Global 1,3 propanediol Market By Source(Bio-based, Petrochemical-based), By Application(Polytrimethylene Terephthalate, Polyurethane, Personal Care, Detergents ), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 37739

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

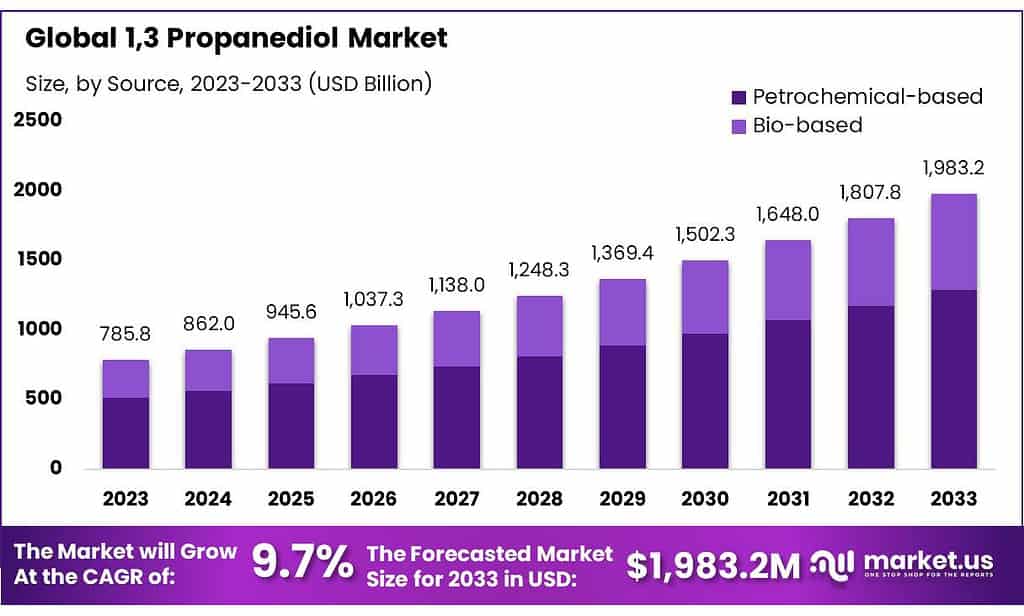

The 1,3 Propanediol Market size is expected to be worth around USD 1983.2 Mn by 2033, from USD 785.78 Mn in 2023, growing at a CAGR of 9.7% during the forecast period from 2023 to 2033.

The global market will continue to be driven by the growing demand for polyesters like poly trimethylene terephthalate (PTT) and increased polyurethane penetration in various end-use sectors. The market is expected to grow with the addition of polyester applications in diverse industries.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Forecast: The 1,3 Propanediol Market is expected to soar to approximately USD 1983.2 billion by 2033 from its valuation of USD 785.78 million in 2023, showcasing a substantial Compound Annual Growth Rate (CAGR) of 9.7%.

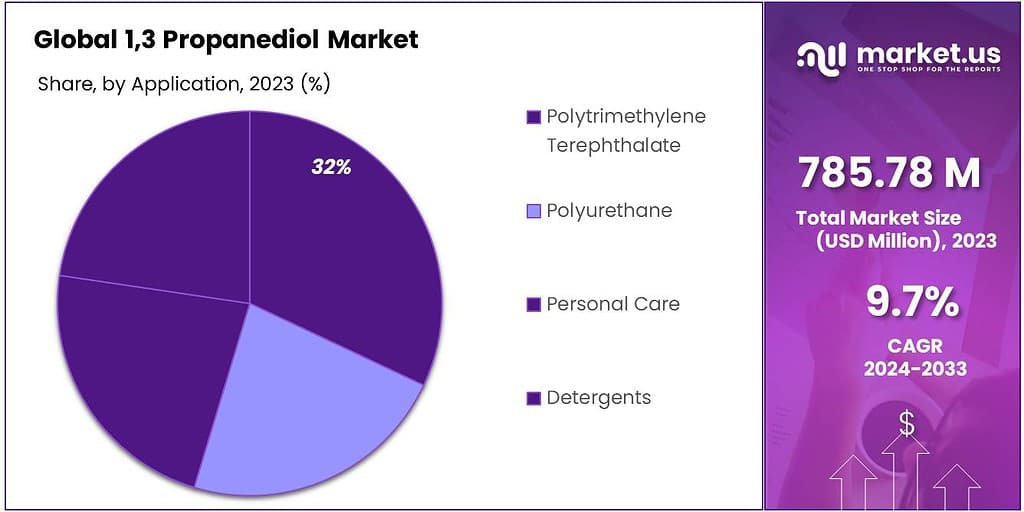

- Market Applications: Polytrimethylene Terephthalate (PTT) holds a significant share in the market due to its usage in clothing, carpets, and furniture covers.

- Source Analysis: Petrochemical-based sources dominate the market owing to their established infrastructure, reliability, and cost advantages.

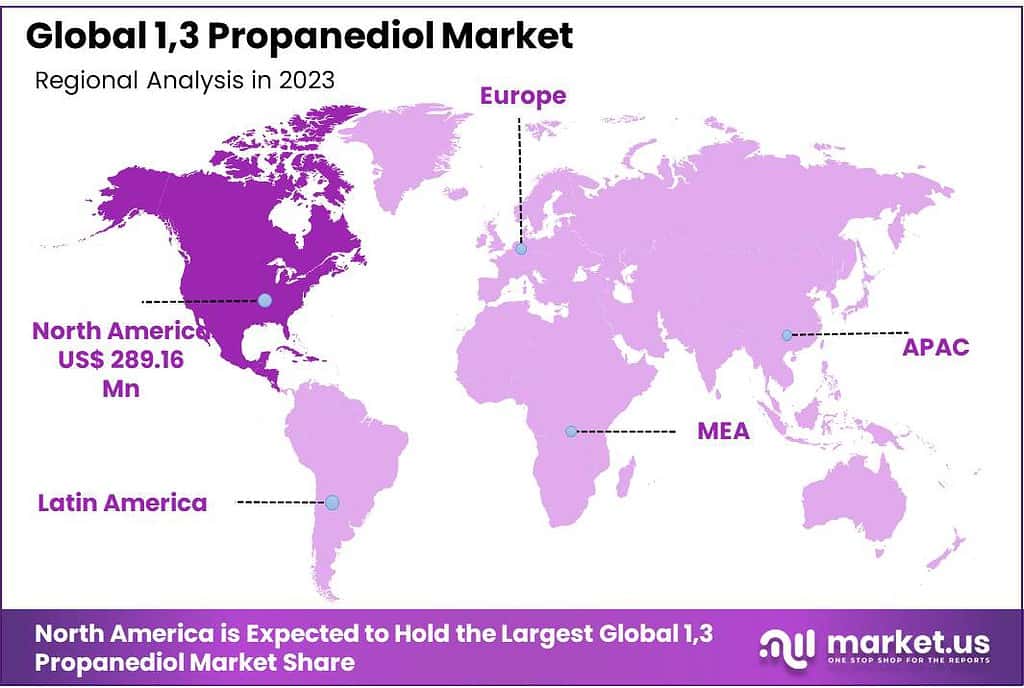

- Regional Insights: North America leads the market, contributing around b of the market revenue in 2023.

- Challenges Faced: Production costs, especially concerning bio-based sources, pose significant hurdles.

- Opportunities for Advancement: Exploring alternative renewable feedstocks, investing in production technologies, strategic collaborations, and diversification into emerging sectors like renewable energy and bioplastics present avenues for market expansion.

- Key Players and Recent Developments: Dominated by a few major players like DuPont Tate & Lyle, Metabolic Explorer, and Shell Chemicals LP, the market has witnessed capacity expansions and strategic partnerships to access emerging markets and enhance production methods.

By Source

In 2023, the 1,3 propanediol market showcased a notable dominance of the Petrochemical-based segment, capturing a substantial market share of over 61%. In 2023, the dominance of the Petrochemical-based segment in the 1,3 propanediol market stemmed from several key factors. Petrochemical sources, derived from petroleum derivatives, benefited from long-established production processes and extensive infrastructure.

This made them highly reliable, scalable, and cost-effective compared to their bio-based counterparts. The petrochemical-based sources of 1,3 propanediol leveraged existing industrial infrastructure designed for petroleum refining. This infrastructure supported efficient extraction and production processes, allowing for large-scale manufacturing at relatively lower costs. As a result, these sources gained significant market traction due to their reliability, availability, and cost efficiency.

Bio-based propanediol products derived from renewable resources such as plant-derived feedstocks held a smaller market share despite offering an eco-friendly alternative that aligned with sustainability goals; however, bio-based sources were unable to reach similar scalability and cost-effectiveness as their petrochemical counterparts.

Bio-based production often experiences difficulties scaling due to factors like variations in crop yields, geographical restrictions on feedstock sources, and technological needs. Additionally, initial costs associated with setting up bio-based production infrastructure could sometimes outstrip those associated with utilizing existing petrochemical refining facilities.

Market landscape analysis revealed a preference for petrochemical-based sources due to their established infrastructure, reliable production processes, and cost advantages. Yet with an increased global focus on sustainability and environmental concerns, there has been increasing interest in exploring and potentially expanding bio-based sources as they develop technology that may address scaleability and cost issues and foster more competition between these sources.

Application Analysis

In 2023, the 1,3 propanediol market was notably steered by Polytrimethylene Terephthalate (PTT), commanding a significant market share of over 54.9%. PTT became important in making fabrics because it’s super stretchy, strong, and doesn’t wrinkle easily. People liked it a lot for making clothes, carpets, and furniture covers, making it the top choice in using 1,3 propanediol.

Another big use of 1,3 propanediol was in making something called Polyurethane. Polyurethane is handy because it’s strong and can be used in lots of things like building stuff, cars, and furniture. It’s good for making coatings, sticking things together, and foams.

Also, 1,3 propanediol became popular in personal care stuff. It’s good for the skin because it keeps it moist and friendly. That’s why it’s used in things like makeup, skincare products, and stuff for staying clean, showing it might grow even more in this area. 1,3 propanediol proved useful in creating eco-friendly detergents due to its eco-friendliness and ability to efficiently cleanse.

Thanks to its biodegradability and surfactant properties, 1,3 propanediol was an invaluable ingredient that enhanced cleaning power while being gentle on the environment – something which cemented its place as a key player in detergent manufacturing. As a result, 1,3 propanediol quickly established itself as an industry staple.

Polytrimethylene Terephthalate (PTT) was big in making textiles, showing how vital 1,3 propanediol is in this area. But 1,3 propanediol isn’t just about textiles; it’s versatile. It’s used in different things like polyurethane, personal care items, and detergents. This shows how it’s valuable and used widely, not just in making fabrics.

Note: Actual Numbers Might Vary In the Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Source

- Bio-based

- Petrochemical-based

By Application

- Polytrimethylene Terephthalate

- Polyurethane

- Personal Care

- Detergents

Drivers

The 1,3 propanediol market saw steady expansion due to several key drivers. Notable among them was rising textile industry demand due to Polytrimethylene Terephthalate’s (PTT) unique qualities – such as its resilience, resilience, and resistance against wrinkling – making it the go-to material for clothing manufacturing, carpets, and upholstery production.

1.3% propanediol’s versatility was also instrumental to market growth, particularly its use in producing Polyurethane, an insulation material with wide applications across sectors like construction, automotive manufacturing and furniture manufacturing due to its durability, elasticity and superb insulation properties. Polyurethane’s broad use fueled demand for 1,3 propanediol in these sectors which led to significant market expansion.

1.3% propanediol usage has also become a significant driver of personal care industry growth. Due to its moisturizing and soothing properties, this ingredient was widely used across cosmetics, skincare, and hygiene products. This trend fuelled its demand and market expansion within the personal care segment. Rising environmental awareness was an influential factor in driving market demand for 1,3 propanediol.

Its biodegradability and eco-friendliness resonated well with consumer concerns regarding environmental sustainability, leading to its adoption as an eco-friendly solution across industries. Continued innovations in production technologies and manufacturing processes have also contributed significantly to market expansion.

Innovations in producing 1,3 propanediol resulted in enhanced efficiency, meeting the growing demands across different applications. All these elements underscored its multidimensional significance – driving its widespread adoption across various industries.

Restraints

The 1,3 propanediol market faced several challenges that impeded its growth trajectory. One significant hurdle revolved around production costs, especially concerning bio-based sources. The initial investment and operational expenses, particularly in establishing bio-based production facilities, remained higher compared to petrochemical-based sources.

This cost disparity affected market competitiveness, hindering broader adoption and market expansion. Navigating diverse and evolving regulatory standards represented another constraint. Meeting stringent environmental and safety protocols demanded significant investments and adjustments from manufacturers. Compliance complexities added operational burdens, potentially limiting market growth due to the resources required to meet these varied regulatory standards.

Feedstock availability was an obstacle in bio-based 1,3 propanediol production. Relying on renewable feedstocks such as corn or sugar presented limitations due to variations in crop yields, geographical restrictions and concerns about competition with food sources – factors which inhibited consistent and scalable production of bio-based 1,3 propanediol.

The competitive landscape and the presence of alternative materials posed challenges. Substitutes offering similar properties and functionalities, alongside a plethora of competing materials, made it challenging to maintain market share and differentiate 1,3 propanediol within various industries, impacting its growth potential.

Technological limitations in scaling up bio-based production processes represented an additional hurdle. Advancements in technology to meet the growing market demands faced challenges, impacting the ability to effectively scale up bio-based production of 1,3 propanediol.

Addressing these challenges necessitated efforts in cost optimization, regulatory adaptation, securing reliable feedstock sources, fostering technological innovations, and effectively positioning 1,3 propanediol in a competitive market. Overcoming these restraints was critical to sustaining market growth and widening the adoption of 1,3 propanediol across diverse industries.

Opportunities

The 1,3 propanediol market revealed diverse opportunities for advancement and expansion. One significant avenue involved exploring alternative renewable feedstocks for bio-based production. Investigating non-food-based or waste-derived sources could enhance production sustainability and decrease reliance on limited agricultural resources, fostering a more robust and environmentally conscious production process.

Advancements in production technologies represent another great opportunity. Both petrochemical and bio-based production could benefit from innovations aimed at increasing efficiency, decreasing costs, and expanding scalability. By investing in technological development efforts, 1,3 propanediol could significantly become more competitively priced and therefore be adopted across industries more readily.

Strategic collaborations among industry stakeholders emerged as an opportunity. Partnerships among manufacturers, researchers and raw material suppliers could accelerate research, innovation and technological advancements; as well as collectively address challenges, foster innovation and accelerate market growth.

The exploration and expansion of 1,3 propanediol applications in emerging sectors presented noteworthy potential. Sectors such as renewable energy, pharmaceuticals, and bioplastics showcased promise due to the versatile nature of 1,3 propanediol. Its eco-friendly characteristics positioned it as a viable solution, opening avenues for diversification and market expansion into new industries.

The rising demand for sustainable and environmentally friendly products offered a significant opportunity. The biodegradable and eco-conscious attributes of 1,3 propanediol aligned perfectly with the growing consumer preference for sustainability. This emphasized the potential for increased adoption across industries seeking more eco-friendly solutions.

Unlocking untapped markets in developing regions proved highly fruitful, as their economic development and industrialization provided fertile grounds for 1,3 propanediol applications. Targeting such regions could open the doors to market expansion and growth opportunities.

Unlocking these opportunities required strategic investments, collaborative efforts, innovative approaches, and an emphasis on sustainability. Adopting these avenues could significantly advance growth and diversification across various industries and regions for 1,3 propanediol markets.

Challenges

The 1,3 propanediol market encountered a series of challenges that hindered its progress and widespread adoption. A significant hurdle was the production costs, especially evident in bio-based 1,3 propanediol. The higher initial investments and ongoing expenses associated with establishing bio-based production facilities posed significant barriers, often surpassing those of petrochemical-based sources.

These cost disparities impacted market competitiveness, constraining broader acceptance. Navigating the complex landscape of regulatory standards and compliance was another formidable challenge. Meeting stringent environmental and safety protocols demanded substantial investments and adaptations by manufacturers.

The varying and evolving compliance standards across different regions added complexity, potentially impeding market expansion due to the resources required to meet these varied regulations.

The availability and consistency of feedstock for bio-based 1,3 propanediol production presented constraints. Dependence on renewable feedstocks faced limitations due to variations in crop yields, geographical dependencies, and concerns regarding competition with food sources.

These factors impeded the consistent and scalable production of bio-based 1,3 propanediol, affecting its market penetration. The competitive landscape posed challenges. The presence of alternative materials and substitutes within similar applications created stiff competition.

Comparable alternatives and a multitude of competing materials made it challenging to maintain market share and distinguish 1,3 propanediol within various industries, impacting its growth potential.

Technological limitations in scaling up bio-based production processes hindered market growth. Advancements in technology to meet the rising market demands faced challenges, impacting the ability to effectively scale up the production of bio-based 1,3 propanediol.

Overcoming these challenges necessitated concerted efforts in cost optimization, regulatory adaptation, securing reliable feedstock sources, fostering technological innovations, and effectively positioning 1,3 propanediol in a competitive market. Addressing these restraints was crucial to sustaining market growth and broadening the adoption of 1,3 propanediol across diverse industries.

Regional Analysis

North America held the highest revenue share at over 36.3% in 2023. The region accounted for approximately three-quarters of global consumption. The fastest growth rates are expected to be experienced in emerging markets like Central & South America and the Asia Pacific during the forecast period.

China, India, and Brazil are expected to lead regional market growth. China, Brazil, and Russia are all taking strenuous steps to reduce fossil fuel dependency and promote biodiesel production. These countries have favorable regulations and mandates for biodiesel production. This will help the market and contribute to higher glycerol levels.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The 1,3 PDO market is oligopolistic and is controlled by a few producers. DuPont has dominated the global production scene for many years. Companies have developed their production methods, which has resulted in a low- to medium amount of white space. Shell Chemicals LP uses ethylene oxide as its method. DuPont Tate & Lyle developed their corn syrup method.

To capture the expanding market in emerging markets, companies have participated in mergers and acquisitions. This industry is undergoing product development and capacity escalation. Low white space and large initial investments required to create new proprietary methods make it difficult to see new entrants. To gain access to the 1,3 PDO market, new players are forming partnerships with established players. Metabolic Explorer, a French producer licensed its 1,3 production process to S.K Chemicals.

Маrkеt Кеу Рlауеrѕ

- DuPont Tate & Lyle

- Metabolic Explorer

- Zhangjiagang Glory Biomaterial Co. Ltd

- Zouping Mingxing Chemical Co., Ltd.

- Shell Chemicals LP

- Merck KGgA

- Sheng Hong Group Holdings Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Primient

- Haihang Industry

- Other Key Players

Recent Developments

2023 DuPont: Announced plans to expand its bio-PDO production capacity in the US by 50%. This move aims to meet the rising demand for PDO in North America.

Report Scope

Report Features Description Market Value (2023) USD 785.78 Mn Forecast Revenue (2032) USD 1983.2 Mn CAGR (2023-2032) 9.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source(Bio-based, Petrochemical-based), By Application (Polytrimethylene Terephthalate, Polyurethane, Personal Care, Detergents ) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape DuPont Tate & Lyle, Metabolic Explorer, Zhangjiagang Glory Biomaterial Co. Ltd, Zouping Mingxing Chemical Co., Ltd., Shell Chemicals LP, Merck KGgA, Sheng Hong Group Holdings Ltd., Tokyo Chemical Industry Co., Ltd., Primient, Haihang Industry, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is 1,3 propanediol (PDO)?1,3 propanediol, commonly referred to as PDO, is a colorless and odorless organic compound primarily used as a chemical intermediate in various industries. It is produced through biological or petrochemical routes and serves as a building block for polymers, cosmetics, pharmaceuticals, and more.

What drives the growth of the 1,3 propanediol market?- Increasing demand for eco-friendly and sustainable materials in various industries.

- Technological advancements leading to the development of bio-based PDO from renewable resources.

- Growing awareness about the advantages of 1,3 propanediol, such as its biodegradability and non-toxic nature.

What are the emerging trends in the 1,3 propanediol market?- Advancements in biotechnological processes for bio-based PDO production.

- Expansion of applications beyond textiles and cosmetics into new industries like automotive and packaging.

- Increased emphasis on circular economy models and recyclability of PDO-based materials.

-

-

- DuPont Tate & Lyle

- Metabolic Explorer

- Zhangjiagang Glory Biomaterial Co. Ltd

- Zouping Mingxing Chemical Co., Ltd.

- Shell Chemicals LP

- Merck KGgA

- Sheng Hong Group Holdings Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Primient

- Haihang Industry

- Other Key Players