Global Image Sensor Market By Technology (Charged Coupled Device (CCD), and Complementary Metal-oxide Semiconductor (CMOS)), By Type (2D, 3D), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 12777

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

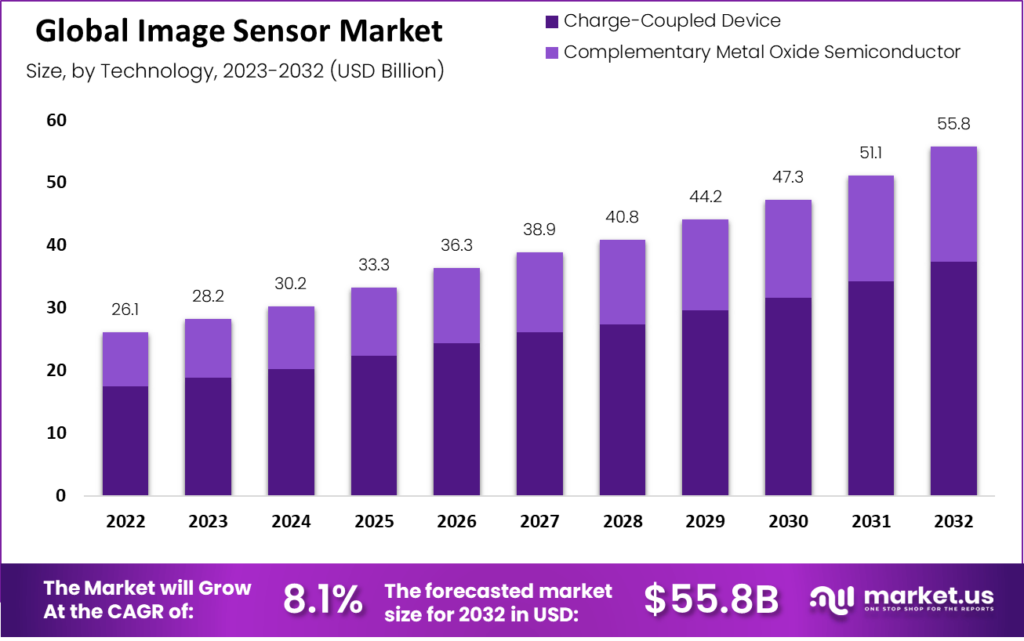

In 2022, the Global Image Sensors Market was valued at USD 26.1 billion. Between 2023 and 2032, this market is estimated to register the highest CAGR of 8.1% and a market value of USD 55.8 billion.

The image sensor market is anticipated to be driven by rising spending on security and surveillance in public places worldwide and the rising adoption of technologies for enhancing anti-terror equipment and reducing security breaches. A significant rise in smartphone use among members of Generation Z is anticipated to further bolster the industry’s expansion path. The integration of numerous cameras into a single smartphone device results in enhanced HDR, optical zoom, and low-light photography. Additionally, it is possible to switch between portrait and landscape modes and use 3D imaging.

Note: Actual Numbers Might Vary In The Final Report

The main contributor to the expanding semiconductor market is now sensors. Sensors are becoming increasingly important as a result of technological advancements and novel application areas. This has resulted in the growth of image sensor market. Modern vehicles, Advanced Driver Assistance Systems (ADAS), cutting-edge medical imaging equipment devices, automated production technologies, intelligent building technologies, and power supply systems are all becoming dependent on sensors.

In parallel, sensors are becoming more cost-effective, robust, specific, precise, and frequently smarter and communicative, making their deployment in the upcoming smart infrastructure more popular. In the beginning, Charge-Coupled Device (CCD) technology dominated because of its superior picture quality and sensitivity. However, since 2004, CMOS image sensors have surpassed CCD image sensors in terms of volume of shipment due to numerous advancements in technology. CCD sensors use high-voltage analog circuitry, but CMOS sensors use less power and come in smaller sizes than CCD sensors. As a result, CMOS is favored over CCD and contributes more revenue to the expansion of the image sensor market.

Key Takeaways

- The Global Image Sensor Market is anticipated to expand at an estimated compound annual growth rate of 8.1% from USD 26.1 billion in 2022 to reach USD 55.8 billion by 2032.

- Rising demand for multiple cameras within the automotive sector is propelling image sensor growth.

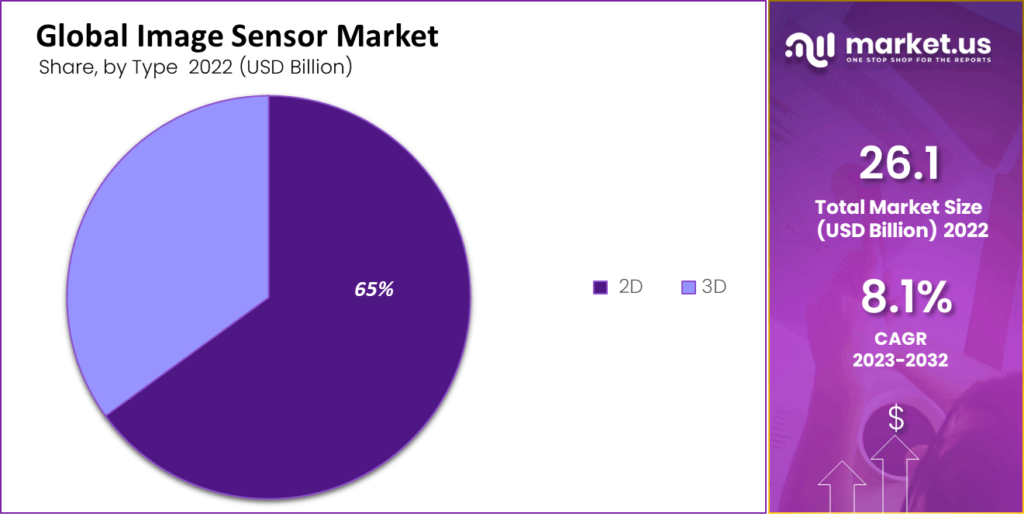

- Type Analysis: The Global Image Sensor Market is primarily dominated by 2D sensors, although 3D image sensors are projected to gain market prominence in the future, particularly with advancements in machine vision and computer vision technologies.

- Application Analysis: The automotive sector is expected to remain the dominant end-user vertical for the image sensor market, driven by the integration of image sensors into automobiles for advanced driver assistance systems (ADAS) and other safety features.

- Asia-Pacific is projected to lead the image sensor market due to the concentration of major market players and expansion in semiconductor technology.

- Key players in the image sensor market include Sony Corporation, Samsung Electronics Co. Ltd., ON Semiconductor Corporation, STMicroelectronics N.V. and Panasonic Corporation.

- Partnerships and collaborations have played an essential role in driving the development of the image sensor market, with companies like Microsoft Corporation and Sony Semiconductor Solutions Corporation working hand-in-hand to develop intelligent camera solutions for enterprise customers.

Driving Factors

The Rise in Demand for Multiple Cameras in this Market

By adopting machine vision, asset management, artificial intelligence, and related innovative technologies, the modern automotive industry is expanding rapidly. Due to its useful features, such as 360-degree vision, anti-lock brakes, lane departure warning, electronic stability control, traction control, and adaptive cruise control, the advanced driver assistant system with a surround camera in 360 degrees is gaining popularity.

Image sensors are extensively utilized by ADAS infrastructure’s machine vision technology. The idea of driverless or automated automobiles has received a boost thanks to ADAS technology. During the forecast period, it is anticipated that these new ideas will make a significant contribution to the rise in demand for image sensors and the adoption of image sensors.

While CCD image sensor technology is declining, CMOS image sensors are gaining popularity because of their smaller size, increased sensitivity, and effective use of power. Due to its lower manufacturing cost and improved image quality, CMOS image sensor technology gained popularity. The image sensor market is expected to expand mainly as CMOS infrastructure development and advanced imaging technologies emerge. BSI CMOS sensors, developed by Sony Corporation in 2018, have been widely adopted due to their high-resolution image quality. With more people using CMOS imaging sensors, the revenue from the image sensor market has increased.

Restraints Factors

Growing Preference For LiDAR Solutions by Automobile Manufacturers

In order to accurately and rapidly determine the change in distance, LiDAR systems make use of millions of laser pulses and require highly tuned systems. These systems are more precise and accurate than image sensor cameras, but they also use a lot of power, don’t work well in bad weather, are heavy, and cost a lot.

Automobile manufacturers still prefer LiDAR systems to image sensor camera systems despite these drawbacks. The image sensor market is slowing down due to the easy availability of light detection and ranging (LiDAR) solutions for autonomous vehicles.

Type Analysis

The 2D Segment is Expected to Dominate This Target Market Over the Forecast Period

The market for image sensors is divided into two types based on the processing type: sensors with two dimensions(2D) and sensors with three dimensions (3D). The current market situation demonstrates the widespread availability and application of two-dimensional technology. However, 3D image sensors are expected to dominate the market for image sensors in the coming years, according to new technologies like machine vision and computer vision.

Time-Of-Fight (TOF) technology focuses on depth sensing in three dimensions. In a variety of contexts, 3D image processing makes precise and dependable depth sensing possible. Infineon Technologies AG, for instance, 3D biometric identification, develops 3D image sensors for 3D scanning, hand gesture, and body tracking recognition.

Note: Actual Numbers Might Vary In The Final Report

In addition, Omni Vision Technologies Inc. is working on 3D imaging machine vision for automotive applications to aid in the performance of new technologies. Moreover, 3D computational photography and smartphone augmented reality (AR) applications are providing opportunities for the image sensor market to expand.

Application Analysis

The Automotive Sector is Expected to Dominate This Target Market Over the Forecast Period

The automotive sector stands to benefit financially from the image sensors market in terms of the end-user vertical. The growing popularity of CMOS sensors is anticipated to dominate the entire market for image sensors. In order to provide the driver and passengers with full protection and safety, these sensors are increasingly being incorporated into automobiles.

The demand for automobile image sensors is also being driven by the growing ADAS trend. In order to meet the needs of the automotive industry in terms of security & surveillance, numerous sensor chip manufacturers are developing cutting-edge solutions in this field.

Key Market Segments

Based on Technology

- Charge-Coupled Device(CCD)

- Complementary Metal Oxide Semiconductor (CMOS)

Based on Type

- 2D

- 3D

Based on Application

- Consumer Electronics

- Aerospace and Defense

- Industrial Robot

- Automotive

- Healthcare

- Security & Surveillance

- Other

Growth Opportunity

Improvements and New Developments in Image Sensors

Innovations in image sensors aim to improve image quality by reducing noise, increasing pixel density, and optimizing sensor platform size. As they are utilized in surgical navigation and guidance systems and robotic surgery systems, features like depth sensing will add significantly to the value of image sensors.

Image sensors can also take advantage of a plethora of growth opportunities provided by the numerous innovations made by ecosystem players. For instance, the most prominent players in the image sensor market observed approximately 23 product launches beginning in January 2022.

Latest Trends

Several vendors are ramping up their use of CMOS image sensor technology, which is continuing its rapid expansion into low-cost camera designs. Despite being frequently disparaged in comparison to charge-coupled device (CCD) sensors, which offer superior image quality at the same price, CMOS sensors are gaining ground at the low-cost end of the consumer market by providing more functions on-chip that make digital cameras design simpler.

These growing markets include consumer electronics, automotive, security & surveillance. The use of these cameras for security is advancing at a rapid rate. The rise in demand for sensors in smartphones with integrated front- and rear-facing cameras has contributed to the expansion of the consumer electronics segment. The development of self-driving automobiles and advancements in driver safety made possible by ADAS have contributed to the expansion of the automotive application.

The CMOS image sensor market for security and surveillance has grown as a result of the increased use of CMOS image sensors in security applications and their ability to function in a variety of lighting conditions, including low light, darkness, and dim light.

- Sony Corporation (Japan) dominates the CMOS image sensor market. As part of its efforts to develop CMOS image sensors for various applications, it has commercialized the CMOS image sensor for automotive cameras and invested USD 895 million (105 billion JPY) to increase production capacity for stacked CMOS image sensors.

- SmartSens, a leading manufacturer of CMOS image sensors, introduced the SC550XS, a 50MP ultra-high-resolution image sensor with a pixel size of 1.0 m, in March 2022. To enable excellent imaging performance, the new product makes use of SmartSens’ numerous proprietary technologies, such as SmartClarity-2 technology, SFCPixel technology, and PixGain HDR technology, as well as the advanced 22nm HKMG Stack process.

- Additionally, many international start-ups place a high priority on product innovation for the studied market. For instance, Metalenz, a company that develops meta-optic lens technology, unveiled a brand-new polarization technology in February 2022. This technology makes it possible for polarization sensing to be incorporated into consumer and mobile devices, leading to improved healthcare management features on smartphones.

Regional Analysis

APAC is Predicated to Dominate This Target Market in the Years to Come

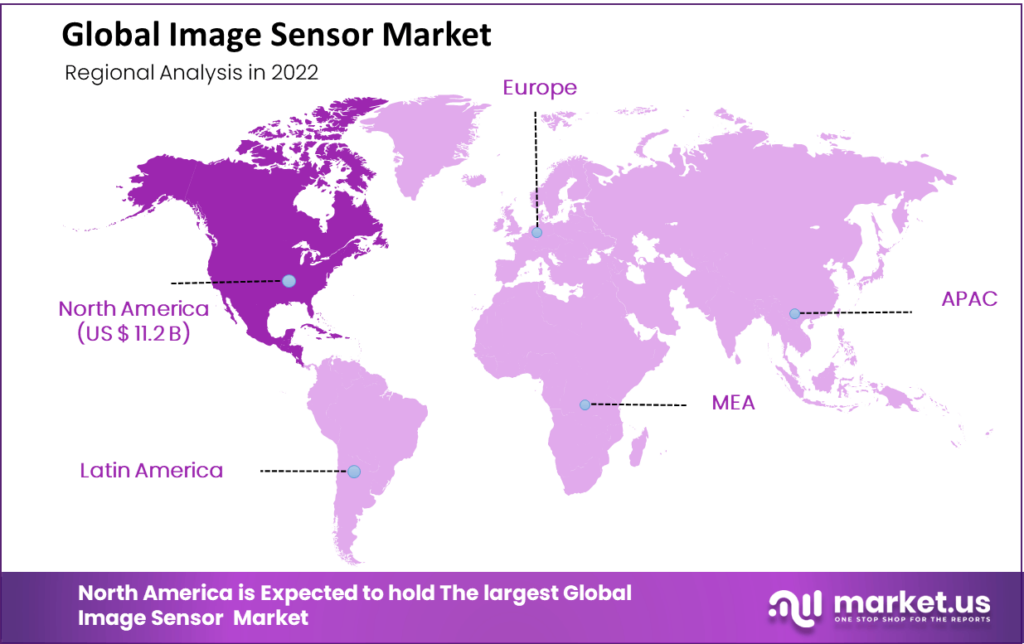

The 6 major geographic regions of North America, Latin America, Eastern Europe, Western Europe, Asia-Pacific, the Middle East & Africa, are the focus of this study on this global market for image sensors. Countries further subdivide these regions.

Among these regions, the market in Europe is likely to see a lot of use of image sensors because more people are buying smartphones and camera modules. In the years to come, this is expected to contribute to the image sensor market growth. Additionally, North America holds a significant share of the imaging market. Advanced imaging solutions gained popularity in the region as a result of technological advancement and the rate of adoption of cutting-edge technologies.

Note: Actual Numbers Might Vary In The Final Report

Additionally, the imaging sensor and its products are more widely used in the automotive, consumer electronics, and healthcare sectors in the region. Due to the growing adoption of ADAS systems and safety regulations in the region, the Middle East and Africa (MEA) market are likely to expand at a healthy rate.

The Asia Pacific (APAC) region generated the most revenue in the image sensor market in 2018, and it is anticipated that it will continue to do so throughout the forecast period as well. The image sensor market’s rapid expansion in Asia-Pacific has been aided by the presence of market leaders and the rapidly expanding semiconductor industry. The expansion of the market for image sensors throughout Asia-Pacific is also attributed to the presence of significant players like Sony Corporation and the availability of a substantial customer base.

In addition, the market is likely to be boosted in the coming years by the advancement of advanced infrastructure and the growing popularity of smartphone photography, smart devices, and digital services in APAC developing nations.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

About three-quarters of the imaging sensors market share is held by the top some key players: Sony Corporation, Samsung Electronics Co. Ltd., ON Semiconductor Corporation, STMicroelectronics N.V., and Panasonic Corporation.

To achieve more precise, robust, and in-depth sensing at an optimal cost, the leading manufacturers of image sensors have been actively modernizing their existing offerings. Time-Of-Fight (TOF) technology for 3D sensing is the most important player in technological innovation. CMOS technology is favored by the industry because of its low power consumption, improved sensitivity, and robust and compact design. Due to the industry’s rapid expansion, the majority of key players contributed to the creation of image sensors for high-quality camera modules, drones, CCTV, and smartphones.

3D depth sensors are being developed by major players for applications like augmented reality, reliable face authentication, and improved photo functions that are derived from precise 3D image data. Future growth of the image sensor market is fueled by the incorporation of image sensors into machine vision, industrial automation, and the development of 3D image sensing technologies for ADAS and automotive visualization. Key players are integrating cutting-edge imaging technologies with brand-new optical diagnostic and optical monitoring equipment.

Top Key Players in Image Sensors Market

- AMS AG.

- Canon, Inc.

- Galaxy Core, Inc.

- Hamamatsu Photonics K.K

- Infineon Technologies AG

- ON Semiconductor Corporation

- OmniVision Technologies Inc.

- Panasonic Corporation

- PMD Technologies AG

- Pixel Plus

- Sony Corporation

- Samsung Electronics Co. Ltd.

- STMicroelectronics N.V.

- SK Hynix, Inc.

- Sharp Corporation

Recent Developments

- Realme announced the availability of the Sony IMX766 image sensor-equipped 9 Pro Series throughout Europe in February 2022. The smartphone’s sensor, which has an extremely large 1/1.56″ size, a large pixel area, and optical image stabilization (OIS), enables it to take exceptional pictures. The sensor also has an aperture of f/1.88, which makes it easier for the user to take clear pictures from a distance.

- In January 2022, Sony Interactive Entertainment LLC (SIE) purchased Bungie, Inc. (Bungie), a leading independent videogame developer and longtime SIE partner who has developed some of the most acclaimed videogame franchises, such as Halo and Destiny. SIE’s goal of reaching billions of players will be boosted as a result of this acquisition because SIE will have access to Bungie’s world-class live game services and technical expertise. Listed below are some of the most prominent Image Sensor industry players.

Report Scope

Report Features Description Market Value (2023) USD 28.2 Bn Forecast Revenue (2032) USD 55.8 Bn CAGR (2023-2032) 8.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Charged Coupled Device (CCD), and Complementary Metal-oxide Semiconductor (CMOS)), By Type (2D, 3D), By Application Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape AMS AG., Canon Inc., Galaxy Core, Inc., Hamamatsu Photonics K.K, Infineon Technologies AG, ON Semiconductor Corporation, OmniVision Technologies Inc., Panasonic Corporation, PMD Technologies AG, Pixel Plus, Sony Corporation, Samsung Electronics Co. Ltd., STMicroelectronics N.V., SK Hynix, Inc., Sharp Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Image Sensor Market?The Global Image Sensor Market size was estimated to be USD 26.1 billion in 2022.

What is the total market value of the Image Sensor Market report?The Global Image Sensor Market size was USD 26.1 billion in 2022 and is expected to reach USD 55.7 billion by 2032 at a CAGR of 8.1% over the forecast period of 2023-2032.

What are the major growth factors of the Image Sensor Market?A significant rise in smartphone use is one of the main factors behind this market's growth. Furthermore, rising spending on security and surveillance and the rising adoption of technologies for enhancing anti-terror equipment and reducing security breaches is expected to aid market growth.

Which region will lead the Global Image Sensor Market?The Asia Pacific (APAC) region generated the most revenue in the image sensor market in 2022. It is anticipated that it will continue to do so throughout the forecast period as well.

Who are the prominent key players in the Image Sensor Market?The major players are Sony Corporation, Samsung Electronics Co. Ltd., ON Semiconductor Corporation, STMicroelectronics N.V.,AMS AG., Canon, Inc., Galaxy Core, Inc. and Panasonic Corporation and several others.

Which segment was the most prominent in the Image Sensor Market?On basis of type analysis, The 2D Segment is expected to dominate this target market over the forecast period. On basis of Application analysis, the automotive sector stands to benefit financially from the image sensors market.

List the segments encompassed in this report on the Image Sensor Market.The Global Image Sensor Market is segmented By Technology (Charged Coupled Device (CCD), and Complementary Metal-oxide Semiconductor (CMOS)), By Type (2D, 3D), By Application (Consumer Electronics, Medical care, Aerospace and Defense, Industrial Robot, Automobile, and Others), By Region (North America, Latin America, Europe, Asia-Pacific, the Middle East & Africa)

-

-

- AMS AG.

- Canon, Inc.

- Galaxy Core, Inc.

- Hamamatsu Photonics K.K

- Infineon Technologies AG

- ON Semiconductor Corporation

- OmniVision Technologies Inc.

- Panasonic Corporation

- PMD Technologies AG

- Pixel Plus

- Sony Corporation

- Samsung Electronics Co. Ltd.

- STMicroelectronics N.V.

- SK Hynix, Inc.

- Sharp Corporation