Quick Navigation

Overview

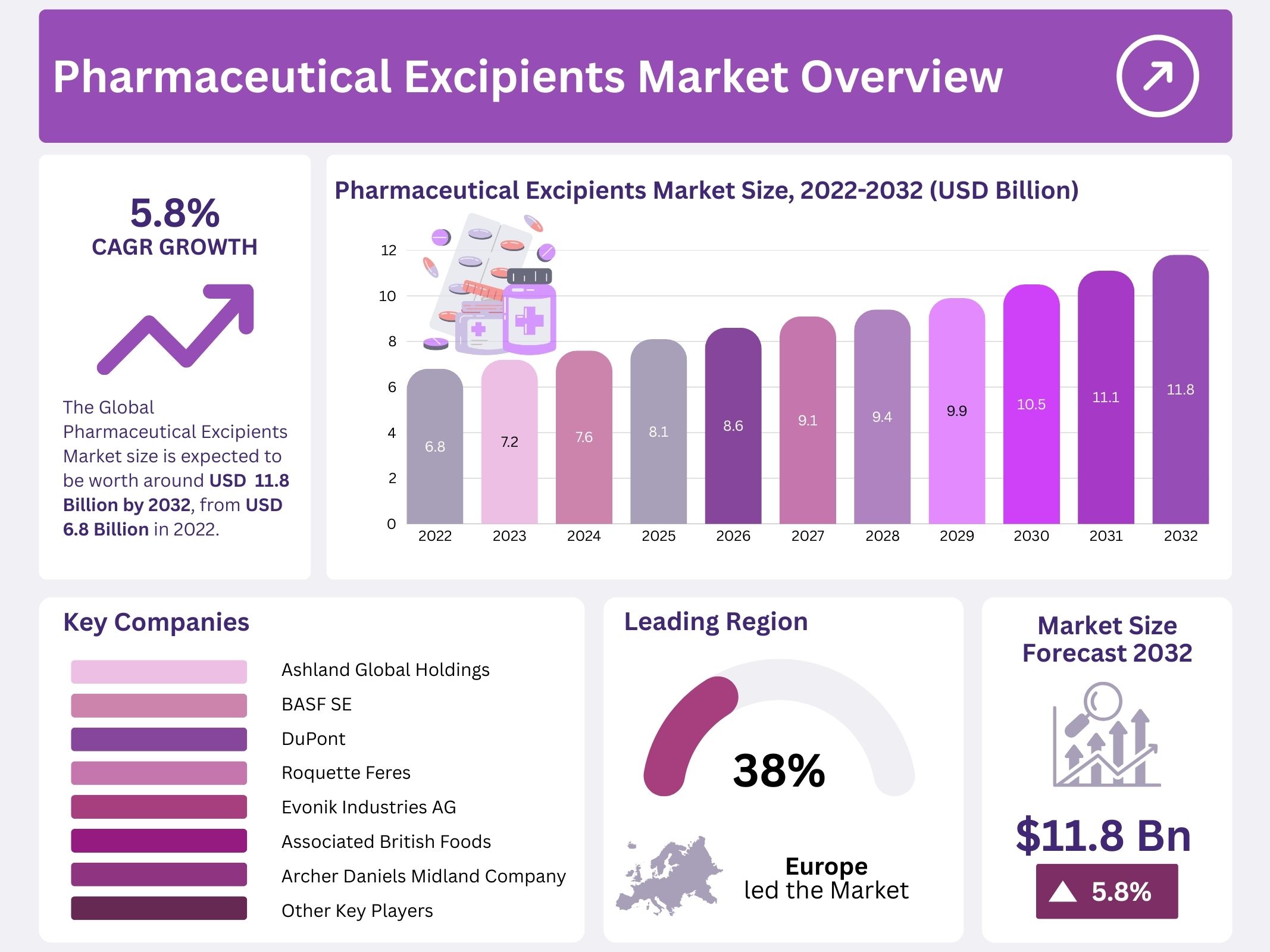

The Global Pharmaceutical Excipients Market is projected to grow from USD 6.8 billion in 2022 to USD 11.8 billion by 2032, expanding at a CAGR of 5.8%. Growth is driven by the rising consumption of pharmaceutical formulations worldwide. Excipients are critical in drug development, ensuring drug stability, solubility, and bioavailability. The increasing prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular disorders, continues to raise demand for oral, injectable, and innovative drug delivery systems.

The expansion of the generic drug market is another major driver. Patent expirations of several branded drugs have accelerated the production of low-cost generics. Excipients are essential to replicate therapeutic performance in these formulations. This trend is most prominent in emerging economies where affordability and accessibility to medicines are critical. Growing generic penetration directly translates into higher excipient demand.

Innovation in drug delivery systems is creating opportunities for excipient manufacturers. Controlled-release, orally disintegrating tablets, and nano-formulations require advanced excipients. The growing preference for patient-friendly dosage forms, combined with increasing investment in biopharmaceutical R&D, has strengthened the need for functional and multifunctional excipients. The rise of biologics and biosimilars also requires specialized stabilizers, solubilizers, and cryoprotectants, further boosting excipient consumption.

Supportive regulations and outsourcing trends are reinforcing market expansion. Regulatory harmonization across the U.S., Europe, and Asia-Pacific is improving excipient approvals, while quality standards are encouraging adoption of high-purity products. Simultaneously, pharmaceutical companies are increasingly relying on contract manufacturing organizations. This shift requires standardized excipients with consistent quality to maintain compliance and support large-scale drug production.

Emerging markets and technological advancements add further momentum. Rising healthcare spending and infrastructure growth in Asia-Pacific, Latin America, and the Middle East are increasing demand, particularly for oral solid dosage forms. Meanwhile, innovations in co-processed and multifunctional excipients are improving drug stability, reducing production steps, and optimizing costs. These developments position excipients as indispensable in the evolving pharmaceutical landscape, ensuring both therapeutic effectiveness and manufacturing efficiency.

Key Takeaways

- The global pharmaceutical excipients market is projected to reach approximately USD 11.8 billion by 2032, showcasing significant long-term expansion potential.

- In 2022, the market value was USD 6.8 billion, marking a strong foundation for the industry’s projected future growth trajectory.

- Expansion is expected to be driven by a compound annual growth rate (CAGR) of 5.8% during the forecast period 2022–2032.

- By product type, organic chemicals dominated the market in 2022 due to their efficiency, stability, and safe, non-toxic characteristics.

- By formulation type, oral formulations led the market share in 2022 because of their widespread advantages and effectiveness in treating multiple diseases.

- By functionality type, fillers and diluents held the largest market share, attributed to their indispensable role in manufacturing tablets and capsules.

- Regionally, Europe dominated the market in 2022, accounting for over 38% of the global pharmaceutical excipients revenue share.

- The Asia-Pacific region is anticipated to register the fastest growth rate during the forecast period, supported by rising healthcare demand and industrial expansion.

Regional Analysis

Europe held the largest share in the global pharmaceutical excipients market in 2022, accounting for 38% of the total revenue. The dominance of this region can be attributed to the robust healthcare industry, which continues to expand. Supportive government schemes aimed at reducing drug prices have also contributed to strengthening demand for excipients. In addition, increasing investments in biologics research and innovative dosage form developments have supported the regional growth trajectory, ensuring Europe’s consistent leadership in this market.

The pharmaceutical excipients market in Europe has been further enhanced by the rising demand for newly developed excipients. Such excipients play a crucial role in the advancement of drug formulation and delivery methods. As pharmaceutical companies in the region continue to innovate, the dependency on excipients to improve safety, stability, and effectiveness of drugs has intensified. This rising demand directly contributes to the growth of the healthcare sector in Europe, creating a favorable environment for future market expansion.

In contrast, the Asia-Pacific region is projected to witness the fastest growth in the pharmaceutical excipients market during the forecast period. The presence of a large and low-cost workforce has positioned the region as a preferred hub for pharmaceutical manufacturing. Additionally, the availability of raw materials at comparatively lower costs provides a competitive advantage. These structural benefits have encouraged multinational players to expand operations in Asia-Pacific, thereby accelerating the region’s contribution to the global pharmaceutical excipients industry.

Countries such as India and China are expected to emerge as key growth engines within the Asia-Pacific market. Both nations have well-established pharmaceutical manufacturing bases, supported by rising healthcare demand and significant government investment in life sciences. The expanding contract manufacturing and research services further add to the attractiveness of these markets. With their large populations, growing disease burden, and increasing affordability of medicines, India and China are likely to capture substantial market share, supporting Asia-Pacific’s rapid expansion in this sector.

Segmentation Analysis

Product Type Analysis

The pharmaceutical excipients market by product type is dominated by organic chemicals. These include proteins, carbohydrates, petrochemicals, and oleo chemicals. Their non-toxic nature and efficiency drive widespread usage in pharmaceutical formulations. Drug manufacturers favor organic excipients to enhance safety and effectiveness in final products. This growing demand significantly supports overall market sales. As pharmaceutical innovation advances, the reliance on organic chemicals is expected to rise, further strengthening their dominant position in the global excipients market.

Formulation Type Analysis

In terms of formulation type, oral formulations account for the largest market share. Capsules, tablets, liquids, and other dosage forms fall under this category. Oral formulations are widely preferred due to their ease of consumption and effectiveness in treating diseases. During the COVID-19 pandemic, the demand for oral antiviral drugs increased sharply, driving growth in this segment. Tablets remain a key dosage form as they are less intrusive and more convenient. This trend continues to push market expansion globally, supported by growing healthcare needs.

Functionality Type Analysis

By functionality, fillers and diluents dominate the market. These excipients are essential in the production of capsules and tablets, ensuring proper dosage and stability. Their role in maintaining formulation quality makes them indispensable in drug manufacturing. High demand for solid dosage forms has accelerated the usage of fillers and diluents. These excipients simplify manufacturing processes and improve patient compliance by providing consistent drug delivery. Their critical applications ensure that this segment holds the largest share within the global pharmaceutical excipients market.

Key Players Analysis

The pharmaceutical excipients market is shaped by a strong presence of global players with operations in multiple regions. Companies such as Ashland Global Holdings, International Flavors & Fragrances, and FMC Corporation hold a significant market presence in the United States. In Europe, Germany remains a hub for excipient manufacturing, led by BASF SE and Evonik Industries AG. France is represented by Roquette Frères, which plays a vital role in starch-based excipients. These companies dominate the market through established distribution networks and consistent product innovation.

BASF SE, Evonik Industries, and Ashland Global Holdings are recognized for their extensive product portfolios in polymers, binders, and solubilizers. Their strong R&D investments drive innovation in excipient functionalities, such as improved drug delivery systems. The dominance of these players is attributed to their collaborations with pharmaceutical companies and expansion into emerging markets. They leverage advanced technologies and regulatory expertise to strengthen their competitive advantage, enabling them to cater to rising demand in oral, topical, and parenteral formulations worldwide.

Other leading players such as DuPont, Associated British Foods, and Archer Daniels Midland Company contribute significantly with their expertise in carbohydrate-based excipients, emulsifiers, and stabilizers. Lubrizol Corporation and Kerry Group add to the competition through their specialized polymer and coating solutions. Croda International PLC supports the market with excipients focused on improved solubility and stability. Together, these firms maintain a diversified supply base, ensuring reliability and quality compliance. Their presence addresses stringent pharmaceutical standards and strengthens global supply chain resilience.

Roquette Frères, known for its plant-based excipients, and FMC Corporation, focusing on cellulose derivatives, continue to capture growing demand for natural and functional excipients. The competition is marked by mergers, acquisitions, and partnerships aimed at strengthening regional penetration and expanding product offerings. Additionally, other key players contribute to the fragmented yet competitive landscape. Continuous innovation in excipient functionality, alongside adherence to regulatory frameworks, positions these companies as central to the growth of the pharmaceutical excipients market across developed and emerging economies.

Market Key Players

- Ashland Global Holdings

- BASF SE

- DuPont

- Roquette Feres

- Evonik Industries AG

- Associated British Foods

- Archer Daniels Midland Company

- Lubrizol Corporation

- Kerry Group

- Croda International PLC

- Roquette Frères

- FMC Corporation

- Other Key Players

Conclusion

The pharmaceutical excipients market is expected to show steady growth as demand for effective and safe drug formulations continues to rise. The market is shaped by growing generic production, increasing use of advanced drug delivery systems, and higher investments in biopharmaceutical research. Excipients play a critical role in improving drug stability, safety, and performance, making them essential across oral, injectable, and innovative formulations. Strong presence of leading global players, coupled with growing opportunities in emerging regions, ensures long-term development. With rising healthcare needs, regulatory support, and ongoing innovation in excipient functionality, the market will remain a vital part of the evolving pharmaceutical industry worldwide.

Get in Touch with Us:

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

Excipients Market || Pharma Excipients Market || Sustained Release Excipients Market || Enteral Feeding Formulas Market || Biopharmaceuticals Market || Biosimilars Market || Specialty Generics Market || Specialty Pharmaceutical market || Specialty PACS Market || Specialty Generics Market || Generic Pharmaceuticals Market || Generic Drugs Market || Generic Sterile Injectable Market