Global Abaca Fiber Market Size, Share, And Business Benefits(By Type (Hand-stripped Abaca Fiber, Machine-stripped Abaca Fiber), By Product Type (Fine Abaca Fiber, Rough Abaca Fiber), By End-use (Paper and Pulp (Tea and Coffee Bags, Meat and Sausages Paper, Paper Money, Cigarettes Papers, Vacuum Cleaners Bags, Others), Fishing (Ships Ropes, Fishing Lines, Fishing Nets, Others)), Automotive, Agriculture, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2023

- Report ID: 63113

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

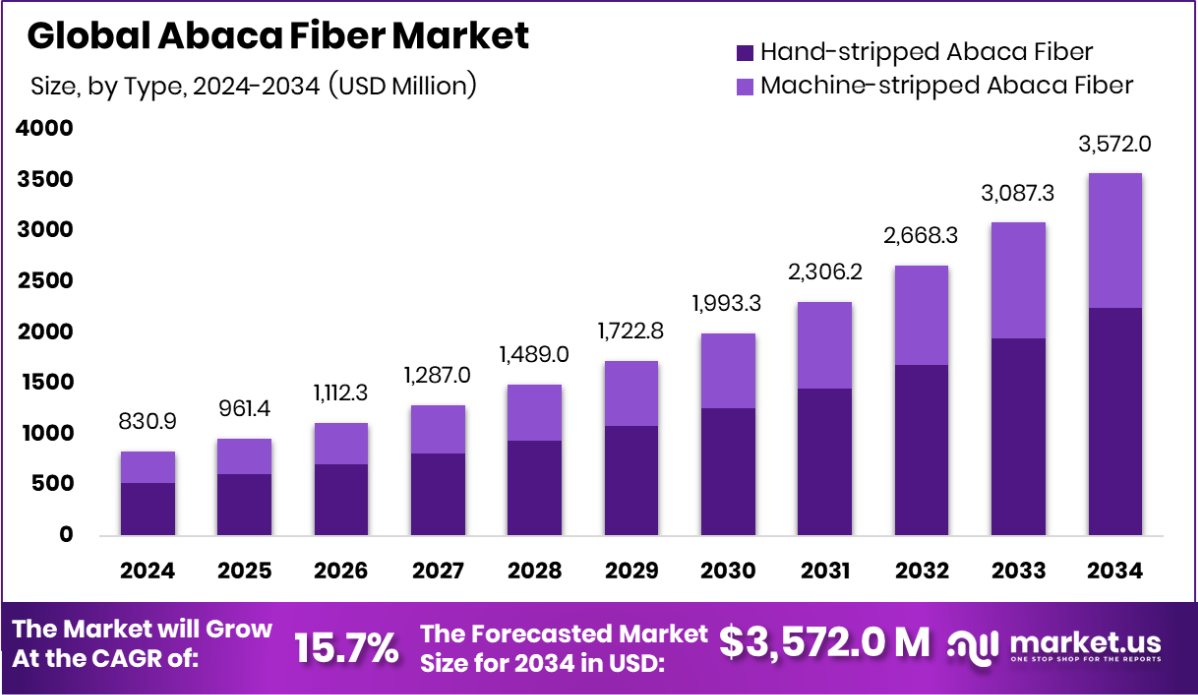

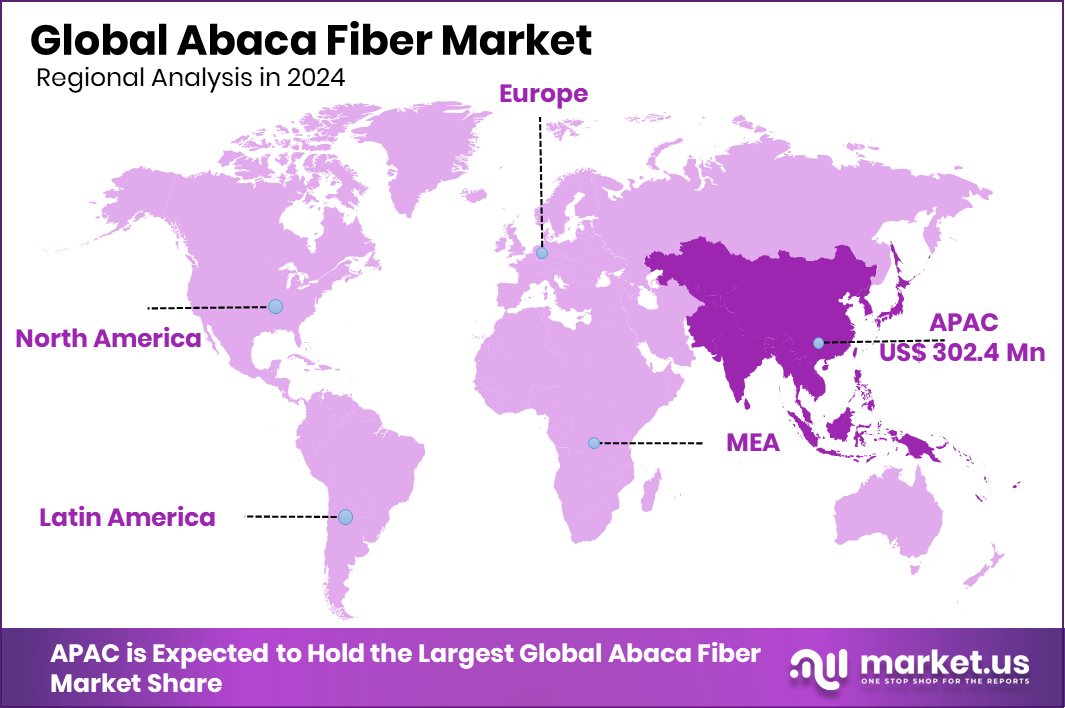

The Global Abaca Fiber Market is expected to be worth around USD 3,572.0 million by 2034, up from USD 830.9 million in 2024, and grow at a CAGR of 15.7% from 2025 to 2034. The Asia-Pacific market was valued at USD 302.4 million during the same year.

Abaca fiber, also known as Manila hemp, is a natural leaf fiber derived from the stalks of the abaca plant, a species of banana native to the Philippines. It is renowned for its exceptional strength, flexibility, and resistance to saltwater damage. Traditionally used in ropes, textiles, and specialty papers, abaca fiber has seen renewed interest due to its biodegradable nature and sustainability credentials.

The abaca fiber market is growing steadily, driven by increasing global demand for eco-friendly and renewable materials. With rising environmental concerns and the shift away from plastics, abaca is being used in packaging, automotive interiors, and construction composites. Its durability and light weight make it a strong candidate for use in various industrial and commercial applications.

One major growth factor is the push for sustainable agriculture and natural resource utilization. Abaca is a high-yield, low-input crop that supports rural livelihoods without harming the environment. As countries invest in green economies and circular practices, abaca cultivation offers both environmental and socio-economic benefits.

Demand is rising, particularly from industries focused on eco-conscious production. Whether in fashion, paper, or home goods, buyers are seeking natural alternatives with low carbon footprints. Abaca’s strength and renewability align with these needs, boosting its market relevance.

Abaca fiber plays a vital role in the Philippines’ economy, generating around $80 million annually. Recently, the Department of Trade and Industry (DTI) invested Php1.2 million to establish a new abaca fiber processing and organic fertilizer facility in Zamboanga Sibugay, boosting regional development and sustainable agriculture.

Key Takeaways

- The Global Abaca Fiber Market is expected to be worth around USD 3,572.0 million by 2034, up from USD 830.9 million in 2024, and grow at a CAGR of 15.7% from 2025 to 2034.

- Hand-stripped abaca fiber dominates the market, contributing 63.40% to global abaca fiber production.

- Fine abaca fiber leads product types, accounting for 57.50% of the abaca fiber market.

- Paper and pulp industry is the largest consumer, utilizing 47.30% of the abaca fiber supply.

- Strong production base and rising demand supported Asia-Pacific’s USD 302.4 million market position.

By Type Analysis

The hand-stripped Abaca fiber dominates the market with a 63.40% share.

In 2024, Hand-stripped Abaca Fiber held a dominant market position in the By Type segment of the Abaca Fiber Market, with a 63.40% share. This dominance is attributed to its superior quality, high tensile strength, and preferred use in premium applications such as specialty papers, handicrafts, and high-end textiles.

Hand-stripping, though labor-intensive, preserves the fiber’s natural luster and integrity, making it highly sought after in both domestic and international markets. The segment benefits from consistent demand from traditional industries and niche applications where strength and aesthetics are essential.

The preference for hand-stripped abaca fiber is also supported by government and local initiatives aimed at preserving traditional processing techniques and improving the livelihood of rural communities. As demand for biodegradable and natural fibers rises globally, the hand-stripped segment is expected to maintain its lead through continued quality assurance and heritage value.

By Product Type Analysis

Fine Abaca fiber holds a 57.50% market share in product types.

In 2024, Fine Abaca Fiber held a dominant market position in the By-Product Type segment of the Abaca Fiber Market, with a 57.50% share. This segment’s leadership is driven by a strong demand for high-grade fibers used in specialized paper, currency notes, and high-end fashion products. Fine abaca fiber is known for its soft texture, light weight, and excellent tensile strength, making it highly suitable for premium applications that require both durability and refined appearance.

The growth of the fine fiber segment is further supported by rising global interest in sustainable materials, where abaca offers an attractive alternative to synthetic fibers. Its natural gloss and smoothness make it ideal for luxury packaging, interior furnishings, and decorative items. Producers have focused on improving harvesting and sorting methods to consistently meet the specifications of fine-grade abaca, boosting its value and appeal.

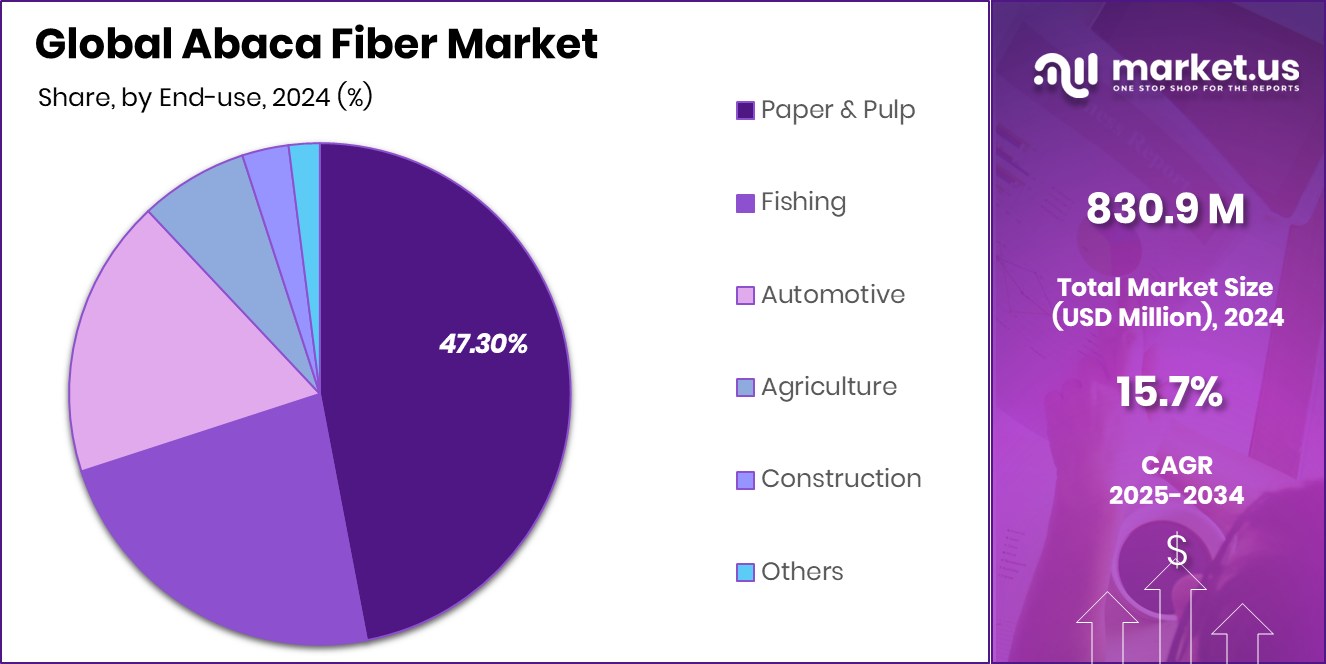

By End-use Analysis

The paper and pulp industry consumes 47.30% of the Abaca fiber market.

In 2024, Paper and Pulp held a dominant market position in the By End-use segment of the Abaca Fiber Market, with a 47.30% share. This segment’s stronghold is largely due to abaca’s superior strength, porosity, and durability, which make it an ideal raw material for high-performance paper products. It is particularly favored for use in currency paper, tea bags, medical filters, and other specialty papers that require tear resistance and long fiber quality.

The paper and pulp industry’s preference for abaca fiber is also influenced by its natural whiteness and ability to blend with other pulp types, enhancing the final product’s quality. Manufacturers continue to rely on abaca for applications where conventional wood pulp falls short, especially in non-woven and technical paper categories. The stable demand from these sectors reinforces the segment’s lead.

Other end-use segments, such as textiles, handicrafts, and composites, are growing but remain secondary in volume share. Despite increasing interest from the automotive and construction sectors, their combined usage did not surpass the paper and pulp sector in 2024.

Key Market Segments

By Type

- Hand-stripped Abaca Fiber

- Machine-stripped Abaca Fiber

By Product Type

- Fine Abaca Fiber

- Rough Abaca Fiber

By End-use

- Paper and Pulp

- Tea and Coffee Bags

- Meat and Sausages Paper

- Paper Money

- Cigarettes Papers

- Vacuum Cleaners Bags

- Others

- Fishing

- Ships Ropes

- Fishing Lines

- Fishing Nets

- Others

- Automotive

- Agriculture

- Construction

- Others

Driving Factors

Growing Demand for Eco-Friendly and Natural Fibers

One of the top driving factors of the Abaca Fiber Market is the rising demand for eco-friendly and natural materials across industries. As environmental concerns grow, companies are moving away from synthetic fibers and turning to biodegradable options like abaca.

Abaca fiber is 100% natural, strong, and renewable, making it an ideal alternative in packaging, textiles, and specialty paper products. Consumers and manufacturers alike are showing more interest in products that have a smaller carbon footprint.

This shift in preference is pushing demand for abaca in both traditional and emerging applications. Governments are also encouraging the use of sustainable materials, further supporting the growth.

Restraining Factors

Limited Production Capacity and Supply Chain Issues

A key restraining factor in the Abaca Fiber Market is the limited production capacity and supply chain challenges. Abaca cultivation is mostly concentrated in specific regions with favorable climates, making the supply dependent on local farming conditions and weather patterns.

Since most abaca is harvested manually, production is labor-intensive and cannot be scaled up quickly. Any disruption—like typhoons, labor shortages, or land limitations—directly affects fiber availability and pricing.

These constraints often lead to supply-demand imbalances, especially when global interest surges. Additionally, poor infrastructure in rural farming areas can delay transportation and impact quality. Until the supply chain becomes more stable and efficient, these limitations may restrict the market’s ability to grow at full potential.

Growth Opportunity

Rising Use in Automotive Composite Material Industry

A major growth opportunity for the Abaca Fiber Market lies in its increasing use in the automotive composite material industry. As automakers search for lightweight, strong, and eco-friendly alternatives to traditional materials, abaca fiber is gaining attention.

Its natural strength, flexibility, and low weight make it suitable for car interiors, panels, and other nonstructural parts. Using abaca can help reduce overall vehicle weight, which improves fuel efficiency and lowers emissions—key goals for modern car manufacturers.

The push toward sustainable sourcing in the automotive sector is also opening new doors for natural fibers like abaca. With further research and better processing technologies, abaca composites could become a regular feature in next-generation eco-friendly vehicles worldwide.

Latest Trends

Blending Abaca with Other Natural Sustainable Fibers

One of the latest trends in the Abaca Fiber Market is the blending of abaca with other natural sustainable fibers like jute, hemp, or cotton. This trend is driven by the goal of improving product performance, reducing costs, and creating customized materials for different uses.

Blended fibers combine the strength of abaca with the softness or flexibility of other materials, making them suitable for textiles, packaging, and composites. Manufacturers are experimenting with different fiber mixes to meet the growing demand for sustainable, high-performance materials.

This approach not only enhances durability but also broadens abaca’s application range. As industries look for creative, green solutions, blended natural fibers are becoming a smart and scalable option for future innovations.

Regional Analysis

In 2024, Asia-Pacific held a 36.40% share in the Abaca Fiber Market.

In 2024, Asia-Pacific emerged as the leading region in the Abaca Fiber Market, holding a dominant 36.40% share, valued at USD 302.4 million. This strong position is driven by the region’s favorable climate for abaca cultivation, established agricultural practices, and growing demand for natural fibers in paper, packaging, and textiles.

Countries in Southeast Asia, particularly those with rich abaca farming heritage, continue to supply a significant portion of the global demand. North America and Europe followed, showing steady growth due to increasing interest in sustainable and biodegradable materials for industrial and consumer applications. While these regions do not produce abaca, they represent important end-use markets for finished and semi-processed fiber products.

The Middle East & Africa and Latin America accounted for smaller shares, with moderate demand observed in the packaging and agricultural sectors. Although their market size is limited, both regions are gradually exploring natural fiber alternatives as part of broader sustainability initiatives.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Abaca Fiber market observed active participation from regional players, with Chandra Prakash and Co., Ching Bee Trading Corporation, and Dragon Vision Trading emerging as notable contributors. These companies play a vital role in maintaining the supply chain, meeting export demands, and supporting regional fiber processing infrastructure.

Chandra Prakash and Co. has strengthened its position by focusing on consistent quality, sourcing capabilities, and catering to the paper and packaging industries. The company continues to benefit from stable domestic demand and growing interest in sustainable materials. Its ability to serve both local and international clients gives it a competitive edge in the mid-range fiber supply segment.

Ching Bee Trading Corporation has maintained a strong foothold as one of the long-standing abaca exporters, especially in the Asia-Pacific market. Known for its robust sourcing networks and reliable fiber grading, the company has been a key supplier to global manufacturers. In 2024, it capitalized on the rising demand for high-quality fibers used in currency paper and specialty applications.

Dragon Vision Trading, with its strategic presence in the fiber export ecosystem, focused on scaling its operations and building strong trading relationships. It has leveraged increased export potential in Europe and North America, tapping into the eco-friendly material shift.

Top Key Players in the Market

- Chandra Prakash and CO

- Ching Bee Trading Corporation

- Dragon Vision Trading

- Erin Rope Corporation

- Hartmannforbes Inc

- Hermin Textile

- Pulp Specialties Philippines Inc

- Simor Abaca Products

- Specialty Pulp Manufacturing, Inc. (SPMI)

- Terranova Papers

- Yzen Handicraft

Recent Developments

- In October 2024, Hartmann & Forbes launched a new wallcovering collection called Groove, made with abaca fiber and water hyacinth. The design blends earthy tones with sustainable materials, showcasing craftsmanship and nature-inspired textures.

- In 2024, HerMin Textile launched a new line of abaca fiber fabrics for shirts, bags, and outerwear. The collection emphasizes eco-friendly design with a natural dry touch and fast-drying properties, expanding sustainable options in fashion.

Report Scope

Report Features Description Market Value (2024) USD 830.9 Million Forecast Revenue (2034) USD 3,572.0 Million CAGR (2025-2034) 15.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered (By Type (Hand-stripped Abaca Fiber, Machine-stripped Abaca Fiber), By Product Type (Fine Abaca Fiber, Rough Abaca Fiber), By End-use (Paper and Pulp (Tea and Coffee Bags, Meat and Sausages Paper, Paper Money, Cigarettes Papers, Vacuum Cleaners Bags, Others), Fishing (Ships Ropes, Fishing Lines, Fishing Nets, Others)), Automotive, Agriculture, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Chandra Prakash and CO, Ching Bee Trading Corporation, Dragon Vision Trading, Erin Rope Corporation, Hartmannforbes Inc, Hermin Textile, Pulp Specialties Philippines Inc, Simor Abaca Products, Specialty Pulp Manufacturing, Inc. (SPMI), Terranova Papers, Yzen Handicraft Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Chandra Prakash and CO

- Ching Bee Trading Corporation

- Dragon Vision Trading

- Erin Rope Corporation

- Hartmannforbes Inc

- Hermin Textile

- Pulp Specialties Philippines Inc

- Simor Abaca Products

- Specialty Pulp Manufacturing, Inc. (SPMI)

- Terranova Papers

- Yzen Handicraft