Global 5G Smartphone Antenna Tuner Market By Type (MEMS, Passive, Active), By Application (Smartphones, Tablets, Wearables, Others), By Technology (Tunable Capacitors, Tunable Inductors, Switches, Others), By Distribution Channel (OEMs, Aftermarket), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034.

- Published date: Dec. 2025

- Report ID: 170077

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Type

- By Application

- By Technology

- By Distribution Channel

- Key reasons for adoption

- Key benefits

- Key usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

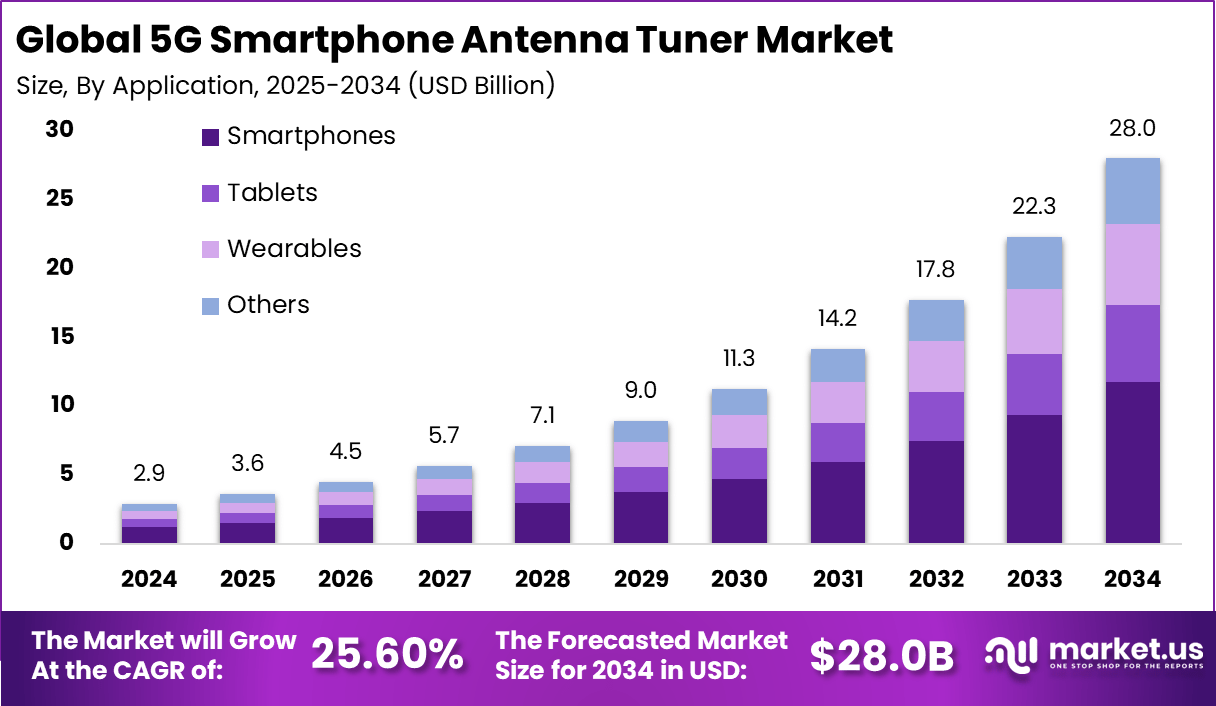

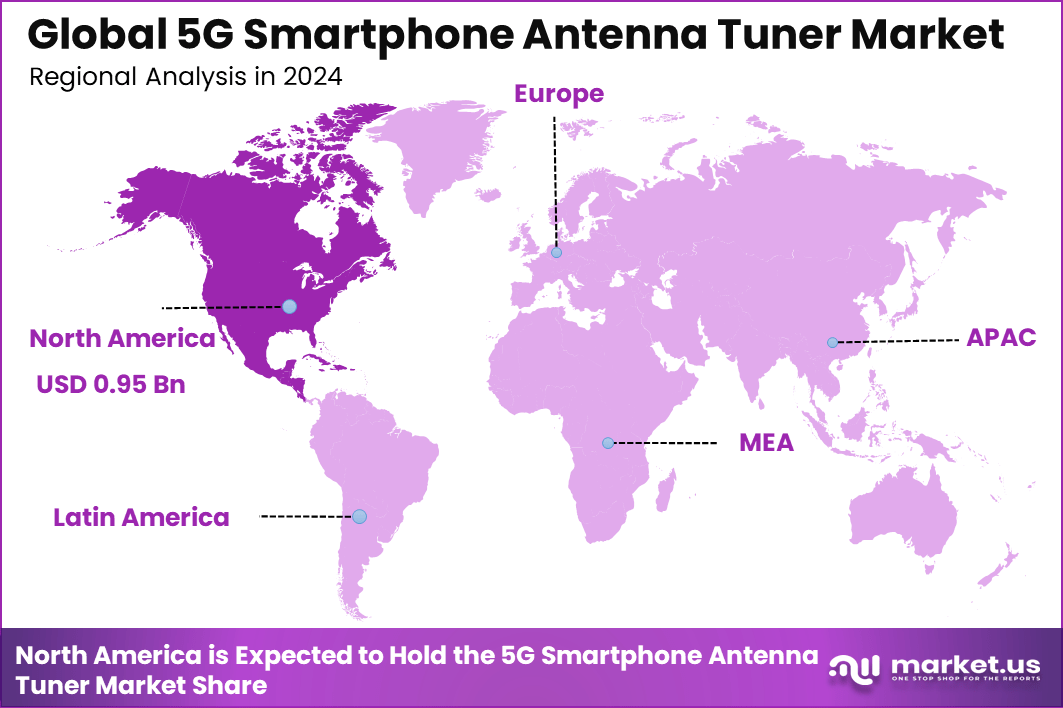

The Global 5G Smartphone Antenna Tuner Market generated USD 2.9 billion in 2024 and is predicted to register growth from USD 3.6 billion in 2025 to about USD 28.0 billion by 2034, recording a CAGR of 25.60% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 33.2% share, holding USD 0.95 Billion revenue.

The 5G smartphone antenna tuner market refers to components integrated into mobile devices that adjust antenna performance for optimal signal reception across multiple frequency bands. These tuners help manage the complex radio frequency environment created by 5G technology, ensuring consistent connectivity and improved user experience.

As 5G networks expand globally, smartphone manufacturers are increasing the use of advanced antenna tuners to support higher data speeds, broader coverage, and reduced interference. The component is essential in modern designs where multiple antennas and spectrum bands must be managed efficiently.

Growth of this market is supported by the rapid rollout of 5G networks and the corresponding need for compatible devices. Consumers and enterprises are upgrading to 5G capable smartphones to benefit from faster download speeds, lower latency, and enhanced connectivity. The complex nature of 5G signals, which operate across low, mid, and high frequency bands, has made advanced antenna tuning critical for reliable performance.

In addition, rising demand for high quality streaming, cloud based applications, and real time services has increased the focus on signal quality and network stability. Component miniaturization and improvements in radio frequency design have also made antenna tuners more effective and easier to integrate. Demand for 5G smartphone antenna tuners is increasing steadily as smartphone shipments shift toward 5G models.

Manufacturers are prioritizing devices that deliver consistent performance across diverse network conditions. Regions with strong 5G infrastructure investments and consumer demand for premium mobile services are seeing higher adoption of advanced antenna tuning technologies. Demand is also influenced by the need to support new 5G services such as Internet of Things connectivity and enhanced mobile broadband.

Top Market Takeaways

- By type, MEMS accounted for 45.5% of the 5G smartphone antenna tuner market, supported by their compact size, low power consumption, and high precision for multi-band 5G RF front-ends.

- By application, smartphones represented 42.0% of the market, reflecting the central role of advanced tuners in maintaining signal quality and data speeds across diverse 5G bands.

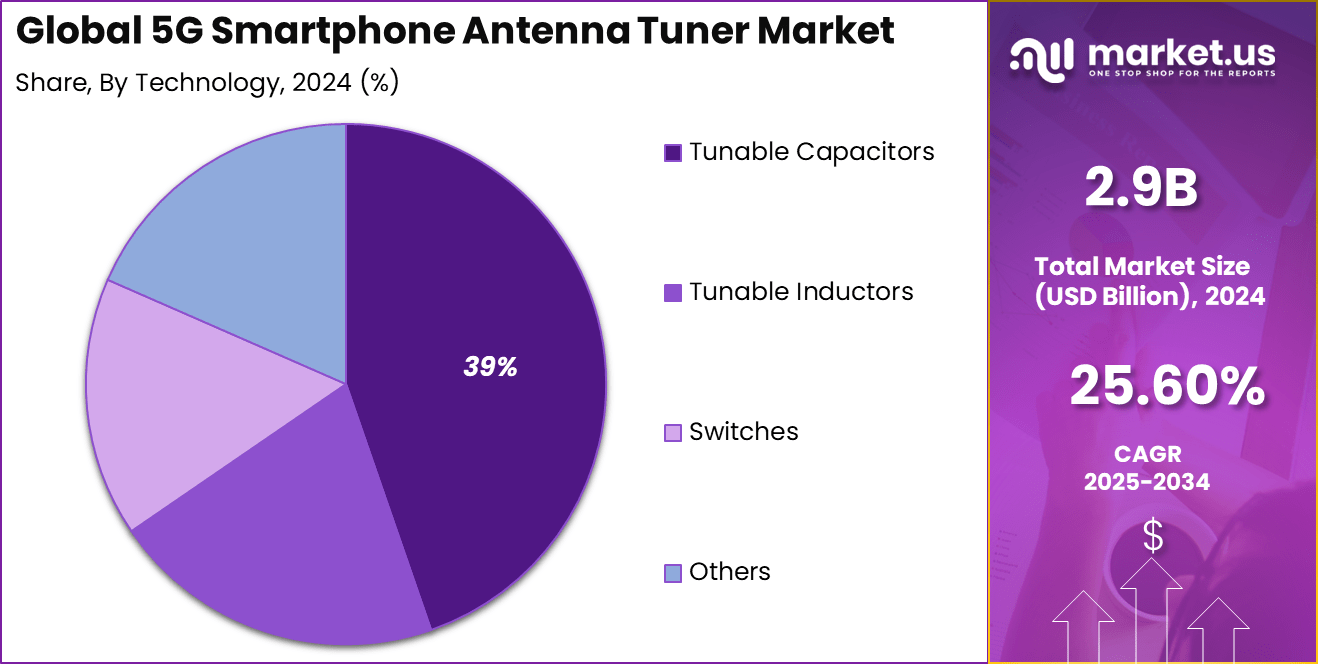

- By technology, tunable capacitors held 38.8% share, favored for precise, efficient tuning of antennas in slim and foldable 5G devices.

- By distribution channel, OEMs contributed 52.6%, as antenna tuners are predominantly integrated directly into smartphones and RF front-end modules by device manufacturers.

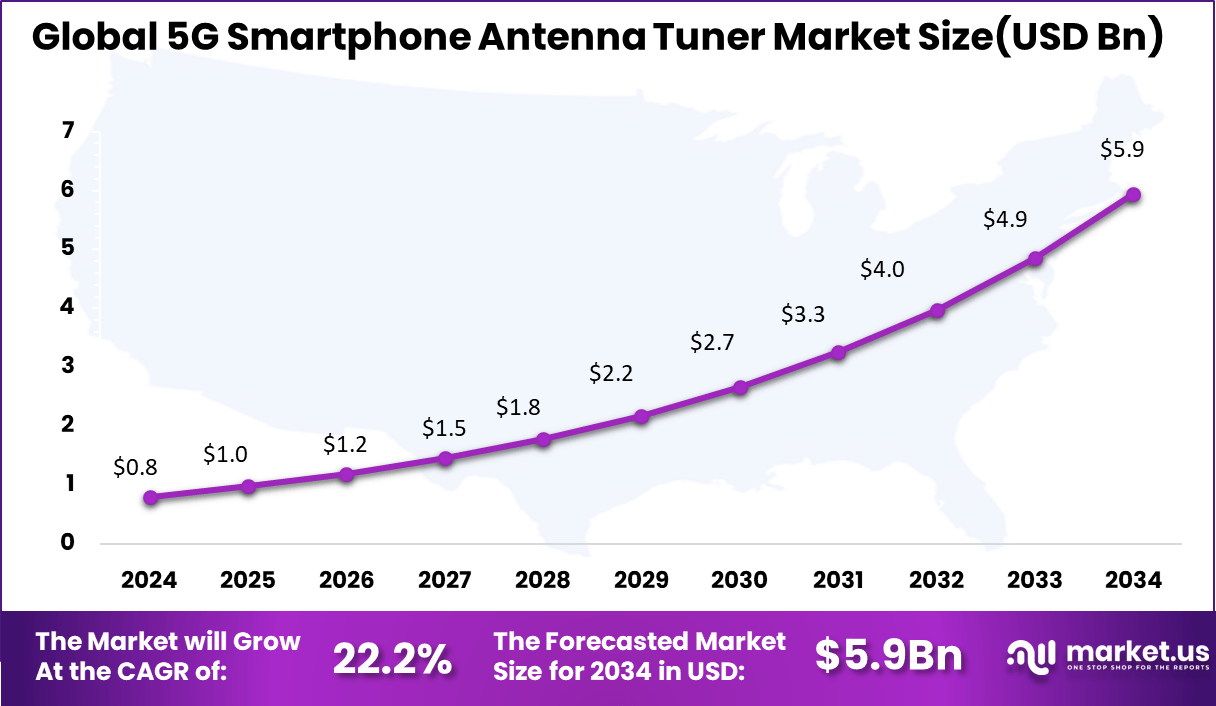

- North America held 33.2% of the global market, with the U.S. valued at USD 0.80 billion in 2025 and projected to grow at a CAGR of 22.2% due to strong 5G smartphone penetration and infrastructure.

By Type

MEMS-based antenna tuners lead with 45.5%, reflecting their strong suitability for compact and high-frequency smartphone designs. MEMS technology enables precise tuning of antenna performance across multiple 5G bands, which is essential for maintaining signal quality and network stability.

Adoption of MEMS tuners is supported by their low power consumption and small form factor. Smartphone manufacturers prefer MEMS solutions as they help improve battery efficiency while supporting advanced radio performance in slim device designs.

By Application

Smartphones account for 42.0%, making them the primary application segment for 5G antenna tuners. The growing use of 5G-enabled smartphones increases the need for advanced tuning systems that can manage signal variation caused by hand position, movement, and network switching.

This segment benefits from rising global smartphone penetration and frequent device upgrades. Antenna tuners help ensure consistent connectivity and improved user experience across different usage conditions and network environments.

By Technology

Tunable capacitors accounted for 39% of the market because they provide an efficient and flexible tuning function that fits the needs of modern 5G antennas. These components allow smartphones to adjust impedance and frequency response dynamically, which supports better throughput and reduced power use.

Their adoption has been strengthened by the growing number of frequency bands in 5G networks, where accurate tuning is needed to maintain strong connectivity. Their electrical performance and durability have made them suitable for large scale integration.Manufacturers continue to invest in tunable capacitor technology because it supports miniaturization and consistent operation under different load conditions.

By Distribution Channel

OEMs represent 52.6%, showing that most antenna tuners are supplied directly to smartphone manufacturers. Direct sourcing allows OEMs to integrate antenna tuning components closely with device design and radio architecture.

This channel benefits from long-term supply agreements and close collaboration between component suppliers and device makers. OEM distribution supports better performance optimization and faster integration of new antenna technologies.

Key reasons for adoption

- Adoption of 5G smartphone antenna tuners is supported by the need to stabilize signal quality across a wider range of 5G bands, as modern devices operate in complex network environments.

- Demand is rising because users expect consistent connectivity even in crowded urban areas, which requires tuners that adjust antenna performance in real time.

- Integration is growing as smartphone manufacturers focus on thinner device designs, where tuners help manage limited internal space without reducing radio performance.

- The shift toward power efficient 5G operation encourages adoption because tuners help optimize antenna impedance and lower energy consumption during data transmission.

- Interest is increasing due to the expansion of advanced applications such as cloud gaming, video streaming, and AR experiences, which rely on steady high speed connections.

Key benefits

- Antenna tuners help maintain stronger and more stable 5G signals, which improves the overall user experience in terms of browsing, streaming, and calling.

- They support better battery life by reducing power loss during radio communication, which makes smartphones more efficient in continuous high data scenarios.

- Their adaptive tuning capabilities allow devices to perform well across global frequency bands, supporting international roaming and multi region compatibility.

- The technology improves network reliability by compensating for hand effects, device orientation changes, and environmental variations.

- Tuners allow manufacturers to design compact smartphones without compromising antenna performance, supporting modern aesthetics and form factors.

Key usage

- Tuners are used extensively in premium and mid range 5G smartphones to deliver stable radio performance across sub-6 GHz and millimeter wave bands.

- They are applied in foldable and compact smartphone designs, where tuning helps manage constrained antenna placement.

- The technology supports devices used for high bandwidth applications such as mobile gaming, HD video streaming, and mixed reality services.

- Tuners are used in global smartphone models that must operate reliably across different regional network standards.

- They are applied in enterprise and industrial mobility devices where uninterrupted 5G connectivity is essential for field operations and real time data transfer.

Emerging Trends

Key Trend Description Better MIMO and Beam Support Antenna tuners work with many antennas and beams in 5G phones to keep signals strong across bands. Smaller Size for Thin Phones New tuner chips fit in slim phones and handle more bands and antennas than older 4G designs. Cover More Bands Tuners now support low, mid and some high 5G bands, enabling stable performance for global travel and fast data anywhere. Smart Auto Tuning Chips detect hand grip and network conditions to auto-adjust antennas for the strongest signal. New Switch Technology Improved switches and materials make tuners faster and more suitable for the high speed needs of 5G. Growth Factors

Key Factors Description 5G Networks Spread Fast More 5G towers mean almost every new smartphone must have tuners for reliable signal quality. More 5G Phones Sold Affordable and premium 5G phones continue to grow in sales, raising demand for tuner chips. Need Fast Data and Low Delay Games, video apps and VR require strong, low-latency signals, increasing the need for advanced tuners. Many New 5G Bands Phones must operate across a wide mix of global 5G bands, making tuners essential for compatibility. More IoT Devices 5G tablets, hotspots and IoT gadgets also require compact tuners, expanding market demand. Key Market Segments

By Type

- MEMS

- Passive

- Active

By Application

- Smartphones

- Tablets

- Wearables

- Others

By Technology

- Tunable Capacitors

- Tunable Inductors

- Switches

- Others

By Distribution Channel

- OEMs

- Aftermarket

Regional Analysis

North America holds 33.2% of the global 5G Smartphone Antenna Tuner market. Tech firms and carriers here push fast 5G rollout across cities, which needs smart tuners to handle many bands and boost signal strength in phones. Factories in the region make high-volume smartphone parts, and demand grows from gaming, streaming, and IoT apps that require steady connections.

Growth comes from new phone models with mmWave support and tests for 5G RedCap tech. Companies invest in RF parts to cut power use and interference, helping a CAGR of 22.2%. Strong supply chains and R&D centers keep North America ahead in tuner tech for next-gen devices.

The U.S. 5G Smartphone Antenna Tuner market reaches USD 0.80 billion with a CAGR of 22.2%. Major phone makers and chip suppliers base operations here, focusing on tuners that switch bands quickly for nationwide 5G coverage. Defense and auto sectors also use similar tech, which spills over to consumer phones.

Consumers demand better battery life and speeds, so firms add AI-driven tuners to flagships. Government funds for 5G infrastructure and trade deals support local production. This makes the U.S. the key driver for North America’s market share in antenna solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rapid Adoption of 5G Smartphones and Higher RF Complexity

The strongest demand driver for the 5G smartphone antenna tuner market is the rapid shift toward 5G handsets and the rising need to support many more bands and carrier aggregation schemes in a slim phone body. As users expect higher data speeds, low latency and stable connections in crowded spectra, handset makers rely on tuners to dynamically match the antenna across sub‑6 GHz and, in some designs, mmWave bands, which improves throughput, coverage at cell edge and battery efficiency.

Together with government‑backed 5G rollouts and broader RF front end content per device, this is creating a structural uplift in antenna tuner attach rates and value per smartphone.At the same time, leading RF vendors highlight that 5G introduces more antenna paths, more MIMO channels and more SKUs per model, which makes active tuning almost indispensable to maintain performance without enlarging the device footprint.

Restraint

Cost Pressure and Integration Constraints in RF Front End

A key restraint for the 5G smartphone antenna tuner market is the intense cost pressure on RF front end design while device makers still need to deliver premium‑grade performance. Analysts note that 5G radios already increase RF content per phone, but end‑user willingness to pay has limits, which forces OEMs and module suppliers to compress margins on components such as tuners, switches and filters.

As RF front end modules grow more complex, integrating tuners for multiple antennas and bands into tight PCB areas raises layout challenges and can raise overall bill of materials when advanced technologies or extra matching networks are required.There is also a regulatory and standards dimension that adds to cost. Different regions allocate and license distinct 5G bands, so vendors must support varying combinations of frequencies and emission rules, which increases design variants and qualification work for each tuner configuration.

Opportunity

Advanced Tuning for MIMO, Carrier Aggregation and Multi‑Device Ecosystems

There is a clear opportunity for antenna tuner vendors to move up the value chain by enabling advanced MIMO, higher order carrier aggregation and multi‑device connectivity scenarios. Technical reviews underline that 5G phones increasingly adopt multi‑antenna arrays and complex MIMO schemes, which benefit from tuners that can manage multiple resonances, states and impedance conditions along a single or multiple radiators.

Solutions that combine tuners, algorithms and sensing to continuously adapt to the user’s hand, head and environment can unlock better real‑world throughput and more consistent quality of service, which handset brands can market as a visible user benefit.Beyond smartphones, the same tuning know‑how can be reused across 5G‑enabled IoT, automotive and industrial devices, where compact antennas must also cover wide frequency ranges with robust links.

Challenge

Balancing Size, Efficiency, Thermal and Antenna Performance in 5G Handsets

A persistent challenge in the 5G smartphone antenna tuner market is balancing antenna efficiency, tuner benefits, device size and thermal behavior. Industry sources explain that each added tuner and RF switch can slightly impact antenna efficiency or bandwidth if not carefully co‑designed, so engineers must trade off how much tuning flexibility they add against raw radiation performance.

At the same time, 5G’s higher frequencies and wide bandwidths increase power draw and heat in RF front ends, so tuning solutions must help rather than worsen thermal and battery constraints inside very thin phone profiles.Device industrial design trends toward thinner and more compact handsets also push antennas closer to the edge of the chassis, near displays, batteries and metal frames, which makes tuning behavior more sensitive to user grip and nearby components.

Competitive Analysis

The 5G Smartphone Antenna Tuner market is moderately concentrated around RF front-end leaders Qorvo, Murata Manufacturing, Skyworks Solutions, Analog Devices, STMicroelectronics, Infineon, NXP and pSemi, which supply high-integration tuner ICs and switches that sit alongside power amplifiers and filters in premium 5G phones.

Qorvo and Skyworks are key suppliers to top OEMs and Apple’s ecosystem for antenna tuning and broader RF modules, leveraging deep patent portfolios and system design know-how, while Murata combines discrete filters, modules and its pSemi subsidiary’s antenna-tuning and mmWave front-end solutions to offer highly integrated modules for sub-6 GHz and mmWave bands.

Analog Devices, STMicroelectronics, Infineon and NXP participate through broader RF and mixed-signal portfolios, focusing more on infrastructure and automotive but increasingly targeting handset design wins as OEMs seek multi-sourcing and cost optimization.

Top Key Players in the Market

- Qorvo

- Murata Manufacturing

- Skyworks Solutions

- TDK Corporation

- STMicroelectronics

- Analog Devices

- Infineon Technologies

- NXP Semiconductors

- Johanson Technology

- Psemi (formerly Peregrine Semiconductor)

- Taoglas

- TE Connectivity

- Amphenol Corporation

- Antenova

- Yageo Corporation

- AVX Corporation

- Vishay Intertechnology

- Molex (a Koch company)

- Sunlord Electronics

- Pulse Electronics

- Others

Future Outlook

The 5G Smartphone Antenna Tuner market is set for sustained expansion as handset makers push to support more frequency bands, carrier aggregation schemes, and advanced features like massive MIMO and beamforming in ever thinner devices.

Growing use of 5G for cloud gaming, video streaming, and XR applications will keep pressure on RF front‑end designers to deliver tuners that maintain strong signal quality across diverse networks, while also reducing power consumption and board space.

As tunable RF components mature, antenna tuners will become more tightly integrated with filters, switches, and power amplifiers, enabling smarter, software‑controlled front ends that adapt dynamically to traffic demands, regional band plans, and emerging standards beyond traditional mobile broadband.

Opportunities lie in

- Developing highly integrated tuner solutions optimized for multi‑antenna 5G flagship and mid‑range smartphones that must support sub‑6 GHz and millimeter‑wave bands in compact designs.

- Supplying tunable components and reference designs for low‑cost 5G devices in emerging markets, where OEMs need flexible RF architectures that can be reused across multiple operators and regions.

- Collaborating with chipset vendors and operators on software‑defined tuning algorithms that use AI and real‑time network feedback to optimize antenna efficiency, battery life, and user experience.

Recent Developments

- June, 2025, Qorvo introduced compact high performance BAW filters and pre driver amplifiers to simplify five G massive MIMO radio designs with smaller footprints.

- August, 2025, company launched five G and SATCOM array calculators to streamline complex antenna tuning and optimization for smartphone and infrastructure applications.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Bn Forecast Revenue (2034) USD 28.0 Bn CAGR(2025-2034) 25.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (MEMS, Passive, Active), By Application (Smartphones, Tablets, Wearables, Others), By Technology (Tunable Capacitors, Tunable Inductors, Switches, Others), By Distribution Channel (OEMs, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Qorvo, Murata Manufacturing, Skyworks Solutions, TDK Corporation, STMicroelectronics, Analog Devices, Infineon Technologies, NXP Semiconductors, Johanson Technology, Psemi (formerly Peregrine Semiconductor), Taoglas, TE Connectivity, Amphenol Corporation, Antenova, Yageo Corporation, AVX Corporation, Vishay Intertechnology, Molex (a Koch company), Sunlord Electronics, Pulse Electronics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  5G Smartphone Antenna Tuner MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

5G Smartphone Antenna Tuner MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Qorvo

- Murata Manufacturing

- Skyworks Solutions

- TDK Corporation

- STMicroelectronics

- Analog Devices

- Infineon Technologies

- NXP Semiconductors

- Johanson Technology

- Psemi (formerly Peregrine Semiconductor)

- Taoglas

- TE Connectivity

- Amphenol Corporation

- Antenova

- Yageo Corporation

- AVX Corporation

- Vishay Intertechnology

- Molex (a Koch company)

- Sunlord Electronics

- Pulse Electronics

- Others