Global Adventure Sports and Activities Market Size, Share, Growth Analysis By Type of Activity (Land-based Activities [Trekking/Hiking, Rock Climbing, Mountain Biking, Caving, Zip-lining], Water-based Activities [Scuba Diving, Snorkeling, White-water Rafting, Surfing, Kayaking/Canoeing], Air-based Activities [Paragliding, Skydiving, Hot Air Ballooning, Bungee Jumping], Hang Gliding), By Age Group (Teenagers (13–19 Years), Young Adults (20–35 Years), Adults (36–50 Years), Seniors (50+ Years)), By Traveller Type (Solo Adventurers, Group Travelers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171882

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

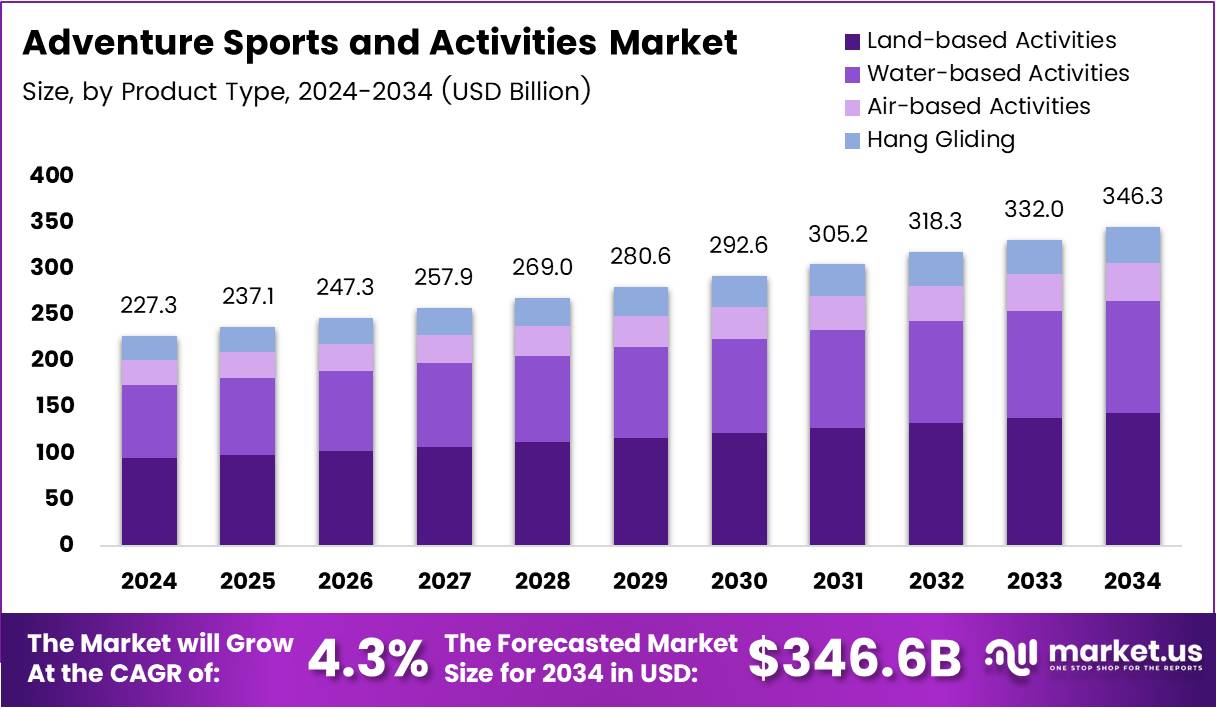

The global Adventure Sports and Activities Market is projected to reach approximately USD 346.6 Billion by 2034, up from USD 227.3 Billion in 2024. This growth reflects a compound annual growth rate of 4.3% throughout the forecast period.

Adventure sports and activities encompass outdoor recreational pursuits that involve physical exertion, exploration, and risk-taking elements. These experiences range from land-based adventures like trekking and rock climbing to water activities such as scuba diving and white-water rafting, along with air-based thrills including paragliding and skydiving.

The market continues gaining momentum as consumers increasingly seek meaningful experiences over material possessions. Millennials and Gen Z demographics drive substantial demand, prioritizing authentic adventures and unique outdoor challenges. This shift transforms traditional tourism patterns into experience-focused travel.

Infrastructure development across emerging economies creates new opportunities for adventure tourism expansion. Governments invest in outdoor recreation facilities, safety protocols, and training programs. These initiatives make adventure activities more accessible while maintaining quality standards and participant safety.

Digital transformation revolutionizes how consumers discover and book adventure experiences. Online platforms simplify reservation processes, provide detailed activity information, and enable customer reviews. Social media amplifies market growth through visual storytelling and peer recommendations.

Technological integration enhances safety measures and participant confidence. Wearable devices, GPS tracking, and smart safety equipment reduce perceived risks. These innovations attract broader demographics, including families and older adults seeking controlled adventure experiences.

Sustainability emerges as a critical market differentiator. Eco-conscious travelers demand environmentally responsible adventure options that minimize ecological impact. Operators respond by implementing green practices, supporting local communities, and promoting conservation awareness.

Corporate sector adoption presents significant growth potential. Companies incorporate adventure-based team-building programs to enhance employee engagement and wellness. Educational institutions similarly integrate outdoor activities into curricula, fostering leadership skills and physical fitness among youth.

According to New York Post, approximately 26% of U.S. travelers identify as Thrillseekers who prioritize adventure and exploration during trips. Furthermore, Solo Traveler World reports that 54% of solo travelers prefer adventure travel over urban tourism experiences. Additionally, Interglobe research indicates over 35% of travelers use social media for travel inspiration, with 50% of under-40s relying on social platforms for planning.

Key Takeaways

- Global Adventure Sports and Activities Market valued at USD 227.3 Billion in 2024, projected to reach USD 346.6 Billion by 2034.

- Market growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

- Land-based Activities segment dominates with 48.7% market share in Type of Activity analysis.

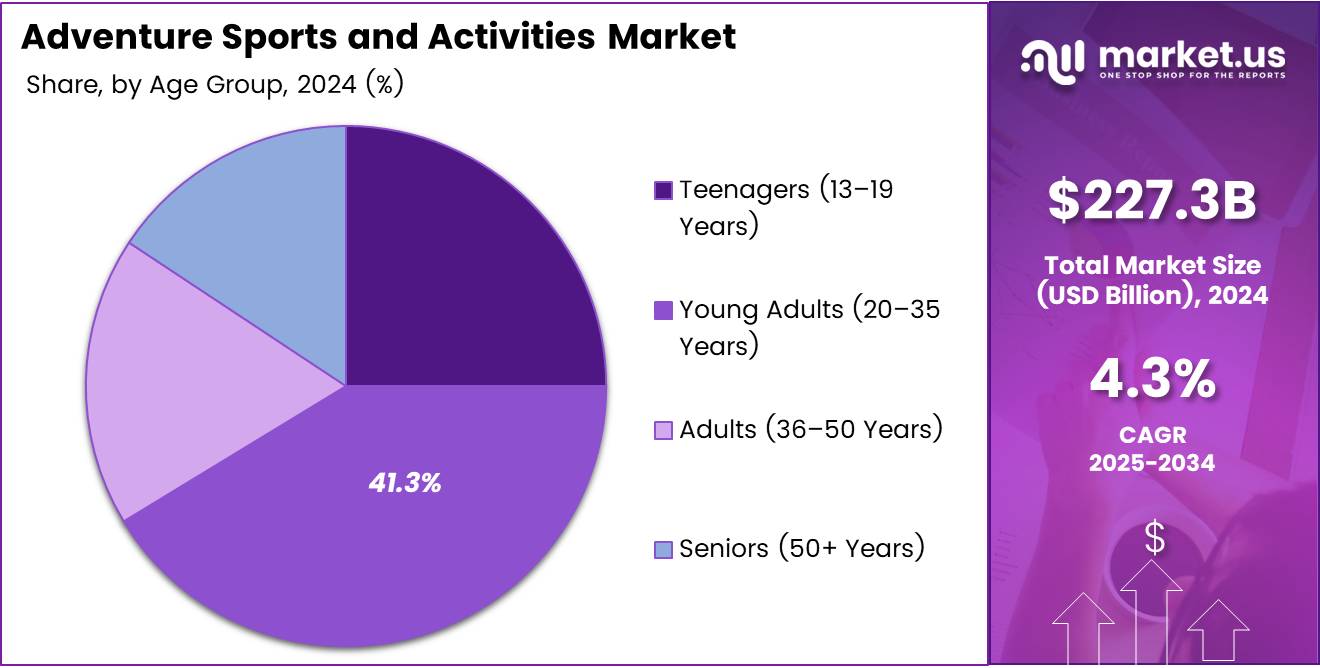

- Young Adults aged 20-35 years hold 41.3% share in Age Group segmentation.

- Group Travelers represent 69.9% of the Traveller Type segment.

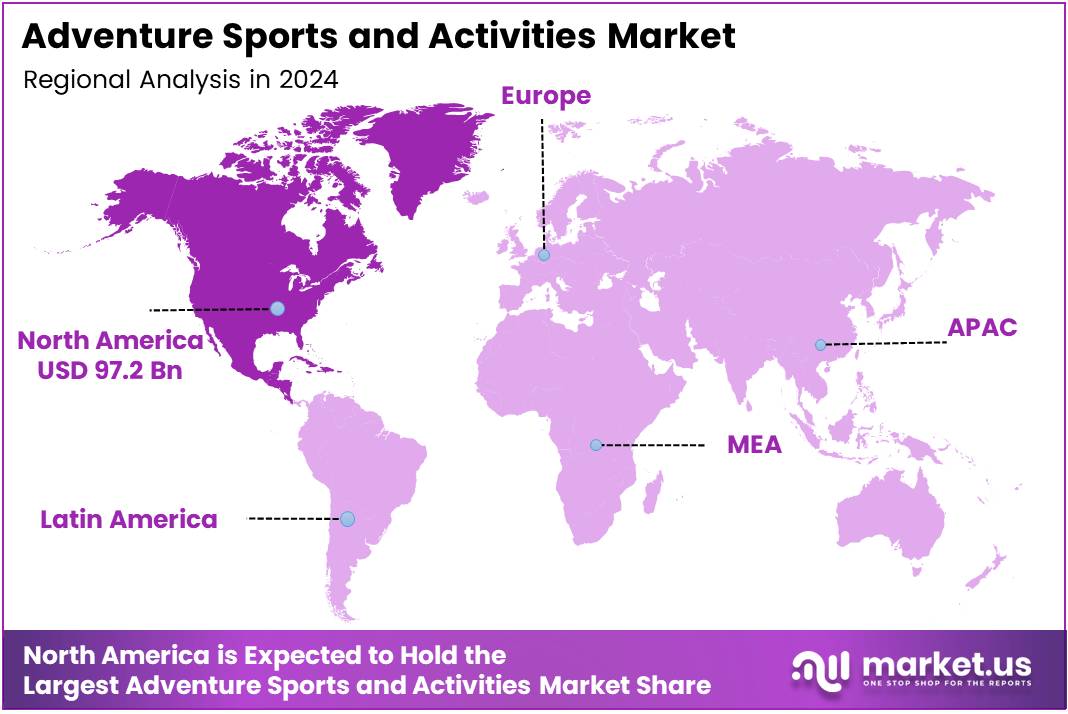

- North America leads regional market with 42.80% share, valued at USD 97.2 Billion.

Type of Activity Analysis

Land-based Activities dominate with 48.7% market share due to widespread accessibility and diverse terrain options.

In 2024, Land-based Activities held a dominant market position in the Type of Activity segment, capturing 48.7% share. Trekking and hiking lead this category through minimal equipment requirements and universal appeal across skill levels. Mountain trails, forest paths, and coastal routes provide varied experiences for enthusiasts worldwide.

Rock climbing attracts adventure seekers through physical challenge and technical skill development. Indoor climbing facilities complement outdoor experiences, enabling year-round participation. Mountain biking combines cardiovascular fitness with terrain navigation, appealing to speed enthusiasts and nature lovers alike.

Caving exploration offers unique underground adventures through natural cave systems and geological formations. Zip-lining provides adrenaline rushes with relatively lower skill barriers, making it popular among families and first-time adventurers seeking memorable thrills.

Water-based Activities represent the second major category, encompassing diverse aquatic adventures. Scuba diving enables underwater exploration of marine ecosystems, coral reefs, and shipwrecks. Snorkeling provides accessible ocean experiences without extensive training requirements, attracting casual participants and vacation travelers.

White-water rafting delivers team-based excitement through river navigation and rapid challenges. Surfing combines athletic prowess with wave reading skills, establishing dedicated communities in coastal regions. Kayaking and canoeing offer peaceful waterway exploration alongside fitness benefits.

Air-based Activities deliver extreme experiences through aerial perspectives and gravity-defying thrills. Paragliding provides soaring freedom with controlled flight over scenic landscapes. Skydiving attracts thrill-seekers through freefall experiences and tandem jump options for beginners.

Hot air ballooning offers gentle aerial views suitable for broader age ranges and comfort preferences. Bungee jumping provides intense adrenaline bursts through controlled free-fall experiences. Hang gliding combines technical skill with extended flight duration over mountainous terrain.

Age Group Analysis

Young Adults aged 20-35 years dominate with 41.3% share driven by disposable income growth and adventure-seeking lifestyles.

In 2024, Young Adults aged 20-35 years held a dominant market position in the Age Group segment, representing 41.3% share. This demographic demonstrates strong preference for physically demanding activities and risk-taking experiences. Their tech-savvy nature facilitates online booking adoption and social media engagement.

Teenagers aged 13-19 years represent emerging market participants seeking identity formation through outdoor challenges. School programs, youth camps, and family vacations introduce adventure activities early. This age group shows increasing independence in activity selection while requiring parental approval and supervision.

Adults aged 36-50 years pursue adventure activities for fitness maintenance and stress relief from professional responsibilities. They prefer guided experiences with established safety protocols and quality equipment. This segment demonstrates higher spending capacity for premium adventure packages and destination travel.

Seniors aged 50 years and above increasingly participate through age-appropriate adventure options and wellness-focused outdoor activities. Lighter physical demands, scenic experiences, and cultural immersion appeal to this growing demographic. Improved health awareness and active aging trends expand market potential within senior segments.

Traveller Type Analysis

Group Travelers dominate with 69.9% share reflecting preference for shared experiences and enhanced safety perceptions.

In 2024, Group Travelers held a dominant market position in the Traveller Type segment, capturing 69.9% share. Organized tour groups provide structured itineraries, professional guidance, and peer companionship throughout adventure journeys. Cost-sharing benefits and logistical convenience attract budget-conscious participants seeking hassle-free experiences.

Solo Adventurers represent a rapidly growing segment driven by independence, flexibility, and personal challenge motivations. This category appeals to self-discovery seekers and experienced outdoor enthusiasts comfortable with self-guided exploration. Digital platforms facilitate solo travel planning through community forums and safety resources.

Key Market Segments

By Type of Activity

- Land-based Activities

- Trekking/Hiking

- Rock Climbing

- Mountain Biking

- Caving

- Zip-lining

- Water-based Activities

- Scuba Diving

- Snorkeling

- White-water Rafting

- Surfing

- Kayaking/Canoeing

- Air-based Activities

- Paragliding

- Skydiving

- Hot Air Ballooning

- Bungee Jumping

- Hang Gliding

By Age Group

- Teenagers (13–19 Years)

- Young Adults (20–35 Years)

- Adults (36–50 Years)

- Seniors (50+ Years)

By Traveller Type

- Solo Adventurers

- Group Travelers

Drivers

Rising Global Demand for Experiential Travel Drives Adventure Sports Market Expansion

Consumer preferences shift dramatically toward experience-based spending rather than material acquisitions. Modern travelers prioritize authentic adventures that create lasting memories and personal growth opportunities. This fundamental behavioral change fuels continuous market expansion across all adventure categories.

Millennials and Gen Z demographics demonstrate particularly strong affinity for adventure experiences over conventional tourism. Their spending power increases steadily as career progression enhances disposable income levels. Social media amplifies experiential value through shareable content and peer validation mechanisms.

Infrastructure development in emerging economies expands adventure tourism accessibility across previously underserved regions. Governments recognize economic benefits from outdoor recreation investments, implementing supportive policies and funding programs. Mountain destinations, coastal areas, and rural communities benefit from improved facilities and safety standards.

Outdoor fitness trends integrate seamlessly with adventure sports participation, attracting health-conscious consumers. Extreme sports lifestyles gain mainstream acceptance through media coverage and athlete influencers. This cultural shift normalizes risk-taking activities and encourages broader demographic participation in adventure pursuits.

Restraints

Safety Concerns and Risk Perception Limit Market Penetration Across Demographics

Inherent physical risks associated with adventure activities create psychological barriers for potential participants. Accidents and injuries receive substantial media attention, amplifying public safety concerns. Insurance complexities and liability issues challenge operators while deterring risk-averse consumers from participation.

Parents particularly hesitate before enrolling children in adventure programs despite educational benefits. Older adults similarly express caution regarding physical capabilities and injury recovery times. These perceptions limit market expansion despite statistical safety improvements and enhanced equipment technology.

Weather dependency severely impacts operational consistency and revenue predictability for adventure tourism operators. Seasonal fluctuations create cash flow challenges and staffing complexities. Mountain activities face winter closures while water sports encounter monsoon interruptions and unpredictable conditions.

Climate variability intensifies operational planning difficulties as extreme weather events increase in frequency. Operators struggle balancing customer expectations with safety protocols during marginal conditions. These limitations constrain market growth potential and profitability across adventure sports sectors.

Growth Factors

Digital Platform Integration Creates New Market Opportunities and Customer Engagement Channels

Online booking systems revolutionize customer acquisition through simplified reservation processes and transparent pricing structures. Digital platforms enable operators to reach global audiences while reducing traditional marketing costs. Personalized adventure packages leverage data analytics to match activities with individual preferences and skill levels.

Untapped destinations in rural, coastal, and mountainous regions offer significant expansion potential for adventure tourism development. Local communities increasingly recognize economic benefits from sustainable outdoor recreation. Infrastructure investments transform remote locations into accessible adventure destinations while preserving natural environments.

Corporate sector adoption of adventure-based team-building programs generates substantial B2B revenue streams. Companies recognize benefits of outdoor challenges for employee engagement, leadership development, and wellness initiatives. This segment demonstrates higher profit margins and consistent demand throughout business cycles.

Educational institutions integrate adventure sports into physical education and personal development curricula. Youth programs emphasize character building, risk management, and outdoor skills through structured adventure activities. Government support for active lifestyles among young populations strengthens long-term market foundations.

Emerging Trends

Sustainable Adventure Tourism and Technology Integration Shape Market Evolution

Eco-adventure experiences surge in popularity as environmental consciousness influences consumer choices. Operators implement sustainable practices including waste reduction, renewable energy, and conservation partnerships. Carbon-neutral adventure packages attract premium pricing from environmentally responsible travelers seeking guilt-free outdoor experiences.

Wearable technology and smart safety equipment transform risk management in adventure sports participation. GPS tracking, emergency communication devices, and biometric monitoring enhance participant safety and operator oversight. These innovations reduce accident rates while providing real-time data for activity optimization.

Solo and small-group adventure experiences gain market share as travelers seek intimate, personalized outdoor encounters. Customized itineraries replace standardized tour packages, enabling flexible scheduling and activity selection. This trend reflects broader consumer preference for authenticity over mass tourism experiences.

Social media influence drives adventure sports adoption through visual storytelling and peer recommendations. Content creators showcase destinations and activities to millions of engaged followers. User-generated content provides authentic perspectives that traditional marketing cannot replicate, significantly impacting destination selection and activity bookings.

Regional Analysis

North America Dominates the Adventure Sports and Activities Market with 42.80% Share, Valued at USD 97.2 Billion

North America leads the global market with 42.80% share, valued at USD 97.2 Billion, driven by established outdoor recreation culture and extensive infrastructure. The region benefits from diverse terrain including mountains, coastlines, forests, and rivers supporting year-round adventure activities. High disposable incomes and strong consumer preference for experiential travel sustain market growth across United States and Canada.

Europe Adventure Sports and Activities Market Trends

Europe demonstrates strong market presence through alpine destinations, Mediterranean water sports, and historic trekking routes. The region attracts international adventure tourists alongside domestic participants seeking weekend getaways. Regulatory frameworks ensure high safety standards while seasonal tourism patterns drive Mediterranean coastal activities and winter mountain sports.

Asia Pacific Adventure Sports and Activities Market Trends

Asia Pacific represents the fastest-growing regional market fueled by rising middle-class incomes and adventure tourism infrastructure investments. Countries develop mountainous regions, coastal areas, and rural destinations for outdoor recreation. Young demographic profiles and increasing domestic travel create substantial growth opportunities across diverse activity categories.

Middle East and Africa Adventure Sports and Activities Market Trends

Middle East and Africa showcase unique adventure offerings through desert expeditions, wildlife safaris, and emerging coastal water sports. Infrastructure development attracts international operators and adventure tourists seeking novel experiences. Government tourism initiatives promote outdoor activities as economic diversification strategies beyond traditional sectors.

Latin America Adventure Sports and Activities Market Trends

Latin America capitalizes on natural attractions including Amazon rainforests, Andean peaks, and extensive coastlines. The region offers cost-competitive adventure packages attracting budget-conscious international travelers. Eco-tourism growth aligns with adventure activities, creating integrated experiences that appeal to environmentally conscious visitors.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Adventure Sports and Activities Company Insights

The global adventure sports and activities market features established operators delivering diverse outdoor experiences across multiple continents. These companies leverage brand reputation, safety records, and destination expertise to capture market share.

REI Adventures operates as a leading provider of guided adventure travel experiences, offering trips across all seven continents. Their cooperative business model and commitment to outdoor stewardship resonate with environmentally conscious consumers. The company maintains strong customer loyalty through quality programming and expert guide networks.

Austin Adventures specializes in active family vacations and multi-generational travel experiences throughout North America and international destinations. Their focus on small-group experiences and customized itineraries appeals to premium market segments. The company differentiates through attention to detail and personalized service delivery.

G Adventures pioneers small-group adventure travel with emphasis on authentic cultural experiences and sustainable tourism practices. Their diverse product portfolio spans budget to premium categories across 100+ countries. The company’s social enterprise initiatives and community tourism projects strengthen brand positioning among socially conscious travelers.

Intrepid Travel leads sustainable adventure tourism through carbon-neutral operations and responsible travel practices. Their small-group tours emphasize local interactions, cultural immersion, and environmental conservation. The company’s certified B Corporation status appeals to ethical consumers seeking purpose-driven adventure experiences.

Key Companies

- REI Adventures

- Austin Adventures

- G Adventures

- Intrepid Travel

- Abercrombie & Kent USA, LLC

- MT Sobek

- TUI Group

- Butterfield & Robinson Inc.

- Explore Worldwide Ltd

- World Expeditions

Recent Developments

- October 2025 – Belgravia Outdoor Education successfully acquired Outdoor Education Group Assets, expanding operational capacity and program offerings. This strategic acquisition strengthens market position in educational adventure programming and broadens geographic reach across key markets.

- May 2024 – River Riders and Wilderness Voyageurs announced their merger, combining two prominent adventure companies renowned for outdoor excursions. The merger creates enhanced service capabilities and expanded destination portfolios for customers seeking white-water rafting and guided wilderness experiences.

Report Scope

Report Features Description Market Value (2024) USD 227.3 Billion Forecast Revenue (2034) USD 346.6 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Activity (Land-based Activities [Trekking/Hiking, Rock Climbing, Mountain Biking, Caving, Zip-lining], Water-based Activities [Scuba Diving, Snorkeling, White-water Rafting, Surfing, Kayaking/Canoeing], Air-based Activities [Paragliding, Skydiving, Hot Air Ballooning, Bungee Jumping], Hang Gliding), By Age Group (Teenagers (13–19 Years), Young Adults (20–35 Years), Adults (36–50 Years), Seniors (50+ Years)), By Traveller Type (Solo Adventurers, Group Travelers) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape REI Adventures, Austin Adventures, G Adventures, Intrepid Travel, Abercrombie & Kent USA, LLC, MT Sobek, TUI Group, Butterfield & Robinson Inc., Explore Worldwide Ltd, World Expeditions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Adventure Sports and Activities MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Adventure Sports and Activities MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- REI Adventures

- Austin Adventures

- G Adventures

- Intrepid Travel

- Abercrombie & Kent USA, LLC

- MT Sobek

- TUI Group

- Butterfield & Robinson Inc.

- Explore Worldwide Ltd

- World Expeditions