Global Acoustic Vector Sensor Market By Component (Sensors, Software, Services), By Application (Defense, Commercial, Industrial, Environmental Monitoring, Others), By Platform (Airborne, Ground, Naval, Space), By End-User (Military, Law Enforcement, Oil & Gas, Environmental Agencies, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167246

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

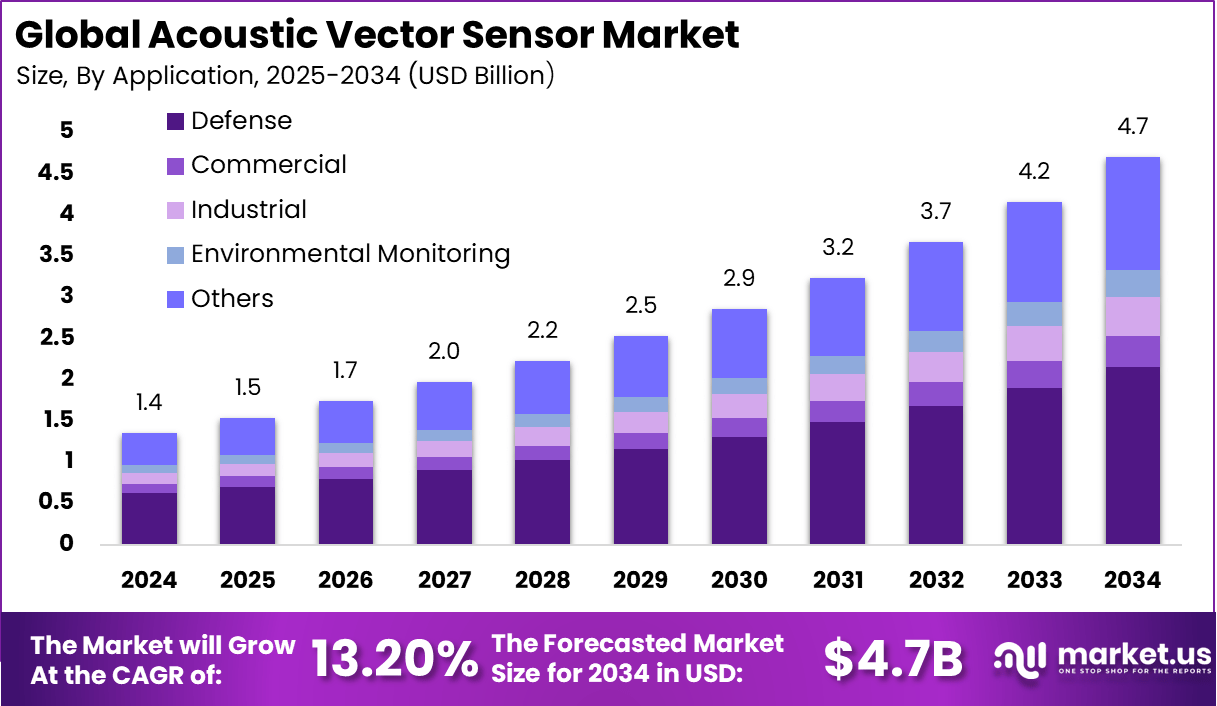

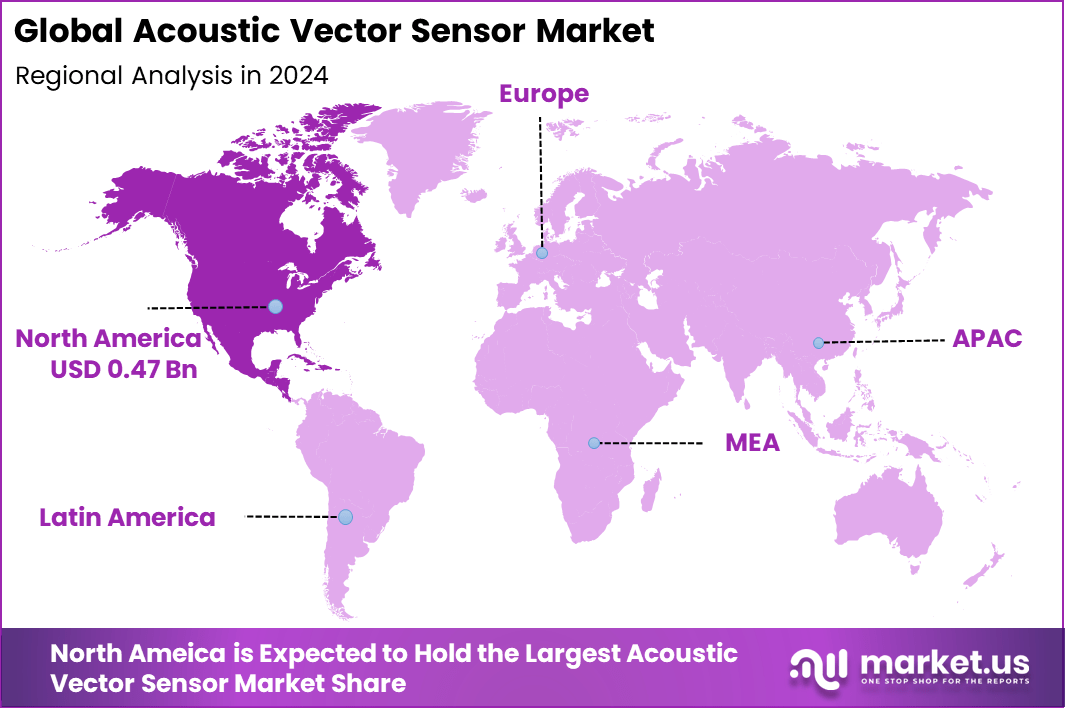

The Global Acoustic Vector Sensor Market generated USD 1.4 billion in 2024 and is predicted to register growth from USD 1.5 billion in 2025 to about USD 4.7 billion by 2034, recording a CAGR of 13.20% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 35.2% share, holding USD 0.47 Billion revenue.

The acoustic vector sensor market has expanded as defence agencies, maritime operators and industrial monitoring systems increasingly rely on sensors that measure both sound pressure and particle velocity. These sensors provide accurate direction-of-arrival information and superior performance in noisy or dynamic environments. Growth reflects rising demand for precise underwater detection, advanced surveillance and improved situational awareness across multiple sectors.

The growth of the market can be attributed to rising security requirements, increasing underwater exploration and growing investment in next generation sonar technologies. AVS systems offer higher accuracy than traditional hydrophones, which strengthens adoption across naval operations. Industrial monitoring, offshore energy projects and environmental studies also contribute to rising demand. Improvements in sensor miniaturisation and digital signal processing further support market expansion.

Demand is rising across naval surveillance, submarine detection, underwater communication, environmental acoustics, seismic monitoring and industrial maintenance. Defence forces require AVS technology to localise targets more quickly and with greater precision. Offshore operators use AVS for structural monitoring, leak detection and asset protection. Research institutions deploy these sensors for marine mammal tracking, oceanographic studies and ambient noise analysis.

Key technologies supporting adoption include vector hydrophones, microelectromechanical sensors, advanced signal processors, beamforming algorithms and integrated underwater acoustic arrays. Modern AVS solutions combine multi-axis particle velocity measurement with real time acoustic analysis. Improvements in onboard computing, low noise materials and high bandwidth data links enhance accuracy and reliability. Integration with autonomous underwater vehicles expands operational flexibility.

Top Market Takeaways

- By component, sensors dominate the market with a 58.6% share. Acoustic vector sensors provide three-dimensional sound detection capabilities critical for defense, underwater navigation, and environmental monitoring.

- By application, defense accounts for about 45.8% of the market, driven by the military’s need for advanced sonar, surveillance, and reconnaissance technologies utilizing acoustic vector sensing for enhanced situational awareness and security.

- By platform, airborne systems lead with 38.9% share, including military aircraft, drones, and surveillance balloons equipped with acoustic vector sensors for wide-area deployment and real-time data acquisition.

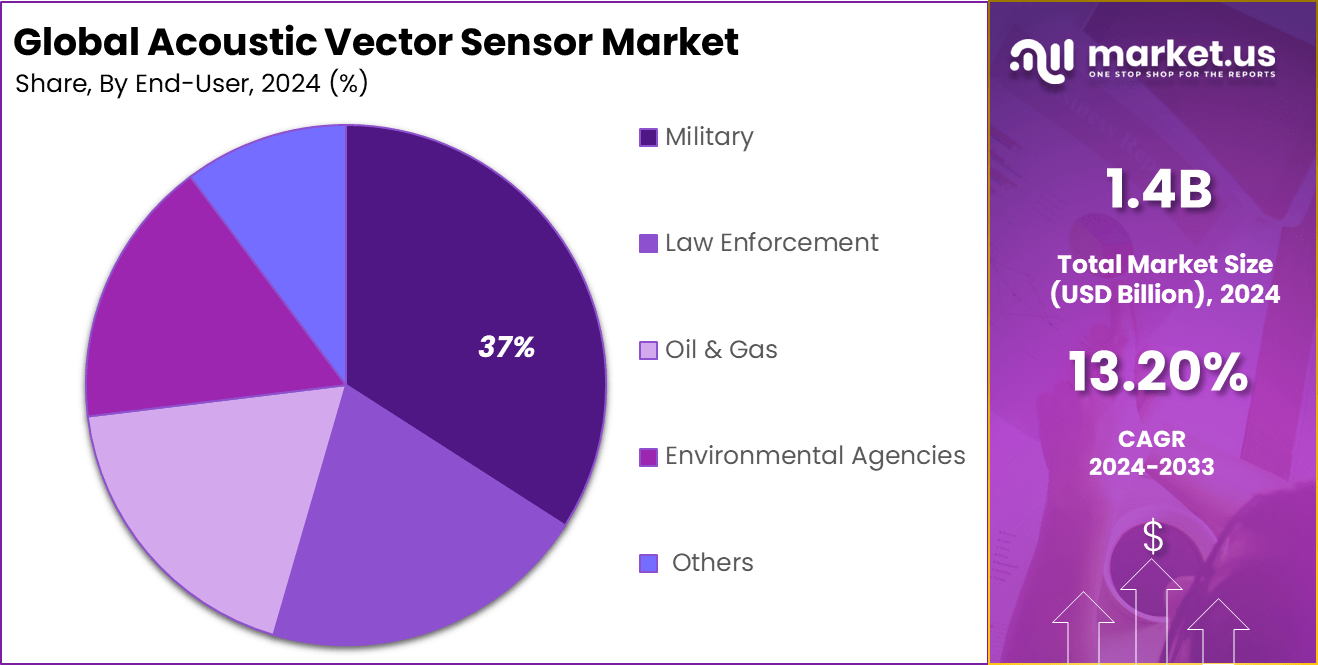

- By end-user industry, the military segment holds 36.7% of the market, reflecting heavy investment in acoustic sensor technologies for anti-submarine warfare, battlefield monitoring, and defense infrastructure.

- North America holds approximately 35.2% market share and is led by the U.S.

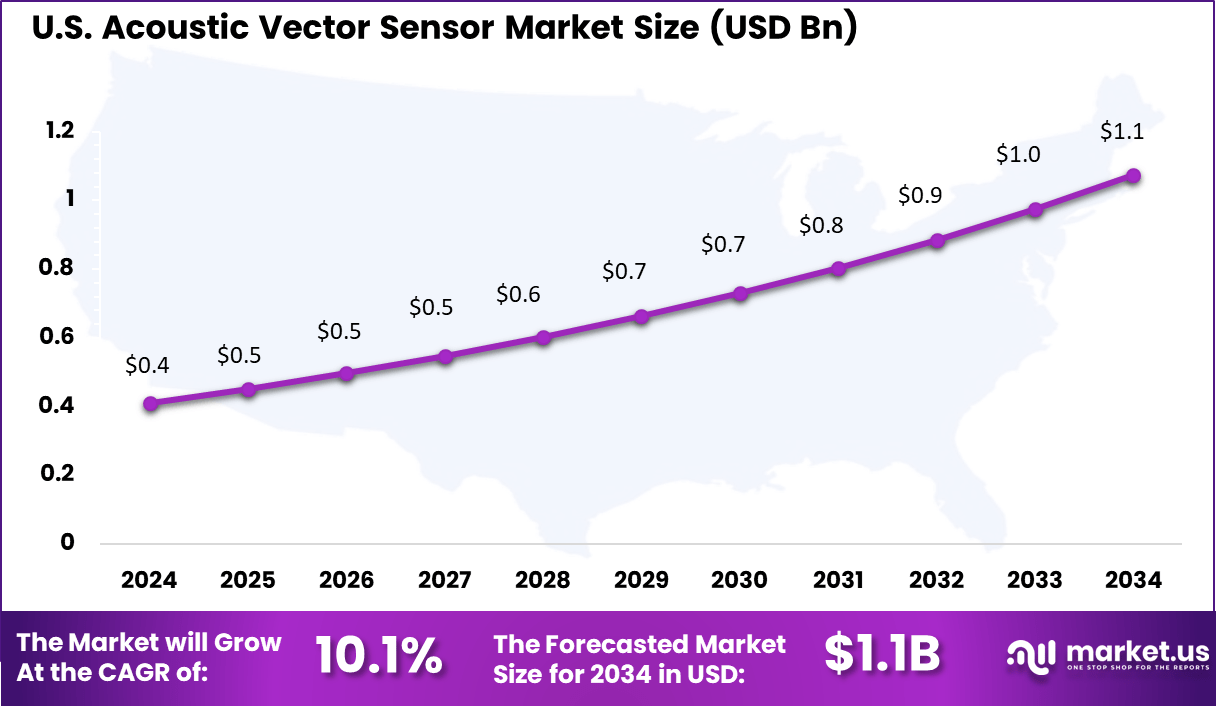

- The U.S. market size is estimated at roughly USD 0.41 billion in 2025.

- The market is growing at a CAGR of about 10.1%, supported by rising defense budgets, technological advancements in MEMS and fiber optic sensors, and increasing adoption in naval and airborne applications.

- Key manufacturers focus on innovation in sensor miniaturization, low power consumption, integration with AI analytics, and expansion into new commercial and industrial sectors.

By Component

In 2024, Sensors dominate the acoustic vector sensor market with a notable 58.6% share. These sensors serve as the core elements that detect and measure the direction and intensity of sound waves in three-dimensional space. Their ability to capture detailed acoustic information makes them indispensable for a variety of high-precision applications where spatial audio data is critical.

Advanced signal processing techniques coupled with sensor technology enhance the accuracy and reliability of acoustic data, enabling real-time monitoring and analytics in complex environments. The market drivers include advances in microelectromechanical systems (MEMS) technology, increasing demand for higher-fidelity sensing in defense, marine, and industrial automation.

By Application

In 2024, The defense sector accounts for 45.8% of acoustic vector sensor market applications, highlighting its reliance on these sensors for surveillance, reconnaissance, anti-submarine warfare, and battlefield awareness.

Acoustic vector sensors enable military forces to detect and localize threats by analyzing sound waves emitted from targets or environmental noises. They provide critical real-time data that enhances decision-making accuracy and operational efficiency.

With escalating global security challenges and increased investment in advanced defense technology, the demand for acoustic vector sensors continues to grow. These systems form a vital part of modern naval and ground-based defense infrastructure, supporting superior threat detection while minimizing human risk.

By Platform

In 2024, Airborne platforms command a 38.9% share in the acoustic vector sensor market. These include deployment on unmanned aerial vehicles (UAVs), military aircraft, and surveillance balloons used for border security, environmental monitoring, and search and rescue operations.

The mobility of airborne platforms enhances the operational range and coverage of acoustic sensors, enabling wide-area situational awareness and rapid response capabilities. The increasing use of lightweight, low-power acoustic vector sensors allows effective integration into airborne systems without substantially affecting flight dynamics or fuel consumption.

By End-User

In 2024, Military end-users hold a prominent 37% share of the acoustic vector sensor market. Military organizations leverage these sensors for their unparalleled capability to capture directional acoustic data essential for underwater navigation, target detection, and surveillance operations. Acoustic vector sensors are integral to advanced sonar systems and autonomous systems that operate in complex, noisy, and contested environments.

Rapid modernization of military assets and rising defense budgets, particularly in North America, Europe, and Asia, stimulate growth in this segment. The military’s demand for precision sensors capable of integration with AI and machine learning technologies continues to drive innovation, enabling smarter, more autonomous defense platforms.

Key reasons for adoption

- Precise direction finding: AVS devices measure both sound pressure and particle velocity, so they can tell not just how loud something is, but where it is coming from in three‑dimensional space.

- Better detection in noisy environments: Their ability to handle complex sound fields and improve direction‑of‑arrival estimation makes them attractive where background noise is high, such as busy harbors or industrial zones.

- Smaller, lighter sensing setups: Compared with large pressure‑sensor arrays, vector sensors offer compact form factors that are easier to deploy on buoys, unmanned platforms, and portable surveillance systems.

- Strong fit with modern sonar and surveillance: Defense users adopt AVS to improve passive surveillance, border protection, and underwater tracking without revealing their own position.

- Support for offshore energy and subsea assets: The oil and gas sector uses AVS for seismic work, leak detection, and structural monitoring where directional acoustic information improves decision making.

- Enabler for autonomous and unmanned systems: AVS technology fits naturally into autonomous underwater vehicles and other unmanned platforms that need compact, low‑power and high‑precision sensing.

- Alignment with digitalization and IoT: As Industry 4.0 and connected assets spread, firms want high‑quality acoustic data for predictive maintenance and situational awareness, which pushes AVS adoption.

- Growing focus on environmental monitoring: AVS are also adopted for tracking marine life, mapping noise pollution, and monitoring the health of underwater ecosystems.

Benefits

- Higher situational awareness: By adding accurate direction and intensity information, AVS give operators a clearer picture of what is happening in the water or around a critical asset, which improves tactical and operational decisions.

- Fewer sensors for the same job: Because a single vector sensor can replace multiple traditional pressure sensors, system designers can simplify arrays and cut hardware count without losing performance.

- Lower deployment and integration burden: Small size, low weight, and reduced cabling make installation faster and cheaper on ships, platforms, vehicles, and fixed sites.

- Better performance per unit cost: Improved detection, tracking, and classification quality means each deployed channel delivers more useful information over its life, which strengthens the business case even when unit prices are higher.

- Enhanced safety and asset protection: Earlier and more reliable detection of threats, leaks, or abnormal acoustic signatures helps protect people, infrastructure, and high‑value equipment.

- Readiness for advanced analytics and AI: Clean, directional acoustic data from AVS feeds directly into modern signal‑processing and AI pipelines, enabling smarter automation and new analytics services.

- Flexibility across programs: The same core sensor concept can be reused across defense, offshore energy, research, and industrial noise monitoring, spreading development and integration costs across multiple programs.

Emerging Trends

- Integration of AI and advanced signal processing algorithms improves accuracy and real-time data analysis.

- Development of miniaturized, high-sensitivity sensors enabling broader application in various industries.

- Increasing use of acoustic vector sensors in autonomous underwater vehicles (AUVs) and drones for precise navigation.

- Expansion of marine environmental monitoring applications, leveraging sensors for ecosystem health assessment.

- Adoption of multi-sensor arrays and 3D acoustic imaging techniques for enhanced spatial sound detection.

Growth Factors

- Rising defense and security spending driving demand for sophisticated sonar and surveillance systems.

- Growth in offshore oil and gas exploration requiring accurate underwater sensing and leak detection.

- Increasing focus on marine environmental conservation promoting use of advanced acoustic monitoring technologies.

- Advancements in sensor fabrication technologies leading to cost reduction and improved modularity.

- Expansion of autonomous systems and robotics across marine, automotive, and industrial sectors bolstering market growth.

Key Market Segments

By Component

- Sensors

- Software

- Services

By Application

- Defense

- Commercial

- Industrial

- Environmental Monitoring

- Others

By Platform

- Airborne

- Ground

- Naval

- Space

By End-User

- Military

- Law Enforcement

- Oil & Gas

- Environmental Agencies

- Others

Regional Analysis

North America held a significant 35.2% share of the global acoustic vector sensor market, driven by strong demand across defense, underwater navigation, and industrial monitoring sectors. The region benefits from advanced research and development capabilities, coupled with substantial government investments in military and maritime technologies.

Innovations in signal processing and integration with AI have enhanced sensor accuracy and real-time data analysis, further boosting market adoption. Industries such as automotive and healthcare are also increasingly incorporating acoustic vector sensors for safety and diagnostic applications, contributing to the market’s diversified growth.

The U.S. is the key market player, valued at approximately USD 0.41 billion in 2024 and growing steadily with a CAGR of 10.1%. The U.S. defense sector accounts for a large portion of demand, utilizing these sensors in sonar systems, underwater surveillance, and autonomous vehicle navigation.

Additionally, the expanding offshore energy sector drives adoption for environmental and infrastructure monitoring. U.S. companies lead innovation in sensor miniaturization, enhanced sensitivity, and AI-enabled features, which strengthen the country’s competitive edge. Supportive governmental policies, high defense spending, and a focus on technological superiority ensure continued growth in the U.S. acoustic vector sensor market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Advanced Defense and Surveillance Systems

The acoustic vector sensor market is propelled by growing demand for precise and reliable underwater surveillance and sonar applications, especially in defense sectors. These sensors provide enhanced detection and localization capabilities by capturing sound intensity and direction, critical for anti-submarine warfare and naval defense operations. Increasing global defense expenditures and modernization programs to counter underwater threats fuel this growth.

Additionally, marine research and environmental monitoring require accurate acoustic sensing for data collection and ecosystem analysis. This diversified use across defense and civil sectors widens market demand for advanced sensor technologies with real-time processing capabilities.

Restraint

High Manufacturing Costs and Calibration Complexities

Despite strong growth prospects, the market faces challenges due to high manufacturing costs of acoustic vector sensors. Producing high-sensitivity, multi-axis sensors with low noise levels involves sophisticated technology and precision engineering, which increases the price barrier for widespread adoption.

Calibration is another complexity affecting market growth. Ensuring accurate directional measurements demands extensive calibration and maintenance, especially when operating in varying environmental conditions like temperature and pressure fluctuations. These factors restrict use in cost-sensitive applications and markets with limited technical capabilities.

Opportunity

Integration with Autonomous Underwater Vehicles and AI

The integration of acoustic vector sensors with autonomous underwater vehicles (AUVs) and AI-driven data analytics presents significant growth opportunities. AUVs used in subsea exploration and inspection benefit immensely from precise acoustic localization, enabling safer, more efficient missions in deep and challenging underwater environments.

AI enhances signal processing by filtering noise and improving detection accuracy, enabling real-time decision-making. This combination opens new possibilities in marine biology, offshore energy, and infrastructure monitoring where autonomous systems require robust sensing capabilities.

Challenge

Environmental Factors and Cybersecurity Risks

Environmental factors like water salinity, temperature, and ocean currents introduce noise and signal distortion, posing challenges to acoustic vector sensor accuracy and reliability. Adapting sensors and algorithms to these dynamic conditions requires ongoing R&D efforts.

Furthermore, the cybersecurity aspect of underwater sensor networks is emerging as a critical concern. Unauthorized data access or interference could compromise mission-critical operations in defense and commercial applications. Ensuring secure communication protocols and data integrity is essential to maintain trust and operational continuity.

Competitive Analysis

The acoustic vector sensor market is moderately consolidated and highly competitive, with companies like Microflown AVISA, Wilcoxon Sensing Technologies, Colibrys, VectorNav, Teledyne Marine, Sonardyne, Kongsberg, L3Harris, Lockheed Martin, Raytheon, Thales, and Northrop Grumman deeply invested in product innovation, especially in multi-sensor array technologies and advanced signal processing algorithms.

These sensors are critical in defense, marine exploration, and industrial monitoring, where precise 3D acoustic data and real-time processing are essential for applications such as underwater navigation, surveillance, and environmental research.

Market players differentiate themselves through continuous R&D, collaborations with defense agencies, and the integration of AI and machine learning to enhance sensor accuracy and data interpretation. Regional growth is strong, driven by defense and industrial sectors in North America, Europe, and Asia-Pacific.

Challenges like the high cost of advanced sensors and environmental noise interference persist, but advances in MEMS technology and AI-assisted calibration present significant growth opportunities. Overall, strategic partnerships, technology leadership, and expanding application scopes define the competitive dynamics of this growing market.

Top Key Players in the Market

- Microflown AVISA

- Wilcoxon Sensing Technologies

- Colibrys Ltd.

- VectorNav Technologies

- Teledyne Marine

- Sonardyne International Ltd.

- Kongsberg Gruppen

- L3Harris Technologies

- Lockheed Martin Corporation

- Raytheon Technologies

- Thales Group

- Northrop Grumman Corporation

- Honeywell International Inc.

- BAE Systems

- General Dynamics Corporation

- Ultra Electronics Holdings plc

- Rheinmetall AG

- ASELSAN A.S.

- Elbit Systems Ltd.

- QinetiQ Group plc

- Other Major Players

Future Outlook

The Acoustic Vector Sensor (AVS) market has a promising future outlook driven by advances in sensor miniaturization, AI-based signal processing, and integration with autonomous underwater and surface vehicles. Growth is propelled by rising demand from defense, maritime surveillance, environmental monitoring, and industrial automation sectors. Emerging economies and regional defense modernization are also fostering expansion. The market is expected to witness robust growth in the coming decade as AVS technology becomes critical for precise, real-time acoustic measurement in complex environments.

- Growing integration of AVS in autonomous underwater vehicles (AUVs) and unmanned surface vehicles (USVs) for enhanced underwater navigation and surveillance.

- Expansion in defense and security applications, including anti-submarine warfare and maritime domain awareness.

- Increasing use in environmental and marine life monitoring to address concerns over ocean pollution and climate change.

- Industrial and automotive sectors adopting AVS for process optimization, advanced driver-assistance systems (ADAS), and industrial automation.

Recent Developments

- April, 2025, Wilcoxon, an Amphenol subsidiary, released the 883M digital triaxial accelerometer with dynamic vibration output operable on Modbus protocol, offering enhanced vibration monitoring for industrial and underwater uses.

- July, 2025, VectorNav opened a new facility focused on advancing tactical embedded navigation systems including tactical-grade inertial measurement units (IMUs) optimized for unmanned systems demanding precise positioning in GNSS-denied environments.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 4.7 Bn CAGR(2025-2034) 13.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Sensors, Software, Services), By Application (Defense, Commercial, Industrial, Environmental Monitoring, Others), By Platform (Airborne, Ground, Naval, Space), By End-User (Military, Law Enforcement, Oil & Gas, Environmental Agencies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microflown AVISA, Wilcoxon Sensing Technologies, Colibrys Ltd., VectorNav Technologies, Teledyne Marine, Sonardyne International Ltd., Kongsberg Gruppen, L3Harris Technologies, Lockheed Martin Corporation, Raytheon Technologies, Thales Group, Northrop Grumman Corporation, Honeywell International Inc., BAE Systems, General Dynamics Corporation, Ultra Electronics Holdings plc, Rheinmetall AG, ASELSAN A.S., Elbit Systems Ltd., QinetiQ Group plc, and other major players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Acoustic Vector Sensor MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Acoustic Vector Sensor MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microflown AVISA

- Wilcoxon Sensing Technologies

- Colibrys Ltd.

- VectorNav Technologies

- Teledyne Marine

- Sonardyne International Ltd.

- Kongsberg Gruppen

- L3Harris Technologies

- Lockheed Martin Corporation

- Raytheon Technologies

- Thales Group

- Northrop Grumman Corporation

- Honeywell International Inc.

- BAE Systems

- General Dynamics Corporation

- Ultra Electronics Holdings plc

- Rheinmetall AG

- ASELSAN A.S.

- Elbit Systems Ltd.

- QinetiQ Group plc

- Other Major Players