Absorbable Nerve Conduits Market By Product Type (5 mm, 5–10 mm, and >10 mm), By Delivery Method (Open Surgery, Endoscopic Surgery, and Microscopic Surgery), By Application (Peripheral Nerve Repair and Cranial Nerve Repair), By Regeneration Mechanism (Neurotrophic Factors, Stem Cells, and Gene Therapy), By End-user (Hospitals, Clinics, and Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151433

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Delivery Method Analysis

- Application Analysis

- Regeneration Mechanism Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

The Absorbable Nerve Conduits Market size is expected to be worth around US$ 7.6 billion by 2034 from US$ 4.9 billion in 2024, growing at a CAGR of 4.5% during the forecast period 2025 to 2034.

Growing demand for innovative solutions in nerve repair and regeneration is driving the expansion of the absorbable nerve conduits market. These medical devices are designed to guide and support the regeneration of peripheral nerves after injury, offering significant advantages over traditional methods such as autografts, which may involve donor site morbidity and complications.

Absorbable nerve conduits gradually degrade in the body, eliminating the need for removal after nerve regeneration, making them an attractive option for patients and healthcare providers alike. The market is experiencing significant growth due to the increasing prevalence of nerve injuries, particularly from trauma, surgery, and certain chronic conditions like diabetes.

Advances in biomaterials, such as those made from natural or synthetic polymers, are enhancing the functionality of these conduits, allowing for more effective and customized treatments. The rise in the number of clinical trials focusing on nerve repair therapies further propels market growth, as does the increasing interest in regenerative medicine.

In September 2024, NervGen Pharma Corp, a clinical-stage biotechnology company, announced its participation at the 63rd International Spinal Cord Society (ISCoS) Annual Scientific Meeting in Antwerp, Belgium. This highlights the growing focus on spinal cord injuries and nerve regeneration, areas where absorbable nerve conduits show great promise in advancing treatment options. The market continues to evolve with innovations aimed at improving the design and effectiveness of nerve conduits, creating significant opportunities for growth in nerve repair therapies.

Key Takeaways

- In 2024, the market for absorbable nerve conduits generated a revenue of US$ 4.9 billion, with a CAGR of 4.5%, and is expected to reach US$ 7.6 billion by the year 2034.

- The product type segment is divided into 5 mm, 5–10 mm, and >10 mm, with 5 mm taking the lead in 2023 with a market share of 39.7%.

- Considering delivery method, the market is divided into open surgery, endoscopic surgery, and microscopic surgery. Among these, open surgery held a significant share of 48.5%.

- Furthermore, concerning the application segment, the market is segregated into peripheral nerve repair and cranial nerve repair. The peripheral nerve repair sector stands out as the dominant player, holding the largest revenue share of 63.5% in the absorbable nerve conduits market.

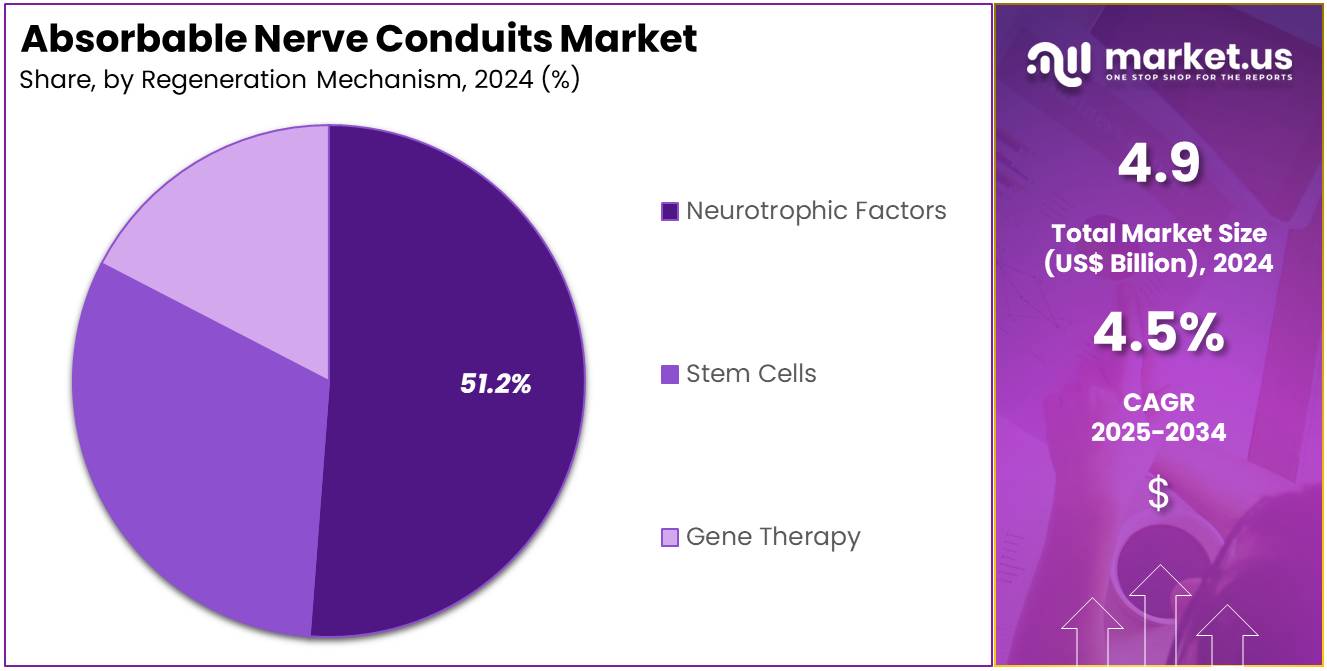

- The regeneration mechanism segment is segregated into neurotrophic factors, stem cells, and gene therapy, with the neurotrophic factors segment leading the market, holding a revenue share of 51.2%.

- Considering end-user, the market is divided into hospitals, clinics, and research institutes. Among these, hospitals held a significant share of 56.7%.

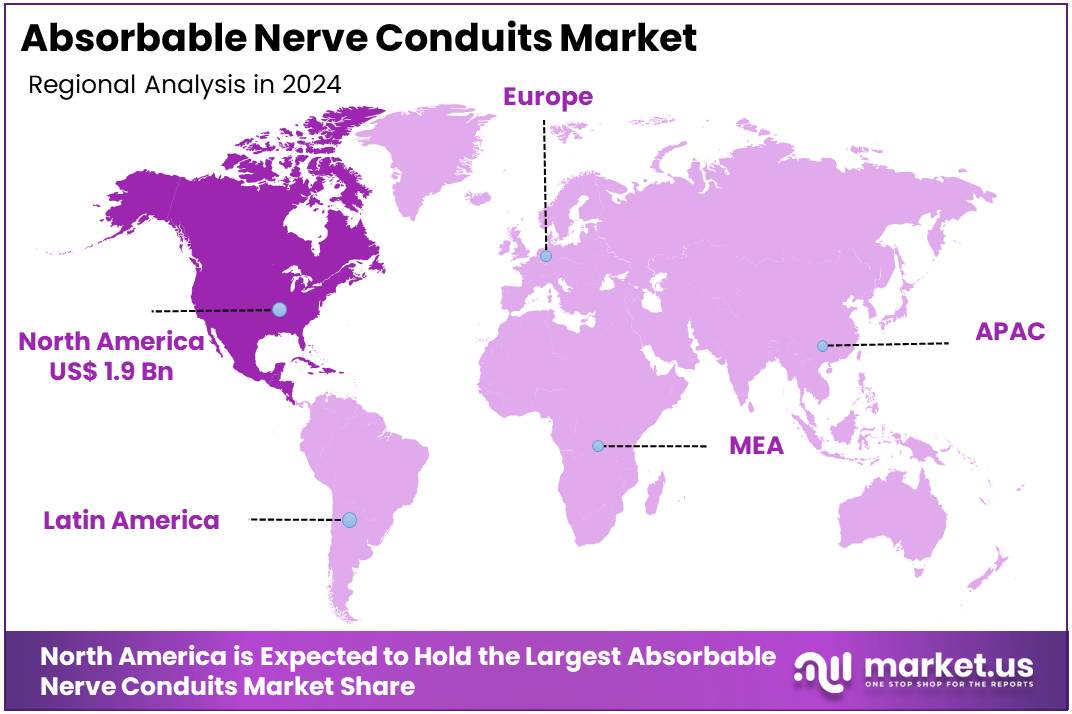

- North America led the market by securing a market share of 38.5% in 2023.

Product Type Analysis

The 5 mm segment is expected to dominate the absorbable nerve conduits market, accounting for 39.7% of the share. The growth of this segment is largely attributed to its widespread use in small nerve repair, especially in cases involving minor peripheral nerve injuries. The 5 mm conduits are anticipated to see continued demand due to their optimal size for small nerve gaps that require effective healing and regeneration.

Their use is expected to rise as healthcare providers increasingly focus on providing more precise treatments for nerve injuries. Additionally, advancements in materials and bioengineering are expected to enhance the effectiveness of 5 mm nerve conduits, further fueling their growth in the market. As the need for specialized nerve repair devices rises, this segment is likely to expand significantly.

Delivery Method Analysis

Open surgery remains the dominant delivery method for nerve conduit implantation, holding 48.5% of the market share. This method is expected to continue its market leadership due to its proven effectiveness in treating a wide range of peripheral nerve injuries. Open surgery allows for direct access to the injured nerve and greater control over the repair process, which is critical in more complex nerve reconstructions.

As the global prevalence of nerve injuries rises, particularly in trauma and accident-related cases, the demand for open surgery procedures is likely to increase. The ongoing advancements in surgical techniques and the growing availability of absorbable nerve conduits that support nerve regeneration are projected to contribute to the sustained growth of this segment.

Application Analysis

Peripheral nerve repair is projected to be the largest application in the absorbable nerve conduits market, comprising 63.5% of the market share. The need for effective solutions in treating peripheral nerve injuries, which are more common due to trauma, surgery, or diseases, is expected to drive this segment’s growth.

The growing understanding of peripheral nerve regeneration and the development of new materials for nerve conduits are anticipated to improve treatment outcomes and reduce recovery time. Moreover, the increasing focus on improving the quality of life for patients with nerve injuries, particularly in the elderly population, will likely boost demand for peripheral nerve repair treatments. As medical advancements continue to enhance nerve regeneration techniques, this application is expected to remain the leading segment in the market.

Regeneration Mechanism Analysis

Neurotrophic factors are expected to be the dominant regeneration mechanism in the absorbable nerve conduits market, accounting for 51.2% of the share. The use of neurotrophic factors, which promote the survival, development, and function of neurons, has shown significant promise in accelerating nerve regeneration. This approach is anticipated to drive market growth, especially in cases of peripheral nerve damage where spontaneous regeneration is slow or incomplete.

The development of more effective neurotrophic factor-based therapies, combined with the increasing focus on cell-based regenerative medicine, is expected to expand the use of these factors in nerve repair. Additionally, as research progresses and clinical outcomes improve, neurotrophic factors are likely to play a pivotal role in advancing the treatment options for nerve injuries, further driving their dominance in the market.

End-User Analysis

Hospitals are projected to be the largest end-user in the absorbable nerve conduits market, holding 56.7% of the market share. The demand for nerve conduit implants in hospitals is expected to rise significantly due to their central role in treating complex and severe nerve injuries. Hospitals are well-equipped to handle the advanced surgical procedures required for nerve repair, making them the primary setting for procedures involving absorbable nerve conduits.

The growing number of trauma-related surgeries and an increasing elderly population susceptible to nerve injuries are expected to contribute to the continued dominance of hospitals in this market. As the healthcare infrastructure expands and more hospitals invest in advanced surgical technologies, the market share of hospital-based nerve repair procedures is projected to grow steadily.

Key Market Segments

By Product Type

- 5 mm

- 5–10 mm

- >10 mm

By Delivery Method

- Open Surgery

- Endoscopic Surgery

- Microscopic Surgery

By Application

- Peripheral Nerve Repair

- Cranial Nerve Repair

By Regeneration Mechanism

- Neurotrophic Factors

- Stem Cells

- Gene Therapy

By End-user

- Hospitals

- Clinics

- Research Institutes

Drivers

Rising Incidence of Peripheral Nerve Injuries is Driving the Market

The increasing global incidence of peripheral nerve injuries (PNIs) resulting from trauma, accidents, surgical complications, and various underlying conditions is a primary driver for the absorbable nerve conduits market. PNIs can lead to debilitating loss of motor, sensory, or autonomic function, necessitating surgical repair to facilitate nerve regeneration.

The National Center for Biotechnology Information (NCBI) published a review in Neural Regeneration Research in September 2024, highlighting that peripheral nerve injuries have an annual incidence of approximately 13 to 23 per 100,000 people globally, emphasizing the widespread occurrence of these injuries. This high incidence creates a consistent demand for effective nerve repair solutions, including conduits that guide regenerating axons across the injury gap and absorb harmlessly over time.

Restraints

Technical Limitations and Inferiority to Autografts for Larger Gaps are Restraining the Market

The absorbable nerve conduits market faces significant restraint due to the technical limitations of these devices and their often-inferior performance compared to autologous nerve grafts, particularly for repairing larger nerve defects. While nerve conduits offer advantages by avoiding donor site morbidity associated with autografts, their efficacy tends to decrease with increasing gap length, as they cannot provide the same comprehensive biological support or cellular components as a living nerve graft.

A 2023 review in Frontiers in Surgery noted that while synthetic nerve conduits are promising, autografts remain the gold standard for nerve gaps exceeding 3 cm due to superior functional outcomes. This limitation in performance for longer or more complex injuries restricts the broader application and market penetration of conduits, despite their convenience.

Opportunities

Advancements in Biomaterial Science and Bioactive Conduits Create Growth Opportunities

Ongoing advancements in biomaterial science and the development of bioactive absorbable nerve conduits present significant growth opportunities in the market. Researchers are integrating growth factors, stem cells, or neurotrophic factors into conduit designs to actively promote nerve regeneration and improve functional outcomes, aiming to bridge the performance gap with autografts. The National Institute of Biomedical Imaging and Bioengineering (NIBIB) at the NIH continues to fund research into advanced biomaterials for tissue regeneration, including nerve repair, indicating a strong governmental focus on this area.

For example, a 2024 publication in Acta Biomaterialia discussed novel electrospun nanofibers loaded with neurotrophic factors, showcasing how material science is enhancing conduit efficacy. These innovations are leading to the development of next-generation conduits with enhanced regenerative properties, expanding their utility and effectiveness for a wider range of nerve injuries.

Impact of Macroeconomic / Geopolitical Factors

Increased Adoption of Minimally Invasive Surgical Techniques is a Recent Trend

A prominent recent trend in the absorbable nerve conduits market is the increased adoption of minimally invasive surgical techniques for nerve repair. Minimally invasive approaches, which often involve smaller incisions and less tissue disruption, are becoming preferred due to benefits such as reduced patient recovery time, lower risk of infection, and decreased pain. The American Society for Surgery of the Hand (ASSH) has seen growing interest in endoscopic and minimally invasive techniques for peripheral nerve release and repair in recent years, as evidenced by educational sessions and publications in 2023-2024.

Absorbable nerve conduits, being pre-formed and easier to handle in confined surgical fields compared to traditional sutured repairs, are well-suited for these techniques. This trend drives demand for conduits that can be deployed effectively through smaller access points, enhancing surgical efficiency and patient comfort.

Latest Trends

Macroeconomic factors significantly influence the absorbable nerve conduits market, primarily through their impact on healthcare infrastructure investment, patient access to specialized surgical procedures, and R&D funding for medical devices. A robust global economy generally leads to increased investment in healthcare systems, including facilities and equipment for specialized surgeries, which supports the adoption of advanced nerve repair solutions.

Conversely, economic downturns or periods of high inflation can result in tighter healthcare budgets, potentially delaying hospital upgrades, limiting patient access to elective reconstructive surgeries, and impacting reimbursement policies for high-cost medical devices. The World Health Organization (WHO) reported in December 2024 that global health spending saw a real-terms decline in 2022, indicating potential future pressures on healthcare budgets.

Geopolitical stability and international trade relations are also crucial, as they affect the global supply chains for specialized biomaterials and manufacturing components used in absorbable nerve conduits. Disruptions caused by geopolitical tensions, such as those impacting global shipping routes in 2024, can lead to increased costs and delays in obtaining critical materials, affecting production and pricing. However, the essential need to restore function and improve the quality of life for individuals suffering from nerve injuries provides a fundamental demand for these devices, offering a degree of market resilience even amidst economic and political volatility.

Current U.S. tariff policies can significantly affect the absorbable nerve conduits market. These devices depend on specialized biomaterials and high-precision components, many of which are sourced internationally. As a result, tariffs on imported medical materials or finished devices can raise manufacturing costs. In 2023, U.S. imports of medical instruments and appliances reached USD 127.6 billion, according to the U.S. Census Bureau. This figure highlights the potential financial exposure of the sector. Increased tariffs may lead to higher prices, ultimately affecting affordability and accessibility for patients and providers.

These cost increases could pose challenges for hospitals, insurers, and patients. The American Hospital Association (AHA) warned in May 2025 that new tariffs may create “significant implications for healthcare.” This includes impacts on medical device availability and procurement budgets. If the cost of absorbable nerve conduits rises, healthcare systems may face reduced purchasing flexibility. As a result, patient access to these advanced therapeutic options could decline. Financial pressures on hospitals may also affect decisions around the adoption of newer, high-cost technologies.

However, tariffs may drive long-term benefits by encouraging domestic production. U.S.-based manufacturers could invest in local facilities to avoid import-related costs. This shift may reduce reliance on foreign suppliers and create a more stable supply chain. Although initial investments and regulatory compliance costs may rise, localized production enhances resilience. In the long run, domestic manufacturing of absorbable nerve conduits could support national health security. This policy-driven transition can foster innovation and prepare the industry for future supply chain disruptions.

Regional Analysis

North America is leading the Absorbable Nerve Conduits Market

North America dominated the market with the highest revenue share of 38.5% owing to the persistent high incidence of peripheral nerve injuries and continuous advancements in nerve repair techniques. While comprehensive, centralized government statistics for peripheral nerve injuries are challenging to precisely track year-over-year from 2022 to 2024 for the entire North American region, estimates suggest that peripheral nerve damage affects millions of people in the U.S. annually. This substantial patient population creates a consistent demand for effective repair solutions, including conduits.

Furthermore, the U.S. Food and Drug Administration (FDA) continues to review and provide clearances for various nerve repair devices, with a specific “Rebuilder nerve guidance conduit” receiving a K180222 clearance in 2024, indicating ongoing regulatory support for innovative products in this space.

Companies specializing in nerve regeneration products also show financial indicators of market expansion; for instance, Axogen, Inc., a key player in nerve repair, reported full-year 2023 revenues of US$ 159.01 million, an increase from US$ 141.0 million in 2022, and projected 2024 revenue between US$ 177 million and US$ 181 million, reflecting consistent growth in procedures and product adoption. These factors collectively indicate a robust and expanding market for nerve repair solutions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing awareness of peripheral nerve injuries, improving healthcare infrastructure, and rising investments in regenerative medicine and advanced surgical technologies. While precise, region-wide governmental statistics on peripheral nerve injury prevalence are not readily available for every Asia Pacific country for 2022-2024, studies from national health institutions indicate a considerable number of such cases due to trauma and other conditions.

For instance, in China, a significant increase in neurological illnesses, including peripheral nerve injuries, is recognized by the National Health Commission, contributing to the demand for effective regeneration treatments.

Governments across the region are also investing in biotechnology and advanced medical technologies; public research funding in biotech in China, encompassing regenerative medicine, is likely to have exceeded CNY 20 billion (approximately US$ 2.6 billion) in 2023.

This increased funding and supportive regulatory environments are anticipated to foster greater adoption of innovative nerve repair solutions. Furthermore, as surgical capabilities improve and a greater emphasis is placed on patient outcomes following nerve damage, the demand for sophisticated repair options is projected to rise throughout Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the absorbable nerve conduits market adopt multiple strategies to drive growth. They focus on broadening their product portfolios by developing innovative therapies and research tools aimed at nerve regeneration. Companies are investing in automation and high-throughput technologies to enhance scalability and reproducibility in drug discovery processes.

Collaborations with biotechnology firms, research institutions, and healthcare providers accelerate innovation and help integrate new therapies into clinical practice. Furthermore, companies aim to strengthen their market presence by establishing manufacturing facilities and distribution networks in key regions, ensuring the timely delivery of products to meet the increasing demand for nerve repair solutions.

Axogen, Inc., based in Alachua, Florida, is a leading player in the nerve repair market. The company specializes in developing technologies for peripheral nerve regeneration and repair. Axogen’s product line includes the Avance Nerve Graft, an off-the-shelf processed human nerve allograft that bridges severed peripheral nerves without requiring a second surgical site.

Other products, such as AxoGuard Nerve Connector, AxoGuard Nerve Protector, and AxoGuard Nerve Cap, are designed to support and protect damaged nerves during the repair process. Axogen’s solutions are widely used by healthcare providers across various medical fields, including plastic and reconstructive surgery, orthopedic and plastic hand surgery, and oral and maxillofacial surgery. The company’s commitment to innovation and quality has made it a key player in advancing nerve repair technologies.

Top Key Players in the Absorbable Nerve Conduits Market

- Polyganics BV

- Orthocell

- Neuraptive Therapeutics

- NeuraGen Therapeutics

- Medtronic plc

- Johnson Johnson

- Baxter Internation Inc

- Braun Melsungen AG

Recent Developments

- In October 2024, Orthocell, a leader in regenerative medicine, raised US$ 17 million to launch its FDA-approved product, Remplir, into the US market. Remplir is a collagen wrap designed for repairing peripheral nerve injuries, providing a compression-free environment and fostering an ideal microenvironment for healing.

- In September 2024, Neuraptive Therapeutics, a novel therapeutics and medical products company, announced that its product NTX-001 had received Breakthrough Therapy Designation. NTX-001 holds the potential to expedite development for patients with peripheral nerve injuries requiring repair.

Report Scope

Report Features Description Market Value (2024) US$ 4.9 billion Forecast Revenue (2034) US$ 7.6 billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (5 mm, 5–10 mm, and >10 mm), By Delivery Method (Open Surgery, Endoscopic Surgery, and Microscopic Surgery), By Application (Peripheral Nerve Repair and Cranial Nerve Repair), By Regeneration Mechanism (Neurotrophic Factors, Stem Cells, and Gene Therapy), By End-user (Hospitals, Clinics, and Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Polyganics BV, Orthocell, Neuraptive Therapeutics, NeuraGen Therapeutics, Medtronic plc, Johnson Johnson, Baxter Internation Inc, B. Braun Melsungen AG. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Absorbable Nerve Conduits MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Absorbable Nerve Conduits MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Polyganics BV

- Orthocell

- Neuraptive Therapeutics

- NeuraGen Therapeutics

- Medtronic plc

- Johnson Johnson

- Baxter Internation Inc

- Braun Melsungen AG