Global 3D Printing Ceramics Market By Form(Filament, Powder, Liquid), By Application(Prototyping, Commercial/ Manufacturing), By End-Use(Aerospace & Defense, Healthcare, Automotive, Consumer Goods & Electronics, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 21745

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

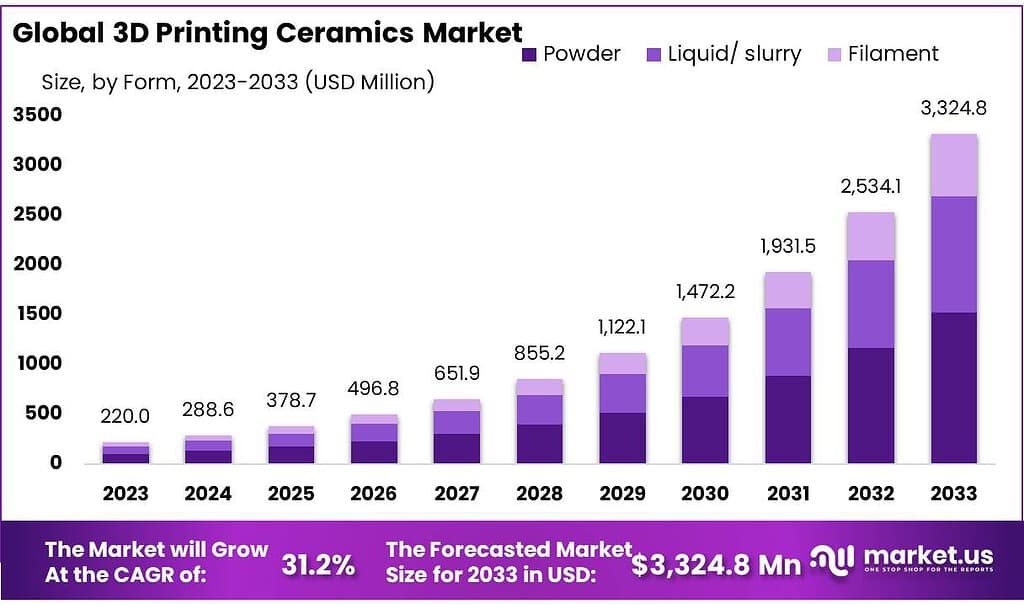

The global 3D printing ceramics market size is expected to be worth around USD 3324.8 Million by 2033, from USD 220 Million in 2023, growing at a CAGR of 31.2% during the forecast period from 2023 to 2033.

Market growth will continue to be driven by demand from the end-use industries, including medical and aerospace.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Size Projection: The 3D printing ceramics market is anticipated to reach around USD 3324.8 Million by 2033 from USD 220 Million in 2023, growing at a staggering CAGR of 31.2% during 2023-2033.

- Factors Driving Market Growth: Industry Demand Drivers: Growing demand from sectors like medical and aerospace fuels market growth. Healthcare Integration: Ceramics’ unique properties make them ideal for orthopedic and dental implants within healthcare applications.

- Forms: Powder dominates the market due to its versatility anduse in intricate ceramic structures.

- Applications: Segmented into prototyping for creativity and commercial/manufacturing for producing final products.

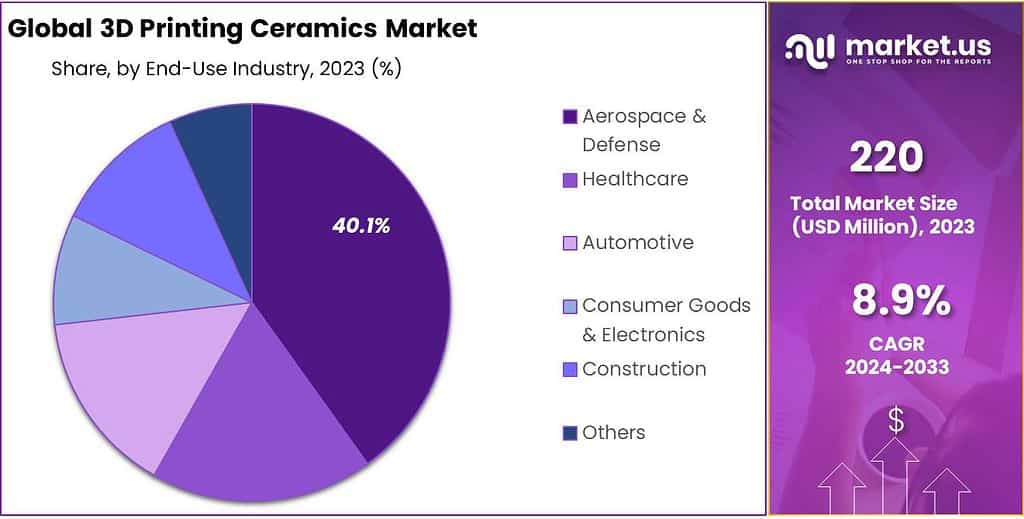

- End-Use: Aerospace and defense holds a significant share, followed by healthcare, automotive, and other sectors.

- Challenges: Material complexity, limited color options, higher costs, size restrictions, and environmental impacts pose hurdles.

- Opportunities: Customized manufacturing, healthcare innovation, aerospace & defense demand, sustainable solutions, and growth in emerging markets provide avenues for market expansion.

- Major Market Players: Companies like 3D Systems Corporation, EOS GmbH, Prodways Group, among others, are focusing on innovations and expanding operations to tap into the growing market.

Form analysis

In 2023, Powder was the most popular form for 3D printing ceramics, accounting for over 42.6% of the market. This dominance was driven by its versatility and ease of use in creating intricate ceramic structures.

The 3D printing ceramics industry may be divided into filament, liquid, and powder categories based on form. Shortly, the powder is anticipated to dominate the market. Due to the increase in the need for laser sintering technology in industrial applications, the powder market has been growing.

Through the use of stereolithography methods, which are commonly used in prototype applications, liquid 3D printing ceramics are used to create a variety of goods in the form of pastes and gels.

By Application

In the realm of 3D printing ceramics, applications can be broadly categorized into prototyping and commercial/manufacturing purposes.

Prototyping serves as the creative playground for designers and engineers. It’s a crucial phase where innovative ideas take shape and are tested for feasibility. This application allows for rapid iteration and experimentation, enabling professionals to visualize concepts and make necessary adjustments before advancing to large-scale production.

In contrast, commercial and manufacturing applications hold immense significance in the 3D printing ceramics market. This facet involves utilizing the technology to craft final products for diverse industries, including aerospace, healthcare, and consumer goods. It’s instrumental in producing intricate, customized, and durable ceramic components at a larger scale, contributing to enhanced efficiency and innovation in manufacturing processes.

Both prototyping and commercial/manufacturing applications play pivotal roles in advancing the 3D printing ceramics market. Prototyping fuels creativity and idea refinement, while commercial and manufacturing applications drive efficiency, customization, and scalability in producing top-notch ceramic end-products for various industries.

End-Use analysis

In 2023, Powder claimed the biggest share in the 3D printing ceramics market, holding over 40.1%. Aerospace & Defense emerged as a key industry driving this demand, leveraging ceramic printing for lightweight, durable parts crucial for aircraft and defense equipment.

Investors will find many opportunities in the medical sector. In 2021, the medical sector accounted for nearly 41% of all volume. 3D printing allows for the complex manufacturing of medical parts. A growing population and rising healthcare requirements are driving demand for medical components.

Other sectors, such as electronics, automotive, and energy, are expected to increase the need for 3D-printed ceramic products. The demand for finished products will be driven by high-resolution techniques and systems such as ceramics injection mold (CIM).

Note: Actual Numbers Might Vary In the Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Form

- Filament

- Powder

- Liquid

By Application

- Prototyping

- Commercial/ Manufacturing

By End-Use

- Aerospace & Defense

- Healthcare

- Automotive

- Consumer Goods & Electronics

- Construction

- Others

Drivers

The surge in the 3D printing ceramics market is being fueled by several key factors. One major driver is the growing demand for 3D printing, particularly within the dental industry, as well as the drive for product modifications and advancements across various end-use sectors.

The healthcare realm, notably in dental applications, is witnessing a notable uptick in the adoption of 3D printing. Ceramics, prized for their inertness, porosity, high wear resistance, strong compression capabilities, and adaptability to diverse shapes, are the preferred material for printing orthopedic and dental implants, as well as heart valves.

Moreover, the increasing integration of 3D printing technology across various industries in emerging economies is set to bolster the market further. This broader adoption of 3D printing across sectors signals a shift toward innovative manufacturing methods, reinforcing the demand for ceramic-based 3D printing materials due to their exceptional properties and suitability for diverse applications.

Restraints

The swift rise in the adoption of 3D printing technology, particularly concerning plastics and metals, poses a challenge to the growth of the 3D printing ceramics market. This trend toward other materials for 3D printing applications could potentially lead to product substitution, diverting attention away from ceramics.

Moreover, the relatively high cost associated with 3D printing ceramics stands as a significant hurdle. This high capital requirement for utilizing ceramic-based 3D printing materials can deter potential adopters and hinder the widespread use of ceramics in the market.

These challenges, revolving around the competition from alternative materials and the considerable investment needed, are expected to act as key restraints in the growth trajectory of the 3D printing ceramics market. Addressing these obstacles will be crucial for unlocking the full potential and broader adoption of ceramics within the 3D printing landscape.

Opportunities

Customized Manufacturing: Using 3D printing ceramics allows businesses to make unique and intricate parts, improving products’ performance and functions.

Healthcare Innovation: In healthcare, 3D printing ceramics are revolutionizing patient care by creating precise implants and prosthetics, enhancing treatment outcomes.

Aerospace and Defense Demand: Ceramics’ heat and wear resistance make them ideal for aerospace and defense applications, fueling a growing need for high-performance ceramic parts.

Sustainable Solutions: Ceramic 3D printing reduces waste and energy use in manufacturing, aligning with the increasing demand for eco-friendly solutions amid environmental concerns.

Growth in Emerging Markets: The Asia Pacific region shows significant potential for ceramic 3D printing, providing opportunities for businesses to expand and reach new customers in these developing markets.

Challenges

Material Complexity: Ceramic materials are tricky to 3D print due to their brittleness, often leading to cracks during the printing process. This makes it hard to create intricate designs.

Limited Color Options: Unlike plastics, ceramics have few color choices, affecting the visual variety of 3D printed ceramic objects.

Higher Costs: 3D printing ceramics can be pricier compared to traditional ceramic manufacturing due to specialized equipment and production processes.

Size Restrictions: The current technology limits the size of 3D printed ceramic objects, restricting their use for larger items.

Environmental Impact: Some ceramic printing processes produce carbon emissions and pollutants, posing environmental concerns in certain instances.

Regional Analysis

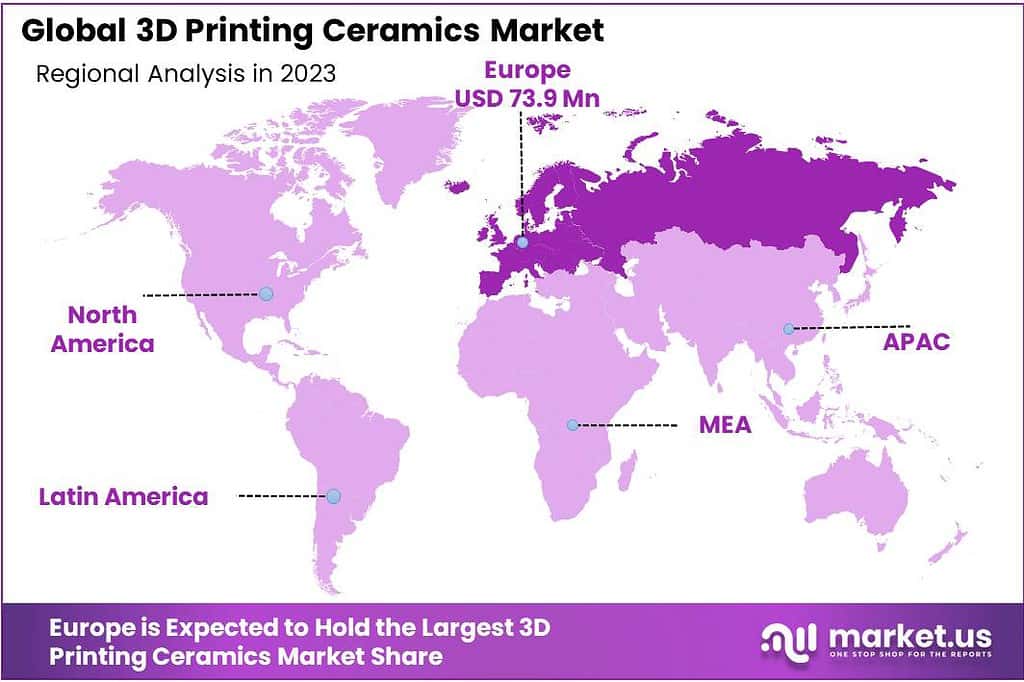

In terms of volume and revenue, Europe held the largest market share of 33.6% for 2023 This region is home to many small and medium-sized aerospace component manufacturers. This region is seeing a rise in the production of military and commercial aircraft.

According to Airbus’s recent report, passenger and freight aircraft demand is expected to rise by approximately 37,403 units in the next 20 years.

Asia Pacific is expected to be the most popular region in the future and grow at the highest CAGR in revenue between 2023-2032. The rising number of people and investments in healthcare will increase the demand for 3D-printed ceramics.

According to the World Health Organization, China’s population above 60 years old is expected to increase to around 241 million in 2020. This will drive demand for 3D printed ceramics for medical applications.

In 2021, the European market was valued at US$ 6 million. It is expected to continue growing at a rapid rate over the forecast period. Numerous aerospace and automotive component manufacturers are found in countries like France and Germany. The demand for these components will continue to be a major growth driver for the 3D printing ceramics industry in the future.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The three-dimensional printing market is focusing on new applications. 3D printing is expected to be adopted by major ceramics manufacturers, suppliers, and end-users. Some players are expanding their operations in other countries.

3DCERAM, a French company, opened a new U.S. facility in 2019 to develop new applications in the motor, aviation, aerospace, and biomedical sector.

Маrkеt Кеу Рlауеrѕ:

- 3D Systems Corporation

- 3D Systems

- 3DResyns

- Admatec Europe

- Admatec

- Aon Inni

- Ceram Tec

- Desktop Metal

- EOS GmbH Electro Optical Systems

- Johnson Matthey

- Kwambio

- Lithoz

- Prodways Group

- Steinbach AG

- Tethon 3D

- The Exone Company

- Voxeljet AG

- Viridis 3D LLC

- 3DCeram

Recent Developments

On 21 February 2022, Stratasys Ltd. unveiled its advanced J750 Digital Anatomy 3D Printer. This printer produces highly realistic anatomical models suitable for surgical planning, training and education purposes. With its latest launch, Stratasys hopes to strengthen its position within the 3D printing ceramic market.

Report Scope

Report Features Description Market Value (2023) USD 220 Million Forecast Revenue (2033) USD 3324.8 Million CAGR (2023-2032) 31.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form(Filament, Powder, Liquid), By Application(Prototyping, Commercial/ Manufacturing), By End-Use(Aerospace & Defense, Healthcare, Automotive, Consumer Goods & Electronics, Construction, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3D Systems Corporation, 3D Systems, 3DResyns, Admatec Europe, Admatec, Aon Inni, Ceram Tec, Desktop Metal, EOS GmbH Electro Optical Systems, Johnson Matthey, Kwambio, Lithoz, Prodways Group, Steinbach AG, Tethon 3D, The Exone Company, Voxeljet AG, Viridis 3D LLC, 3DCeram Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the 3D Printing Ceramics market in 2021?The 3D Printing Ceramics market size is US$ 50.68 million in 2021.

Q: What is the projected CAGR at which the 3D Printing Ceramics market is expected to grow at?The 3D Printing Ceramics market is expected to grow at a CAGR of 35% (2023-2032).

Q: List the segments encompassed in this report on the 3D Printing Ceramics market?Market.US has segmented the 3D Printing Ceramics market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Form, market has been segmented into Filament, Powder, and Liquid. By End User, the market has been further divided Medical, Aerospace, and Industrial Machinery.

Q: List the key industry players of the 3D Printing Ceramics market?Tethon3D, Lithoz, Steinbach AG, 3D CERAM, PRODWAYS, Desamanera S.r.l., Additive Elements GmbH, Materialise, DDM Systems, and Other Key Players engaged in the 3D Printing Ceramics market.

Q: Which region is more appealing for vendors employed in the 3D Printing Ceramics market?North America accounted for the highest revenue share of 35.1%. Therefore, the 3D Printing Ceramics industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for 3D Printing Ceramics?The U.S., Western Europe, Eastern Europe, China, Japan, are key areas of operation for 3D Printing Ceramics Market.

Q: Which segment accounts for the greatest market share in the 3D Printing Ceramics industry?With respect to the 3D Printing Ceramics industry, vendors can expect to leverage greater prospective business opportunities through the aerospace segment, as this area of interest accounts for the largest market share.

3D Printing Ceramics MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

3D Printing Ceramics MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Tethon3D

- Lithoz

- Steinbach AG

- 3D CERAM

- PRODWAYS

- Desamanera S.r.l.

- Additive Elements GmbH

- Materialise

- DDM Systems

- Other Key Players