Global 8K Technology Market By Device (Monitor & Laptop, Television, Professional Camera, Projector), By End-User (Consumer Electronics, Sports & Media, Medical, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120530

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

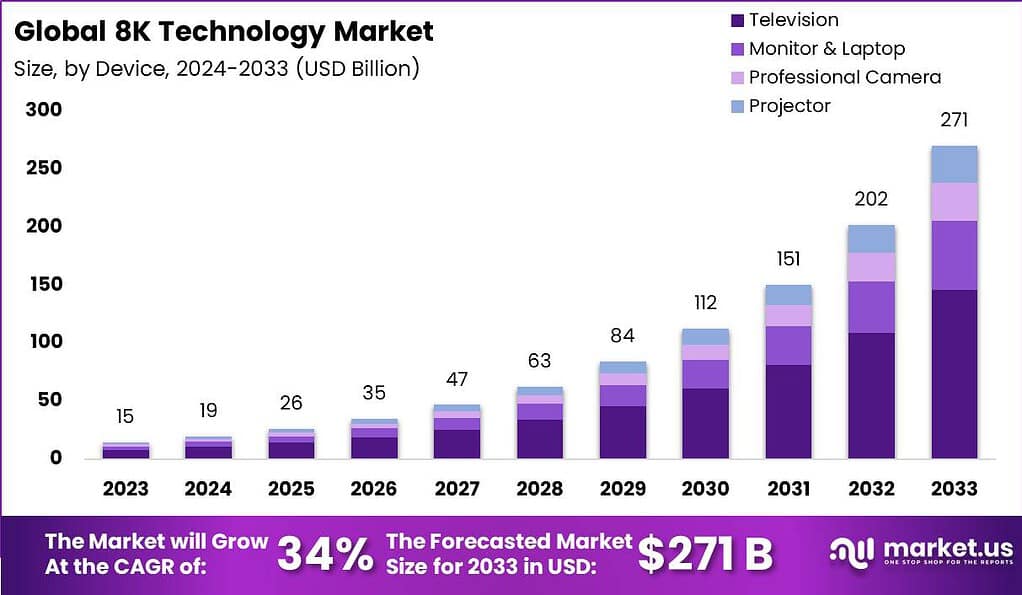

The Global 8K Technology Market size is expected to be worth around USD 271 Billion By 2033, from USD 15 Billion in 2023, growing at a CAGR of 34% during the forecast period from 2024 to 2033.

8K technology refers to the display resolution of 7680 x 4320 pixels, which is four times the resolution of 4K and sixteen times the resolution of Full HD. It offers an incredibly sharp and detailed viewing experience, making it ideal for large screens and immersive applications such as virtual reality (VR) and augmented reality (AR).

The 8K technology market has been experiencing significant growth in recent years, driven by various factors such as increasing consumer demand for higher resolution displays, advancements in display technologies, and the proliferation of content creation in 8K. For instance In January 2023, Samsung and LG introduced new high-resolution gaming monitors. At the CES 2023 event, Samsung announced the launch of the Odyssey Neo G9, which is the world’s first 8K ultra-wide monitor.

On the other hand, LG released the LG Ultra Gear 38GN9YG. This monitor has a 38-inch curved screen, offers a resolution of 7680 x 1600, and supports a refresh rate of 144Hz, making it ideal for high-performance gaming. One of the key growth factors for the 8K technology market is the rising demand for enhanced visual experiences. Consumers are increasingly seeking high-resolution displays to enjoy content with greater clarity and detail. The availability of larger screen sizes, especially in televisions, has further fueled the demand for 8K technology.

The gaming industry is also contributing to the growth, as gamers seek immersive and lifelike experiences, which can be achieved through 8K displays. Advancements in display technologies have played a crucial role in the growth of the 8K market. Manufacturers have been able to develop displays with higher pixel densities, improved color accuracy, and enhanced contrast ratios, resulting in stunning visual quality.

Additionally, the development of more efficient image processing algorithms and chipsets has made it possible to handle the massive amount of data required for rendering 8K content in real-time. Despite the promising growth prospects, the 8K technology market also faces several challenges. One of the primary challenges is the scarcity of native 8K content. While the demand for 8K displays is increasing, the availability of content produced in 8K resolution is relatively limited.

Content creators and broadcasters need to invest in upgrading their production and distribution infrastructure to keep pace with the demand for 8K content. Despite the challenges, the 8K technology market presents several opportunities. As the demand for 8K content grows, content creators, broadcasters, and streaming platforms have an opportunity to expand their offerings and cater to the needs of consumers who seek higher resolution experiences.

Key Takeaways

- The 8K Technology Market is estimated to reach USD 271 billion by 2033, with a robust Compound Annual Growth Rate (CAGR) of 34% throughout the forecast period.

- In 2023, the Television segment held a dominant market position within the 8K technology market, capturing a significant share.

- In 2023, the Consumer Electronics segment held a dominant market position in the 8K technology market, capturing more than a 37% share

- In 2023, the Asia-Pacific (APAC) region held a dominant position in the 8K technology market, capturing more than a 35% share.

Device Analysis

In 2023, the Television segment held a dominant market position within the 8K technology market, capturing a significant share. This leadership can be attributed to several pivotal factors. Firstly, the substantial rise in consumer demand for higher resolution and better picture quality has driven the adoption of 8K televisions. Advances in display technologies and the decreasing cost of 8K TV units have made them more accessible to a broader audience, contributing to their increased market penetration.

According to Ofcom, smart TVs, which can run apps and access the internet, are now common in many UK households. Last year, 67% of homes in the United Kingdom had a smart TV. There is a growing trend towards adopting 8K technology in televisions, prompting companies to quickly introduce new models of 8K televisions to meet this increasing demand.

Moreover, the proliferation of high-quality content production, particularly in the media and entertainment sectors, has encouraged consumers to opt for 8K televisions. The ability of these devices to provide exceptionally detailed and immersive viewing experiences aligns with the growing consumer preference for advanced home entertainment solutions.

Additionally, manufacturers have heavily marketed 8K televisions, highlighting their superior resolution and compatibility with emerging technologies such as virtual reality (VR) and augmented reality (AR), which require high-resolution displays to deliver enriched user experiences. Another factor supporting the dominance of the Television segment is the strategic collaborations between content creators and television manufacturers, aimed at promoting 8K content.

These partnerships have been crucial in showcasing the capabilities of 8K technology, thus stimulating consumer interest and adoption. Overall, the Television segment’s leadership in the 8K technology market is underpinned by significant advancements in technology, favorable consumer trends, and effective market strategies by key players, ensuring its prominent position in the industry landscape.

End-User Analysis

In 2023, the Consumer Electronics segment held a dominant market position in the 8K technology market, capturing more than a 37% share. This leadership stems primarily from the rapid consumer adoption of high-resolution devices, such as 8K TVs, monitors, and cameras, which offer superior image and video quality. As households increasingly opt for advanced technological solutions, the demand for these products has surged, boosting the segment’s growth.

Additionally, the integration of 8K technology in consumer electronics is being driven by enhancements in complementary technologies like high-speed Internet, improved streaming capabilities, and the evolution of graphic processing units (GPUs). These advancements make 8K content more accessible and enhance the overall user experience, contributing to the popularity of 8K devices in the consumer electronics space. Manufacturers are also focusing on expanding their product portfolios to include 8K technology, which is becoming a key factor in their competitive strategy.

The forward momentum of the Consumer Electronics segment is further supported by significant investments in marketing and consumer education, aimed at highlighting the benefits of 8K technology. As a result, consumer awareness and interest in upgrading to 8K-enabled devices have grown, solidifying this segment’s leading position in the market. Moreover, ongoing technological innovations and price reductions are expected to continue driving the expansion of 8K technology within the consumer electronics sector, promising sustained growth in the coming years.

Key Market Segments

By Device

- Monitor & Laptop

- Television

- Professional Camera

- Projector

By End-User

- Consumer Electronics

- Sports & Media

- Medical

- Others

Driver

Advancements in Display Technology and Increasing Content Creation

The rapid advancements in display technologies are a key driver for the growth of the 8K technology market. Innovations in Ultra-High Definition (UHD) display panels and the expansion of production capabilities enhance the visual experience, making 8K technology increasingly appealing to consumers and professionals alike.

Additionally, the financial support from governments for technological advancements further accelerates market growth. This driver is complemented by the increasing availability of various products designed for creating and delivering 8K content, which fosters greater adoption of 8K technology across different sectors

Restraint

Limited Availability of 8K Content

One significant restraint facing the 8K technology market is the limited availability of native 8K content. While the technology for 8K displays continues to advance, the content ecosystem has not kept pace, leading to a scarcity of media that can fully utilize 8K resolution capabilities.

This gap hinders the potential for widespread adoption of 8K technology, as the benefits of higher resolution displays are not fully realized without appropriate content. Moreover, there is uncertainty about the application of 8K technology in various industries, including smartphones, tablets, and automotive, which could further limit market growth in these segments.

Opportunity

8K Broadcasts in Sports and Entertainment

The 8K technology market has significant opportunities in the broadcasting sector, particularly in sports and entertainment. The ability to stream ultra-high-definition broadcasts offers a more immersive viewing experience, which is particularly appealing during large-scale sporting events and cinematic productions.

Additionally, the proliferation of 5G technology and increasing demand for on-demand content provide fertile ground for the expansion of 8K technology, not only in home entertainment but also in digital signage and other commercial applications.

Challenge

High Costs and Technical Complexity

The high cost associated with 8K technology-based products poses a major challenge for market growth. The manufacturing and integration of advanced display technology make 8K devices more expensive than their lower-resolution counterparts, which can deter average consumers from adopting this technology.

Furthermore, the technical complexity involved in producing and streaming 8K content requires significant computational power and bandwidth, which can be a barrier for content providers and consumers alike. This complexity also extends to the integration of 8K technology in different platforms and industries, requiring substantial investment in infrastructure.

Growth Factors

- Increased Adoption in Consumer Electronics: The widespread integration of 8K technology in consumer electronics, particularly in televisions and monitors, is a primary growth factor. As consumers seek higher resolution and image quality, the demand in this segment significantly propels the market forward.

- Technological Advancements in Displays: Continuous innovations in display technology enhance the visual experience, thus driving consumer interest in 8. Improvements in color accuracy, upscaling algorithms, and the overall quality of displays are key factors that enhance market growth.

- Growth in Content Creation and Broadcasting: There’s an increasing amount of 8K content being produced, especially in the realms of cinema and broadcasting. This is not only due to the technology’s superior capabilities but also because of its potential for highly immersive experiences.

- Expansion of 5G Technology: The rollout of 5G networks enhances the capabilities for streaming high-resolution content, which is crucial for the practical usability of 8K technology. This network advancement lowers the barriers for streaming and accessing high-quality content, encouraging further adoption of 8K technology.

- Market Initiatives and Promotional Activities: Active marketing efforts by key industry players and promotional campaigns significantly contribute to the awareness and adoption of 8K technology. These initiatives help in educating consumers about the benefits of 8K resolution, thus stimulating market demand.

Latest Trends

- Increasing Integration in Smartphones: Many recent smartphones are now capable of capturing and displaying 8K video, catering especially to the younger demographics who prioritize advanced camera functionalities. This trend is rapidly transforming mobile technology into a key platform for 8K content creation and consumption.

- Upscaling Technologies: As 8K display technology becomes more prevalent, upscaling lower-resolution content to 8K is becoming an important feature. This allows consumers to enjoy a high-quality visual experience even with content not originally produced in 8K.

- Enhanced Gaming Experiences: The gaming industry is adopting 8K technology to provide more immersive experiences. High-end gaming PCs and consoles capable of supporting 8K resolution are becoming more popular, particularly in regions with high technology uptake like North America .

- Diversification of Use Cases: Beyond entertainment and consumer electronics, 8K technology is finding applications in fields such as digital signage, medical imaging, and professional photography, broadening the market scope and potential for growth.

- Regional Market Expansion: Asia Pacific, led by countries like China, Japan, and South Korea, is seeing significant growth in the 8K market. This is driven by the strong local production of consumer electronics and governmental initiatives aimed at upgrading technological infrastructure.

Regional Analysis

In 2023, the Asia-Pacific (APAC) region held a dominant position in the 8K technology market, capturing more than a 35% share. This significant market presence can be attributed to several factors, including rapid technological advancements and the high adoption rate of new technologies among consumers. The demand for 8K technology in APAC was valued at USD 5.2 billion in 2023 and is anticipated to grow significantly in the forecast period.

Major economies such as China, Japan, and South Korea are leading the adoption, driven by strong local manufacturing capabilities and substantial investments in research and development. Additionally, the region’s thriving entertainment and gaming industries continue to demand higher resolution displays, further propelling the market growth.

Meanwhile, North America also shows substantial involvement in the 8K technology sector. The region is characterized by high consumer spending power and a keen interest in the latest entertainment technologies, making it a critical market for 8K TVs and displays. Companies in North America are investing heavily in enhancing content availability to match the capabilities of 8K technology, which is crucial for market uptake.

Furthermore, partnerships between technology providers and content creators are becoming more common, aiming to push the limits of what 8K technology can offer to consumers. Overall, while APIA maintains a larger share, North America’s focus on high-quality content and technological innovation positions it as a key player in the global 8K market. Both regions are pivotal in driving the expansion and adoption of 8K technology, with each contributing uniquely to its development and penetration in the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the competitive landscape of the 8K Technology Market, several key players vie for market share, employing various strategies to maintain their competitive edge. Notable manufacturers include Huawei Technologies Co., Ltd., Hangzhou Hikvision Digital Technology Co., Ltd., Samsung Electronics Co., Ltd., Sharp Corporation (Hon Hai Precision Industry Co., Ltd.), LG Electronics, Panasonic Corporation, Ikegami Tsushinki Co. Ltd, Hisense Co. Ltd, Dell Inc., Canon Inc., Sony Group Corporation, and BOE Technology Group Co., Ltd.

These industry players are strategically focusing on several key business strategies to expand their product portfolio and increase their market shares across different regions. Partnerships, mergers, acquisitions, and product innovations are prominent strategies employed to solidify market presence. Expansion and investments also feature prominently, with companies investing extensively in research and development, building new manufacturing facilities, and optimizing supply chains.

Top Key Players in the Market

- Huawei Technologies Co. Ltd.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Samsung Electronics Co. Ltd.

- Sharp Corporation (Hon Hai Precision Industry Co. Ltd.)

- LG Electronics

- Panasonic Corporation

- Ikegami Tsushinki Co. Ltd

- Hisense Co. Ltd

- Dell Inc.

- Canon Inc.

- Sony Group Corporation

- BOE Technology Group Co. Ltd.

Recent Developments

- Samsung Electronics Unveils Cutting-edge Display Lineup (January 2024): Samsung Electronics introduced its latest lineup of QLED, MICRO LED, OLED, and Lifestyle displays. This unveiling includes the Neo QLED 8K and 4K TVs, boasting unparalleled picture quality, top-tier audio technology, and a diverse selection of apps and services. These offerings cater to consumers seeking premium entertainment experiences, showcasing Samsung’s commitment to innovation in the 8K display segment.

- Sharp NEC Display Solutions Europe Introduces Advanced Digital Cinema Projector (November 2023): Sharp NEC Display Solutions Europe launched the NEC NC603L digital cinema projector. Boasting exceptional quietness at less than 39dB and advanced laser technology for nearly maintenance-free operation, this projector offers long-term performance. Compatible with NEC NC1000C lenses, it provides enhanced cinematic experiences, emphasizing Sharp NEC’s dedication to delivering high-quality projection solutions.

- Sony Electronics Inc. Launches BRAVIA XR TV Lineup (January 2023): Sony Electronics Inc. debuted its 2023 BRAVIA XR TV Lineup, featuring the Cognitive Processor XR for unparalleled home entertainment. The lineup comprises five new models: X95L and X93L Mini LED, X90L Full Array LED, A95L QD-OLED, and A80L OLED, offering diverse options to consumers. This launch underscores Sony’s commitment to pushing the boundaries of display technology and delivering immersive viewing experiences.

Report Scope

Report Features Description Market Value (2023) USD 15 Bn Forecast Revenue (2033) USD 271 Bn CAGR (2024-2033) 34% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device (Monitor & Laptop, Television, Professional Camera, Projector), By End-User (Consumer Electronics, Sports & Media, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Huawei Technologies Co.Ltd., Hangzhou Hikvision Digital Technology Co.Ltd., Samsung Electronics Co. Ltd., Sharp Corporation (Hon Hai Precision Industry Co.Ltd.), LG Electronics, Panasonic Corporation, Ikegami Tsushinki Co.Ltd, Hisense Co.Ltd, Dell Inc., Canon Inc., Sony Group Corporation, BOE Technology Group Co.Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is 8K technology?8K technology refers to a display resolution with 7680 x 4320 pixels, offering four times the resolution of 4K and sixteen times that of Full HD. This high resolution provides extremely detailed and sharp images, making it ideal for large screens and professional applications.

How big is 8K Technology Market?The Global 8K Technology Market size is expected to be worth around USD 271 Billion By 2033, from USD 15 Billion in 2023, growing at a CAGR of 34% during the forecast period from 2024 to 2033.

Who are the key players in the 8K technology market?Leading companies in the 8K technology market include Huawei Technologies Co. Ltd., Hangzhou Hikvision Digital Technology Co. Ltd., Samsung Electronics Co. Ltd., Sharp Corporation (Hon Hai Precision Industry Co. Ltd.), LG Electronics, Panasonic Corporation, Ikegami Tsushinki Co. Ltd, Hisense Co. Ltd, Dell Inc., Canon Inc., Sony Group Corporation, BOE Technology Group Co. Ltd

What trends are driving the adoption of 8K technology?The adoption of 8K technology is driven by several trends including increasing consumer demand for high-end displays, advancements in display technologies such as OLED and MicroLED, rising disposable incomes, and the growing production of 8K content for movies, games, and broadcasting.

What are the main challenges facing the 8K technology market?The 8K technology market faces challenges such as the high cost of 8K displays, which limits widespread adoption, and the limited availability of 8K content. Economic slowdowns can also affect consumer spending on premium technology products.

-

-

- Huawei Technologies Co. Ltd.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Samsung Electronics Co. Ltd.

- Sharp Corporation (Hon Hai Precision Industry Co. Ltd.)

- LG Electronics

- Panasonic Corporation

- Ikegami Tsushinki Co. Ltd

- Hisense Co. Ltd

- Dell Inc.

- Canon Inc.

- Sony Group Corporation

- BOE Technology Group Co. Ltd.