Global 2D Barcode Reader Market By Product Type (Fixed, Handheld), By Application (Logistics, Warehousing, Factory Automation, E-commerce), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Dec. 2023

- Report ID: 24378

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

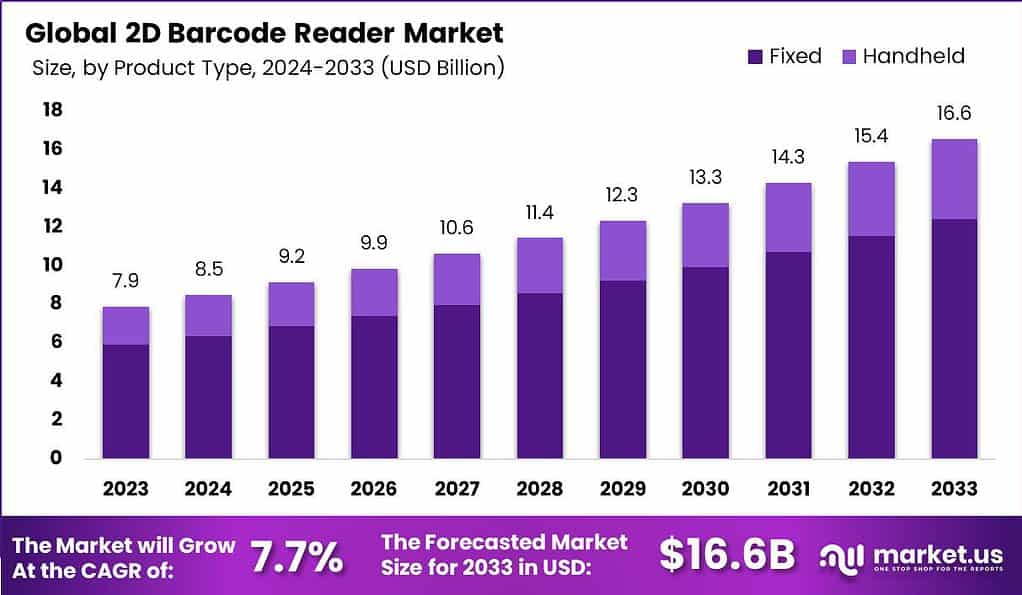

The Global 2D Barcode Reader Market size is expected to be worth around USD 16.6 Billion by 2033 from USD 7.9 Billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

A 2D barcode reader, also known as a 2D scanner. It is a tool that reads and decodes two-dimensional barcodes. In contrast to traditional 1D barcodes, which only have information stored in horizontal format, 2D barcodes can store data vertically and horizontally, which allows them to hold a more extensive amount of data. They can hold a variety of kinds of information, such as numbers, text URLs, text or even images.

An 2D barcode reader makes use of advanced imaging technologies that includes scanners or cameras, to read and interpret barcode data. This technology lets businesses effectively analyze and scan barcodes within diverse applications, such as inventory management, tracking of products tickets, payment systems.

Note: Actual Numbers Might Vary In Final Report

In retail stores, the widespread adoption of barcode readers plays a crucial role in swiftly and accurately scanning product barcodes during the point of sale. Furthermore, the increasing use of these devices extends beyond the retail sector, finding application in industries such as healthcare, where it is poised to contribute to market expansion. A notable example of this is observed in intensive healthcare facilities within the United States. In these settings, barcode technology is harnessed to mitigate medication errors effectively.

As part of this process, each patient is provided with a unique barcode wristband, which is intricately connected to central computer systems to establish and maintain individual patient records. When it comes to medication administration, nurses employ barcode scanners. They scan both the patient’s wristband and the medication to be administered. Subsequently, this data is transmitted to the central computer, where specialized software performs thorough cross-checks against various databases. Only after this meticulous verification process does the system grant approval for medication administration.

Key Takeaways

- The 2D Barcode Reader Market size is anticipated to be around USD 16.6 Billion by 2033, compared to USD 7.9 billion in 2023. It is expected to grow at an annual rate of 7.7% during the forecast period from 2024 until 2033.

- In 2023, it was the Handheld segment of the 2D Barcode Reader market asserted their dominance, holding the largest market share, which is more than 75% of market share.

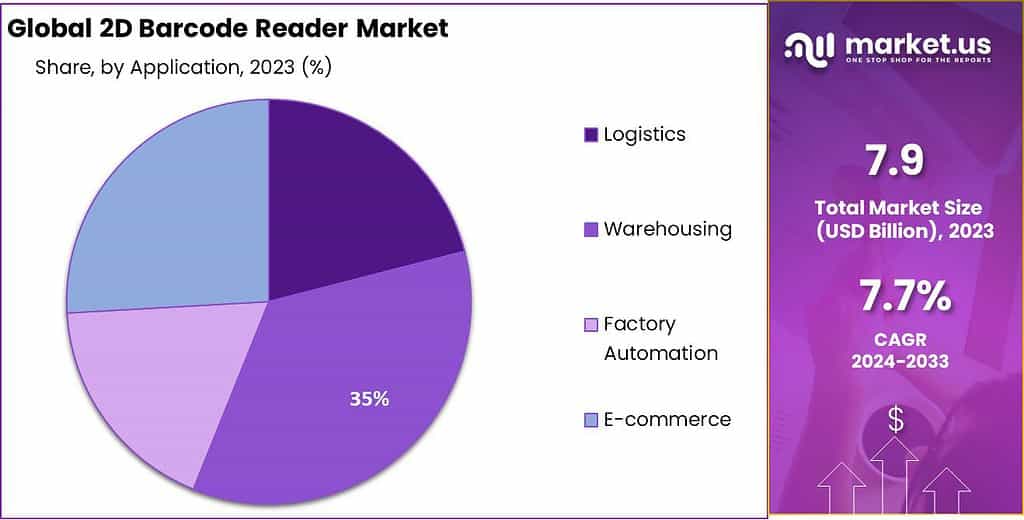

- In 2023, the Warehousing segment occupied a top spot in the 2D Barcode Reader market, being the top player with more than 35.1% of the total market share.

- In 2023, the Asia-Pacific (APAC) the region was an influential player in the 2D Barcode Reader market, with a market share of 42.7%.

- Drivers: The market is driven by factors such as the growth of e-commerce, the need for traceability in various industries, technological advancements, and integration with mobile devices.

- Challenges: Challenges in the market include high initial investment costs, complexity in implementation, security concerns, and the risk of obsolescence due to rapid technological advances.

- Growth Opportunities: The healthcare sector offers significant growth potential, with 2D barcode readers being used for medication tracking and patient identification.

- The key players in the market for 2D barcode readers include companies such as Honeywell International Inc., Zebra Technologies Corporation, Cognex Corporation, Datalogic S.p.A., Symbol Technologies (a subsidiary of Zebra Technologies), Opticon Sensors Europe B.V., TSC Auto ID Technology Co., Ltd., Denso Wave Incorporated, Code Corporation, Newland AIDC, Unitech Electronics Co., Ltd., Microscan (a part of Omron Corporation), Other Key Players

Product Type Analysis

In 2023, the Handheld segments of the 2D Barcode Reader market asserted its dominance, having a large market share which is over 75% of total market. This robust presence is due to the ease of use and flexibility that handheld barcode readers offer. These portable devices are favored by a variety of companies and industries for their user-friendliness and mobility, which makes them indispensable tools in inventory management and logistics, as well as retail applications.

2-dimensional handheld barcode readers are well-known for their flexibility across a variety of workplaces and allow users to quickly identify and read barcodes that are on packages, items and other documents. Furthermore they are compatible with phones as well as tablets makes them more appealing as they allow seamless integration with the existing systems and apps. This is why the Handheld segment is still enjoying an important position on the 2D Barcode Reader market, serving the changing requirements of companies seeking effective methods of data collection.

On the other hand the Fixed segment of the 2D Barcode Reader market also has a significant role to play although it has a lesser market percentage. Barcode scanners that are fixed can be stationary machines typically included in conveyor belts, manufacturing lines as well as point-of-sale (POS) system. They are particularly effective in situations that require items to pass through a specific scanning point, which ensures rapid and precise barcode reading.

While their market share could be smaller than others but the fixed segment is crucial for industries that require high-speed scanning and automated capture. It is important to note that the decision between fixed and handheld barcode scanners is contingent on business needs as both are able to offer comprehensive solutions to the ever-changing world that is barcode-related technology.

Application Analysis

In 2023, the Warehousing segment took a significant leading position within the 2D Barcode Reader market, holding a leading position with over 35.1% of the overall market share. This substantial presence highlights the crucial role 2D barcode scanners play in enhancing warehouse operations. Warehouses are heavily dependent on efficient information capture and inventory management which is where 2D barcode scanners excel at scanning and tracking the shipments of products.

They improve the efficiency and accuracy in inventory management, decreasing errors and enhancing the overall efficiency of warehousing. The need for 2D barcode readers in the warehousing industry can be attributed to the growth of online commerce industry, and the requirement for a seamless logistics process as well as the constant digital revolution in logistics management.

Furthermore, the logistics sector is an important participant within the 2D Barcode Reader market, making up a significant portion in the overall market. The logistics industry is heavily dependent on barcode technology to track the shipments of goods, making sure that deliveries are accurate and maximizing routes planning.

Barcode readers in 2D are essential in these applications, offering the ability to capture data in real time and integrate it into systems that speed up logistics processes. With the growing globalization of trade as well as the requirement for accurate monitoring and tracking of the movement of goods as well as the Logistics segment is the largest customer of 2D barcode technology.

Furthermore, the Factory Automation segment is another noteworthy player in the market, leveraging 2D barcode readers to enhance automation and control processes. In modern manufacturing environments, these devices enable seamless tracking of components, work-in-progress, and finished products. By facilitating precise identification and monitoring of items, 2D barcode readers contribute to improved quality control and production efficiency within factory automation.

The E-commerce sector is also a major factor in the need for barcode 2D readers, prompted by the explosive increase in online retail. They play a vital function in the fulfillment of orders as well as inventory management and tracking packages for e-commerce businesses. While online shopping continues flourish, the e-commerce industry is a key application with 2D barcode scanner technology, which ensures the precise and prompt delivery of goods to the customers.

Note: Actual Numbers Might Vary In Final Report

Driving Factors

- Increasing E-commerce Activity: The increase in E-commerce and online retail platforms are leading to the need for barcode scanners with 2D technology to increase the management of inventory and order processing efficiency.

- Rising Need for Traceability: In many industries, stringent regulations including food and pharmaceuticals are pushing for the adoption of barcode readers with 2D technology to ensure traceability of products and authenticate them.

- Advancements in Technology: Continuous technological advances such as enhanced scanning speed and accuracy is boosting the popularity for 2D barcode readers across all industries.

- Integration with Mobile Devices: The ability of barcode readers 2D to seamlessly connect with tablets and smartphones expands their applications specifically for mobile ticketing and payment systems.

Restraining Factors

- Initial Investment Costs: The expensive initial cost of investment for advanced 2D barcode readers could pose a challenge for smaller and medium-sized companies.

- Complexity of Implementation: Integration of 2D barcode scanner technologies into systems may be time-consuming, difficult and could discourage some businesses.

- Security Concerns: As 2D barcodes are commonly used to access sensitive information security concerns about possible breaches and access to data need to be properly addressed.

- Market Fragmentation: The presence of multiple players that offer different technologies may result in the market becoming fragmented and confusing for buyers.

Growth Opportunities

- Healthcare Sector Adoption: The healthcare sector has huge growth potential as barcode scanners with 2D technology are being increasingly utilized to identify patients for medication tracking, identification of patients, and for sample management.

- Expansion in Developing Markets: Emerging economies offer untapped markets, where the demand for 2D barcode readers is anticipated to increase rapidly, particularly in manufacturing and logistics.

- IoT Integration: The integration of 2D barcode readers with the Internet of Things (IoT) for real-time tracking and data analytics creates new avenues for growth, particularly in supply chain management.

- Customization Services: Offering customized solutions and services that meet market needs could be an opportunity to grow profitably that market leaders.

Challenges

- Competitive Market: The intense competition among suppliers and manufacturers in the market for 2D barcode readers presents challenges in terms of pricing and differentiation of products.

- Data Accuracy and Interpretation: The accuracy of data taken by 2D barcode scanners and effectively interpreting it is a challenge, especially with large amounts of data.

- Regulatory Compliance: Keeping up to the ever-changing regulatory standards and requirements across different industries can be a major issue for those who are involved in the market.

- Obsolescence Risk: The rapid technological advances make it possible for older barcode scanner models could be obsolete in a short time, requiring constant development.

Key Market Trends

- AI Integration: The incorporation of artificial intelligence (AI) for image recognition and data analysis is a prominent trend, enhancing the capabilities of 2D barcode readers.

- Rise of Mobile Scanning Apps: mobile scanning apps Applications that use mobile smartphone’s cameras to perform 2D barcode scanning are becoming more popular, particularly for those that are geared towards the consumer.

- Blockchain Integration: Certain industries are examining the possibility of using blockchain technology along with 2D barcodes to improve the security and transparency of supply chains.

- Environmental Sustainability: The market is witnessing a trend towards eco-friendly 2D barcode labels and readers to align with growing sustainability concerns.

Kеу Маrkеt Ѕеgmеntѕ

By Product Type

- Fixed

- Handheld

By Application

- Logistics

- Warehousing

- Factory Automation

- E-commerce

Regional Analysis

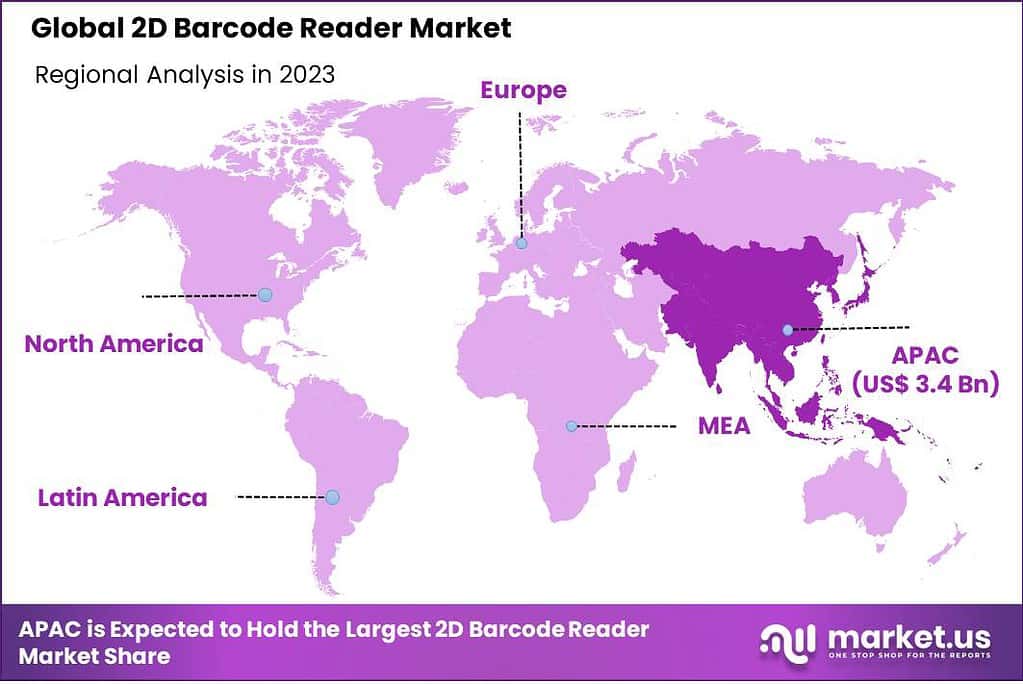

In 2023, Asia-Pacific (APAC) region became a dominant force within the 2D Barcode Reader market, with a significant market share of over 42.7%. As APAC countries see an increase in logistics, manufacturing as well as retail sectors. The demand for 2D Barcode Reader in Asia-Pacific was valued at USD 3.4 billion in 2023 and is anticipated to grow significantly in the forecast period.

These devices play a vital function in managing inventory and supply chain optimization and overall efficiency improvement across a variety of sectors. The growing popularity of e-commerce as well as the need for reliable and secure data tracking systems have led to the widespread adoption of barcode readers with 2D throughout the APAC region, further establishing its market leadership position.

However, North America has also held a substantial market share, focusing on technological advancements as well as the early adoption of revolutionary barcode-reading solutions. This region’s focus on automation, in conjunction with the requirement for real-time data capture and analysis has fueled the need for 2D barcode readers across a range of sectors. As a result, North America secured a substantial part of the market by 2023, demonstrating its solid industrial presence and its commitment to improving the efficiency of its operations.

Europe is a well-established industrial sector and a concentration on optimizing supply chain is responsible for a substantial portion of the 2D Barcode Reader market. The acceptance of barcode technology within manufacturing logistic, healthcare, and other sectors has helped boost its position in the market. Furthermore, stringent regulations regarding traceability of products and safety have further pushed the use of barcodes in 2D readers, which has ensured Europe’s position in the market.

Latin America, Middle East and Africa regions have shown significant potential for growth, aided by the rapid growth of industrialization and the requirement for a more efficient management of data. The regions are experiencing an increasing use of barcode scanners in the 2D format particularly in the retail and logistics sectors, as businesses try to improve accuracy and decrease mistakes in tracking and data capture processes.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the industry are actively investing resources in research and development activities to fuel growth and optimize internal business operations. The upcoming report will feature comprehensive company analyses, delving into their financial performances, product benchmarking, key business strategies, and recent strategic alliances. These companies are strategically pursuing mergers, acquisitions, and partnerships to elevate their products and gain a competitive edge in the market.

A significant focus is being placed on innovation through new product development and the enhancement of existing products, aiming to attract new customers and expand their share in the industry. For instance, as of January 2023, Cognex Corp. has introduced the DataMan 580, a fixed-mount barcode scanner. This product launch is geared towards accelerating operational processes while improving accountability.

The incorporation of edge intelligence, management, and performance solutions in this scanner allows real-time tracking of system performance, ultimately leading to operational optimization in logistics. Such initiatives showcase the commitment of key players to staying at the forefront of technological advancements and ensuring their offerings meet the evolving needs of the market.

Top Key Players

- Honeywell International Inc.

- Zebra Technologies Corporation

- Cognex Corporation

- Datalogic S.p.A.

- Symbol Technologies (a subsidiary of Zebra Technologies)

- Opticon Sensors Europe B.V.

- TSC Auto ID Technology Co., Ltd.

- Denso Wave Incorporated

- Code Corporation

- Newland AIDC

- Unitech Electronics Co., Ltd.

- Microscan (a part of Omron Corporation)

- Other Key Players

Recent Developments

Acquisitions

- Honeywell International acquires HandHeld Products: In significant development, Honeywell strengthens its position in the market for rugged mobile computers by purchasing HandHeld Products, known for its 2D barcode readers with high-performance specifically designed for harsh conditions. This acquisition broadens Honeywell’s capabilities into areas like logistics, transport and field services.

- Zebra Technologies acquires Motorola Solutions’ Enterprise Mobility business: Zebra, a major player in the market for barcode readers has expanded its offerings through the acquisition of Motorola Solutions’ Enterprise Mobility business. The deal also comprises Motorola’s barcode scanner brand, which will bring an additional level of technologies and market share Zebra.

- Datalogic acquires PSC Identification: Datalogic is a renowned maker for industrial barcode scanners expands its offerings to the health sector by purchasing PSC Identification, a provider of wristbands as well as patient identification solutions. This acquisition will allow Datalogic to provide complete system for tracking and identifying patients.

New Trends

- Rise of Mobile Scanners: The traditional handheld scanners are paving the way for mobile scanners that are integrated with tablets and smartphones. This is a result of the growing use of mobile technology in diverse industries as well as the need for more cost-effective and flexible scanning solutions.

- Smarter Readers with Advanced Features: 2D barcode readers are getting more sophisticated, featuring features such as images recording, OCR capability, as well as data analysis. These capabilities allow businesses to gather and analyze more information from barcodes, enhancing the efficiency of their operations and providing important information.

- Integration with Internet of Things (IoT): 2D barcode readers are increasingly being integrated into IoT platforms to track goods as well as assets at a real time. This integration allows companies to track the level of inventory, improve supply chains and enhance the management of assets.

Company News

- Honeywell launches new generation of industrial barcode scanners: Honeywell introduces its new generation of barcode scanners that have enhanced scanning speeds, improved ergonomics, and improved connectivity options. The launch is a demonstration of Honeywell’s dedication to innovation and the delivery of top-of-the-line solutions for challenging environments.

- Zebra partners with Amazon Web Services (AWS) for cloud-based data capture: Zebra announces a collaboration with AWS to provide cloud-based data capture services for barcode scanning. This partnership gives businesses more flexibility and capacity to manage the barcode data.

- Datalogic expands its service offerings: Datalogic launches a new service program that provides on-site maintenance, repair and instruction for its 2D barcode readers. This program highlights Datalogic’s emphasis on providing a comprehensive support for customers.

Report Scope

Report Features Description Market Value (2023) US$ 7.9 Bn Forecast Revenue (2033) US$ 16.6 Bn CAGR (2024-2033) 7.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fixed, Handheld), By Application (Logistics, Warehousing, Factory Automation, E-commerce) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Honeywell International Inc., Zebra Technologies Corporation, Cognex Corporation, Datalogic S.p.A., Symbol Technologies (a subsidiary of Zebra Technologies), Opticon Sensors Europe B.V., TSC Auto ID Technology Co., Ltd., Denso Wave Incorporated, Code Corporation, Newland AIDC, Unitech Electronics Co., Ltd., Microscan (a part of Omron Corporation), Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a 2D Barcode Reader?A 2D Barcode Reader is a device equipped with advanced imaging technologies, such as scanners or cameras, designed to read and interpret two-dimensional barcodes. Unlike traditional 1D barcodes, 2D barcodes store data both horizontally and vertically, allowing them to hold a larger amount of information.

How big is the 2D barcode reader market?The Global 2D Barcode Reader Market size is expected to be worth around USD 16.6 Billion by 2033 from USD 7.9 Billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

Which segment accounted for the largest 2D barcode reader market share?The Asia Pacific region dominated the market for 2D barcode reader in 2023 and accounted for a global revenue share of over 42.7%. The growth can be attributed to the growing e-commerce and retail industry in the regional market.

What are the key applications of 2D Barcode Readers?2D Barcode Readers are widely used in various applications, including inventory management, product tracking, ticketing, payment systems, logistics, warehousing, factory automation, healthcare, and retail. Their versatility makes them valuable tools in optimizing operational processes across different industries.

Who are the key players in the 2D barcode reader market?Key players in the 2D barcode reader market include companies like Honeywell International Inc., Zebra Technologies Corporation, Cognex Corporation, Datalogic S.p.A., Symbol Technologies (a subsidiary of Zebra Technologies), Opticon Sensors Europe B.V., TSC Auto ID Technology Co., Ltd., Denso Wave Incorporated, Code Corporation, Newland AIDC, Unitech Electronics Co., Ltd., Microscan (a part of Omron Corporation), Other Key Players

What are the factors driving the 2D barcode reader market?The growth of the 2D barcode reader market is propelled by factors such as the increasing demand for efficient inventory management, rising adoption of barcode technology in healthcare, logistics, and retail, and the expansion of e-commerce. Additionally, advancements in scanning technology and the integration of barcode readers with other systems contribute to market growth.

-

-

- Honeywell International Inc.

- Zebra Technologies Corporation

- Cognex Corporation

- Datalogic S.p.A.

- Symbol Technologies (a subsidiary of Zebra Technologies)

- Opticon Sensors Europe B.V.

- TSC Auto ID Technology Co., Ltd.

- Denso Wave Incorporated

- Code Corporation

- Newland AIDC

- Unitech Electronics Co., Ltd.

- Microscan (a part of Omron Corporation)

- Other Key Players