Global Acne Treatment Market By Product Type (Antibiotics, Isoretinoin, Retinoids, and Others), By Route of Administration (Topical and Oral), By Age Group (18 to 44 years, 45 to 64 years, 10 to 17 years, and 65 years & above), By Application (Medications and Therapeutic Devices), By Distribution Channel (Retail & Online Pharmacies and Hospital Pharmacies), By End-user (MedSpa and Dermatology Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 58388

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Route of Administration Analysis

- Age Group Analysis

- Application Analysis

- Distribution Channel Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

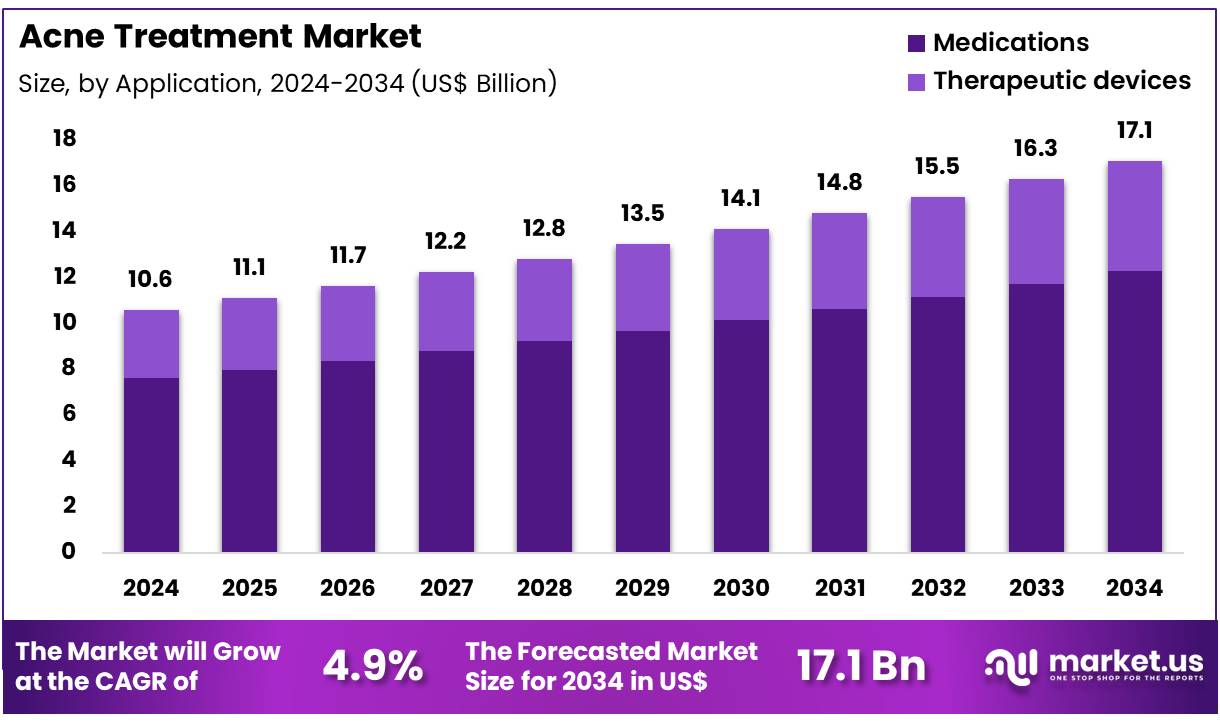

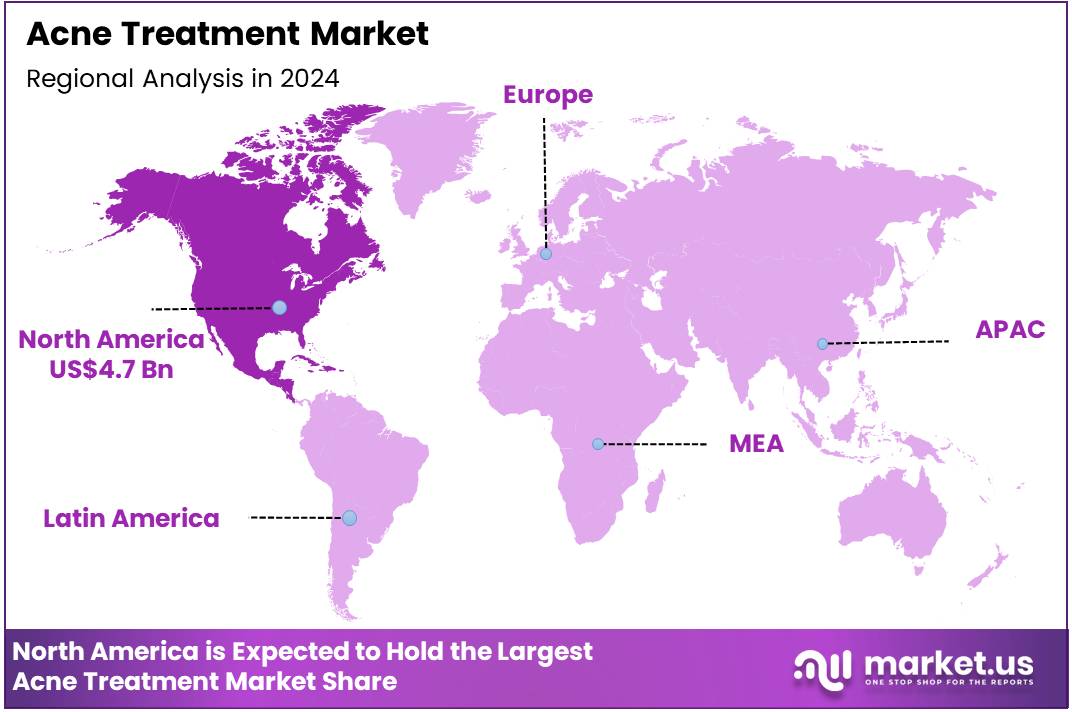

The Global Acne Treatment Market size is expected to be worth around US$ 17.1 Billion by 2034 from US$ 10.6 Billion in 2024, growing at a CAGR of 4.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 44.7% share with a revenue of US$ 4.7 Billion.

Increasing regulatory flexibility drives the Acne Treatment Market, as streamlined programs enhance access to potent systemic therapies. Dermatologists prescribe isotretinoin for severe nodular acne, achieving long-term remission through sebaceous gland suppression. These treatments support adolescent care by combining oral retinoids with topical agents, addressing hormonal and inflammatory factors.

Patients benefit from revised monitoring protocols that maintain safety while reducing barriers to adherence. In April 2025, the U.S. FDA revised the iPLEDGE program for isotretinoin, adopting gender-neutral categories and at-home testing to improve compliance and safety. This reform accelerates market growth by facilitating broader, more efficient use of high-efficacy acne medications.

Growing public-private research collaborations create opportunities in the Acne Treatment Market, as partnerships expedite novel therapeutic development. Pharmaceutical companies advance topical clascoterone formulations to inhibit androgen receptors in mild acne, offering hormone-modulating alternatives. These initiatives target early intervention with non-antibiotic options, mitigating resistance concerns in Propionibacterium acnes management.

Clinical trials integrate microbiome analysis to tailor treatments for individualized lesion control. In November 2024, Sanofi, A*STAR, and the National Skin Centre signed an MoU to launch a Phase 1 trial for mild acne therapeutics. This collaboration drives market expansion by building robust pipelines for innovative, evidence-based acne solutions.

Rising global regulatory approvals propel the Acne Treatment Market, as expanded indications strengthen dermatology portfolios worldwide. Manufacturers introduce topical anti-androgen creams like Winlevi to manage papulopustular acne in adults, complementing benzoyl peroxide regimens. These products support combination therapy protocols, enhancing clearance rates in resistant cases.

Digital health integrations enable remote prescription management, improving patient follow-up. In March 2024, Sun Pharmaceutical Industries secured approval from Australia’s Therapeutic Goods Administration for Winlevi cream, extending its reach across multiple regulatory jurisdictions. This milestone positions the market for sustained growth through diversified, accessible acne treatment options.

Key Takeaways

- In 2024, the market generated a revenue of US$ 10.6 Billion, with a CAGR of 4.9%, and is expected to reach US$ 17.1 Billion by the year 2034.

- The product type segment is divided into antibiotics, isoretinoin, retinoids, and others, with antibiotics taking the lead in 2023 with a market share of 42.7%.

- Considering route of administration, the market is divided into topical and oral. Among these, topical held a significant share of 64.3%.

- Furthermore, concerning the age group segment, the market is segregated into 18 to 44 years, 45 to 64 years, 10 to 17 years, and 65 years & above. The 18 to 44 years sector stands out as the dominant player, holding the largest revenue share of 53.8% in the market.

- The application segment is segregated into medications and therapeutic devices, with the Medications segment leading the market, holding a revenue share of 71.9%.

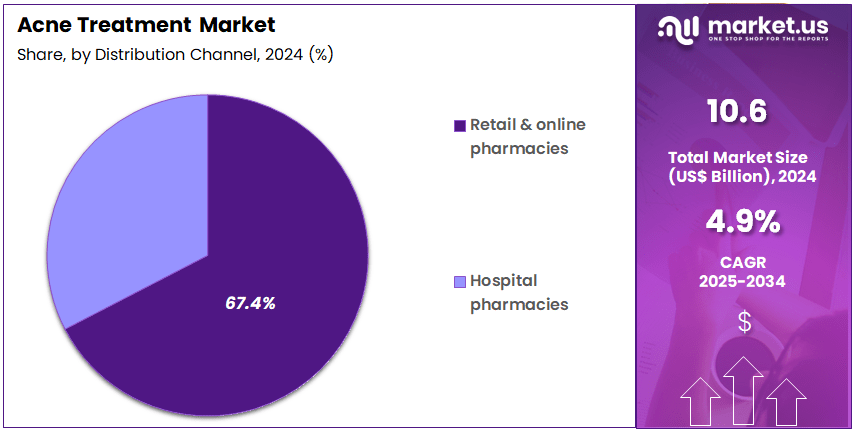

- The distribution channel segment is divided into retail & online pharmacies and hospital pharmacies, with retail & online pharmacies taking the lead in 2023 with a market share of 67.4%.

- Considering end-user, the market is divided into medspa and dermatology clinics. Among these, dermatology clinics held a significant share of 59.8%.

- North America led the market by securing a market share of 44.7% in 2023.

Product Type Analysis

Antibiotics account for 42.7% of the Acne Treatment market and are projected to remain dominant due to their effectiveness in reducing inflammation and bacterial growth in moderate to severe acne cases. Dermatologists frequently prescribe topical and oral antibiotics to target Cutibacterium acnes, the primary bacterium responsible for acne lesions.

The growing preference for combination therapies—where antibiotics are used alongside retinoids or benzoyl peroxide—enhances treatment efficacy and limits bacterial resistance. The availability of advanced formulations with controlled-release systems has improved patient compliance and outcomes. Increasing awareness among adolescents and adults regarding early acne management contributes to the rising use of antibiotic-based therapies.

Pharmaceutical companies are focusing on developing narrow-spectrum antibiotics to reduce adverse effects and resistance concerns. The expansion of tele-dermatology platforms is improving accessibility to prescription antibiotics, particularly in remote areas. As treatment personalization advances through microbiome-targeted research, antibiotics are expected to remain a mainstay in acne management strategies globally.

Route of Administration Analysis

Topical treatments hold 64.3% of the Acne Treatment market and are anticipated to maintain dominance due to their convenience, safety profile, and direct application on affected areas. The segment benefits from the growing demand for non-systemic therapies that minimize systemic side effects. Advancements in formulation technologies, such as microencapsulation and nanocarrier delivery systems, are enhancing drug absorption and reducing irritation.

The increasing availability of over-the-counter (OTC) topical solutions containing retinoids, benzoyl peroxide, and salicylic acid strengthens market accessibility. Consumers increasingly prefer topical gels and creams due to their affordability and ease of use in daily skincare routines. Pharmaceutical and cosmetic brands are launching combination topical therapies that target multiple acne pathways simultaneously.

Growing acceptance of dermatologist-recommended topical products in online and retail channels is accelerating adoption. The rising prevalence of mild-to-moderate acne among adults and adolescents supports sustained demand. As personalized skincare gains traction, topical treatments are expected to remain the first-line approach in acne management.

Age Group Analysis

The 18 to 44 years age group holds 53.8% of the Acne Treatment market and is projected to remain dominant due to the high prevalence of acne among young adults and working professionals. Hormonal fluctuations, stress, and lifestyle factors significantly contribute to acne occurrence within this demographic. The increasing focus on appearance and skin health among millennials and Gen Z fuels consistent product demand.

The surge in social media influence and marketing by skincare brands enhances product awareness and adoption. Rising disposable incomes and willingness to invest in premium dermatological products support sustained market growth. The growing use of cosmetics and exposure to pollution further contribute to acne incidence.

Dermatology clinics and online platforms offer personalized regimens targeting adult acne, driving treatment accessibility. The expansion of direct-to-consumer skincare brands tailored for this age group strengthens the segment. As awareness about long-term skin health and preventive care rises, the 18 to 44 years demographic remains a critical growth driver for the global acne treatment market.

Application Analysis

Medications dominate the Acne Treatment market with a 71.9% share and are expected to sustain growth due to continuous advancements in pharmacological formulations and personalized treatment approaches. The segment benefits from the broad therapeutic range covering antibiotics, retinoids, and hormonal agents. The increasing prevalence of moderate-to-severe acne cases requires prescription medications for effective management.

Pharmaceutical companies are developing new-generation molecules with reduced irritation potential and improved stability. The availability of both topical and oral prescription options allows tailored therapy based on acne severity. The global expansion of dermatology research programs focused on anti-inflammatory and antimicrobial drug discovery accelerates innovation.

Growing collaborations between dermatologists and pharmaceutical firms enhance clinical awareness and accessibility to advanced treatments. The introduction of combination medications that reduce the need for multiple products increases adherence. As the demand for evidence-based and dermatologist-approved acne care rises, the medication segment is projected to continue leading the market through enhanced efficacy and patient-centric product design.

Distribution Channel Analysis

Retail & online pharmacies account for 67.4% of the Acne Treatment market and are likely to dominate due to increased accessibility, affordability, and convenience for consumers. The rapid expansion of e-commerce platforms offering dermatologist-recommended and OTC acne solutions drives growth. Consumers increasingly rely on digital retail channels for discreet purchasing and access to a wider range of products. Subscription-based online pharmacy models offering recurring deliveries for acne medication enhance treatment continuity.

Retail pharmacies maintain dominance in offline sales through partnerships with dermatologists and promotional campaigns. Growing internet penetration and digital health awareness have significantly improved patient engagement and self-management of skin conditions. Online reviews and product comparisons influence consumer purchasing behavior, boosting digital sales.

Major pharmaceutical companies are leveraging omnichannel strategies to strengthen brand visibility across retail and online networks. As digital healthcare ecosystems mature and logistics improve, retail and online pharmacies are expected to remain the preferred distribution channel for acne treatment products.

End-User Analysis

Dermatology clinics hold 59.8% of the Acne Treatment market and are projected to continue leading as key providers of specialized acne management and advanced skin care procedures. The growing preference for professional consultations and customized treatment regimens enhances clinic-based care demand. Clinics offer a combination of pharmaceutical therapy and aesthetic treatments such as chemical peels, laser therapy, and light-based acne management.

The increasing prevalence of adult and hormonal acne among urban populations contributes to clinic visits. Rising consumer willingness to invest in premium dermatologist-supervised treatments supports segment growth. Clinics are expanding service portfolios by integrating AI-driven diagnostic tools and digital skin analysis systems. Collaboration between dermatologists and pharmaceutical brands improves access to the latest therapies and devices.

Growing awareness of post-acne scarring prevention and cosmetic correction boosts repeat visits. The expansion of multi-specialty dermatology chains in emerging economies increases treatment accessibility. As personalized dermatological care continues to advance, dermatology clinics remain central to delivering effective, evidence-based acne management solutions.

Key Market Segments

By Product Type

- Antibiotics

- Isoretinoin

- Retinoids

- Others

By Route of Administration

- Topical

- Oral

By Age Group

- 18 to 44 years

- 45 to 64 years

- 10 to 17 years

- 65 years & above

By Application

- Medications

- Therapeutic Devices

By Distribution Channel

- Retail & Online Pharmacies

- Hospital Pharmacies

By End-User

- MedSpa

- Dermatology Clinics

Drivers

Rising Global Prevalence of Acne is Driving the Market

The expanding global prevalence of acne has considerably expanded the acne treatment market, as heightened awareness and access to care fuel demand for effective topical and systemic interventions. Acne vulgaris, primarily affecting adolescents and young adults, manifests through comedones and inflammatory lesions, necessitating multifaceted approaches to manage sebum overproduction and bacterial colonization. This driver is amplified by urbanization and dietary changes, which exacerbate hormonal imbalances, prompting consumers to seek dermatological consultations and over-the-counter remedies.

Pharmaceutical firms are responding with broader portfolios, including retinoids and benzoyl peroxide formulations, to address varying severities. The condition’s psychological toll further incentivizes early treatment, integrating behavioral support with pharmacological options. Health campaigns worldwide emphasize its treatability, encouraging self-care routines that sustain market growth.

The Pierre Fabre Laboratories study, published in the Journal of the American Academy of Dermatology in February 2024, revealed a global prevalence of 20.5% for acne, reaching 28.3% among adolescents and young adults aged 16 to 24 years. This statistic illustrates the widespread need, as treatments alleviate scarring and emotional distress through consistent application.

Developments in gentle exfoliants improve tolerability, catering to sensitive skin types. From an economic standpoint, accessible therapies reduce long-term healthcare burdens, warranting investments in distribution networks. Regional alliances standardize care guidelines, facilitating equitable product availability.

This prevalence surge not only elevates therapeutic consumption but also fortifies the market’s alignment with preventive dermatology. In conclusion, it stimulates innovations in combination regimens, synchronizing treatments with lifestyle modifications.

Restraints

Adverse Effects of Conventional Treatments is Restraining the Market

The occurrence of adverse reactions from standard acne therapies continues to curtail market penetration, as patients experience irritation and dryness that lead to discontinuation. Topical retinoids and oral isotretinoin, while potent, often induce erythema and photosensitivity, deterring adherence among those with mild cases. This constraint is compounded by antibiotic resistance concerns, limiting systemic options and prompting cautious prescribing.

Coverage limitations exacerbate the issue, with out-of-pocket expenses for specialized creams straining budgets in low-income groups. Developers face extended safety profiling, diverting funds from efficacy enhancements to mitigation studies. The resulting hesitancy perpetuates untreated cases, inflating indirect societal costs. A patient study in the Journal of International Medical Research, published in November 2022, found that over 45% of acne patients discontinued treatment prematurely due to unresponsiveness and side effects.

This rate underscores compliance barriers, as reactions undermine trust in pharmacological solutions. Physician recommendations shift toward monitoring, favoring observation over aggressive regimens. Efforts to formulate hypoallergenic variants progress steadily, limited by formulation complexities. These side effect challenges not only hamper utilization but also erode the market’s reliability perception. Therefore, they necessitate patient education to reconcile benefits with tolerable profiles.

Opportunities

Proliferation of Over-the-Counter Remedies is Creating Growth Opportunities

The surge in over-the-counter acne products has generated considerable expansion potentials for the market, offering affordable, accessible alternatives that empower self-management without prescriptions. These remedies, featuring salicylic acid and tea tree oil, target mild lesions through daily routines, appealing to cost-conscious consumers. Opportunities emerge in e-commerce integrations, where virtual consultations pair OTC selections with personalized advice.

Brand collaborations subsidize ingredient innovations, addressing natural preferences in eco-aware demographics. This accessibility counters prescription delays, establishing OTC as gateways to advanced care. Allocations for retail expansions accelerate shelf placements, varying to inclusive formulations for diverse skin tones. Formulations with non-comedogenic bases enhance compatibility, alleviating application barriers.

As digital platforms evolve, OTC analytics yield trend-based revenues. These retail advancements not only diversify consumer options but also embed the market into everyday wellness practices. Thus, they promote synergies with telehealth, strengthening outreach in remote locales.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic pressures, including persistent inflation and volatile disposable incomes, constrain consumer spending on premium acne treatments, compelling manufacturers to elevate prices and prompting shoppers to favor cost-effective generics over innovative formulations. Geopolitical tensions exacerbate these challenges by disrupting global supply chains for essential active ingredients, resulting in production delays and heightened costs that ripple through the industry.

Current US tariffs, imposing up to 10% on imports from key suppliers like China and South Korea, inflate expenses for imported acne creams and serums, potentially eroding profit margins and deterring small brands from market entry. However, these economic headwinds inadvertently accelerate demand for domestically produced alternatives, fostering innovation in US-based retinoid and topical therapies that prioritize affordability and efficacy.

Furthermore, heightened consumer awareness of skin health amid these shifts drives sustained investment in preventive skincare regimens, bolstering overall market resilience.

Latest Trends

Shift Toward Microbiome-Targeted Therapies is a Recent Trend

The emergence of microbiome-modulating interventions has signaled a transformative direction in acne treatment during 2024, harnessing probiotics to restore skin barrier equilibrium and suppress pathogenic Cutibacterium acnes overgrowth. These therapies, incorporating Lactobacillus strains, foster commensal diversity, mitigating inflammation without disrupting beneficial flora. This orientation represents an evolution beyond antibiotics, supporting sustained remission through topical or oral delivery.

Certification processes affirm their safety, accelerating clinical trials for combination regimens. This modulation complements existing topicals, interfacing with microbial sequencing for tailored prescriptions. The approach resolves dysbiosis root causes, favoring live biotherapeutics adaptable to individual microbiomes. A study in Frontiers in Medicine (Lausanne) in 2024 demonstrated Lactobacillus plantarum MH-301 as an effective adjuvant to isotretinoin, improving acne outcomes in a randomized trial.

These results emphasize therapeutic viability, as adjuncts align with systemic standards. Forecasters envision guideline inclusions, amplifying its priority in holistic protocols. Progressive analyses reveal efficacy boosts, refining strategic evaluations. The future anticipates phage integrations, envisioning strain-specific suppressions. This microbial pivot not only elevates treatment specificity but also coordinates with ecological dermatology principles.

Regional Analysis

North America is leading the Acne Treatment Market

In 2024, North America accounted for 44.7% of the global acne treatment market, experiencing notable expansion driven by heightened awareness campaigns from the American Academy of Dermatology that promoted early intervention for moderate-to-severe cases, leading to increased prescriptions for topical retinoids and oral isotretinoin in adolescents aged 12-19, where hormonal fluctuations exacerbate inflammatory lesions.

Dermatologists increasingly adopted combination therapies like benzoyl peroxide with adapalene to combat antibiotic resistance, achieving clearance rates up to 70% in clinical settings, while FDA approvals for novel formulations such as clascoterone cream in 2020 continued to influence 2024 utilization amid rising adult female cases linked to stress and cosmetics.

The National Institutes of Health’s research on acne’s psychosocial impacts supported expanded access through tele-dermatology platforms, correlating with federal funding for underserved communities, where self-esteem issues affect 25% of sufferers. These factors underscored the region’s emphasis on multifaceted, accessible dermatological solutions.

The American Academy of Dermatology estimates that acne affects 50 million Americans annually, with over 85% of individuals aged 12-24 experiencing it, based on data persisting from 2022 surveys.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The market in Asia Pacific is projected to expand during the forecast period, as governments intensify public awareness drives to address adolescent acne burdens in densely populated nations through subsidized topical therapies. Officials in Australia and Japan invest in retinoid formulations, outfitting community pharmacies to treat inflammatory lesions in school-aged children from high-stress environments.

Pharmaceutical companies collaborate with regional health bodies to refine benzoyl peroxide combinations, anticipating improved outcomes for adult female cases in urban professional cohorts. Regulatory agencies in India and Indonesia endorse oral isotretinoin protocols, positioning rural clinics to manage severe nodules without urban referrals.

National initiatives estimate integrating treatment data into digital health apps, facilitating adherence for hormonal acne in young women. Local dermatologists develop salicylic acid variants, aligning with WHO networks to monitor resistance patterns in tropical climates. These strategies cultivate a comprehensive ecosystem for dermatological care. The Australian Therapeutic Goods Administration approved Winlevi clascoterone cream 1% in 2024 for acne vulgaris in patients aged 12 and older.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the dermatological therapeutics sector drive expansion by launching combination topicals that pair retinoids with novel antibacterials, targeting resistant strains and reducing inflammation for faster lesion resolution. They cultivate e-commerce partnerships with tele-dermatology platforms to offer personalized regimens via AI skin analysis, broadening consumer reach beyond traditional channels. Companies invest in microbiome-modulating agents to restore skin barrier function, appealing to patients seeking non-antibiotic alternatives.

Executives pursue acquisitions of cosmeceutical brands to integrate LED devices and peels, creating holistic treatment ecosystems. They intensify marketing in Latin America and South Asia, leveraging influencer campaigns to educate on early intervention and secure market share. Additionally, they introduce subscription refill models with progress tracking apps, enhancing adherence and generating predictable recurring revenue.

Galderma S.A., founded in 1981 and headquartered in Lausanne, Switzerland, specializes in dermatology solutions, delivering prescription and aesthetic products for skin conditions worldwide. The company advances its Differin and Epiduo lines, combining adapalene with benzoyl peroxide to manage acne severity across adolescent and adult demographics. Galderma channels dedicated R&D into neurocosmetics and biologic pathways, prioritizing evidence-based formulations for long-term efficacy.

CEO Flemming Ørnskov leads a global enterprise operating in over 90 countries, emphasizing physician education and patient support programs. The firm collaborates with aesthetic clinics to bundle injectables with acne scar therapies, elevating comprehensive care. Galderma upholds its leadership by fusing scientific rigor with consumer-centric innovation to redefine skin health standards.

Top Key Players

- The BeautyHealth Company

- Skin Medica

- Skin Better Science

- Sente

- Revision Skincare

- Perricone MD

- PCA

- Obaji

- Jan Marini Skin Research

- Glow Biotics LLC

Recent Developments

- In April 2025, Douglas Pharmaceuticals launched Winlevi® (clascoterone cream 1%) in New Zealand following Medsafe approval. The product’s entry into a new market expands the availability of hormone-targeting topical treatments, addressing demand for safer, non-systemic acne therapies and driving market penetration across Oceania.

- In February 2025, Glenmark Pharmaceuticals and Cosmo Pharmaceuticals NV received MHRA approval for Winlevi in the UK. This regulatory milestone broadens access to novel topical anti-androgen therapy for acne vulgaris, reinforcing the shift toward prescription-strength creams with minimal side effects and boosting the global acne therapeutics segment.

Report Scope

Report Features Description Market Value (2024) US$ 10.6 Billion Forecast Revenue (2034) US$ 17.1 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Antibiotics, Isoretinoin, Retinoids, and Others), By Route of Administration (Topical and Oral), By Age Group (18 to 44 years, 45 to 64 years, 10 to 17 years, and 65 years & above), By Application (Medications and Therapeutic Devices), By Distribution Channel (Retail & Online Pharmacies and Hospital Pharmacies), By End-user (MedSpa and Dermatology Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The BeautyHealth Company, Skin Medica, Skin Better Science, Sente, Revision Skincare, Perricone MD, PCA, Obaji, Jan Marini Skin Research, Glow Biotics LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The BeautyHealth Company

- Skin Medica

- Skin Better Science

- Sente

- Revision Skincare

- Perricone MD

- PCA

- Obaji

- Jan Marini Skin Research

- Glow Biotics LLC