Quick Navigation

Overview

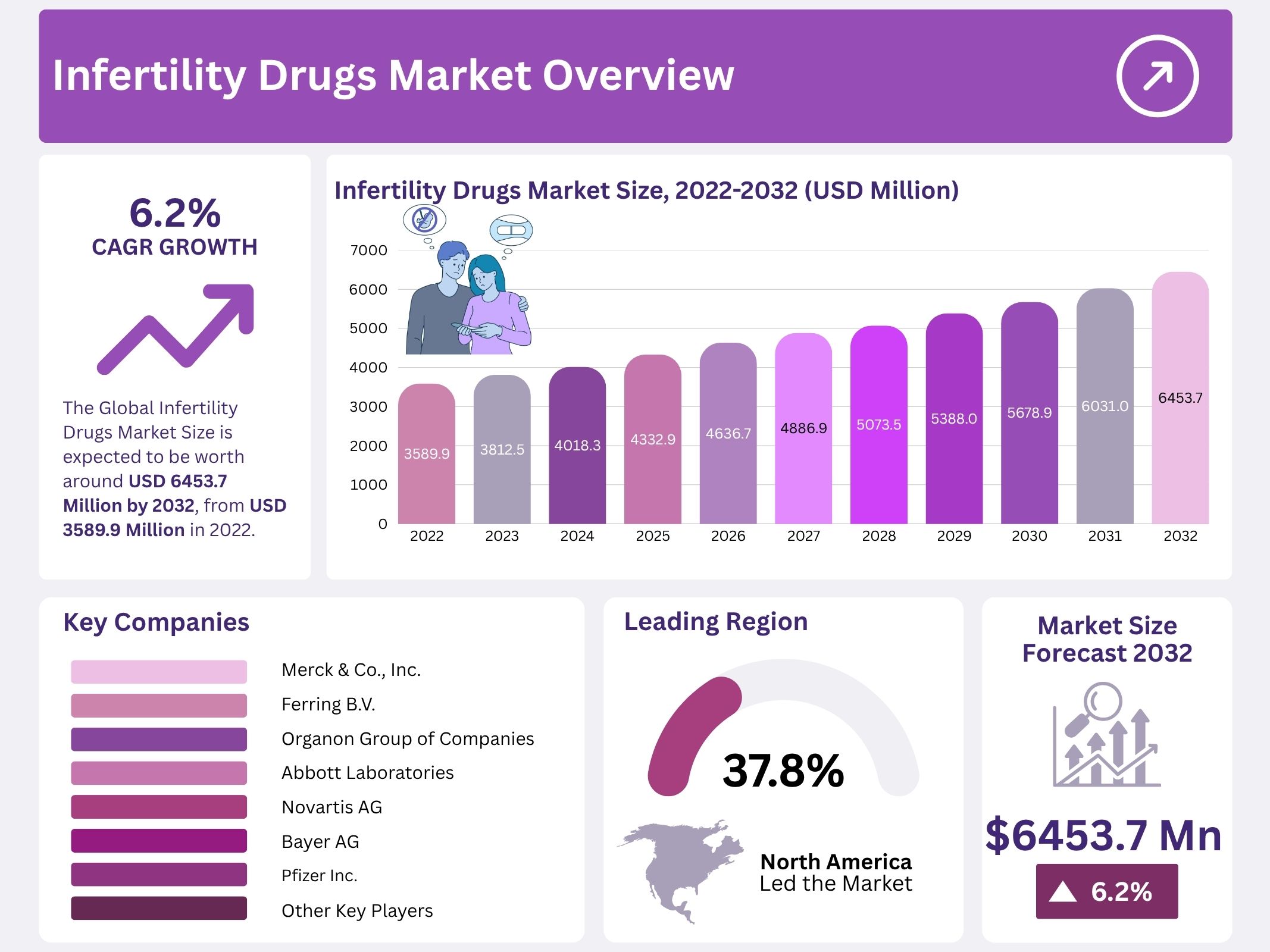

The Global Infertility Drugs Market is projected to reach USD 6453.7 million by 2032, rising from USD 3589.97 million in 2022. A CAGR of 6.2% is anticipated during 2022–2032. The expansion of this market can be attributed to a sustained rise in infertility rates and greater access to fertility care. Growing interest in reproductive health, combined with changing family planning trends, has supported demand for pharmacological therapies. Increasing willingness to seek medical interventions and improved affordability in many regions have strengthened the long-term growth outlook for infertility medications across key patient populations.

Infertility prevalence has risen steadily due to delayed childbearing, lifestyle changes, and health conditions affecting reproductive function. Higher cases of hormonal imbalance, obesity, and stress-related disorders continue to influence fertility health worldwide. As infertility affects more individuals of reproductive age, demand for treatment options grows. Ovulation-inducing drugs, hormonal therapies, and gonadotropins are experiencing higher adoption rates. The need for effective pharmacological support in treatment pathways has strengthened the commercial potential of infertility drugs and fostered consistent market expansion.

Awareness and acceptance of fertility treatments have increased through health campaigns, digital platforms, and educational initiatives. Reduced social stigma and improved access to reproductive health information have encouraged earlier diagnosis and timely treatment. Couples and individuals are showing greater readiness to pursue clinical interventions. Fertility therapies supported by medication are gaining wider usage as medical professionals emphasize early care pathways. This shift toward proactive treatment decisions has enhanced medication demand and reinforced a supportive market environment for drug manufacturers.

Technological advancements in assisted reproductive technology (ART) have substantially contributed to drug demand. Innovations in in-vitro fertilization (IVF), intrauterine insemination (IUI), and controlled ovarian stimulation protocols require effective pharmaceutical support. Higher success rates of ART cycles are closely tied to optimized drug regimens, encouraging continuous development of advanced hormonal formulations. Expansion of fertility centers and reproductive hospitals also improves infrastructure availability, enabling better patient evaluation and treatment access. These advances are expected to continue driving clinical adoption and market growth.

Government initiatives and private sector investments are improving access to fertility care. Subsidies, insurance coverage programs, and reproductive health policies have supported affordability in several regions. Investment in fertility service networks and drug development pipelines has strengthened market readiness. Rising focus on women’s health, particularly related to conditions such as polycystic ovary syndrome (PCOS) and age-related infertility, has increased therapy demand. Favorable healthcare reforms and innovation-led growth strategies are expected to sustain strong momentum in the infertility drugs market throughout the forecast period.

Key Takeaways

- The market for infertility drugs was reported to be expanding steadily, projected to grow at 6.2% CAGR and reach nearly USD 6.45 billion by 2032.

- Gonadotropins were highlighted as the leading drug class, supported by an estimated 8.2% CAGR, attributed to their strong clinical effectiveness in fertility treatment.

- Aromatase inhibitors were observed experiencing rising adoption, growing at a 7.4% CAGR in 2022, driven by favorable success rates and clinical outcomes.

- Hospital pharmacies were identified as the primary distribution channel, capturing 53.4% share and showing an 8.9% CAGR, reflecting patient preference for specialist care settings.

- Online and other pharmacy channels were described as expanding steadily, holding 37.6% market share with a 7.2% CAGR, supported by increasing digital healthcare access.

- Female patients represented the predominant user group, accounting for 74.6% market share and registering an 8.3% CAGR in 2022, aligned with treatment demand patterns.

- The women’s treatment segment was identified as the fastest‐growing category, expected to maintain strong momentum with projected high CAGR during 2022–2031.

- Infertility was reported to affect approximately 48 million couples and 186 million individuals globally, emphasizing significant unmet reproductive healthcare needs.

- North America was recognized as the leading regional market, securing 37.8% share and demonstrating a 7.2% CAGR, underpinned by advanced healthcare infrastructure.

- Asia Pacific was cited as the fastest‐growing regional market, forecast to achieve a 6.8% CAGR, supported by rising fertility treatment adoption and healthcare investments.

Regional Analysis

North America held the largest share of revenue in the infertility drugs market in 2022. A share of about 37.8% was recorded. Growth in the region has been supported by a rise in infertility rates among both men and women. Advanced healthcare infrastructure has also supported increasing treatment adoption. Ongoing product launches and rapid availability of fertility medicines have strengthened market penetration. Investments in research focused on reproductive health have grown steadily. Supportive reimbursement systems and rising awareness are further stimulating regional demand.

Market expansion in North America is expected to continue over the forecast period. A CAGR of about 7.2% has been projected. Rising collaboration among pharmaceutical companies and research organizations has contributed to innovation in treatment options. For example, a four-year agreement between Ferring B.V. and Igenomix has targeted pregnancy-related treatment development. Clinical studies addressing reproductive disorders are increasing. Higher infertility diagnosis rates and expanding access to fertility clinics are anticipated to sustain long-term demand for infertility drugs.

Asia Pacific has been identified as the fastest-growing region during the forecast horizon. A CAGR of approximately 6.8% has been forecast. Major market players have introduced new fertility drugs and expanded commercial footprints in the region. Improvements in healthcare spending and better access to infertility treatments are driving adoption. Government support programs and favorable healthcare reforms have enabled a wider use of reproductive medicines. Growing awareness about reproductive health and changing lifestyle conditions are also contributing factors. The region shows strong potential for commercial expansion.

Regulatory approval activities in Asia Pacific have strengthened market prospects. Authorities in Japan approved an additional twelve infertility therapies. Among them were Letrozole from Novartis AG and Cabaser from Pfizer. These label expansion decisions have increased drug accessibility and are likely to boost treatment uptake. The supportive regulatory environment has promoted innovation in fertility care. An increasing number of couples seeking medical help for conception is enhancing market growth. Continued investments by global pharmaceutical companies are expected to support sustained regional momentum.

Segmentation Analysis

The gonadotropins segment has been identified as the most lucrative drug class in the infertility drugs market. Strong adoption is driven by higher success rates in ovulation stimulation and conception outcomes. Premium brands such as Gonal-F, Follistim, and Menopur are widely prescribed, and their clinical effectiveness has supported a projected CAGR of 8.2%. Higher treatment costs have not hindered uptake, as strong therapeutic performance has encouraged recurring use and attracted new patients. As a result, revenue generation remains strong in this segment.

The aromatase inhibitors segment has been observed as the fastest-growing drug class category in the infertility drugs market. This segment held about 28.3% share in 2022 and is projected to expand at a CAGR of 7.4% during the forecast period. Demand has risen due to favorable success rates in inducing ovulation and supporting conception. Improved pregnancy outcomes and fewer side effects compared to alternative therapies have further supported adoption. These advantages are expected to maintain strong momentum across global markets.

The hospital pharmacy segment has been recorded as the leading distribution channel for infertility drugs, with a 53.4% share and an estimated CAGR of 8.9%. Strong patient traffic in hospital facilities and the presence of specialized fertility units support this dominance. Clinical oversight, medication monitoring, and immediate access to fertility treatment services further enhance prescription volumes. Other pharmacy channels, including online platforms, are expanding at a CAGR of 7.2% due to increased patient privacy needs, digital pharmacy penetration, and strategic partnerships with fertility care providers.

The women segment accounted for the major share in the infertility drugs market, with 74.6% revenue contribution and an expected CAGR of 8.3% through the forecast period. Rising infertility prevalence, lifestyle-related reproductive challenges, and increasing cases of PCOS, thyroid disorders, and ovarian-related conditions have elevated demand for treatment solutions among women. Sedentary lifestyles, delayed childbearing trends, and increased awareness of fertility support therapies are expected to sustain strong market growth, making women the most prominent and fastest-growing end-user group.

Key Market Segments

Based on Drug Class

- Gonadotropins

- Aromatase Inhibitors

- Selective Estrogen Receptor Modulators (SERMs)

- Dopamine Agonists

- Other Class

Based on Distribution Channel

- Hospital Pharmacy

- Speciality & Retail Pharmacy

- Other Distribution Channels

By End-User

- Men

- Women

Key Players Analysis

The infertility drugs market has been shaped by advanced reproductive technologies and strong investment in fertility care. Innovation in hormonal therapies and ovarian stimulation medicines has supported treatment outcomes. A diversified product portfolio is seen across leading firms, with strategies focused on global patient access and clinical effectiveness. Continuous research into improved IVF success rates and patient-friendly drug delivery systems has strengthened competitive positioning. Key players with broad experience in reproductive health remain essential to market leadership, supported by specialized manufacturing and targeted therapy pipelines.

Established pharmaceutical groups have played a central role by providing proven fertility medicines. Major contributors offer leading hormone therapies for controlled ovarian stimulation and ovulation induction. Merck KGaA and Organon Group of Companies provide widely used fertility drugs, while Abbott Laboratories and Novartis AG support advanced reproductive treatment programs. Bayer AG and Pfizer Inc. maintain strong positions through continued development efforts and robust product safety standards within regulated fertility care environments.

The competitive landscape also includes biotechnology companies and reproductive medicine specialists. These firms supply critical solutions for assisted reproductive technologies and laboratory-grade reproductive products. Ferring Pharmaceuticals and Teva Pharmaceutical Industries Ltd. offer therapeutic formulations for hormonal support. Vitrolife and Irvine Scientific supply IVF media and laboratory consumables used in embryo culture and sperm preparation. Cook Medical provides specialized devices for ART procedures. Their contributions enhance treatment precision and clinical outcomes across fertility clinics globally.

Emerging players and regional contributors strengthen accessibility, especially in fast-growing fertility hubs. Mankind Pharma Ltd. demonstrates expanding reach across developing markets with competitive fertility drug portfolios. Genea Biomedx supports technological progress by offering culture systems and IVF lab equipment that improve embryo development environments. Sanofi S.A. continues to advance reproductive therapeutics with extensive research capabilities. Collectively, these companies support rising demand for infertility treatments, strengthen market competition, and encourage the adoption of modern reproductive care practices to address global fertility challenges.

Market Key Players

- Merck & Co., Inc.

- Ferring B.V.

- Organon Group of Companies

- Abbott Laboratories

- Novartis AG

- Bayer AG

- Pfizer Inc.

- Mankind Pharma Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sanofi S.A.

- Other Key Players

Conclusion

The infertility drugs market is expected to remain on a steady growth path, supported by rising infertility cases and greater acceptance of fertility care worldwide. Demand has been strengthened by lifestyle shifts, delayed parenthood, and improved awareness of reproductive health. Advancements in treatment technologies and wider availability of assisted reproductive services continue to encourage use of medication-based therapies. Supportive healthcare policies and investment in reproductive research also assist market expansion. Strong participation from global pharmaceutical companies, alongside increasing access to specialist fertility centers, is expected to maintain momentum. Continued focus on innovation and patient access is likely to support long-term market stability and development.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

Infertility Services Market || Infertility Treatment Market || Fertility Supplements Market || Reproductive Genetics Market || Assisted Reproductive Technology Market || IVD Raw Materials Market || Donor Egg IVF Market || IVF Devices And Consumables Market || In Vitro Fertilization Market