Global Aerospace Composites Market By Fibre Type (Carbon fibre, Glass fibre, Aramid fibre, Other), By Manufacturing Process (ATL or AFP, Filament Winding, Resin Transfer Molding, Hand Layup, Other), By Aircraft (Commercial Aircraft, Business and General Aviation, Civil Helicopter, Other), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122484

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

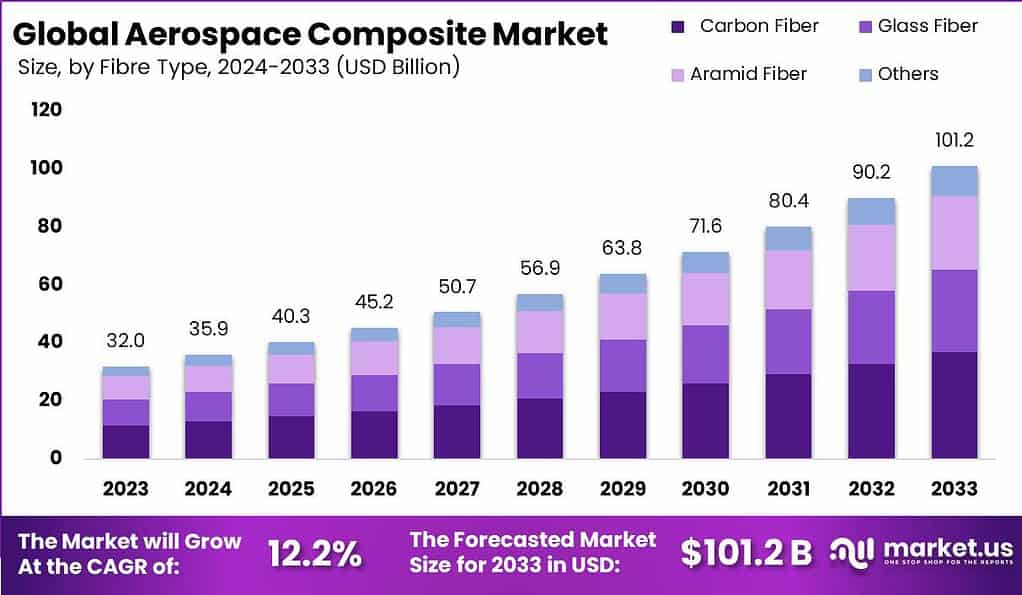

The Global Aerospace Composites Market size is expected to be worth around USD 101.2 Billion By 2033, from USD 32.0 Billion in 2023, growing at a CAGR of 12.2% during the forecast period from 2024 to 2033.

The aerospace composites market plays a vital role in the aviation industry, providing lightweight and high-strength materials for aircraft manufacturing. Aerospace composites are composite materials made from a combination of fibers, such as carbon or glass, embedded in a matrix material, typically resin. These materials possess excellent properties, including strength, durability, and resistance to corrosion, making them well-suited for aerospace applications.

One of the key growth factors driving the aerospace composites market is the increasing demand for fuel-efficient aircraft. Aerospace composites offer significant weight reduction compared to traditional metal alloys, leading to improved fuel efficiency and reduced carbon emissions. As the aviation industry seeks to enhance sustainability and reduce operating costs, the adoption of aerospace composites becomes increasingly attractive.

However, the aerospace composites market also faces certain challenges. One of the primary challenges is the high cost associated with the production and manufacturing processes. The raw materials used in aerospace composites, such as carbon fibers, are expensive, making the overall production cost higher compared to traditional materials. This cost factor poses a barrier to entry for new players in the market.

For instance, Akasa Air, a new Indian airline, began operating in August 2022, initially serving one route with 28 weekly flights and later expanding to include two more routes. In October 2022, Alaska Airlines placed an order for 52 Boeing B737 MAX aircraft, demonstrating its commitment to fleet expansion. Alaska Airlines also announced plans to transition to an all-Boeing mainline fleet by the end of 2023, aiming to streamline operations and improve efficiency.

New entrants in the aerospace composites market can find opportunities by focusing on research and development to improve material properties and reduce production costs. Investing in innovative manufacturing processes and technologies can help new players gain a competitive edge. Collaborations with established aerospace companies and participation in government-funded projects can also provide avenues for growth and market penetration.

Key Takeaways

- The global Aerospace Composites Market size is estimated to reach USD 101.1 billion in the year 2033 with a CAGR of 12.2% during the forecast period and was valued at USD 32 billion in the year 2023.

- Based on the Component, the Carbon Fibre segment has dominated the market with a share of 36.5% in the year 2023.

- Based on the Manufacturing Process, the ATL or AFP segment has dominated the market with a share of 28.5% in the year 2023.

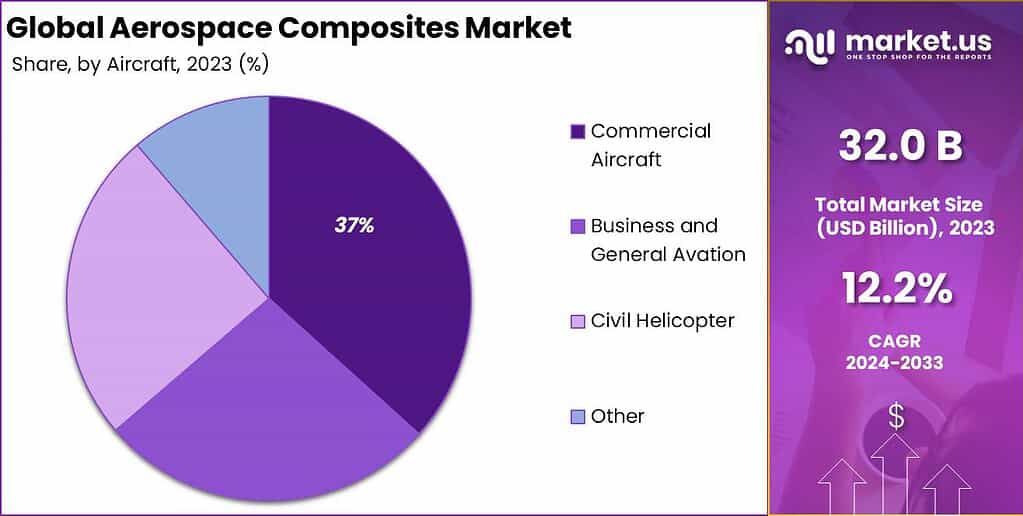

- Based on the Aircraft, the Commercial Aircraft segment has dominated the market with a share of 36.7% in the year 2023.

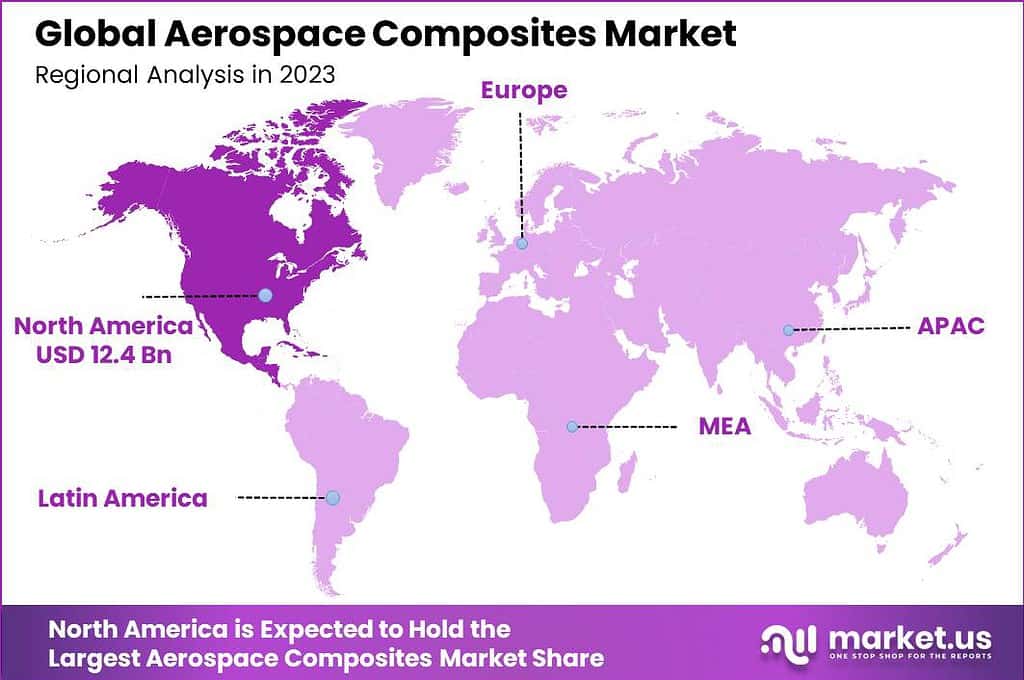

- In 2023, North America held a dominant market position in the Aerospace Composites Market, capturing more than a 39% share with revenues reaching approximately USD 12.4 billion.

Fibre Type Analysis

In 2023, the Carbon Fibre segment held a dominant market position within the Aerospace Composites Market, capturing more than a 36.5% share. This segment’s leadership is primarily attributed to the superior properties of carbon fiber, including its high strength-to-weight ratio, superior stiffness, and resistance to chemical corrosion and thermal expansion. These characteristics make it exceptionally suitable for aerospace applications where performance and durability are paramount.

The demand for carbon fiber composites has been further bolstered by the increasing production of new generation aircraft that prioritize fuel efficiency and reduced emissions. The utilization of carbon fiber in aerospace components such as fuselages, wings, and propulsion systems helps in significantly reducing the overall weight of aircraft. This reduction in weight directly contributes to enhanced fuel efficiency and lower operational costs, aligning with the ongoing industry trends towards sustainability and cost-effectiveness.

Moreover, the ongoing advancements in composite technology, including the development of hybrid composites and 3D printing with carbon fibers, continue to expand the application range of this material, further cementing its position in the market. Looking forward, the Carbon Fiber segment is expected to maintain its market dominance due to continuous innovations and investments in aerospace technologies.

Companies are actively seeking ways to optimize the manufacturing processes and reduce the costs associated with carbon fiber composites, which could potentially lead to even wider adoption in the aerospace sector. Furthermore, with the global aerospace industry’s gradual recovery post-pandemic and the anticipated increase in aircraft production rates, the demand for carbon fiber composites is likely to see a significant uptick, supporting the segment’s growth trajectory through the forecast period.

Manufacturing Process Analysis

In 2023, the ATL (Automated Tape Laying) or AFP (Automated Fiber Placement) segment held a dominant market position within the Aerospace Composites Market, capturing more than a 28.5% share. This prominence is largely due to the high degree of precision and efficiency these technologies offer in the manufacturing of composite structures, which are critical in the aerospace industry.

ATL and AFP allow for the automated placement of pre-impregnated fibers in predetermined paths, reducing material waste and ensuring consistent quality, which is essential for the high-performance standards required in aerospace applications. The adoption of ATL and AFP technologies is particularly advantageous in the production of complex components such as fuselages and wing sections, where the alignment and uniformity of fibers play a crucial role in determining the strength and performance of the final product.

These methods provide improved control over the fiber orientation and are capable of handling challenging contours, significantly enhancing the mechanical properties of the composite materials used. Furthermore, the ongoing push towards automation in manufacturing processes, driven by the need to increase production rates while reducing labor costs and minimizing human error, continues to boost the adoption of ATL and AFP in the aerospace sector.

As the industry advances towards more innovative aircraft designs with increased composite content, the ATL and AFP segment is expected to witness sustained growth, driven by technological advancements and the expanding application of composites in next-generation aircraft.

Aircraft Analysis

In 2023, the Commercial Aircraft segment held a dominant market position within the Aerospace Composites Market, capturing more than a 36.7% share. This segment’s leadership can be primarily attributed to the ongoing expansion of global airline fleets and the increasing adoption of composite materials in commercial aircraft manufacturing.

Composites are favored in this segment due to their crucial role in enhancing aircraft performance by reducing weight, which directly translates into improved fuel efficiency and lower emissions – a significant factor given the strict environmental regulations facing the aviation industry. Commercial aircraft manufacturers are increasingly integrating composites in structural and non-structural components to meet the demand for newer, more efficient aircraft.

This trend is driven by the need to replace older aircraft with new models that offer better operational economics and meet newer environmental standards. The use of advanced composite materials in wings, fuselages, and propulsion systems is particularly notable. For instance, major aircraft like the Boeing 787 and Airbus A350 consist of over 50% composite materials, underscoring the critical role of composites in contemporary aircraft design.

The future growth of the Commercial Aircraft segment is expected to be supported by rising air passenger traffic globally, which drives demand for new aircraft and subsequently for advanced composites. Furthermore, the recovery of the aviation sector post-pandemic, with renewed investments in fleet expansion and upgrades by airlines, is likely to bolster the market further.

As technology in composite materials continues to evolve, offering even greater benefits in terms of performance and cost-effectiveness, their adoption in commercial aviation is anticipated to continue growing, sustaining the segment’s leading position in the aerospace composites market.

Key Market Segments

By Fibre Type

- Carbon Fibre

- Glass Fibre

- Aramid Fibre

- Other

By Manufacturing Process

- ATL or AFP

- Filament Winding

- Resin Transfer Molding

- Hand Layup

- Other

By Aircraft type

- Commercial Aircraft

- Business and General Aviation

- Civil Helicopter

- Other

Driver

Growing Demand for Lightweight and Fuel-Efficient Aircraft

The aerospace composites market is significantly driven by the escalating demand for lightweight materials that contribute to enhanced fuel efficiency in aircraft. As airlines continue to seek ways to reduce fuel consumption and carbon emissions, the utilization of aerospace composites offers a pivotal solution due to their reduced weight compared to traditional materials.

The aerospace industry’s commitment to meeting stringent environmental regulations and reducing operational costs has spurred the adoption of composites, particularly in commercial aircraft where the benefits of weight reduction are magnified across large fleets.

Restraint

Economic Downturns Affecting Aircraft Deliveries

One of the primary restraints in the aerospace composites market is the reduction in aircraft deliveries, which can be attributed to economic slowdowns. Economic fluctuations often lead to decreased spending in the airline sector, affecting the order books of aircraft manufacturers and subsequently the demand for aerospace composites. This was evident during periods of economic distress, where the aerospace sector saw a slowdown in production, directly impacting the composites market as fewer materials were required for new aircraft.

Opportunity

Advancements in Composite Material Technology

There is a significant opportunity in the aerospace composites market through the continuous advancement and innovation in composite materials technology. Developments such as improved resin systems, fiber materials, and manufacturing techniques are enhancing the performance and reducing the costs of composites. These advancements are making composites more attractive for a wider range of aerospace applications, from commercial to military aircraft, thereby broadening the market’s growth potential.

Challenge

Recycling and Reusability of Composites

A major challenge in the aerospace composites market is the difficulty associated with recycling composite materials. Composites are designed for durability and high performance, which makes their end-of-life disposal problematic. The aerospace industry is increasingly focused on sustainability, and the inability to efficiently recycle materials such as composites poses a significant environmental and operational challenge. Addressing this issue requires technological innovations and industry-wide collaboration to develop viable recycling processes for aerospace composites.

Growth Factors

- Augmented Demand for Fuel Competence: Composite materials are lighter than outdated metals, important to momentous fuel savings and concentrated emissions, which is vital for meeting inflexible environmental regulations.

- Rising Aircraft Production: Growing air travel demand has encouraged production of commercial and military aircraft, which widely use composites for numerous components.

- Technological Improvements: Inventions in manufacturing processes, such as automated fibre placement (AFP) and automated tape laying (ATL), improve the production of intricate composite parts.

- Resilience and Performance: Composites offer higher strength-to-weight ratios and resistance to corrosion and fatigue, enhancing aircraft performance and lifespan.

Latest Trends

- Augmented Use of Carbon fibre Composites: Due to their extraordinary strength-to-weight ratio, carbon fibre composites are becoming more predominant in aircraft manufacturing.

- Developments in Manufacturing Techniques: Automated fibre placement (AFP) and automated tape laying (ATL) are in advance traction for manufacturing complex composite parts competently.

- Emphasis on Sustainability: There is an increasing emphasis on eco-friendly materials and procedures to decrease the environmental impression of aircraft production.

- Incorporation of Smart Materials: Advance of smart composites that can monitor structural health and performance in real-time.

- Development in Emerging Markets: Growing aerospace activities in Asia-Pacific and the Middle East are dynamic market growth.

Regional Analysis

In 2023, North America held a dominant market position in the Aerospace Composites Market, capturing more than a 39% share with revenues reaching approximately USD 12.4 billion. This leading position can be attributed to the region’s advanced aerospace manufacturing capabilities and the presence of major aerospace manufacturers such as Boeing and Lockheed Martin.

North America has been at the forefront of adopting new technologies, including aerospace composites, due to its robust research and development infrastructure and supportive government policies aimed at maintaining the competitiveness of its aerospace industry. The region’s focus on enhancing aircraft performance and fuel efficiency has driven the demand for lightweight and strong composite materials.

Moreover, the United States, in particular, benefits from a well-established military sector that extensively uses composites for aircraft, including fighters and helicopters, which further fuels the demand within the market. The significant investment in defense and aerospace by the U.S. government, coupled with the presence of a large number of composites manufacturers, contributes to the growth and sustainability of the aerospace composites industry in North America.

Looking ahead, North America is expected to maintain its leadership due to continuous innovations in composite materials and manufacturing processes. The increasing trend towards modernizing aircraft fleets for both commercial and military use is likely to keep driving the region’s demand for aerospace composites. This is supported by ongoing programs and investments aimed at developing next-generation aircraft that are more environmentally friendly and economically viable, solidifying North America’s position as a key player in the global aerospace composites market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The aerospace composites market features a range of key players, each contributing to the industry’s dynamics through innovative products and strategic expansions. Solvay and Hexcel Corporation are prominent for their extensive portfolios of composite materials that cater to aerospace applications, emphasizing durability and weight reduction. VX Aerospace Corporation, while smaller, stands out with bespoke composite solutions that push the boundaries of aerospace design and functionality.

TEIJIN LIMITED and Mitsubishi Electric Corporation are noted for their advances in carbon fiber and other composite materials, with TEIJIN expanding its global footprint through strategic acquisitions and partnerships aimed at harnessing local market potentials. TORAY INDUSTRIES, INC., a giant in the material science sector, continues to lead with innovations in carbon fiber composites, driving developments across commercial and military aerospace sectors.

Bally Ribbon Mills excels in the specialized production of woven materials that are critical for aerospace applications, while Spirit AeroSystems, Inc. integrates composite materials into its extensive aircraft component manufacturing operations. DuPont is renowned for its high-performance materials that enhance the safety and durability of aerospace components.

Top Key Players in the Market

- Solvay

- Hexcel Corporation

- VX Aerospace Corporation

- TEIJIN LIMITED.

- Mitsubishi Electric Corporation

- TORAY INDUSTRIES, INC.

- Bally Ribbon Mills

- Spirit AeroSystems, Inc.

- DuPont

- SGL Carbon

- Other Key Players

Recent Developments

- In January 2024, Materion Beryllium and Composites has partnered with Liquidmetal Technologies Inc., to use its alloy production technologies to provide a higher quality products and support services.

- June 2023: Solvay entered a strategic collaboration with Ascendance Flight Technologies and Airborne to develop advanced materials and aerospace technologies aimed at enhancing sustainability and efficiency in aviation. This partnership focuses on innovative composite materials and structural adhesives to reduce the environmental impact of aircraft.

- February 2023: Solvay and Spirit AeroSystems expanded their partnership, with Solvay becoming a strategic partner in Spirit’s Aerospace Innovation Centre in Prestwick, Scotland. This collaboration focuses on research into sustainable aircraft technologies.

Report Scope

Report Features Description Market Value (2023) USD 32 Bn Forecast Revenue (2033) USD 101.2 Bn CAGR (2024-2033) 12.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By fibre Type (Carbon fibre, Glass fibre, Aramid fibre, Other), By Manufacturing Process (ATL or AFP, Filament Winding, Resin Transfer Molding, Hand Layup, Other), By Aircraft (Commercial Aircraft, Business and General Aviation, Civil Helicopter, Other) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Solvay, Hexcel Corporation, VX Aerospace Corporation, TEIJIN LIMITED., Mitsubishi Electric Corporation, TORAY INDUSTRIES, INC., Bally Ribbon Mills, Spirit AeroSystems, Inc., DuPont, SGL Carbon, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are aerospace composites?Aerospace composites are materials composed of two or more constituent materials with significantly different physical or chemical properties. These materials are combined to form a final product that is lightweight, strong, and durable, making them ideal for use in aerospace applications.

How big is Aerospace Composites Market?The Global Aerospace Composites Market size is expected to be worth around USD 101.2 Billion By 2033, from USD 32.0 Billion in 2023, growing at a CAGR of 12.2% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Aerospace Composites Market?The key factors driving the growth of the aerospace composites market include the increasing demand for fuel-efficient and lightweight aircraft, advancements in composite manufacturing technologies, and the rising investments in defense and commercial aviation sectors.

What are the current trends and advancements in the Aerospace Composites Market?Current trends in the aerospace composites market include the integration of automated manufacturing processes, the development of new composite materials such as nanocomposites and bio-based composites, and the growing use of digital technologies like AI and data analytics for process optimization.

What are the major challenges and opportunities in the Aerospace Composites Market?Major challenges in the aerospace composites market include high initial investment costs, complex design and certification requirements, and fluctuations in raw material prices. However, there are significant opportunities in the development of advanced composite materials, integration of additive manufacturing techniques, and increasing demand for sustainable and recyclable composite solutions.

Who are the leading players in the Aerospace Composites Market?Leading players in the aerospace composites market include Solvay, Hexcel Corporation, VX Aerospace Corporation, TEIJIN LIMITED., Mitsubishi Electric Corporation, TORAY INDUSTRIES, INC., Bally Ribbon Mills, Spirit AeroSystems, Inc., DuPont, SGL Carbon, Other Key Players.

Aerospace Composites MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Aerospace Composites MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Solvay

- Hexcel Corporation

- VX Aerospace Corporation

- TEIJIN LIMITED.

- Mitsubishi Electric Corporation

- TORAY INDUSTRIES, INC.

- Bally Ribbon Mills

- Spirit AeroSystems, Inc.

- DuPont

- SGL Carbon

- Other Key Players