Acute Hospital Care Market By Facility Type (Psychiatric Hospitals, Rehabilitation Hospitals, Specialized Hospitals, General Acute Care Hospitals, and Long-term Acute Care), By Medical Condition (Short-term Stabilization, Acute Care Surgery, Trauma Care, Emergency Care, and Others), By Service (Intensive Care Unit (ICU), Neonatal Intensive Care Unit (NICU), Coronary Care Unit (CCU), and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2025

- Report ID: 130230

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

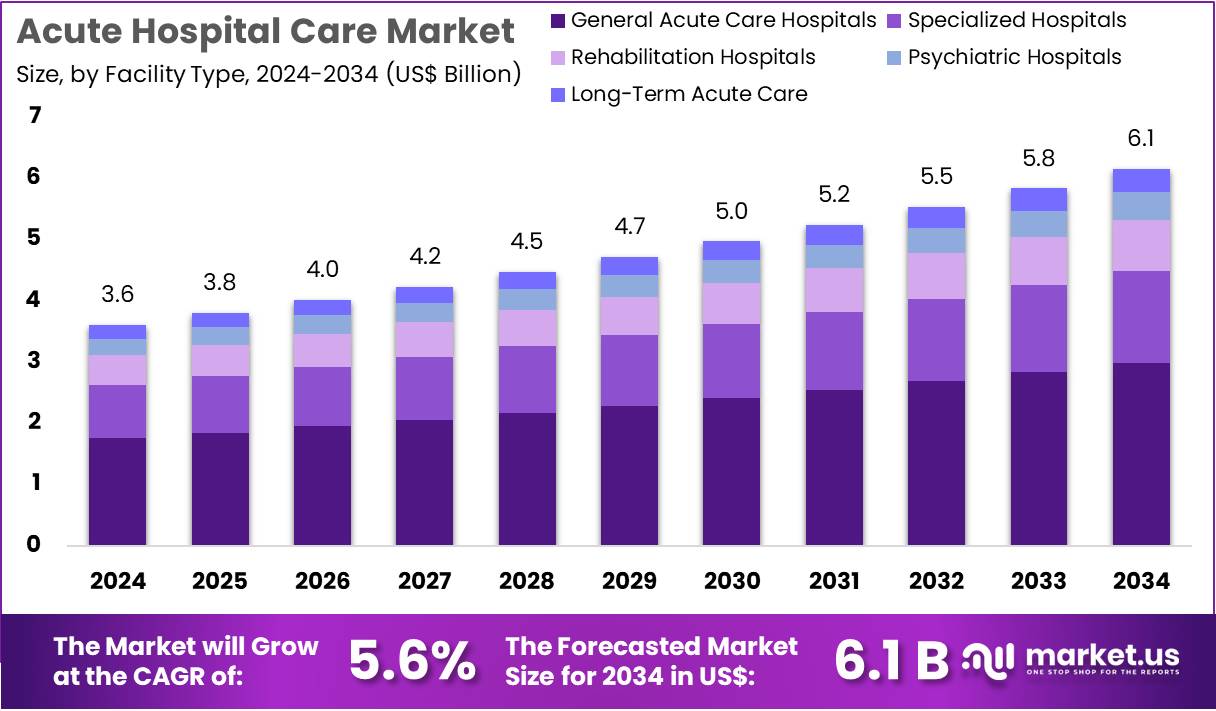

The Acute Hospital Care Market Size is expected to be worth around USD 6.1 billion by 2034 from USD 3.6 billion in 2024, growing at a CAGR of 5.6% during the forecast period 2025 to 2034.

Growing demand for acute hospital care services stems from the increasing prevalence of chronic diseases, such as heart disease, diabetes, and respiratory conditions, which often necessitate immediate and intensive medical attention. Healthcare providers focus on enhancing patient outcomes through advanced treatment protocols, innovative technologies, and improved care coordination.

Recent trends indicate a shift towards value-based care models, emphasizing quality over volume, which encourages hospitals to enhance their operational efficiencies and patient satisfaction. Additionally, the rise of telemedicine and remote monitoring tools facilitates quicker access to care, allowing patients to receive timely interventions.

In December 2021, Tenet Healthcare announced its acquisition of a controlling stake in Aspen Healthcare, a healthcare management firm that operates a network of hospitals and clinics in the United Kingdom. This strategic move expands Tenet’s international presence and creates new growth opportunities within the acute care sector.

The integration of advanced technologies, such as electronic health records (EHRs) and artificial intelligence (AI), continues to revolutionize care delivery, streamlining processes and reducing medical errors. Furthermore, as hospitals increasingly adopt patient-centric approaches, they enhance overall healthcare experiences, positioning themselves favorably in a competitive market.

Key Takeaways

- In 2024, the market for Acute Hospital Care generated a revenue of USD 3.6 billion, with a CAGR of 5.6%, and is expected to reach USD 6.1 billion by the year 2033.

- The facility type segment is divided into psychiatric hospitals, rehabilitation hospitals, specialized hospitals, general acute care hospitals, and long-term acute care, with general acute care hospitals taking the lead in 2024with a market share of 48.6%.

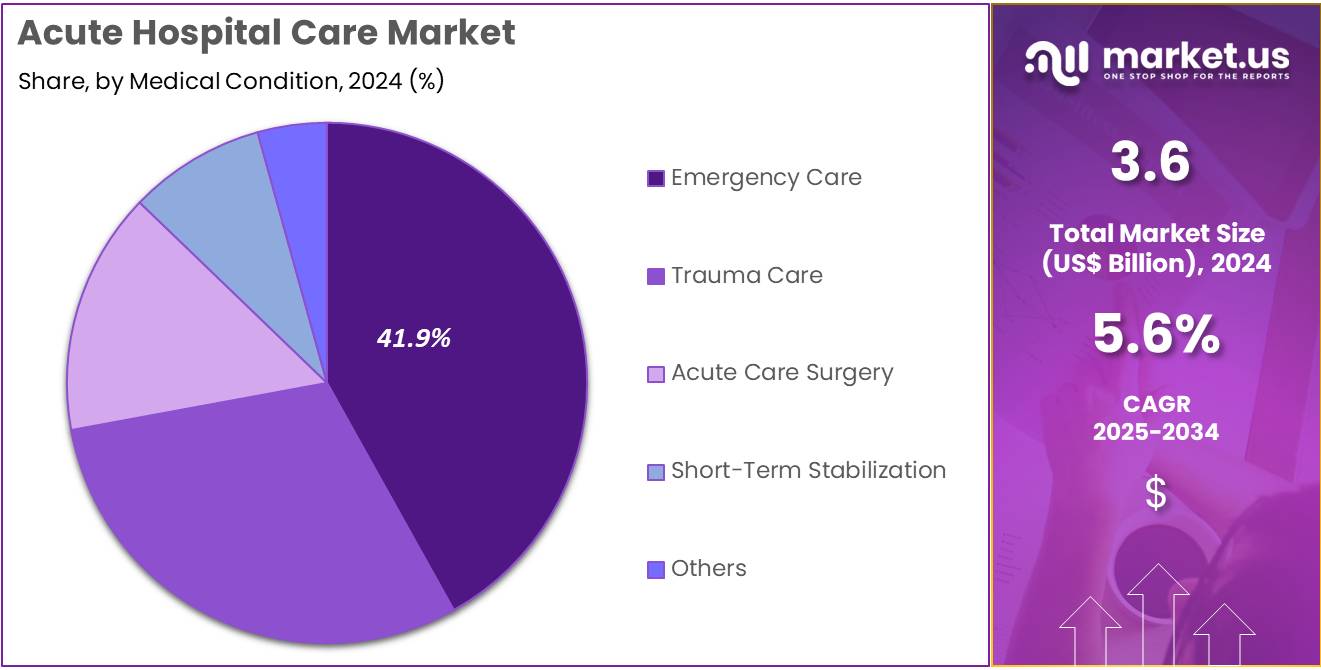

- Considering medical condition, the market is divided into short-term stabilization, acute care surgery, trauma care, emergency care, and others. Among these, emergency care held a significant share of 41.9%.

- Furthermore, concerning the service segment, the market is segregated into intensive care unit (ICU), neonatal intensive care unit (NICU), coronary care unit (CCU), and others. The intensive care unit (ICU) sector stands out as the dominant player, holding the largest revenue share of 55.2% in the Acute Hospital Care market.

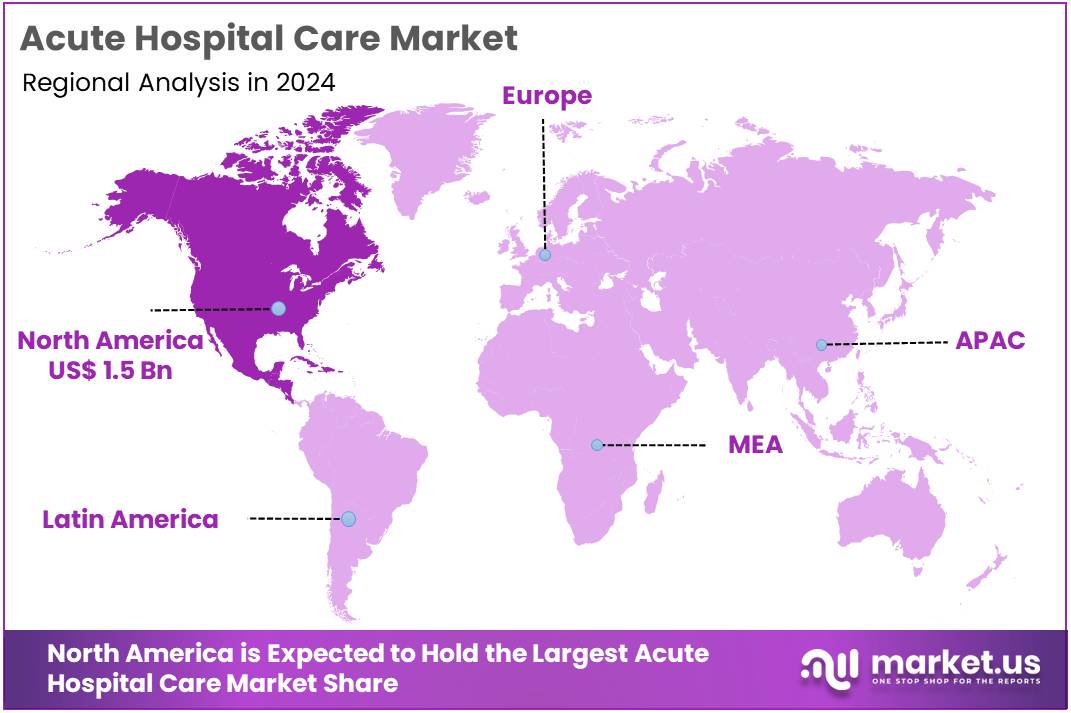

- North America led the market by securing a market share of 41.3% in 2023.

Facility Type Analysis

The general acute care hospitals segment led in 2024, claiming a market share of 48.6% owing to the increasing demand for comprehensive healthcare services. This segment plays a critical role in delivering a wide range of medical treatments, particularly for patients with serious illnesses or injuries requiring immediate attention.

The rising incidence of chronic diseases, coupled with an aging population, is anticipated to elevate the need for acute care services across various demographics. Additionally, the ongoing development of healthcare infrastructure and investments in advanced medical technologies are likely to enhance the capabilities of general acute care facilities, making them more efficient in patient management.

The emphasis on integrated care models and improved patient outcomes is projected to drive further expansion, as general acute care hospitals adapt to meet the evolving healthcare landscape. As hospitals increasingly focus on providing holistic care that encompasses both physical and mental health, the general acute care segment is likely to solidify its position as a cornerstone of the healthcare system.

Medical Condition Analysis

The emergency care held a significant share of 41.9% due to the rising need for immediate medical intervention for various medical conditions. Factors such as increased awareness of trauma and emergency management are likely to boost demand for emergency services, particularly in urban areas with high population densities.

The escalation in road traffic accidents, natural disasters, and sudden medical emergencies further contributes to the growing reliance on emergency care facilities. Advances in emergency medical services (EMS) and improved triage systems are expected to enhance the efficiency of emergency care, attracting more patients seeking timely treatment.

Additionally, the ongoing efforts to streamline emergency response protocols and enhance collaboration among healthcare providers are anticipated to facilitate better patient outcomes. As healthcare systems prioritize rapid access to care, the emergency care segment is likely to expand, reflecting broader trends in health service delivery.

Service Analysis

The intensive care unit (ICU) segment had a tremendous growth rate, with a revenue share of 55.2% owing to the increasing complexity of patient care needs and the rising prevalence of severe health conditions.

The growing number of patients requiring critical care, particularly those with respiratory diseases, cardiovascular issues, and post-surgical complications, is anticipated to elevate the demand for ICU services. Advances in medical technology, such as telemedicine and remote monitoring systems, are likely to enhance patient management in intensive care settings, improving outcomes and operational efficiency.

Furthermore, the emphasis on specialized care in units like neonatal intensive care (NICU) and coronary care units (CCU) is projected to drive further growth, as healthcare providers focus on tailoring services to specific patient populations. The increasing recognition of the importance of critical care in managing high-acuity patients is expected to solidify the ICU segment’s significance in the acute hospital care market, ensuring that hospitals are equipped to meet the evolving healthcare challenges.

Key Market Segments

By Facility Type

- Psychiatric Hospitals

- Rehabilitation Hospitals

- Specialized Hospitals

- General Acute Care Hospitals

- Long-term Acute Care

By Medical Condition

- Short-term Stabilization

- Acute Care Surgery

- Trauma Care

- Emergency Care

- Others

By Service

- Intensive Care Unit (ICU)

- Neonatal Intensive Care Unit (NICU)

- Coronary Care Unit (CCU)

- Others

Drivers

Growing Prevalence of Cardiac Problems Drives Market Growth

Increasing prevalence of cardiac problems significantly drives the acute hospital care market. As cardiovascular diseases remain a leading cause of morbidity and mortality, healthcare systems are compelled to enhance their capacity for specialized care. According to the American Health Association’s 2021 annual survey, the United States has approximately 15,160 cardiac intensive care beds dedicated to treating patients with serious heart conditions.

These specialized wards are staffed by trained medical personnel who provide targeted cardiology services. The growing number of patients requiring acute interventions for cardiac issues necessitates the expansion of healthcare facilities and resources. As the demand for comprehensive cardiac care continues to rise, healthcare providers are expected to invest more in acute care solutions, leading to a robust growth trajectory for the market.

Restraints

Financial Pressures Restrain Market Expansion

High financial pressures on healthcare systems restrain the growth of the acute hospital care market. Many facilities face increasing operational costs, which include staffing, equipment, and maintenance expenses, straining budgets and limiting the ability to invest in advanced technologies. The escalating costs associated with providing high-quality care often lead to tough decisions regarding resource allocation and service availability.

Additionally, as public and private insurance reimbursements face pressure, hospitals may struggle to cover the expenses associated with acute care services, leading to reduced access for patients. This financial burden is expected to impede the market’s expansion, particularly in regions where healthcare resources are already limited, thereby affecting the delivery of essential acute services.

Opportunities

Surge in Trauma Cases Presents Opportunities

Rising number of trauma cases creates significant opportunities for the acute hospital care market. Trauma remains the leading cause of death among individuals under 45 years of age, leading to increased demand for emergency services. According to data from the National Institutes of Health published in 2023, trauma not only impacts mortality rates but also has substantial economic repercussions due to the loss of socio-economically active individuals.

Each traumatic event leads to numerous Emergency Department (ED) visits, hospital admissions, intensive care unit (ICU) admissions, and can result in lifelong disabilities. As the incidence of trauma-related injuries continues to escalate, healthcare systems are likely to enhance their acute care capabilities to address this urgent need, driving growth in the market for trauma care services and resources.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the market for short-term medical treatment services. Economic downturns often lead to reduced healthcare budgets, resulting in constrained resources for hospitals, which may adversely affect service delivery. Rising inflation can increase operational costs, including salaries, equipment, and pharmaceuticals, further challenging financial sustainability.

Geopolitical tensions may disrupt supply chains, delaying the procurement of essential medical supplies and technology. However, governments’ increasing focus on improving healthcare infrastructure and services fosters positive growth opportunities. The rising prevalence of chronic diseases also drives demand for acute interventions, pushing hospitals to enhance their service offerings.

Overall, despite the challenges posed by economic and geopolitical dynamics, the commitment to improving patient outcomes and expanding access to healthcare presents a promising outlook for the industry.

Latest Trends

Rise of Partnerships and Collaborations

Growing partnerships and collaborations are anticipated to drive significant growth in the market for short-term medical treatment services. Organizations increasingly seek strategic alliances to enhance service delivery and improve patient care.

These collaborations enable hospitals to leverage shared expertise and resources, ultimately resulting in more comprehensive care models. For instance, in January 2024, US Acute Care Solutions expanded its partnership with Inova Health System to encompass comprehensive emergency medicine services at Inova Fairfax Medical Campus. This expansion emphasizes the importance of integrated care in enhancing patient outcomes and operational efficiency.

As more healthcare entities form strategic alliances, the market is likely to experience improved service offerings and innovative approaches to acute care delivery, benefiting patients and healthcare providers alike.

Regional Analysis

North America is leading the Acute Hospital Care Market

North America dominated the market with the highest revenue share of 41.3% owing to several key factors that underscore the evolving landscape of healthcare services. The increasing prevalence of chronic diseases, such as diabetes and heart conditions, has led to a greater demand for hospitalization and acute medical care.

Furthermore, the ongoing effects of the COVID-19 pandemic have heightened awareness of the importance of robust hospital services, pushing healthcare systems to enhance their capacities. Major hospital operators, such as HCA Healthcare, have expanded their service offerings to address diverse patient needs; for instance, in January 2022, HCA announced its acquisition of Agape Care Group, the largest hospice provider in the United States.

This strategic move allowed HCA to broaden its service spectrum to include end-of-life care, thereby addressing the growing demand for comprehensive healthcare solutions. Additionally, advancements in medical technologies and treatments have improved patient outcomes, further fueling the market’s expansion. Overall, these dynamics have created a thriving environment for acute hospital care in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to In the Asia Pacific region, the acute hospital care market is expected to experience substantial growth during the forecast period. The rising incidence of chronic illnesses and an increasing elderly population are anticipated to drive demand for hospital services.

Governments across the region are likely to invest significantly in healthcare infrastructure, enhancing the availability of advanced medical facilities and technologies. Moreover, the growing middle-class population is projected to increase access to healthcare services, resulting in higher hospital utilization rates. In addition, the prevalence of communicable diseases and the need for urgent medical interventions contribute to the rising demand for acute care services.

The ongoing development of telehealth and remote monitoring solutions is expected to further improve access to hospital care, particularly in rural areas. As healthcare systems continue to evolve and adapt to these challenges, the acute care market in Asia Pacific is likely to flourish, driven by both increasing demand and improved service delivery.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Acute Hospital Care market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the acute care market implement growth strategies centered around enhancing service delivery and patient outcomes.

They invest in advanced technologies, such as telemedicine and electronic health records, to streamline operations and improve patient management. Forming partnerships with healthcare systems and community organizations enables them to expand their reach and provide integrated care solutions.

Companies focus on workforce development by offering training and support programs to improve staff competencies and retention. Additionally, they emphasize expanding into emerging markets, tailoring their services to meet the specific healthcare needs of diverse populations.

Top Key Players in the Acute Hospital Care Market

- Universal Health Services, Inc.

- Tenet Healthcare Corporation

- Tenet Healthcare Corporation

- Lewis Gale Medical Center

- Emerus

- Community Health System

- Ascension Health

- Ardent Health Services

- Adeptus Health Inc.

Recent Developments

- In October 2022: Lewis Gale Medical Center commenced operations in Roanoke Valley, U.S., after 12 years of development. This facility is dedicated to treating medically fragile pre-term and full-term infants. The establishment of specialized centers for vulnerable populations is expected to enhance care delivery in acute settings, thereby contributing to the growth of the acute hospital care market by increasing the capacity to manage complex pediatric cases.

- In October 2022: The Grange Unit was inaugurated at Grange University Hospital to facilitate same-day emergency care visits, addressing treatment pressures within the Accident and Emergency (A&E) department. This initiative arose from the finding that nearly 32.8 percent of patients were experiencing wait times exceeding four hours in emergency departments. By streamlining emergency care processes and reducing wait times, this move is anticipated to improve patient flow and outcomes, thus supporting the expansion of the acute hospital care market through enhanced service efficiency and patient satisfaction.

Report Scope

Report Features Description Market Value (2024) USD 3.6 billion Forecast Revenue (2034) USD 6.1 billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Facility Type (Psychiatric Hospitals, Rehabilitation Hospitals, Specialized Hospitals, General Acute Care Hospitals, and Long-term Acute Care), By Medical Condition (Short-term Stabilization, Acute Care Surgery, Trauma Care, Emergency Care, and Others), By Service (Intensive Care Unit (ICU), Neonatal Intensive Care Unit (NICU), Coronary Care Unit (CCU), and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Universal Health Services, Inc., Tenet Healthcare Corporation, Tenet Healthcare Corporation, Lewis Gale Medical Center, Emerus, Community Health System, Ascension Health, Ardent Health Services, and Adeptus Health Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Acute Hospital Care MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Acute Hospital Care MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Universal Health Services, Inc.

- Tenet Healthcare Corporation

- Tenet Healthcare Corporation

- Lewis Gale Medical Center

- Emerus

- Community Health System

- Ascension Health

- Ardent Health Services

- Adeptus Health Inc.