Active Wound Care Market By Product Type (Biomaterials and Skin Substitutes), By End-User (Hospitals, Specialty Clinics, Home Healthcare, and Other End-Users), By Indication (Diabetic Foot Ulcers, Pressure Ulcers Venous Leg Ulcers, and Trauma), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 95265

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

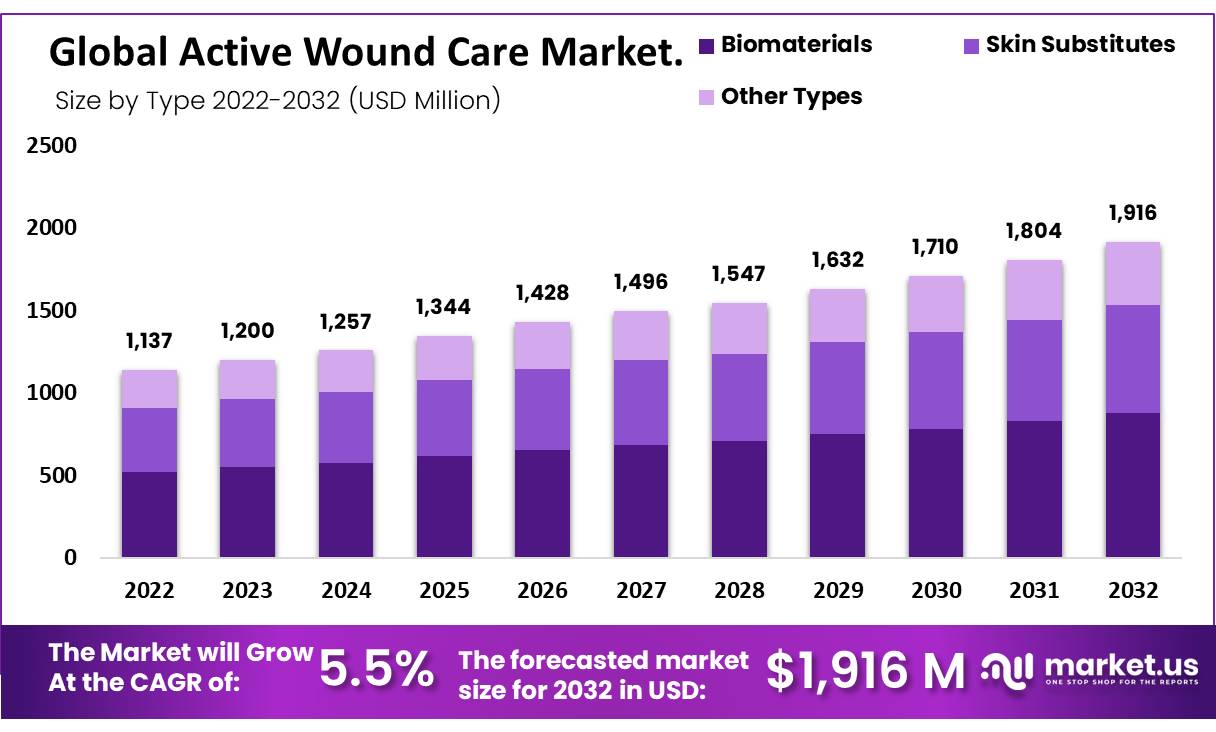

The Global Active Wound Care Market Size is expected to be worth around US$ 1916 Million by 2033, from US$ 1137 Million in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

Advancement in technology is the primary factor that will propel the active wound care market. The rising numbers of chronic wounds are being seen in people of old age and those with diabetes conditions (foot ulcer, venous ulcer, pressure ulcer), and inadequate wound healing procedures are expected to boost this market in upcoming years.

The increasing geriatric population is one of the factors behind the increase in chronic wounds. According to NCBI, chronic wounds impact 5.5-6 Mn people in the US.

In the UK, according to a report of 2019 by the Independent Diabetes Trust of the UK, 278,300 people suffered from a venous ulcer, and 115,200 from diabetic foot ulcer, which usually takes 200 days to cure. As a result, the demand for active wound care products for chronic and acute wounds is predicted to increase.

According to the data published by Mary Ann Liebert, Inc. in the US, a proposed 0.5-0.6 Mn people have venous leg ulcers. Venous leg ulcer can be challenging to the elderly population and requires an extended hospital stay. Thus the elderly population is projected to increase demand for advanced wound care products.

Key Takeaways

- Market Growth: The market is set to grow at a 5.5% CAGR, reaching USD 1,916 million by 2032 from USD 1,137 million in 2022.

- Chronic Wounds: Diabetic foot ulcers, pressure ulcers, and venous leg ulcers drive the market due to their high prevalence.

- Product Types: Biomaterials hold the largest share at 45.8%, while skin substitutes are set to grow at a CAGR of 5.39%.

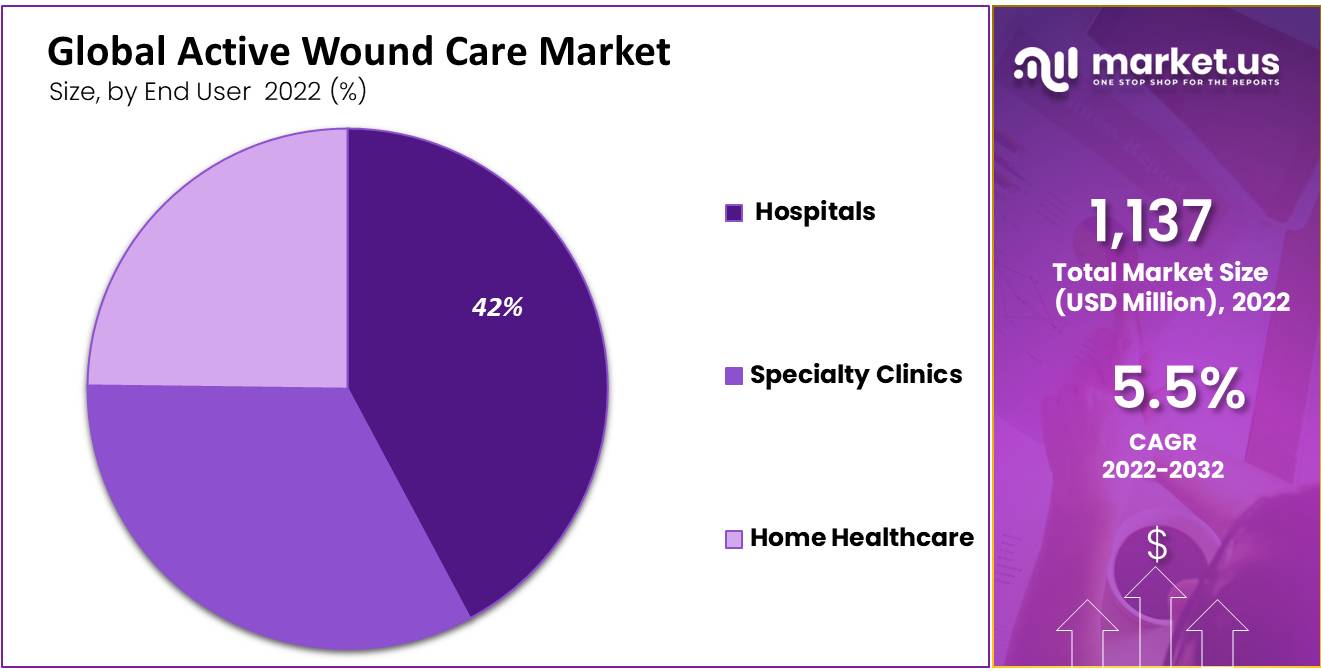

- End-User Analysis: Hospitals account for 42.3% of the market, and home healthcare is expected to grow by 6.9% by 2032.

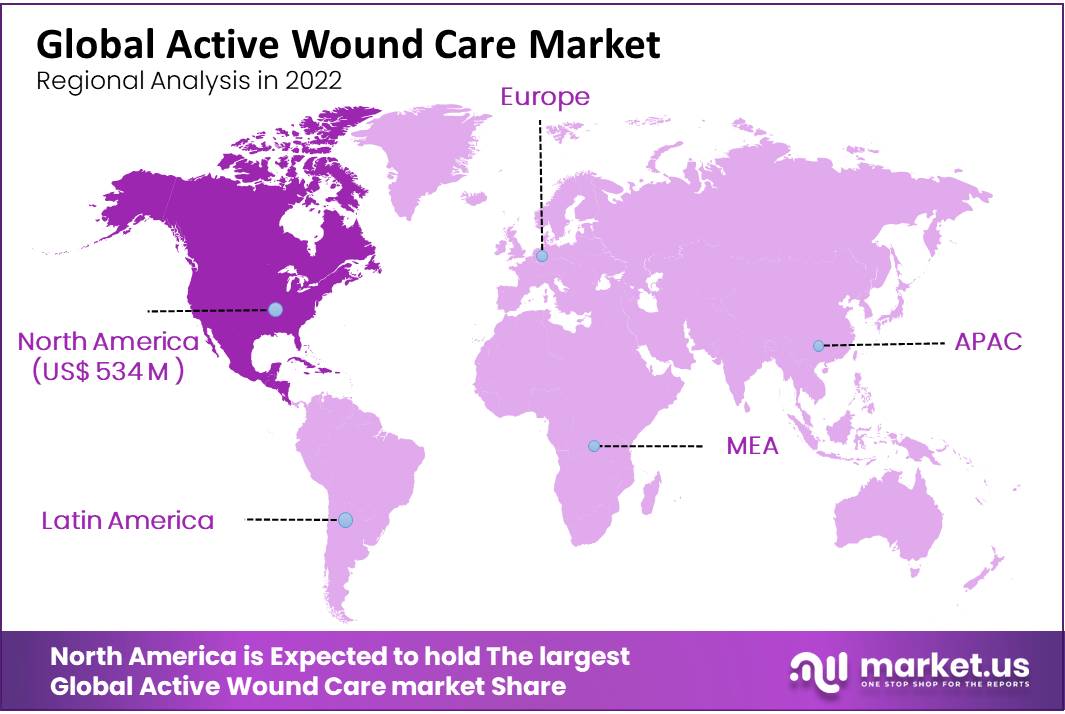

- Geographic Dominance: North America dominates with a 47% market share, while Asia Pacific is projected to grow at a 5.9% CAGR.

- Opportunities: Emerging economies in Latin America and Asia Pacific offer significant growth opportunities for market expansion.

- Trends: Continuous technological advancements and product innovations are essential for staying competitive in the market.

Product Type Analysis

The biomaterials segment accounted for the largest share of global sales in 2022 at 45.8%. The growth of this segment is attributed to rapid technological progress in the use of biomaterials for wound healing treatments. These wound care products contain both synthetic and natural substances that support both wound healing and tissue regeneration.

In addition, increasing R&D activities and continued market launches by key players further contribute to the growth of the segment. For example, in November 2020, UCLA researchers collaborated with Duke University to develop a wound-healing biomaterial that reduces scarring and allows skin tissue regeneration, resulting in healthier, stronger skin.

The skin substitute products segment is expected to register the fastest CAGR of 5.39%. A skin substitute is an artificial tissue that temporarily or permanently replaces the form and function of the skin.

An advanced dermal substitute prevents infection, limits fluid loss, improves cytokine and growth factor production, reduces subsequent scarring and inflammatory response, and serves to cover healing wounds. Furthermore, tissue-engineered skin substitutes are beneficial to deal with the shortage of donor skin grafts.

Technological advances in the development of skin substitutes such as synthetic collagen bilaminates and tissue culture-derived are the major factors predicted to contribute to the growth of the segment.

End-User Analysis

Based on the end-user analysis, it includes hospitals, specialty clinics, home healthcare, and other end-users. Chronic wounds caused by trauma and diabetic conditions are preferred to treatment at hospitals by most people. Maxicocel is used to treat chronic wounds.

In contrast, some acute injuries are chosen to treat at home or by other methods. Extreme burn cases are mandatory to be treated at hospitals. These incidence leading to chronic wounds drives the dominance of hospital segments in the active wound care market. The hospitals’ segment individually upholds a Revenue of 42.3% in 2022, which was 41.3% in 2021, the largest among all.

Home healthcare is expected to grow at a CAGR of 6.9% by 2032. The factors like increasing hospital costs and the onset of COVID-19 led to the promotion of home healthcare.

One of the factors responsible for its dominance is burn cases, while diabetic conditions stay at the top. Skin substitutes and growth factors regulatory approvals are increasing due to these factors. Over the forecast period, such segments are anticipated to boost the active wound care market growth.

Indication Analysis

Based on indications analysis, it includes diabetic foot ulcers, pressure ulcers, and venous leg ulcers. The increasing prevalence of diabetes among individuals may cause foot ulcers, pressure ulcers, venous leg ulcers, and other chronic wounds, which may be expected to propel this segment’s growth.

For example, according to ScienceDirect, diabetic foot ulcers affect more than 25% of the diabetic population and can lead to foot amputation in 20% of patients. A diabetic foot ulcer is described as an open sore wound that generally occurs in 15 to 20% of patients with diabetes, and most commonly, it occurs at the bottom of the foot.

Diabetic foot ulcer comes in the category of chronic wounds, which needs a long hospital stay. Therefore the diabetic foot ulcer segment dominated the market. In addition, according to data published by Mary Ann Liebert, Inc., an estimated 500,000 to 650,000 people in the United States suffer from venous leg ulcers, resulting in a healthcare burden of approximately US$ 1500 Mn. Therefore, the increasing number of chronically ill patients should increase the demand for active wound care products. In addition, the rising geriatric population is also a key factor boosting the market growth of this segment.

Moreover, the trauma segment is the key upsurging factor for the sale of active wound care products as it requires instant hospitalization; therefore, the rising commercial activities, rising population, and the majority of incidents are likely to boost the market growth of this segment.

Key Market Segments

Based on Product Type

- Biomaterials

- Skin Substitutes

Based on End-User

- Hospitals

- Specialty Clinics

- Home Healthcare

- Other End-Users

Based on Indication

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Trauma

Drivers

Increased Surgical Access and Affordability

Increased affordability and access to surgical care, technological advancements, the prevalence of chronic diseases, and rising incidence of associated surgical wounds and infections.

Over the forecast period, due to globally increased affordability and access to surgical care, it is anticipated that there will be an uptick in the number of surgeries conducted due to rising cases of chronic wounds.

Increased incidence of associated surgical wounds and infections is led by the prevalence of chronic diseases and bacterial growth. Ultimately this will give rise to advanced wound care products and debridement procedures, along with advanced techniques like NPWT.

Excessive bleeding wound infection or tissue damage associated with surgical procedures are treated with honey wound dressings loaded with antimicrobial agents, which came up as a viable option for dealing with bacterial growth and enhancing the wound.

According to National Center for Biotechnology Information, 9.2 to 26.3 Mn people are healing. These overall benefits of different products used during and after surgical procedures will register their demand over the forecast period affected by diabetic foot ulcers.

Technological advancements for developing skin substitutes, such as tissue culture-derived and collagen bilaminates, are predicted to support segment growth.

The segment growth is mainly driven by the increasing geriatric population coupled with the upsurging prevalence of diabetes. The National Health Institute assesses that the worldwide pervasiveness of diabetes-related heel sores is 6.6%.

Restraints

Higher Cost Of Wound Care Products

Over the forecast period, Higher cost of wound care products, especially in cost-sensitive markets like Asia, RoW may decline their adoption and negatively impact the market. Physicians and patients in these regions opt for less expensive wound care products.

However, awareness about the benefits of advanced wound care products is expected to increase in the coming years. Chronic wounds have a financial burden associated with considerable morbidity and mortality rates.

Opportunity

Rising Population Of Asia Pacific And More Adaptive Regulatory Policies

Compared to North America and Europe, Latin America, and Asia Pacific have huge growth potential and are relatively untapped Markets for advanced wound management. Considering this, various players are looking to enter these regions to increase their presence in the active wound care market.

Emerging economies such as India, South Korea, Malaysia, and Middle Eastern countries like Israel, UAE, and Saudi Arabia offer significant growth opportunities to market players.

These can be attributed to their business-friendly and more adaptive regulatory policies compared to other developed countries. Asia Pacific’s growing population is one factor, and a large patient pool provides more growth opportunities and supports the increased healthcare sector and infrastructure expenditure.

Trends

Advancement In Existing Technologies And Launch Of New Products

Enlarging current technologies’ capabilities and launching new novels is critical in dealing with market trends. Modifications in simple wound care to advancement in their properties such as absorption, hydration, and antimicrobial activities have brought the unique introduction of the product and led to the different beneficial outcomes of APIs to expect its wide domination in the active wound care market.

In 2020, North America was the largest regional active wound care market for advanced wound care products. On the other hand, in 2020 Hospitals, ASCs accounted for the largest share of the market by the end user.

Regional Analysis

North America to hold Maximum Wound Care Market Share

In 2022 the market share of 47% was upheld by North America, which dominated the active wound care market. Further, it is expected to have a stable growth rate over a forecast period.

According to the Agency for Healthcare Research and quality, the Pressure Ulcer count per year in the United States is more than 2.4 Million. Adequate reimbursement policies in North America are the factors responsible for its dominance in the active wound care market.

Second in the list of active wound care market stands Asia Pacific, where major players operate. Over the forecast period, The Asia Pacific market in wound care is estimated to expand by a CAGR of 5.9%. That can be accredited to changing lifestyles leading to an increase in chronic wounds and the presence of a large population.

These factors increase regulatory approvals of wound care products, including skin substituents and growth factors. In 2017 in India roughly 80% of all non-traumatic amputations in India were of diabetic foot ulcers.

Additionally, the increasing number of surgical procedures is due to increased tourism in this region. Thus, According to the regional analysis, North America is the dominating region of the active wound care market. Other major regions are the Middle East & Africa, as well as South Africa.

Key Regions

- North America

- The US

- Canada

- Mexico

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Several small and large manufacturers highly shred the wound care market. It is assumed that the competitive rivalry will escalate due to the increasing presence of many players in the market. Moreover, leading players involve collaborations, approvals, acquisitions, and product launches to broaden their product portfolios over the forecast period. This forms the competitive landscape between prominent players for active wound care products.

Market Key Players

- Smith & Nephew

- MiMedx

- Tissue Regenix

- Organogenesis Inc.

- Acell Inc.

- Integra Lifesciences

- Solsys Medical

- Osiris Therapeutics Inc.

- Cytori Therapeutics Inc.

- Human BioSciences

- Wright Medical Group N.V.

- ConvaTec Group PLC.

- Derma sciences Inc.

- Baxter International Inc.

- Axio Biosolutions

- Coloplast Corp.

- MTF Biologics

- Cardinal Health Inc.

- Coloplast Group, B

- 3M Group

- Paul Hartmann AG

- Braun Melsungen AG

- Molnylcke Healthcare AB.

- Other Key Players

Recent Developments

- In August 2024: ReNu® Program Development Update, Organogenesis announced progress in its ReNu® development program, which is a cryopreserved amniotic suspension allograft aimed at managing symptoms associated with knee osteoarthritis. The company completed enrollment for its second Phase 3 clinical trial, which included 594 patients, significantly surpassing enrollment expectations. This trial is a crucial step toward a Biologics License Application (BLA) submission expected by the end of 2025. The company’s progress reflects a robust response to its clinical trial phases, aiming to address a substantial unmet medical need for non-surgical knee osteoarthritis treatments.

- In November 2023: Smith & Nephew finalized the acquisition of CartiHeal, a developer of the Agili-C cartilage regeneration technology for knee repairs. The initial payment for this acquisition was $180 million, with potential additional payments of up to $150 million contingent on future financial performance. Agili-C is an innovative, off-the-shelf treatment designed for a broad range of patients, including those with mild to moderate osteoarthritis.

Report Scope

Report Features Description Market Value (2022) US$ 1,137 Million Forecast Revenue (2032) US$ 1,916 Million CAGR (2023-2032) 5.5% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments. Segments Covered By Product Type -Biomaterials and Skin Substitutes; By End-User – Hospitals, Specialty Clinics, Home Healthcare, and Other End-Users; By Indication – Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, and Trauma Regional Analysis North America – The US, Canada, & Mexico; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Smith & Nephew, MiMedx, Tissue Regenix, Organogenesis Inc., Acell Inc., Integra Lifesciences, Solsys Medical, Osiris Therapeutics Inc., Cytori Therapeutics Inc., Human BioSciences, Wright Medical Group N.V., ConvaTec Group PLC., Derma sciences Inc., Baxter International Inc., Axio Biosolutions, Coloplast Corp., MTF Biologics, Cardinal Health Inc., Coloplast Group, B., 3M Group, Paul Hartmann AG, Braun, Melsungen AG, Molnylcke Healthcare AB., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Smith & Nephew

- MiMedx

- Tissue Regenix

- Organogenesis Inc.

- Acell Inc.

- Integra Lifesciences

- Solsys Medical

- Osiris Therapeutics Inc.

- Cytori Therapeutics Inc.

- Human BioSciences

- Wright Medical Group N.V.

- ConvaTec Group PLC.

- Derma sciences Inc.

- Baxter International Inc.

- Axio Biosolutions

- Coloplast Corp.

- MTF Biologics

- Cardinal Health Inc.

- Coloplast Group, B

- 3M Group

- Paul Hartmann AG

- Braun Melsungen AG

- Molnylcke Healthcare AB.

- Other Key Players