Water and Wastewater Pipe Market Infographics Description

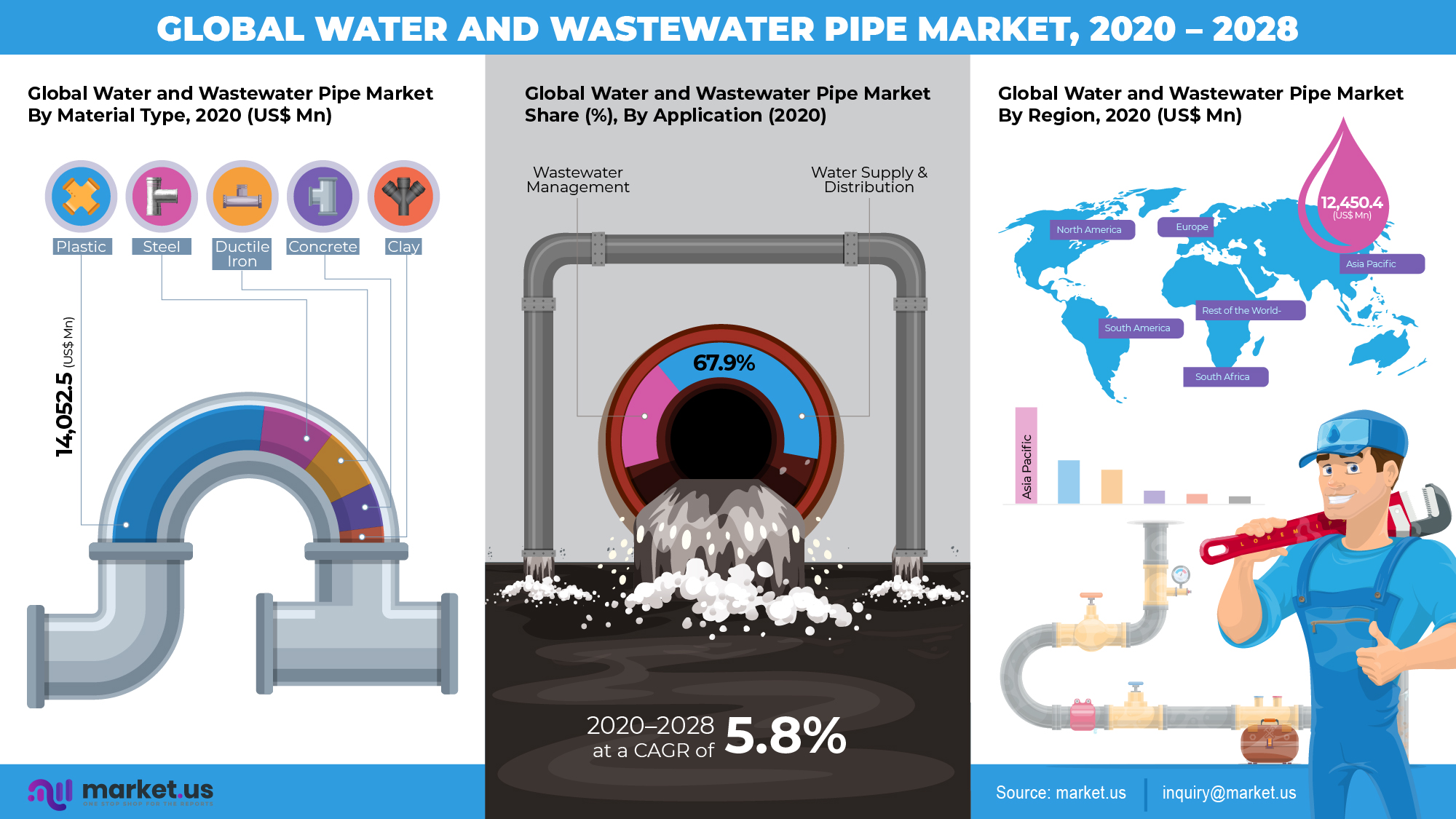

- The global water and wastewater pipe market is estimated at the US $ 26,108.9 Mn in 2020.

- The global water and wastewater pipe market is projected to reach US $ 40,959.9 Mn in 2028 at a CAGR of 5.8% from 2021 to 2028.

- Amongst material types, the plastic segment in the global water and wastewater pipe market is estimated to account for a majority revenue share of 53.8% by 2020 end.

- Among all the application segments, the wastewater management segment is expected to register the highest CAGR of over 7.4%, followed by water supply & distribution.

- Amongst end-use segment, the municipal segment in the global water and wastewater pipe market is estimated to account for a majority revenue share of 41.7% by 2020 end.

- Asia-Pacific market is expected to dominate the global water and wastewater pipe market. It is expected to account for the largest market revenue share than that of markets in other regions.

- Companies profiled in the report are Compagnie de Saint-Gobain S.A, China Lesso Group Holdings Limited, Aliaxis S.A, Mexichem, S.A.B. de C.V, Sekisui Chemical Co., Ltd., Tenaris S.A, Welspun Corp Limited, Nan Ya Plastics Corporation, Advanced Drainage Systems, Inc., Tata Steel Limited, Wienerberger AG, and ISCO Industries, LLC.

Report Overview

As per the latest insights from Market.us, the global Water and Wastewater Pipe Market is projected to reach an impressive value of approximately USD 60 billion by 2033, growing from USD 32 billion in 2023. This growth represents a robust CAGR of 6.4% over the forecast period from 2023 to 2033.

The rising demand for efficient water distribution and wastewater management systems is driving this expansion. Rapid urbanization, industrial growth, and increasing investments in infrastructure development are key factors contributing to the market’s upward trajectory. Additionally, growing awareness about sustainable water management practices and the need for upgrading aging pipelines further bolster the demand for advanced piping solutions.

Water and wastewater pipes are essential components in managing water supply and sanitation systems globally. These pipes facilitate the efficient transportation of clean water to various end-users and ensure the safe movement of wastewater away from populated areas to treatment facilities. The versatility of these pipes, which vary in material, size, and durability, supports their use across diverse environments and applications. They are vital in both new constructions and the maintenance of existing infrastructure, contributing to sustainable development and public health.

The water and wastewater pipe market is witnessing substantial growth, driven by several critical factors. Increasing urbanization and the consequent rise in population density are leading to a heightened demand for robust municipal water and wastewater management systems. This demand is particularly pronounced in developing economies where rapid urban expansion is continuous. The market is also benefiting from technological advancements such as the introduction of smart pipe systems and eco-friendly materials that enhance the sustainability and efficiency of water management practices.

There are significant opportunities in the water and wastewater pipe market linked to the global push towards sustainable and resilient urban development. Innovations such as antimicrobial plastic pipes and multi-layer piping materials are setting new standards for hygiene and durability in the industry. Moreover, the trend toward smart water management systems, capable of reducing water losses and enhancing distribution efficiency, is creating lucrative prospects for market players. These technological advancements not only address immediate infrastructure needs but also align with broader environmental goals, such as reducing the ecological footprint of water and sanitation systems.

Key Takeaways

- The global Water and Wastewater Pipe Market is set to reach USD 60 billion by 2033, growing at a steady CAGR of 6.4%. This growth is driven by rising demand across industries and increased focus on sustainable water management systems.

- Plastic pipes are leading the pack, accounting for 38.3% of the market share, thanks to their lightweight nature and resistance to corrosion. These features make them a preferred choice across construction and infrastructure sectors.

- When it comes to size, pipes with diameters up to 1200 mm dominate the market with a 39.4% share. Their versatility in applications ranging from water distribution to sewage systems makes them highly sought after.

- The water supply and distribution segment is the largest application area, holding a significant 67.4% share. With the growing need for clean and efficient water infrastructure, this segment remains crucial for future development.

- Regionally, the Asia-Pacific market leads with a 44.5% share, driven by massive infrastructure investments in countries like China and India. The region’s fast-paced urbanization and industrial growth continue to fuel demand for advanced pipe systems.

- However, leakage from water distribution systems remains a global challenge. In England and Wales, approximately 20% of treated water is lost due to leaks.

- In the United States, aging infrastructure accounts for 14% to 18% water loss, while in Canada, over $25 billion will be required to replace and upgrade aging water and wastewater systems over the next decade.

Driver

Urbanization and Infrastructure Development

One of the primary drivers of the water and wastewater pipe market is the rapid urbanization across the globe, especially in developing economies. As cities expand, the demand for robust municipal water and wastewater systems increases significantly. This growth is not only fueled by the increasing population in urban areas but also by heightened industrial activities that require substantial water management systems.

For example, the development of new residential and commercial areas necessitates extensive water distribution and sewage management systems to cater to the needs of the growing urban populations. Furthermore, governments are increasingly investing in infrastructure projects, including water sanitation and pipeline installations, which directly boosts the demand for water and wastewater pipes. These initiatives are often supported by international development organizations which further enhances market growth prospects.

Restraint

High Installation and Maintenance Costs

A major restraint in the water and wastewater pipe market is the high cost associated with the installation and ongoing maintenance of pipe systems. The financial burden is particularly significant in developing countries where funding for large-scale infrastructure projects may be limited. The installation involves not only the cost of the pipes themselves but also extensive labor costs and disruption to existing systems.

Additionally, the maintenance of water and wastewater pipes requires regular upgrades and repairs to prevent leaks and breaks, which can be costly over the long term. This financial aspect can be a significant barrier, slowing down the adoption of new projects and the upgrade of existing systems, especially in economically constrained environments.

Opportunity

Technological Advancements and Eco-Friendly Materials

The market for water and wastewater pipes is witnessing significant opportunities through technological advancements and the increasing use of eco-friendly materials. Innovations such as trenchless technology allow for less disruptive and more cost-effective pipe installation, which is becoming a game-changer in urban settings.

Additionally, the shift towards sustainable materials like polypropylene and high-density polyethylene, which are both durable and have a lower environmental impact compared to traditional materials, opens up new avenues for market growth. These materials are not only easier to install but also contribute to the longevity of pipe systems with their resistance to corrosion and wear. This trend towards sustainability is expected to continue driving market growth as environmental regulations become stricter and consumer preferences lean towards more eco-friendly solutions.

Challenge

Modernization of Aging Infrastructure

A significant challenge in the water and wastewater pipe market is the modernization of aging and outdated infrastructure, particularly in developed countries. Many existing water supply and sewage systems are decades old and are in dire need of upgrades to meet current standards for efficiency and environmental impact. The process of modernizing these systems is not only costly but also technically challenging, as it often requires integrating new technologies with old systems.

Additionally, there is the logistical challenge of carrying out upgrades in densely populated urban areas without disrupting the daily activities of the community. This modernization is crucial for preventing water loss and contamination, which are critical for public health and environmental conservation.

Key Market Segments

By Type

- Plastic

- Steel

- Ductile Iron

- Concrete

- Clay

By Diameter

- Upto 1200 mm

- 1200 mm to 3600 mm

- Abovee 3600 mm

By Business Type

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Application

- Water Supply & Distribution

- Wastewater Management

By End-use

- Municipal

- Industrial

- Agriculture

Key Market Players

- Compagnie de Saint-Gobain S.A

- China Lesso Group Holdings Limited

- Aliaxis S.A.

- Mexichem

- S.A.B. de C.V.

- Sekisui Chemical Co.Ltd.

- Tenaris S.A.

- Welspun Corp Limited

- Nan Ya Plastics Corporation

- Advanced Drainage Systems Inc.

- Tata Steel Limited

- Wienerberger AG

- ISCO Industries LLC