The healthcare BPO market is moving toward strong and steady growth as healthcare providers and payers increasingly depend on outsourcing to reduce costs and improve efficiency. The demand is supported by rising healthcare spending, complex regulations, and the adoption of advanced technologies like AI, automation, and analytics. BPO partners are becoming vital for ensuring compliance, improving revenue cycle management, and supporting the shift to value-based care. Growth opportunities are further enhanced by expanding insurance markets, globalization, and the need for specialized services. With a competitive environment shaped by both global leaders and regional players, outsourcing remains a strategic pillar in modern healthcare operations.

Quick Navigation

Overview

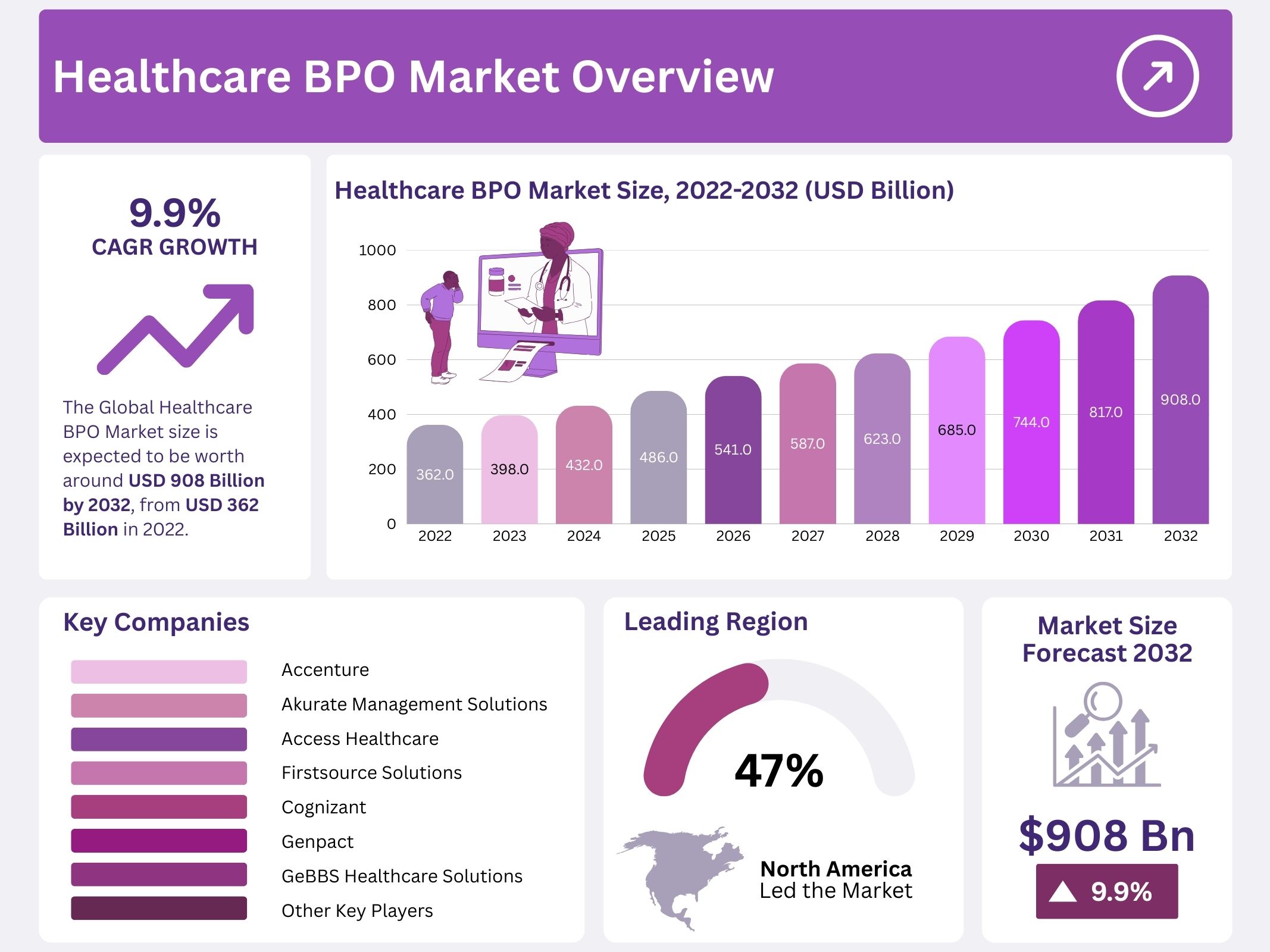

The global healthcare BPO market was valued at USD 362 billion in 2022. It is expected to reach nearly USD 908 billion by 2032, growing at a CAGR of 9.9%. This growth is supported by rising healthcare expenditure and the need for cost efficiency. Outsourcing has become an effective way for healthcare providers and payers to manage operations. Services such as billing, claims processing, and revenue cycle management are increasingly outsourced to reduce financial pressure while focusing on patient-centric care.

The industry faces complex regulatory requirements, such as HIPAA in the United States and GDPR in Europe. Frequent policy updates create operational challenges. Healthcare organizations are turning to outsourcing partners with strong compliance expertise to reduce risks. Specialized BPO providers ensure adherence to international standards, minimizing penalties and legal costs. This ability to navigate regulatory complexity positions BPO providers as trusted partners in risk management and compliance-driven operations across healthcare systems globally.

Cost reduction remains a central factor driving outsourcing demand. Rising administrative and operational expenses push healthcare providers to adopt external solutions. BPO partners deliver standardized processes and economies of scale. Advanced technologies, including automation and analytics, allow them to improve efficiency without compromising service quality. By leveraging outsourcing, healthcare organizations achieve measurable savings while maintaining patient care outcomes. This pressure to lower costs while handling complex functions ensures long-term adoption of BPO models.

Technological progress has significantly enhanced healthcare outsourcing services. Tools such as artificial intelligence (AI), robotic process automation (RPA), cloud computing, and big data analytics are transforming workflows. These innovations improve fraud detection, enhance claims accuracy, and optimize patient engagement. The adoption of technology-driven outsourcing solutions has become central to operational efficiency. Healthcare BPO providers are leveraging these tools to offer faster, more reliable, and cost-effective services, thereby making them indispensable in modern healthcare delivery.

Emerging Trends and Opportunities in Healthcare BPO

The focus on core healthcare functions has accelerated outsourcing growth. Providers now delegate non-core tasks such as payroll, customer support, and billing to external experts. This approach allows hospitals and clinics to dedicate more resources to patient care. By transferring repetitive back-office processes, organizations enhance efficiency and improve patient satisfaction. The outsourcing trend reflects the increasing priority given to specialized service partners who can manage administrative workloads with precision.

Insurance sector expansion is another factor supporting market growth. Emerging economies are extending insurance coverage, while developed markets deal with complex claims management. This has created demand for BPO services in claims adjudication, policy administration, and customer engagement. As insurers face rising operational complexity, outsourcing partnerships help them achieve scalability and efficiency. BPO providers are now playing an essential role in enabling insurance companies to manage vast volumes of claims and ensure seamless policyholder services.

The shift from volume-based to value-based care models is reshaping healthcare operations. Providers must now demonstrate outcomes rather than service volume. This requires advanced analytics and outcome tracking, which many organizations lack internally. BPO providers deliver expertise in data analysis and reimbursement systems, helping organizations adjust to these models. Their services ensure smooth adaptation to value-based frameworks, enabling improved patient outcomes while meeting evolving payment standards. This shift enhances the strategic importance of outsourcing partners in healthcare reform.

Globalization and patient data growth further stimulate outsourcing demand. Offshore centers in countries such as India and the Philippines provide skilled professionals at reduced costs. Meanwhile, rising use of electronic health records, telemedicine, and wearable devices has expanded patient data volumes. BPO providers specializing in data management and analytics are essential for compliance and insight generation. Additionally, globalization has created demand for multilingual support in call centers, transcription, and scheduling. This broad service scope ensures the long-term relevance of healthcare BPO solutions.

Key Takeaways

- The Provider Service sector was identified as the revenue frontrunner, maintaining dominance across the forecast period from 2023 to 2032.

- Within payer services, claim management service emerged as the strongest performer, showcasing the highest CAGR between 2023 and 2032.

- In pharmaceutical services, the research and development segment gained prominence, positioned to deliver remarkable growth throughout the projected forecast period.

- North America commanded leadership in 2022, securing 47% of the market revenue share, the highest among all regions globally.

- Europe sustained its relevance in 2022 by accounting for 25% of the overall revenue share across the healthcare services market.

- Asia-Pacific is anticipated to outpace other regions, expected to achieve the fastest CAGR growth rate between 2023 and 2032.

Regional Analysis

North America is anticipated to hold the largest share in the healthcare BPO market. The growth in this region can be attributed to the presence of a strong base of healthcare BPO service providers, particularly in the United States. The US is recognized as the most desirable destination for these services, supported by its advanced healthcare infrastructure and technology adoption. The large populace that benefits from healthcare outsourcing further strengthens the region’s position as a leader in the global healthcare BPO market.

Europe is expected to represent the second-largest market for healthcare BPO services. The region benefits from well-established healthcare systems and structured government support. Countries such as the UK, Germany, and France are expected to play a major role in driving growth across Europe. These nations are investing in healthcare technology and outsourcing solutions, enabling efficient service delivery. As a result, Europe is positioned to maintain a significant presence in the market, following closely behind North America.

The Asia Pacific region is projected to witness the fastest growth in the healthcare BPO market. This growth is supported by a large pool of potential customers in countries such as India, China, Japan, and South Korea. Rising demand for cost-effective healthcare solutions and expanding medical facilities are key drivers in the region. Meanwhile, the Rest of the World is anticipated to capture a smaller share. However, markets in the Middle East are likely to grow quickly, supported by increasing awareness and demand for healthcare outsourcing services.

Segmentation Analysis

The global healthcare BPO market by provider services is dominated by the revenue cycle management (RCM) segment. RCM helps healthcare organizations reduce payment delays, manage operating costs, and enhance cash flow. It includes processes such as billing, coding, claims management, patient collections, and accounts receivable. Patient enrolment services, such as registration, eligibility verification, and insurance authorization, further support healthcare efficiency. These services improve financial performance and streamline administrative operations, which in turn contribute to better patient experiences and improved care outcomes.

Payer service analysis shows that claims management has been the largest and fastest-growing segment between 2023 and 2032. Claims management involves claims processing, adjudication, and denial management while ensuring accurate payments through coordination with providers and third-party companies. Other payer services include product development business acquisition (PDBA), member management, and provider management. Care management, billing, and accounts services also play key roles. The growth of claims management is driven by rising insurance enrollments, demand for error-free transactions, and operational efficiency in healthcare.

The pharmaceutical services segment highlights research and development (R&D) as a leading contributor to market growth. This segment includes drug discovery, drug development, and clinical trials. Rising demand for innovative medications and vaccines, particularly after COVID-19, has driven R&D outsourcing. Manufacturing services such as packaging, logistics, and distribution also support the healthcare BPO sector. Non-clinical services, including regulatory compliance, sales, and marketing, further contribute to efficiency. Increased outsourcing in R&D is expected to sustain growth, as pharmaceutical companies aim to reduce costs and accelerate time-to-market for new therapies.

Key Players Analysis

The global healthcare BPO market is dominated by leading companies such as Accenture, Cognizant, Genpact, Wipro, Capgemini, TCS, IBM, HP, Dell, and HCL Technologies. Accenture holds a strong position in the US and European markets. Its services include revenue cycle management, medical billing, and clinical data management. Cognizant also captures a major market share with diversified healthcare services. Genpact has a notable presence in the Asia-Pacific region. It specializes in healthcare services such as medical coding, claims processing, and billing operations.

The market remains highly competitive and fragmented due to the presence of many local and regional players. Intense rivalry arises from established brands with strong networks and recognition. To enhance market positions, leading companies have adopted strategic initiatives such as partnerships, product launches, and expansion programs. These strategies allow them to increase product visibility and expand customer reach. As competition continues to intensify, innovation and service diversification remain key focus areas for global healthcare BPO leaders.

Market Key Players

- Accenture

- Akurate Management Solutions

- Access Healthcare

- Firstsource Solutions

- Cognizant

- Genpact

- GeBBS Healthcare Solutions

- Wipro

- HCL Technologies

- IQVIA

- Mphasis

- NTT Data Corporation

- Sykes Enterprises

- IBM Corporation

- Infosys BPM

- Invensis Technologies

- Lonza

- Omega Healthcare

- Parexel International

- R1 RCM

- Sutherland Global

- WNS (Holdings) Limited

- Xerox Corporation

- Tata Consultancy Services

- UnitedHealth Group

Conclusion

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

Smart Healthcare Market || Healthcare CRM Market || Healthcare Business Intelligence Market || Generative AI in Healthcare Market || Healthcare Information Systems Market || Metaverse in Healthcare Market || Digital Twins in Healthcare Market || 5g In Healthcare Market || Big Data in Healthcare Market || AI In Healthcare Market