Global 4K UHD AI-Powered Webcam Market Size, Share and Analysis Report By Component (Hardware, Software & Services), By Connectivity (USB, Wireless, Ethernet), By End-User (Enterprise & Corporate Users, Content Creators & Streamers, Education & Remote Learning, Healthcare & Telemedicine, Others), By Application (Video Conferencing & Collaboration, Live Streaming & Content Creation, Online Education & Tutoring, Telehealth & Remote Consultations, Security & Monitoring, Others), By Distribution Channel (Online Retail, Electronics & Specialty Stores, Direct Sales to Enterprises, System Integrators, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174751

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Component Analysis

- Connectivity Analysis

- End-User Analysis

- Application Analysis

- Distribution Channel Analysis

- North America Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

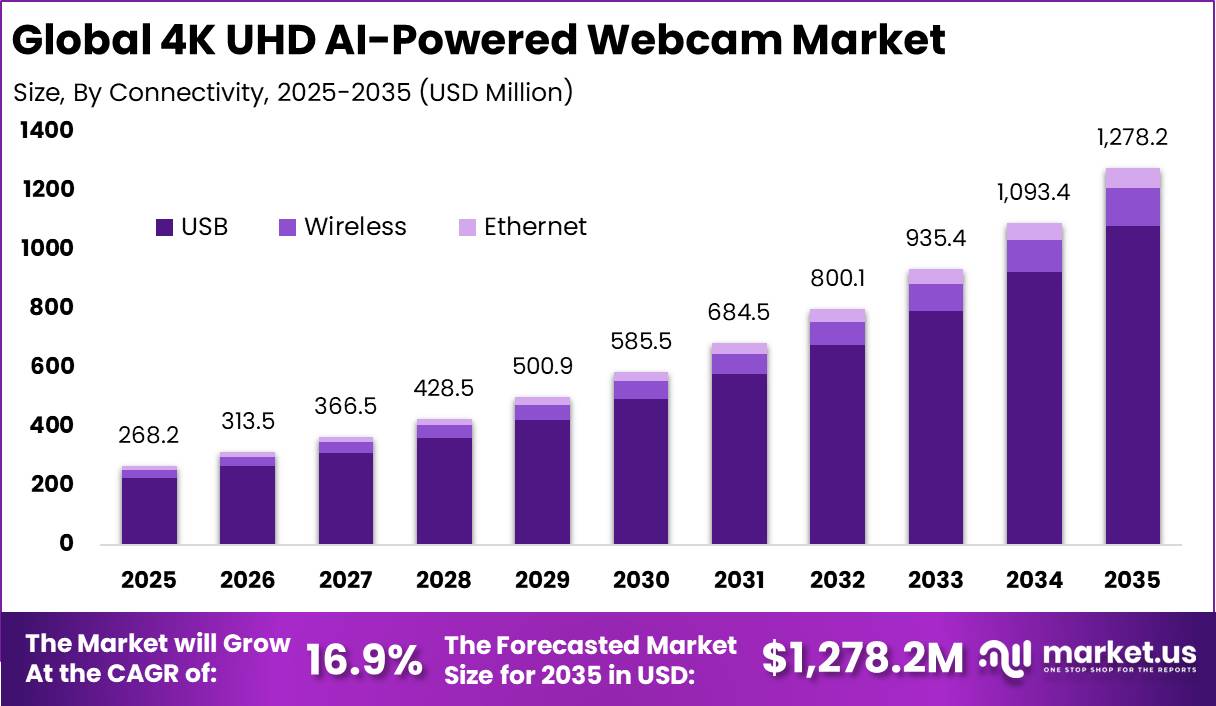

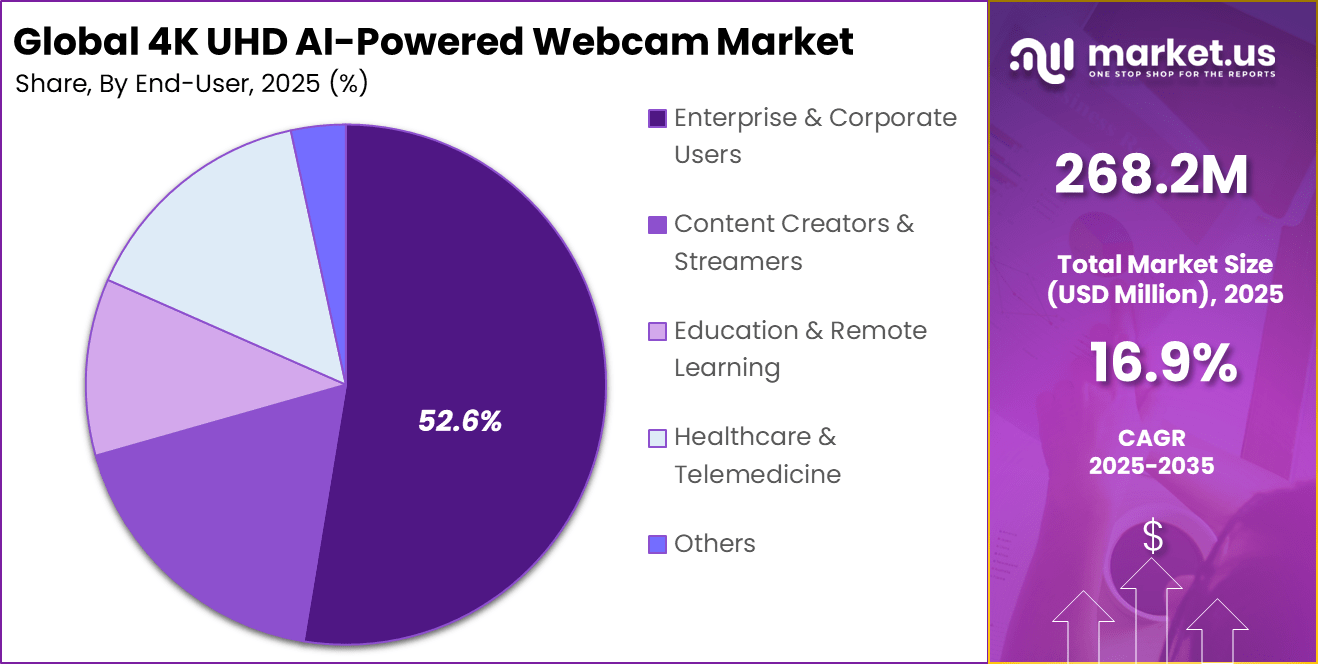

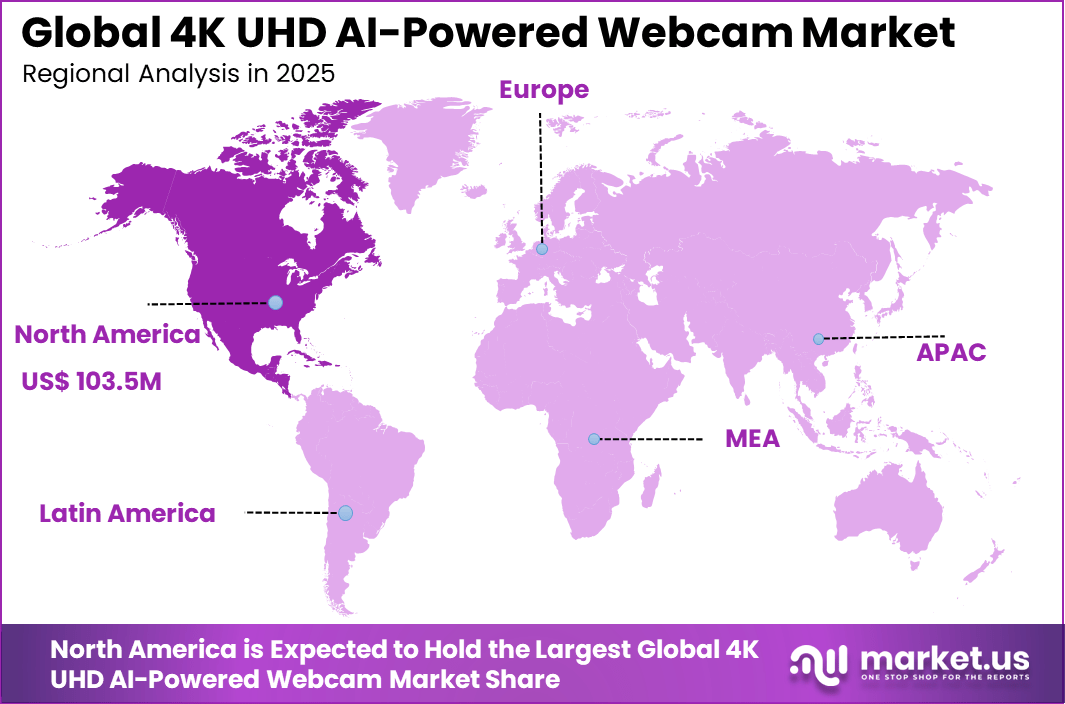

The Global 4K UHD AI-Powered Webcam Market size is expected to be worth around USD 1,278.2 Million By 2035, from USD 268.2 Million in 2025, growing at a CAGR of 16.9% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 38.6% share, holding USD 103.5 Million revenue.

The 4K UHD AI powered webcam market refers to advanced camera devices that combine ultra high-definition video resolution with artificial intelligence features. These webcams deliver 4K video quality while using AI to enhance image clarity, lighting, framing, and focus. They are used for professional video conferencing, content creation, online education, streaming, and enterprise communication. AI capabilities automatically adjust visuals based on environment and user movement.

Adoption supports higher quality and more reliable video interactions. Market development has been influenced by the growing importance of video-based communication. Remote work, virtual collaboration, and digital content creation require clear and professional video quality. Standard webcams often struggle with lighting and resolution limitations. AI powered 4K webcams address these challenges through intelligent image processing. As visual communication becomes more critical, demand continues to rise.

One major driving factor of the 4K UHD AI powered webcam market is the need for high-quality video communication. Businesses and creators seek professional-grade video for meetings and broadcasts. 4K resolution provides sharper images and better detail. AI enhancements improve consistency across environments. Quality expectations drive adoption. Another key driver is the growth of content creation and live streaming activities. Creators rely on clear visuals to engage audiences.

AI powered webcams reduce the need for complex camera setups. Automatic framing and focus improve presentation. Creator economy growth supports market expansion. Demand for 4K UHD AI powered webcams is influenced by the expansion of remote and hybrid work models. Professionals require reliable and high-quality video for virtual meetings. Clear visuals improve communication effectiveness. AI features reduce setup complexity. Workplace adoption increases demand.

Top Market Takeaways

- Hardware leads by component with a 68.9% share, driven by demand for advanced sensors, lenses, and onboard AI processing to deliver ultra-high-definition video quality.

- USB connectivity dominates with 84.7%, reflecting ease of installation, broad device compatibility, and plug-and-play convenience across enterprise environments.

- Enterprise and corporate users account for 52.6%, supported by widespread adoption of professional video tools for meetings, training, and remote collaboration.

- Video conferencing and collaboration represent 71.5% of applications, highlighting strong reliance on high-resolution webcams for hybrid work and virtual communication.

- Online retail leads distribution with 58.4%, enabled by wider product availability, competitive pricing, and direct-to-buyer purchasing models.

- North America holds 38.6% of the global market, backed by high remote-work penetration and early adoption of AI-enabled video technologies.

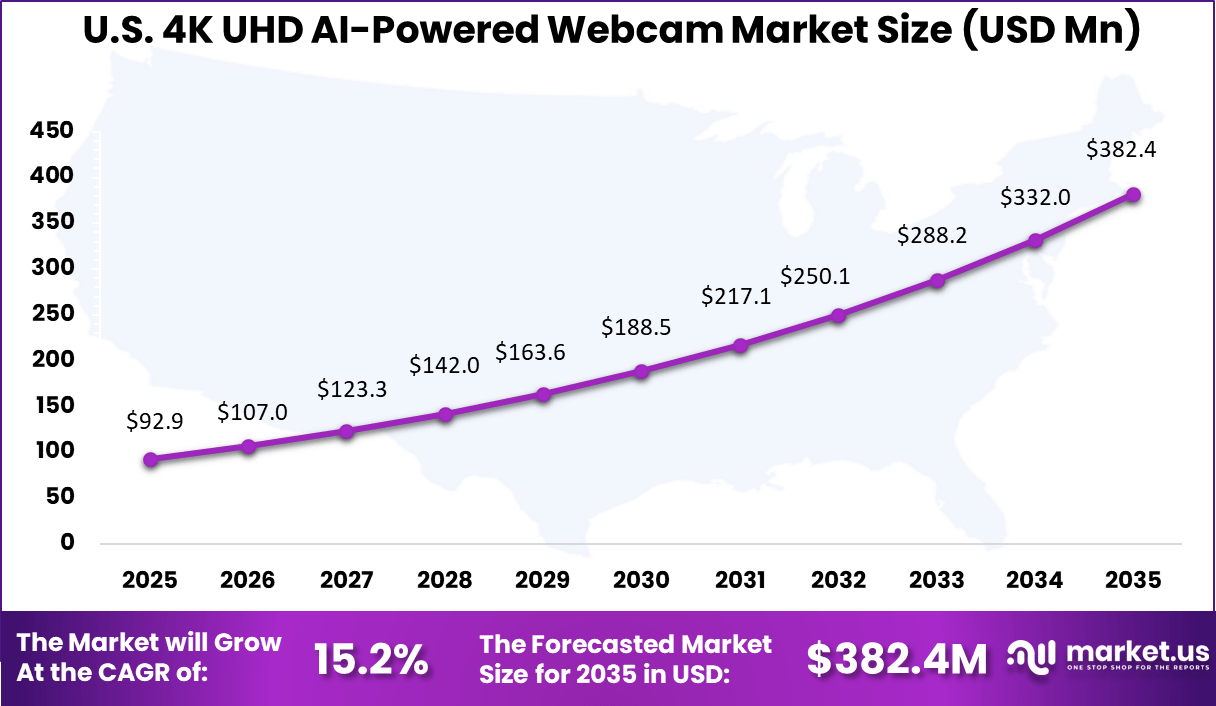

- The U.S. market reached USD 92.9 million, expanding at a 15.23% CAGR, driven by sustained demand for premium video quality in enterprise communication and collaboration.

Component Analysis

Hardware – 68.9%

Hardware accounts for 68.9% of the 4K UHD AI-powered webcam market, reflecting the central role of physical imaging components. High-resolution sensors, lenses, and embedded processors are critical for delivering clear video quality and AI-driven features. Enterprises prioritize reliable hardware to support long working hours and consistent performance.

The demand for advanced hardware is driven by the need for accurate image processing and real-time enhancement. AI-enabled chipsets allow webcams to perform functions such as auto framing, noise reduction, and light correction directly on the device. This reduces dependence on external computing resources.

As video quality expectations increase, hardware innovation remains a key focus area. Manufacturers continue to improve sensor efficiency and processing speed. Hardware investment is expected to remain dominant as performance requirements continue to rise.

Connectivity Analysis

USB – 84.7%

USB connectivity leads the market with an 84.7% share, highlighting its simplicity and broad compatibility. USB webcams can be easily integrated with desktops, laptops, and docking stations without complex setup. This makes them suitable for enterprise and home office environments.

The widespread adoption of USB is supported by its plug-and-play functionality. Enterprises prefer standardized connections to reduce deployment and maintenance complexity. USB also supports stable power delivery and high data transfer speeds required for 4K video.

As organizations standardize video equipment, USB remains the preferred connectivity option. Its reliability and universal acceptance reinforce long-term adoption. USB connectivity continues to support large-scale enterprise deployments.

End-User Analysis

Enterprise and Corporate Users – 52.6%

Enterprise and corporate users represent 52.6% of market demand, driven by professional communication needs. Organizations rely on high-quality video tools to support internal meetings, client interactions, and remote collaboration. AI-powered webcams improve visual clarity and communication effectiveness.

Enterprises value features such as background optimization, speaker tracking, and image consistency. These capabilities enhance meeting quality and reduce manual adjustments. As remote and hybrid work models expand, demand for professional video hardware continues to grow.

Corporate adoption is also influenced by standardization policies and IT procurement strategies. Companies invest in durable and secure devices for long-term use. This positions enterprise users as the primary revenue contributors in the market.

Application Analysis

Video Conferencing and Collaboration – 71.5%

Video conferencing and collaboration account for 71.5% of application demand, making it the dominant use case. Organizations depend on video communication to maintain productivity across distributed teams. 4K UHD webcams provide clearer visuals that improve engagement and comprehension.

AI features enhance conferencing by automatically adjusting framing, focus, and lighting. These improvements reduce distractions and create a more natural meeting experience. Users benefit from consistent video quality across different environments.

The continued reliance on digital collaboration tools supports sustained demand. As video becomes central to daily operations, advanced webcams remain essential. This application segment continues to drive market growth.

Distribution Channel Analysis

Online Retail – 58.4%

Online retail holds a 58.4% share, reflecting changing purchasing behavior for professional electronics. Enterprises and individual users increasingly prefer online platforms for convenience and faster procurement. Digital channels provide access to detailed product information and specifications.

Online distribution supports broader market reach and efficient supply chains. Buyers can compare features, pricing, and compatibility before purchase. This transparency supports informed decision making.

The growth of online procurement aligns with enterprise digital purchasing policies. As logistics and delivery networks improve, online retail continues to gain importance. This channel remains a key route for market expansion.

North America Regional Analysis

Market Share 38.6% | United States USD 92.9 Mn | CAGR 15.23%

North America accounts for 38.6% of the global 4K UHD AI-powered webcam market, supported by strong enterprise adoption. Organizations across the region invest in advanced video infrastructure to support remote work and digital collaboration. High technology awareness supports early adoption.

The United States contributes USD 92.9 million in market value, driven by corporate demand and technology-driven workplaces. Enterprises focus on improving communication quality and employee productivity. AI-powered webcams align well with these objectives.

A CAGR of 15.23% indicates steady growth across the region. Continued hybrid work adoption and enterprise digital transformation support expansion. North America remains a key contributor to overall market development.

Driver Analysis

The 4K UHD AI-powered webcam market is being driven by the rising demand for high-quality video communication and content creation across professional, educational, and consumer segments. As remote work, virtual collaboration, and live streaming become standard practices, organisations and individuals require webcams that deliver ultra-high-definition resolution and intelligent features for clearer, more natural video.

AI-powered capabilities such as auto framing, background enhancement, real-time noise reduction, and facial recognition improve video quality and user experience without manual adjustments. The integration of advanced imaging sensors and machine learning emphasises clarity, reliability, and adaptability in dynamic environments, strengthening preference for smart webcams over basic models.

Restraint Analysis

A key restraint in the 4K UHD AI-powered webcam market relates to cost and integration complexity in professional environments. Ultra-high-definition hardware combined with embedded AI algorithms requires sophisticated components, which can increase product pricing relative to standard webcams. For budget-constrained buyers, initial investment may be a barrier despite potential long-term benefits.

Integration with enterprise communication systems, collaboration platforms, and device management frameworks also requires technical alignment, which can be time consuming and demand specialised IT support. These factors may delay deployment and limit adoption, particularly among small organisations with constrained technology budgets.

Opportunity Analysis

Emerging opportunities in the 4K UHD AI-powered webcam market are linked to expanding use cases in hybrid work, telehealth, online education, and immersive content creation. AI-enhanced webcams can support advanced features such as gesture recognition, contextual scene understanding, and adaptive lighting that cater to varied usage scenarios.

There is also opportunity in vertical-specific solutions tailored for professional broadcast, virtual events, and high-end conferencing suites that prioritise visual fidelity and intelligent automation. As user expectations for seamless virtual interaction continue to evolve, suppliers that offer compatible, easy-to-deploy solutions can capture demand beyond traditional desktop environments.

Challenge Analysis

A central challenge confronting this market relates to balancing AI performance with privacy and data security concerns. Intelligent webcam features often process facial and environmental data to optimise visuals, which raises questions about how video analytics data is collected, stored, and protected.

Organisations must ensure compliance with data protection standards and provide transparent user controls to maintain trust. Additionally, optimising real-time AI processing while minimising latency and hardware strain requires efficient algorithm design and hardware integration, which can be technically demanding and resource intensive.

Emerging Trends

Emerging trends in the 4K UHD AI-powered webcam landscape include increased adoption of edge AI processing that enables intelligent imaging without continuous cloud dependency, enhancing privacy and reducing latency.

Another trend involves modular AI features that users can customise based on their specific requirements, such as presentation mode, virtual backgrounds, and adaptive framing. Integration with collaboration platforms and operating systems is also improving through standardised APIs and plug-and-play designs, simplifying deployment and cross-platform compatibility.

Growth Factors

Growth in the 4K UHD AI-powered webcam market is supported by the continued expansion of remote engagement, hybrid work models, and digital content creation. Organisations and individuals prioritise professional visual quality and intuitive camera behaviour that adapts to real-time conditions.

Technological advancements in imaging sensors, AI-enabled video enhancement, and connectivity standards strengthen the value proposition of smart webcams. As applications extend from business meetings to interactive events, telehealth consultations, and online education, demand for intelligent, high-resolution webcams is expected to remain robust.

Key Market Segments

By Component

- Hardware

- Image Sensor & Lens Module

- AI Processing Chip (NPU)

- Microphone Array

- Mechanical Components (Pan-Tilt-Zoom)

- Others

- Software & Services

- AI Enhancement Software Suite

- Auto-Framing & Face Tracking

- Background Removal & Virtual Backgrounds

- Noise Cancellation & Voice Enhancement

- Gesture & Expression Recognition

- Companion Mobile/Desktop Applications

- Cloud-based AI Features & Subscription Services

- Others

- AI Enhancement Software Suite

By Connectivity

- USB

- Wireless

- Ethernet

By End-User

- Enterprise & Corporate Users

- Content Creators & Streamers

- Education & Remote Learning

- Healthcare & Telemedicine

- Others

By Application

- Video Conferencing & Collaboration

- Live Streaming & Content Creation

- Online Education & Tutoring

- Telehealth & Remote Consultations

- Security & Monitoring

- Others

By Distribution Channel

- Online Retail

- Electronics & Specialty Stores

- Direct Sales to Enterprises

- System Integrators

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Leading vendors such as Logitech International S.A., Razer Inc., and Microsoft Corporation drive adoption through premium 4K webcams with AI features. Their products focus on auto framing, low light enhancement, and noise reduction. Dell Technologies Inc., HP Inc., and Lenovo Group Limited strengthen enterprise demand. These brands benefit from strong distribution and trust in business and hybrid work environments.

Imaging and creator focused players such as AVer Information Inc., Insta360, and Elgato emphasize content creation and live streaming use cases. AI powered background blur and subject tracking improve video quality. Poly supports professional conferencing needs. These companies target streamers, educators, and corporate users. Demand is supported by growth in video first communication and creator economy adoption.

Value oriented and connectivity focused vendors such as Aoni, NexiGo, and Anker Innovations Technology Co., Ltd. address mass market demand. TP-Link Technologies Co., Ltd. integrates webcams with smart home ecosystems. Mevo supports mobile streaming workflows. Other regional vendors expand price competitiveness. This competitive landscape supports steady innovation and wider access to AI powered 4K webcams.

Top Key Players in the Market

- Logitech International S.A.

- Razer Inc.

- Microsoft Corporation

- Dell Technologies Inc.

- HP Inc.

- Lenovo Group Limited

- AVer Information Inc.

- Insta360

- Elgato (Corsair Gaming, Inc.)

- Aoni (Depstech)

- NexiGo

- Anker Innovations Technology Co., Ltd.

- TP-Link Technologies Co., Ltd.

- Mevo (by Logitech)

- Poly (Plantronics, Inc.)

- Others

Recent Developments

- January, 2026: Logitech announced two new AI-powered video solutions at a January 22 event, building on their Brio 4K line to boost meeting room flexibility and intelligence.

- July, 2025: Elgato (Corsair Gaming, Inc.) launched the Facecam 4K, a studio-grade webcam hitting 4K at 60fps with Sony STARVIS 2 sensor, HDR support, and unique 49mm lens filter compatibility for pro creators.

- November, 2025: Razer Inc. introduced the Kiyo V2, blending 4K 30fps visuals with adaptive AI for auto-framing, lighting tweaks, and noise reduction, partnering with Reincubate’s Camo Studio for seamless streaming.

Report Scope

Report Features Description Market Value (2025) USD 268.2 Mn Forecast Revenue (2035) USD 1,278.2 Mn CAGR(2026-2035) 16.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software & Services), By Connectivity (USB, Wireless, Ethernet), By End-User (Enterprise & Corporate Users, Content Creators & Streamers, Education & Remote Learning, Healthcare & Telemedicine, Others), By Application (Video Conferencing & Collaboration, Live Streaming & Content Creation, Online Education & Tutoring, Telehealth & Remote Consultations, Security & Monitoring, Others), By Distribution Channel (Online Retail, Electronics & Specialty Stores, Direct Sales to Enterprises, System Integrators, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  4K UHD AI-Powered Webcam MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

4K UHD AI-Powered Webcam MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Logitech International S.A.

- Razer Inc.

- Microsoft Corporation

- Dell Technologies Inc.

- HP Inc.

- Lenovo Group Limited

- AVer Information Inc.

- Insta360

- Elgato (Corsair Gaming, Inc.)

- Aoni (Depstech)

- NexiGo

- Anker Innovations Technology Co., Ltd.

- TP-Link Technologies Co., Ltd.

- Mevo (by Logitech)

- Poly (Plantronics, Inc.)

- Others