Global 3D Cell Culture Market By Product (Scaffold Based 3D Cell Cultures, Scaffold Free 3D Cell Cultures, Bioreactors, Microchips, and Other Products), By Application (Cancer Research, Drug Discovery, Stem Cell Research, Regenerative Medicine, and Other Applications), By End-User (Biotechnology & Pharmaceutical Companies, Contract Research Laboratories, Academic Institutes, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Aug 2024

- Report ID: 21329

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

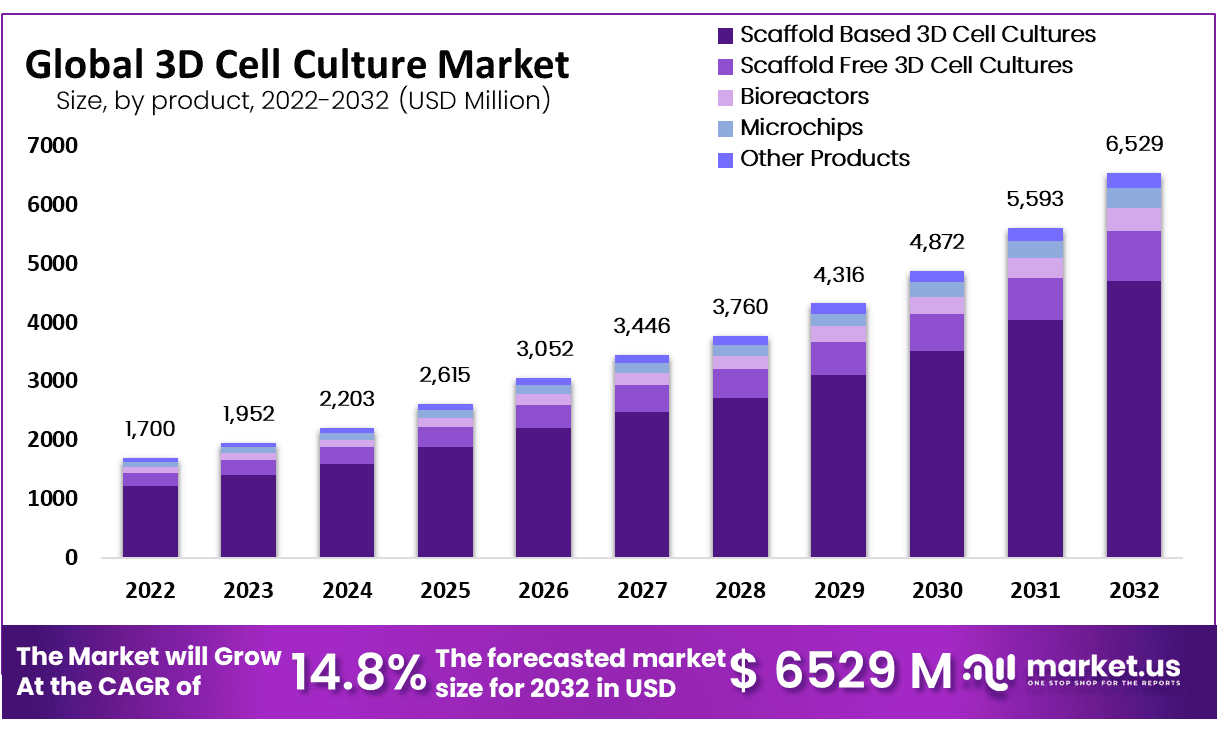

The Global 3D Cell Culture Market size is expected to be worth around USD 6,529 Million by 2032 from USD 1,700 Million in 2022, growing at a CAGR of 14.8% during the forecast period from 2023 to 2032.

3D cell culture refers to an in-vitro technique that involves the creation of an artificial environment. After that, the biological cells can grow, formulate, or interact with their surroundings in all three dimensions. After reacting with their three-dimensional surroundings, 3D cell migrates or differentiates from normal cells. It was proven that cell grown in the 3D culture models is physiologically relevant.

These cells have shown improvements in various studies of biological mechanisms, including proliferation, cell morphology, cell number monitoring, migration & invasion of tumor cells, viability, differentiation, drug metabolism, immune system evasion, response to stimuli, and others.

Therefore, 3D cell cultures facilitate the adoption in the research field as it is beneficial in analyzing and studying the etiology of diseases. The growth of the 3D cell culture market is driven mainly by the increasing focus on personalized medicine, the rising incidence of chronic diseases, the availability of funding for research, and the increasing focus on developing alternatives to animal testing.

Key Takeaways

- Market Growth: The 3D cell culture market is projected to grow from USD 1,700 million in 2022 to USD 6,529 million by 2032 at a 14.8% CAGR.

- Scaffold-Based Dominance: Scaffold-based 3D cell cultures held 68% of the market share in 2022, driving significant market growth.

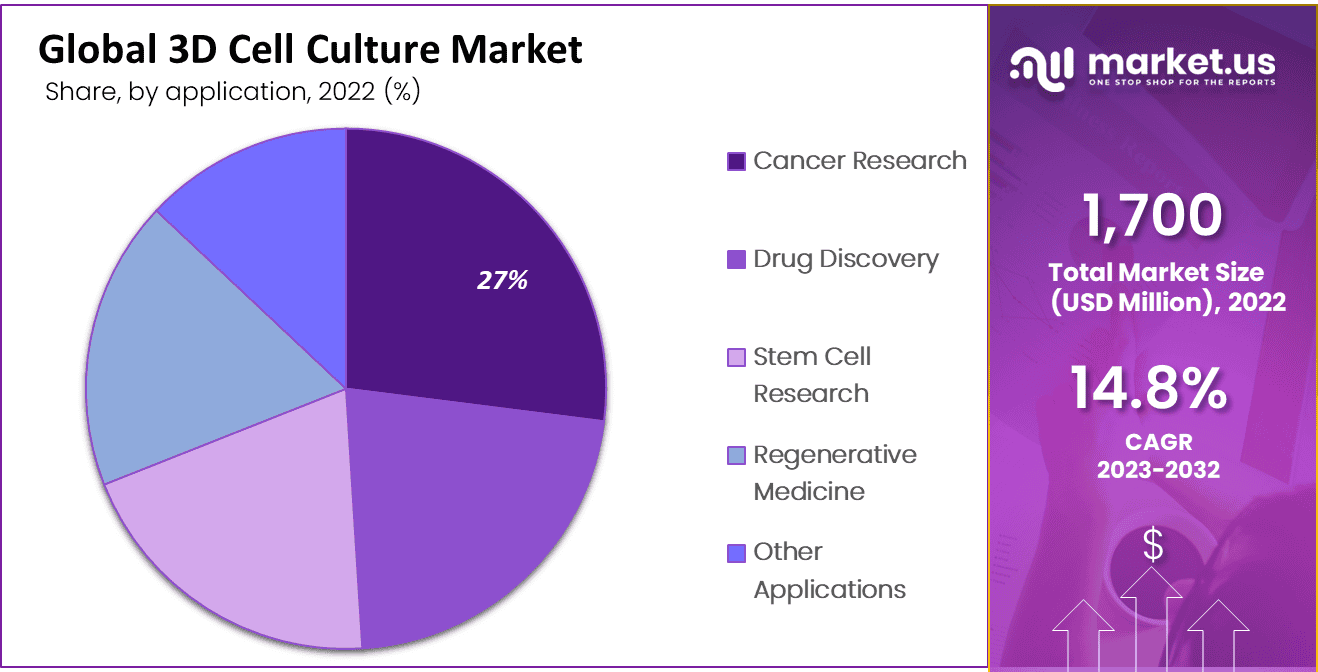

- Cancer Research: Cancer research application accounted for 27% of the market revenue, leading the application segment.

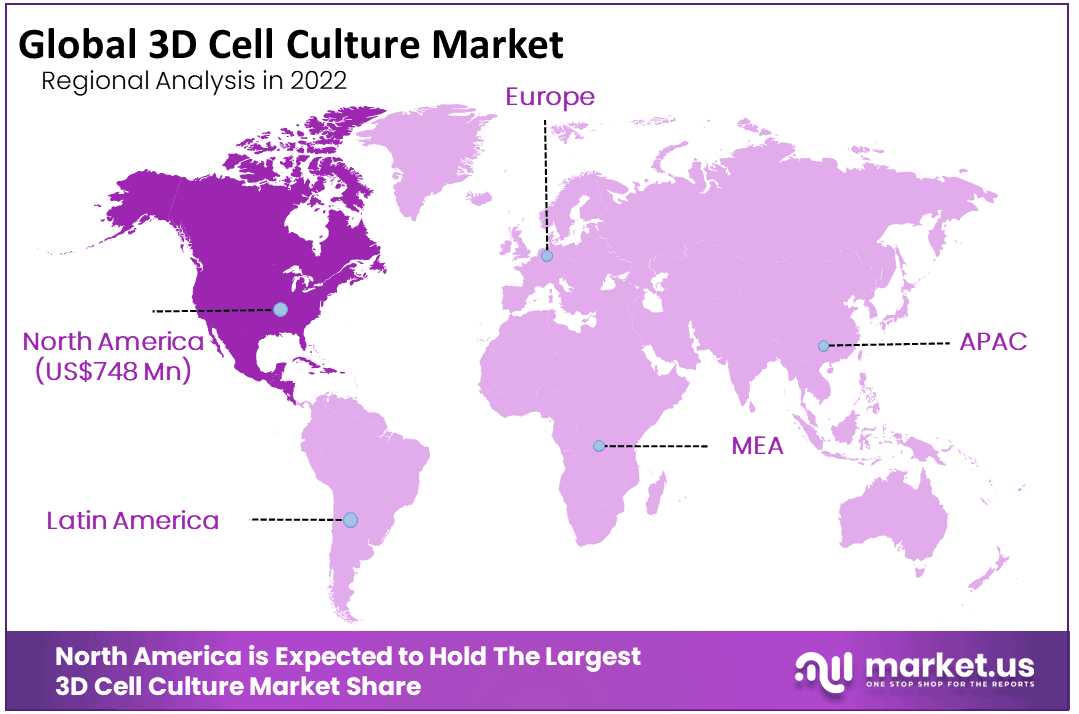

- North America Leadership: North America dominated the market with a 44% revenue share in 2022, maintaining its lead during the forecast period.

- Asia Pacific Growth: Asia Pacific is the fastest-growing region, driven by increased investments and development in emerging economies.

- Biotech and Pharma: Biotechnology and pharmaceutical companies are the largest end-users, leveraging 3D cell cultures for drug discovery and development.

- Product Inconsistencies: Variability in scaffold growth factors poses challenges, affecting the consistency and reliability of 3D cell culture products.

- Innovative Products: New products, like eNUVIO Inc.’s EB-Plate, enhance 3D cell culture applications, reducing single-use plastic waste.

- Collaborative Efforts: Key players engage in collaborations, such as Lonza and Israel Biotech Fund, to advance biologics and small molecule production.

- Technological Advancements: Microfluidics in 3D cell culture enable the simulation of tissue environments, enhancing research accuracy and relevance.

Product Analysis

Scaffold-based 3D Cell Culture Dominated the Market

In 2022, scaffold-based 3D cell culture held the largest revenue share at 68%. Using scaffolds in 3D cell culture-based research assists in integrating sophisticated mechanical and biochemical signs as a mirror of the native extracellular matrix. Furthermore, the rising need for developments in hydrogels to provide robust platforms for studying cellular and human physiology and the launch of novel products is estimated to propel the market growth during the forecast period 2023-2032.

Furthermore, the increasing popularity and awareness in biomedical research are estimated to create possible growing scenarios for nanofiber-based scaffolds. Thus, it increases the demand and sales for scaffold-based technology. Also, 3D tissue-constructed magnetic levitation assembly is a developing and fast-growing label & scaffold-free method for tissue engineering. Hence, it is estimated to propel the growth of the scaffold-free segment with the highest CAGR over the forecast period of 2023-2032.

Application Analysis

The Cancer Segment Accounted for the Highest Revenue Share

The cancer segment is estimated to hold the highest revenue share of 27% of the market. While studying anticancer therapies, using spheroids as model systems is one of the crucial factors driving the R&D in this segment.

Furthermore, in screening and pre-clinical testing, 3D cellular models to study cancer biology are estimated to boost the segment’s growth. The stem cell research segment is estimated to register the fastest CAGR. An increase in applications of 3D cell culture platforms for regenerative medicine is expected to boost the segment’s growth.

End-User Analysis

The Biotechnology and Pharmaceutical Companies Segment Dominated the Market

The biotechnology and pharmaceutical companies segment is estimated to register the highest revenue share of the market. 3D cell cultures have benefits regarding non-uniform exposure of cells within a spheroid to a drug, realistic cell-to-cell interactions compared with 2D cell culture, and optimal oxygen & nutrients gradient to study drug candidates. All these factors drive segment growth because it makes 3D cell cultures better for drug discovery and development.

Key Market Segments

Based on Product

- Scaffold Based 3D Cell Cultures

- Hydrogels

- Polymeric Scaffolds

- Micro-Patterned Surface

- Nonofiber-Based Scaffolds

- Scaffold Free 3D Cell Cultures

- Hanging Drop Microplates

- Microfluidic 3D Cell Culture

- Spheroid Microplates with ULA Coating

- Magnetic Levitation & 3D Bioprinting

- Bioreactors

- Microchips

- Other Products

Based on Application

- Cancer Research

- Drug Discovery

- Stem Cell Research

- Regenerative Medicine

- Other Applications

Based on End-User

- Biotechnology & Pharmaceutical Companies

- Contract Research Laboratories

- Academic Institutes

- Other End-Users

Drivers

Key Market Player’s Strategies

In the 3D cell culture market, prominent key players collaborate and partner with pharmaceutical companies to build their market position. With this strategy, market players estimate the performance of various organ-on-chips. For example, in July 2021, Roche and MIMETAS declared a collaboration to develop human disease models to describe novel compounds in IBD (inflammatory bowel disease).

The Expansion of 3D Cell Culture with the Help of Microfluidics

Recent advancements in 3D cell culture microfluidics support the foundation of microenvironments. It mimics the tissue-tissue interface and promotes tissue differentiation, and mechanical microenvironments form in organs and chemical gradients. The model permits the development of in vitro disease models, the study of human physiology in an accordion setting, toxicity assessment, and replacement for animal models in the drug development process.

Restraints

Lack of Consistency in Products which was Developed Through 3D Cell Culture

The use of scaffolds has positively affected the 3D cell cultures. It has increased the scope of various research opportunities. However, numerous growth factors in scaffolds cause differences from batch to batch, making pharmacological studies difficult. Moreover, the cells developed on scaffolds with low growth had phenotypes compared to those developed on high growth factors.

Opportunities

Introduction of New Products

The extensive use of 3D protocols in biological research and the introduction of new products are a few factors propelling the market growth. For instance, in December 2020, a biotechnology company based in Canada named eNUVIO Inc. introduced EB-Plate. It is a reusable microplate for 3D cell culture. It is estimated to increase the utility of 3-dimensional microplates, speed up the zero-waste movement, and decrease single-use plastic waste.

Trends

The Rapid Adoption of 3D Cell Culture Technology

The faster utilization and acceptance of 3D technology have resulted in modifying a trend toward customized research solutions in both industrial and academic areas. Hence, there has been raised in the usage of additional models to conduct experiments and understand cellular behavior. This drives the growth of the global 3D cell culture market.

There is an improvement in the 3D cell culture technique due to the advancements in analytical systems, technology, and functionality in cell imaging. The research based on cell biology has transformed due to the introduction of new matrices, and more accurate conclusions and experimental data can be witnessed. These modern culturing techniques have provided experimental models that are more similar to natural body systems. Hence, it is a useful resource for numerous application-based research. Thus, it leads to increasing implementation of these models.

Regional Analysis

North America Held the Largest Revenue Share for the Global 3D Cell Culture Market

North America accounted for the highest revenue share of 44% for the global 3D cell culture market, and it is estimated that the dominance will be retained throughout the forecast period. The factors such as high healthcare spending, the presence of various research organizations & universities investigating different stem cell-based approaches, and the availability of government & private funding for the development of advanced 3D cell culture models and others were propelling the growth of the market in this region.

On the other hand, Asia Pacific was projected to register as the fastest-growing region during the forecast period 2023-2032. This is due to increasing investments by numerous international companies in the developing economies in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Corning, Inc. Introduced the Corning X-SERIES Cell Processing Platform.

Major market players have focused on collaborations with other players and novel product launches to increase their market presence. For example, in June 2020, Corning, Inc. presented the Corning X-SERIES manufactured by ThermoGenesis Holdings, Inc. It is a cell processing platform used in cell and gene therapy applications.

Also, it delivers fast, sterile, automated, and efficient processing. A few prominent players in the market are PromoCell GmbH, Corning Incorporated, TissUse GmbH, Becton Dickinson and Company, Greiner Bio, Avantor Inc., Emulate Inc., Advanced Biomatrix Inc., QGel SA, others.

Listed below are some of the most prominent 3D cell culture market players.

Market Key Players

- Thermo Fisher Scientific Inc.

- Merch KGaA

- 3D Biotek LLC

- Lonza Group AG

- Corning Inc.

- Tecan Trading AG

- Global Cell Solitions, Inc.

- 3D Biomatrix Inc.

- InSphero AG

- Other Key Players

Recent Developments

- December 2023: Tecan introduced advanced tools and technologies within the scaffold-based segment of the 3D cell culture market. These developments are designed to support the structuring and functionality of 3D cellular models, playing a crucial role in academic and research applications. This initiative highlights Tecan’s ongoing commitment to enhancing the utility and adoption of 3D cell culture solutions in various research and clinical settings.

- July 2023: Merck KGaA expanded its Lenexa, Kansas facility, significantly increasing its capabilities in cell culture media production. This expansion includes the addition of 98,000 square feet of lab and production space, making it the largest dry powder cell culture media facility and Center of Excellence in North America. This investment enhances Merck’s ability to meet the growing global demand for cell culture media, essential in biomanufacturing for therapies including vaccines and gene therapy.

- February 2023: Corning Life Sciences showcased their latest innovations in 3D cell culture at the SLAS2023 conference. They demonstrated several key products including the Corning Matribot Bioprinter, the Corning Lambda EliteMax Semi-automated Benchtop Pipettor, and the Corning Cell Counter. These tools are designed to enhance workflow efficiency in drug discovery and other critical areas of biomedical research.

- August 2022: Thermo Fisher Scientific expanded its dry powder media manufacturing facility in Grand Island, New York. This $76 million investment enhances the site’s capacity to produce critical raw materials used in developing and manufacturing vaccines and biologic therapies. The expansion included adding more than 45,000 square feet of Animal Origin Free (AOF) manufacturing space, thereby increasing the facility’s capability to meet the growing global demand for cell culture media, crucial for vaccine and biologic production.

Report Scope

Report Features Description Market Value (2022) USD 1,700 Million Forecast Revenue (2032) USD 6,529 Million CAGR (2023-2032) 14.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product- Scaffold Based 3D Cell Cultures, Scaffold Free 3D Cell Cultures, Bioreactors, Microchips, and Other Products; By Application- Cancer Research, Drug Discovery, Stem Cell Research, Regenerative Medicine, and Other Applications; and End-User- Biotechnology & Pharmaceutical Companies, Contract Research Laboratories, Academic Institutes, and Other End-Users. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Thermo Fisher Scientific Inc., Merch KGaA, 3D Biotek LLC, Lonza Group AG, Corning Inc., Tecan Trading AG, Global Cell Solitions, Inc., 3D Biomatrix Inc., InSphero AG, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is 3D cell culture?3D cell culture is a technique that involves growing cells in a three-dimensional environment, more closely mimicking the natural conditions in the human body compared to traditional two-dimensional cell cultures.

How big is the 3D Cell Culture Market?The global 3D Cell Culture Market size was estimated at USD 1,700 Million in 2022 and is expected to reach USD 6,529 Million in 2032.

What is the 3D Cell Culture Market growth?The global 3D Cell Culture Market is expected to grow at a compound annual growth rate of 14.8%. From 2022 To 2032

Who are the key companies/players in the 3D Cell Culture Market?Some of the key players in the 3D Cell Culture Markets are Thermo Fisher Scientific Inc., Merch KGaA, 3D Biotek LLC, Lonza Group AG, Corning Inc., Tecan Trading AG, Global Cell Solitions, Inc., 3D Biomatrix Inc., InSphero AG, and Other Key Players.

Why is 3D cell culture important in research?3D cell culture provides a more physiologically relevant model for studying cell behavior, tissue development, and disease mechanisms. It better recapitulates the complexity of in vivo conditions, offering valuable insights for drug discovery and disease understanding.

How does the 3D Cell Culture Market contribute to scientific advancements?The 3D Cell Culture Market provides advanced technologies and products that support researchers in creating more realistic in vitro models. This market facilitates the development of better experimental systems, leading to enhanced drug screening, toxicology studies, and tissue engineering applications.

What are the key factors driving the growth of the 3D Cell Culture Market?Factors driving market growth include the increasing adoption of 3D cell culture techniques in drug discovery, rising demand for organ transplantation research, and advancements in technology offering more sophisticated and reproducible 3D culture systems.

How is the 3D Cell Culture Market addressing challenges in traditional cell culture methods?The 3D Cell Culture Market addresses challenges by providing tools and technologies that allow researchers to create environments that better mimic the in vivo conditions, offering improved predictive accuracy and relevance in preclinical studies.

-

-

- Thermo Fisher Scientific Inc.

- Merch KGaA

- 3D Biotek LLC

- Lonza Group AG

- Corning Inc.

- Tecan Trading AG

- Global Cell Solitions, Inc.

- 3D Biomatrix Inc.

- InSphero AG

- Other Key Players