Global 3D Virtual Event Platforms Market Size, Share, Industry Analysis Report By Component (Platform/Software, Services), By Deployment (Cloud-based, On-Premises), By Application (Conferences & Summits, Job Fairs & Recruiting, Trade Shows & Exhibitions, Corporate Meetings & Internal Events, University/Campus Events, Others), By End-User (Enterprises, Educational Institutions, Government, Event Organizers, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 164869

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Adoption Rate Statistics

- Usage Statistics and Trends

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Deployment Analysis

- Application Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

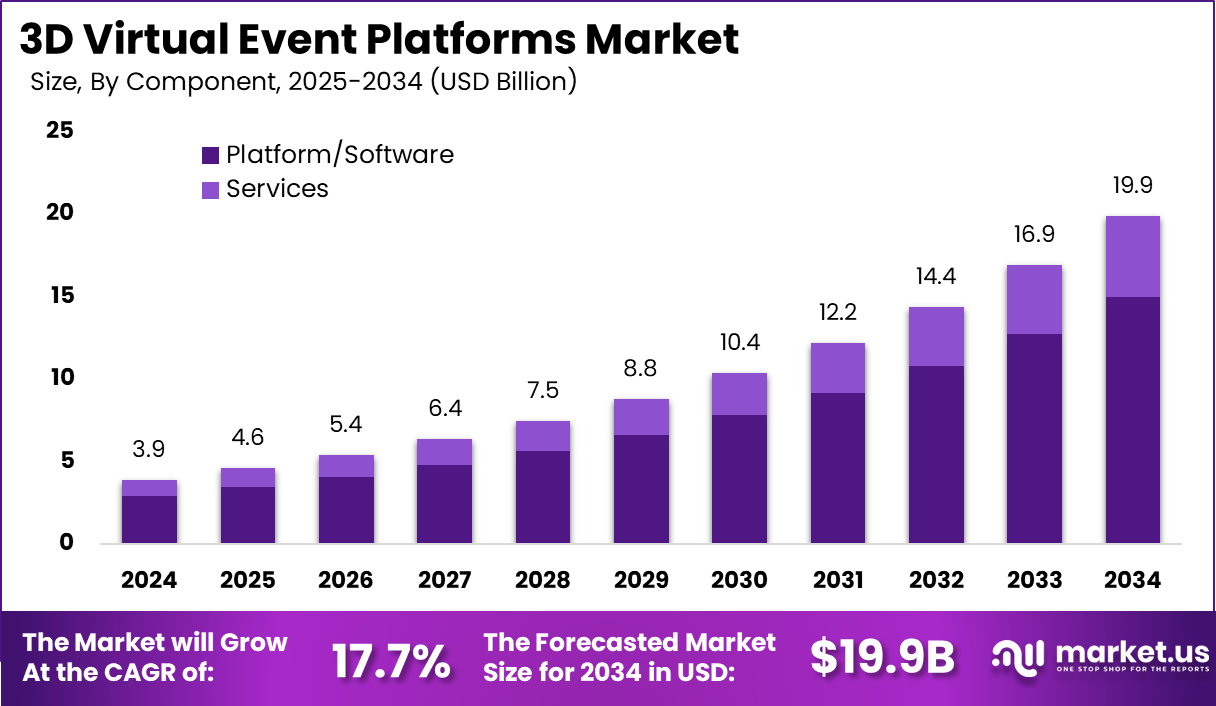

The Global 3D Virtual Event Platforms Market size is expected to be worth around USD 19.9 billion by 2034, from USD 3.9 billion in 2024, growing at a CAGR of 17.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 42.5% share, holding USD 1.65 billion in revenue.

The 3D Virtual Event Platform market is growing rapidly due to rising demand for immersive and interactive digital experiences. Technologies like virtual reality and augmented reality enable these platforms to mimic real-life events with high-quality graphics and customizable virtual environments. The shift to remote work and global collaboration has accelerated adoption, as organizations seek scalable and flexible alternatives to physical events.

The growing adoption of faster internet like 5G has enabled smooth real-time interaction, boosting demand for 3D immersive events. The COVID-19 pandemic turned virtual events into an essential solution. Their ability to engage audiences globally without travel and reduce environmental impact continues to drive adoption, with about 85% of event organizers reporting higher attendee engagement on 3D platforms than on traditional virtual setups.

Increasing adoption technologies center on augmented reality (AR), virtual reality (VR), and artificial intelligence (AI). AI is used for matchmaking attendees and personalizing user experiences, which boosts satisfaction and retention. The rise of cloud computing also supports flexible deployment options, from on-premises to fully cloud-hosted solutions. Companies cite these technologies as key reasons for switching, enabling realistic in-event interaction and comprehensive data collection.

Investment opportunities are seen in platform development, AI-driven feature enhancements, and integration services. Capital flows are focusing on start-ups innovating in gamification and personalized engagement features. Governments and institutions investing in digital infrastructure provide additional growth avenues. Venture capital interest has surged due to the market’s combination of technology adoption and pandemic-driven structural changes in event planning.

For instance, in October 2024, PandaMR offers a mixed reality platform enabling virtual and hybrid events with customizable 3D stands, real-time interaction, AI-powered voice assistants, and integrations with productivity tools like Slack and Google Calendar. They cater to event organizers, exhibitors, and visitors aiming for lifelike virtual event experiences.

Key Takeaway

- The Platform/Software segment led the market with 75.3%, driven by rising enterprise investments in immersive digital environments and customizable virtual event ecosystems.

- Cloud-based deployment dominated with 92.2%, reflecting strong demand for scalable, accessible, and cost-efficient hosting solutions that support global participation.

- The Conferences & Summits segment captured 35.8%, highlighting increased adoption of 3D platforms for professional networking, knowledge sharing, and interactive corporate events.

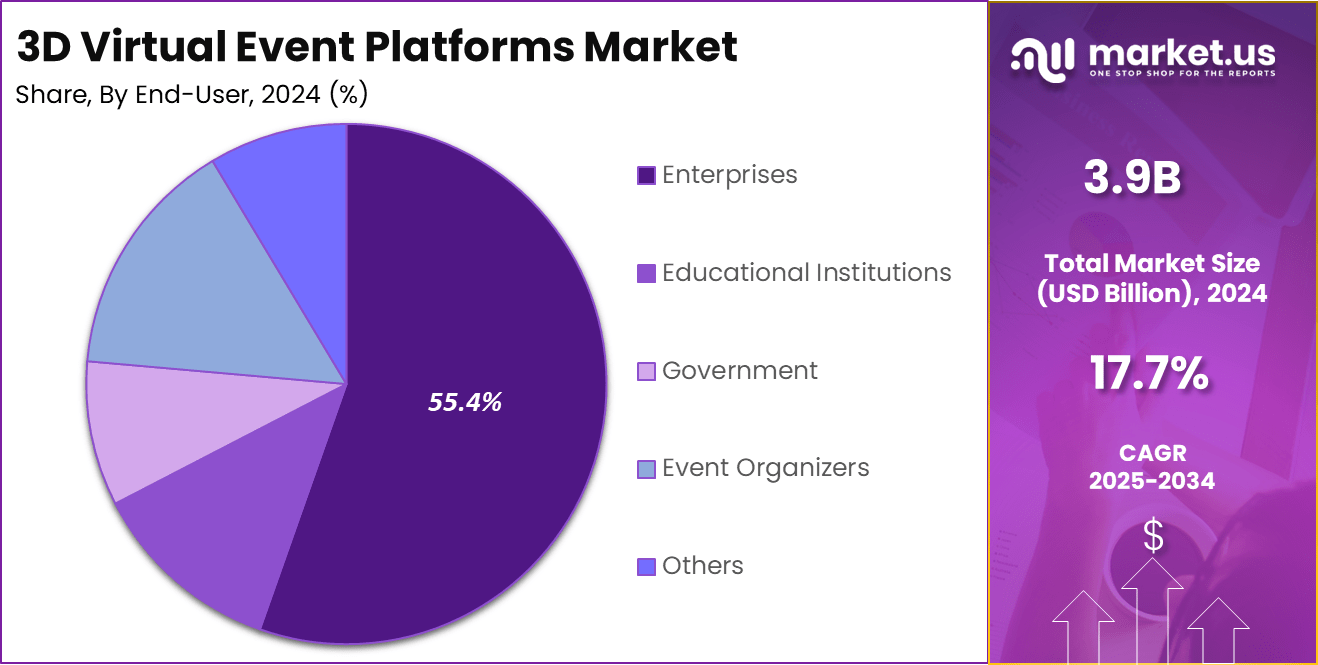

- The Enterprises (B2B) segment accounted for 55.4%, as large organizations increasingly use 3D virtual platforms for product launches, trade exhibitions, and hybrid event strategies.

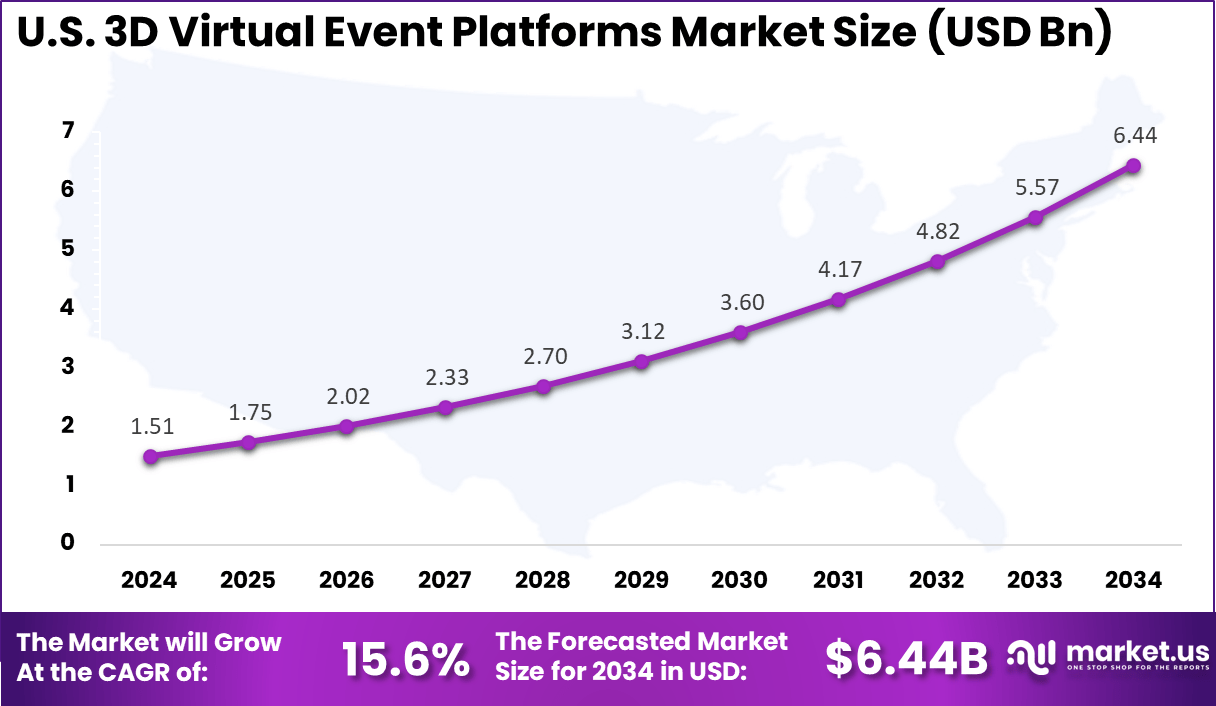

- The U.S. market reached USD 1.51 Billion in 2024, expanding at a robust 15.6% CAGR, supported by technological advancements and enterprise adoption of metaverse-based engagement tools.

- North America held a leading 42.5% share of the global market, driven by strong digital infrastructure, early adoption of immersive technologies, and growing hybrid event trends among enterprises.

Adoption Rate Statistics

- Overall virtual event adoption: Over 72% of businesses now host events through virtual platforms. Organizations continue to rely on these solutions for their cost efficiency, accessibility, and global reach.

- Enterprise integration: By 2024, more than 85% of Fortune 500 companies had incorporated virtual or hybrid event platforms into their event plans. This shows a strong preference for digital event management among large enterprises.

- Organizer intent: About 63% of event organizers planned to increase their investment in virtual events during 2025, reflecting growing confidence in digital engagement strategies.

- AR and VR adoption: Technologies such as Augmented Reality (AR) and Virtual Reality (VR) are gaining corporate interest. Around 91% of businesses were already using or planning to use AR or VR systems to enhance event experiences.

Usage Statistics and Trends

- Higher engagement: Approximately 64% of event organizers report that using AR and VR tools improves attendee engagement. Immersive and interactive features are driving interest in 3D and hybrid events.

- Immersive experience shift: Organizations are focusing on creating realistic 3D environments and VR-based networking spaces. Sectors such as education, real estate, and entertainment are leading in adopting these immersive formats.

- B2B applications: In the B2B space, 74% of event organizers reported achieving a positive return on investment within six months of holding virtual events.

Main uses for AR and VR:

- 60% use it to assist labor on production floors.

- 53% use it for virtual customer visits.

- 53% apply it in virtual design and product engineering.

- 26% use it for employee training.

Role of Generative AI

Generative AI plays an important role in 3D virtual event platforms by transforming how digital content is created and personalized. Through generative AI, event organizers can quickly generate 3D environments, avatars, and live content customized for each user. This not only speeds up design processes but also enriches user engagement by making virtual experiences feel more real and interactive.

AI tools can handle tasks like creating session summaries and real-time event updates, which significantly enhance attendee interaction and operational efficiency. Approximately 43% of virtual event platforms are integrating generative AI to automate and personalize event content delivery, showing its rising influence in the space. Moreover, generative AI improves accessibility by providing live translations and captioning during events, making them inclusive for global audiences.

Around 37% of events now leverage AI-powered chatbots for on-demand attendee support and networking recommendations, which deepens engagement. This technology also helps reduce operational costs, allowing event organizers to scale virtual meetings without proportionally increasing staff or resources, creating a balance between automation and a human touch.

Investment and Business Benefits

Investment opportunities in the 3D virtual event platform market are expanding rapidly, fueled by strong capital inflows from technology investors seeking exposure to immersive digital event solutions. Startups focusing on AI-driven metaverse capabilities, avatar customization, and interactive content creation are attracting significant funding. Public and private sectors investing in digital infrastructure and innovation also provide fertile ground for growth.

The increasing corporate and educational expenditure on virtual events ensures ongoing demand for improved features and platform scalability, making this a promising area for long-term investment. Business benefits realized by using 3D virtual event platforms include enhanced return on investment due to lower operational costs, increased attendee engagement through interactivity, and expanded market reach with global accessibility.

Organizations also benefit from environmental sustainability by cutting travel and physical resource consumption. Real-time data collection provides insights into participant behavior that help optimize future events. The platforms support brand visibility with customizable virtual spaces and offer opportunities for sponsorships and live product demos, making them valuable tools for marketing and business growth.

U.S. Market Size

The market for 3D Virtual Event Platforms within the U.S. is growing tremendously and is currently valued at USD 1.51 billion, the market has a projected CAGR of 15.6%. This growth is driven by increasing demand for immersive and interactive virtual experiences that can replicate physical events remotely. Businesses and organizations are turning to these platforms for conferences, trade shows, and corporate meetings to reduce travel costs and expand global reach.

For instance, in October 2025, Virbela continues to establish itself as a go-to immersive platform for virtual events and business collaboration in the U.S., offering customizable 3D environments that support tens of thousands of participants simultaneously. Their advanced spatialized voice technology and enterprise-grade security have cemented their role as a leader in creating engaging, scalable virtual campus experiences for education, corporate events, and networking.

In 2024, North America held a dominant market position in the Global 3D Virtual Event Platforms Market, capturing more than a 42.5% share, holding USD 1.65 billion in revenue. This dominance is primarily attributed to the region’s advanced digital infrastructure and early adoption of immersive technologies. The presence of tech giants and continuous innovation in cloud computing, augmented reality, and virtual reality further bolsters North America’s leadership.

Additionally, North America’s strong economy and status as a corporate hub drive extensive demand for virtual event solutions. Increasing adoption of hybrid work models and the need for innovative, cost-effective event experiences contribute to sustained growth in this market.

For instance, In October 2025, Spatial gained attention for advancing 3D interface and spatial web design trends in the U.S., driving adoption of immersive digital environments and redefining user interaction through spatial computing.

Component Analysis

In 2024, The Platform/Software segment held a dominant market position, capturing a 75.3% share of the Global 3D Virtual Event Platforms Market. This segment includes the core software solutions that enable immersive 3D environments, event management tools, and interactive features.

The dominance is largely driven by the demand for versatile, scalable, and customizable software that can efficiently manage complex virtual events. Businesses are increasingly investing in software that supports real-time engagement, networking opportunities, and analytics tools, enhancing the overall event experience and return on investment.

This significant market share highlights how software platforms form the backbone of 3D virtual events, delivering essential functionalities such as avatar interaction, virtual booths, and gamification elements. Continuous innovation in this space, including integrations with AI and augmented reality, further fuels the preference for robust platform-based solutions.

For Instance, in June 2025, PraxiLabs expanded its interactive 3D virtual science labs with new immersive and user-friendly designs to enhance virtual learning experiences. Their platform offers a range of hands-on simulations in chemistry and physics, enabling institutions to deliver engaging virtual lab sessions in a risk-free 3D environment.

Deployment Analysis

In 2024, the Cloud-based segment held a dominant market position, capturing a 92.2% share of the Global 3D Virtual Event Platforms Market. The massive preference for cloud solutions is due to their flexibility, scalability, and cost-efficiency, allowing event organizers to host large-scale virtual sessions without heavy infrastructure investment. Cloud platforms simplify accessibility, enabling seamless participation for attendees across different locations and devices, which is crucial for global events.

The growing adoption of cloud technology also supports faster deployment and easier updates, ensuring events run smoothly with minimal downtime. Furthermore, cloud security measures are continuously improving to meet the stringent data privacy needs of enterprise users, reassuring organizations about the safety of their event data on these platforms.

For instance, in August 2025, Spektra Systems LLC leads in cloud computing products and services. Their CloudLabs AI platform delivers scalable, end-to-end virtual learning experiences powered by Microsoft Azure, offering cloud-hosted workshops and demos designed for training providers and system integrators, reflecting strong deployment in cloud-based virtual platforms.

Application Analysis

In 2024, The Conferences & Summits segment held a dominant market position, capturing a 35.8% share of the Global 3D Virtual Event Platforms Market. These event types benefit greatly from 3D virtual platforms as they provide immersive, interactive settings that replicate in-person experiences. Organizers can deliver keynote presentations, breakout sessions, and networking opportunities in dynamic virtual spaces that foster engagement beyond traditional video calls.

This preference underscores how sectors reliant on knowledge exchange, professional networking, and thought leadership find strong value in 3D virtual environments. As conferences increasingly blend physical and virtual attendance, the demand for sophisticated 3D platforms tailored to such large-scale, interactive formats continues to rise.

For Instance, in June 2025, Samaaro highlighted its AI-driven event marketing platform that supports virtual conferences by integrating event management, personalized attendee engagement, and marketing automation. Their solutions enable seamless virtual conferences and summits with enhanced operational efficiency and attendee interaction.

End-User Analysis

In 2024, the Enterprises (B2B) segment held a dominant market position, capturing a 55.4% share of the Global 3D Virtual Event Platforms Market. These organizations leverage virtual events to enhance business communications, training, product launches, and stakeholder engagement in a cost-effective and scalable manner.

Enterprises benefit from virtual platforms by connecting dispersed teams, partners, and clients without geographical constraints. The enterprise preference reflects the growing trend of digital transformation and remote collaboration in business. Many large organizations prioritize virtual events for their ability to increase outreach, optimize resources, and maintain continuity during disruptions, making enterprises the largest consumer group for these solutions.

For Instance, in August 2025, MootUp showcased its 3D virtual event platform tailored for business users, supporting virtual and hybrid events accessible from any device without VR headsets. MootUp targets enterprises with customizable 3D avatars and digital twin venues, helping businesses run immersive B2B events, training, and marketing programs at scale.

Emerging trends

One key trend is the increasing use of immersive technologies like virtual reality (VR) and augmented reality (AR) in 3D event platforms. These tools enable participants to engage with virtual trade shows and product demonstrations in much richer, interactive formats.

Immersive experiences are expected to shape the majority of virtual events, with VR/AR adoption growing at around 45% annually in the sector. Events designed with these technologies allow attendees to “walk through” digital spaces, enhancing interaction and memory retention compared to traditional 2D platforms. Another emerging trend involves AI-powered personalization, where platforms use data analytics to tailor event content and networking opportunities for individual attendees.

About 52% of 3D virtual events now implement AI recommendation engines to suggest sessions and connections based on attendees’ interests and prior interactions. This personalization not only boosts attendee satisfaction but also improves retention and participation rates by making digital events feel more relevant and engaging.

Growth Factors

A major factor driving growth is the surge in demand for remote and hybrid work models, pushing organizations to seek robust virtual collaboration tools. Nearly 60% of enterprises now use 3D virtual event platforms to complement or replace in-person meetings, especially in sectors like education, corporate training, and government. This shift reduces travel costs and logistical hurdles, offering scalable and flexible event solutions that attract wide adoption.

Technological advancements such as cloud computing and faster internet also promote market growth. Around 48% of users report increased satisfaction with the quality and reliability of virtual event experiences due to better infrastructure. Enhanced digital security and data privacy measures on these platforms further encourage trust and adoption among enterprises and governments, reinforcing steady market expansion.

Key Market Segments

By Component

- Platform/Software

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud-based

- On-Premises

By Application

- Conferences & Summits

- Job Fairs & Recruiting

- Trade Shows & Exhibitions

- Corporate Meetings & Internal Events

- University/Campus Events

- Others

By End-User

- Enterprises

- Educational Institutions

- Government

- Event Organizers

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for Immersive Digital Experiences

The growing demand for immersive and interactive digital experiences is a key driver fueling the growth of the 3D virtual event platforms market. Organizations are increasingly using these platforms to create realistic, engaging environments that overcome geographical barriers, allowing participants to feel more connected and involved than traditional 2D webinars or video calls.

This trend is especially visible in industries like education, healthcare, and corporate training, where interactive experiences add significant value. Additionally, the shift toward remote work and global collaboration has accelerated adoption as businesses seek scalable solutions to connect dispersed teams and stakeholders.

For instance, In February 2025, PraxiLabs presented its virtual science labs at a major Saudi tech event, showcasing immersive tools that enhance remote science education and accelerate global adoption of 3D digital learning solutions.

Restraint

High Cost of Advanced Technology Implementation

Despite the benefits, the implementation cost of advanced 3D virtual event technologies acts as a significant restraint. Developing and maintaining sophisticated platforms with high-quality graphics, VR/AR integration, and interactive features requires substantial investment in hardware and software. This increases entry barriers for smaller companies or organizations with limited budgets.

Furthermore, ongoing operational expenses such as server maintenance, security, and regular platform updates add to the total cost. These high costs can deter adoption, especially in traditional sectors where budget constraints are tighter, slowing overall market growth despite rising interest.

For instance, in October 2025, Spektra Systems’ CloudLabs exhibited their advanced, AI-ready hands-on lab platform at EDUCAUSE, showcasing their commitment to scalable and secure virtual training. However, the complexity and high investment required to maintain such sophisticated platforms underline financial constraints as a restraint for wider adoption.

Opportunities

Expansion into Emerging Markets and Industry-Specific Solutions

Emerging markets represent a major opportunity for 3D virtual event platforms as digital infrastructure and internet accessibility improve globally. Countries in the Asia Pacific, Latin America, and the Middle East & Africa are witnessing rising adoption driven by government initiatives, increasing smartphone penetration, and growing tech-savvy populations. Vendors who localize their offerings and invest in these regions can capitalize on unmet demand.

Moreover, developing industry-specific solutions tailored for healthcare conferences, manufacturing showcases, or government training programs can open new revenue streams. Platforms that integrate with e-commerce, social media, and learning management systems are also positioned to innovate and cater to specialized use cases, expanding market reach further.

For instance, in September 2025, Samaaro raised substantial funding to expand its AI-driven event marketing platform across India and the Middle East. This investment enables them to tap into emerging markets where digital event solutions are gaining traction, showing the significant opportunity in untapped regions.

Challenges

Data Privacy and Regulatory Compliance Concerns

A major challenge for the 3D virtual event platforms market lies in addressing data privacy and regulatory compliance. The platforms collect vast amounts of participant data, including behavioral and personal information, raising concerns over security and misuse. Different regions have diverse data protection laws, complicating compliance for global platform providers.

Additionally, slow adoption by traditional industries resistant to digital transformation and the shortage of skilled professionals capable of managing complex virtual environments hinder smooth market penetration. Vendors must invest heavily in security measures, user education, and partnership ecosystems to build trust and overcome these obstacles.

For instance, in October 2025, Wevr announced the opening of a new creative studio in Malta to expand its immersive experiences in Europe. While this growth signals opportunity, it also brings the challenge of navigating different regulatory environments and data privacy laws across countries.

Key Players Analysis

The 3D Virtual Event Platforms Market is led by innovators such as Aviantet, Hopin, vFairs, and ON24, which specialize in delivering immersive virtual environments for conferences, exhibitions, and training programs. These platforms integrate real-time interaction, 3D visualization, and analytics tools to enhance attendee engagement and simulate physical event experiences in virtual spaces.

Prominent participants including Virbela, Spatial, and 6Connex focus on enabling enterprise collaboration, education, and trade shows through extended reality (XR) and metaverse technologies. Their solutions allow users to create customizable virtual venues with lifelike avatars, fostering networking and content sharing across global audiences.

Complementary players such as Praxilabs, Spektra Systems LLC (CloudLabs AI), Samaaro, PandaMR, 3D Bear, Outreal XR, Holo-SDK, Wevr, WorldViz, Inc., and other market contributors are advancing the ecosystem through 3D learning, simulation, and interactive event modules. Their technologies bridge the gap between physical and virtual engagement, supporting hybrid collaboration models for businesses, education, and entertainment sectors.

Recent Developments

- In October 2025, Spektra Systems LLC’s CloudLabs showcased its AI-ready hands-on lab platform at the EDUCAUSE Annual Conference. They demonstrated seamless migration from Azure Lab Services to their advanced VM Labs solution, emphasizing scalability and security for remote tech education.

- In February 2025, PraxiLabs expanded its 3D virtual science labs by adding dozens of new simulations in chemistry and physics, enhancing hands-on learning opportunities for students globally. They showcased these advancements at major educational tech events such as LEAP 2024 in Saudi Arabia, underlining their mission to revolutionize virtual science education.

Top Key Players in the Market

- Praxilabs

- Spektra Systems LLC (Cloudlabs AI)

- Samaaro

- PandaMR

- 3D Bear

- Outreal XR

- Holo-SDK

- Wevr

- Worldviz, Inc.

- Aviantet

- Hopin

- MootUp

- vFairs

- 6Connex

- ON24

- Virbela

- Spatial

- Others

Report Scope

Report Features Description Market Value (2024) USD 3.9 Bn Forecast Revenue (2034) USD 19.9 Bn CAGR (2025-2034) 17.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Platform/Software, Services), By Deployment (Cloud-based, On-Premises), By Application (Conferences & Summits, Job Fairs & Recruiting, Trade Shows & Exhibitions, Corporate Meetings & Internal Events, University/Campus Events, Others), By End-User (Enterprises, Educational Institutions, Government, Event Organizers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Praxilabs, Spektra Systems LLC (Cloudlabs AI), Samaaro, PandaMR, 3D Bear, Outreal XR, Holo-SDK, Wevr, Worldviz, Inc., Aviantet, Hopin, MootUp, vFairs, 6Connex, ON24, Virbela, Spatial, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3D Virtual Event Platforms MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

3D Virtual Event Platforms MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Praxilabs

- Spektra Systems LLC (Cloudlabs AI)

- Samaaro

- PandaMR

- 3D Bear

- Outreal XR

- Holo-SDK

- Wevr

- Worldviz, Inc.

- Aviantet

- Hopin

- MootUp

- vFairs

- 6Connex

- ON24

- Virbela

- Spatial

- Others