Global ABS Filament 3D Printing Material Market Size, Share, Growth Analysis By Material Type (Standard ABS Filament, ABS + Carbon Fiber, ABS + Glass Fiber, Others), By Application (Prototyping, Functional Parts & Manufacturing, Tooling & Fixtures, Education & Research, Consumer Goods, Others), By End-Use Industry (Automotive, Aerospace & Defense, Consumer Electronics, Healthcare & Medical Devices, Industrial Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176765

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

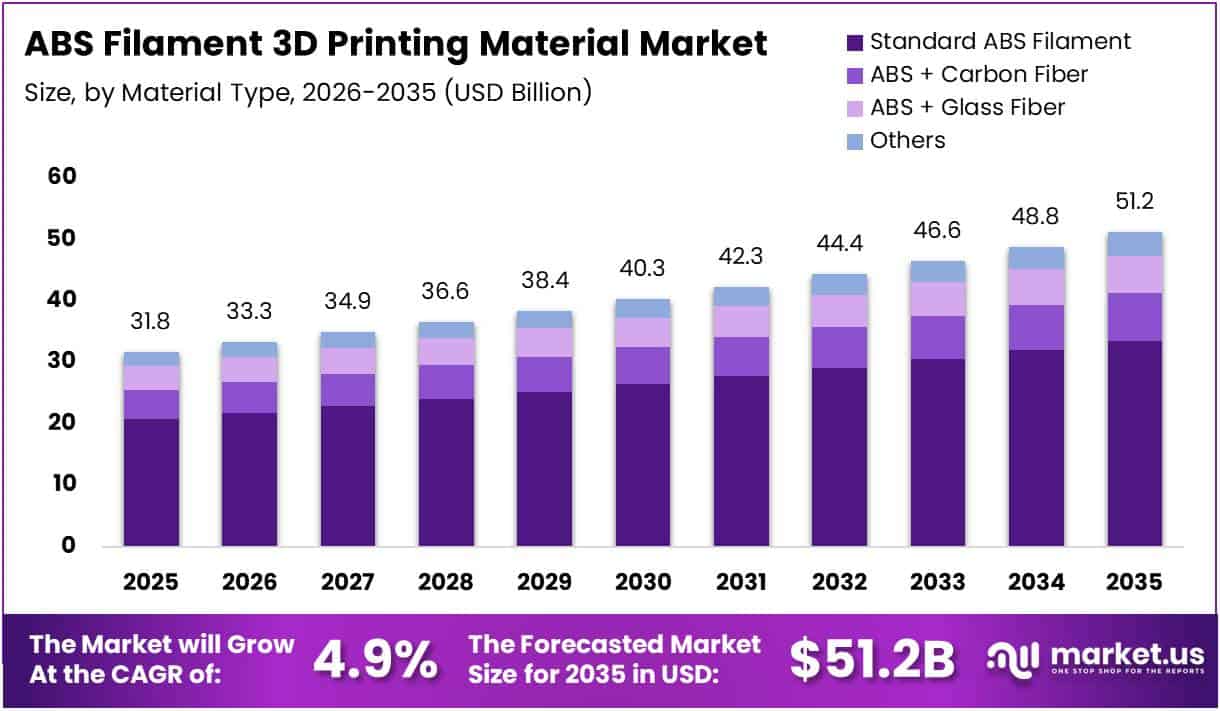

The Global ABS Filament 3D Printing Material Market size is expected to be worth around USD 51.2 Billion by 2035 from USD 31.75 Billion in 2025, growing at a CAGR of 4.9% during the forecast period 2026 to 2035.

ABS filament represents a thermoplastic polymer widely used in fused deposition modeling 3D printing applications. This material offers exceptional impact resistance, heat tolerance, and mechanical strength. Consequently, it serves as a preferred choice for creating durable prototypes and functional parts across various industries.

The market experiences robust growth driven by increasing adoption in automotive prototyping and industrial manufacturing. Moreover, desktop FDM printer installations continue expanding globally, creating substantial demand. ABS filament provides cost-effective solutions compared to high-performance engineering polymers, attracting budget-conscious manufacturers and educational institutions.

Industrial applications benefit from ABS material properties including dimensional stability and excellent layer adhesion. However, manufacturers increasingly address printing challenges such as warping and shrinkage through innovative formulations. Additionally, the development of modified ABS variants with reduced odor emission enhances workplace safety and user experience.

Government initiatives supporting additive manufacturing adoption accelerate market expansion across developed and emerging economies. Furthermore, regulatory frameworks promoting sustainable manufacturing practices encourage recycled ABS filament development. These policies create favorable conditions for market participants to invest in research and innovation.

According to Filamentive, ABS is used by about 21% of UK 3D printing respondents, demonstrating significant market penetration. According to ScienceDirect, neat ABS achieves optimal performance at a 0.20 mm layer thickness for FFF printing, while carbon fiber-reinforced ABS reaches best performance at 0.125 mm.

According to ResearchGate, ABS filament blended with 20% virgin material achieved a Young’s modulus of approximately 2329 MPa and UTS of approximately 40.82 MPa. These technical advancements validate the material’s reliability for demanding applications, supporting continued market growth through 2035.

Key Takeaways

- Global ABS Filament 3D Printing Material Market projected to reach USD 51.2 Billion by 2035 from USD 31.75 Billion in 2025 at 4.9% CAGR

- Standard ABS Filament dominates Material Type segment with 65.5% market share in 2025

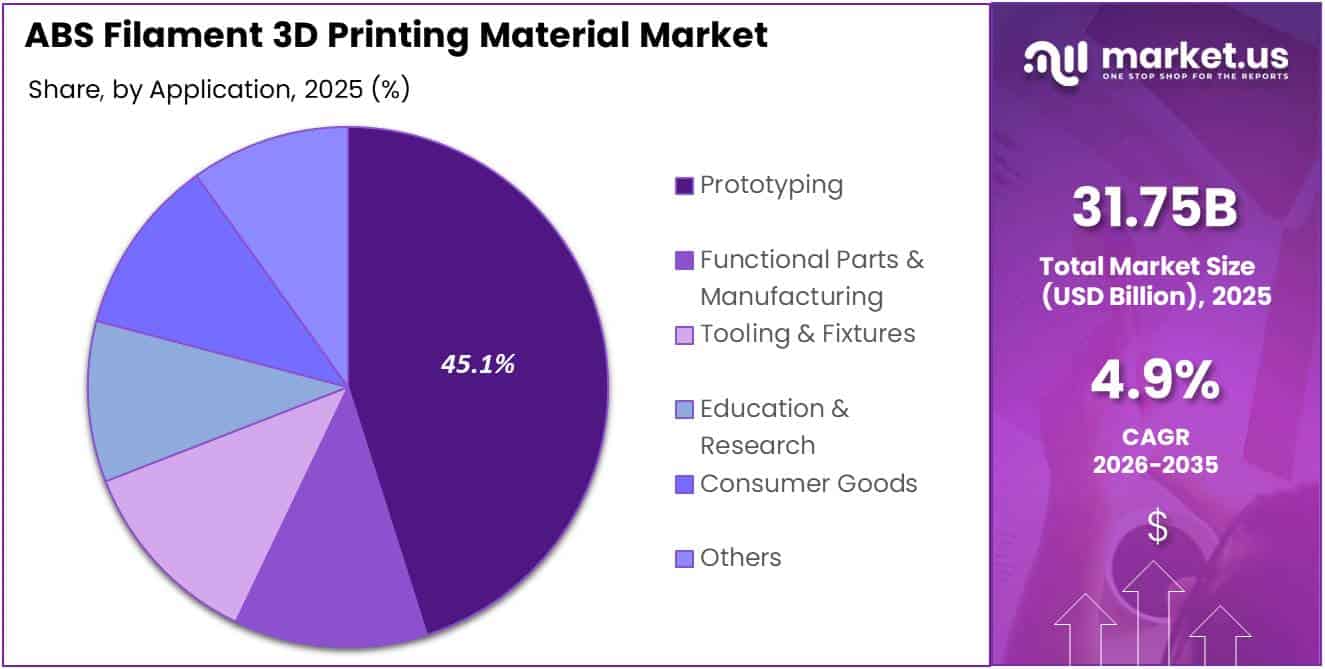

- Prototyping application leads with 45.1% share, driving widespread adoption across industries

- Automotive end-use industry holds 32.1% market share, demonstrating strong sector demand

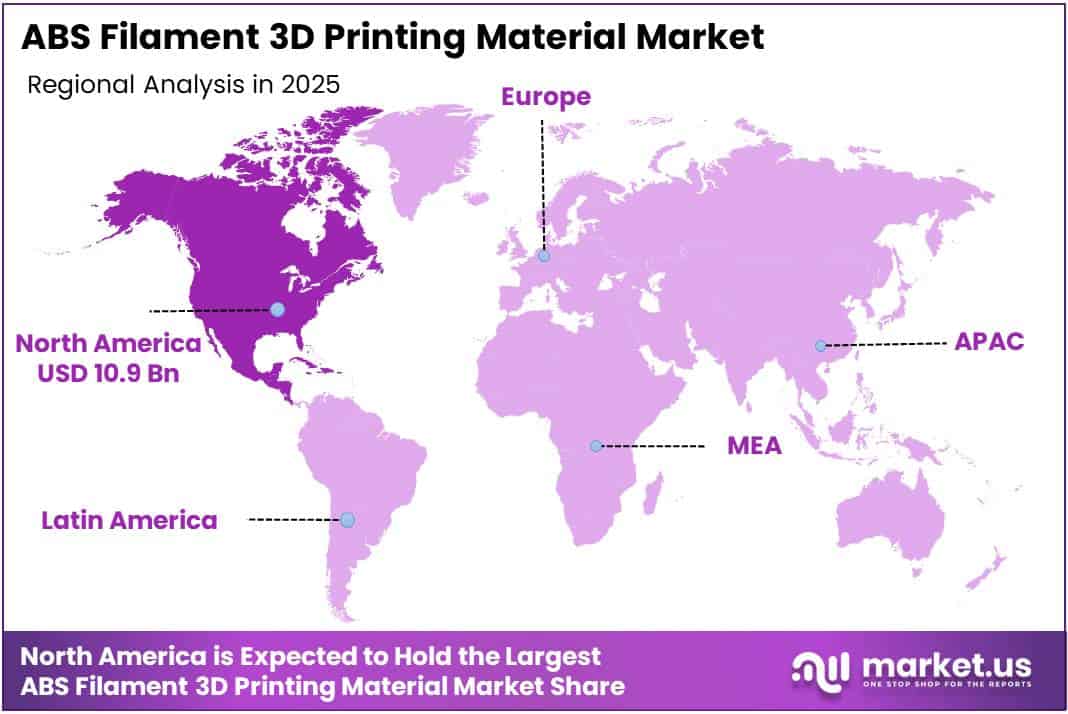

- North America dominates regional landscape with 35.9% share, valued at USD 10.9 Billion

Material Type Analysis

Standard ABS Filament dominates with 65.5% due to cost-effectiveness and broad compatibility with FDM printers.

In 2025, Standard ABS Filament held a dominant market position in the By Material Type segment of ABS Filament 3D Printing Material Market, with a 65.5% share. This material variant offers excellent balance between affordability and performance characteristics. Additionally, standard ABS demonstrates reliable printability across various desktop and professional 3D printing systems, making it accessible to diverse user segments.

ABS + Carbon Fiber represents an advanced composite material providing enhanced mechanical strength and stiffness properties. This variant serves specialized applications requiring superior tensile strength and reduced weight characteristics. Moreover, carbon fiber reinforcement enables manufacturers to produce lightweight yet durable functional components for aerospace and automotive sectors.

ABS + Glass Fiber combines traditional ABS properties with improved dimensional stability and heat resistance capabilities. This material addresses specific industrial requirements where standard ABS formulations prove insufficient. Furthermore, glass fiber addition reduces material shrinkage during cooling, minimizing warping issues and enabling larger print geometries with consistent quality.

Others category encompasses specialty ABS formulations including flame-retardant variants, electrically conductive blends, and custom-colored materials. These niche products serve specific industry regulations and application requirements. Additionally, innovative material developers continue introducing modified ABS composites targeting emerging market needs and specialized manufacturing challenges.

Application Analysis

Prototyping dominates with 45.1% due to rapid iteration requirements and ABS material versatility.

In 2025, Prototyping held a dominant market position in the By Application segment of ABS Filament 3D Printing Material Market, with a 45.1% share. This application benefits from ABS filament’s ability to create accurate design validation models quickly. Consequently, product development teams across industries rely on ABS for iterative testing and concept verification processes.

Functional Parts & Manufacturing represents growing adoption of ABS filament for producing end-use components and production tooling. This application segment leverages material durability and heat resistance for operational environments. Moreover, manufacturers increasingly replace traditional fabrication methods with additive manufacturing to reduce lead times and inventory costs.

Tooling & Fixtures utilizes ABS filament for creating custom jigs, fixtures, and manufacturing aids efficiently. This application enables rapid production of specialized tools without expensive machining processes. Additionally, ABS material properties withstand repeated use in assembly line environments, providing cost-effective solutions for industrial operations.

Education & Research leverages ABS filament for teaching additive manufacturing principles and conducting material science investigations. Academic institutions adopt this material for hands-on learning experiences and experimental research projects. Furthermore, affordable pricing and widespread availability make ABS accessible for educational budgets supporting STEM curriculum development.

Consumer Goods employs ABS filament for producing customized products, replacement parts, and small-batch manufacturing of retail items. This application serves makers, small businesses, and entrepreneurs creating unique market offerings. Moreover, material aesthetic capabilities enable attractive finished products suitable for direct consumer use and personalized merchandise production.

Others includes diverse applications such as architectural modeling, artistic creations, medical device prototyping, and hobbyist projects. These varied uses demonstrate ABS filament versatility across creative and technical domains. Additionally, emerging applications continue expanding as users discover innovative ways to leverage ABS material properties for unique problem-solving requirements.

End-Use Industry Analysis

Automotive dominates with 32.1% due to extensive prototyping needs and functional part production.

In 2025, Automotive held a dominant market position in the By End-Use Industry segment of ABS Filament 3D Printing Material Market, with a 32.1% share. This sector utilizes ABS filament for interior components, under-hood parts, and design verification models. Furthermore, automotive manufacturers leverage 3D printing to accelerate development cycles and customize low-volume production components.

Aerospace & Defense adopts ABS filament for lightweight tooling, cabin interior prototypes, and non-critical aircraft components. This industry demands materials combining mechanical strength with weight reduction capabilities. Additionally, aerospace applications benefit from ABS heat resistance and dimensional accuracy for producing functional test articles and assembly fixtures.

Consumer Electronics relies on ABS filament for creating device enclosures, housings, and protective cases with aesthetic finishes. This sector values material properties enabling complex geometries and smooth surface quality. Moreover, electronics manufacturers utilize ABS for rapid prototyping of new product designs and limited production runs before mass manufacturing investment.

Healthcare & Medical Devices utilizes ABS filament for producing anatomical models, surgical planning tools, and non-implantable medical device prototypes. This industry benefits from material biocompatibility for external applications and sterilization capability. Furthermore, healthcare professionals employ ABS-printed models for patient education, pre-surgical visualization, and custom medical equipment development supporting personalized treatment approaches.

Industrial Manufacturing adopts ABS filament for creating production tooling, assembly aids, and factory floor equipment across diverse manufacturing operations. This sector values material durability for repeated industrial use and chemical resistance properties. Additionally, on-demand production capabilities reduce tooling lead times and enable rapid response to changing manufacturing requirements and process improvements.

Others encompasses industries including construction, entertainment, marine, and agricultural sectors utilizing ABS for specialized applications. These diverse industries leverage material versatility for unique operational requirements and custom solutions. Moreover, expanding 3D printing awareness continues driving adoption across emerging industry segments discovering additive manufacturing benefits for their specific operational challenges.

Key Market Segments

By Material Type

- Standard ABS Filament

- ABS + Carbon Fiber

- ABS + Glass Fiber

- Others

By Application

- Prototyping

- Functional Parts & Manufacturing

- Tooling & Fixtures

- Education & Research

- Consumer Goods

- Others

By End-Use Industry

- Automotive

- Aerospace & Defense

- Consumer Electronics

- Healthcare & Medical Devices

- Industrial Manufacturing

- Others

Drivers

Rising Adoption of ABS Filament in Automotive Prototyping and Functional End-Use Parts Drives Market Growth

Automotive manufacturers increasingly adopt ABS filament for accelerated product development and cost reduction initiatives. This material enables rapid prototyping of design concepts and functional testing of components. Moreover, ABS heat resistance and impact durability meet automotive industry standards for interior parts and under-hood applications.

Industrial manufacturing sectors expand ABS filament usage for producing jigs, fixtures, and assembly line tooling efficiently. Traditional manufacturing methods require substantial lead times and capital investment for custom tooling. Consequently, additive manufacturing with ABS provides flexible, on-demand production capabilities that reduce operational costs and improve manufacturing agility.

Desktop and professional FDM printer installations continue expanding globally, creating substantial infrastructure supporting ABS filament consumption. Additionally, cost-effectiveness compared to high-performance engineering polymers makes ABS accessible to small manufacturers and educational institutions. Therefore, market penetration increases across diverse user segments seeking reliable 3D printing materials for various applications.

Restraints

Emission of Fumes and Odor During ABS Printing Creating Workplace Safety Concerns Limits Market Adoption

ABS filament releases styrene fumes and characteristic odor during high-temperature extrusion processes, raising workplace safety considerations. These emissions require adequate ventilation systems and enclosed printing environments for operator protection. Consequently, smaller facilities and home users face challenges implementing proper safety measures, limiting adoption potential.

Warping and shrinkage issues significantly affect print quality, particularly when using open-frame 3D printers without heated chambers. ABS material contracts during cooling, causing parts to detach from build platforms and creating dimensional inaccuracies. Moreover, large-format prints experience greater warping tendencies, restricting design possibilities and requiring additional post-processing efforts.

Organizations must invest in upgraded equipment featuring enclosed build chambers and controlled thermal environments for successful ABS printing. These infrastructure requirements increase overall implementation costs compared to materials like PLA with simpler printing parameters. Furthermore, technical expertise needed for optimizing ABS print settings creates barriers for inexperienced users entering additive manufacturing markets.

Growth Factors

Increasing Use of ABS Filament in Consumer Electronics Enclosures and Housings Accelerates Market Expansion

Consumer electronics manufacturers increasingly utilize ABS filament for producing device housings, protective cases, and component enclosures. This material provides excellent aesthetic finish capabilities and dimensional accuracy required for electronic products. Additionally, ABS impact resistance protects sensitive electronic components while maintaining lightweight characteristics essential for portable devices.

Development of low-odor and modified ABS formulations addresses workplace safety concerns and expands user accessibility. Material scientists create innovative polymer blends reducing styrene emissions during printing processes. Moreover, these enhanced formulations maintain traditional ABS mechanical properties while improving printing experience and environmental compatibility for broader market adoption.

Educational institutions and training centers adopt 3D printing technology for STEM education and vocational skill development programs. ABS filament serves as practical teaching material demonstrating additive manufacturing principles and engineering applications. Furthermore, growing investment in educational infrastructure and workforce development initiatives creates sustained demand for accessible, reliable 3D printing materials supporting technical education objectives.

Emerging Trends

Shift Toward High-Precision ABS Filaments Optimized for Professional-Grade Printing Reshapes Market Landscape

Manufacturers develop high-precision ABS filaments featuring consistent diameter tolerances and optimized flow characteristics for professional applications. These advanced materials enable reliable production of complex geometries with minimal printing failures. Moreover, tighter specification controls improve dimensional accuracy and surface finish quality, meeting stringent industrial manufacturing requirements for functional components.

Rising integration of ABS filament with enclosed and heated-chamber 3D printers enhances print reliability and expands design possibilities. Modern printer designs incorporate controlled thermal environments minimizing warping issues inherent to ABS materials. Consequently, users achieve better results with larger parts and complex geometries previously challenging with open-frame systems.

Growing focus on recyclable and environment-optimized ABS filament variants reflects increasing sustainability priorities across manufacturing sectors. Material developers explore recycled ABS blends maintaining mechanical performance while reducing environmental impact. Furthermore, circular economy initiatives encourage filament manufacturers to establish take-back programs and develop sustainable material formulations supporting corporate environmental responsibility objectives.

Regional Analysis

North America Dominates the ABS Filament 3D Printing Material Market with a Market Share of 35.9%, Valued at USD 10.9 Billion

North America leads global market adoption driven by extensive automotive and aerospace manufacturing presence. The region benefits from advanced additive manufacturing infrastructure and strong R&D investment. Moreover, 35.9% market share reflects widespread industrial adoption valued at USD 10.9 Billion, with United States representing primary contributor through established 3D printing ecosystem and technology innovation centers.

Europe ABS Filament 3D Printing Material Market Trends

Europe demonstrates robust growth through automotive industry concentration in Germany and manufacturing excellence across regional economies. This market benefits from government initiatives supporting Industry 4.0 adoption and sustainable manufacturing practices. Additionally, strong technical education infrastructure and research institutions drive innovation in additive manufacturing applications and material development initiatives.

Asia Pacific ABS Filament 3D Printing Material Market Trends

Asia Pacific experiences rapid expansion driven by manufacturing sector growth and increasing technology adoption in China, Japan, and India. The region benefits from cost-competitive production capabilities and growing middle-class consumer markets. Furthermore, government initiatives promoting advanced manufacturing technologies and substantial electronics industry presence create favorable conditions for market development and filament consumption growth.

Latin America ABS Filament 3D Printing Material Market Trends

Latin America shows emerging adoption patterns with Brazil and Mexico leading regional market development through automotive and manufacturing investments. This market faces challenges including economic volatility and infrastructure limitations affecting technology penetration. However, increasing awareness of additive manufacturing benefits and educational institution adoption support gradual market expansion across region.

Middle East & Africa ABS Filament 3D Printing Material Market Trends

Middle East & Africa represents developing market with adoption concentrated in GCC countries and South Africa through oil and gas sector applications. The region experiences gradual growth driven by economic diversification initiatives and technology investment in advanced manufacturing capabilities. Additionally, educational programs and government support for innovation ecosystems encourage emerging adoption of 3D printing technologies across various industrial applications.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Hatchbox 3D maintains strong market position through competitive pricing strategies and reliable filament quality targeting hobbyist and professional segments. The company offers diverse ABS formulations with consistent diameter specifications and broad color selections. Moreover, direct-to-consumer distribution channels and responsive customer support establish brand loyalty among desktop 3D printing communities worldwide.

Stratasys leads professional additive manufacturing solutions through advanced FDM systems and proprietary ABS materials optimized for industrial applications. The company provides high-performance filaments designed for enclosed printer environments ensuring dimensional accuracy and mechanical reliability. Additionally, comprehensive material certification programs and technical support services position Stratasys as preferred supplier for aerospace and automotive manufacturers.

Polymaker US differentiates through innovative ABS formulations addressing common printing challenges including warping and layer adhesion issues. The company develops specialty materials combining ABS with performance-enhancing additives for specific industrial applications. Furthermore, commitment to sustainable manufacturing practices and recycled material development attracts environmentally conscious customers seeking responsible material sourcing options.

Ultimaker delivers premium ABS filaments engineered for compatibility with professional 3D printing ecosystems and open-source platforms. The company emphasizes material consistency and reliability through rigorous quality control processes and transparent specification documentation. Moreover, strategic partnerships with industrial users and educational institutions expand market reach while gathering valuable feedback for continuous product improvement initiatives.

Key Players

- Hatchbox 3D

- Stratasys

- Polymaker US

- Ultimaker

- MatterHackers Inc.

- Shenzhen Esun

- Fillamentum

- Prusa Research a.s.

- SainSmart

- BASF Forward AM

- Gizmo Dorks

- Flashforge

- Mitsubishi Chemical

- Sunlu

- Overture 3D

- Other Key Players

Recent Developments

- In November 2025, Stratasys launched the ABS Fortus PLUS TrueRefill system, introducing innovative refill cartridge technology reducing material waste and operational costs. This development enhances sustainability while maintaining consistent print quality for industrial users requiring high-volume production capabilities with reliable material performance.

- In May 2025, 3DBGPRINT introduced a new product line of ABS filament specifically engineered for professional 3D printing applications. The launch features advanced formulations with improved layer adhesion and reduced warping characteristics, addressing common challenges faced by industrial manufacturers seeking consistent results in demanding production environments.

- In May 2025, Stratasys acquired key assets and operations of Forward AM Technologies GmbH, expanding material portfolio and strengthening market position. The strategic acquisition valued at undisclosed amount integrates BASF’s additive manufacturing expertise, enabling enhanced material development capabilities and broader customer access to advanced ABS formulations for industrial applications.

Report Scope

Report Features Description Market Value (2025) USD 31.75 Billion Forecast Revenue (2035) USD 51.2 Billion CAGR (2026-2035) 4.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Standard ABS Filament, ABS + Carbon Fiber, ABS + Glass Fiber, Others), By Application (Prototyping, Functional Parts & Manufacturing, Tooling & Fixtures, Education & Research, Consumer Goods, Others), By End-Use Industry (Automotive, Aerospace & Defense, Consumer Electronics, Healthcare & Medical Devices, Industrial Manufacturing, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Hatchbox 3D, Stratasys, Polymaker US, Ultimaker, MatterHackers Inc., Shenzhen Esun, Fillamentum, Prusa Research a.s., SainSmart, BASF Forward AM, Gizmo Dorks, Flashforge, Mitsubishi Chemical, Sunlu, Overture 3D, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  ABS Filament 3D Printing Material MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

ABS Filament 3D Printing Material MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Hatchbox 3D

- Stratasys

- Polymaker US

- Ultimaker

- MatterHackers Inc.

- Shenzhen Esun

- Fillamentum

- Prusa Research a.s.

- SainSmart

- BASF Forward AM

- Gizmo Dorks

- Flashforge

- Mitsubishi Chemical

- Sunlu

- Overture 3D

- Other Key Players