Global 3D CAD Software Market By Deployment (Cloud and On-Premise), By Application (Healthcare, Manufacturing, AEC, Media & Entertainment, Automotive, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 25279

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

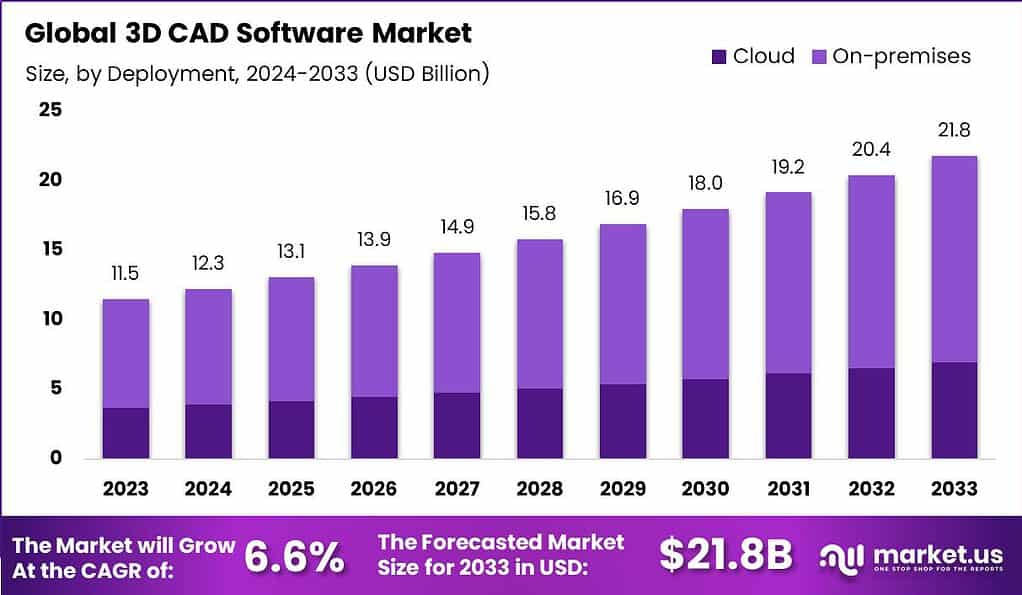

The Global 3D CAD Software Market size is expected to be worth around USD 21.8 Billion by 2033 from USD 11.5 Billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2023 to 2032.

3D CAD (Computer-Aided Design) software is a technology used by professionals to create precise drawings and models in various fields, including engineering, architecture, manufacturing, and entertainment. This software enables users to visualize and manipulate three-dimensional objects on a computer, enhancing accuracy and efficiency in the design process. It supports various functions such as drafting, modeling, rendering, and animation, making it an essential tool for modern design and engineering projects.

The market for 3D CAD software is expanding, driven by increasing demand across multiple industries. This growth is bolstered by the need for enhanced visualization and simulation capabilities in product development and testing phases. As industries continue to adopt digital and automated solutions, the importance of 3D CAD software in reducing production costs and time-to-market for new products becomes more pronounced. Additionally, advancements in technology, such as AI integration and cloud-based CAD solutions, are opening new avenues for market expansion.

The growth of the 3D CAD software market can be attributed to several factors. There is a growing adoption of 3D CAD in automotive, aerospace, and construction industries for its efficiency and precision in design processes. The integration of new technologies such as AI and machine learning enhances the capabilities of 3D CAD tools, making them more intelligent and adaptive to complex design requirements. Furthermore, the shift towards cloud-based solutions offers scalability and remote accessing capabilities, appealing to a broader range of businesses, from SMEs to large corporations.

The demand for 3D CAD software is expected to rise steadily as industries seek to improve design accuracy and streamline production cycles. The increasing complexity of product design and the push for customization in manufacturing demand more advanced design solutions, which 3D CAD software provides. Opportunities in the market are particularly notable in emerging regions where industrialization is growing. There is also significant potential in expanding the application of 3D CAD software into new sectors such as healthcare and consumer electronics, where innovation is rapidly advancing.

Key Takeaways

- Market Growth: 3D CAD Software Market is predicted to expand at an annual compound growth rate (CAGR) that is 6.6%, and reach the size of USD 21.8 billion in 2033, an increase from 11.5 billion by 2023.

- What is 3D CAD Software?: 3D CAD (computer-aided design) software permits users to design and modify 3D digital models for use in a variety of industries, including design and engineering, architecture and manufacturing. It is an essential instrument for creating virtual models that can be used to replicate physical objects.

- Deployment Trends: In 2023, the On-premises deployment of 3D CAD Software held a dominant market share of over 68%. It is preferred by industries with stringent data security and compliance requirements like aerospace and healthcare.

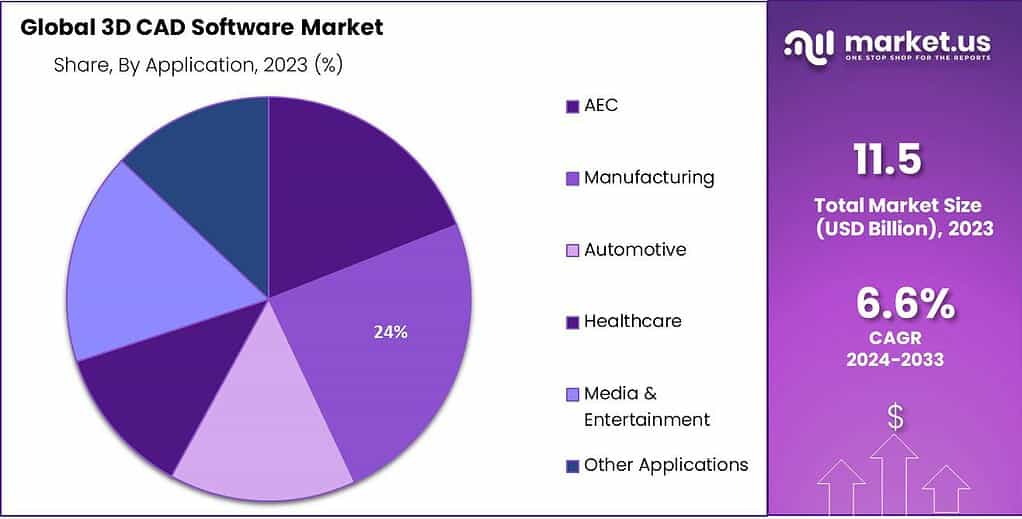

- Application Dominance: The Manufacturing segment accounted for over 27% of the market share in 2023.

- Driving Factors: The use of 3D CAD software is driven by a variety of factors, including digital transformation and international collaboration, growth of 3D printing as well as the cost and time efficiency it provides in designing processes.

- Challenges: Challenges in the adoption of 3D CAD software include high initial costs, a learning curve for users, data security concerns, and compatibility issues with existing IT infrastructure.

- Growth Opportunities: Growth opportunities in the market include the adoption of cloud-based solutions, integration with Augmented and Virtual Reality, emphasis on sustainability in product design, and exploring emerging markets.

- Key Market Trends: Some key trends in the market include generative design driven by AI, mobile CAD applications, the use of blockchain for data security, and a shift towards subscription-based licensing models.

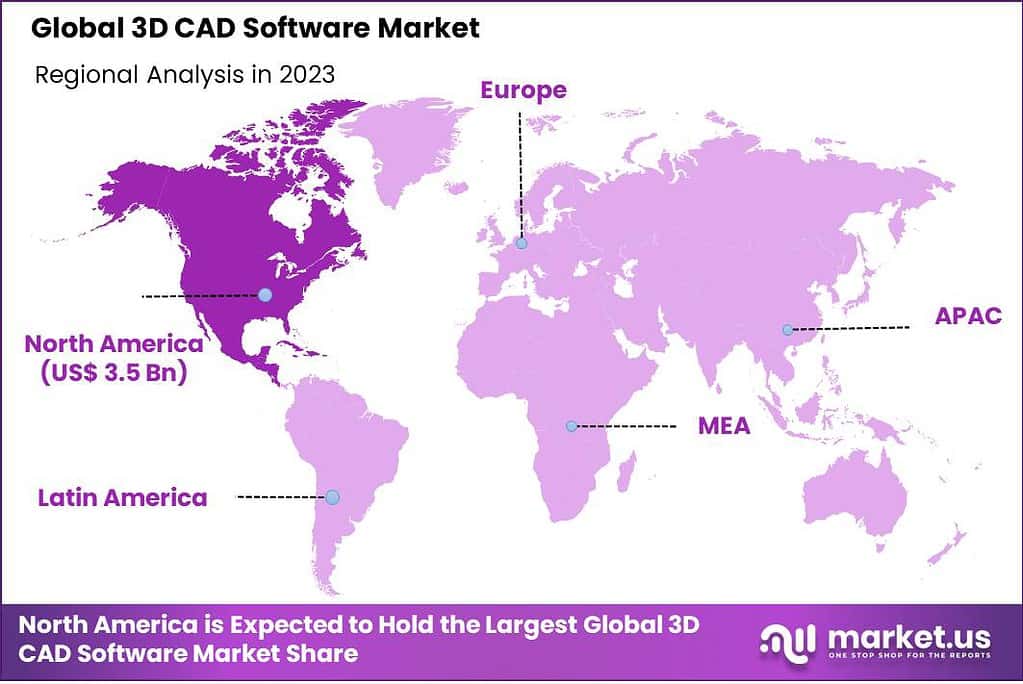

- Regional Analysis: North America leads the market, capturing over 31% of the market share in 2023, followed by Europe. Asia-Pacific is growing rapidly due to the expansion of construction and manufacturing industries.

- Key Players: Major players in the 3D CAD Software Market include Autodesk, Bentley Systems, Dassault Systemes, Hexagon AB, PTC Inc., Siemens AG, and more.

- Recent Developments: Notable developments in the market include acquisitions of 3D printing systems, updates and releases of new 3D CAD software by companies like 3D Systems, Nextech AR Solutions Corp., Autodesk, Siemens PLM Software, and Dassault Systèmes.

Deployment Analysis

In 2023, the 3D CAD Software market witnessed the On-premises segment firmly establish its dominant market position, capturing an impressive share of over 68%. This substantial lead can be attributed to several factors, including the preference for traditional on-premise software solutions among industries with stringent data security and compliance requirements, such as aerospace and healthcare.

On-premises 3D CAD software provides organizations with greater control over their design data, enabling them to manage sensitive intellectual property within their own secure environments. Additionally, established businesses often have existing IT infrastructure that supports on-premises software, making it a seamless choice for integrating 3D CAD tools into their existing workflows.

On the other hand, the Cloud segment, while representing a growing portion of the market, caters to organizations seeking flexibility and scalability in their 3D CAD software solutions. Cloud-based CAD software offers the advantage of remote access, collaboration, and cost-efficiency, making it an attractive option for smaller businesses, startups, and those embracing digital transformation initiatives. This segment is gaining traction as industries evolve toward more agile and collaborative design processes.

Application Analysis

In 2023, the 3D CAD Software market witnessed the Manufacturing segment firmly establish its dominant market position, capturing an impressive share of over 27%. The substantial advantage can be credited to the pivotal role played by 3D CAD software in contemporary manufacturing processes. Sectors like aerospace, automotive, and consumer goods heavily depend on 3D CAD solutions to simplify product design, improve accuracy, and expedite time-to-market.

The adaptability of 3D CAD software empowers manufacturers to craft intricate and personalized designs, conduct simulations, and refine production workflows. As manufacturing increasingly embraces automation and Industry 4.0 principles, the demand for robust and innovative 3D CAD tools continues to grow, solidifying the segment’s prominence.

Meanwhile, other segments like Healthcare, Architecture, Engineering, and Construction (AEC), Media & Entertainment, and Automotive, although representing significant portions of the market, cater to their unique application needs. Healthcare leverages 3D CAD software for medical device design and patient-specific modeling, while AEC professionals use it for architectural planning and structural analysis.

The Media & Entertainment industry relies on 3D CAD tools for animation and digital content creation, while the Automotive sector benefits from design visualization and virtual prototyping. The market’s diversity reflects the adaptability and broad applicability of 3D CAD software across various industries, all contributing to its overall growth and market relevance.

Note: Actual Numbers Might Vary In Final Report

Driving Factors

- Digital Transformation: The drive towards digital transformation in industries like manufacturing, architecture, and healthcare fuels the adoption of 3D CAD software, enabling organizations to streamline design processes and enhance productivity.

- Global Collaboration: Increasing globalization necessitates collaborative design and engineering efforts, and 3D CAD software allows geographically dispersed teams to work together seamlessly, driving its adoption.

- Rise of 3D Printing: The growth of 3D printing technologies relies heavily on 3D CAD software for creating intricate and customized designs, boosting the demand for such software in prototyping and manufacturing.

- Cost and Time Efficiency: 3D CAD software reduces design iteration times, minimizes material wastage, and enhances design accuracy, resulting in significant cost savings and shorter time-to-market for products.

Restraining Factors

- High Initial Costs: The initial investment required for licenses, training, and hardware can be a barrier for small and medium-sized businesses, limiting their adoption of 3D CAD software.

- Learning Curve: The complexity of some 3D CAD software solutions requires users to undergo training, and the learning curve can slow down the integration process in organizations.

- Data Security Concerns: Storing design data in digital formats raises concerns about data security and intellectual property theft, especially in industries with sensitive designs.

- Compatibility Issues: Ensuring compatibility with existing IT infrastructure and other software tools can pose challenges during the implementation of 3D CAD solutions.

Growth Opportunities

- Cloud-Based Solutions: The adoption of cloud-based 3D CAD software offers scalability, remote access, and reduced infrastructure costs, making it an attractive option for businesses seeking flexibility and cost-efficiency.

- Augmented and Virtual Reality Integration: Integration with AR and VR technologies enhances design visualization and collaboration, opening up opportunities for immersive design experiences.

- Sustainability Emphasis: Growing environmental concerns drive the demand for 3D CAD software in sustainable product design and materials optimization, particularly in industries like automotive and construction.

- Emerging Markets: Emerging economies with expanding manufacturing and infrastructure sectors present untapped growth opportunities for 3D CAD software providers.

Challenges

- Data Interoperability: Ensuring seamless data exchange and interoperability between different 3D CAD software platforms remains a challenge in multi-tool environments.

- Regulatory Compliance: Meeting industry-specific regulations and standards, particularly in highly regulated sectors like healthcare and aerospace, can be demanding for 3D CAD software users.

- Hardware Requirements: High-performance hardware is often required to run resource-intensive 3D CAD applications, adding to the overall cost of adoption.

- User Resistance: Resistance to change and the reluctance of employees to adapt to new software tools can hinder the successful implementation of 3D CAD solutions.

Key Market Trends

- Generative Design: Generative design, driven by AI and machine learning, is gaining prominence, enabling software to automatically generate optimized designs based on user-defined criteria.

- Mobile CAD: The development of mobile-compatible 3D CAD applications allows users to work on designs from their mobile devices, enhancing flexibility and remote collaboration.

- Blockchain for Data Security: The exploration of blockchain technology for secure and traceable design data storage and sharing is an emerging trend in the 3D CAD software market.

- Subscription-Based Models: The shift towards subscription-based licensing models, as opposed to traditional perpetual licenses, offers greater flexibility and cost control for users.

Key Market Segments

By Deployment

- Cloud

- On-Premise

By Application

- Healthcare

- Manufacturing

- AEC (Architecture, Engineering, and Construction)

- Media & Entertainment

- Automotive Sectors

- Packaging Industry

- Other Application Development

Regional Analysis

In 2023, North America asserted its dominant market position in the 3D CAD Software market, capturing an impressive share of over 31%. This significant lead can be attributed many factors, such as the advanced manufacturing industry in the region and the widespread adoption of digital technology, and an emphasis on product innovation and innovation.

The demand for 3D CAD Software in North America was valued at US$ 3.5 billion in 2023 and is anticipated to grow significantly in the forecast period. North American businesses across various industries, such as aerospace, automotive and healthcare, rely in large part on 3D CAD applications in order to improve their design and engineering processes.

Additionally, a well-established network of software providers as well as research institutions and highly skilled professionals aids in the region’s leading position within this 3D CAD software market. In addition, Europe, with its solid manufacturing base and renowned engineering continues to be a significant market player and is embracing 3D CAD software to support a variety of applications.

In the Asia-Pacific (APAC) zone is growing rapidly thanks to the expansion of construction and manufacturing industries and the growing investments in technological advances. Latin America, Middle East as well as Africa are also adopting 3D CAD software. It has the potential to be utilized in areas such as energy development and infrastructure.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Due to the presence of many players, this market is relatively fragmented. 3D CAD software allows companies to minimize production errors and maximize the use of technology and other resources. Key players have procurement teams that are based in the major revenue-generating countries to procure goods or services from various suppliers. These criteria include sustainability, the total cost of ownership, and credentials.

They also consider factors such as the creativity and innovation of suppliers, contract commitments, and demand for utmost quality components and completeness. Key market players sell their advanced products through both direct and indirect channels, which include distributors and resellers.

Top Player’s Company Profiles

- Autodesk, Inc.

- Bentley Systems Inc.

- Bricsvs NV.

- Dassault Systemes

- Graphisoft

- Hexagon AB

- Oracle

- PTC Inc.

- Schott Systeme GmbH

- Siemens AG

- Dassault Systemes SE

- ANSYS Inc.

- Other Key Players

Recent Developments

- In February 2023, 3D Systems revealed that the BWT Alpine F1 Team had acquired four SLA 750 3D printing systems to enhance innovation and track speed. These printing systems feature 3D Sprint®, an all-in-one software developed by 3D Systems for preparing, optimizing, and printing 3D CAD data.

- In February 2023, Nextech AR Solutions Corp. introduced the “Quad Typology Converter Update,” positioning Toggle3D as the leading all-in-one platform for CAD to web 3D design. Users of the Toggle3D platform now have the capability to generate quad tessellations, thereby enhancing the overall quality of 3D models.

- On February 25, 2023, Dassault Systèmes announced the launch of its latest 3D CAD software, SolidWorks 2024.

- On March 8, 2023, Autodesk unveiled its newest 3D CAD software, AutoCAD 2024.

- On January 20, 2023, Siemens PLM Software disclosed the release of its latest 3D CAD software, NX 2024.

Report Scope

Report Features Description Market Value (2023) US$ 11.5 Bn Forecast Revenue (2033) US$ 21.8 Bn CAGR (2023-2033) 6.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment (Cloud and On-Premise), By Application (Healthcare, Manufacturing, AEC, Media & Entertainment, Automotive, and Other Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Autodesk Inc., Bentley Systems Inc., Bricsvs NV., Dassault Systemes, Graphisoft, Hexagon AB, Oracle, PTC Inc., Schott Systeme GmbH, Siemens AG, Dassault Systemes SE, ANSYS Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is 3D CAD software?3D CAD software refers to computer-aided design tools that enable users to create, modify, and optimize three-dimensional models, playing a crucial role in product design and manufacturing.

Which industries benefit from 3D CAD software?Industries such as aerospace, automotive, consumer goods, and more extensively benefit from 3D CAD software for streamlined product design, enhanced precision, and accelerated time-to-market.

How big is 3D CAD Software Market?The Global 3D CAD Software Market size is expected to be worth around USD 21.8 Billion by 2033 from USD 12.3 Billion in 2024, growing at a CAGR of 6.6% during the forecast period from 2023 to 2032.

What is the significance of 3D CAD software in product design?3D CAD software is highly significant in product design as it enables designers to create detailed and accurate three-dimensional models, facilitating better visualization and understanding of the final product.

What is the future of 3D CAD?The future of 3D CAD is promising, with ongoing advancements in technology, including artificial intelligence and cloud-based solutions. The industry is expected to evolve towards more collaborative and integrated design processes.

Who is the market leader in CAD?Autodesk is a notable market leader in the CAD industry, offering a comprehensive suite of CAD software solutions widely used in various sectors.

Which 3D software is most in demand?Autodesk's AutoCAD is consistently in high demand, being one of the most widely used 3D CAD software globally. Other popular choices include SolidWorks and Rhino.

What are the trends in the CAD industry?Trends in the CAD industry include the integration of artificial intelligence, cloud-based collaboration, generative design, and the development of more user-friendly interfaces for enhanced accessibility.

-

-

- Autodesk, Inc.

- Bentley Systems Inc.

- Bricsvs NV.

- Dassault Systemes

- Graphisoft

- Hexagon AB

- Oracle

- PTC Inc.

- Schott Systeme GmbH

- Siemens AG

- Dassault Systemes SE

- ANSYS Inc.

- Other Key Players