Global 4-Octylphenol Market Size, Share, and Business Benefits By Purity (Up to 99%, Above 99%), By End-User (Chemical, Textile, Rubber, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162474

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

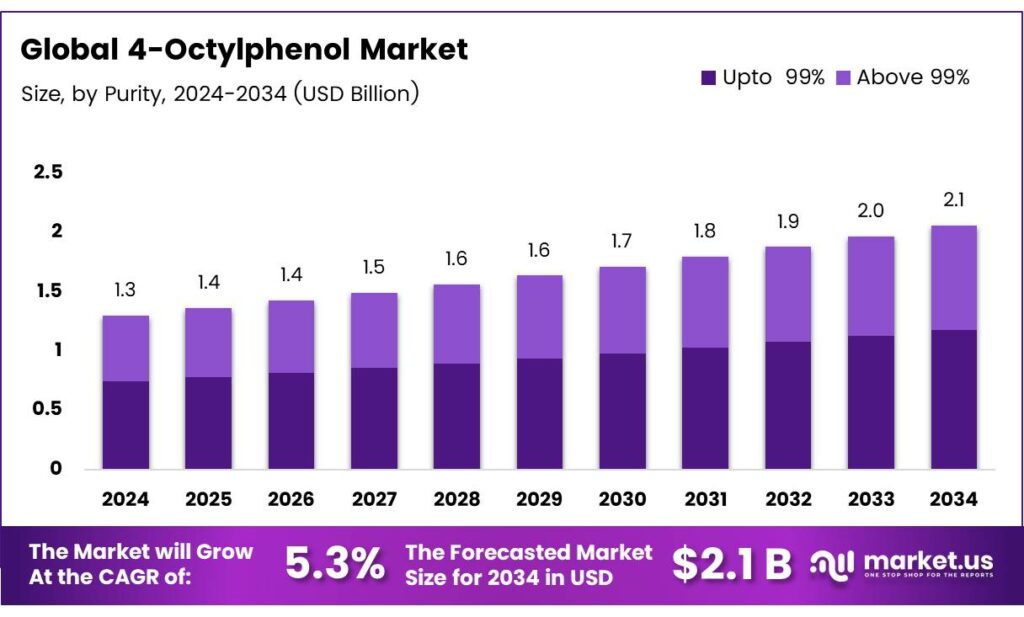

The Global 4-Octylphenol Market size is expected to be worth around USD 2.1 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

4-Octylphenol, a degradation product of alkylphenols used industrially, is a potent xenoestrogen. It features an octyl group at the para-position, acting as a surfactant and metabolite. Poorly biodegradable, it persists in the environment and accumulates in organisms. Its estrogenic activity, 1/1000 that of 17β-estradiol, poses risks to male reproductive health. It is more toxic than other estrogenic alkylphenols.

Research shows 4-octylphenol’s harmful effects on male reproductive systems during puberty. Male pubertal mice exposed to doses of 0, 1, 10, and 100 mg/kg for 28 days exhibited dose-dependent toxicity. Medium- and high-dose groups showed reduced testicular mass and seminiferous tubule damage. Increased oxidative stress and apoptosis in testicular tissue were observed. Sperm quality also declined significantly in these groups.

Prior studies confirm 4-octylphenol’s toxicity, particularly in developing male reproductive systems. Li et al. found that 35-day exposure in suckling mice halted spermatogenesis at the round spermatid stage. High doses impaired sperm production and epididymal development, with minimal mature sperm. Bian et al. reported reduced sperm count and motility in rats at 450 mg/kg/day. These findings highlight its severe reproductive toxicity.

Puberty is a critical period when testicular development is highly sensitive to disruptors. Long-term exposure to 100 μM 4-octylphenol disrupts testicular homeostasis in prepubertal Leydig cells. This impairs testicular development, causing lasting reproductive issues. Limited research exists on its pubertal effects, necessitating further study. Its environmental persistence underscores the urgency for mitigation strategies.

Key Takeaways

- The Global 4-Octylphenol Market is projected to grow from USD 1.3 billion in 2024 to USD 2.1 billion by 2034 at a 5.3% CAGR.

- Upto 99% purity segment led in 2024 with a 57.3% share due to its cost-effective use in surfactants and resins.

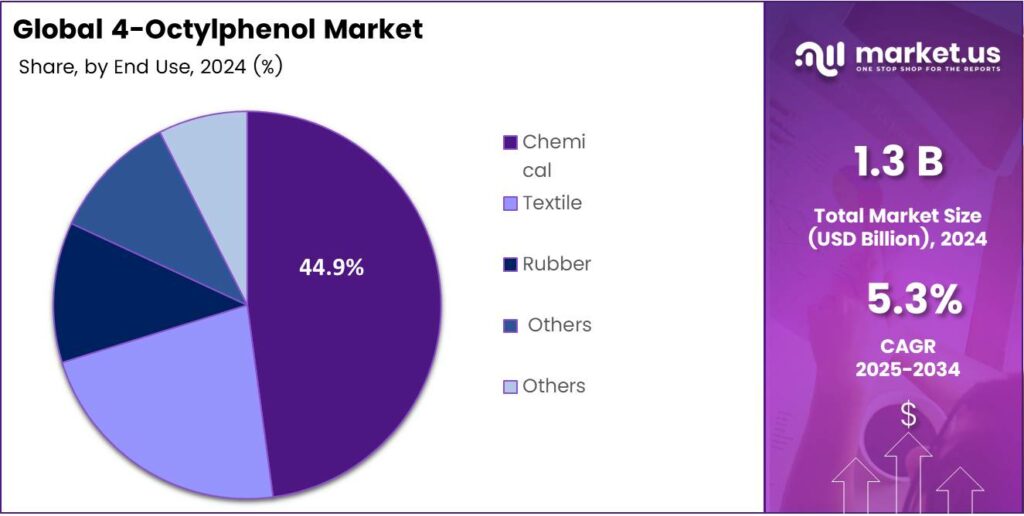

- Chemical applications dominated in 2024, holding a 44.9% share as a key intermediate in resin and surfactant synthesis.

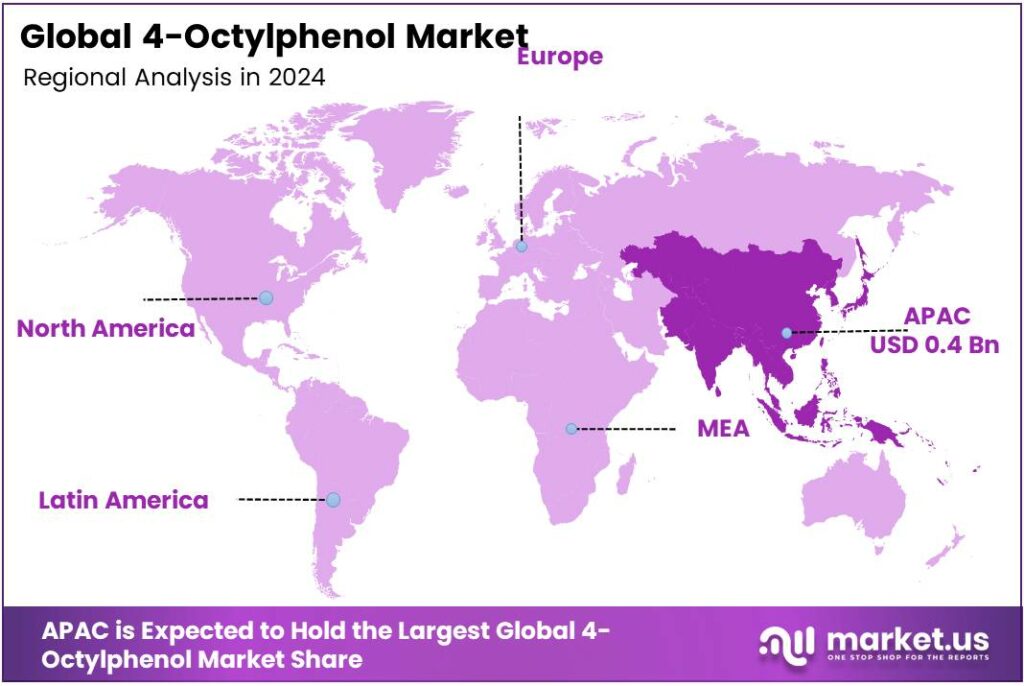

- Asia-Pacific led the market in 2024 with a 34.9% share, valued at USD 0.4 billion, driven by robust chemical manufacturing.

By Purity

Upto 99% Purity Leads with 57.3% Share

In 2024, Upto 99% purity held a dominant market position in the global 4-Octylphenol market, capturing more than a 57.3% share. This segment’s leadership stems from its wide industrial use in producing surfactants, resins, and polymer additives, where moderate purity levels provide both cost efficiency and consistent performance.

Manufacturers across Asia-Pacific and Europe prefer this grade due to its balanced reactivity and ease of integration into industrial formulations. In 2025, demand for up to 99% purity 4-Octylphenol is expected to rise further, supported by expanding chemical and coating applications, especially in manufacturing sectors focusing on performance and affordability.

By End-User

Chemical End-User Dominates with 44.9% Share

In 2024, Chemical held a dominant market position in the global 4-Octylphenol market, capturing more than a 44.9% share. This dominance arises from its extensive use as an intermediate in the synthesis of resins, surfactants, and plastic additives that serve multiple downstream chemical industries.

Chemical manufacturers across Asia-Pacific and North America utilize 4-Octylphenol for producing phenolic resins and stabilizers essential in coatings, polymers, and adhesives. In 2025, the demand from this segment is expected to strengthen further as industrial output and polymer production expand steadily, reinforcing the role of the chemical sector as the backbone of 4-Octylphenol consumption worldwide.

Key Market Segments

By Purity

- Upto 99%

- Above 99%

By End-Use

- Chemical

- Textile

- Rubber

- Others

Emerging Trends

Shift Toward Safer and Bio-Based Alternatives

One major emerging trend in the 4-Octylphenol industry is the global shift toward safer and bio-based substitutes driven by environmental and regulatory pressures. The European Chemicals Agency (ECHA) has listed 4-tert-Octylphenol (CAS 140-66-9) as a Substance of Very High Concern (SVHC) due to its endocrine-disrupting and bioaccumulative properties under REACH Annex XVII restrictions.

- These regulations, which limit their use in industrial formulations, are encouraging chemical producers to invest in greener phenolic intermediates and alternative surfactant feedstocks. The OECD 2023 report on Endocrine Disrupting Chemicals in Freshwater highlighted that global emissions of alkylphenols, including octylphenol, have decreased by over 40%, reflecting improved wastewater management and innovation in chemical design.

This transition aligns with global sustainability programs such as the EU Green Deal and EPA’s Safer Choice initiative, which promote the development of low-toxicity and biodegradable phenolic compounds. By 2025, leading chemical manufacturers are expected to allocate a larger portion of their R&D budgets to bio-derived phenols and eco-friendly surfactant bases, enhancing compliance and corporate responsibility.

Drivers

Expanding Demand from Resin and Coating Industries

A major driving factor for the 4-Octylphenol market is its growing utilization in phenolic resins, stabilizers, and polymer modifiers across the coatings, adhesives, and plastics industries. According to the U.S. Environmental Protection Agency (EPA), phenolic resin consumption in the U.S. exceeded 1.6 million metric tons in 2024, with derivatives like octylphenol forming a key precursor for high-performance resins.

These materials are widely used for improving heat resistance, hardness, and chemical durability in industrial coatings and molded products. The rise in construction, electronics, and automotive production, especially in the Asia-Pacific, continues to sustain demand. China’s Ministry of Industry and Information Technology reported a 7.8% increase in coatings output in 2024, directly boosting the need for alkylphenol-based intermediates.

Moreover, the push toward high-durability materials for infrastructure projects in India and Southeast Asia further enhances octylphenol demand in resin formulations. As manufacturers focus on performance improvement and product lifespan, the need for 4-Octylphenol in polymer synthesis remains a crucial growth driver for 2025 and beyond.

Restraints

Stringent Environmental and Health Regulations

One of the major restraints in the 4-Octylphenol market is the tightening of environmental and human health regulations across major economies. The European Commission, through REACH Annex XVII, has placed strict limits on the manufacture and use of 4-tert-Octylphenol due to its persistent, bioaccumulative, and toxic (PBT) characteristics.

Similarly, the U.S. EPA has prioritized this compound under the TSCA Health and Safety Data Reporting Rule, requiring manufacturers to provide detailed hazard and exposure data. These restrictions have led to the gradual phase-out of octylphenol in surfactants and detergent formulations, pushing industries to adopt alternatives like linear alkylbenzene sulfonates and nonyl-free ethoxylates.

- Compliance costs, including process modification and effluent treatment, have risen by an estimated 20–25% for mid-scale producers since 2023, according to the OECD’s chemical safety division. Moreover, growing public awareness of endocrine disruptors has increased consumer scrutiny, especially in Europe and Japan. These regulatory and social pressures collectively restrain market expansion despite industrial demand stability.

Opportunity

Development of Low-Toxicity and Circular Alternatives

A promising opportunity for the 4-Octylphenol industry lies in the development of low-toxicity derivatives and circular production models. Governments and chemical producers are investing in sustainable innovation to replace hazardous phenols with bio-based and recyclable alternatives.

- Under the EU Horizon Europe Program, over €60 million has been allocated to projects focused on bio-aromatic intermediates and phenolic resins derived from lignin and agricultural waste. These initiatives aim to create drop-in substitutes with equivalent performance but lower environmental impact. In parallel, several Asian producers are adopting closed-loop recovery systems to recycle phenolic intermediates from wastewater streams, reducing disposal and emissions.

The OECD chemical circularity framework predicts that integrating recovery technologies could lower industrial phenol waste by 30%, strengthening sustainability credentials. As environmental compliance becomes a competitive differentiator, companies investing in renewable feedstocks and green chemistry innovations are well-positioned to capture future market share in the evolving 4-Octylphenol value chain.

Regional Analysis

Asia-Pacific leads with a 34.9% share and a USD 0.4 Billion market value.

In 2024, Asia-Pacific dominated the 4-Octylphenol market, accounting for a 34.9% share valued at around USD 0.4 billion. This dominance is primarily driven by the region’s extensive chemical manufacturing base and the growing demand for phenolic intermediates across end-use industries such as coatings, resins, and polymers.

Countries like China, India, South Korea, and Japan serve as major production and consumption hubs due to their large-scale industrial infrastructure and rising investments in specialty chemicals. The continued expansion of construction, automotive, and electronics sectors in the region has further increased the use of octylphenol-based resins and stabilizers for high-performance applications.

Government-backed industrial modernization programs, such as China’s Made in China 2025 and India’s Make in India, have encouraged the domestic production of phenolic compounds, reducing reliance on imports and strengthening supply security. The rise in resin exports from Asia-Pacific to Western markets also reinforces its global leadership. The region is expected to maintain its lead, supported by strong demand for industrial coatings, adhesives, and surfactants.

Additionally, increasing R&D efforts toward safer and more sustainable phenol derivatives aligns with evolving environmental norms, ensuring balanced growth. Overall, Asia-Pacific’s strategic industrial landscape and chemical integration capabilities make it the most influential region in shaping the global 4-Octylphenol market trajectory.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sasol leverages its massive integrated chemical operations to be a key 4-Octylphenol supplier. Its strength lies in strong backward integration and a robust global distribution network, ensuring consistent supply and competitive pricing. The company’s significant R&D focus allows it to cater to diverse industrial demands, particularly in plastics and chemical intermediates. Sasol’s established market presence and scale make it a dominant and reliable force in the global 4-Octylphenol supply chain, serving a broad customer base.

SI Group is a major, innovation-driven player in the 4-Octylphenol market. Renowned for its high-performance specialty chemicals, the company focuses on producing high-purity 4-Octylphenol for demanding applications. Its key strength is a strong commitment to R&D and quality control, serving advanced sectors like engineering polymers and specialty adhesives. SI Group differentiates itself through technical expertise and customer-specific solutions, positioning it as a preferred supplier for value-added, performance-critical applications rather than competing solely on price.

Kumho P&B Chemicals is a significant force in the Asian 4-Octylphenol market. The company benefits from its strong regional presence and proximity to key end-user industries. It is known for its efficient production capabilities and competitive cost structure, making it a crucial supplier for the region’s robust plastics and rubber sectors. Kumho’s strategic focus on the Asian market and its reliable manufacturing output solidify its position as a key regional supplier of 4-Octylphenol and its derivatives.

Top Key Players in the Market

- Sasol Limited

- SI Group

- Kumho P&B Chemicals Inc.

- LG Chem Ltd.

- Dow Chemical Company

- INEOS Group Holdings S.A.

- BASF SE

- ExxonMobil Chemical Company

- Chevron Phillips Chemical Company

- Others

Recent Developments

- In 2025, Sasol confirmed it mothballed its Alkylphenol plant in Marl, Germany, and will close its US phenolics plants in Texas as part of an International Chemicals reset. This directly affects alkylphenol availability used as octylphenol/alkylphenol intermediates.

- In 2025, EcoVadis Bronze for corporate social responsibility, strengthening supplier qualification status for resin/UV-stabilizer chains that often draw on alkylphenol intermediates. New Azelis partnership for plastics additives alongside Brenntag, broadening access to SI Group’s additives and alkylphenol-based intermediates portfolio.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.1 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Up to 99%, Above 99%), By End-User (Chemical, Textile, Rubber, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sasol Limited, SI Group, Kumho P&B Chemicals Inc., LG Chem Ltd., Dow Chemical Company, INEOS Group Holdings S.A., BASF SE, ExxonMobil Chemical Company, Chevron Phillips Chemical Company, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Sasol Limited

- SI Group

- Kumho P&B Chemicals Inc.

- LG Chem Ltd.

- Dow Chemical Company

- INEOS Group Holdings S.A.

- BASF SE

- ExxonMobil Chemical Company

- Chevron Phillips Chemical Company

- Others