Global Automotive Torque Converter Market Size, Share, Growth Analysis By Transmission Type (Automatic Transmission, Continuously Variable Transmission, Dual Clutch Transmission, Others), By Application (Passenger Vehicle, Commercial Vehicle), By Vehicle Type (Hybrid Electric Vehicle, Plug-In Hybrid Electric Vehicle), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171003

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

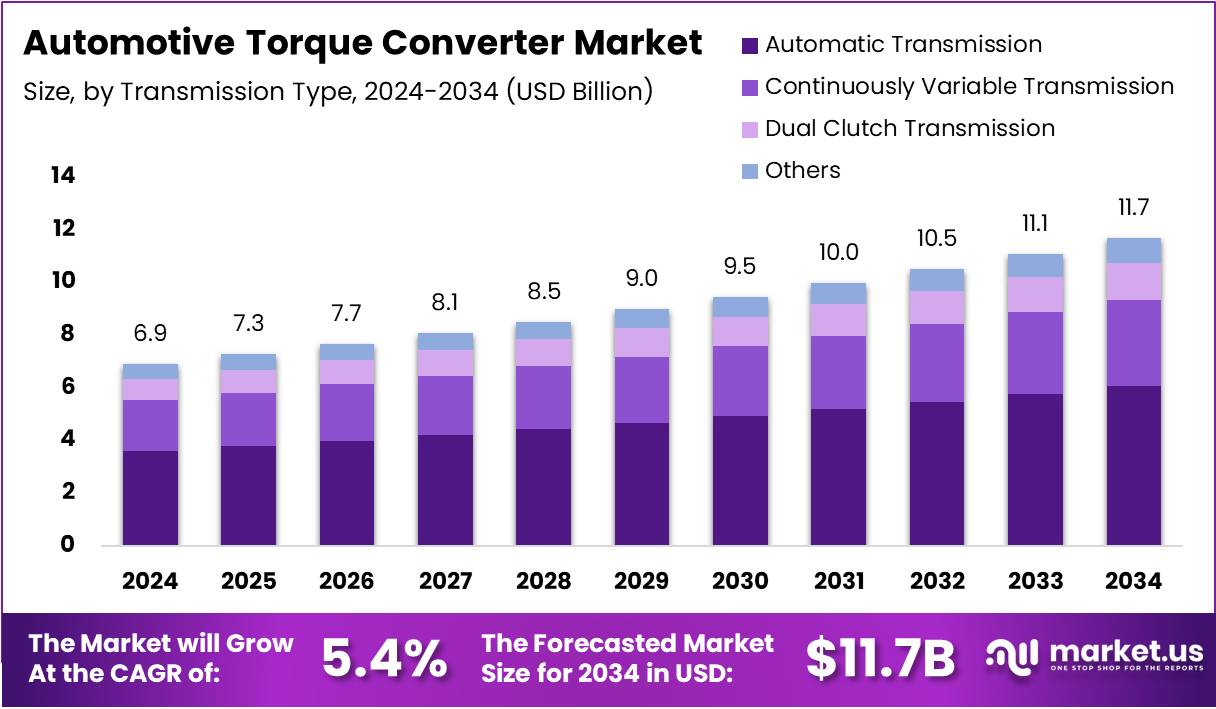

The Global Automotive Torque Converter Market size is expected to be worth around USD 11.7 Billion by 2034, from USD 6.9 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The Automotive Torque Converter Market represents a critical component ecosystem within automatic transmission systems, facilitating smooth power transfer between engines and drivetrains. This fluid coupling device multiplies engine torque while enabling vehicles to idle without stalling. Consequently, torque converters have become indispensable in modern automatic transmission architectures, driving sustained market expansion globally.

Market growth accelerates as consumer preferences shift toward automatic transmissions, particularly in developing economies. Meanwhile, technological advancements in lock-up clutch systems enhance fuel efficiency and performance capabilities. Furthermore, the integration of electronic controls optimizes torque multiplication ratios, creating substantial opportunities for manufacturers investing in advanced converter technologies.

Government regulations mandating improved fuel economy standards significantly influence market dynamics. Therefore, automotive manufacturers prioritize developing sophisticated torque converter solutions that minimize transmission losses. Additionally, emission reduction policies across major automotive markets compel industry players to innovate lightweight, high-efficiency converter designs that align with environmental compliance requirements.

Investment opportunities emerge as hybrid and electric vehicle segments expand, requiring specialized torque converter adaptations. However, traditional internal combustion engine vehicles continue dominating market volumes, ensuring steady demand. Moreover, aftermarket replacement needs generate consistent revenue streams, particularly in regions with aging vehicle fleets requiring transmission component upgrades.

Operational efficiency improvements demonstrate remarkable potential through advanced lock-up strategies. Research indicates that aggressive lock-up configurations maintain engagement for 67.6% of driving cycles, compared to merely 8.3% under conventional strategies. This substantial difference translates directly into enhanced fuel economy and reduced parasitic losses during operation.

Market penetration reaches exceptional levels in developed economies, particularly North America. Statistics reveal that 95% of cars sold domestically feature automatic transmissions, underscoring the transmission system’s dominance. Furthermore, torque converter performance parameters exhibit maximum torque multiplication ratios between 2.3 to 3.0 at zero speed ratios, declining to 1.0 once speed ratios exceed 0.85 to 0.9, establishing critical engineering benchmarks for product development initiatives.

Key Takeaways

- The global automotive torque converter market is projected to grow from USD 6.9 Billion in 2024 to USD 11.7 Billion by 2034, at a 5.4% CAGR.

- Automatic Transmission leads the transmission type segment with a market share of 53.7%, reflecting its strong adoption across vehicle categories.

- Passenger Vehicles dominate the application segment, accounting for 69.2% of total market demand in 2024.

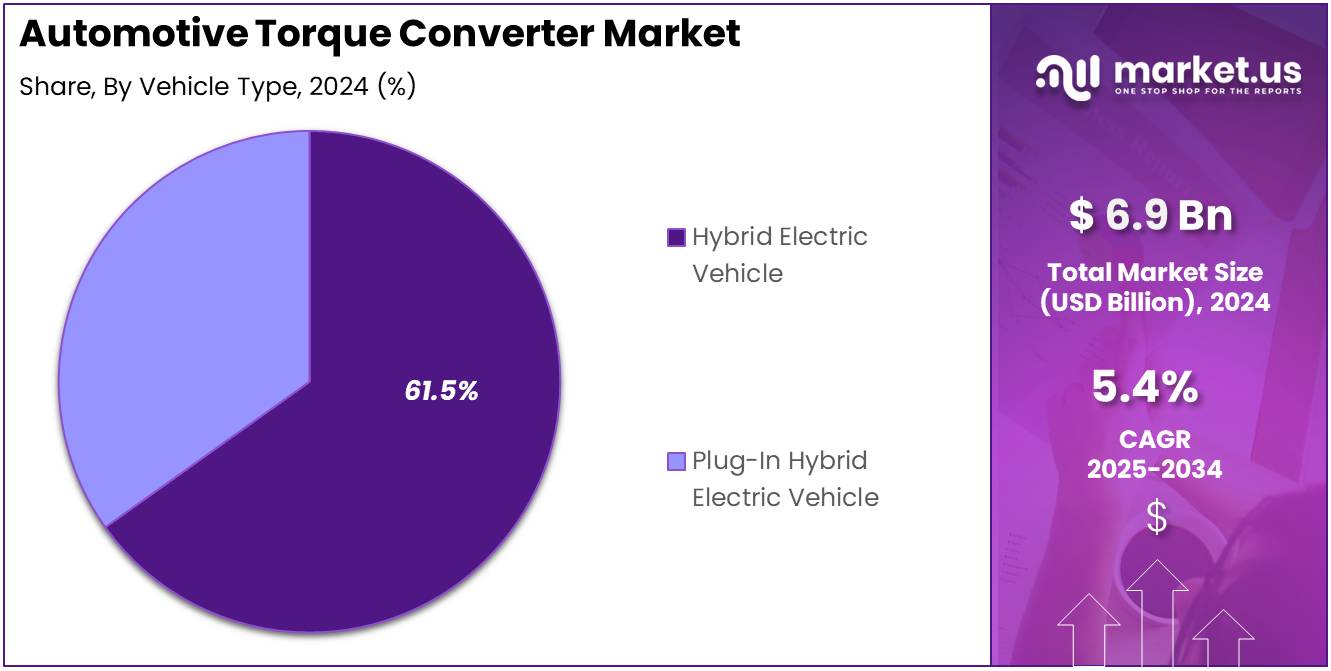

- Hybrid Electric Vehicles represent the largest vehicle type segment with a share of 61.5%, driven by electrification trends.

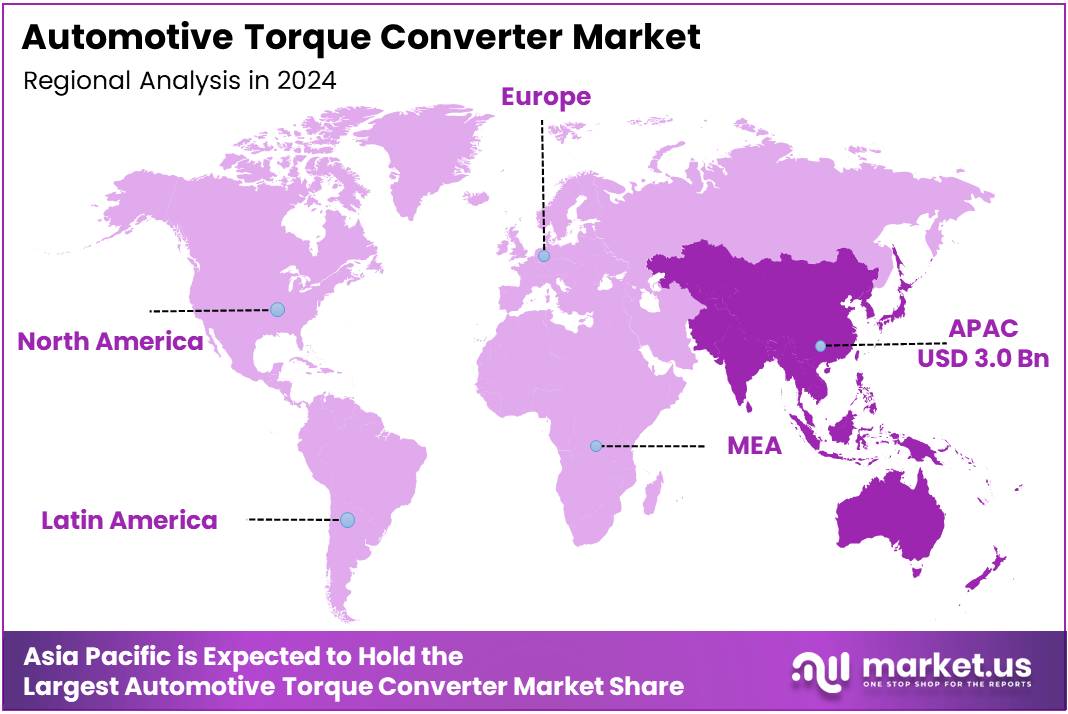

- Asia Pacific is the leading region, holding 44.9% of the global market and valued at approximately USD 3 Billion.

Transmission Type Analysis

Automatic Transmission dominates with 53.7% due to its widespread adoption and proven reliability in torque management.

In 2024, Automatic Transmission held a dominant market position in the By Transmission Type Analysis segment of Automotive Torque Converter Market, with a 53.7% share. This segment leads due to superior power transfer and enhanced fuel efficiency. Manufacturers prefer automatic transmissions for optimizing engine performance. Growing consumer demand for comfortable driving experiences significantly boosts adoption in automatic systems across vehicle segments.

Continuously Variable Transmission represents a growing segment driven by emphasis on fuel economy and seamless acceleration. CVT systems utilize specialized torque converters enabling infinite gear ratios for optimal efficiency. Manufacturers increasingly integrate CVT technology in compact vehicles to meet emission regulations. This segment appeals to environmentally conscious consumers seeking improved performance characteristics.

Dual Clutch Transmission gains traction among performance-oriented manufacturers due to rapid gear shifting and enhanced power delivery. DCT systems employ torque converters for launch control and low-speed maneuverability. This segment particularly appeals to sports car manufacturers and premium automotive brands. The technology bridges manual precision with automatic convenience effectively.

Others category encompasses emerging transmission technologies including automated manual and hybrid systems. These configurations utilize specialized torque converter designs addressing niche market requirements. The segment serves heavy-duty applications and specialized vehicles where conventional types may not provide optimal solutions. Innovation drives growth in this category.

Application Analysis

Passenger Vehicle dominates with 69.2% due to rising global automobile production and increasing consumer preferences for automatic transmissions.

In 2024, Passenger Vehicle held a dominant market position in the By Application Analysis segment of Automotive Torque Converter Market, with a 69.2% share. This dominance stems from exponential passenger car production growth worldwide, particularly in emerging economies. Modern passenger vehicles increasingly feature automatic and CVT transmissions requiring high-performance torque converters. Consumer preferences shift toward enhanced comfort, smooth acceleration, and improved fuel efficiency across various road conditions.

Commercial Vehicle segment represents substantial market portion driven by expanding logistics and transportation industries globally. Commercial vehicles including trucks and buses require robust torque converters handling heavy loads under demanding operational conditions. Growing e-commerce accelerates commercial vehicle production, consequently increasing torque converter demand. Fleet operators increasingly prefer automatic transmission equipped vehicles to reduce driver fatigue and improve operational efficiency significantly.

Vehicle Type Analysis

Hybrid Electric Vehicle dominates with 61.5% due to increasing environmental regulations and consumer shift toward sustainable mobility solutions.

In 2024, Hybrid Electric Vehicle held a dominant market position in the By Vehicle Type Analysis segment of Automotive Torque Converter Market, with a 61.5% share. Hybrid vehicles require specialized torque converters efficiently managing power distribution between internal combustion engines and electric motors. Global emphasis on reducing carbon emissions prompts manufacturers to invest heavily in hybrid technology. Government incentives and stringent emission norms accelerate hybrid vehicle adoption across major automotive markets.

Plug-In Hybrid Electric Vehicle segment experiences rapid expansion as consumers seek extended electric-only driving ranges combined with conventional fuel flexibility. PHEVs utilize sophisticated torque converter systems managing complex power transitions between electric and combustion modes. Rising investments in charging infrastructure and battery technology advancements make PHEVs increasingly attractive. This segment particularly appeals to urban drivers seeking reduced fuel costs and lower emissions while maintaining extended range capabilities.

Key Market Segments

By Transmission Type

- Automatic Transmission

- Continuously Variable Transmission

- Dual Clutch Transmission

- Others

By Application

- Passenger Vehicle

- Commercial Vehicle

By Vehicle Type

- Hybrid Electric Vehicle

- Plug-In Hybrid Electric Vehicle

Drivers

Growing Global Automotive Production Supporting Increased Torque Converter Demand

The automotive torque converter market is experiencing significant growth driven by expanding vehicle manufacturing worldwide. As global automotive production continues to rise, particularly in emerging economies, the demand for torque converters has seen corresponding increases. Manufacturers are ramping up production to meet the needs of growing vehicle populations across Asia-Pacific, Latin America, and Africa.

Consumer preferences are shifting notably toward automatic transmissions, which require torque converters for smooth operation. Modern drivers increasingly favor the convenience and comfort of automatic gear systems over traditional manual transmissions. This preference is especially strong in urban areas where stop-and-go traffic makes automatic transmissions more practical and less fatiguing for daily commuting.

Technological improvements in torque converter design are also propelling market expansion. Engineers have developed advanced materials and specialized coatings that significantly enhance component durability and operational efficiency. These innovations reduce wear and tear while improving power transfer between the engine and transmission. Better materials mean longer-lasting torque converters that deliver improved fuel economy and smoother performance throughout the vehicle’s lifespan, making them more attractive to both manufacturers and consumers.

Restraints

Increasing Shift Towards Electric Vehicles Reducing Demand for Conventional Torque Converters

The automotive torque converter market faces notable challenges as the industry undergoes fundamental transformation. The most significant restraint comes from the accelerating adoption of electric vehicles, which do not require traditional torque converters. As governments worldwide push for emission reductions and automakers invest heavily in EV technology, the long-term demand for conventional torque converters is declining. This shift represents a fundamental market disruption that manufacturers must address through diversification strategies.

Technical complexity presents another substantial challenge for the industry. Modern automatic and hybrid transmission systems have become increasingly sophisticated, making torque converter integration more difficult and costly. Engineers must ensure compatibility with advanced transmission control systems, electronic management units, and hybrid powertrains. These integration challenges require significant research and development investment, raising production costs and extending development timelines.

The combination of these restraints creates uncertainty for traditional torque converter manufacturers. Companies must balance current production needs with future market realities, requiring careful strategic planning and potential business model adjustments to remain competitive in an evolving automotive landscape.

Growth Factors

Integration of Torque Converters with Hybrid Powertrain Systems for Improved Fuel Efficiency

The automotive torque converter market presents compelling growth opportunities despite evolving industry dynamics. Hybrid vehicle technology offers particularly promising prospects, as manufacturers work to optimize torque converters for hybrid powertrains. These specialized components help improve fuel efficiency by managing power flow between electric motors and combustion engines. The growing hybrid vehicle segment creates sustained demand for advanced torque converter solutions tailored to these complex systems.

Premium vehicle segments are driving demand for specialized high-performance torque converters. Sports car and luxury vehicle manufacturers require lightweight components that deliver exceptional performance without compromising efficiency. These applications command premium pricing and offer attractive profit margins for manufacturers who can meet exacting performance specifications and quality standards.

Emerging markets represent substantial untapped potential for aftermarket growth. As vehicle ownership expands in developing regions, the need for maintenance, repair, and replacement services increases correspondingly. Independent service centers and parts distributors in these markets require reliable torque converter supplies. Establishing distribution networks and service partnerships in countries with rapidly growing automotive sectors can generate significant long-term revenue streams for forward-thinking companies willing to invest in market development.

Emerging Trends

Adoption of Lock-Up Torque Converters for Enhanced Vehicle Fuel Economy

Several important trends are reshaping the automotive torque converter landscape. Lock-up torque converter technology has gained widespread adoption as manufacturers pursue improved fuel efficiency. These systems mechanically lock the converter at certain speeds, eliminating slippage losses and reducing fuel consumption. Regulatory pressure for better fuel economy across global markets makes lock-up technology increasingly standard rather than optional in modern vehicles.

Noise, vibration, and harshness reduction has become a critical focus area for torque converter development. Consumers expect quieter, smoother driving experiences, pushing engineers to design components that minimize unwanted noise and vibration transmission. Advanced damping systems, precision manufacturing techniques, and refined hydraulic designs help achieve these comfort objectives without sacrificing performance or durability.

Commercial and heavy-duty vehicle applications are increasingly incorporating multi-stage torque converter technology. These sophisticated systems use multiple turbine stages to improve power multiplication and efficiency across broader operating ranges. Trucks, buses, and construction equipment benefit from enhanced low-speed torque multiplication while maintaining efficient highway operation.

Regional Analysis

Asia Pacific Dominates the Automotive Torque Converter Market with a Market Share of 44.9%, Valued at USD 3 Billion

Asia Pacific commands the automotive torque converter market with a dominant market share of 44.9%, valued at USD 3 billion, driven by robust automotive manufacturing capabilities and expanding vehicle production across China, India, Japan, and South Korea. The region benefits from favorable government policies, rising middle-class populations with increasing disposable incomes, and strong adoption of automatic transmission systems in emerging economies, solidifying its leadership position in the global market.

North America Automotive Torque Converter Market Trends

North America represents a significant market characterized by high consumer preference for automatic transmission vehicles and advanced automotive technologies. The region’s growth is supported by established automotive manufacturers, stringent fuel efficiency regulations, and increasing demand for SUVs and light commercial vehicles equipped with sophisticated torque converter systems that enhance performance and driving comfort.

Europe Automotive Torque Converter Market Trends

Europe maintains a substantial market presence driven by engineering innovation and stringent emission standards that demand advanced torque converter technologies. Key manufacturing hubs in Germany, France, and the United Kingdom focus on developing high-efficiency systems with improved lock-up capabilities, while the growing emphasis on hybrid vehicle development creates opportunities for next-generation torque management solutions.

Middle East and Africa Automotive Torque Converter Market Trends

The Middle East and Africa region exhibits steady growth supported by increasing vehicle sales in Gulf Cooperation Council countries and gradual automotive sector development across African nations. Rising infrastructure investments, growing urbanization, and preference for automatic transmission vehicles in affluent Middle Eastern markets drive demand, though economic volatility and price sensitivity in certain areas moderate growth rates.

Latin America Automotive Torque Converter Market Trends

Latin America represents an emerging market with growth centered around Brazil, Mexico, and Argentina as key automotive hubs. The region’s market development is influenced by increasing middle-class purchasing power, establishment of manufacturing facilities by global automotive companies, and gradual shift toward automatic transmission systems, despite challenges from economic fluctuations and traditional preference for manual transmissions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Torque Converter Company Insights

Aisin Seiki Co., Ltd. maintains its position as a dominant force in the market, leveraging its deep integration within the Toyota supply chain and extensive research capabilities to deliver high-efficiency torque converters that meet increasingly stringent fuel economy standards. The company’s focus on hybrid and electric vehicle applications positions it well for the evolving automotive landscape.

Allison Transmission Holdings, Inc. stands out particularly in the commercial vehicle segment, where its specialized torque converters are engineered for heavy-duty applications including trucks, buses, and off-highway equipment. The company’s reputation for durability and performance in demanding environments has solidified its market share among fleet operators and commercial vehicle manufacturers globally.

BorgWarner Inc. demonstrates strong market presence through its comprehensive portfolio of advanced torque converter technologies, emphasizing reduced weight and improved hydraulic efficiency. The company’s strategic investments in electrification and sustainable mobility solutions reflect its commitment to adapting traditional torque converter expertise to next-generation powertrains, including hybrid systems that require sophisticated torque management.

EXEDY Corporation has carved a significant niche as a leading supplier of torque converters across both OEM and aftermarket channels. Known for its precision manufacturing and quality standards, EXEDY serves major automotive manufacturers while also maintaining strong relationships with transmission rebuilders and performance enthusiasts. The company’s ability to balance mass production efficiency with customization capabilities has enabled consistent growth across diverse market segments and geographic regions throughout 2024.

Top Key Players in the Market

- Aisin Seiki Co., Ltd.

- Allison Transmission Holdings, Inc.

- BorgWarner Inc.

- EXEDY Corporation

- JATCO Ltd.

- Schaeffler Group

- Precision of New Hampton, Inc.

- Raybestos Powertrain, LLC

- Sonnax Industries, Inc.

- Transtar Industries, Inc.

Recent Developments

- In October 2025, Valeo received the International Automotive Innovation Award at EQUIP AUTO Paris for its remanufactured dual-clutch and torque converter components.This recognition highlights the growing focus on the circular economy and sustainable aftermarket parts within the automotive transmission ecosystem.

- In June 2025, Toyota launched the Land Cruiser Hybrid 48V in Europe, equipped with an 8-speed automatic transmission and a refined torque converter.The system supports a smooth transition between the diesel engine and the 48V electric motor, improving drivability and efficiency.

- In March 2025, Aisin announced the adoption of its newly developed hybrid transmission unit with a high-efficiency torque converter for the Mitsubishi Xforce HEV.This marked the first production of such an electric transmission unit in the ASEAN region.

- In October 2024, Mitsubishi Electric Mobility and Aisin Corporation formed a strategic business partnership targeting electrified vehicles (xEVs).

The collaboration focuses on integrating torque management and transmission components with advanced electric drive units.

Report Scope

Report Features Description Market Value (2024) USD 6.9 Billion Forecast Revenue (2034) USD 11.7 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Transmission Type (Automatic Transmission, Continuously Variable Transmission, Dual Clutch Transmission, Others), By Application (Passenger Vehicle, Commercial Vehicle), By Vehicle Type (Hybrid Electric Vehicle, Plug-In Hybrid Electric Vehicle) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aisin Seiki Co., Ltd., Allison Transmission Holdings, Inc., BorgWarner Inc., EXEDY Corporation, JATCO Ltd., Schaeffler Group, Precision of New Hampton, Inc., Raybestos Powertrain, LLC, Sonnax Industries, Inc., Transtar Industries, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Torque Converter MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Torque Converter MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aisin Seiki Co., Ltd.

- Allison Transmission Holdings, Inc.

- BorgWarner Inc.

- EXEDY Corporation

- JATCO Ltd.

- Schaeffler Group

- Precision of New Hampton, Inc.

- Raybestos Powertrain, LLC

- Sonnax Industries, Inc.

- Transtar Industries, Inc.