Global Accounts Receivable Automation Market By Component(Solution, Services), By Deployment Mode(Cloud-Based, On-Premise), By Organization Size(Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical(IT and Telecommunications, BFSI, Healthcare, Manufacturing, Retail and E-commerce, Energy and Utilities, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 128403

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Accounts Receivable Automation Market size is expected to be worth around USD 10.0 Billion By 2033, from USD 3.2 Billion in 2023, growing at a CAGR of 12.1% during the forecast period from 2024 to 2033. North America dominated the Accounts Receivable Automation Market in 2023, holding a 36.2% share with USD 1.15 billion in revenue.

Accounts Receivable Automation involves using software tools to manage and streamline the process of collecting payments from customers. This technology automates invoice processing, payment matching, and record-keeping tasks, significantly reducing manual effort and errors while improving the speed and accuracy of accounts receivable operations.

The Accounts Receivable Automation Market is experiencing significant growth driven by the increasing demand for efficiency in financial operations across various industries. Companies are keen to improve their cash flow and reduce days sales outstanding (DSO), which boosts the adoption of these automation solutions.

The market’s expansion is fueled by advancements in AI and machine learning, which enhance automation capabilities. Additionally, the growing integration of cloud-based solutions offers scalability and remote access, appealing to businesses of all sizes.

There is a considerable opportunity to develop integrated platforms that combine accounts receivable with other financial systems to provide holistic insights. Furthermore, expanding into emerging markets, where digital transformation is accelerating, presents a lucrative avenue for growth.

The Accounts Receivable Automation market is poised for substantial growth, underscored by the immense volume of unoptimized financial processes prevalent in businesses today. In the United States alone, companies are encumbered with approximately USD 3 trillion in outstanding accounts receivable, encapsulating about 24% of monthly income that remains unrealized due to trade credit inefficiencies. This substantial financial inertia presents a fertile ground for the integration of automation technologies.

Presently, the penetration of Robotic Process Automation (RPA) in financial reporting remains modest, with only 29% of chief accounting officers employing such technologies. This indicates a significant runway for growth in the adoption of automated systems. The strategic implementation of these technologies not only promises enhanced operational efficiencies but also positions firms to capitalize on the latent potential within their receivables, thus optimizing cash flows and financial health.

Over the next decade, more than half of C-level accounting executives anticipate a transformative impact on their operations due to automated accounting systems. The evolving landscape suggests a shift towards a more agile and precise financial management paradigm, driven by technological advancements.

As firms increasingly recognize the value proposition of automation in bolstering their financial operations against the backdrop of a dynamic economic environment, the Accounts Receivable Automation market is expected to witness robust expansion. This growth trajectory is further supported by the ongoing digital transformation initiatives across various sectors, seeking to harness the strategic benefits of automation to enhance competitiveness and operational resilience.

Key Takeaways

- The Global Accounts Receivable Automation Market size is expected to be worth around USD 10.0 Billion By 2033, from USD 3.2 Billion in 2023, growing at a CAGR of 12.1% during the forecast period from 2024 to 2033.

- In 2023, Solution held a dominant market position in the By Component segment of the Accounts Receivable Automation Market, capturing more than a 70.5% share.

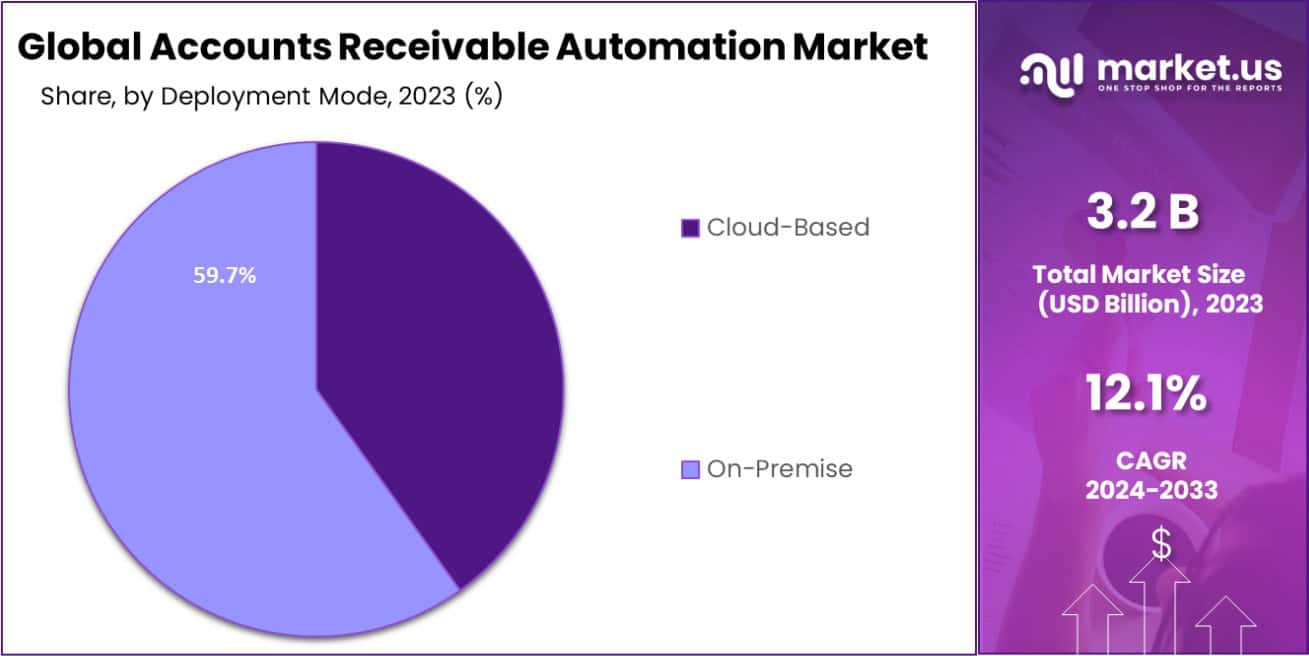

- In 2023, On-Premise held a dominant market position in the By Deployment Mode segment of the Accounts Receivable Automation Market, capturing more than a 59.7% share.

- In 2023, Large Enterprises held a dominant market position in the By Organization Size segment of the Accounts Receivable Automation Market, capturing more than a 67.3% share.

- In 2023, BFSI held a dominant market position in the By Industry Vertical of the Accounts Receivable Automation Market, capturing more than a 23.0% share.

- North America dominated a 36.2% market share in 2023 and held USD 1.15 Billion in revenue from the Accounts Receivable Automation Market.

By Component Analysis

In 2023, Solution held a dominant market position in the By Component segment of the Accounts Receivable Automation Market, capturing more than a 70.5% share. This significant market share is attributed to the increasing adoption of automated solutions by enterprises seeking to enhance their invoice management and cash flow processes.

Solutions in this segment typically include software platforms that integrate seamlessly with existing financial systems to automate tasks such as billing, credit management, and collections. This automation not only reduces the potential for human error but also significantly improves operational efficiency.

On the other hand, Services accounted for nearly 29.5% of the market share. This segment includes support, maintenance, and optimization services that are crucial for the deployment and effective functioning of automation solutions. The services component is essential for organizations that require technical expertise and ongoing support to adapt to evolving financial practices and regulatory requirements.

As businesses continue to recognize the benefits of full-scale automation, the demand for comprehensive services that ensure the reliability and scalability of automation solutions is expected to grow.

By Deployment Mode Analysis

In 2023, On-Premise held a dominant market position in the By Deployment Mode segment of the Accounts Receivable Automation Market, capturing more than a 59.7% share. This preference for on-premise solutions is primarily driven by larger organizations that prioritize data security and control over their financial operations.

On-premise systems allow companies to maintain full authority over their data and infrastructure, which is particularly important in industries subject to stringent compliance and regulatory standards. These systems are also favored for their capability to be customized to specific business needs, offering a tailored approach to automation.

Conversely, Cloud-Based solutions accounted for about 40.3% of the market. Despite holding a smaller share, the cloud-based segment is growing rapidly due to its cost-effectiveness and scalability. Small to medium-sized enterprises (SMEs) are increasingly adopting cloud-based accounts receivable automation solutions because they require lower upfront investments and offer greater flexibility.

The cloud model also facilitates remote access to financial data and tools, which is advantageous in today’s increasingly mobile and distributed work environments. As cloud security continues to advance, the adoption rate among enterprises is expected to increase, potentially shifting the market dynamics in the coming years.

By Organization Size Analysis

In 2023, Large Enterprises held a dominant market position in the By Organization Size segment of the Accounts Receivable Automation Market, capturing more than a 67.3% share. This substantial market presence is largely due to the complex financial processes and high volume of transactions handled by large organizations, which necessitate robust automation systems to manage accounts receivable efficiently.

Large enterprises often operate across multiple geographies, further compounding the intricacy of their financial operations and underscoring the need for comprehensive, scalable solutions that can streamline financial processes, enhance accuracy, and improve cash flow management.

On the other side, Small and Medium-Sized Enterprises (SMEs) accounted for approximately 32.7% of the market share. While smaller in comparison, the SME segment is witnessing rapid growth as these businesses increasingly recognize the benefits of automation in reducing operational costs and improving efficiency.

Automation tools for SMEs are becoming more accessible and affordable, encouraging their adoption even among businesses with limited budgets. As technology providers continue to tailor solutions for the specific needs of SMEs, including simplified deployment and user-friendly interfaces, the gap in adoption rates between large enterprises and SMEs is expected to narrow.

By Industry Vertical Analysis

In 2023, BFSI (Banking, Financial Services, and Insurance) held a dominant market position in the Industry Vertical of the Accounts Receivable Automation Market, capturing more than a 23.0% share. This dominance is primarily driven by the sector’s critical need for precise financial management and robust compliance with regulatory requirements.

Financial institutions are increasingly leveraging automation technologies to streamline their accounts receivable processes, enhance transaction accuracy, and reduce operational risks associated with manual handling. The adoption of these solutions in the BFSI sector helps improve cash flow management and customer satisfaction by accelerating invoice processing times and offering more reliable financial services.

Other key sectors in the market include IT and Telecommunications, Healthcare, Manufacturing, Retail and E-commerce, and Energy and Utilities, with each industry recognizing the benefits of automating financial operations. For instance, healthcare institutions are adopting these solutions to manage patient billings more efficiently, while retail businesses use them to handle large volumes of transactions more effectively.

As each sector continues to evolve, the demand for specialized accounts receivable automation solutions tailored to meet industry-specific requirements is expected to grow, further diversifying the market landscape.

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Healthcare

- Manufacturing

- Retail and E-commerce

- Energy and Utilities

- Other Industry Verticals

Drivers

Key Drivers of AR Automation

As an analyst observing the Accounts Receivable Automation market, it’s evident that several key drivers are fueling its growth. Primarily, businesses are looking to increase efficiency and reduce the time spent on manual tasks, which AR automation directly addresses by streamlining invoice processing and payment collections.

Additionally, the need for better cash flow management is critical for companies, especially in unpredictable economic times. AR automation provides real-time data and analytics, helping businesses make informed decisions quickly and improving their financial health.

Furthermore, as remote work becomes more common, the demand for cloud-based solutions that support decentralized teams is increasing, thus pushing the adoption of AR automation technologies. This market is set to expand as more businesses recognize the significant cost savings and productivity gains it offers.

Restraint

Challenges in AR Automation Adoption

As an analyst studying the Accounts Receivable Automation market, it’s clear that despite its benefits, there are notable restraints affecting its adoption. One major challenge is the high initial costs involved in implementing AR automation systems.

These costs can be prohibitive for small to medium enterprises (SMEs) that may not have the financial flexibility of larger corporations. Additionally, there’s often resistance to change from employees accustomed to traditional methods of managing receivables, which can slow down the transition to automated systems.

Another significant barrier is the concern over data security, especially as these systems handle sensitive financial information. Companies are wary of breaches that could compromise their data integrity and customer trust. These factors combined make it difficult for the AR automation market to penetrate deeper into potential industries.

Opportunities

Expanding AR Automation Market

As an analyst exploring the Accounts Receivable Automation market, it’s apparent that significant opportunities lie ahead. The integration of artificial intelligence (AI) and machine learning (ML) technologies presents a chance to enhance these systems further, enabling more sophisticated prediction capabilities for payment behaviors and cash flow trends.

This technological advancement can help businesses optimize their financial operations and improve decision-making processes. Additionally, the increasing global push towards digital transformation in financial operations offers a broad avenue for growth, particularly in regions that are transitioning from traditional financial practices to more modern, digital ones.

Moreover, the ongoing development of stricter regulatory compliance around financial transactions globally can spur the adoption of AR automation, as it ensures greater accuracy and auditability in financial records. These factors position the AR automation market for substantial expansion in the coming years.

Challenges

Hurdles in AR Automation Integration

As an analyst assessing the Accounts Receivable Automation market, one observes that despite its potential, the sector faces significant challenges. Primarily, the integration complexities associated with existing financial systems can deter many companies from adopting AR automation.

These systems often require substantial customization to align with specific business processes, adding both time and cost to implementation projects. Additionally, there is a notable skill gap in many organizations, with a lack of technical expertise to manage and maintain sophisticated automation tools effectively. This shortfall can lead to underutilization of the technology, reducing its potential benefits.

Furthermore, the apprehension about losing personal touch in customer interactions, which is crucial in managing receivables and maintaining client relationships, also poses a challenge. These challenges need addressing for the AR automation market to realize its full potential.

Growth Factors

Boosting AR Automation Adoption

As an analyst focused on the Accounts Receivable Automation market, it’s clear that several growth factors are driving its expansion. Increasing organizational demand for improved efficiency and accuracy in accounts receivable processes is a primary growth driver.

Companies are seeking to accelerate payment cycles and reduce days sales outstanding (DSO), which directly improves cash flow and operational efficiency. The growing adoption of cloud-based solutions is also a significant factor, as these platforms offer scalability, remote access, and lower upfront costs, making AR automation more accessible to a broader range of businesses.

Additionally, the surge in regulatory compliance requirements is pushing companies towards automation to ensure accuracy and transparency in financial transactions. These factors collectively contribute to the robust growth of the AR automation market, facilitating more streamlined, effective financial operations across industries.

Emerging Trends

Trends Shaping AR Automation

As an analyst observing the Accounts Receivable Automation market, several emerging trends are reshaping this landscape. The integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) is a standout trend, enabling more predictive analytics and risk assessment capabilities within AR processes.

These technologies help in forecasting payment behaviors and enhancing decision-making, thus reducing credit risk. There is also a noticeable shift towards mobile accessibility, with companies adopting mobile-compatible AR solutions that allow staff to manage and monitor invoicing and payments remotely, aligning with the growing trend of mobile workforces.

Moreover, the emphasis on real-time reporting capabilities is increasing, as businesses demand up-to-the-minute insights into their financial standing to make quicker, more informed decisions. These trends are crucial in driving the next phase of growth and efficiency in the AR automation space.

Regional Analysis

The Accounts Receivable Automation market is experiencing significant growth across various regions, with North America leading the charge. North America, holding a dominant 36.2% market share, is valued at USD 1.15 billion. This dominance is attributed to the early adoption of advanced technologies, a high concentration of market players, and the strong presence of large enterprises driving the demand for automation solutions.

Europe follows closely, with a substantial market share driven by the growing emphasis on financial process optimization and compliance with stringent regulatory frameworks. The Asia Pacific region is witnessing rapid growth, fueled by the increasing adoption of automation technologies in emerging economies like China and India, where businesses are looking to streamline their financial operations.

The Middle East & Africa region is also seeing gradual adoption, particularly in the UAE and Saudi Arabia, where digital transformation initiatives are gaining momentum. Latin America, while still in the early stages of adoption, is expected to grow steadily as more companies recognize the benefits of automating their accounts receivable processes. The overall market is poised for continued expansion, with regional variations reflecting the pace of technological adoption and economic development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Accounts Receivable Automation market is significantly influenced by key players such as SAP SE, Oracle Corporation, and The Sage Group plc, each contributing uniquely to the market’s dynamics.

SAP SE continues to solidify its position as a market leader by leveraging its extensive experience in enterprise software solutions. The company’s SAP S/4HANA Finance, a key product in its portfolio, integrates advanced automation features that streamline accounts receivable processes.

SAP’s strong focus on innovation, combined with its ability to cater to large-scale enterprises globally, ensures it remains at the forefront of the market. The company’s commitment to enhancing its cloud-based offerings is expected to drive further adoption, particularly in regions like North America and Europe, where digital transformation initiatives are accelerating.

Oracle Corporation is another major player shaping the Accounts Receivable Automation landscape. Oracle’s robust suite of financial management solutions, particularly its Oracle Fusion Cloud ERP, is designed to automate and optimize accounts receivable functions.

The company’s focus on AI and machine learning capabilities within its solutions sets it apart, offering clients predictive insights and enhanced decision-making tools. Oracle’s strong presence in the Asia Pacific region, coupled with its strategic partnerships, positions it well to capture a growing share of the market.

The Sage Group plc has carved out a niche by catering primarily to small and medium-sized enterprises (SMEs). Sage Intacct, its flagship product, is recognized for its ease of use and integration capabilities. The company’s emphasis on providing scalable, cloud-based solutions makes it an attractive choice for SMEs looking to automate their financial processes. As SMEs increasingly adopt digital tools, Sage is well-positioned to benefit from this trend, particularly in emerging markets.

Top Key Players in the Market

- SAP SE

- Oracle Corporation

- The Sage Group plc

- Workday, Inc.

- Intuit Inc.

- Xero Limited

- Zoho Corporation

- BlackLine Inc.

- HighRadius Corporation

- Fiserv, Inc.

- Zuora, Inc.

- Quadient

- Other Key Players

Recent Developments

- In August 2023, Workday launched an AI-powered automation tool to simplify accounts receivable, enhancing speed by 30% and reducing errors by 20%.

- In July 2023, Intuit secured $150 million in funding to expand its accounts receivable automation software, boosting user adoption by 40% within months.

- In June 2023, Xero introduced a new feature that automates invoice reminders, cutting manual work by 25% and improving payment times by 15%.

Report Scope

Report Features Description Market Value (2023) USD 3.2 Billion Forecast Revenue (2033) USD 10.0 Billion CAGR (2024-2033) 12.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component(Solution, Services), By Deployment Mode(Cloud-Based, On-Premise), By Organization Size(Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical(IT and Telecommunications, BFSI, Healthcare, Manufacturing, Retail and E-commerce, Energy and Utilities, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAP SE, Oracle Corporation, The Sage Group plc, Workday, Inc., Intuit Inc., Xero Limited, Zoho Corporation, BlackLine Inc., HighRadius Corporation, Fiserv, Inc., Zuora, Inc., Quadient, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Accounts Receivable Automation MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Accounts Receivable Automation MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP SE

- Oracle Corporation

- The Sage Group plc

- Workday, Inc.

- Intuit Inc.

- Xero Limited

- Zoho Corporation

- BlackLine Inc.

- HighRadius Corporation

- Fiserv, Inc.

- Zuora, Inc.

- Quadient

- Other Key Players