Global Acromegaly Treatment Market By Product-(Somatostatin analogs, GHRA, Others) By End-Use-(Hospitals, Specialty Clinics, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 42625

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

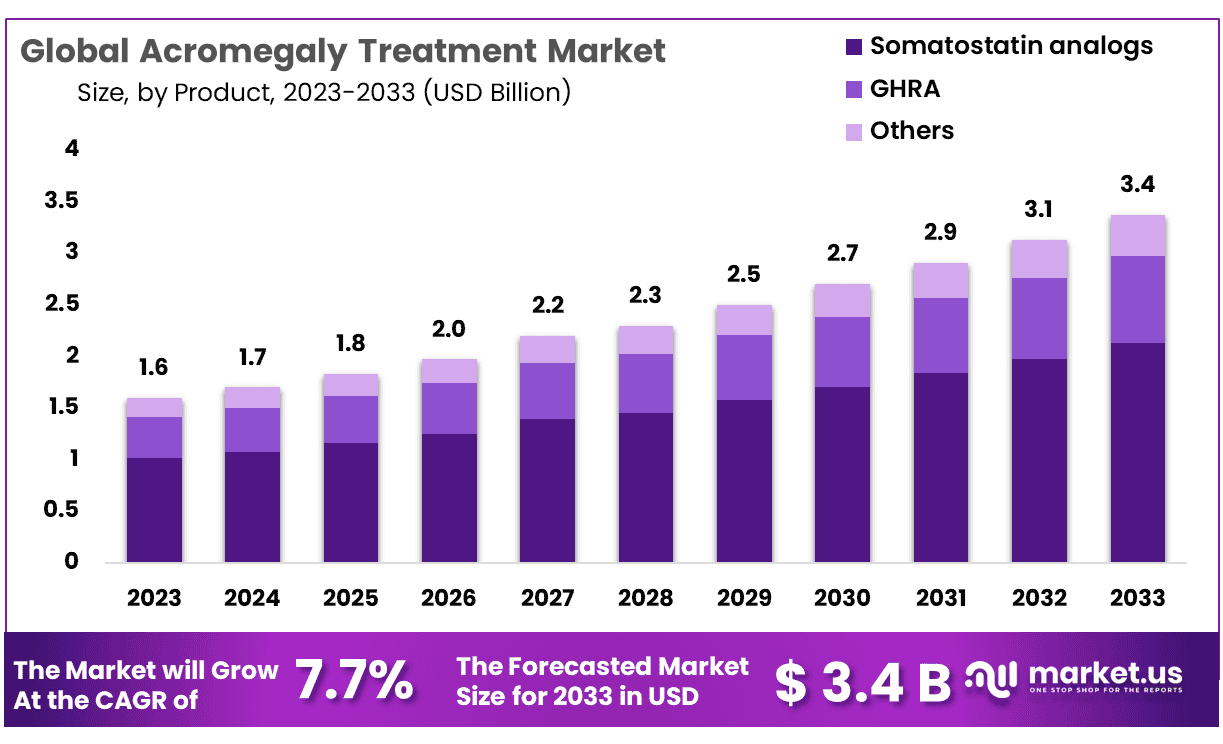

The Global Acromegaly Treatment Market size is expected to be worth around USD 3.4 Billion by 2033 from USD 1.6 Billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

Acromegaly, or Growth Hormone Overproduction Syndrome, is an uncommon hormonal disorder resulting from adults’ excessive production of Growth Hormone (GH), usually as the result of a benign tumor in their pituitary gland. Estimations estimate 40-125 cases per million population globally with various clinical symptoms manifested such as enlarged hands, feet, facial features as well as complications such as high blood pressure, diabetes and cardiovascular disease being evident as consequences of Acromegaly.

Surgery is usually the primary method used to treat acromegaly; however, many patients require additional therapies, including radiation and pharmacological approaches. Somatostatin Analogs (SSAs), synthetic versions of naturally-occurring hormone somatostatin, have become the standard first-line pharmaceutical treatments for acromegaly. Octreotide and Lanreotide are two agents often utilized as first line treatments; both work by decreasing secretions of Growth Hormone (GH) and Insulin-Like Growth Factor-1 (IGF-1); ultimately treating all clinical symptoms associated with the condition.

The key driver of the acromegaly market is a strong drug pipeline. Seven somatostatin analogues and two growth hormone receptor antagonists will be approved by the FDA by 2032. This market will also benefit from technological advancements such as radiosurgery and radiolabelled imaging technologies that provide cost-efficiency with minimal side effects.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size: Acromegaly Treatment Market size is expected to be worth around USD 3.4 Billion by 2033 from USD 1.6 Billion in 2023.

- Market Growth: The market is growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

- Product Analysis: Somatostatin Analogs market held 44.50% share by revenue share.

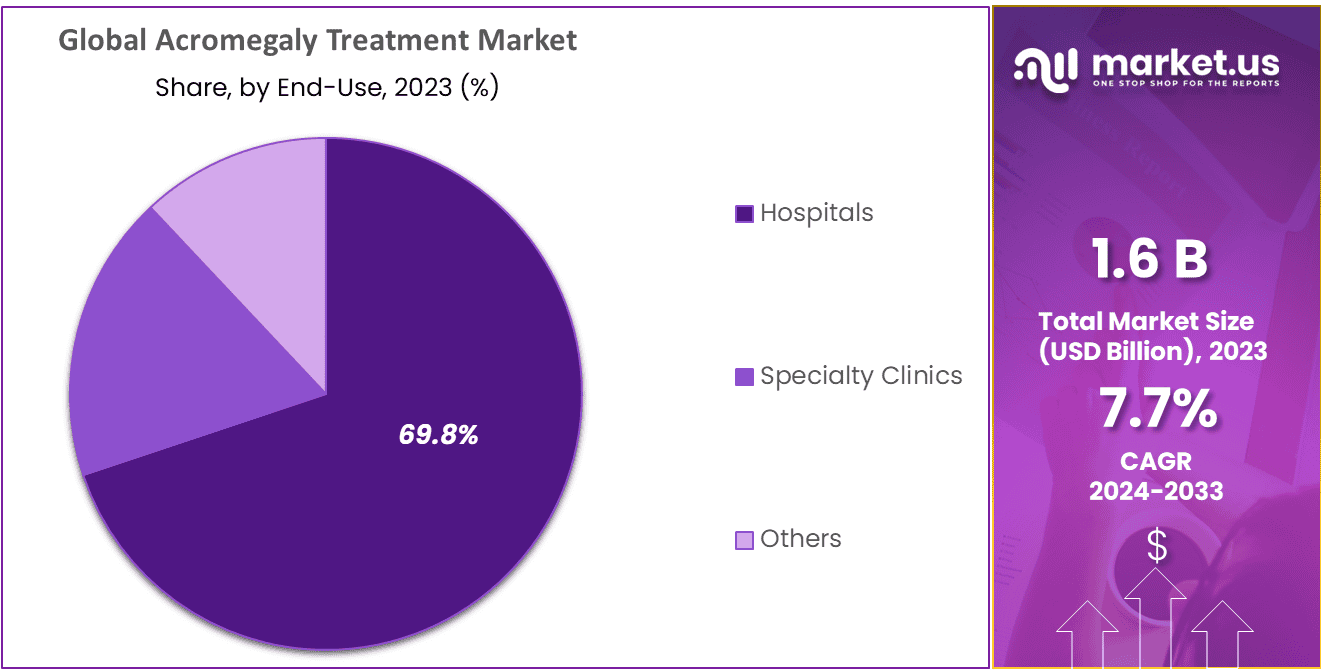

- End-Use Analysis: hospitals and clinics held 70.03% of revenue for acromegaly treatment market in 2023.

- Regional Analysis: North America was the country with dominating 45.6% market share and the highest revenue of USD 0.729% in 2023

- Innovation Driven Market Growth: Acromegaly treatment markets are experiencing significant expansion, driven by advances in treatment modalities.

- Early Detection Trends: One key trend in Acromegaly treatment market is an emphasis on early diagnosis and intervention.

- Opportunities in Untapped Markets: Though Acromegaly treatment markets face challenges, they do have opportunities for growth through untapped regions with lower awareness and suboptimal diagnosis rates.

- Geographic Expansion Strategy: Geographic expansion presents pharmaceutical companies in the Acromegaly treatment market with an invaluable opportunity.

Product Analysis

In 2023, the Somatostatin Analogs market held 44.50% share by revenue share. Healthcare practitioners have relied upon somatostatin analogs as the go-to treatment option for several decades due to their wide availability and cost-efficiency. Novartis Sandostatin LAR and Signifor LAR from Novartis as well as Ipsen Pharma Somatuline Depot stand out as notable pharmaceuticals within this category, being first-line therapeutic options trusted by medical communities as first-choice therapies. Their prevalence in the market demonstrates how integral these somatostatin analogs have become for treating healthcare needs for relevant conditions. Over the last few decades, the first-line treatment option for somatostatin analogues has been recommended by healthcare professionals. This is due to the availability of drugs and the cost-efficiency.

A strong pipeline of drugs will also be a key driver for future growth. Somatuline Autogel from Ipsen Pharma, CRN00808 of Crinetics Pharmaceuticals and MYCAPSSA oral, Chiasma Inc. are all currently in clinical trials. They should be approved within the next few years. Pfizer Inc. currently offers Somavert (Pegvisomant), which is the only Growth Hormone Receptor Antagonist. Two GHRIs currently in development are ISIS 766720 and Ionis Pharmaceuticals Inc., which is currently undergoing phase II clinical trials.

End-Use Analysis

In 2023, hospitals and clinics held 70.03% of revenue for healthcare services providers primarily driven by an array of diagnostic tests and surgeries performed within these facilities. This segment’s dominance is further demonstrated by advanced diagnostic facilities and access to skilled surgeons, and by its dominance of this sector overall. However, potential limitations to its future growth stem from low public awareness about disease as well as delayed detection. These factors could thwart the sector’s expansion in the near future. Recognizing their key role in healthcare delivery, hospitals and clinics must recognize how improving disease awareness and early detection could play a pivotal role in mitigating challenges to ensure sustained growth in this segment.

Other segments include government and private organizations. A research study was done in China’s government hospital. 527 patients with the acromegalic disease were identified using facial photos and machine learning. This initiative encouraged early detection of the disease in the population.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

Product

- Somatostatin analogs

- GHRA

- Others

End-Use

- Hospitals

- Specialty Clinics

- Others

Driver

Progress in Treatment Modalities

Acromegaly treatment market growth is being propelled by numerous advances in treatment modalities. Traditional approaches, including surgery and radiation therapy, have been enhanced by novel pharmaceutical interventions that offer relief. Somatostatin analogs and growth hormone receptor antagonists have revolutionized Acromegaly management. These medications offer superior effectiveness with reduced side effects and greater patient compliance – all contributing to an expanding market for treatment solutions. Personalized medicine, which tailors treatments specifically to individual patient profiles, has become another significant force behind its advancement. Not only can this approach enhance treatment results and lower adverse side effects but it can also create more favorable market environments.

In the coming years, rising demand will be a result of the increasing prevalence of genetic diseases and lifestyle changes. The growth is expected to be supported by an increase in the incidence of hormone diseases such as hypopituitarism, endocrine disorders, and hypopituitarism. Market players will benefit from technological advancements and government support.

Research and development activities related to Acromegaly treatment are fuelling innovation. Pharmaceutical companies and research institutions collaborate closely in finding new therapeutic agents. Gene therapies and targeted therapies hold immense promise of revolutionizing treatment landscape, so as these innovations pass clinical trials and gain regulatory approvals they could significantly contribute towards growing Acromegaly market size.

Trend

Greater Emphasis on Early Diagnosis and Intervention

Acromegaly treatments market trends include an increasing focus on early diagnosis and intervention. Healthcare professionals as well as general population members alike have become aware of its significance; early diagnosis enables timely initiation of therapy that prevents further progression while mitigating possible long-term side effects associated with unregulated growth hormone excess. This trend is underpinned by advances in diagnostic technologies including better imaging modalities and biomarker identification technologies.

Encouragingly, multidisciplinary care models are becoming an ever-increasing trend: endocrinologists, neurosurgeons and other specialists are coming together to form comprehensive treatment plans tailored specifically for Acromegaly patients. A holistic approach that incorporates not only pharmaceutical interventions but also surgery or radiation therapies is making a noticeable impactful statement about Acromegaly treatment markets today; ultimately leading to enhanced patient-centric care resulting in greater overall treatment results.

Another key contributor to market growth is the availability of favorable government insurance policies and programs for patients with rare illnesses. In the U.S. and Europe, there are multiple government healthcare agencies, including the National Institutes of Health and the National Center for Advancing Translational Sciences (NCATS), that offer subsidized medications for rare diseases. Acromegaly is a Japanese incurable disease. The entire treatment cost can be covered by insurance. These initiatives will likely boost growth in the near future.

Restraint

High Cost of Intervention

One of the primary barriers to Acromegaly treatment market growth is cost. Pharmaceutical therapies like Somatostatin analogs and Growth Hormone Receptor Antagonists tend to come at premium price levels, creating financial burden for patients as well as healthcare systems alike. Furthermore, accessing advanced therapies may become limited due to limited budgets; additionally patients might not adhere to treatment regimens prescribed and this would significantly compromise Acromegaly management efforts overall.

Long-term treatment costs associated with Acromegaly can add significant economic burden. Recurring surgeries, imaging studies and ongoing medication add further expenses that must be covered; one key challenge lies in striking an appropriate balance between innovative yet cost-effective therapies and widespread adoption due to economic considerations. Strategies used to overcome this restraint include exploring cost-effective therapeutic alternatives; negotiating pricing models with pharmaceutical companies and devising reimbursement strategies designed to ease patients’ and healthcare systems’ financial strain.

Opportunity

Untapped Markets and Geographic Expansion

Acromegaly treatment market presents many opportunities for growth through untapped markets and geographical expansion, particularly unexploited regions that still lack awareness about Acromegaly diagnosis rates are subpar; outreach programs, educational initiatives and awareness campaigns may play a pivotal role in raising disease awareness in these under-explored markets as well as driving early diagnosis rates up in unchartered territories – this would enable pharmaceutical companies and healthcare providers to expand their patient bases as well as market shares by targeting these regions with new therapies or by expanding geographical reach of existing treatments offered services provided.

Geographical expansion involves more than simply entering new markets; it also means tailoring treatment approaches specifically for each regional variation. Genetic predispositions, environmental conditions and cultural influences all play a part in how Acromegaly manifests and responds to treatments; hence customizing treatments according to regional characteristics can give pharmaceutical companies an edge against competitors in this growing treatment market. Collaborations with healthcare providers, regulatory bodies and patient advocacy groups are crucial parts of successful geographical expansion strategies in Acromegaly treatment markets.

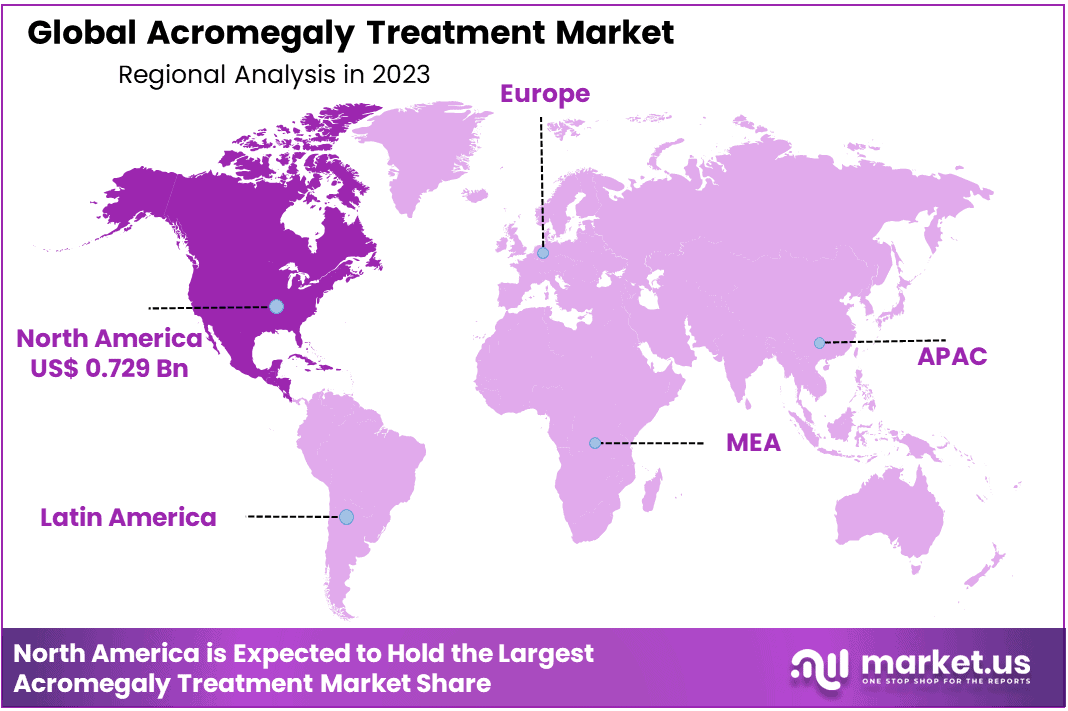

Regional Analysis

North America was the country with dominating 45.6% market share and the highest revenue of USD 0.729% in 2023, due to its increasing prevalence and favorable government policies. A report from the U.S. Endocrine Society states that acromegaly prevalence was between 42 and 126 cases per thousand in 2021. The regional market will be boosted by the increased collaboration between major players in the development of new formulations and the assurance of high-quality products.

Asia Pacific will, however, be experiencing the fastest CAGR over the forecast period. In the near future, there will be remunerative growth opportunities due to the rising healthcare spending in countries like China and India. Sun Pharma and WOCKHARDT, for example, are currently developing new formulations of the octreotide molecule.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

Markets are consolidated by large and small companies. It is led by players such as Novartis AG, Ipsen Pharma, and Pfizer Inc. In the past few years, many key contributors and new players have been added to the organization.

Companies are now focusing on the implementation of strategies such as new formulations, partnerships, distribution agreements, and regional expansion to increase revenue share. Novartis, for example, launched Signifor LAR to maintain its market share following the expiry of Sandostatin LAR’s patent. Chiasma Inc., which is currently in the clinical trial phase, is developing oral octreotide that is easier to administer. ISIS 766720, a clinical trial by Ionis Pharmaceuticals Inc., is currently in phase 2.

Market Key Players

- Pfizer Inc.

- Novartis International AG

- Ipsen Pharma

- F. Hoffmann-La Roche Ltd.

- Merck & Co, Inc.

- Chiasma, Inc.

- Amryt Pharma

- Crinetics Pharmaceuticals, Inc.

- Dauntless Pharmaceuticals, Inc.

Recent Developments

- Ipsen Pharma: Osigodrostat: Ipsen reported positive Phase III results for Osigodrostat in October 2021, showing its effectiveness at normalizing IGF-1 levels among acromegaly patients and hoping for FDA approval by 2024.

- Novartis International AG: Somatropin (Somatulin) remains an effective therapy option for acromegaly. No significant developments in its usage have been witnessed recently.

- Pfizer Inc: Somatropin (Genotropin): Genotropin remains a mainstay on the market, without any major announcements related to acromegaly developments.

- F. Hoffmann-La Roche Ltd: Octreotide (Sandostatin): Primarily prescribed to treat other conditions, it has also been used off-label in treating acromegaly without reported developments or side effects.

- Merck & Co, Inc.: Pegvisomant (Somavert) is typically prescribed to treat other conditions, but can also be taken off-label to manage acromegaly; there have been no specific reports regarding this use in patients with this disorder.

- Chiasma, Inc: Octreotide Acetate (Octreotide LA): Marketed under the brand name Naltrexone Depot for treating opioid dependency, Chiasma Inc is now investigating its potential as an Acromegaly treatment option; Phase IIa results presented in November 2023 were very encouraging.

Report Scope

Report Features Description Market Value (2023) USD 1.6 Billion Forecast Revenue (2033) USD 3.4 Billion CAGR (2024-2033) 7.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product-(Somatostatin analogs, GHRA, Others);End-Use-(Hospitals, Specialty Clinics, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Pfizer Inc., Novartis International AG, Ipsen Pharma, F. Hoffmann-La Roche Ltd., Merck & Co, Inc., Chiasma, Inc., Amryt Pharma, Crinetics Pharmaceuticals, Inc., Dauntless Pharmaceuticals, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is driving the growth of the Acromegaly Treatment Market?The growth of the Acromegaly Treatment Market is primarily driven by advancements in treatment modalities, including the development of innovative pharmaceutical interventions such as somatostatin analogs and growth hormone receptor antagonists. These advancements offer improved efficacy and reduced side effects, contributing to a positive treatment landscape.

How big is the Acromegaly Treatment Market?The global Acromegaly Treatment Market size was estimated at USD 1.6 Billion in 2023 and is expected to reach USD 3.4 Billion in 2033.

What is the Acromegaly Treatment Market growth?The global Acromegaly Treatment Market is expected to grow at a compound annual growth rate of 7.7%. From 2024 To 2033

Who are the key companies/players in the Acromegaly Treatment Market?Some of the key players in the Acromegaly Treatment Markets are Pfizer Inc., Novartis International AG, Ipsen Pharma, F. Hoffmann-La Roche Ltd., Merck & Co, Inc., Chiasma, Inc., Amryt Pharma, Crinetics Pharmaceuticals, Inc., Dauntless Pharmaceuticals, Inc.

What trends are shaping the Acromegaly Treatment Market?A significant trend in the Acromegaly Treatment Market is the increasing emphasis on early diagnosis and intervention. Improved diagnostic technologies, coupled with a shift towards multidisciplinary care models, are facilitating early detection of Acromegaly, leading to timely treatment initiation and improved patient outcomes.

What is a key restraint in the Acromegaly Treatment Market?A notable restraint in the Acromegaly Treatment Market is the high cost associated with treatment. The pricing of advanced pharmaceuticals, such as somatostatin analogs, can pose financial challenges for both patients and healthcare systems, potentially limiting access to these effective therapies.

Are there opportunities for market growth in specific regions?Yes, there are opportunities for growth in the Acromegaly Treatment Market through untapped regions with low awareness and diagnosis rates. Initiatives such as education programs and awareness campaigns present opportunities to expand the market in these regions.

How can pharmaceutical companies strategically approach market expansion?Geographical expansion is a strategic opportunity in the Acromegaly Treatment Market. Customizing treatment strategies based on regional variations, including genetic and cultural factors, can enhance effectiveness. Collaboration with local healthcare providers and regulatory bodies is crucial for successful expansion strategies.

Acromegaly Treatment MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Acromegaly Treatment MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc.

- Novartis International AG

- Ipsen Pharma

- F. Hoffmann-La Roche Ltd.

- Merck & Co, Inc.

- Chiasma, Inc.

- Amryt Pharma

- Crinetics Pharmaceuticals, Inc.

- Dauntless Pharmaceuticals, Inc.