Global 2-Ethylhexyl Nitrate Market Size, Share Analysis Report By Form (Liquid, Power), By Application (Solvent, Fuel Additive, Reagent in Chemical Synthesis, Others), By End-User (Petrochemicals, Pharmaceuticals, Chemicals, Paints and Coatings, Agricultural Chemicals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 163876

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

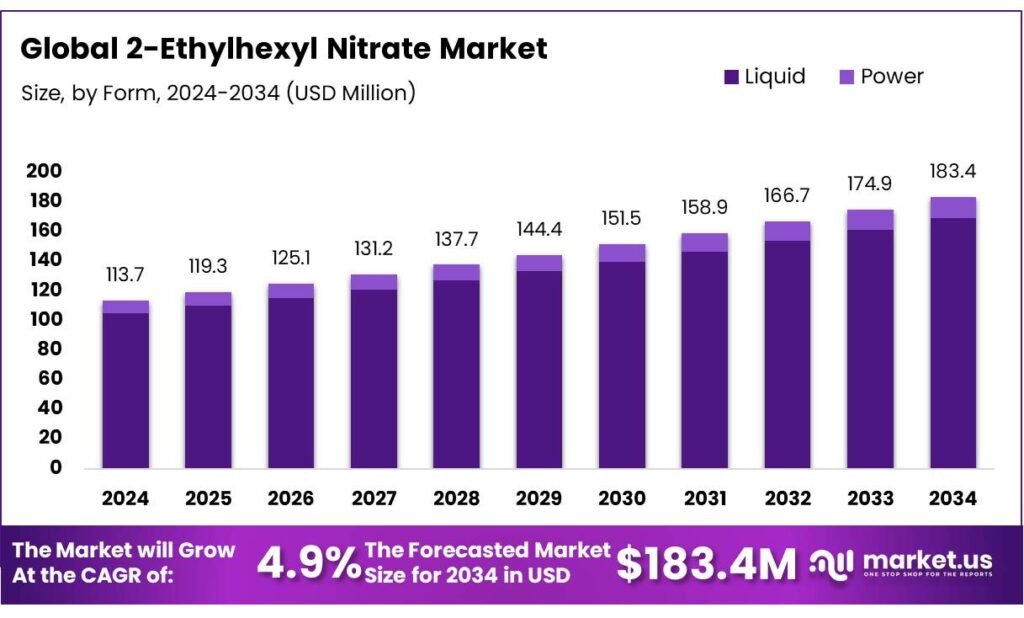

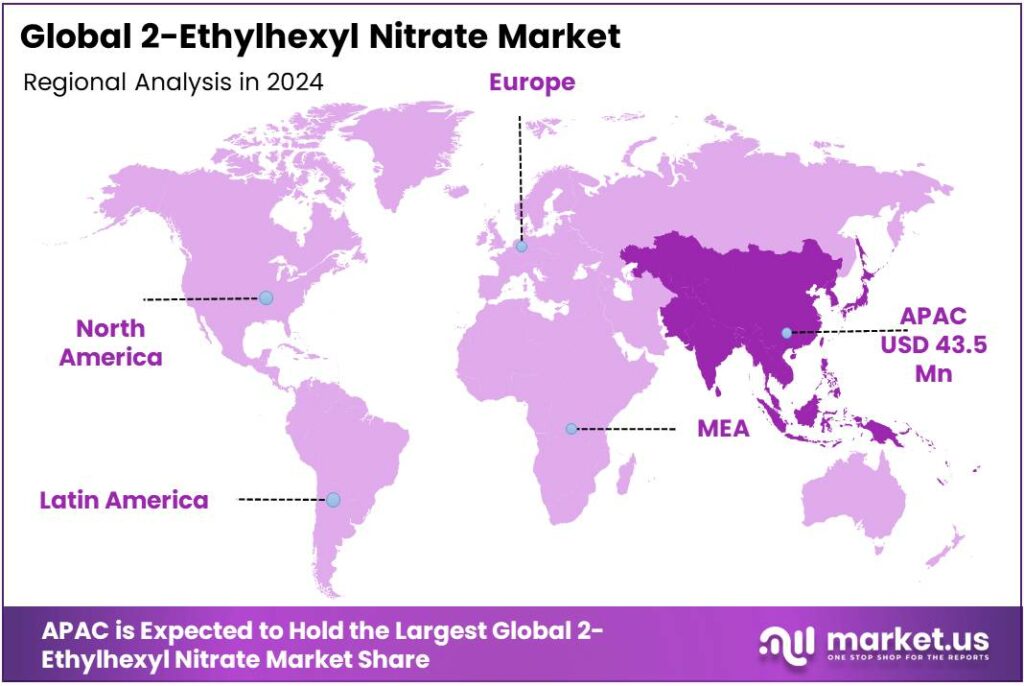

The Global 2-Ethylhexyl Nitrate Market size is expected to be worth around USD 183.4 Million by 2034, from USD 113.7 Million in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 45.8% share, holding USD 0.6 Billion in revenue.

2-Ethylhexyl nitrate (2-EHN) is the dominant diesel cetane improver used at low treat rates to shorten ignition delay and stabilize combustion across ultra-low sulfur diesel (ULSD), biodiesel blends, and marine distillates. Demand for 2-EHN is structurally linked to the size and quality requirements of the diesel pool. In 2023, world oil demand averaged 101.7 mb/d, with growth slowing versus 2022 as efficiency and EVs gained traction—yet transport fuels still anchor consumption trends. In 2024, the International Energy Agency (IEA) projected oil demand growth of ~1.1 mb/d, underscoring a maturing liquid fuels outlook but one still requiring high-quality diesel for freight, agriculture, and construction.

Fuel-quality regulations underpin the industrial case for cetane improvers. In the United States, EPA’s diesel rules phased in ULSD at 15 ppm sulfur starting June 2006, enabling advanced aftertreatment; the program covers on-road and non-road categories. ASTM D975/US EPA requirements also specify either a minimum cetane index of 40 or 35% maximum aromatics for on-road diesel, sustaining demand for ignition quality additives when refinery streams are tight.

States can go further: Texas “Low Emission Diesel” requires a minimum cetane number of 48, directly increasing additive pull when base fuel falls short. Europe standardized automotive diesel at 10 ppm sulfur under EN 590 by 2009, consistent with refinery streams that can exhibit lower natural cetane and therefore greater reliance on 2-EHN.

India’s nationwide Bharat Stage VI also mandates 10 ppm sulfur from April 2020, aligning one of the world’s fastest-growing diesel markets with additive-intensive ULSD. In marine fuels, MARPOL Annex VI set the global sulfur cap at 0.50% m/m from 1 January 2020, while 0.10% m/m applies inside Emission Control Areas—drivers of marine gas/diesel oil use and ignition-quality management in low-sulfur blends.

Industrial dynamics in 2024-2026 mix supportive quality mandates with plateauing diesel volumes. According to the Energy Institute’s Statistical Review, global diesel/gasoil demand fell ~0.5% in 2024, signaling macro softness even as additive intensity per barrel trends higher. IEA’s Oil 2024 outlook expects advanced-economy oil demand to decline from 45.7 mb/d in 2023 to 42.7 mb/d by 2030, while emerging Asia continues to expand—shifting 2-EHN consumption toward APAC hubs and importers.

Electrification is a headwind for long-run diesel, with electric-car sales reaching ~17 million in 2024, displacing future road-fuel growth. IEA further estimates EVs and efficiency will displace ~6 mb/d of gasoline and diesel demand by 2030, reinforcing a quality-over-quantity additive thesis.

Key Takeaways

- 2-Ethylhexyl Nitrate Market size is expected to be worth around USD 183.4 Million by 2034, from USD 113.7 Million in 2024, growing at a CAGR of 4.9%.

- Liquid held a dominant market position, capturing more than a 92.3% share of the 2-Ethylhexyl Nitrate market.

- Fuel Additive held a dominant market position, capturing more than a 56.9% share of the global 2-Ethylhexyl Nitrate market.

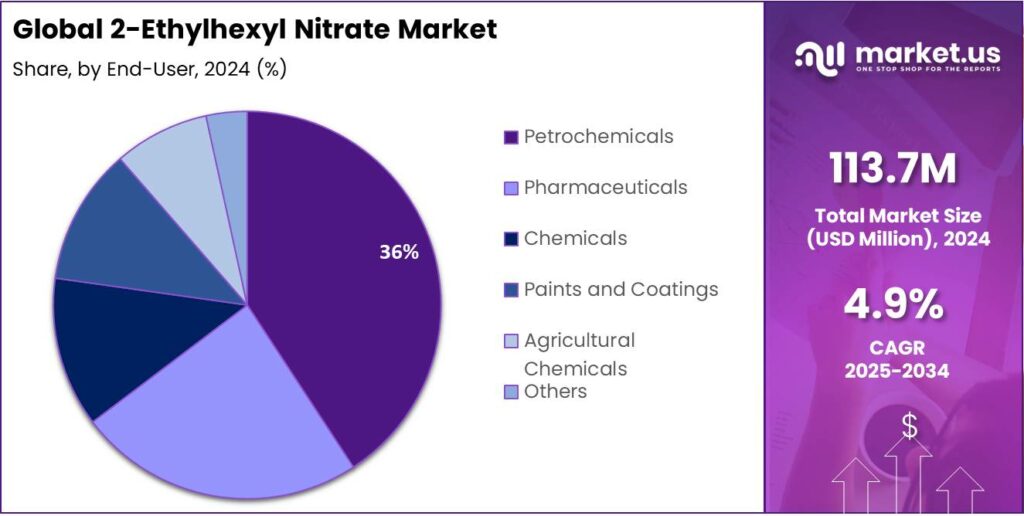

- Petrochemicals held a dominant market position, capturing more than a 35.8% share of the global 2-Ethylhexyl Nitrate market.

- Asia-Pacific (APAC) held a dominant market position in the global 2-Ethylhexyl Nitrate (2-EHN) industry, accounting for more than 38.3% of total revenue, valued at USD 43.5 million.

By Form Analysis

Liquid form dominates with 92.3% owing to its handling ease and broad compatibility

In 2024, Liquid held a dominant market position, capturing more than a 92.3% share of the 2-Ethylhexyl Nitrate market, reflecting clear industry preference for the liquid form driven by its straightforward dosing, ease of blending into diesel streams, and lower handling complexity compared with solid or slurry alternatives. The liquid grade has been favoured by formulators and refiners because it permits precise metering at low concentrations, simplifies logistics for bulk transport and storage, and reduces processing steps during blending operations; these operational efficiencies have resulted in the liquid form being the primary commercial offering across fuel additive producers and downstream customers.

In 2025, the liquid form is expected to retain its majority position as end-users continue to prioritise supply reliability and ease of integration with existing fuel handling infrastructure. The sustained dominance of the liquid segment underscores its role as the default commercial presentation for cetane improvers, supporting stable procurement patterns among refiners and large fleet operators.

By Application Analysis

Fuel Additive dominates with 56.9% driven by rising diesel engine optimization demand

In 2024, Fuel Additive held a dominant market position, capturing more than a 56.9% share of the global 2-Ethylhexyl Nitrate market. This strong dominance was attributed to the compound’s extensive use as a cetane improver in diesel fuels, which enhances combustion efficiency, reduces ignition delay, and lowers emissions. The growing demand for clean-burning fuels, particularly in the transportation and logistics sectors, has significantly boosted the use of 2-Ethylhexyl Nitrate as a fuel additive. In 2025, this segment is expected to maintain its lead, supported by tightening emission standards across Asia-Pacific and Europe, and continued diesel vehicle utilization in heavy-duty transport.

The compound’s ability to deliver fuel economy benefits and ensure compliance with environmental norms makes it indispensable for refineries and fuel blenders. Additionally, ongoing government focus on reducing particulate matter and nitrogen oxide emissions is anticipated to reinforce the market position of 2-Ethylhexyl Nitrate in fuel additive applications, sustaining its commercial relevance in the coming years.

By End-User Analysis

Petrochemicals dominate with 35.8% share supported by rising fuel additive production and refining demand

In 2024, Petrochemicals held a dominant market position, capturing more than a 35.8% share of the global 2-Ethylhexyl Nitrate market. This leadership was primarily driven by its widespread application in refining operations and fuel formulation processes across major industrial economies. Petrochemical manufacturers utilized 2-Ethylhexyl Nitrate to enhance the performance of diesel fuels and improve combustion efficiency in industrial engines. The compound’s chemical stability and high energy output have made it a preferred additive for large-scale blending in refinery operations. In 2025, the segment is projected to retain its dominance, backed by increased diesel consumption in manufacturing and logistics sectors in Asia-Pacific and the Middle East.

Additionally, expanding refinery capacities in India and China, along with growing investments in low-emission fuel additives, are expected to strengthen the petrochemical segment’s contribution. Continuous government emphasis on reducing carbon intensity and improving fuel quality standards will further sustain demand for 2-Ethylhexyl Nitrate in the petrochemical industry, ensuring consistent market growth through the forecast period.

Key Market Segments

By Form

- Liquid

- Power

By Application

- Solvent

- Fuel Additive

- Reagent in Chemical Synthesis

- Others

By End-User

- Petrochemicals

- Pharmaceuticals

- Chemicals

- Paints and Coatings

- Agricultural Chemicals

- Others

Emerging Trends

Front-of-pack labels and sugar taxes push nonstop reformulation

Cyclopentanone is riding a quiet but powerful trend: governments are reshaping how foods and drinks present nutrition, and how much sugar they can reasonably contain, which forces constant recipe tweaks to protect taste. The clearest signal is front-of-pack nutrition labelling (FOPL). A 2024 global review finds 44 countries now have a government-endorsed FOPL policy, with 16 making it mandatory—so the “at-a-glance” nutrition score or warning is no longer niche; it is becoming normal.

Taxes on sugar-sweetened beverages (SSBs) are the second big engine behind reformulation. WHO’s Eastern Mediterranean work shows how these taxes are spreading and standardizing across the region, and it documents 50% excise rates on many sugary drinks in Saudi Arabia and the United Arab Emirates, levels that make sugar reduction a board-room priority. WHO also communicates the policy’s expected punch: a 20% tax on sugary drinks can cut consumption by up to 20%, a magnitude that quickly pressures portfolios and triggers flavor re-engineering at scale.

Real-world outcomes confirm the shift. The United Kingdom’s Soft Drinks Industry Levy (announced 2016) is repeatedly credited by government with deep reformulation, delivering a 46% average sugar reduction in in-scope soft drinks between 2015 and 2020. For formulators, such a change is not just less sucrose; it is a new sensory landscape requiring top-notes, cooling/green nuances, and off-note masking—roles where small, high-impact molecules like cyclopentanone are familiar tools.

In October 2024, WHO issued draft guidance encouraging clearer front-of-package nutrition information and noted that ~43 WHO Member States had some form of FOP labelling, with more expected as guidance is finalized. And in the United States, the FDA has proposed front-of-package nutrition labels, signalling that the world’s largest packaged-food market may soon join the FOPL club—typically with a 3–4 year compliance window once finalized.

Drivers

Food And beverage reformulation that boosts flavor-ingredient demand

A practical force behind cyclopentanone’s growth is the steady reformulation of foods and drinks. Two big levers are at play: rising consumption that widens the canvas for flavoring, and public-health policies that push brands to cut sugar while keeping products appealing. The OECD-FAO outlook projects that average daily calorie intake in middle-income countries will increase by about 7% by 2033, reflecting higher consumption of staples, animal products and fats—conditions that typically require more nuanced flavor work in processed and packaged foods.

The policy lever is equally important. The WHO reports that 108 countries have some form of sugar-sweetened beverage (SSB) taxation, yet on average the excise tax accounts for just 6.6% of soda’s retail price, signaling further room for fiscal measures—and continued reformulation—in the near term. Evidence keeps accumulating in regions adopting these tools.

A WHO-supported analysis in the Eastern Mediterranean documented standardized SSB tax designs across 22 countries/territories, underscoring how fiscal policy has become a mainstream catalyst for recipe changes. Beyond taxes, the FAO quantifies the societal push to improve diets: unhealthy dietary patterns impose about US$8 trillion in hidden costs on agrifood systems each year—making the economic case for reformulation that preserves taste while lowering risk nutrients.

Regulatory clarity also supports adoption. In the United States, FDA regulations allow synthetic flavoring substances to be used under good manufacturing practice in foods (21 CFR 172.515), providing the legal framework companies rely on during flavor redesigns. Cyclopentanone itself sits within the formal safety ecosystem used by the food industry: FEMA assigns it FEMA No. 3910, and it has a JECFA number 1101, reflecting evaluation within the FAO/WHO scientific advice system for flavorings.

Trade and export momentum add a real economy anchor. The U.S. Department of Agriculture notes that U.S. processed food exports reached a record US$14.73 billion in 2023, a signal that the variety and reach of shelf-stable foods keep expanding in key markets.

Restraints

Tightening food-safety scrutiny and front-of-pack labeling pressure

A major brake on cyclopentanone in food flavors is the steady rise in food-safety scrutiny and labeling rules that make formulators more cautious with synthetic flavoring building blocks. Regulators and public-health agencies are pushing manufacturers to simplify labels and reduce any perceived risk. The World Health Organization estimates that unsafe food causes 600 million illnesses and 420,000 deaths every year—equal to 33 million healthy life-years lost—placing constant pressure on authorities to harden standards and on companies to minimize compliance risk.

On the regulatory side, cyclopentanone—like any flavoring—sits inside a dense, evolving safety framework that can slow use or require extra data. In the European Union, EFSA’s multi-year program is re-evaluating legacy additives at scale: as of 14 August 2025, 315 additives approved before 2009 were slated for review, with 135 EFSA scientific opinions covering 243 individual additives already published, and 72 still pending—evidence of a large and moving compliance target for formulators.

Global harmonization adds complexity. The Codex General Standard for Food Additives is continuously updated and sets the accepted conditions for additive uses worldwide. If an intended use of a flavoring falls outside the Codex provisions adopted by Member States, companies face extra justification or must reformulate. In the United States, FDA’s 21 CFR 172.515 only permits synthetic flavoring substances when used at the minimum quantity needed under good manufacturing practice—language that, in practice, triggers conservative treat rates and rigorous supplier controls to avoid regulatory findings.

Public-health economics reinforce the trend. WHO estimates US$110 billion in productivity and medical costs each year from unsafe food in low- and middle-income countries; that magnitude keeps food-safety on political agendas and encourages risk-averse purchasing standards in retail and foodservice.

For cyclopentanone suppliers, the practical result is slower specification, longer toxicology and regulatory-affairs cycles, and sometimes late-stage substitutions if country labels or retail customers object. None of this questions the legitimate uses of cyclopentanone in flavor creation; rather, it recognizes a market reality: when 600 million people fall ill from foodborne causes annually and more countries adopt front-of-pack schemes, every unfamiliar line on the ingredient list must earn its place.

Opportunity

Reformulation for healthier, tastier foods at global scale

A clear growth lane for cyclopentanone is the reformulation wave that helps brands cut sugar yet keep beloved taste profiles. Demand-side volume is there: the OECD-FAO projects average daily calorie intake in middle-income countries will rise about 7% by 2033, as diets include more staples, animal products and fats—expanding the canvas for packaged foods and the flavor building blocks they require.

Policy is the big nudge behind reformulation. The World Health Organization reports 108 countries now tax some form of sugar-sweetened beverages, yet the average excise equals only 6.6% of the retail price—leaving significant headroom for stronger policy and, in turn, more recipe change. Real-world evidence shows what happens when policy bites: the UK’s Soft Drinks Industry Levy (SDIL) helped drive a 46% average sugar reduction in drinks within scope between 2015 and 2020, proving that fiscal levers can trigger rapid, large-scale reformulation.

The UK government has also challenged broader food categories to reduce sugar by 20%, embedding reformulation into long-term obesity strategy. In India, the FSSAI’s Eat Right movement encourages companies to gradually reduce fat, sugar and salt—a steady, system-level signal to R&D teams to protect taste while cleaning labels.

Trade trends make this opportunity tangible. U.S. agricultural exports totaled US$175.5 billion in 2023, underlining the scale and reach of processed foods that must satisfy evolving nutrition rules in multiple markets. Within that, U.S. processed food exports hit a record US$14.73 billion in 2023, a concrete proxy for the shelf-stable, flavor-sensitive categories where small, high-impact aroma inputs—like cyclopentanone—carry outsized weight.

Regional Insights

Asia-Pacific leads the 2-Ethylhexyl Nitrate market with 38.3% share, driven by strong fuel additive consumption and industrial expansion

In 2024, Asia-Pacific (APAC) held a dominant market position in the global 2-Ethylhexyl Nitrate (2-EHN) industry, accounting for more than 38.3% of total revenue, valued at USD 43.5 million. The region’s leadership is attributed to the robust growth of the automotive, petrochemical, and industrial manufacturing sectors in countries such as China, India, Japan, and South Korea.

The increasing adoption of diesel engines in commercial vehicles, coupled with rapid urbanization and infrastructure development, has intensified fuel consumption across the region. According to the International Energy Agency (IEA), diesel demand in Asia is expected to grow by nearly 2.1% annually through 2025, supporting the use of cetane improvers like 2-Ethylhexyl Nitrate to enhance engine efficiency and reduce emissions.

China remains the largest consumer within the region, driven by its extensive refining capacity—exceeding 920 million metric tons annually—and its ongoing efforts to meet stricter emission standards under its “Blue Sky” environmental initiative. India has also witnessed increased demand, supported by expanding transportation networks and the government’s focus on improving fuel quality under the Bharat Stage VI emission norms.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, JX Nippon Oil & Energy Corporation maintained a strong presence in the global 2-Ethylhexyl Nitrate (2-EHN) market, driven by its advanced fuel additive technologies and integrated refinery operations. The company leveraged its large-scale production facilities in Japan, contributing significantly to the supply of high-purity EHN used in diesel fuel blending. With a revenue exceeding USD 74 billion in FY2024, JX Nippon focused on improving cetane enhancer efficiency to meet evolving emission norms and cleaner energy targets.

Longchang Chemical, based in China, was a key manufacturer in the 2-Ethylhexyl Nitrate market in 2024, supported by its large production capacity and extensive export network across Asia and Europe. The company produced over 18,000 tons of EHN annually, catering primarily to the fuel additive and petrochemical industries. Its focus on product quality and environmental compliance strengthened its position within China’s growing diesel additive sector. Longchang Chemical’s technological improvements and cost-effective production boosted its competitiveness in 2025.

Deepak Nitrite Limited, one of India’s leading chemical manufacturers, played a pivotal role in the regional 2-Ethylhexyl Nitrate industry during 2024. The company’s growth was supported by expanding petrochemical operations and increased demand from the domestic automotive sector. With a total consolidated revenue of around INR 8,000 crore (USD 960 million) in FY2024, Deepak Nitrite focused on high-performance chemicals and fuel additives, including EHN, to support India’s shift toward cleaner and more efficient diesel fuels.

Top Key Players Outlook

- JX Nippon Oil & Energy

- Longchang Chemical

- Deepak

- Others

Recent Industry Developments

In FY 2024, Deepak Nitrite reported consolidated revenue of ₹7,682 crore and net profit of ₹811 crore, marking resilient growth in its chemical intermediates business.

In 2024, Longchang Chemical in Changyi City, Shandong Province, China marked its presence as a manufacturer and supplier of high-purity Cyclopentanone — listing a grade of ≥ 99.5% assay and impurity limit of ≤ 0.5% on its product page.

Report Scope

Report Features Description Market Value (2024) USD 113.7 Mn Forecast Revenue (2034) USD 183.4 Mn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Power), By Application (Solvent, Fuel Additive, Reagent in Chemical Synthesis, Others), By End-User (Petrochemicals, Pharmaceuticals, Chemicals, Paints and Coatings, Agricultural Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape JX Nippon Oil & Energy, Longchang Chemical, Deepak, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2-Ethylhexyl Nitrate MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

2-Ethylhexyl Nitrate MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- JX Nippon Oil & Energy

- Longchang Chemical

- Deepak

- Others