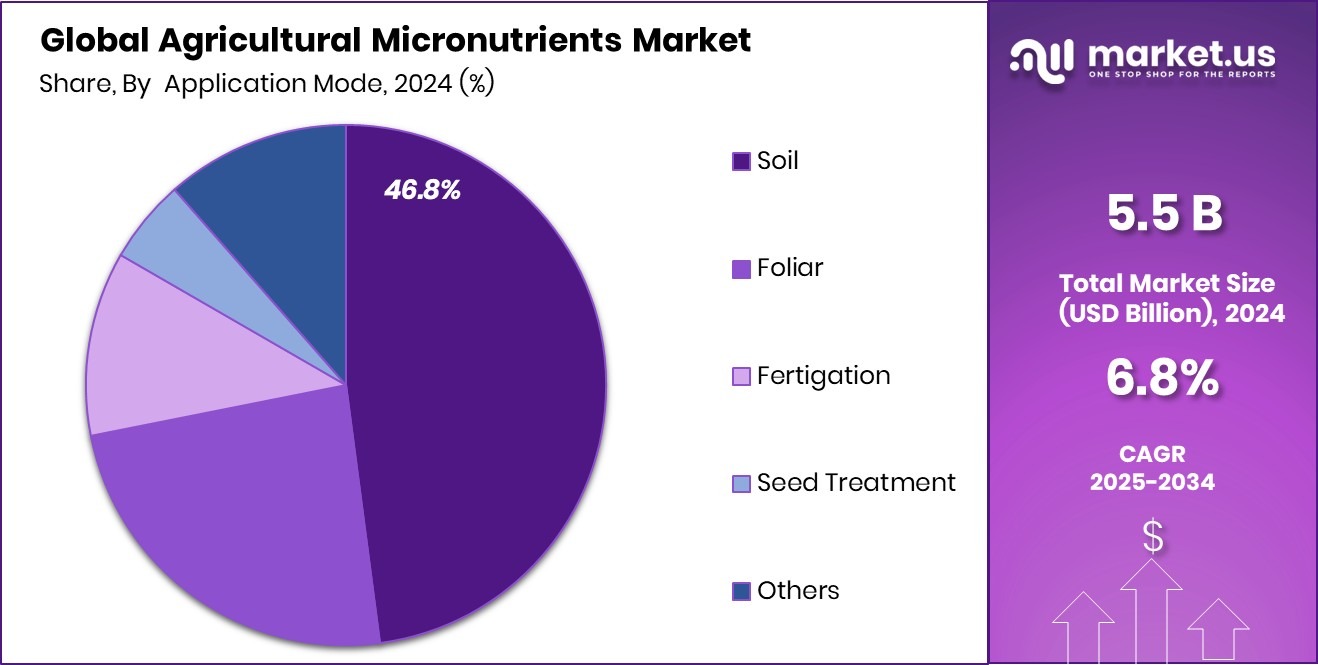

- Soil application led the market with 46.8% share, ensuring direct nutrient supply for healthy crops.

- Cereals accounted for a 41.1% share, reflecting their global demand and essential reliance on micronutrient supplementation.

- Asia-Pacific’s 42.80% strong dominance reflects growing crop demand and rising soil deficiency concerns in 2024.

By Type Analysis

In 2024, zinc accounted for 37.4% of the agricultural micronutrients market.

In 2024, Zinc held a dominant market position in the By Type segment of the Agricultural Micronutrients Market, with a 37.4% share. Zinc has become one of the most essential micronutrients for crop health, as it plays a crucial role in enzyme activation, protein synthesis, and growth regulation.

Its widespread use across major crops such as cereals, rice, wheat, and maize has strengthened its position in the market. Farmers increasingly recognize that zinc deficiency in soil directly impacts yields and reduces the nutritional value of crops, making zinc-based solutions a priority in modern farming practices.

The dominance of zinc is also linked to the rising problem of soil depletion caused by years of intensive cultivation and excessive reliance on macronutrient fertilizers. According to agricultural studies, zinc deficiency is among the most common micronutrient gaps globally, especially in regions with calcareous and alkaline soils.

Addressing this deficiency through zinc-based fertilizers has proven to enhance both crop productivity and quality, aligning with the global demand for higher food output.

By Form Analysis

Solid formulations dominated with a 61.9% share in the Agricultural Micronutrients Market.

In 2024, Solid held a dominant market position in the By Form segment of the Agricultural Micronutrients Market, with a 61.9% share. Solid formulations, which include powders, granules, and other easy-to-apply forms, have been widely adopted by farmers due to their cost-effectiveness, ease of handling, and suitability for large-scale farming.

These products are often blended with traditional fertilizers, allowing for seamless integration into existing farming practices without additional investments in specialized equipment. Their longer shelf life and stability compared to liquid alternatives further strengthen their preference among growers.

The growth of solid micronutrient use is also supported by the rising adoption of soil application methods. Farmers rely on solid formulations to directly enrich soil with essential elements like zinc, boron, and iron, ensuring steady nutrient availability throughout the crop cycle. This approach is especially valuable in regions facing widespread soil deficiencies caused by intensive agriculture and overuse of chemical inputs.

Additionally, the dominance of solid forms reflects the expanding focus on bulk crop production such as cereals and pulses, where these products are most effective in improving yields. With growing awareness about balanced nutrient management and government initiatives encouraging soil health improvement, the solid form segment continues to lead the agricultural micronutrients market.

By Application Mode Analysis

Soil application mode held a 46.8% share in the agricultural micronutrients market.

In 2024, Soil held a dominant market position in the By Application Mode segment of the Agricultural Micronutrients Market, with a 46.8% share. Soil application has emerged as the most preferred method for delivering micronutrients because it ensures direct enrichment of the root zone, where plants can readily absorb essential elements.

This method allows farmers to correct widespread nutrient deficiencies in agricultural soils, particularly for zinc, boron, and iron, which are commonly lacking in intensively farmed lands. The ability to blend micronutrients with traditional fertilizers also adds convenience, making soil application both practical and efficient for large-scale farming.

The popularity of soil application is further driven by its long-lasting impact on soil fertility. Unlike foliar methods that often provide short-term benefits, soil application creates a nutrient reservoir that supports plant growth over an extended period. This is especially critical for staple crops such as rice, wheat, and maize, where consistent nutrient availability directly influences yield and quality.

Moreover, rising government programs promoting soil health management have boosted awareness about the benefits of applying micronutrients directly to the soil. As farmers increasingly seek sustainable ways to enhance productivity, soil application continues to dominate, underlining its role in long-term agricultural sustainability.

By Crop Type Analysis

The cereals segment captured a 41.1% share in the agricultural micronutrients market globally.

In 2024, Cereals held a dominant market position in the By Crop Type segment of the Agricultural Micronutrients Market, with a 41.1% share. Cereals such as wheat, rice, maize, and barley form the foundation of global food security, and their cultivation demands balanced nutrition for both yield and quality.

The significant share of cereals in this segment highlights the rising need for micronutrients like zinc, iron, and manganese, which are essential for improving grain development, chlorophyll formation, and overall plant health. Farmers prioritize micronutrient use in cereals because even small deficiencies can lead to considerable yield losses and reduced grain quality.

The dominance of cereals is also tied to the growing demand for staple foods worldwide. With the global population expanding, ensuring sufficient cereal production has become a critical agricultural goal.

Micronutrient-enriched soils and targeted application methods have proven to enhance cereal productivity, making these inputs vital for meeting food supply needs. Additionally, governments and agricultural extension services in major cereal-producing regions are actively promoting micronutrient application to address widespread soil deficiencies.

Key Market Segments

By Type

- Zinc

- Boron

- Manganese

- Iron

- Molybdenum

- Copper

- Others

By Form

- Solid

- Liquid

By Application Mode

- Soil

- Foliar

- Fertigation

- Seed Treatment

- Others

By Crop Type

- Cereals

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Driving Factors

Rising Food Demand Boosts Need for Micronutrients

One of the top driving factors for the Agricultural Micronutrients Market is the increasing global demand for food. As the world population continues to grow, farmers are under pressure to produce more crops from the same amount of land.

Micronutrients such as zinc, boron, and iron play a critical role in plant growth by supporting enzymes, photosynthesis, and grain quality. Without them, yields can drop, and food shortages may increase.

Governments and agricultural experts are also promoting balanced fertilizer use to fight soil deficiencies, making micronutrients a necessary part of sustainable farming. This rising food demand, combined with the need for healthy soils, is pushing the agricultural micronutrients market forward at a steady pace.

Restraining Factors

High Product Cost Limits Farmers’ Wider Adoption

A major restraining factor for the Agricultural Micronutrients Market is the high cost of these products compared to traditional fertilizers. Many small and medium-scale farmers, especially in developing countries, find it difficult to afford micronutrient-enriched fertilizers or specialized formulations.

While the benefits of micronutrients are well known, the upfront investment often discourages farmers who already face tight profit margins and rising input costs. Limited awareness and lack of subsidies in some regions add to the challenge, making adoption slower.

Unless cost-effective solutions or government support programs are expanded, many farmers may continue relying only on macronutrient fertilizers, which restricts the full growth potential of the agricultural micronutrients market.

Growth Opportunity

Precision Farming Creates New Opportunities for Micronutrients

A key growth opportunity for the Agricultural Micronutrients Market lies in the expansion of precision farming practices. Precision farming uses modern tools such as sensors, GPS, and data analytics to monitor soil health and deliver the exact nutrients crops need. This approach reduces waste, improves yields, and helps farmers apply micronutrients more effectively.

With growing awareness about sustainable agriculture and resource efficiency, precision farming is gaining popularity in both developed and developing regions. By combining technology with tailored micronutrient solutions, farmers can improve crop productivity while protecting soil health.

This shift offers significant potential for the micronutrients market, opening the door for innovative products and customized solutions that support long-term agricultural growth.

Latest Trends

Growing Shift Toward Eco-Friendly Micronutrient Solutions

One of the latest trends in the Agricultural Micronutrients Market is the increasing shift toward eco-friendly and sustainable micronutrient products. Farmers and policymakers are becoming more conscious about reducing the harmful effects of chemical-intensive farming on soil, water, and the environment.

As a result, there is a rising interest in bio-based and organic micronutrient formulations that are safe, effective, and environmentally friendly. These products not only improve crop yields but also support soil health and long-term sustainability.

The move aligns with global goals for climate-friendly agriculture and healthier food systems. This trend is expected to shape future product innovation, driving the adoption of greener solutions across farms worldwide and boosting long-term market growth.

Regional Analysis

In 2024, the Asia-Pacific held a 42.80% share of the Agricultural Micronutrients Market, reaching USD 2.3 Bn.

The Agricultural Micronutrients Market shows strong regional diversity, with Asia-Pacific emerging as the dominating region in 2024, holding a 42.80% share valued at USD 2.3 billion. The dominance of Asia-Pacific is largely attributed to the region’s extensive agricultural base, growing population, and rising need for higher crop productivity to meet food demand.

Countries such as India and China, which are among the world’s largest producers of cereals, rice, and pulses, face significant soil deficiencies, particularly in zinc and boron. This has driven greater adoption of micronutrient-enriched fertilizers and soil health improvement programs supported by governments. Moreover, awareness campaigns and extension services in Asia-Pacific are helping farmers understand the benefits of balanced nutrient application, further pushing market growth.

While North America and Europe continue to focus on advanced farming practices and sustainability, Asia-Pacific’s large-scale dependency on agriculture and increasing investment in sustainable farming solutions firmly position it as the leading market.

The region’s strong dominance underlines the vital role of micronutrients in ensuring food security, crop quality, and sustainable practices. As agricultural land becomes more intensively cultivated in the Asia-Pacific region, the demand for micronutrients is expected to remain on a steady upward trajectory.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to stand out with its focus on innovation and advanced crop solutions. The company emphasizes integrated nutrient management, enabling farmers to address micronutrient deficiencies while improving yields. Its global presence and research capabilities allow it to deliver scalable solutions for diverse crop and soil conditions.

Coromandel International plays a crucial role in emerging markets, especially across the Asia-Pacific, by providing accessible micronutrient products tailored to regional soil needs. The company has built strong farmer connections and promotes balanced fertilization practices, ensuring greater adoption at the grassroots level.

Grupa Azoty, a well-established European fertilizer producer, integrates micronutrient formulations into its broader portfolio, supporting sustainable farming systems in the region. Its expertise in fertilizer chemistry and expansion into value-added products enhances its position as a trusted supplier.

Haifa Group remains a key player with its specialization in specialty fertilizers, including micronutrients that are widely used in horticulture and high-value crops. The company’s focus on precision nutrition and efficient nutrient delivery aligns with the growing trend toward sustainability and resource optimization.

Top Key Players in the Market

- BASF SE

- Coromandel International

- Grupa Azoty

- Haifa Group

- Helena AgriEnterprises, LLC

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Israel Chemicals Ltd.

- Koch Agronomic Services, LLC

- Nouryon Chemicals Holdings B.V.

- Nufarm

Recent Developments

- In March 2025, Grupa Azoty rolled out RSM BioShot, a liquid nitrate-urea fertilizer featuring 32% nitrogen and enriched with sucrose. It’s tailored for deep-soil placement, delivering nutrients straight to the root zone and promoting stronger root and plant development.

- In May 2024, Coromandel International introduced ten new crop protection solutions, including a neem-coated bio plant and soil health promoter, five generic formulations, and two innovative patented fungicides targeting diseases such as rice sheath blight and infections in potatoes, grapes, and tomatoes. The portfolio also includes a high-impact pest control product developed in collaboration with ISK Japan, named Prachand, aimed at protecting paddy crops from stem borers and leaf folders.

Report Scope

Report Features Description Market Value (2024) USD 5.5 Billion Forecast Revenue (2034) USD 10.6 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Zinc, Boron, Manganese, Iron, Molybdenum, Copper, Others), By Form (Solid, Liquid), By Application Mode (Soil, Foliar, Fertigation, Seed Treatment, Others), By Crop Type (Cereals, Pulses and Oilseeds, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Coromandel International, Grupa Azoty, Haifa Group, Helena AgriEnterprises, LLC, Indian Farmers Fertiliser Cooperative Limited (IFFCO), Israel Chemicals Ltd., Koch Agronomic Services, LLC, Nouryon Chemicals Holdings B.V., Nufarm Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural Micronutrients MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Micronutrients MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Coromandel International

- Grupa Azoty

- Haifa Group

- Helena AgriEnterprises, LLC

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Israel Chemicals Ltd.

- Koch Agronomic Services, LLC

- Nouryon Chemicals Holdings B.V.

- Nufarm