Global Abrasive Blasting Equipment Market By Product(Portable Blaster, Stationary Blaster), By Operation(Manual Operation, Semi-automatic Operation, Automatic Operation), By Blasting Type(Dry Blasting, Wet Blasting), By End-Use(Construction, Automotive, Marine, Oil & Gas, Metal Fabrication & Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: April 2024

- Report ID: 50392

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

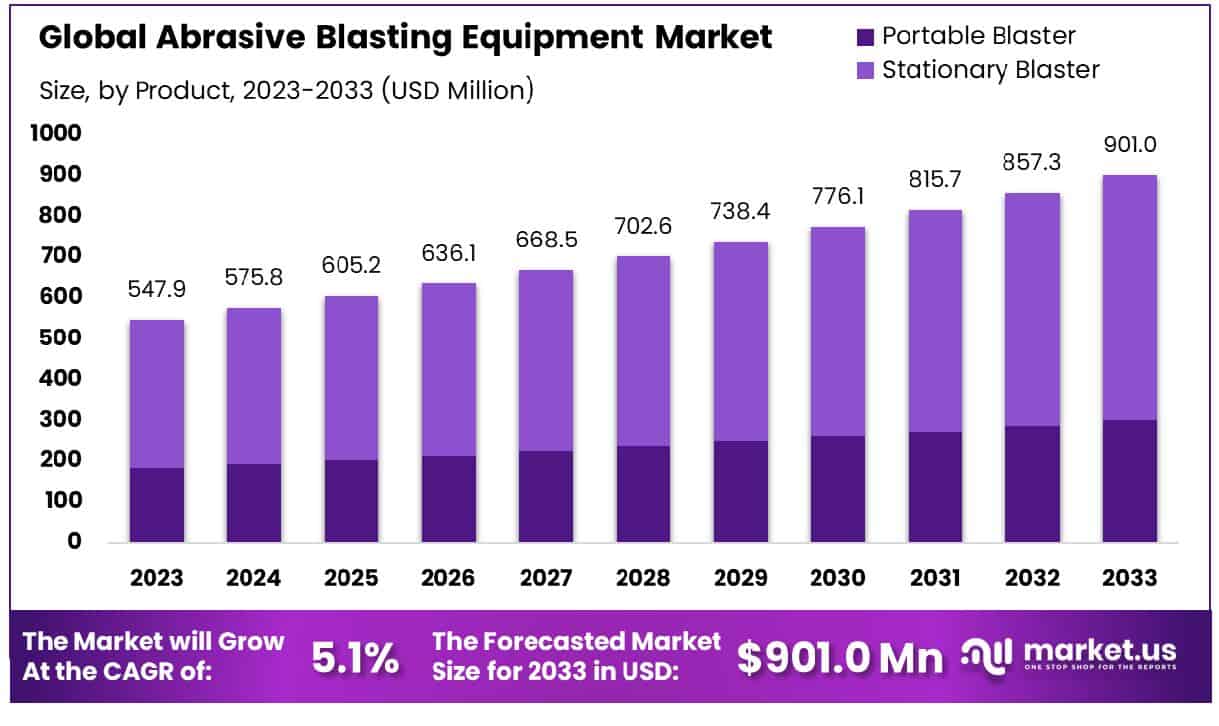

The Global Abrasive Blasting Equipment Market size is expected to be worth around USD 901.0 Million by 2033, From USD 547.9 Million by 2023, growing at a CAGR of 5.10% during the forecast period from 2024 to 2033.

The Abrasive Blasting Equipment Market encompasses a range of systems used for forcibly propelling a stream of abrasive material against a surface, typically for surface conditioning, cleaning, or preparation for coatings. This market caters to sectors including automotive, construction, metalworking, and aerospace, where precision and efficiency in surface preparation are crucial. Key components include blast cabinets, pots, and media recovery systems.

As industries seek more sustainable and efficient surface treatment solutions, advancements in automation and abrasive recycling technology continue to drive market growth. Strategic insights into this market are vital for leaders aiming to enhance operational outcomes and competitive positioning.

The abrasive blasting equipment market is experiencing a significant transformation driven by the evolving demands of home improvement and construction sectors. This market is strategically positioned to benefit from the increase in renovation activities, where homeowners aim to enhance both the aesthetic and functional aspects of their properties.

According to data from Architectural Digest, the impetus for home improvements varies: 30% of homeowners initiate projects to replace worn-out surfaces, finishes, and materials, while 20% focus on adding features to improve livability, and 16% undertake renovations for a fresh change. These motivations underline the critical role of durable and efficient abrasive blasting equipment in preparing surfaces for refinishing or painting.

Furthermore, the satisfaction derived from home improvements is significantly boosting homeowners’ happiness, leading to greater dwelling time within these spaces—84% of homeowners expressed a desire to spend more time in their renovated homes, with 69% experiencing increased enjoyment. This trend directly influences the demand for abrasive blasting equipment, as it is often essential for the successful commencement of these projects.

Financially, the return on investment (ROI) from these renovations is notable. Specific projects such as kitchen and bathroom renovations yield ROIs of 75% and 71%, respectively, showcasing the value added through substantial home improvements. Abrasive blasting plays a crucial role in these projects, particularly in the preparation stages, ensuring that surfaces are adequately prepared for high-quality finishes.

Moreover, the market for abrasive blasting equipment is further bolstered by the extensive use of these techniques in about 30% of all U.S. home improvements. Notably, exterior remodeling projects like new roofing and garage door installations, which provide a 100% ROI, frequently utilize abrasive blasting for surface preparation, highlighting its essential function in enhancing home value.

The increasing trend towards maintaining and upgrading residential spaces underscores a robust growth trajectory for the abrasive blasting equipment market, with an ongoing need for innovations and enhancements in equipment efficiency and effectiveness.

Key Takeaways

- Market Growth: The Global Abrasive Blasting Equipment Market size is expected to be worth around USD 901.0 Million by 2033, From USD 547.9 Million by 2023, growing at a CAGR of 5.10% during the forecast period from 2024 to 2033.

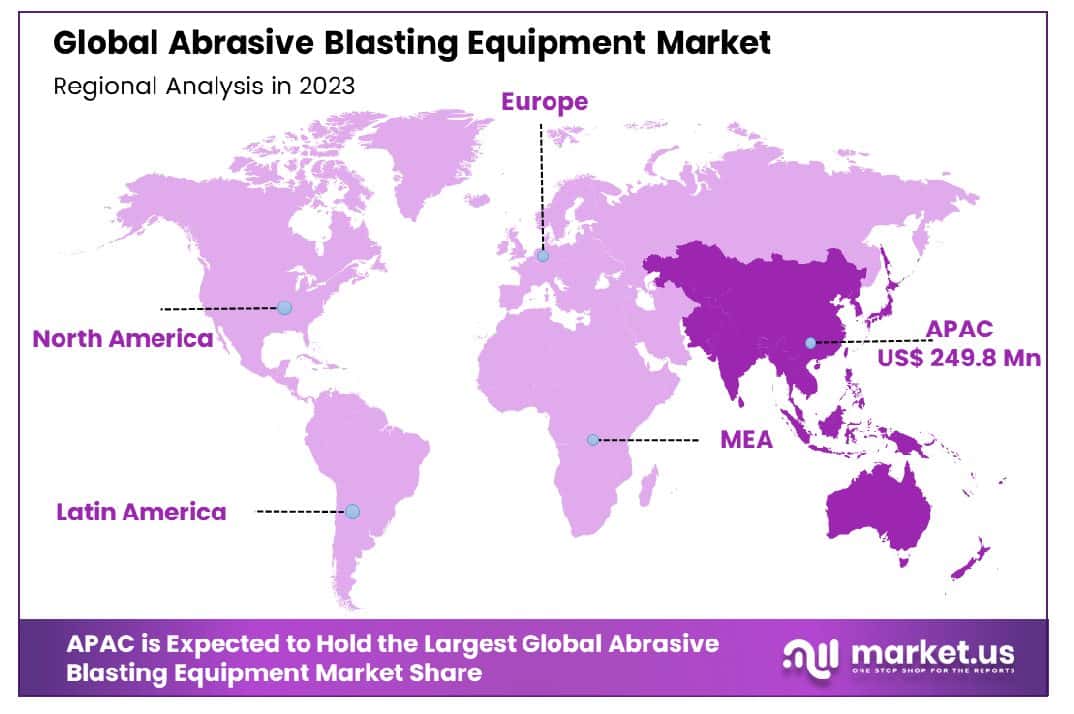

- Regional Dominance: Asia-Pacific dominates with 45.6% of the global Abrasive Blasting Equipment Market.

- Segmentation Insights:

- By Product: Stationary blasters dominate the market, holding a 64.3% share by product.

- By Operation: Automatic operation is preferred in 38.9% of cases, reflecting efficiency demands.

- By Blasting Type: Dry blasting leads with a 60.4% share, favored for its versatility.

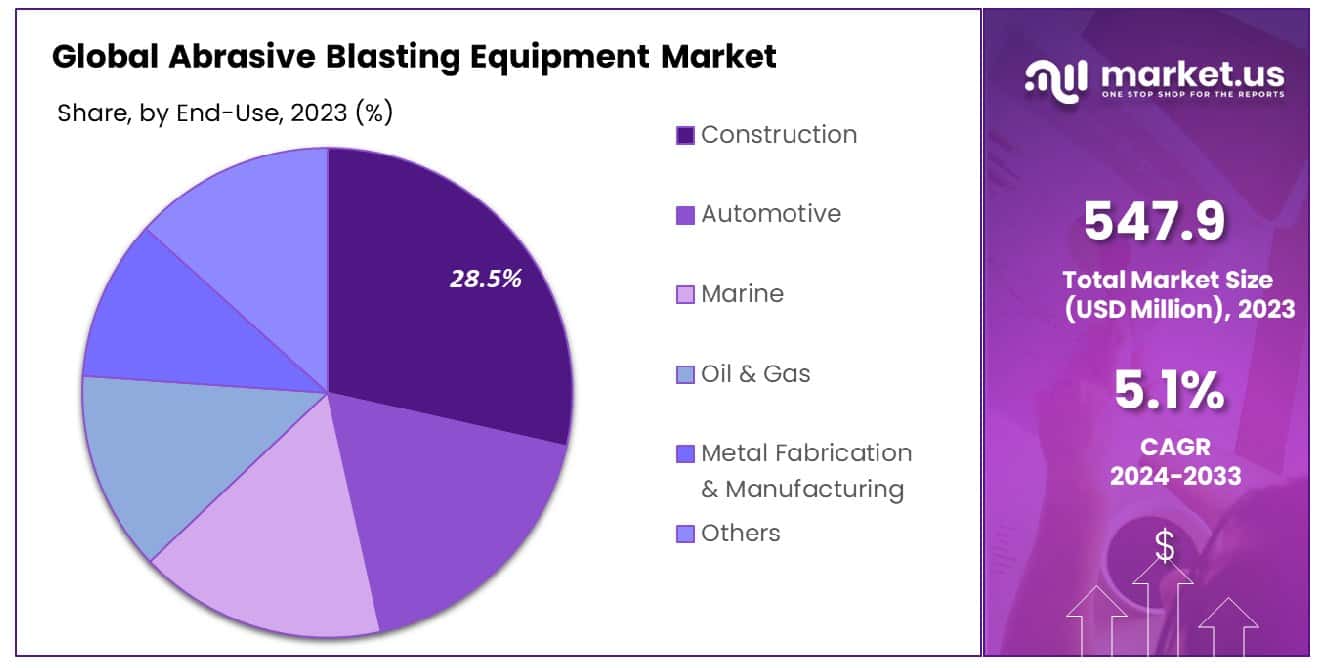

- By End-Use: Construction is the largest end-use sector, accounting for 28.5% of demand.

- Growth Opportunities: In 2023, the Abrasive Blasting Equipment Market is poised for growth through increased adoption of automated systems and a focus on enhancing efficiency and sustainability, driving industry-wide advancements.

Driving Factors

Expansion in Construction and Automotive Industries

The growth of the abrasive blasting equipment market is significantly propelled by expansions in the construction and automotive industries. In the construction sector, abrasive blasting is extensively employed for surface preparation, a critical step required to ensure the adhesion and longevity of protective coatings on various structures. Market analysts project that the global construction industry will expand by 3.5% annually through 2025, thus augmenting the demand for abrasive blasting technologies.

Similarly, in the automotive industry, abrasive blasting is crucial for auto body work, including paint removal and surface smoothing. As global automotive production is expected to grow, with projections indicating a rebound to pre-pandemic levels by 2024, the demand for efficient and effective surface preparation technologies like abrasive blasting will surge correspondingly.

Stringent Regulations Regarding Environmental Protection

Environmental regulations are increasingly shaping the abrasive blasting equipment market. Stricter environmental standards compel industries to adopt cleaner and more efficient blasting technologies, such as those using recyclable media or equipment with advanced filtration systems to minimize airborne contaminants.

For instance, regulations in the European Union and North America that mandate significant reductions in volatile organic compounds (VOCs) and particulate emissions have led to increased adoption of eco-friendly blasting techniques. These regulatory frameworks not only drive innovation in developing less harmful blasting media but also promote the use of equipment that can operate with reduced environmental impact, thus supporting market growth.

Rising Demand for Abrasive Blasting in Aerospace and Defense

The aerospace and defense industries represent key growth avenues for the abrasive blasting equipment market. Abrasive blasting plays a vital role in the maintenance and manufacturing processes of aircraft and military equipment, where precision and surface integrity are paramount.

The global aerospace and defense market, poised for a 4% annual growth over the next five years, demands high standards of cleanliness and surface preparation to ensure the durability and performance of critical components. This sector’s stringent requirements for precision surface conditioning significantly drive the development and uptake of specialized abrasive blasting solutions, thereby fueling market expansion.

Restraining Factors

Health and Safety Regulations

Health and safety regulations serve as a significant restraining factor in the abrasive blasting equipment market. These regulations mandate stringent control measures to protect workers from the health hazards associated with abrasive blasting, such as exposure to silica dust, which can cause serious respiratory diseases. For example, in the United States, OSHA (Occupational Safety and Health Administration) regulations require employers to implement engineering controls and provide personal protective equipment to reduce workers’ exposure to hazardous dust.

Such requirements increase the operational costs for businesses that use abrasive blasting technologies, potentially limiting the adoption of traditional blasting equipment in favor of less hazardous alternatives. While these regulations challenge market growth by imposing additional costs and operational hurdles, they also stimulate innovation in developing safer and more compliant blasting technologies.

Limited Awareness in Developing Countries

In many developing countries, limited awareness regarding the benefits and applications of advanced abrasive blasting techniques restricts market expansion. These regions often rely on traditional, labor-intensive methods for surface preparation due to a lack of knowledge about more efficient alternatives. Additionally, the initial investment required for modern abrasive blasting equipment can be a significant barrier for small and medium enterprises (SMEs) in these economies.

However, this factor also presents an opportunity for market growth as education and economic development continue to advance. Increased industrialization and urbanization in these areas are likely to lead to greater awareness and adoption of advanced technologies, including abrasive blasting equipment, thus gradually overcoming this initial restraint.

By Product Analysis

Stationary blasters dominate the market with a 64.3% share, essential for fixed-location operations.

In 2023, Stationary Blaster held a dominant market position in the By Product segment of the Abrasive Blasting Equipment Market, capturing more than a 64.3% share. Conversely, the Portable Blaster segment accounted for a smaller portion of the market. The dominance of the Stationary Blaster can be attributed to its extensive application across various heavy industries including shipbuilding, infrastructure, and automotive sectors, where large-scale surface preparation tasks necessitate robust and high-capacity equipment.

The preference for Stationary Blasters is driven by their efficiency and capability to handle larger and more complex blasting operations as compared to Portable Blasters. These systems typically offer higher power output and greater material capacity, leading to increased adoption in settings where performance and speed are prioritized.

Market trends indicate a growing investment in infrastructure and manufacturing sectors, particularly in emerging economies. This is expected to further boost the demand for Stationary Blasters, as these sectors rely heavily on effective surface treatment and preparation technologies to enhance the longevity and performance of coated surfaces.

The Portable Blaster segment, while smaller, also shows promise due to its mobility and versatility, making it suitable for remote and smaller-scale operations. It is anticipated that technological advancements and innovations in portable blasting equipment will enhance its efficiency and application scope, potentially increasing its market share in the coming years.

By Operation Analysis

Automatic operation blasters, holding 38.9% of the market, enhance efficiency and reduce labor costs.

In 2023, the Abrasive Blasting Equipment Market was segmented by operation into three primary categories: Manual Operation, Semi-automatic Operation, and Automatic Operation. Automatic Operation held a dominant market position, capturing more than 38.9% of the market share. This dominance can be attributed to the increased adoption of automation technologies that enhance precision and efficiency in abrasive blasting processes. The shift towards Automatic Operation is driven by its capability to minimize labor costs and reduce operational time, thereby maximizing productivity in various industrial applications.

Manual Operation and Semi-automatic Operation also played significant roles in the market, though to a lesser extent compared to Automatic Operation. Manual Operation, while less efficient, remains critical in applications requiring detailed and fine control that cannot yet be replicated by automated systems. Semi-automatic Operation serves as a transitional technology, offering a balance between control and automation, appealing to sectors that are gradually shifting towards fully automated solutions.

The growth in the Automatic Operation segment is further bolstered by advancements in robotics and control systems, making these technologies more accessible and cost-effective for industries ranging from automotive to aerospace. These industries are increasingly relying on automated abrasive blasting equipment to achieve uniform surface treatments, essential for the high-quality standards required in their final products.

As this segment continues to evolve, the market is expected to see an increase in investment by key players, aiming to innovate and expand the capabilities of automatic systems. This will likely enhance the overall market growth, reinforcing the trend towards automation in industrial environments. The ongoing developments and the increasing integration of IoT and AI technologies are anticipated to propel the demand for Automatic Operation in the coming years, further solidifying its market position.

By Blasting Type Analysis

Dry blasting is preferred in 60.4% of cases, valued for its versatility and effectiveness.

In 2023, the Abrasive Blasting Equipment Market was segmented by blasting type into two primary categories: Dry Blasting and Wet Blasting. Dry Blasting held a dominant market position, capturing more than 60.4% of the market share. This method’s prevalence is largely due to its effectiveness and versatility in various industrial applications. Dry Blasting is favored for its ability to efficiently clean surfaces, remove contaminants, and prepare substrates for coatings without the use of water, which can be advantageous in environments where moisture can damage the substrate or result in unwanted residue.

Wet Blasting, while holding a smaller market share, is significant in applications where dust control is critical. This method uses a mixture of water and abrasive materials, reducing the dust produced during the blasting process, thus making it ideal for operations within confined or environmentally sensitive spaces. Wet Blasting is also recognized for its ability to provide a finer finish and reduce the heat generated during the blasting process, which can prevent distortion on delicate surfaces.

The substantial market share held by Dry Blasting can be attributed to its broad applicability across industries such as automotive, aerospace, and construction, where rapid, dry, and effective surface preparation is essential. The method’s efficiency in preparing large surfaces swiftly makes it a preferred choice for reducing downtime in production processes.

As environmental regulations become stricter and the demand for precision in surface treatments increases, both segments are expected to evolve. Technological advancements are anticipated to enhance the efficiency and environmental compliance of both Dry and Wet Blasting methods, potentially increasing their adoption across more diverse industries.

By End-Use Analysis

The construction sector, utilizing 28.5% of the market, relies heavily on abrasive blasting for surface preparation.

In 2023, the Abrasive Blasting Equipment Market was segmented by end-use into six primary categories: Construction, Automotive, Marine, Oil & Gas, Automotive Metal Fabrication & Manufacturing, and Others. Construction held a dominant market position, capturing more than 28.5% of the market share. This prominence is attributed to the extensive use of abrasive blasting techniques in surface preparation and cleaning tasks necessary for building and infrastructure projects. Abrasive blasting is integral in ensuring proper adhesion for coatings and paints, a critical step in protecting structures from environmental factors and prolonging their lifespan.

The Automotive sector also significantly utilizes abrasive blasting for finishing and cleaning auto components to ensure that surfaces are adequately prepared for subsequent processes like painting and coating. Similarly, in the Marine mining industry, abrasive blasting is vital for maintaining ships and other watercraft, especially for removing old paint and controlling the corrosion of metal surfaces.

Oil & Gas and Metal Fabrication & Manufacturing industries rely on abrasive blasting for maintaining equipment and preparing metal surfaces to withstand extreme conditions and stresses. These sectors value the method’s ability to achieve desired surface textures and cleanliness with high efficiency.

Despite the strong position of Construction, ongoing developments across all sectors, driven by technological advancements in abrasive blasting equipment, are expected to create a more balanced distribution of market shares. Innovations aimed at improving efficiency, reducing environmental impact, and enhancing worker safety are likely to increase the adoption of abrasive blasting across various industries, potentially reshaping market dynamics shortly.

Key Market Segments

By Product

- Portable Blaster

- Stationary Blaster

By Operation

- Manual Operation

- Semi-automatic Operation

- Automatic Operation

By Blasting Type

- Dry Blasting

- Wet Blasting

By End-Use

- Construction

- Automotive

- Marine

- Oil & Gas

- Metal Fabrication & Manufacturing

- Others

Growth Opportunities

Adoption of Automated Blasting Equipment

The global Abrasive Blasting Equipment Market stands on the brink of transformation with the increasing adoption of automated blasting equipment. In 2023, this trend is particularly driven by the rising need for precision and uniformity in surface treatments across various industries, including automotive, aerospace, and manufacturing. Automated systems offer significant advantages over traditional manual methods, including consistent quality, higher safety standards, and reduced manpower costs.

The integration of advanced technologies such as robotics and AI into abrasive blasting systems further enhances their appeal by enabling more complex and detailed surface processing tasks to be performed with minimal human intervention. The shift towards automation not only streamlines operations but also opens up new opportunities for market growth, particularly in regions and sectors that are experiencing labor shortages or seeking to reduce occupational hazards.

Increasing Focus on Improving Efficiency and Productivity

Efficiency and productivity remain critical factors driving innovations and investments in the Abrasive Blasting Equipment Market. As industries strive for faster turnaround times and lower operational costs, the demand for more efficient blasting equipment is escalating. This includes the development of machines that consume less abrasive material and energy while maintaining or enhancing performance.

Furthermore, the focus on sustainability is prompting companies to adopt equipment that minimizes waste and environmental impact. For instance, improvements in dust collection technologies and the use of recyclable abrasives are becoming increasingly prevalent. As a result, manufacturers who invest in these efficiency-enhancing innovations are likely to gain a competitive edge, making it a pivotal area for growth in the market during 2023 and beyond.

Latest Trends

Increasing Demand for Eco-Friendly and Sustainable Blasting Solutions

In 2023, a significant trend within the global Abrasive Blasting Equipment Market is the escalating demand for eco-friendly and sustainable blasting solutions. This shift is largely influenced by stringent environmental regulations and a growing industry commitment to reducing ecological footprints. Companies are increasingly adopting green abrasive materials that are less harmful to the environment and are investing in advanced filtration systems that minimize airborne dust and pollutants.

These sustainable practices not only comply with regulatory demands but also appeal to a broader client base that prioritizes environmental responsibility. Additionally, the use of water-based and biodegradable media in wet blasting techniques is gaining traction as a method to further enhance environmental sustainability while ensuring high-quality surface finishes.

Technological Advancements in Blasting Equipment

The market is also witnessing substantial technological advancements in blasting equipment, with a notable increase in the development of portable and lightweight equipment. These innovations are designed to meet the needs of on-site and field operations, allowing for greater flexibility and accessibility in surface treatment processes. Portable blasting equipment is particularly beneficial in industries such as construction and restoration, where mobility is essential.

Moreover, the evolution of compact, lightweight systems does not compromise on power or efficiency, enabling users to achieve optimal results even in less accessible project sites. These advancements significantly contribute to operational efficiencies, opening up new application areas and expanding the potential market for abrasive blasting equipment.

Regional Analysis

In 2023, the Asia-Pacific region dominated the Abrasive Blasting Equipment Market with a 45.6% share.

In the global landscape of the Abrasive Blasting Equipment Market, regional dynamics display varied growth trends and market penetrations. Asia-Pacific emerges as the dominating region, holding a substantial 45.6% market share. This dominance is driven by rapid industrialization in countries such as China and India, coupled with significant investments in infrastructure and manufacturing sectors. The region benefits from low-cost labor and the availability of raw materials, which bolster the local manufacturing of abrasive blasting equipment.

North America also represents a significant portion of the market, supported by stringent regulatory standards requiring the maintenance and preparation of surfaces in industries like automotive and aerospace. The demand in this region is characterized by a high adoption rate of technologically advanced, eco-friendly blasting solutions, aligning with North America’s strong focus on sustainability and environmental conservation.

Europe follows closely, with a robust emphasis on innovation and safety. The region’s market is propelled by the automotive and restoration sectors, where precision and surface quality are critical. European regulations promoting worker safety and environmental protection further drive the demand for advanced blasting equipment.

The Middle East & Africa and Latin America, while holding smaller shares, are experiencing growth due to increasing activities in the construction and oil & gas sectors. These regions present untapped opportunities, with the Middle East & Africa focusing on infrastructural developments and Latin America gradually advancing in industrial capabilities.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Abrasive Blasting Equipment Market continues to be shaped by the activities and innovations of key players, each contributing unique technological advancements and market strategies. Guyson Corporation stands out with its high-quality automated blasting systems, catering primarily to precision-intensive industries like electronics and automotive. Hangzhou Color Powder Coating Equipment Co., Ltd., known for its robust and versatile equipment, serves a broad range of industrial applications, emphasizing the Asian market’s growth.

Norton Sandblasting Equipment and Airblast B.V. both capitalize on their extensive ranges of portable and eco-friendly blasting solutions, which are increasingly favored in North America and Europe due to stringent environmental regulations. Axxiom Manufacturing, Inc. continues to innovate in the field of pressure blasting equipment, offering solutions that enhance efficiency and reduce operational costs.

Hangzhou Huashengtong Machinery Equipment Co., Ltd. is making significant inroads in the Chinese market by providing competitively priced and technologically advanced equipment, whereas Surface Blasting Systems, LLC excels in providing customized solutions that cater to specific industrial needs, particularly in the U.S.

Clemco Industries Corporation remains a leader in providing rugged and reliable equipment, widely respected for its durability and performance across various harsh industrial environments. MMLJ, Inc., known for its pioneering role in dustless blasting technology, continues to evolve this offering to meet the growing demand for environmentally friendly blasting methods.

Finally, European companies like CONIEX SA and Fratelli Pezza emphasize innovation in the decorative and architectural glass sectors, expanding the applications of abrasive blasting technology in artistic and aesthetic domains. These key players, through their diverse and innovative product portfolios, are crucial in driving the global market’s growth and responding to evolving industry demands.

Market Key Players

- Guyson Corporation

- Hangzhou Color Powder Coating Equipment Co., Ltd.

- Norton Sandblasting Equipment

- Airblast B.V.

- Axxiom Manufacturing, Inc.

- Hangzhou Huashengtong Machinery Equipment Co., Ltd.

- Surface Blasting Systems, LLC

- Clemco Industries Corporation

- MMLJ, Inc.

- CONIEX SA

- Fratelli Pezza

Recent Development

- In July 2023, P&C Fabrication and Coating integrates a Titan Blast Room to streamline powder coating operations, overcoming weather constraints and enabling media reclamation for enhanced productivity and profitability.

- In April 2023, Kennametal introduced Blast Ninja, an abrasive blast nozzle designed for enhanced productivity and noise reduction, meeting OSHA guidelines. Developed with Oceanit, it leverages military-grade technology for improved surface preparation efficiency.

- In May 2021, University of Toronto researcher Bethany Krebs explored a new fingerprint detection method using sandblasting with fluorescent yellow cornstarch powder, showing promise for faster, more efficient crime scene investigations.

Report Scope

Report Features Description Market Value (2023) USD 547.9 Million Forecast Revenue (2033) USD 901.0 Million CAGR (2024-2033) 5.10% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Portable Blaster, Stationary Blaster), By Operation(Manual Operation, Semi-automatic Operation, Automatic Operation), By Blasting Type(Dry Blasting, Wet Blasting), By End-Use(Construction, Automotive, Marine, Oil & Gas, Metal Fabrication & Manufacturing, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Guyson Corporation, Hangzhou Color Powder Coating Equipment Co., Ltd., Norton Sandblasting Equipment, Airblast B.V., Axxiom Manufacturing, Inc., Hangzhou Huashengtong Machinery Equipment Co., Ltd., Surface Blasting Systems, LLC, Clemco Industries Corporation, MMLJ, Inc., CONIEX SA, Fratelli Pezza Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Abrasive Blasting Equipment Market in 2023?The Global Abrasive Blasting Equipment Market size is USD 547.9 Million in 2023.

What is the projected CAGR at which the Global Abrasive Blasting Equipment Market is expected to grow at?The Global Abrasive Blasting Equipment Market is expected to grow at a CAGR of 5.10% (2024-2033).

List the segments encompassed in this report on the Global Abrasive Blasting Equipment Market?Market.US has segmented the Global Abrasive Blasting Equipment Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product(Portable Blaster, Stationary Blaster), By Operation(Manual Operation, Semi-automatic Operation, Automatic Operation), By Blasting Type(Dry Blasting, Wet Blasting), By End-Use(Construction, Automotive, Marine, Oil & Gas, Metal Fabrication & Manufacturing, Others)

List the key industry players of the Global Abrasive Blasting Equipment Market?Guyson Corporation, Hangzhou Color Powder Coating Equipment Co., Ltd., Norton Sandblasting Equipment, Airblast B.V., Axxiom Manufacturing, Inc., Hangzhou Huashengtong Machinery Equipment Co., Ltd., Surface Blasting Systems, LLC, Clemco Industries Corporation, MMLJ, Inc., CONIEX SA, Fratelli Pezza

Name the key areas of business for Global Abrasive Blasting Equipment Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Abrasive Blasting Equipment Market.

Abrasive Blasting Equipment MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Abrasive Blasting Equipment MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Guyson Corporation

- Hangzhou Color Powder Coating Equipment Co., Ltd.

- Norton Sandblasting Equipment

- Airblast B.V.

- Axxiom Manufacturing, Inc.

- Hangzhou Huashengtong Machinery Equipment Co., Ltd.

- Surface Blasting Systems, LLC

- Clemco Industries Corporation

- MMLJ, Inc.

- CONIEX SA

- Fratelli Pezza