Global 2,4’-Dichloroacetophenone (CAS 937-20-2) Market By Purity (Upto 98%, 98-99%, and Above 99%), By Application (Pharmaceutical, Agrochemical, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: April 2024

- Report ID: 118240

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

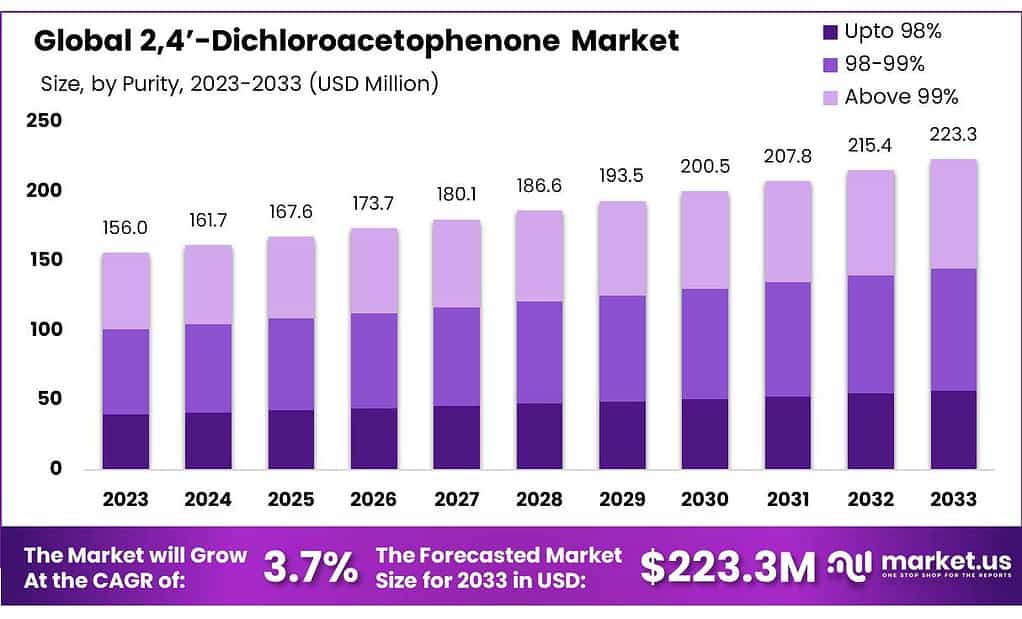

The global 2,4’-Dichloroacetophenone Market size is expected to be worth around USD 223.3 Million by 2033, from USD 156.0 Million in 2023, growing at a CAGR of 3.7% during the forecast period from 2023 to 2033.

2,4′-Dichloroacetophenone primarily caters to the production of pharmaceuticals, and agrochemicals, and as an intermediate in organic synthesis. The demand for this chemical compound is driven by its essential role in the synthesis of more complex chemical entities.

Market growth is influenced by factors such as advancements in chemical manufacturing processes, regulatory frameworks, and the expanding pharmaceutical sector. Market growth is influenced by factors such as advancements in chemical manufacturing processes, regulatory frameworks, and the expanding pharmaceutical sector.

The strategic importance of 2,4’-Dichloroacetophenone is underscored by its application in the development of new medicinal compounds and agricultural products, positioning it as a critical material in the global chemical supply chain.

Key Takeaways

- The global 2,4’-Dichloroacetophenone market was valued at US$ 156.0 million in 2023.

- The global 2,4’-Dichloroacetophenone market is projected to grow at a CAGR of 3.7% and is estimated to reach US$ 223.3 million by 2033.

- Among Purity, 98-99% accounted for the largest market share of 7%.

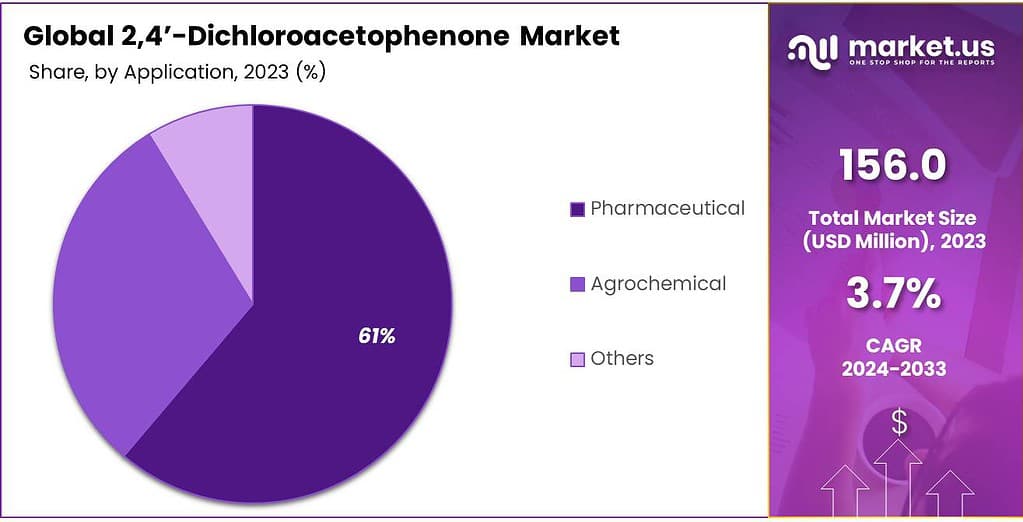

- Among Applications, Pharmaceuticals accounted for the majority of the market share at 2%.

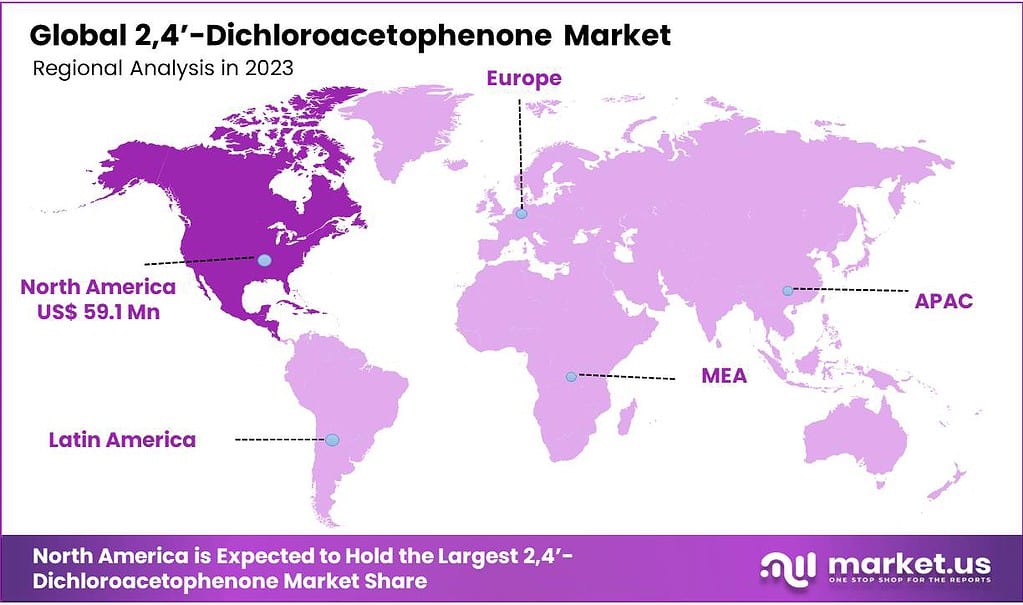

- North America is expected to hold the largest global 2,4’-Dichloroacetophenone market share with 4% of the market share.

- Asia-Pacific is anticipated to register a higher CAGR of 2% with a revenue share of 30.7% in 2023.

Purity Analysis

2,4’-Dichloroacetophenone with a Purity Between 96-98% Dominated the Market, Owing to Their Cost-Effectiveness,

The 2,4’-Dichloroacetophenone market is segmented based on purity into up to 98%, 98-99%, and above 99%. In 2023, the segment of the 2,4’-Dichloroacetophenone market with a purity level of 98-99% garnered a significant majority of revenue share, accounting for 39.7%%. This preeminence in market share can be attributed to several critical factors.

Primarily, the 98-99% purity range of 2,4’-Dichloroacetophenone strikes a balance between cost-effectiveness and the chemical efficacy required for a broad spectrum of industrial applications. Such applications demand a level of purity that ensures performance while also managing production costs, making this purity range particularly appealing to manufacturers and end-users alike.

Moreover, this purity level facilitates a versatile utility in various chemical synthesis processes and pharmaceutical applications, where absolute purity above 99% may not significantly enhance performance to justify the additional cost. The manufacturing process for achieving 96-98% purity is comparatively less resource-intensive than that for higher purities, leading to lower production costs and, consequently, more competitive pricing in the market.

Furthermore, the demand within this segment is bolstered by its broad applicability across multiple industries, including pharmaceuticals, agrochemicals, and others, which require this specific range of purity for optimal balance between product efficacy and cost. This widespread utility and cost-effectiveness combination underpin the dominant revenue share held by the 96-98% purity segment in the 2,4’-Dichloroacetophenone market in 2023.

Application Analysis

2,4’-Dichloroacetophenone Market Is Majorly Dominated By Pharmaceutical Sector.

Based on applications, the market is further divided into pharmaceutical, agrochemical, and others. The predominance of the pharmaceutical sector, commanding a substantial 61.2% market share in 2023, can be attributed to several pivotal factors that underscore its integral role within the broader market.

Firstly, the escalating global demand for innovative healthcare solutions and pharmaceuticals has been a primary driver. This surge is in response to the growing prevalence of chronic diseases, an aging global population, and heightened health awareness among consumers.

Moreover, the pharmaceutical industry’s significant investment in research and development activities has led to the discovery of novel drugs and therapies. These advancements are essential for addressing unmet medical needs and improving patient outcomes, further solidifying the sector’s market dominance. Additionally, regulatory support and incentives for pharmaceutical research have facilitated the rapid commercialization of new medications, contributing to the sector’s growth.

The integration of advanced technologies, such as biotechnology and nanotechnology, into pharmaceutical production processes has also enhanced drug efficacy and delivery mechanisms, expanding the range of treatable conditions.

Consequently, the pharmaceutical application’s lion’s share of the market is a reflection of its critical role in advancing healthcare, fueled by continuous innovation, regulatory frameworks, and an increasing demand for medical treatments. This confluence of factors has positioned the pharmaceutical sector as a cornerstone of market growth, underscoring its substantial impact on the overall market dynamics.

Key Market Segments

By Purity

- Upto 98%

- 98-99%

- Above 99%

By Application

- Pharmaceutical

- Agrochemical

- Other Applications

Drivers

Growing Pharmaceutical Industry Is Expected to Drive the 2,4’-Dichloroacetophenone Market’s Growth

The primary driver of the 2,4’-Dichloroacetophenone market (CAS 937-20-2) is its critical role in the pharmaceutical industry, particularly in the synthesis of advanced pharmaceutical intermediates and active pharmaceutical ingredients (APIs). This compound serves as a key building block in the manufacture of a variety of drugs, including antihistamines, anti-inflammatory agents, and other specialized medications that address a range of health conditions.

The increasing global demand for pharmaceutical products, driven by an aging population, rising prevalence of chronic diseases, and continuous efforts in drug development and innovation, significantly propel the market for 2,4’-Dichloroacetophenone.

Furthermore, the expansion of the pharmaceutical sector in emerging economies, combined with increased investments in research and development (R&D) activities, underpins the growth of this market. The surge in healthcare spending and the focus on developing novel therapeutics contribute to the escalating demand for high-purity chemical intermediates, thereby enhancing the market prospects for 2,4’-Dichloroacetophenone.

Additionally, advancements in chemical synthesis technologies and processes have improved the efficiency, yield, and purity of 2,4’-Dichloroacetophenone production, making it more accessible and cost-effective for pharmaceutical and agrochemical manufacturers. This development has enabled the industry to meet the growing demand for this compound more effectively, further driving its market growth. Environmental and regulatory factors also play a significant role in shaping the market dynamics for 2,4’-dichloroacetophenone.

Stringent environmental regulations and the push for greener chemical processes have led to innovations in the production of this compound, minimizing waste and reducing environmental impact. Such advancements align with the industry’s commitment to sustainable practices, making 2,4’-Dichloroacetophenone more attractive to environmentally conscious stakeholders and contributing to its market expansion.

Restraints

Regulatory Challenges May Hinder the Growth of the Market for A Certain Extent

The market for 2,4’-Dichloroacetophenone (CAS No. 937-20-2) faces several significant restraints that impact its growth and expansion. Among these, regulatory challenges emerge as a primary concern. The production and use of chemical compounds, including 2,4’-Dichloroacetophenone, are subject to stringent regulatory scrutiny worldwide.

Environmental regulations, in particular, mandate the minimization of hazardous emissions and the implementation of safe waste disposal practices. These requirements add to the operational costs and compel manufacturers to invest in cleaner technologies and processes, potentially hindering market growth.

Furthermore, health and safety concerns related to the handling and exposure to 2,4’-Dichloroacetophenone pose additional constraints. The compound’s toxicological profile necessitates strict handling procedures and protective measures to safeguard worker health, adding complexity and cost to manufacturing processes.

This aspect not only limits the compound’s applicability in certain industries but also raises concerns among stakeholders about long-term liabilities and the potential for regulatory penalties. Market dynamics also play a crucial role in restraining the 2,4’-dichloroacetophenone market.

The availability of substitute compounds that offer similar chemical properties with potentially lower environmental and health risks can lead to a shift in preference among end-users. This competition from alternatives may result in reduced demand for 2,4’-Dichloroacetophenone, impacting its market position and profitability.

Opportunity

Diversification of Application Areas Is Anticipated To Create Lucrative Opportunities

The 2,4’-Dichloroacetophenone market, identified by CAS No. 937-20-2, finds its major opportunity in the expanding pharmaceutical and agrochemical sectors. As a critical intermediate in organic synthesis, its utility in the production of advanced pharmaceuticals and agrochemical products is unparalleled.

The ongoing research and development activities within the pharmaceutical industry, aimed at discovering novel therapeutic agents, present a significant growth avenue for the demand for 2,4’-Dichloroacetophenone. This is particularly relevant in the context of rising global health challenges, including the emergence of new diseases and the increasing burden of chronic conditions, which necessitate the continuous development of new drugs.

Moreover, the agrochemical industry’s endeavor to enhance crop protection solutions through more effective and safer chemicals underscores another vital area of opportunity. The role of 2,4’-Dichloroacetophenone in synthesizing compounds that contribute to increased agricultural productivity and sustainability is crucial. This aligns with the global imperative to ensure food security for a growing population amidst climatic uncertainties.

The trend toward more sustainable and environmentally friendly manufacturing processes also presents an opportunity for innovation in the production of 2,4’-dichloroacetophenone. The development of greener synthesis methods, minimizing the environmental footprint while maintaining or enhancing yield and purity, could set new standards in the chemical manufacturing industry. Such advancements would not only respond to regulatory pressures and societal demand for more sustainable practices but also open up new markets and applications for 2,4’-Dichloroacetophenone, particularly in sectors increasingly governed by stringent environmental standards.

Trends

Adoption of Green Chemistry Principles Is Marked as a Major Trend in The Global Market

The 2,4’-Dichloroacetophenone market, represented by CAS No. 937-20-2, has witnessed significant technological advancements in production processes, marking a major trend that contributes to its growth and sustainability. These advancements are primarily aimed at enhancing efficiency, reducing environmental impact, and optimizing yield, thereby catering to the increasing demand in various end-use sectors such as pharmaceuticals and agrochemicals.

One of the prominent technological trends is the adoption of green chemistry principles. This involves the use of environmentally benign solvents and renewable raw materials, which significantly reduces the generation of hazardous waste. Moreover, green chemistry practices emphasize energy efficiency, further aligning with global sustainability goals. Such advancements not only improve the eco-friendliness of production processes but also enhance the overall appeal of 2,4’-Dichloroacetophenone in markets increasingly sensitive to environmental concerns.

Catalysis technology has also seen substantial improvements, with the development of more selective catalysts that facilitate higher yields and purities in the synthesis of 2,4’-Dichloroacetophenone. These catalysts minimize side reactions and reduce the need for extensive purification steps, thus lowering production costs and improving efficiency.

The integration of continuous flow chemistry represents another significant advancement, offering advantages in terms of safety, scalability, and control over reaction parameters. This technology enables more precise management of the reaction environment, leading to better product quality and consistency.

Furthermore, the implementation of digitalization and automation in chemical manufacturing processes has enhanced production control, data analysis, and process optimization. Advanced sensors and control systems allow for real-time monitoring and adjustments, ensuring optimal conditions throughout the production cycle. This level of control is crucial for maintaining the purity and quality of 2,4’-Dichloroacetophenone, especially given its applications in sensitive fields such as pharmaceuticals.

Geopolitical Impact Analysis

Disruptions In The Global Supply Chain Owing to Geopolitical Tensions Negatively Impact the Growth of the 2,4’-Dichloroacetophenone Market

The impact of geopolitical tensions and ongoing wars on the 2,4’-Dichloroacetophenone market (CAS No. 937-20-2) can be significant, influencing both the supply chain dynamics and market stability. Geopolitical tensions and conflicts can lead to disruptions in the global supply chain. Regions embroiled in conflict or subject to sanctions may face difficulties in exporting or importing chemical precursors and finished products.

For the 2,4’-Dichloroacetophenone market, this could mean delayed deliveries and increased costs due to the need for rerouting shipments or finding alternative suppliers. Moreover, 2,4’-Dichloroacetophenone production relies on specific raw materials that may become scarce or more expensive as a result of geopolitical unrest.

The increase in raw material costs is often passed down the supply chain, leading to higher prices for end-users and potentially reducing demand. Furthermore, geopolitical tensions can lead to a tightening of export controls and an increase in trade barriers. Companies operating in the 2,4’-Dichloroacetophenone market may find themselves navigating a more complex regulatory landscape, requiring additional resources to ensure compliance.

This could impede market access and limit growth opportunities in affected regions. Uncertainty caused by geopolitical tensions and wars can deter investment in new production capacities or research and development activities. For the 2,4’-Dichloroacetophenone market, this might slow down technological advancements and innovation, critical for maintaining competitiveness and meet evolving market demands.

Geopolitical tensions often lead to volatility in currency and commodity markets. Such volatility can have a direct impact on the 2,4’-Dichloroacetophenone market, affecting pricing strategies and contract negotiations. Fluctuations in currency exchange rates, for instance, can significantly impact export competitiveness and profit margins.

The end-use sectors for 2,4’-Dichloroacetophenone, particularly pharmaceuticals and agrochemicals, may themselves be affected by geopolitical tensions, influencing demand patterns. For example, increased demand for pharmaceuticals in conflict zones could spike short-term demand for 2,4’-Dichloroacetophenone, whereas long-term demand may be impacted by broader economic downturns resulting from prolonged conflicts.

Regional Analysis

North America Held the Major Share of the Global 2,4’-Dichloroacetophenone Market

North America held the largest market share, with 38.4% of the 2,4’-Dichloroacetophenone market in 2023. North America holds a significant share of the global 2,4’-Dichloroacetophenone market, primarily due to its advanced pharmaceutical and agrochemical industries, which are major consumers of this chemical compound.

North America, especially the United States, is home to several of the world’s largest pharmaceutical companies. These companies engage in extensive research and development activities, requiring high-quality chemical intermediates such as 2,4’-Dichloroacetophenone for the synthesis of complex pharmaceuticals.

The demand from this sector alone provides a substantial market for 2,4’-dichloroacetophenone. Moreover, the region’s commitment to technological innovation in chemical manufacturing processes has led to more efficient, sustainable, and cost-effective production methods for 2,4’-dichloroacetophenone. This technological edge not only meets domestic demand but also positions North American producers as key suppliers in the global market.

The regulatory framework in North America, particularly in the U.S., supports the development of the chemical industry through stringent safety and environmental standards. This has encouraged the adoption of advanced manufacturing technologies and practices, ensuring high-quality production of 2,4’-Dichloroacetophenone.

Companies in North America often engage in strategic alliances and partnerships for research, development, and distribution. These collaborations enhance market reach and strengthen the supply chain, further solidifying the region’s position in the global 2,4’-Dichloroacetophenone market.

These factors underscore North America’s major share in the global 2,4’-Dichloroacetophenone market, driven by robust demand from the pharmaceutical and agrochemical sectors, technological advancements, a supportive regulatory environment, and strategic industry alliances.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Strong Focus On Product Portfolio Expansion Through Various Strategies Maintain the Dominance of Industry Leaders

Leading companies are allocating substantial resources to R&D efforts aimed at enhancing the production process, improving product quality, and developing innovative applications for 2,4’-dichloroacetophenone. By staying at the forefront of technological advancements, these firms can gain a competitive edge and meet evolving market demands more effectively. Some companies are opting for vertical integration by controlling multiple stages of the supply chain, from raw material sourcing to distribution.

This vertical integration enables firms to streamline operations, ensure consistent product quality, and capture greater value throughout the production process. By exerting control over critical aspects of the supply chain, companies can mitigate risks associated with external dependencies and enhance their market position.

Market Key Players

The global 2,4′ Dichloroacetophenone Market has various established as well as small key players. The major operating companies are FUJIFILM Corporation, Hefei TNJ Chemical Industry Co., Ltd., BLDpharm, Icon Pharma Chem, Aromsyn Co., Ltd, Pratap Organics Pvt. Ltd, Matrix Fine Chemicals GmbH, Capot Chemical Co., Ltd., GREENTEC CHEMICALS PVT. LTD, Ality Group, Kaimosi BioChem Tech Co., Ltd, Henan Alfa Chemical Co., Ltd., Vesino Industrial Co., Ltd, Alfa Chemistry, and other key players.

These companies vying for dominance in the 2,4’-Dichloroacetophenone market are leveraging a combination of these strategies to strengthen their competitive position, drive innovation, and capitalize on evolving market dynamics.

In pursuit of sustainable growth, companies are exploring opportunities for market expansion and diversification into adjacent product categories or geographic regions. By diversifying their product portfolio and tapping into new markets, firms can mitigate risks associated with market volatility and capitalize on emerging opportunities for revenue growth.

The following are some of the major players in the industry

- FUJIFILM Corporation

- Hefei TNJ Chemical Industry Co., Ltd.

- BLDpharm

- Icon Pharma Chem

- Aromsyn Co., Ltd

- Pratap Organics Pvt. Ltd

- Matrix Fine Chemicals GmbH

- Capot Chemical Co., Ltd

- GREENTEC Chemicals Pvt. Ltd

- Ality group

- Kaimosi BioChem Tech Co., Ltd

- Henan Alfa Chemical Co., Ltd.

- Vesino Industrial Co., Ltd

- Alfa Chemistry

- Others Key Players

Report Scope

Report Features Description Market Value (2023) US$ 156.0 Mn Market Volume (2023) XX Ton Forecast Revenue (2033) US$ 223.3 Mn CAGR (2024-2033) 3.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Purity (Upto 98%, 98-99%, and Above 99%), By Application (Pharmaceutical, Agrochemical, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape FUJIFILM Corporation, Hefei TNJ Chemical Industry Co., Ltd., BLDpharm, Icon Pharma Chem, Aromsyn Co., Ltd, Pratap Organics Pvt. Ltd, Matrix Fine Chemicals GmbH, and Capot Chemical Co., Ltd., GREENTEC CHEMICALS PVT. LTD, Ality Group, Kaimosi BioChem Tech Co., Ltd, Henan Alfa Chemical Co., Ltd., Vesino Industrial Co., Ltd, Alfa Chemistry, and other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of 2,4’-Dichloroacetophenone Market?2,4’-Dichloroacetophenone Market size is expected to be worth around USD 223.3 Million by 2033, from USD 156.0 Million in 2023

What CAGR is projected for the 2,4’-Dichloroacetophenone Market?The 2,4’-Dichloroacetophenone Market is expected to grow at 3.7% CAGR (2024-2033).Name the major industry players in the 2,4’-Dichloroacetophenone Market?FUJIFILM Corporation, Hefei TNJ Chemical Industry Co., Ltd., BLDpharm, Icon Pharma Chem, Aromsyn Co., Ltd, Pratap Organics Pvt. Ltd, Matrix Fine Chemicals GmbH, Capot Chemical Co., Ltd, GREENTEC Chemicals Pvt. Ltd, Ality group, Kaimosi BioChem Tech Co., Ltd, Henan Alfa Chemical Co., Ltd., Vesino Industrial Co., Ltd, Alfa Chemistry, Others Key Players,

2,4’-Dichloroacetophenone (CAS 937-20-2) MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

2,4’-Dichloroacetophenone (CAS 937-20-2) MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- FUJIFILM Corporation

- Hefei TNJ Chemical Industry Co., Ltd.

- BLDpharm

- Icon Pharma Chem

- Aromsyn Co., Ltd

- Pratap Organics Pvt. Ltd

- Matrix Fine Chemicals GmbH

- Capot Chemical Co., Ltd

- GREENTEC Chemicals Pvt. Ltd

- Ality group

- Kaimosi BioChem Tech Co., Ltd

- Henan Alfa Chemical Co., Ltd.

- Vesino Industrial Co., Ltd

- Alfa Chemistry

- Others Key Players