Global Automotive Wiring Harness Market By Component(Electric Wires, Connectors, Terminals, Others), By Application(Body, Roof, Door & Window, Facia, Seat, Engine, Chassis, HVAC, Sensors), By Vehicle Type(Passenger Cars, Commercial Vehicles, LCV HCV), By Propulsion(IC Engine Vehicle, Electric Vehicle), By Material((Metallic,(Aluminum, Copper, Other Metals)), (Optical Fiber,(Plastic Optical Fiber, Glass Optical Fiber))), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 18925

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Component Analysis

- By Application Analysis

- By Vehicle Type Analysis

- By Propulsion Analysis

- By Material Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

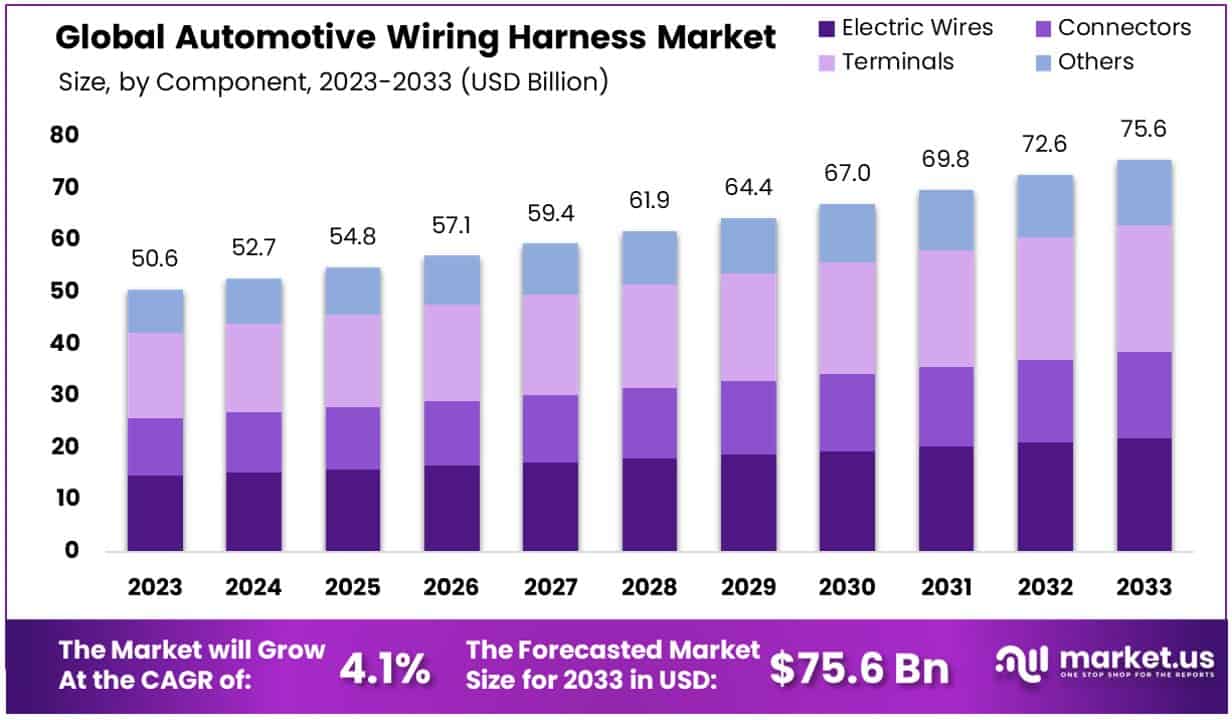

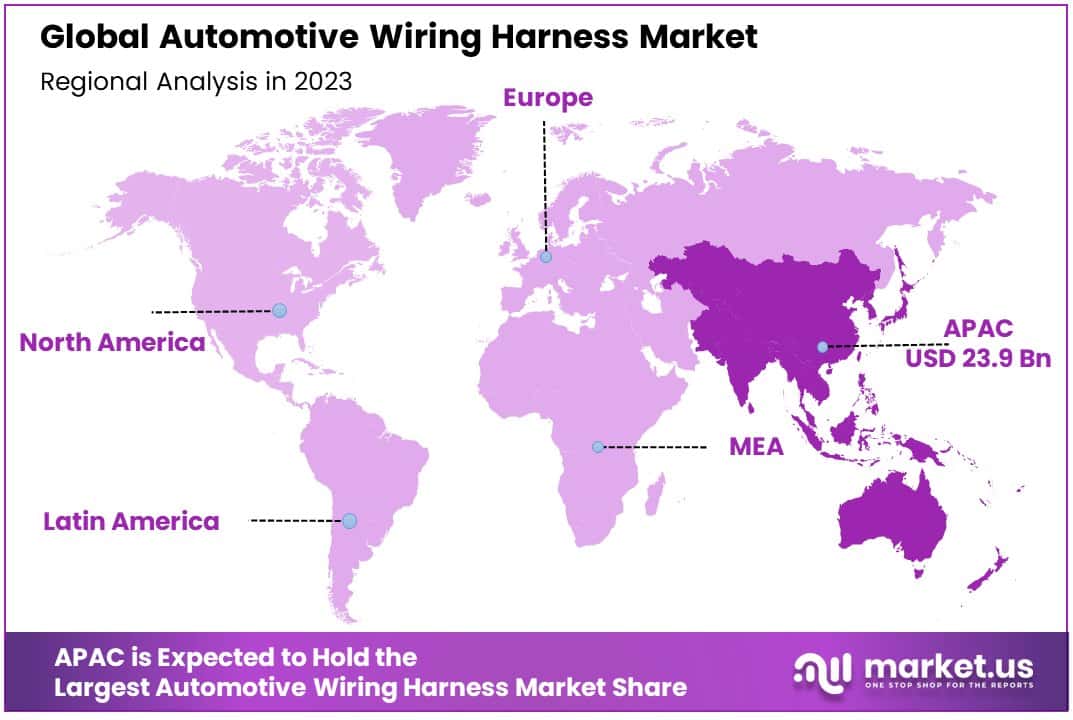

The Global Automotive Wiring Harness Market size is expected to be worth around USD 75.6 Billion by 2033, from USD 50.6 Billion in 2023, growing at a CAGR of 4.10% during the forecast period from 2024 to 2033. Asia Pacific dominated a 47.3% market share in 2023 and held USD 23.93 Billion revenue of the Automotive Wiring Harness Market.

An automotive wiring harness is a structured set of wires, terminals, and connectors that transmit power and information throughout the vehicle. It is essentially the vehicle’s central nervous system, enabling the functioning of various components such as the headlights, engine, and entertainment system.

The Automotive Wiring Harness Market refers to the global industry responsible for the design, production, and supply of these essential systems. This market is driven by advancements in automotive technology, including electrification and autonomous driving, which demand more complex wiring solutions to handle increased power and data transmission needs.

The surge in demand for electric vehicles (EVs) significantly drives the automotive wiring harness market. As EVs require complex wiring systems to handle high voltages and connect multiple batteries and motors, manufacturers are focusing on developing durable and efficient wiring harnesses.

Safety enhancements in vehicles, such as advanced driver-assistance systems (ADAS), increase the demand for sophisticated wiring harnesses. These systems require reliable connections for sensors and cameras, pushing automakers to invest in high-quality wiring solutions to ensure safety and functionality.

The shift towards autonomous vehicles presents significant opportunities for the wiring harness market. Autonomous technologies require extensive sensor and data integration, necessitating advanced wiring harness architectures that can support high-speed data transmission and connectivity, opening new avenues for growth and innovation in the market.

The automotive wiring harness market is poised for substantial growth, driven by the escalating adoption of electric vehicles (EVs) and the integration of advanced automotive technologies. This growth trajectory is further supported by significant governmental initiatives such as the Production Linked Incentive (PLI) schemes and the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) program.

For instance, the PLI scheme for automobiles, initially set at ₹604 crore for the fiscal year 2023-24, underscores the government’s commitment to promoting sustainable automotive technologies, despite a revised allocation of ₹483.77 crore.

Similarly, the FAME scheme, aimed at bolstering electric and hybrid vehicle adoption, was allocated ₹5,171.97 crore, later adjusted to ₹4,807.40 crore. These financial revisions reflect strategic reallocations in response to evolving market conditions and government spending priorities.

Moreover, the transition towards more sustainable mobility solutions necessitates advancements in the automotive wiring harness sector to accommodate new electrical architectures required for EVs and autonomous vehicles. As vehicles become more technologically equipped, the demand for sophisticated wiring systems capable of supporting high data and power transmissions grows, presenting a fertile ground for market expansion.

Opportunities abound for stakeholders who can innovate in the design and manufacture of durable, scalable, and efficient wiring harness systems. Success in this arena hinges on embracing next-generation technologies and aligning with global sustainability goals, positioning the automotive wiring harness market as a critical component in the automotive industry’s evolution towards electrification and intelligent transportation solutions

Key Takeaways

- The Global Automotive Wiring Harness Market size is expected to be worth around USD 75.6 Billion by 2033, from USD 50.6 Billion in 2023, growing at a CAGR of 4.10% during the forecast period from 2024 to 2033.

- In 2023, Terminals held a dominant market position in the By Component segment of the Automotive Wiring Harness Market, with a 32.4% share.

- In 2023, Chassis held a dominant market position in the By Application segment of the Automotive Wiring Harness Market, with a 34.5% share.

- In 2023, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Automotive Wiring Harness Market, with a 58.4% share.

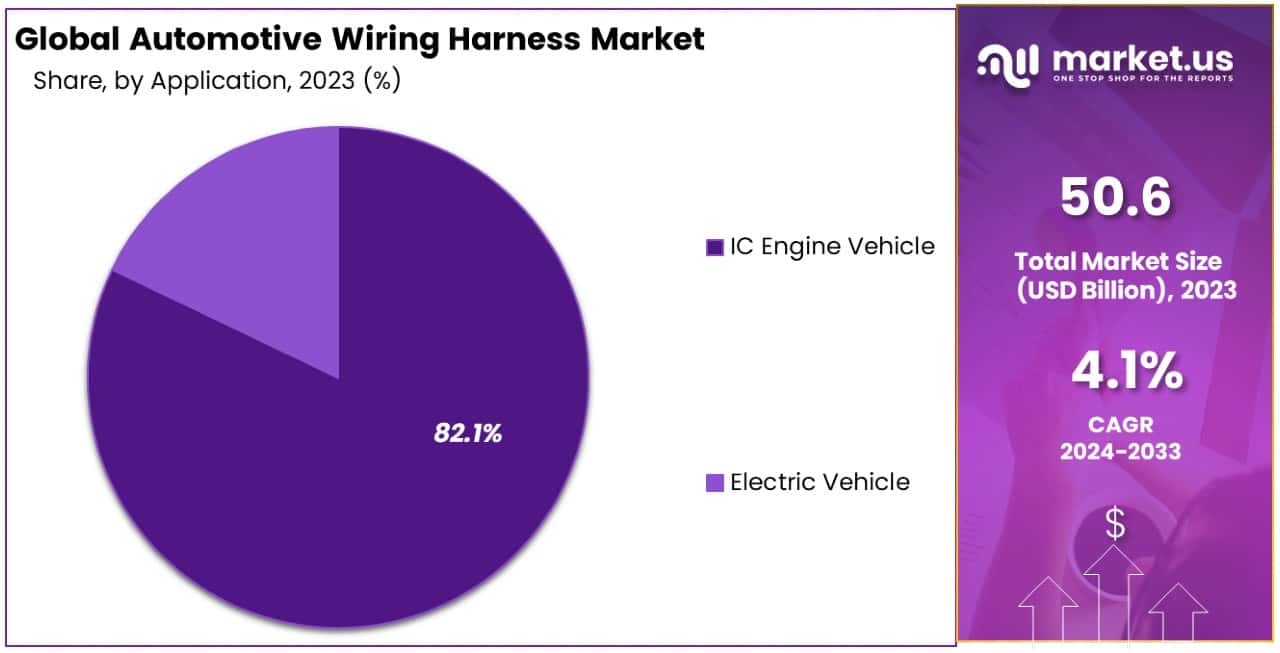

- In 2023, IC Engine Vehicle held a dominant market position in the propulsion segment of the Automotive Wiring Harness Market, with an 82.1% share.

- In 2023, Metallic held a dominant market position in the By Material segment of the Automotive Wiring Harness Market, with a 72.4% share.

- Asia Pacific dominated a 47.3% market share in 2023 and held USD 23.93 Billion revenue of the Automotive Wiring Harness Market.

By Component Analysis

In 2023, Terminals held a dominant market position in the “By Component” segment of the Automotive Wiring Harness Market, capturing a 32.4% share. This segment leads due to the critical role terminals play in ensuring reliable connections and efficient power and data distribution across various vehicle systems.

Following Terminals, Connectors also represented a significant portion of the market, essential for securing the integration of multiple wiring interfaces and enhancing the overall system’s robustness against environmental factors. Electric Wires, fundamental for transmitting electrical power and signals throughout the vehicle, also constituted a substantial share, emphasizing their indispensability in automotive electrical frameworks.

The category labeled as Others, which includes various minor components crucial for specialized applications or advanced technology integrations, held the smallest share but remains vital for addressing specific market needs and innovations.

The segmentation within the Automotive Wiring Harness Market highlights the diverse technological demands of modern vehicles, from basic connectivity to complex systems integration.

The dominance of Terminals underscores the industry’s focus on durability and efficiency, essential for supporting the next generation of electric and autonomous vehicles. As automotive technologies evolve, each component’s role is likely to shift, reflecting new standards in vehicle design and consumer expectations.

By Application Analysis

In 2023, Chassis held a dominant market position in the “By Application” segment of the Automotive Wiring Harness Market, with a 34.5% share. This segment’s prominence is due to the chassis’ integral role in integrating various control systems and providing the structural base for mounting components.

Following closely, the Engine segment accounted for a significant share, driven by the complexity of modern engines that require sophisticated wiring harnesses for optimal performance and efficiency. HVAC systems also captured a notable portion of the market, reflecting the increasing demand for advanced climate control technologies in vehicles.

Other segments like Body, Roof, Door & Window, Facia, Seat, and smart Sensors, though smaller in market share, are crucial for their specific functions. These components support the vehicle’s overall functionality and enhance the driver’s experience through improved safety, comfort, and performance.

The diverse applications of wiring harnesses in these areas underscore the market’s adaptability and the automotive industry’s shift towards more electrified and digitally connected vehicles. As automakers continue to innovate, the wiring harness market will likely see shifts in segment dominance, aligning with evolving automotive technologies and consumer preferences.

By Vehicle Type Analysis

In 2023, Passenger Cars held a dominant market position in the “By Vehicle Type” segment of the Automotive Wiring Harness Market, commanding a 58.4% share. This leading position reflects the substantial volume of passenger cars produced globally, each requiring extensive wiring harness systems to support a growing array of electronic functions from safety systems to infotainment.

Commercial Vehicles also secured a significant market share, driven by the increasing adoption of advanced electronic systems in buses and trucks for enhanced operational efficiency and compliance with emission standards.

Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs) collectively form another vital component of the market. These vehicles are increasingly equipped with sophisticated electronic devices for better fleet management and real-time monitoring, further expanding the demand for reliable and efficient wiring harness solutions.

The distinction between LCVs and HCVs in the market segmentation highlights differing technological needs and customization levels required by varying vehicle sizes and uses.

Overall, the Automotive Wiring Harness Market’s landscape is significantly shaped by the rise in electronic content per vehicle, stringent automotive standards, and consumer demand for high-performance, feature-rich vehicles.

The dominance of the Passenger Cars segment underscores the broader trend toward vehicle electrification and automation, driving continuous innovations and growth in the wiring harness industry.

By Propulsion Analysis

In 2023, IC Engine Vehicle held a dominant market position in the “By Propulsion” segment of the Automotive Wiring Harness Market, with a commanding 82.1% share. This substantial share underscores the pervasive use of internal combustion engines across the global automotive sector, despite the growing interest in electric vehicles.

IC engines continue to be the backbone of transportation, necessitating complex wiring harness systems to manage everything from basic engine functions to advanced emissions control and fuel efficiency technologies.

Conversely, the Electric Vehicle segment, while smaller, is rapidly gaining market share due to increasing investments in EV technology and supportive environmental policies. Electric vehicles require specialized wiring harnesses designed to handle higher voltages and the complex interconnections of battery management systems, motors, and onboard charging systems. This segment’s growth is fueled by the automotive industry’s shift towards sustainable mobility solutions and the global push for reduced carbon emissions.

The stark contrast in market share between IC Engine Vehicles and Electric Vehicles highlights the ongoing transition within the automotive industry, reflecting both the enduring prevalence of traditional propulsion systems and the dynamic growth potential of electric mobility. As regulatory pressures and technological advancements converge, the wiring harness market for electric vehicles is expected to witness significant expansion, reshaping the future dynamics of the industry.

By Material Analysis

In 2023, Metallic held a dominant market position in the “By Material” segment of the Automotive Wiring Harness Market, capturing a 72.4% share. This significant market share is attributed to the durability, conductivity, and cost-effectiveness of metallic components, predominantly copper, which remains the standard in automotive electrical systems for its superior electrical conductivity and flexibility.

Following closely, Aluminum, recognized for its lightweight properties, accounted for a substantial portion of the market. This material is increasingly favored in vehicle design to reduce overall weight and improve fuel efficiency, aligning with the automotive industry’s push toward sustainability.

Other metals also play a critical role, particularly in specialty applications where properties like high-temperature resistance and additional strength are required. Meanwhile, segments like Optical Fiber, including both Plastic Optical Fiber and Glass Optical Fiber, though smaller in share, are gradually emerging in the market.

These materials are gaining traction for their ability to provide high-speed data transmission essential for advanced driver-assistance systems (ADAS) and in-vehicle infotainment systems.

The material composition of wiring harnesses is a key factor in their functionality and performance, with Metallic materials leading due to their established use and reliability.

However, as the automotive industry evolves towards more electric and digitally connected vehicles, the demand for advanced materials like optical fibers is expected to grow, reflecting broader technological shifts within the sector.

Key Market Segments

By Component

- Electric Wires

- Connectors

- Terminals

- Others

By Application

- Body

- Roof

- Door & Window

- Facia

- Seat

- Engine

- Chassis

- HVAC

- Sensors

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- LCV HCV

By Propulsion

- IC Engine Vehicle

- Electric Vehicle

By Material

- Metallic

- Aluminum

- Copper

- Other Metals

- Optical Fiber

- Plastic Optical Fiber

- Glass Optical Fiber

Drivers

Key Drivers in the Wiring Harness Market

The Automotive Wiring Harness Market is experiencing robust growth, primarily driven by the increasing electrification of vehicles. As automakers continue to introduce more electric and hybrid models, the complexity and number of electronic components in vehicles are rising significantly.

This surge in electronic integration necessitates more sophisticated wiring harness systems to efficiently manage power distribution and data transmission across various vehicle systems. Additionally, advancements in automotive safety technologies such as advanced driver-assistance systems (ADAS) require complex wiring solutions to ensure reliable performance.

The push for enhanced vehicle connectivity and autonomous driving technologies further accelerates the demand for high-quality automotive wiring harnesses. Collectively, these factors are propelling the market forward, as manufacturers innovate to meet the evolving needs of modern vehicles.

Restraint

Challenges in the Wiring Harness Market

One significant restraint in the Automotive Wiring Harness Market is the high cost of advanced wiring harness systems. These systems are crucial for newer, technology-laden vehicles, including electric and autonomous cars, but their complexity and the need for high-quality, durable materials drive up production costs.

This is particularly challenging in competitive markets where cost efficiency is crucial. Additionally, the installation of these sophisticated systems requires more time and precision, increasing labor costs and complexity in manufacturing processes.

The reliance on global supply chains for components also poses risks, such as supply chain disruptions or tariffs, which can further inflate costs and affect market growth. These factors collectively pose challenges to the expansion of the automotive wiring harness market, impacting both manufacturers and consumers.

Opportunities

Growth Avenues in the Harness Market

The Automotive Wiring Harness Market is ripe with opportunities, particularly from the rapid advancements in vehicle technology. The ongoing shift towards electric vehicles (EVs) and autonomous driving systems opens up new prospects for wiring harness manufacturers.

These vehicles require more complex wiring systems that can handle increased electrical loads and data communications essential for sensors, cameras, and other high-tech components. Moreover, the global push for cleaner and more efficient transportation solutions encourages innovations in lightweight and high-performance wiring harness materials, offering additional growth potential.

Furthermore, the integration of connectivity features such as IoT devices in vehicles presents another exciting opportunity for the development of smarter, more integrated wiring solutions that can enhance vehicle functionality and user experience, positioning the wiring harness industry at the forefront of automotive technology evolution.

Challenges

Hurdles in Harness Market Growth

The Automotive Wiring Harness Market faces several challenges that could impede its growth. One major challenge is the increasing complexity of automotive electrical systems, which demands more sophisticated and costly wiring harness solutions.

As vehicles incorporate more advanced technologies like autonomous driving and connectivity features, the wiring systems become more intricate, raising production difficulties and costs. Additionally, the global dependency on intricate supply chains for components exposes manufacturers to risks such as material shortages and logistic disruptions, which can lead to production delays.

Environmental regulations also pose challenges, as they require manufacturers to adopt eco-friendly materials and processes, potentially increasing costs and complicating compliance. These challenges require manufacturers to innovate continuously while managing costs and supply chain risks to maintain competitiveness in the dynamic automotive market.

Growth Factors

Drivers Boosting Harness Market

The Automotive Wiring Harness Market is propelled by several growth factors that reflect the evolving automotive landscape. The increasing demand for electric vehicles (EVs) is a primary driver, as these vehicles require complex wiring systems to manage higher electrical loads and connectivity needs.

Additionally, the ongoing advancement in safety features, like advanced driver-assistance systems (ADAS), necessitates more intricate wiring harnesses to ensure reliability and functionality. The global push towards connected and autonomous vehicles also stimulates market growth, as these technologies demand enhanced data transmission capabilities within the vehicle’s infrastructure.

Furthermore, regulatory mandates for vehicle safety and emissions standards drive continuous innovation in this sector, making automotive wiring harnesses more integral to modern vehicle architectures. These factors collectively fuel the market’s expansion, aligning with the industry’s shift towards more sophisticated and technology-integrated vehicles.

Emerging Trends

Trends Shaping Harness Market

Emerging trends in the Automotive Wiring Harness Market are significantly influenced by the industry’s technological advancements. One prominent trend is the integration of environmentally friendly and lightweight materials in wiring harnesses to support the automotive industry’s shift towards sustainability and improved fuel efficiency.

Another trend is the increasing use of modular and scalable wiring harness designs that can be easily adapted for different vehicle models and technologies, reducing production costs and time. Additionally, there is a growing adoption of smart wiring solutions that incorporate sensors and IoT technologies, allowing for real-time diagnostics and enhanced vehicle performance monitoring.

These trends are driven by the need for more efficient, durable, and technologically advanced wiring systems that meet the demands of modern, electronically complex vehicles, setting a dynamic pace for future developments in the market.

Regional Analysis

The Automotive Wiring Harness Market exhibits distinct regional dynamics, with Asia Pacific leading the charge, commanding a dominant 47.3% market share and valued at USD 23.93 billion.

This region’s prominence is bolstered by its robust automotive manufacturing base, particularly in countries like China, Japan, and South Korea, which are major hubs for vehicle production and technological innovation. North America also holds a significant position in the market, driven by advanced technological adoption and stringent safety regulations that necessitate sophisticated wiring harness systems.

Europe follows closely, with its strong emphasis on automotive safety and environmental standards, contributing to a steady demand for high-quality wiring harnesses. Meanwhile, the Middle East & Africa and Latin America are emerging markets in this sector, experiencing gradual growth due to increasing vehicle production and an expanding automotive sector.

These regions are witnessing a rise in automotive investments and a shift towards more technologically advanced vehicles, providing new opportunities for market expansion. Overall, while Asia Pacific continues to dominate, each region presents unique growth prospects based on its automotive industry development and technological adoption levels.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Automotive Wiring Harness Market, key players such as Yura Corporation, Aptiv PLC, and Lear Corporation are strategically positioned to capitalize on the market’s growth trends. Each company brings unique strengths to the forefront, influencing its market standing and competitive dynamics.

Yura Corporation, primarily based in South Korea, leverages its geographical advantage in Asia Pacific, the dominant region in the market. With a strong focus on R&D and close ties with major Asian automotive manufacturers, Yura is well-placed to innovate and expand its presence in wiring harness solutions, particularly for electric vehicles, which are rapidly gaining market share in this region.

Aptiv PLC, known for its high engineering capabilities and commitment to sustainable mobility, is a major player in both North America and Europe. Aptiv’s strategy focuses on next-generation technologies, including advanced safety systems and connectivity solutions. Their investment in autonomous driving technologies and electrification is positioning them as a leader in the development of complex wiring harnesses that meet stringent regulatory and environmental standards.

Lear Corporation excels in integrating electrical systems and seating into comprehensive automotive solutions. With a strong manufacturing and design presence globally, Lear is adept at catering to the evolving needs of the market, emphasizing durability and performance in harsh environments. Their focus on modular designs in wiring harnesses enhances flexibility and reduces manufacturing costs, aligning with the industry’s push towards more efficient production practices.

Collectively, these companies underscore the competitive nature of the market, where innovation, strategic regional focus, and adaptability to industry trends define the leaders in the automotive wiring harness space. Each is responding to the shifts in automotive technologies and consumer demands, ensuring their growth in a rapidly evolving marketplace.

Top Key Players in the Market

- Yura Corporation

- Lear Corporation

- Delphi Automotive LLP

- Fujikura Ltd.

- Sumitomo Electric Industries, Ltd.

- SamvardhanaMotherson Group

- SPARK MINDA

- THB Group

- NexansAutoelectric

- Yazaki Corporation

- PKC Group

- Furukawa Electric Co. Ltd

- Leoni Ag

Recent Developments

- In March 2023, Delphi Automotive LLP launched a new series of high-voltage wiring harnesses designed for next-generation electric vehicles. This product launch aims to meet the growing demand for EV infrastructure and enhance vehicle efficiency.

- In February 2023, Fujikura Ltd., acquired a smaller electronics manufacturer to bolster its capacity for producing automotive wiring harnesses. This move is intended to expand its product offerings and improve integration with smart vehicle technologies.

- In January 2023, Sumitomo Electric Industries, Ltd., received a significant investment of $50 million to enhance its production facilities for automotive wiring harnesses. This funding is part of Sumitomo’s strategy to advance its manufacturing processes and increase output to support rising global demand.

Report Scope

Report Features Description Market Value (2023) USD 50.6 Billion Forecast Revenue (2033) USD 75.6 Billion CAGR (2024-2033) 4.10% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component(Electric Wires, Connectors, Terminals, Others), By Application(Body, Roof, Door & Window, Facia, Seat, Engine, Chassis, HVAC, Sensors), By Vehicle Type(Passenger Cars, Commercial Vehicles, LCV HCV), By Propulsion(IC Engine Vehicle, Electric Vehicle), By Material((Metallic,(Aluminum, Copper, Other Metals)), (Optical Fiber,(Plastic Optical Fiber, Glass Optical Fiber))) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Yura Corporation, Aptiv PLC, Lear Corporation, Delphi Automotive LLP, Fujikura Ltd., Sumitomo Electric Industries, Ltd., SamvardhanaMotherson Group, SPARK MINDA, THB Group, NexansAutoelectric, Yazaki Corporation, PKC Group, Furukawa Electric Co. Ltd, Leoni Ag Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Wiring Harness MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Wiring Harness MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Yura Corporation

- Lear Corporation

- Delphi Automotive LLP

- Fujikura Ltd.

- Sumitomo Electric Industries, Ltd.

- SamvardhanaMotherson Group

- SPARK MINDA

- THB Group

- NexansAutoelectric

- Yazaki Corporation

- PKC Group

- Furukawa Electric Co. Ltd

- Leoni Ag