Global 3D Printing Construction Market Size, Share and Report Analysis By Method (Extrusion, Powder Bonding, Other), By Material Type (Concrete, Metal, Composite, Others), By End Use (Building, Infrastructure) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175134

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

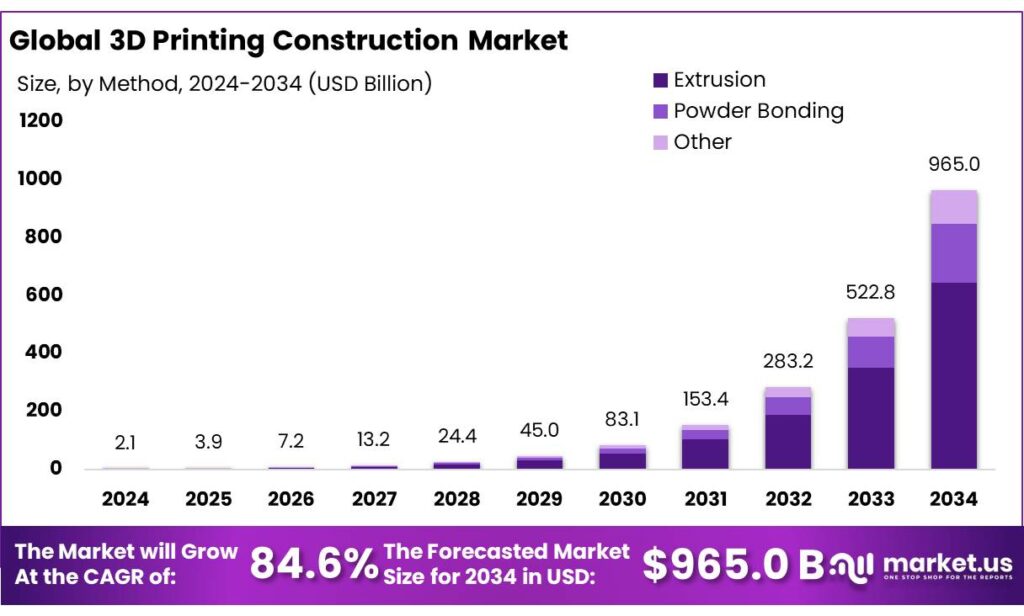

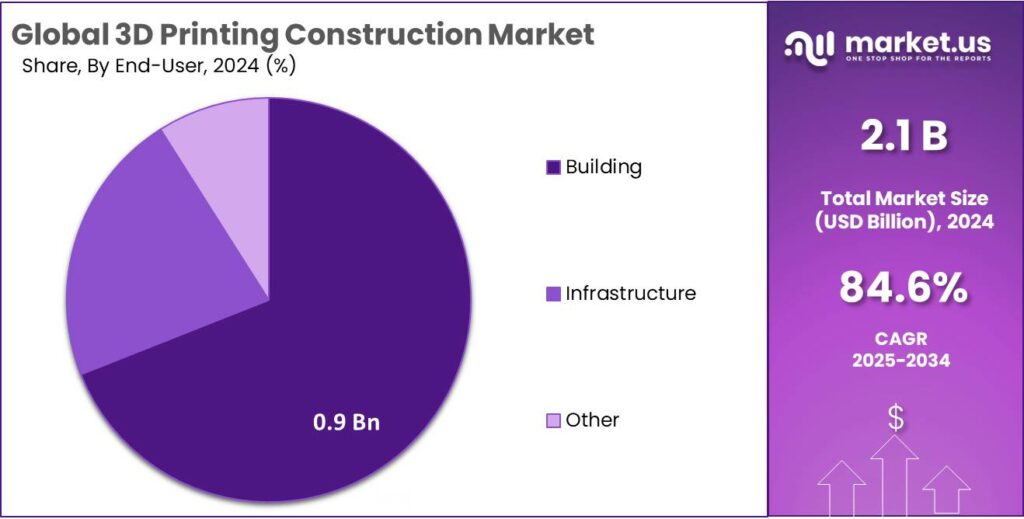

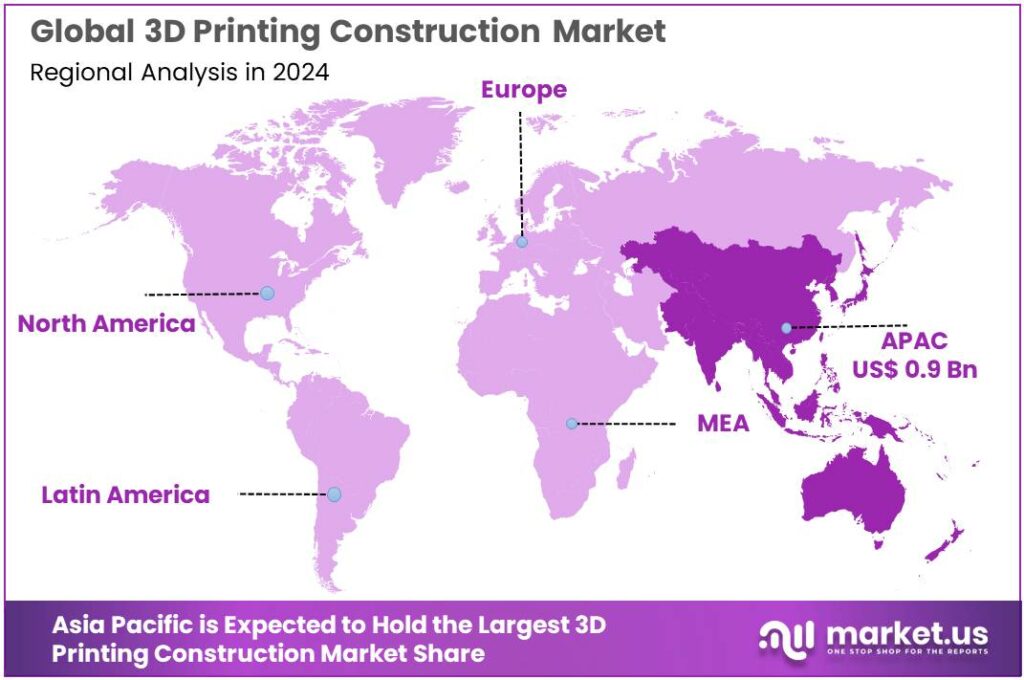

Global 3D Printing Construction Market size is expected to be worth around USD 965.0 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 84.6% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 44.6% share, holding USD 0.9 Billion in revenue.

3D printing in construction is shifting from “pilot builds” toward early commercial deployment because it tackles two persistent pain points at once: housing supply pressure and productivity constraints in traditional building workflows. In the U.S., the housing conversation is anchored by documented shortages—Congressional Research Service summarizes estimates such as a 3.78 million-unit shortfall—and HUD data shows how tight affordability is at the bottom of the market, with only 59 affordable units per 100 very low-income renter households in 2023.

Industrially, the market is organizing around a few repeatable use-cases: walls and structural shells printed on-site; factory-printed modules assembled into homes or small facilities; and defense/infrastructure prototypes where speed and logistics matter. A recent proof of industrial scale is the U.S. Army’s award to ICON: a $62.8 million production contract for a new series of 3D-printed barracks at Fort Bliss, signaling that large buyers are beginning to treat the method as a program, not a one-off demonstration.

Key demand drivers are increasingly structural rather than experimental. Sustainability and material efficiency are central because buildings and construction remain a major climate and resource hotspot: UNEP’s global status reporting cites the sector consuming 32% of global energy and contributing 34% of global CO₂ emissions. At the same time, the sector generates about 2 billion tonnes of construction and demolition waste annually, creating economic and regulatory pressure to reduce waste at source. In that context, industry participants point to quantified waste reduction potential—Cemex Ventures notes 3D printing can generate up to 60% less jobsite waste by placing material only where needed.

Government initiatives are shaping the industrial scenario by de-risking materials, energy performance, and defense logistics. The U.S. Department of Energy has backed R&D aimed at “3D-printed concrete walls” for improved energy and construction efficiency, reflecting public interest in faster, lower-waste envelope systems. Defense-linked funding is also present: the U.S. Army Corps supported work on AI-enabled 3D printed concrete with a reported award of USD 1.4 million, underscoring demand for rapid, deployable infrastructure.

Government-backed programs and high-visibility targets are also shaping adoption incentives. Dubai’s official strategy sets a goal that 25% of buildings in Dubai will be based on 3D printing technology by 2030, a policy signal that can accelerate demand for compliant materials, qualified contractors, and localized printing capacity. On the innovation frontier, NASA awarded ICON a contract valued at $57.2 million running through 2028 to advance lunar construction systems—this is not traditional real-estate demand, but it funds breakthroughs in automation, materials science, and autonomous construction workflows that can spill back into terrestrial applications.

Key Takeaways

- 3D Printing Construction Market size is expected to be worth around USD 965.0 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 84.6%.

- Extrusion held a dominant market position, capturing more than a 67.2% share.

- Concrete held a dominant market position, capturing more than a 62.9% share.

- Building held a dominant market position, capturing more than a 69.4% share.

- Asia Pacific held the leading position in the 3D Printing Construction Market, accounting for 44.6% and reaching USD 0.9 Bn.

By Method Analysis

Extrusion dominates the 3D printing construction landscape with a strong 67.2% share, driven by its speed, material flexibility, and structural reliability.

In 2024, Extrusion held a dominant market position, capturing more than a 67.2% share, reflecting its growing acceptance as the most practical and scalable method in 3D-printed construction. This approach, which uses large-scale printers to deposit concrete or cementitious mixtures layer by layer, has become the preferred choice for residential and low-rise commercial projects. Contractors value extrusion because it delivers consistent wall geometry, minimizes formwork costs, and shortens construction timelines. During 2024, multiple projects adopted extrusion-based methods for printing single-family homes, affordable housing units, and on-site structural components, further solidifying its leadership within the industry.

By Material Type Analysis

Concrete leads the 3D printing construction space with a solid 62.9% share, supported by its strength, availability, and proven structural performance.

In 2024, Concrete held a dominant market position, capturing more than a 62.9% share, reflecting its role as the most dependable and widely adopted material in 3D-printed construction. Builders consistently favor concrete because it offers strong load-bearing capacity, weather resistance, and compatibility with large-scale extrusion printers. Throughout 2024, most printed housing projects—including affordable homes, disaster-relief units, and small community developments—relied on specially formulated concrete mixes designed for quick setting, high flowability, and layer bonding. These material qualities helped concrete maintain a clear lead over alternative materials due to its practicality and wide industry familiarity.

By End Use Analysis

Building dominates the 3D printing construction market with a strong 69.4% share, supported by rising housing demand and faster project delivery.

In 2024, Building held a dominant market position, capturing more than a 69.4% share, driven mainly by the growing global need for affordable, quickly built, and durable housing solutions. Residential developers, nonprofit housing groups, and public agencies increasingly turned to 3D printing to shorten construction timelines and reduce labor dependencies. Most large-scale printed projects in 2024—including single-family homes, duplexes, community housing clusters, and emergency shelters—fell under this building segment. The method’s ability to print walls within hours and complete structures within days made it especially attractive for regions facing housing shortages or disaster-recovery needs.

Key Market Segments

By Method

- Extrusion

- Powder Bonding

- Other

By Material Type

- Concrete

- Metal

- Composite

- Others

By End Use

- Building

- Infrastructure

Emerging Trends

Integration of Automation and Digital Workflows in 3D Printing Construction

Governments are taking notice and encouraging these developments. Dubai’s 3D Printing Strategy, which aims for 25% of buildings to be based on 3D printing technology by 2030, reinforces the idea that digital and automated construction is part of future city planning. When policymakers highlight specific targets like this, they help justify the upfront investments in software, training, and integrated systems that make digital workflows viable.

The global food system—which includes production, processing, transport, consumption, and waste—faces enormous coordination challenges across long value chains. According to the Food and Agriculture Organization (FAO), roughly 13.2% of food is lost before it reaches retail, and the United Nations Environment Programme (UNEP) estimated that 1.05 billion tonnes of food was wasted in 2022 by households, retailers, and food service sectors.

This integration of automation and digital workflows is likely to expand beyond structural printing into areas like electrical, plumbing, and HVAC coordination. When designers, programmers, and on-site teams can all work from the same digital blueprint, the result is less rework, fewer surprises, and projects that feel more predictable and humane to build. For homeowners and occupants, that means faster delivery with fewer delays and unexpected costs—an important shift for an industry long known for slow timelines and cost overruns.

Drivers

Housing supply pressure is pushing 3D-printed building adoption

One major driver for 3D printing in construction is the urgent need to add housing faster, with fewer on-site labor constraints. In 2024 and into 2025, the technology is being pulled forward less by “cool prototypes” and more by practical delivery problems: crews are hard to staff, schedules slip easily, and traditional methods struggle to scale when demand spikes. 3D printing answers that pain point by automating a repeatable part of the build, so projects can move from design to site execution with tighter control over time and workforce requirements.

Policy signals are reinforcing this shift from experimentation to planning. Dubai’s government-backed 3D Printing Strategy sets a clear adoption target: 25% of buildings in Dubai are intended to be based on 3D printing technology by 2030. That kind of target matters commercially because it encourages local permitting pathways, workforce training, and supplier readiness—three blockers that normally slow new construction methods. When a city sets an explicit goal, contractors and equipment providers can justify capacity investment because demand becomes more visible and policy-backed, rather than speculative.

A second proof point is how affordable-housing programs are beginning to intersect with printed construction. In Houston, the Zuri Gardens development is planned for 80 homes, and the project received a $1.8 million forgivable loan through the city’s affordable housing support to help fund the build. This is important not because it is a “one-off” project, but because it shows how public funding can de-risk early deployments. When city financing is attached to a printed-housing community, it signals that officials see the method as a viable way to expand supply—especially for buyers who are priced out of new builds.

R&D funding from trusted public institutions also strengthens the same driver, even when it comes from outside the housing market. NASA awarded ICON a contract valued at $57.2 million running through 2028 to advance lunar construction technologies. While the Moon is not the near-term commercial market, the work accelerates automation, material handling, and robotic construction control—capabilities that translate back into faster, more standardized building on Earth.

Restraints

Lack of Clear Regulations and Standards Hampers Wider Adoption

One major restraining factor slowing the growth of 3D printing construction is the absence of robust, universally accepted regulations and building standards. Even as the technology shows promise, governments and permit authorities around the world are still grappling with how to treat 3D-printed structures in official codes. Traditional building codes were written with conventional materials and methods in mind, so they often do not directly apply to printed walls, joints, or load-bearing systems that differ from cast or framed construction.

Compounding this is a lack of standardized material specifications for 3D-printed mixes. Concrete mixes designed for extrusion need very specific flow, setting, and strength characteristics to be safely layered and cured without collapsing, but most traditional standards do not cover these behaviours. As a result, each material formulation often requires bespoke testing and approval, which further fragments regulatory acceptance. Tools like centralized certification programs or national printing standards could help bridge this gap, but they are still in early stages in many countries.

This regulatory hurdle is compounded by the workforce challenge. Construction holds a huge role in global employment, and agrifood systems provide a useful contrast: according to the FAO, agrifood systems employ an estimated 1.23 billion people globally, amounting to about one-third of the world’s labour force. Those systems depend on well-understood processes and established training pathways that governments support through policy and investment.

Government action can mitigate some of these restraints. Policies like the Dubai 3D Printing Strategy, which aims for 25% of buildings to use 3D printing by 2030, send a powerful signal that authorities are willing to create frameworks for adoption. However, to translate this kind of aspirational target into everyday building practice, authorities must also invest in clear standards and certification systems that give builders confidence they can comply without ambiguity.

Opportunity

Low-carbon printed concrete opens a big next wave

One of the clearest growth opportunities for 3D printing in construction is the shift toward lower-carbon, “smarter” concrete mixes that can be printed reliably and approved faster. In 2024–2025, the sector is learning a hard truth: printing the walls is only half the story—what really scales the business is a material system that is consistent, testable, and easier for regulators to accept. The Global Cement and Concrete Association notes that concrete’s essential role comes with a heavy footprint, with the sector responsible for about 7% of global CO₂ emissions.

In 2024, governments and public agencies strengthened the demand case for 3D printing in housing and resilient buildings, creating room for suppliers that can offer compliant, greener mixes. Dubai’s official strategy states a goal that 25% of buildings in Dubai will be based on 3D printing technology by 2030—a target that encourages investment in equipment, materials qualification, and local supply chains. In the United States, HUD publicly showcased 3-D printing as an innovative solution to boost affordable housing supply, which helps normalize the method in the eyes of housing stakeholders and permitting ecosystems.

A practical pathway to lower-carbon printable mixes is also getting attention: replacing a portion of cement with supplementary materials—some of which can come from agricultural by-products. This is where credible food-system numbers highlight the scale of unused resources. FAO reports that 13.2% of food is lost in supply chains before retail, and UNEP estimates 19% of food available to consumers is wasted; UNEP’s Food Waste Index Report 2024 puts the waste volume at 1.05 billion tonnes in 2022.

The opportunity becomes bigger and more commercial: suppliers that can package print-ready, lower-carbon mixes with repeatable testing, clear documentation, and stable performance can win contracts faster than those selling only hardware. Regulators and developers want proof—compressive strength consistency, bond quality between layers, fire performance, and durability in freeze–thaw or high-humidity conditions.

Regional Insights

Asia Pacific dominates with a 44.6% share, valued at USD 0.9 Bn, supported by rapid urban growth and high construction demand.

In 2024, Asia Pacific held the leading position in the 3D Printing Construction Market, accounting for 44.6% and reaching USD 0.9 Bn in value. This dominance is closely linked to the region’s unmatched pace of urban expansion and the constant need to add housing, public facilities, and basic infrastructure at scale. Asia-Pacific is home to over 2.2 billion urban dwellers, making it the world’s largest urban region, which keeps pressure on cities to build faster and manage costs more tightly.

From an industry standpoint, 3D printing fits the region’s practical needs: it can reduce formwork, compress wall-building timelines, and help contractors work around labor gaps on repetitive site tasks. The technology is also being pulled forward by dense-city realities—many Asian cities are expanding vertically and outward at the same time, which increases demand for quicker project cycles and more standardized construction outputs.

Wider urbanization trends support this direction: the World Bank’s urbanization data (sourced from the UN’s World Urbanization Prospects) shows the steady rise in urban population shares across East Asia & Pacific, reinforcing long-term construction volume in the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Apis Cor positions itself around mobile, on-site printing for residential shells and rapid builds. A key numeric signal is its regulated fundraising: an SEC offering circular lists an offering of up to 35,000,000 common shares with a minimum investment of $1,000, showing how it funds scale and factory capacity.

ICON’s numbers reflect both ambition and operational reality. It holds a NASA contract worth $57.2 million running through 2028 to advance lunar construction systems, keeping its R&D pipeline well-funded. On the workforce side, a WARN-related report said ICON laid off 114 employees in January 2025, showing cost control during scaling cycles.

Contour Crafting is one of the earliest names in construction-scale printing. On its official site, the company highlights its founder’s portfolio of 100+ US and international patents in the field, creating a strong defensible base for licensing and industrial partnerships. It also notes recognition from NASA, including a 2014 selection as Grand Prize among 1,000+ competing technologies.

Top Key Players Outlook

- Apis Cor

- COBOD International A/S

- Contour Crafting Corporation

- CyBe Construction

- ICON Technology, Inc.

- MX3D

- Sika AG

- WASP S.r.I

- XtreeE

Recent Industry Developments

In 2025, ICON tightened operations and funding at the same time: a WARN filing reported 114 layoffs in Texas, and soon after ICON confirmed a $56 million Series C round, showing investors still back the long-term housing automation play.

In 2024, COBOD International A/S reported revenue of DKK 89.768 million and a net profit of DKK 813,383, ending the year with equity of DKK 23,161,946 and a team size of 79 people—numbers that suggest a stable, engineering-led business even in a slower construction cycle.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 965.0 Bn CAGR (2025-2034) 84.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Method (Extrusion, Powder Bonding, Other), By Material Type (Concrete, Metal, Composite, Others), By End Use (Building, Infrastructure) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Apis Cor, COBOD International A/S, Contour Crafting Corporation, CyBe Construction, ICON Technology, Inc., MX3D, Sika AG, WASP S.r.I, XtreeE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3D Printing Construction MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

3D Printing Construction MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Apis Cor

- COBOD International A/S

- Contour Crafting Corporation

- CyBe Construction

- ICON Technology, Inc.

- MX3D

- Sika AG

- WASP S.r.I

- XtreeE