Global 3D Printing Market By Component (Software, Hardware, Services), By Printer Type (Industrial 3D Printer, Desktop 3D Printer), By Technology (Selective Laser Sintering, Stereolithography, Fuse Deposition Modeling, Direct Metal Laser Sintering, Inkjet Printing, Polyjet Printing, Electron Beam Melting, Laminated Object Manufacturing, Digital Light Processing, Laser Metal Deposition, Others), By Application (Functional Parts, Tooling, Prototyping), By Vertical(Industrial 3D Printing [Automotive, Aerospace & Defense, Healthcare, Consumer Electronics, Industrial, Power & Energy, Others], Desktop 3D Printing [Educational Purpose, Fashion & Jewelry, Objects, Dental, Food, Others]), By Material (Metal, Polymer, Ceramic), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Sept. 2025

- Report ID: 102268

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

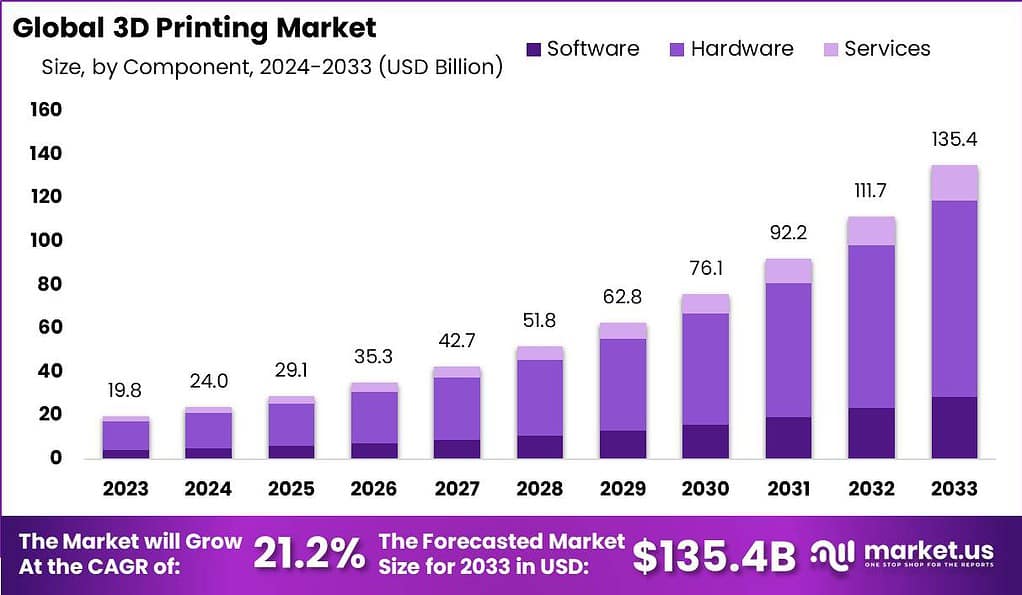

The Global 3D Printing Market size is expected to be worth around USD 135.4 Billion By 2033, from USD 19.8 Billion in 2023, growing at a CAGR of 21.2% during the forecast period from 2024 to 2033.

The 3D Printing Market involves technologies that build three-dimensional objects from digital models by adding material layer by layer. It includes hardware (printers), software (design, scanning, workflow management), and services (printing, finishing, consulting). Industries such as healthcare, aerospace, automotive, consumer goods, and industrial manufacturing use 3D printing for prototyping, tooling, and end-use parts in addition to customization.

One major driver is the increasing demand for rapid prototyping, which allows manufacturers to shorten design cycles, test ideas faster, and reduce waste. Another driver is the push toward lightweight and complex geometries that are difficult or costly with traditional manufacturing. Advances in materials science, allowing more durable, high-performance metals, polymers, ceramics, and composites, are helping widen usable applications.

Opportunities in the 3D printing industry are large. As the technology improves and becomes more accessible, it opens doors for entrepreneurs and innovators to create unique products and start their own businesses. Industries like healthcare, automotive, and aerospace can benefit greatly from the customization and cost-saving potential of 3D printing. Additionally, the ability to produce complex designs and prototypes quickly allows for faster product development and iteration.

The 3D printing industry is poised for significant growth, with expected annual savings for the construction sector projected to reach $20 billion by 2025. Germany, the largest consumer of 3D printing technology in Europe, holds a substantial 37% share of the market. Notably, 47% of schools and universities worldwide have integrated 3D printers into their educational programs. The cost of modern 3D printers ranges widely from $200 to $10,000, depending on the quality and specific requirements.

In terms of market size, the United States leads with a market value of $3.1 billion, representing 22% of the global market. Meanwhile, Europe is home to 52% of all 3D printing businesses. The UK stands out as a significant player, with an estimated market size of £468 million, making it the second-largest market in Europe and the fifth-largest globally. By 2030, the global 3D printing market is expected to grow at an annual rate of 20.8%, potentially reaching a value of $62.76 billion (£48.88 billion). In the UK, the market is anticipated to reach £685 million by 2026, growing at a CAGR of around 10%.

A substantial 61% of 3D printer users have expressed a desire to increase their investment in the technology, with only 36% intending to maintain their current level of investment. On average, customers spend over £8,000 annually on 3D printing, while 23% report spending close to £80,000. These statistics underscore the robust growth trajectory and increasing adoption of 3D printing technology across various sectors.

Key Takeaways

- The Global 3D Printing Market size is projected to reach USD 135.4 Billion by 2033, up from USD 19.8 Billion in 2023, reflecting a CAGR of 21.2% during the forecast period from 2024 to 2033.

- In 2023, the Hardware segment of the 3D printing market held a dominant position, capturing more than a 67% share.

- The Industrial 3D Printer segment also maintained a leading market position in 2023, securing over a 75% share.

- The Stereolithography (SLA) segment dominated within the 3D printing industry in 2023, capturing more than an 11% share.

- In 2023, the Prototyping segment held a significant market position within the 3D printing industry, capturing over a 54% share.

- The Automotive segment within Industrial 3D Printing commanded a dominant market position in 2023, with a share exceeding 61%.

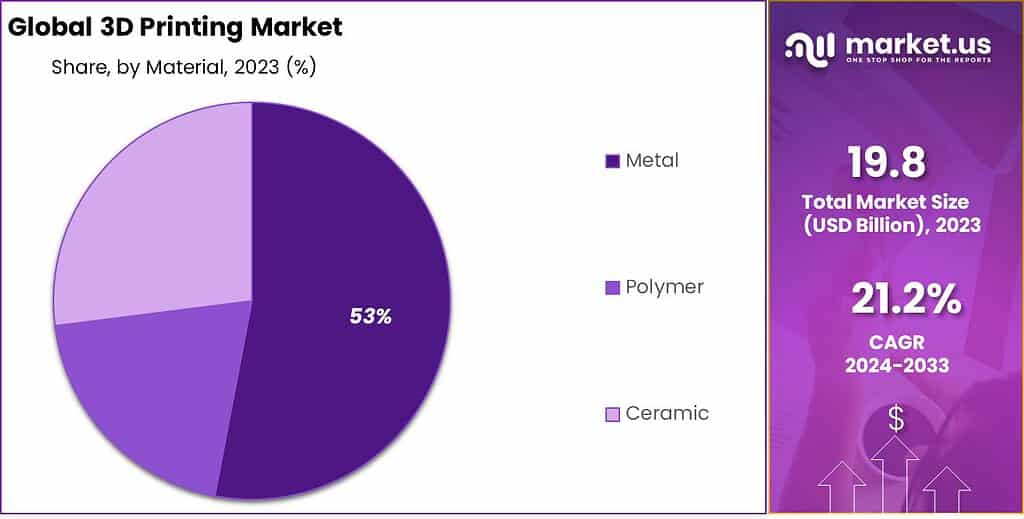

- The Metal segment led the 3D printing market in 2023, capturing more than a 53% share.

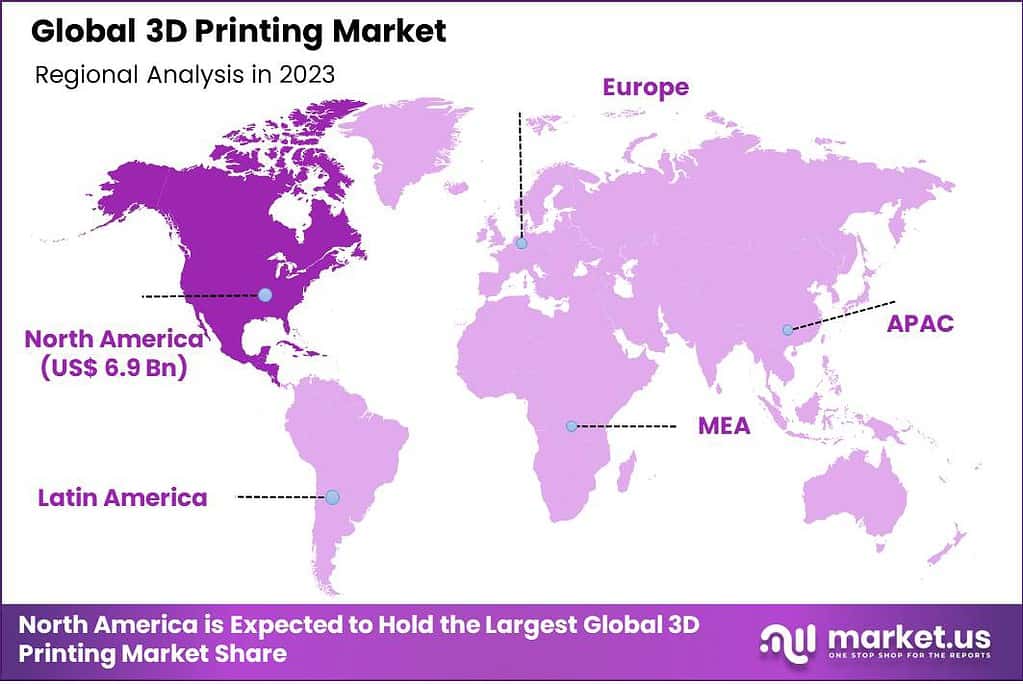

- In 2023, North America held a dominant position in the 3D printing industry, capturing over a 35% share with revenues amounting to USD 6.9 billion.

Component Analysis

In 2023, the Hardware segment of the 3D printing market held a dominant position, capturing more than a 67% share. This segment leads primarily due to the essential role of 3D printers, scanners, and other physical devices in the actual production process.

The demand for these hardware components has surged as industries increasingly recognize the advantages of 3D printing in creating complex designs with high precision and efficiency. As companies invest in these technologies to stay competitive, the hardware segment continues to grow, fueled by innovations that make 3D printing more accessible and effective.

The strength of the hardware segment also stems from continuous technological advancements that enhance the capabilities and reduce the costs of 3D printers. For instance, improvements in printer speed and the ability to work with a wider variety of materials have made 3D printing a viable option for a broad range of applications, from prototyping to final product manufacturing.

Furthermore, as the technology matures, the costs associated with 3D printing hardware are gradually decreasing, making it more accessible to smaller businesses and individual consumers, thus expanding the market base. Overall, the robust growth of the hardware segment is expected to continue as 3D printing technology becomes integral to manufacturing processes across industries.

Printer Type Analysis

In 2023, the Industrial 3D Printer segment held a dominant market position, capturing more than a 75% share. This leadership is largely attributed to the extensive use of industrial 3D printers in high-volume manufacturing sectors such as automotive, aerospace, and healthcare. These printers offer superior precision, efficiency, and capacity for large-scale production runs, making them indispensable in settings where durability and material integrity are critical.

The high investment in industrial 3D printers by these sectors reflects their pivotal role in modern manufacturing processes, where customization and complex geometries are increasingly demanded. The predominance of the Industrial 3D Printer segment is also reinforced by the ongoing technological advancements that enhance their speed, material compatibility, and overall functionality.

These improvements have expanded the scope of applications, allowing industries to explore new uses and integrate 3D printing into more stages of the manufacturing process. Furthermore, as companies aim to reduce waste and increase production agility, industrial 3D printers are seen as a key technology in achieving these sustainability and efficiency goals.

Looking ahead, the Industrial 3D Printer segment is poised for sustained growth. Continuous innovation in printer technology and materials science is expected to open up even more applications, further cementing the segment’s importance in the 3D printing market. As industries continue to push the boundaries of what can be achieved with 3D printing, industrial printers will remain at the forefront, driving forward the capabilities and adoption of this transformative technology.

Technology Analysis

In 2023, the Stereolithography (SLA) segment held a dominant market position within the 3D printing industry, capturing more than an 11% share. This prominence is largely due to SLA’s ability to achieve high precision and excellent surface finish, which are crucial for applications in dental, medical, and jewelry design where detail is paramount.

Stereolithography offers a unique advantage in creating complex geometries and intricate designs that other 3D printing technologies might struggle with. The high resolution and accuracy of SLA printers make them particularly attractive for producing highly detailed prototypes and end-use parts. The leadership of the Stereolithography segment is further solidified by its adaptability to a variety of materials, including novel photopolymers that have enhanced properties such as increased strength and flexibility.

This adaptability allows industries to innovate with new product designs that were previously unachievable, pushing the boundaries of what can be manufactured through 3D printing. Moreover, ongoing advancements in SLA technology have led to faster printing processes and lower operational costs, making it more accessible and appealing to a broader market.

Looking forward, the Stereolithography segment is expected to continue its growth trajectory. As the technology advances, it is likely to find new applications in other fields that require high precision and detail, further expanding its market reach. This will be driven by continuous improvements in speed, cost-efficiency, and material capabilities, ensuring that SLA remains a key technology in the evolving landscape of 3D printing.

Application Outlook

In 2023, the Prototyping segment held a dominant market position within the 3D printing industry, capturing more than a 54% share. This segment leads primarily because 3D printing is exceptionally well-suited for the rapid creation of prototypes, allowing for faster design iterations and speedier development processes.

Industries such as automotive, aerospace, and consumer electronics rely heavily on 3D printing for prototyping to test form, fit, and function of components before committing to large-scale production. This capability not only speeds up product development but also significantly reduces costs associated with traditional prototyping methods.

The leadership of the Prototyping segment is also reinforced by the continued advancements in 3D printing technologies that provide higher accuracy, better material properties, and increased printing speeds. These improvements enhance the ability of companies to produce prototypes that closely mimic the final product, which is crucial for effective testing and development.

Additionally, as the range of materials compatible with 3D printing expands, so too does the versatility of prototyping applications, allowing for more industries to adopt this technology. The Prototyping segment is expected to maintain its stronghold in the market as the demand for rapid product innovation continues to rise.

With ongoing technological advancements making 3D printing more efficient and cost-effective, the prototyping applications of this technology are set to become even more integral to the design and manufacturing processes across various industries. This trend will likely propel further growth in the 3D printing market, with prototyping at the forefront of this expansion.

Vertical Insights

In 2023, the Automotive segment within Industrial 3D Printing held a dominant market position, capturing more than a 61% share. This substantial market share is largely due to the automotive industry’s increasing reliance on 3D printing to streamline production processes, enhance customization, and reduce lead times.

Automotive manufacturers utilize 3D printing not only for prototyping but also for the production of complex parts that are difficult or too expensive to manufacture through traditional methods. This includes everything from lightweight components that improve fuel efficiency to intricate parts used in the assembly of electric vehicles.

The leadership of the Automotive segment is further bolstered by the continuous technological advancements in 3D printing, such as improved printing speeds and the availability of a wider range of durable materials. These advancements have made it possible for automotive companies to achieve significant cost reductions and increased flexibility in design and production.

Additionally, the ability to rapidly produce parts on demand reduces inventory costs and enables faster response to market changes, which is invaluable in the competitive automotive industry. Looking ahead, the Automotive segment is poised for continued growth as the adoption of electric vehicles and the push for more sustainable manufacturing practices drive further integration of 3D printing technologies.

Material Analysis

In 2023, the Metal segment held a dominant position in the 3D printing market, capturing more than a 53% share. This leadership is primarily attributed to the widespread adoption of metal materials in industries such as aerospace, automotive, and healthcare, which are increasingly relying on 3D printing for its precision and efficiency in producing complex parts.

Metals like titanium, stainless steel, and aluminum are favored for their strength, durability, and high-performance characteristics under extreme conditions. The ability to produce lightweight yet strong components is particularly beneficial in aerospace and automotive sectors, where weight reduction is crucial for fuel efficiency and overall performance.

Moreover, advancements in metal 3D printing technologies, including laser and electron-beam melting processes, have enhanced the feasibility of producing intricate metal parts more reliably and at higher speeds. This has encouraged more companies to integrate metal 3D printing into their production lines, fostering growth within this segment. Additionally, as the technology matures, the cost of metal 3D printing is gradually decreasing, making it more accessible to a broader range of industries, including energy and electronics.

The leadership of the Metal segment is also bolstered by significant investments in research and development from leading market players. These investments are aimed at improving the quality of metal prints and expanding the range of metal materials that can be used, further enhancing the appeal of metal 3D printing. With ongoing innovations and growing industry acceptance, the metal segment is expected to maintain its leading position in the 3D printing market, continuing to drive the industry forward with new applications and improved technologies.

Key Market Segmentation

Component

- Software

- Hardware

- Services

Printer Type

- Industrial 3D Printer

- Desktop 3D Printer

Technology

- Selective Laser Sintering

- Stereolithography

- Fuse Deposition Modeling

- Direct Metal Laser Sintering

- Inkjet Printing

- Polyjet Printing

- Electron Beam Melting

- Laminated Object Manufacturing

- Digital Light Processing

- Laser Metal Deposition

- Others

Application

- Functional Parts

- Tooling

- Prototyping

Vertical

- Industrial 3D Printing

- Automotive

- Aerospace & Defense

- Healthcare

- Consumer Electronics

- Industrial

- Power & Energy

- Others

- Desktop 3D Printing

- Educational Purpose

- Fashion & Jewelry

- Objects

- Dental

- Food

- Others

Material

- Metal

- Polymer

- Ceramic

Driver

Customization and Complexity in Design

The driving force in the 3D printing market is the capability to produce complex and customized products efficiently. Industries such as aerospace, automotive, and healthcare significantly benefit from this technology, which allows for the manufacturing of complex designs that are difficult and often impossible to achieve through traditional methods.

For instance, in aerospace and automotive sectors, 3D printing is utilized to produce lightweight structures and components, enhancing performance while reducing costs. In healthcare, the technology is vital for creating customized medical implants and prosthetics tailored to individual patient needs. This customization capability not only drives product innovation but also accelerates the development of new applications across various sectors.

Restraint

High Cost of Materials and Equipment

A major restraint for the 3D printing market is the high cost associated with 3D printing materials and equipment. Initial investments for industrial-grade printers are significant, and the materials required, such as specialized polymers, metals, and ceramics, are typically more expensive than those used in traditional manufacturing.

This high cost limits the accessibility of 3D printing technology, particularly for small and medium-sized enterprises (SMEs) that might benefit from the technology but cannot afford the initial capital outlay. Furthermore, the maintenance and operation of 3D printers demand skilled personnel, adding to the overall expenses.

Opportunity

Expansion into New Industries and Applications

3D printing presents substantial opportunities for expansion into new industries and applications. The technology is increasingly being adopted in sectors like construction, fashion, and food, where its potential for customization and rapid prototyping can be fully leveraged.

For example, in the construction industry, 3D printing is used for creating complex building structures and components, which allows for innovative architectural designs while reducing waste and costs. Additionally, the ongoing advancements in 3D printing technologies and materials are continually opening up new application areas, promising a broader adoption and integration of 3D printing across various sectors.

Challenge

Technological Limitations and Scale

While 3D printing technology offers numerous benefits, it also faces challenges related to technological limitations and scalability. The speed of 3D printing can be relatively slow compared to traditional manufacturing processes, which may not be suitable for high-volume production needs.

Moreover, the size of products that can be printed is often limited by the size of the 3D printers available, which constrains the scale of production. Overcoming these limitations requires ongoing technological advancements and investments in research and development to enhance the speed, efficiency, and scalability of 3D printing processes.

Growth Factors

- Increased Adoption in Healthcare: 3D printing is becoming integral in healthcare for creating customized medical devices and implants tailored to individual patient needs, which significantly improves surgical outcomes and patient recovery times.

- Advancements in Printing Materials: Continuous development of new materials with enhanced properties, such as increased durability and flexibility, broadens the applications of 3D printing across various industries, including automotive and aerospace.

- Supportive Government Initiatives: Governments worldwide are supporting the adoption of 3D printing through funding, grants, and educational programs aimed at fostering innovation and reducing the technology’s entry barriers.

- Integration of AI and Machine Learning: The integration of artificial intelligence and machine learning with 3D printing technologies is optimizing the manufacturing process, improving print quality, and reducing waste and operational costs.

- Sustainability and Waste Reduction: 3D printing promotes sustainability by minimizing waste through precise material usage and the potential for recycling materials, aligning with global trends towards eco-friendly manufacturing practices.

Emerging Trends

- Bioprinting: The use of 3D printing for creating tissue and organ structures is rapidly advancing, offering potential breakthroughs in medical research and transplant medicine.

- Construction 3D Printing: There’s growing interest in using 3D printing for building homes and infrastructure, particularly as a way to reduce costs and construction times while enhancing design flexibility.

- Print-on-Demand Production: Businesses across sectors are increasingly adopting print-on-demand models facilitated by 3D printing, allowing for cost-effective small batch production and customization.

- Expansion into Food Industry: 3D printing is entering the culinary world, where it is used to create intricate food items tailored to specific dietary requirements and aesthetic preferences.

- Hybrid Manufacturing Systems: Combining traditional manufacturing techniques with 3D printing is becoming more prevalent to leverage the strengths of both methodologies, providing greater flexibility and efficiency in production processes.

Regional Analysis

In 2023, North America held a dominant market position in the 3D printing industry, capturing more than a 35% share with revenues amounting to USD 6.9 billion. This leadership can be attributed to several key factors. Primarily, the region boasts a robust technological infrastructure, which is crucial for the advancement and adoption of 3D printing technologies.

Major tech hubs such as Silicon Valley and Boston have become centers of innovation, not only providing the necessary technological prowess but also driving significant R&D activities that contribute to the evolution of 3D printing techniques and materials. Furthermore, North America is home to some of the largest players in the 3D printing industry, including companies that specialize in hardware, software, and specialized materials.

These companies benefit from the supportive venture capital environment, which facilitates continuous innovation and expansion into new applications. Industries such as aerospace, automotive, and healthcare in North America are rapidly adopting 3D printing technologies to revolutionize manufacturing processes, enhance customization, and reduce time-to-market, reinforcing the region’s leading position in the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic 3D printing market, several key players are driving innovation through strategic initiatives such as acquisitions, new product launches, and mergers. Stratasys Ltd., a frontrunner in the industry, has continually expanded its product portfolio to cater to diverse sectors including healthcare and automotive. Materialise has been pivotal in integrating 3D printing software solutions with hardware, enhancing user accessibility and efficiency.

EnvisionTec Inc., recognized for its detailed and high-speed printing capabilities, has recently launched new printers that serve both medical and industrial applications. 3D Systems Inc. has significantly broadened its influence through the acquisition of smaller firms, boosting its technological stack and market reach. GE Additive has made notable advancements in metal printing technologies, positioning itself as a leader in aerospace and automotive sectors.

Autodesk Inc. continues to innovate in software development for 3D design, simulation, and manufacturing, often partnering with hardware manufacturers to optimize 3D printing processes. Made In Space, known for its off-earth manufacturing technology, has developed unique systems suited for microgravity environments, contributing to its growth. Canon Inc., entering the market with its full-color 3D printers, aims at transforming the graphic arts and design industries. Voxeljet AG focuses on large-format printing, which has seen significant growth and application across various sectors.

Top Key Players in the 3D Printing Market

- Stratasys Ltd

- Materialise

- EnvisionTec Inc

- 3D Systems Inc

- GE Additive

- Autodesk Inc

- Made In Space

- Canon Inc

- Voxeljet AG

- Other Key Players

Recent Developments

- In March 2024, Stratasys introduced two new software packages, GrabCAD Streamline Pro and an updated version of GrabCAD Print Pro, aimed at improving operational efficiency and reducing costs for users of its 3D printing systems.

- Materialise completed the acquisition of Link3D in February 2023, which is expected to enhance its software portfolio and provide better integration for customers across the additive manufacturing workflow.

- 3D Systems proposed a $1.33 billion merger with Stratasys in June 2023. The merger aims to create a global leader in additive manufacturing, with significant synergies expected from the combined operations.

- In July 2023, Autodesk released major updates to its Fusion 360 software, enhancing its capabilities for 3D printing and additive manufacturing workflows.

Report Scope

Report Features Description Market Value (2023) US$ 19.8 Bn Forecast Revenue (2033) US$ 135.4 Bn CAGR (2024-2033) 21.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Hardware, Services), By Printer Type (Industrial 3D Printer, Desktop 3D Printer), By Technology (Selective Laser Sintering, Stereolithography, Fuse Deposition Modeling, Direct Metal Laser Sintering, Inkjet Printing, Polyjet Printing, Electron Beam Melting, Laminated Object Manufacturing, Digital Light Processing, Laser Metal Deposition, Others), By Application (Functional Parts, Tooling, Prototyping), By Vertical(Industrial 3D Printing [Automotive, Aerospace & Defense, Healthcare, Consumer Electronics, Industrial, Power & Energy, Others], Desktop 3D Printing [Educational Purpose, Fashion & Jewelry, Objects, Dental, Food, Others]), By Material (Metal, Polymer, Ceramic) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Stratasys Ltd, Materialise, EnvisionTec Inc, 3D Systems Inc, GE Additive, Autodesk Inc, Made In Space, Canon Inc, Voxeljet AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is 3D printing?3D printing, also known as additive manufacturing, is a process of creating three-dimensional objects from a digital file by layering materials in succession until the object is formed.

How big is 3D Printing Market?The Global 3D Printing Market size is expected to be worth around USD 135.4 Billion By 2033, from USD 19.8 Billion in 2023, growing at a CAGR of 21.2% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the 3D Printing Market?Key factors include advancements in 3D printing technology, increasing adoption across various industries (such as healthcare, automotive, aerospace, and manufacturing), demand for customized products, reduction in manufacturing costs, and the growing use of 3D printing for prototyping and production.

What are the current trends and advancements in the 3D Printing Market?Current trends include the development of new materials for 3D printing, the rise of metal 3D printing, advancements in bioprinting for medical applications, increased use of 3D printing in construction, and the integration of AI and machine learning for optimizing 3D printing processes.

What are the major challenges and opportunities in the 3D Printing Market?Major challenges include high initial costs, limited material availability, intellectual property concerns, and quality control issues. Opportunities include innovations in materials and technology, expanding applications in various industries, cost reductions, and the potential for mass customization and on-demand production.

Who are the leading players in the 3D Printing Market?Leading players include 3D Systems, Stratasys Ltd, Materialise, EnvisionTec Inc, 3D Systems Inc, GE Additive, Autodesk Inc, Made In Space, Canon Inc, Voxeljet AG, Other Key Players

-

-

- Stratasys Ltd

- Materialise

- EnvisionTec Inc

- 3D Systems Inc

- GE Additive

- Autodesk Inc

- Made In Space

- Canon Inc

- Voxeljet AG

- Other Key Players